North America Beverage Cups And Lids Market Size and Growth

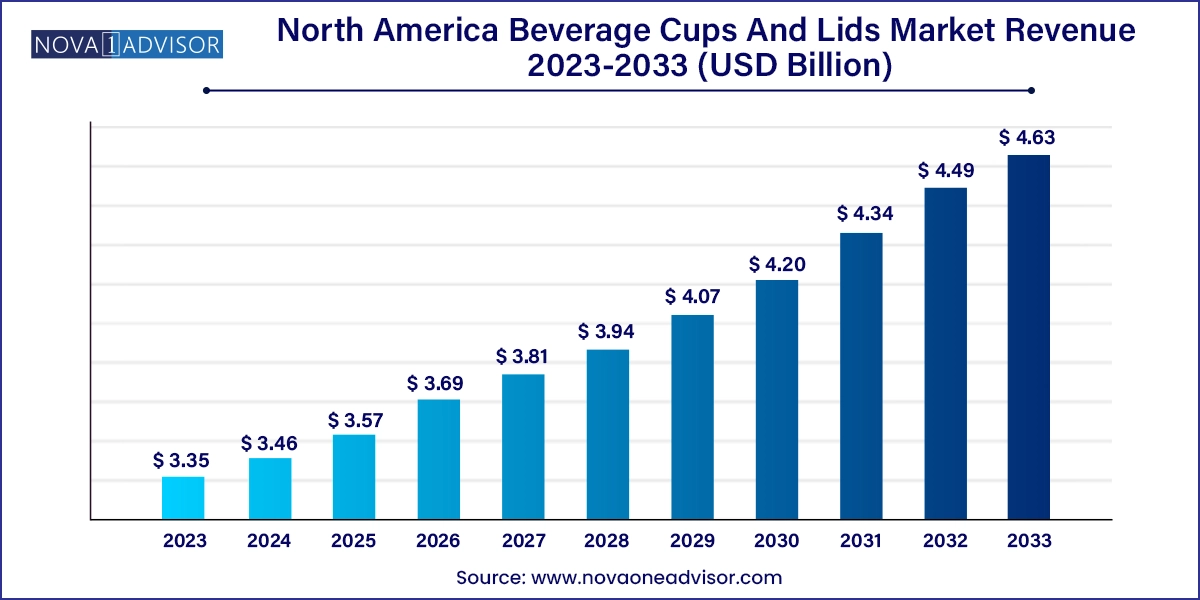

The North America beverage cups and lids market size was exhibited at USD 3.35 billion in 2023 and is projected to hit around USD 4.63 billion by 2033, growing at a CAGR of 3.3% during the forecast period 2024 to 2033.

North America Beverage Cups And Lids Market Key Takeaways:

- The paper segment is anticipated to dominate the overall market with a share of over 51.0% in 2023.

- The plastic segment is expected to grow at a moderate CAGR over the forecast period

