North America Cannabis Grow Lights Market Size and Trends

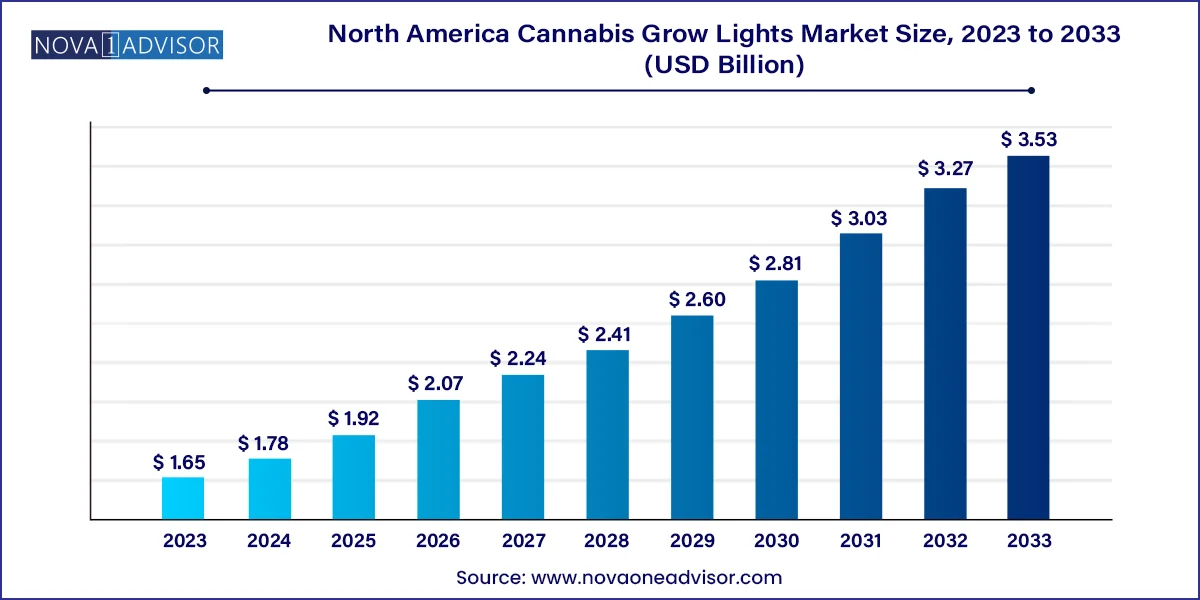

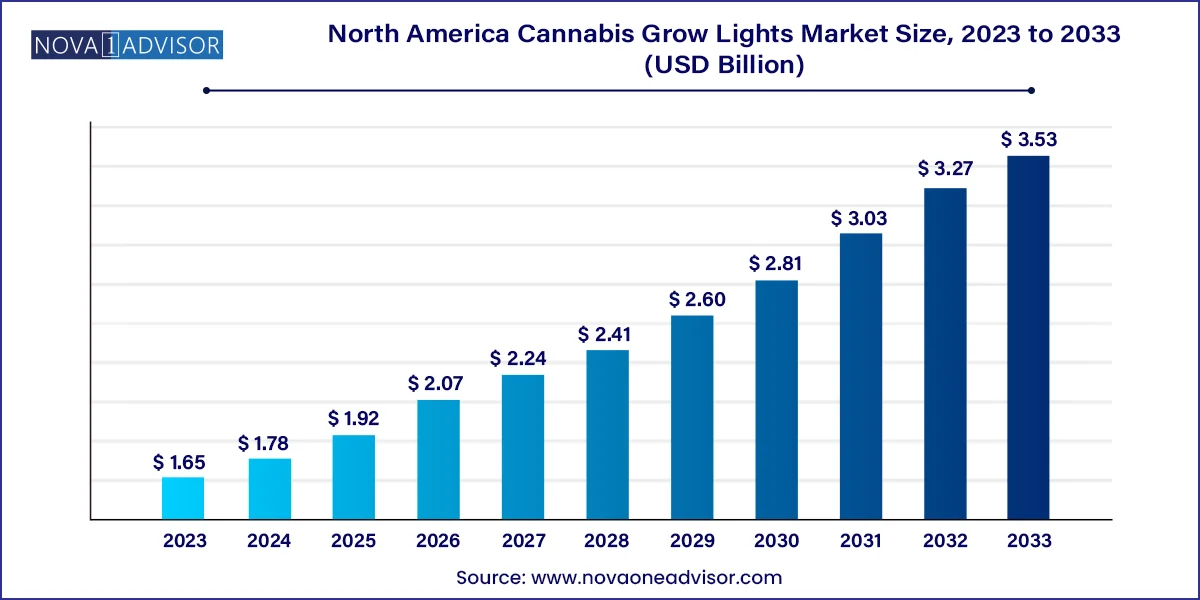

The North America cannabis grow lights market size was exhibited at USD 1.65 billion in 2023 and is projected to hit around USD 3.53 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

North America Cannabis Grow Lights Market Key Takeaways:

- The light-emitting diode (LED) segment dominated the market with the largest revenue share of around 43.0% in 2023.

