North America Bloodstream Infection Testing Market Size and Research

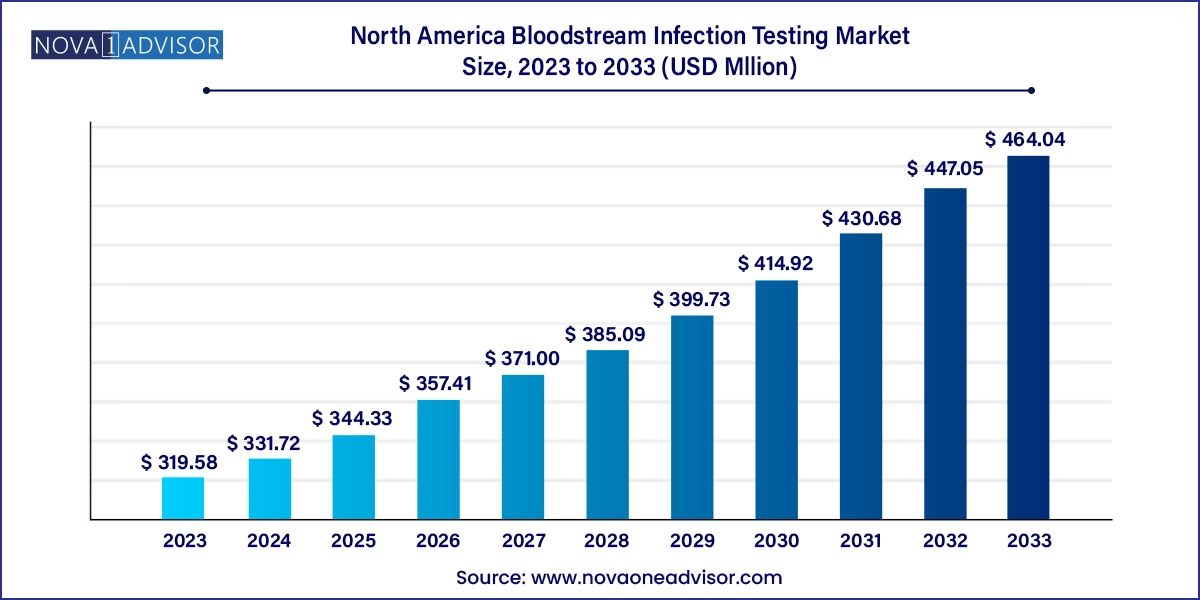

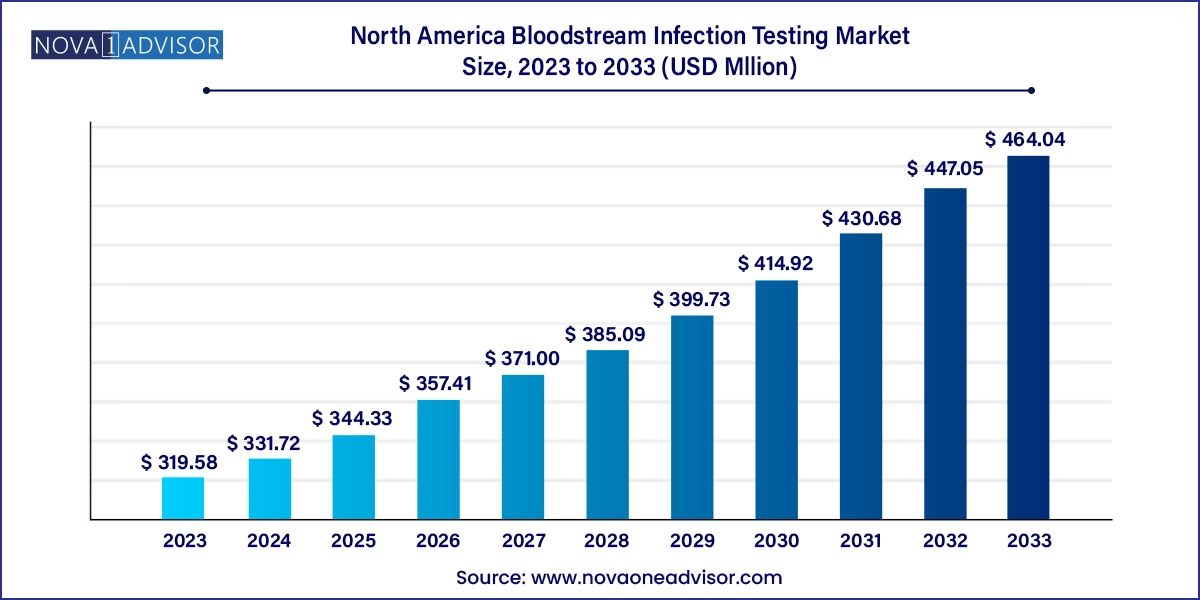

The North America bloodstream infection testing market size was exhibited at USD 319.58 million in 2023 and is projected to hit around USD 464.04 million by 2033, growing at a CAGR of 3.8% during the forecast period 2024 to 2033.