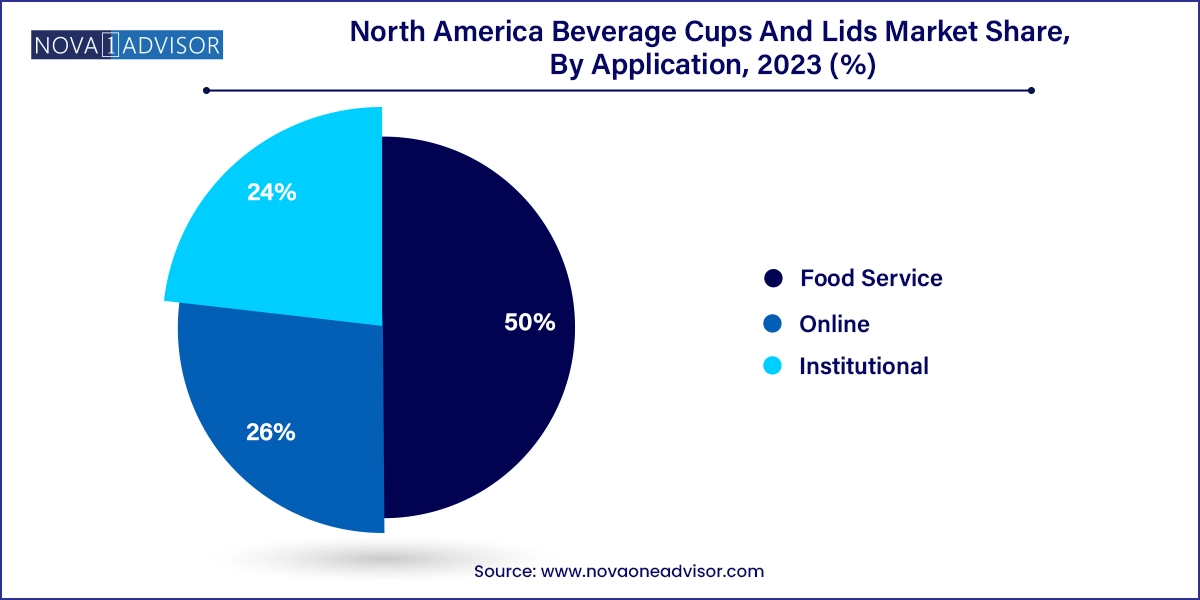

- Food service application segment dominated market and accounted for largest revenue share of over 50.0% in 2023.

- The online application segment is projected to progress at the fastest CAGR of 4.6% over the forecast period.

- The cups segment dominated the market and accounted for largest revenue share of over 67.0% in 2023.

- The direct distributors segment dominated the distribution channel segment and accounted for largest revenue share of over 45.0% in 2023.

- The group purchasing organizations (GPOs) distribution channel segment is anticipated to witness the fastest CAGR of 4.3% from 2024 to 2033.

Market Overview

The North America beverage cups and lids market is a robust and evolving segment within the broader food packaging industry, propelled by the region’s highly active food service sector, growing on-the-go consumption culture, and strong presence of quick service restaurants (QSRs), cafes, and institutional caterers. As consumers increasingly demand convenience, safety, and sustainability in food and drink packaging, beverage cups and lids have become more than just disposable utilities—they represent brand identity, environmental consciousness, and user experience.

North America, home to global food chains like Starbucks, McDonald's, and Tim Hortons, has long been a driver of innovation in cup and lid designs, moving from generic disposable options to eco-friendly, custom-branded, and specialty-function containers. The wide-scale consumption of hot and cold beverages—including coffee, tea, smoothies, soft drinks, and health beverages—across fast-casual outlets, corporate events, institutional cafeterias, and delivery platforms has ensured sustained demand for reliable, cost-effective beverage packaging solutions.

Additionally, regulatory pressures across the U.S. and Canada regarding single-use plastics and waste reduction have accelerated the shift toward recyclable, compostable, and biodegradable materials. This has spurred manufacturers to invest in paper-based cups, PLA-coated lids, and hybrid packaging that meets both functional and environmental performance criteria. In Mexico, rapid urbanization and the expansion of Western-style cafes and chains are also contributing to the growing demand for modern beverage cups and lids.

Major Trends in the Market

-

Surge in Demand for Sustainable Packaging: Increased environmental awareness is driving demand for compostable, recyclable, and plant-based materials in cup and lid production.

-

Growth of Online Food and Beverage Delivery: Platforms like Uber Eats, DoorDash, and Grubhub have created a surge in demand for spill-proof, insulated, and branded beverage containers.

-

Customization and Branding: Beverage cups, especially in the café and QSR sectors, are becoming tools for marketing, with brands investing in custom-printed designs to enhance recognition.

-

Innovation in Lid Designs: New ergonomic and leak-resistant lids, including sipper and strawless variants, are being introduced to improve convenience and reduce plastic straws.

-

Legislation Driving Material Innovation: U.S. states and Canadian provinces are introducing laws limiting foam and single-use plastics, prompting investment in paper and biopolymer-based alternatives.

-

Institutional and Corporate Expansion: Hospitals, universities, and offices are increasing use of disposable beverage packaging for hygiene and efficiency, especially post-pandemic.

-

Demand for Dual-purpose Packaging: Combination cup-and-lid solutions for hot and cold beverages are gaining traction, particularly in vending and self-service models.

Report Scope of North America Beverage Cups And Lids Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.46 Billion |

| Market Size by 2033 |

USD 4.63 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Product, Application, Distribution Channel, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico |

| Key Companies Profiled |

Georgia-Pacific; Amhil; Huhtamaki Oyj; Printpack; Dart Container Corporation; WinCup; Graphic Packaging International, LLC; Mondi; Airlite Plastics; Reynolds Consumer Products; Material Motion, Inc.; CMG Plastics; Berry Global Inc.; Evanesce Inc.; Karat by Lollicup |

Key Market Driver: Expansion of the Foodservice Industry

A core driver of the North America beverage cups and lids market is the relentless expansion of the foodservice industry, particularly QSRs, cafes, and beverage-focused outlets. Chains such as Dunkin’, Starbucks, and McCafé serve millions of beverages daily, and each serving requires a cup and typically a lid. This continuous throughput of disposable packaging has created a baseline demand that fuels the industry.