- The high-intensity discharge (HID) lamps/lights segment is anticipated to grow at a CAGR of over 8.0% during the forecast period.

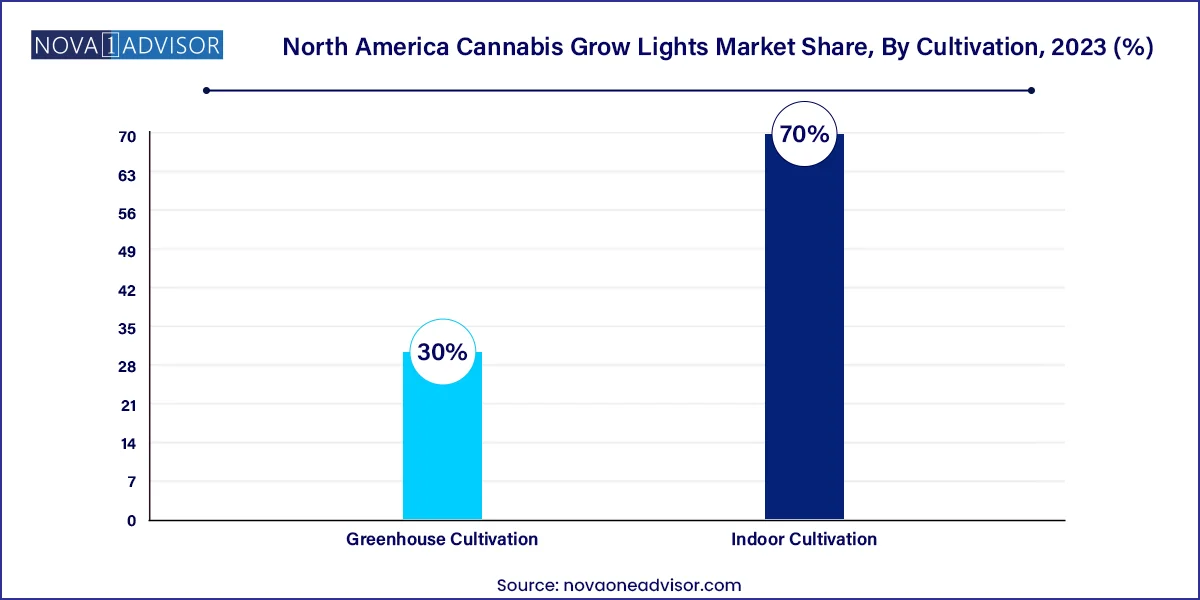

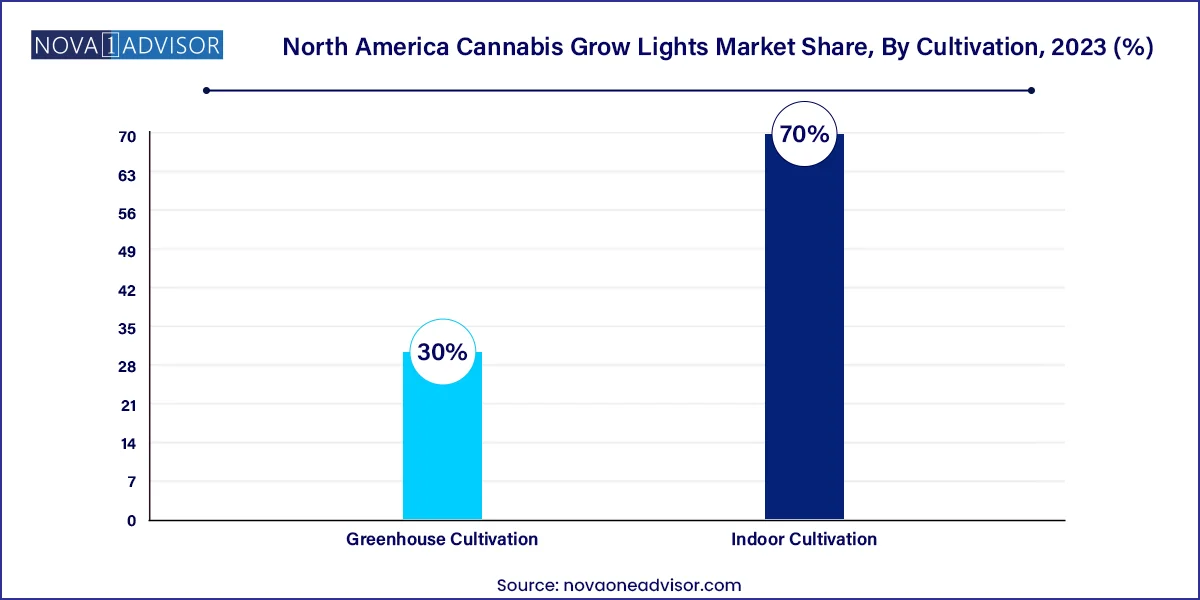

- The indoor cultivation segment dominated the market with the largest revenue share 70.0% in 2023 and is expected to grow at the fastest CAGR over the forecast period.

- The greenhouse cultivation segment is also expected to grow lucratively over the forecast period.

Market Overview

The North America cannabis grow lights market is gaining significant traction amid the expanding legalization and commercialization of cannabis cultivation across the region. With cannabis moving from the shadows of illicit production into mainstream agriculture, especially for medicinal and recreational uses, the need for technologically advanced and energy-efficient growing solutions has never been more prominent. Grow lights, essential for simulating optimal sunlight conditions in controlled environments, have become pivotal in ensuring high-yield and high-quality cannabis crops, especially in regions with limited sunlight or for indoor cultivation practices.

The market spans various lighting technologies from traditional High-Intensity Discharge (HID) lamps to energy-efficient and spectrum-controlled Light Emitting Diodes (LEDs). North American cultivators, particularly in the U.S. and Canada, are rapidly adopting these solutions as indoor farming and greenhouse cultivation become more dominant methods. This shift is largely driven by urban constraints, regulatory controls, and the desire for precision agriculture to enhance the yield, consistency, and potency of cannabis plants.

Amid mounting competition and evolving consumer demands, cultivators are under pressure to achieve better yields while reducing energy costs and environmental impact. As a result, the cannabis grow lights market is becoming a vital component in the larger cannabis cultivation ecosystem. Governments and private enterprises alike are investing heavily in R&D to support energy-efficient, full-spectrum lighting technologies. These dynamics are creating a fertile ground for growth and innovation across the cannabis grow lights landscape in North America.

Major Trends in the Market

-

LED grow lights are dominating the market, driven by their energy efficiency, long lifespan, and customizable light spectrums tailored for cannabis growth cycles.

-

Vertical farming and stackable indoor cultivation units are increasing the demand for compact and adaptable lighting systems.

-

Smart lighting integration with IoT and AI for automated control of light cycles and intensities is gaining traction.