North America Bloodstream Infection Testing Market Key Takeaways:

- The reagents and consumables segment accounted for the largest revenue share of 89.12% in 2023.

- The blood culture segment accounted for the largest revenue share of 75.81% in 2023 and is expected to witness the fastest CAGR over the forecast period.

- The PCR segment held the largest revenue share of 60.7% in 2023.

- The hospital and diagnostic centers segment accounted for the largest revenue share of 45.85% in 2023 and is expected to witness the fastest CAGR from 2024 to 2033.

- The U.S. dominated the regional market for bloodstream infection testing and accounted for the largest revenue share of 81.71% in 2023.

Market Overview

The North America bloodstream infection (BSI) testing market stands as a critical pillar in the continent’s infectious disease diagnostics ecosystem. Bloodstream infections are a major cause of morbidity and mortality, particularly in hospitalized patients, immunocompromised individuals, and the elderly. The rising incidence of sepsis, antimicrobial resistance, and hospital-acquired infections (HAIs) has intensified the demand for early, accurate, and rapid diagnostic methods. Consequently, the market for bloodstream infection testing in North America is experiencing strong growth, driven by technological advancements, increased healthcare awareness, and government-led initiatives to improve patient outcomes.

Bloodstream infection diagnostics rely on the detection of pathogens bacteria, fungi, or viruses present in the blood. These pathogens can proliferate quickly, making timely detection imperative to mitigate life-threatening complications. Traditionally, blood culture has been the gold standard, but it suffers from long turnaround times and sensitivity limitations. In response, novel diagnostic technologies such as polymerase chain reaction (PCR), mass spectrometry, and molecular assays have emerged, delivering faster and more reliable results.

North America's advanced healthcare infrastructure, strong funding for research and innovation, and the presence of leading diagnostic companies make it a fertile ground for the adoption of BSI testing solutions. The region's focus on reducing hospital stays, preventing complications, and improving antimicrobial stewardship is expected to support long-term growth in the bloodstream infection testing market.

Major Trends in the Market

-

Rapid Diagnostics are Gaining Traction: There is a marked shift toward rapid molecular diagnostic platforms that can identify bloodstream pathogens within hours, rather than days.

-

Multiplex Panels in Demand: Laboratories are adopting multiplex assays that can detect a wide range of pathogens and resistance markers in a single run.

-

Integration of AI in Diagnostics: Artificial Intelligence is being integrated into diagnostic platforms to analyze complex datasets and provide predictive insights for clinicians.

-

Antimicrobial Resistance (AMR) Surveillance: There is increasing adoption of bloodstream infection tests that include AMR markers, aiding in the selection of targeted therapies.

-

Growth in Point-of-Care Testing: Compact, automated testing platforms are expanding the use of bloodstream infection diagnostics in decentralized and outpatient settings.

-

Collaborations Between Hospitals and Diagnostic Firms: Healthcare institutions are partnering with diagnostic companies for tailored solutions to combat local epidemiological patterns.

-

Rising Adoption of Reagent Rental Models: To reduce upfront capital expenditure, hospitals are opting for reagent rental agreements with manufacturers.

-

Sample-to-Answer Platforms Becoming Mainstream: Fully automated platforms requiring minimal manual intervention are being widely adopted to improve lab efficiency.

Report Scope of North America Bloodstream Infection Testing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 331.72 Million |

| Market Size by 2033 |

USD 464.04 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 3.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Sample Type, Technology, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada |

| Key Companies Profiled |

bioMérieux SA; BD; Cepheid; Seegene Inc.; Abbott; F. Hoffmann-La Roche Ltd.; Siemens Healthcare Limited; Luminex Corporation; Bruker; Accelerate Diagnostics, Inc. |

Key Market Driver: Growing Incidence of Sepsis and HAIs

One of the most significant drivers of the North America bloodstream infection testing market is the increased incidence of sepsis and hospital-acquired infections (HAIs). Sepsis, a life-threatening response to infection that can rapidly lead to tissue damage, organ failure, and death, affects over 1.7 million people in the U.S. annually, resulting in nearly 270,000 deaths. Bloodstream infections are often the underlying cause of sepsis, making early detection essential for survival.