The driver becomes more compelling when considering the changing dynamics of beverage consumption. Busy lifestyles and urban commuting patterns across North American cities have led to a preference for beverages that can be consumed on the go. Whether it’s a hot espresso on a winter morning in Toronto or a chilled smoothie in sunny Los Angeles, the foodservice industry’s dependency on practical, insulated, and branded cup and lid solutions is inseparable from its operations. Furthermore, seasonal offerings and promotional campaigns often introduce limited-edition cups, increasing per capita consumption of beverage packaging even further.

Key Market Restraint: Environmental Scrutiny and Regulatory Pressures on Single-use Products

While demand for disposable beverage packaging remains high, the mounting regulatory pressure and consumer backlash against single-use plastics and foam materials pose a significant restraint. Multiple U.S. states such as California and New York, and Canadian provinces like British Columbia, have introduced bans or restrictions on polystyrene foam and certain types of plastic lids.

These policies directly affect manufacturers who traditionally relied on foam or low-cost plastic for mass-market beverage cups and lids. Transitioning to sustainable alternatives like paperboard or PLA bioplastics often involves higher costs, limited supply chains, and shorter shelf lives, particularly for hot beverages. Smaller retailers and foodservice operators struggle to adapt to these changes due to budget constraints, creating market resistance.

Additionally, the lack of nationwide recycling infrastructure further complicates the environmental case for recyclable materials. A cup labeled compostable in Seattle may end up in landfill in another region lacking composting facilities. This fragmented regulatory and waste management landscape is a bottleneck for uniform innovation and adoption.

Key Market Opportunity: Innovation in Biodegradable and Functional Packaging

The greatest opportunity lies in the integration of biodegradable materials with performance-enhancing innovations. As demand rises for cups and lids that are not only sustainable but also spill-resistant, heat-retentive, and suitable for both hot and cold drinks, there’s a surge in R&D activity around next-gen materials.

PLA-coated paper cups, bamboo fiber lids, molded pulp, and starch-based biopolymers are gaining popularity among eco-conscious brands. Moreover, adding functional layers—like moisture barriers, insulation wraps, and ergonomic sipping lids—presents a premium offering. Fast-growing coffee chains like Bluestone Lane and eco-focused retailers like Whole Foods are pushing their suppliers toward high-performing compostable packaging.

Another dimension to this opportunity is digital—smart packaging elements, such as QR codes for promotions or batch traceability for sustainable sourcing, can be embedded on cups and lids, transforming disposable packaging into a marketing and transparency tool. This intersection of sustainability and technology holds significant promise for companies looking to differentiate in a competitive market.

North America Beverage Cups And Lids Market By Material Insights

Paper dominates the material segment due to its adaptability, environmental perception, and compatibility with printing and coating technologies. Most café and QSR beverages especially hot drinks like coffee and tea are served in double-wall or PLA-coated paper cups. Chains like Starbucks and Tim Hortons have already committed to replacing traditional plastic-lined cups with more sustainable paper-based alternatives. Paper cups are easy to brand, hold up well under hot temperatures, and are widely accepted in consumer recycling streams.

Plastics, particularly recyclable PET and polypropylene, are growing rapidly in cold beverage applications such as iced coffees, juices, and smoothies. These cups offer excellent clarity, leak-proof properties, and are often paired with dome or sipper lids. However, the fastest-growing material segment is molded fiber and biodegradable foam alternatives, which are being rapidly adopted in response to plastic bans. Innovative startups and legacy brands alike are experimenting with compostable foams and bio-resins to match the functionality of traditional options while minimizing ecological footprint.

North America Beverage Cups And Lids Market By Application Insights

Food service remains the largest application segment, encompassing QSRs, cafes, food trucks, and restaurants. These establishments use a wide array of beverage cups and lids for dine-in, takeaway, and delivery operations. High beverage consumption volume, need for brand consistency, and frequent promotional campaigns make foodservice a steady and substantial demand generator.

Meanwhile, the online segment is experiencing the fastest growth, fueled by the rising popularity of food and drink delivery apps. Online ordering has transformed the requirements for beverage packaging—demanding better sealing, insulation, and tamper resistance. Operators are also moving toward personalized and traceable packaging to ensure safety and customer trust. This growth trajectory is likely to remain strong even post-pandemic, as hybrid and remote work lifestyles sustain the convenience-driven delivery economy.