Hospitals are under pressure to comply with strict clinical guidelines for sepsis management, including the CMS SEP-1 bundle in the U.S., which mandates rapid testing and administration of appropriate antibiotics. Diagnostic tests that can identify the exact pathogen and its resistance profile enable physicians to optimize treatment and reduce the use of broad-spectrum antibiotics, which in turn helps combat antimicrobial resistance.

In Canada, similar initiatives by provincial health authorities aim to lower the mortality rates from HAIs and sepsis through improved diagnostics and infection control protocols. As a result, healthcare providers across North America are investing in high-performance diagnostic solutions for BSI detection, reinforcing market growth.

Key Market Restraint: High Cost of Advanced Diagnostic Technologies

While technological innovation has significantly improved diagnostic capabilities, the high cost of advanced BSI testing technologies remains a major restraint, particularly for smaller healthcare facilities and budget-constrained public hospitals. Sophisticated platforms like mass spectrometry or multiplex PCR require capital-intensive equipment, trained personnel, and expensive reagents.

Moreover, reimbursement policies for some of these tests can be inconsistent across states and provinces, leading to financial strain on diagnostic centers. Smaller community hospitals often delay the adoption of these systems due to budget constraints or inadequate ROI, which limits widespread accessibility.

Although pricing is expected to become more competitive over time, the cost barrier could continue to hinder adoption in economically constrained or rural areas across North America.

Key Market Opportunity: Rise of Personalized Antimicrobial Therapy

An emerging opportunity in the bloodstream infection testing market lies in personalized antimicrobial therapy, which tailors treatment to the specific pathogen and resistance profile detected in the patient’s bloodstream. With rising awareness around antimicrobial stewardship and the global threat of AMR, there is increasing emphasis on selecting the most effective antibiotic with minimal side effects or resistance risk.

New diagnostic platforms are being developed to simultaneously identify pathogens and resistance genes. These tools help clinicians make data-driven decisions about antibiotic selection, duration, and dosage. Companies that integrate predictive analytics and AI-based decision support into their platforms stand to benefit in this space.

Moreover, healthcare insurers and payers are starting to recognize the long-term cost benefits of avoiding ineffective treatments and reducing hospital readmissions, making personalized treatment a commercially viable model for diagnostics providers.

North America Bloodstream Infection Testing Market By Product Insights

Reagents and consumables dominated the North America bloodstream infection testing market. These products are essential for each diagnostic run and are used in high volumes due to routine testing in hospitals and laboratories. The ongoing need for diagnostic reagents to perform pathogen detection, resistance profiling, and quality control ensures a steady revenue stream for manufacturers. As labs shift toward high-throughput platforms and syndromic testing panels, the demand for proprietary and compatible reagents is expected to rise further. Subscription-based reagent supply models and reagent rental agreements are becoming commonplace, especially in the U.S., contributing to the segment’s strength.

On the other hand, instruments are expected to be the fastest-growing segment, owing to the rapid technological advancements and automation of diagnostic workflows. Hospitals and diagnostics centers are increasingly adopting fully automated platforms with minimal user input, reducing the chance of human error and improving turnaround times. Next-generation instruments with AI-powered interfaces, cloud-based data integration, and scalable throughput are witnessing high demand. In particular, instruments with multi-pathogen detection and point-of-care adaptability are attracting substantial investment in both the U.S. and Canadian markets.

North America Bloodstream Infection Testing Market By Sample Type Insights

Blood culture was the most widely used sample type, as it remains the conventional method for diagnosing bloodstream infections. Despite the availability of more advanced molecular technologies, blood cultures are the standard-of-care for initial infection screening and pathogen identification in most healthcare settings. Their broad accessibility, lower cost, and established clinical utility ensure their continued dominance. Moreover, manufacturers are continuously improving culture-based systems to reduce detection time and enhance sensitivity, which supports the sample type’s relevance.

However, whole blood is expected to emerge as the fastest-growing sample type, especially as molecular diagnostic methods gain traction. Whole blood-based assays allow for direct detection of pathogens without the need for prolonged culture incubation, significantly reducing the time to diagnosis. This approach is especially beneficial in emergency departments and intensive care units where rapid treatment initiation is vital. Technologies such as direct-from-blood PCR, digital PCR, and microfluidic platforms are advancing the use of whole blood as a reliable sample type.