North America Beverage Cups And Lids Market By Product Insights

Cups account for the largest share of the market, simply because they are the primary vessel for beverage containment. They vary by size, temperature resistance, and branding needs. The expansion of delivery and mobile ordering services has further driven the demand for high-performance cups that maintain beverage integrity during transit. Seasonal and promotional cup designs also contribute to higher sales turnover, particularly in peak seasons such as winter holidays and summer.

However, lids are the fastest-growing product category, thanks to the surge in beverage mobility and safety requirements. The demand for tamper-evident lids, strawless sipper lids, and dual-function lids (for hot and cold) is rising rapidly. Innovations like recyclable coffee cup lids that prevent spills while reducing plastic use are gaining favor. Regulatory efforts to eliminate plastic straws have also led to lid redesigns, especially for iced drinks, thus driving fresh demand and market interest.

North America Beverage Cups And Lids Market By Distribution Channel Insights

Corporate distributors dominate the distribution landscape, especially due to their large-scale servicing of chain restaurants, institutions, and national foodservice providers. They benefit from long-term contracts, volume discounts, and integrated logistics systems that support high throughput. These distributors often source in bulk directly from manufacturers and are pivotal in standardizing packaging across franchise locations.

Group Purchasing Organizations (GPOs) and direct distributors are among the fastest-growing segments, particularly in the U.S. and Canada’s institutional sector. Hospitals, universities, and government facilities often leverage GPOs to negotiate better rates and meet sustainability benchmarks. As the institutional sector expands post-pandemic and focuses on hygiene, these distribution channels are becoming more strategic and central to procurement planning.

Country Insights

United States

The United States leads the North American beverage cups and lids market by a significant margin. It is home to the largest foodservice industry globally, housing thousands of domestic and international chains. Cities like New York, Chicago, and Los Angeles set consumption trends that ripple throughout the continent. With robust investments in innovation and a highly competitive environment, U.S. companies are at the forefront of sustainable cup and lid development.

State-level bans on polystyrene foam (e.g., in California and Maine) and city-led initiatives on reducing single-use plastics (like Seattle's straw ban) have transformed product development. Companies now prioritize recyclability, compostability, and life-cycle traceability. Moreover, seasonal campaigns by major players—such as Starbucks’ holiday cups—have created a unique marketing niche within beverage packaging.

Canada

Canada has become a leader in sustainable beverage packaging practices, thanks to federal and provincial initiatives aiming to eliminate harmful plastics. Several cities, including Vancouver and Toronto, have implemented bans or reduction strategies for single-use cups and straws. This has accelerated the adoption of molded fiber, FSC-certified paper cups, and PLA-based lids, especially among eco-conscious retailers and local café chains.

In addition, Canadian consumers exhibit a high willingness to pay a premium for sustainable packaging, enabling local manufacturers to innovate and commercialize novel eco-friendly designs. Universities, hospitals, and public service institutions across Canada are also increasingly sourcing compostable beverage packaging through institutional contracts and GPOs.

Mexico

Mexico is witnessing rapid growth in the beverage cups and lids market, driven by rising urbanization, expanding QSR presence, and growth in middle-class consumption. Brands like Starbucks, Oxxo, and local café chains have increased their footprint, bringing modern beverage packaging trends to cities such as Guadalajara, Monterrey, and Mexico City.

While plastic still dominates, transitioning toward recyclable and paper-based options is underway, especially in export-focused urban centers. The government’s broader anti-plastic initiative has influenced importers and local producers to explore cost-effective sustainable options. With Mexico’s role in cross-border foodservice supply chains, the country is set to become a key participant in the region’s evolving cup and lid production landscape.

Some of the prominent players in the North America beverage cups and lids market include:

- Georgia-Pacific

- Amhil

- Huhtamaki Oyj

- Printpack

- Dart Container Corporation

- WinCup

- Graphic Packaging International, LLC

- Mondi

- Airlite Plastics

- Reynolds Consumer Products

- Material Motion, Inc.

- CMG Plastics

- Berry Global Inc.

- Evanesce Inc.

- Karat by Lollicup

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America beverage cups and lids market

Material

- Paper

- Plastics

- Foam

- Others

Product

Distribution Channel

- Corporate Distributors

- Individual Distributors

- Group Purchasing Organizations (GPOs)

- Direct Distributors

- Others

Application

- Food Service

- Online

- Institutional

Country