North America Bloodstream Infection Testing Market By Technology Insights

Polymerase Chain Reaction (PCR) led the market due to its speed and sensitivity. PCR-based testing platforms have become ubiquitous in North America for pathogen detection owing to their ability to deliver accurate results within hours. The widespread availability of multiplex PCR panels that can detect multiple organisms simultaneously makes them highly valuable in urgent care and hospital settings. The use of real-time PCR for sepsis diagnosis has become increasingly common in both U.S. and Canadian hospitals, allowing for early intervention.

In contrast, mass spectrometry is poised to be the fastest-growing technology, thanks to its ability to rapidly identify a wide array of pathogens and resistance markers from cultured isolates. Technologies such as MALDI-TOF (Matrix-Assisted Laser Desorption Ionization Time-of-Flight) are revolutionizing pathogen identification by delivering results in minutes once a culture is obtained. Furthermore, as healthcare providers seek comprehensive pathogen profiling and susceptibility testing, the utility of mass spectrometry is likely to expand, particularly in reference laboratories and academic research centers.

North America Bloodstream Infection Testing Market By End-user Insights

Hospitals and diagnostic centers were the dominant end-user group, given their central role in managing acute infections, sepsis, and emergency cases. These facilities conduct high volumes of blood culture and molecular tests on a daily basis. Integration of BSI testing into routine hospital workflows is critical for patient care and compliance with infection control guidelines. Tertiary hospitals, in particular, rely heavily on automated platforms for rapid diagnostics to improve turnaround and patient outcomes.

Meanwhile, custom laboratory service providers are expected to witness the fastest growth. These entities offer specialized testing services tailored to client needs, including drug susceptibility profiling, molecular testing, and novel biomarker detection. The flexibility and expertise offered by such labs appeal to smaller hospitals, outpatient clinics, and research institutes. Additionally, many startups and diagnostic innovators are partnering with these service providers to pilot new test kits and platforms in real-world settings across North America.

North America Bloodstream Infection Testing Market By Regional Insights

United States

The U.S. remains the largest and most advanced market for bloodstream infection testing in North America. Factors such as the high prevalence of sepsis, robust healthcare infrastructure, and favorable reimbursement landscape contribute to sustained growth. Federal initiatives like the CDC’s National Healthcare Safety Network (NHSN) and CMS quality reporting measures have encouraged hospitals to adopt comprehensive BSI diagnostic protocols. Major academic hospitals and diagnostic chains like Quest Diagnostics and LabCorp are at the forefront of adopting AI-integrated molecular platforms, ensuring the country remains a global innovation hub for infection diagnostics.

Canada

Canada's BSI testing market is characterized by centralized healthcare procurement, provincial funding programs, and growing awareness of antimicrobial resistance. Canadian hospitals have been increasingly investing in syndromic panels and rapid testing technologies, especially in provinces like Ontario and British Columbia. The Canadian government’s pan-Canadian AMR action plan has created demand for diagnostic tools that support antimicrobial stewardship. Collaborations between public health laboratories and universities are also enhancing diagnostic capabilities for bloodstream infections across the country.

Some of the prominent players in the North America bloodstream infection testing market include:

- bioMérieux SA

- BD

- Cepheid

- Seegene Inc.

- Abbott

- F. Hoffmann-La Roche Ltd

- Siemens Healthcare Limited

- Luminex Corporation

- Bruker

- Accelerate Diagnostics, Inc.

Recent Developments

-

April 2025: BioMérieux announced the North American launch of its next-generation BACT/ALERT® VIRTUO® 3D blood culture system, featuring enhanced automation and cloud connectivity.

-

February 2025: Thermo Fisher Scientific unveiled its latest rapid antimicrobial susceptibility testing (AST) solution for bloodstream infections, promising same-day results.

-

December 2024: Accelerate Diagnostics entered a partnership with leading U.S. hospital systems to pilot its next-gen rapid ID/AST platform for bloodstream infections.

-

October 2024: Sepsis Alliance and Roche Diagnostics USA launched a joint awareness campaign on the importance of rapid diagnostics in sepsis management.

-

August 2024: Luminex Corporation (DiaSorin Group) expanded its NxTAG® Respiratory Pathogen Panel to include sepsis-related pathogens relevant to bloodstream infections.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America bloodstream infection testing market

Product

- Reagents & Consumables

- Instruments

Sample Type

- Whole Blood

- Blood Culture

Technology

- PCR

- Mass Spectroscopy

- In Situ Hybridization

- Others

End-user

- Hospitals & Diagnostic Centers

- Custom Laboratory Service Providers

- Academic & Research Institutes

- Others

Regional