-

Shifts toward sustainability and energy conservation have prompted a decline in traditional HID lamp usage.

-

Government subsidies and incentives for energy-efficient agriculture practices are promoting LED adoption in cannabis cultivation.

-

Hybrid cultivation models (indoor + greenhouse) are leveraging combined lighting technologies to optimize productivity year-round.

-

Technological convergence with environmental sensors and climate control systems is enabling more precise control of cannabis growth conditions.

Report Scope of North America Cannabis Grow Lights Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.78 Billion |

| Market Size by 2033 |

USD 3.53 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Cultivation, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico |

| Key Companies Profiled |

Koninklijke Philips N.V.; Valoya ; Heliospectra ; Kind LED Grow Lights; VIVOSUN; California LightWorks; Biological Innovation and Optimization Systems, LLC; ViparSpectra; Mars Hydro; Hydrobuilder.com; Hydrofarm |

Market Driver: Legalization and Commercialization of Cannabis

One of the most powerful drivers of the North America cannabis grow lights market is the widespread legalization of cannabis cultivation for medical and recreational purposes, particularly in the United States and Canada. As more states legalize marijuana, both for medicinal and adult use, demand for high-quality cannabis production has surged. This legal clarity encourages investment in infrastructure, including grow lighting systems, which are integral to both small-scale and commercial operations.

Commercial cultivators need reliable and efficient lighting solutions to maintain consistent crop cycles and achieve regulatory compliance for product quality. In particular, indoor grow operations where sunlight is absent rely entirely on artificial lighting to stimulate photosynthesis and support plant development. As a result, light technologies such as full-spectrum LEDs, which can mimic the sun’s natural light and support various growth stages of cannabis, have become critical. Companies are capitalizing on this trend by offering tailored lighting solutions, which has further fueled the market’s upward trajectory.

Market Restraint: High Initial Investment Costs

Despite the strong growth potential, the high upfront cost of advanced grow lighting systems acts as a restraint for many small and medium-scale cultivators. Setting up an indoor grow room equipped with efficient LEDs, cooling systems, and environmental controls can require substantial capital investment, which may be prohibitive for new entrants or individual growers operating under limited budgets.

Even though LED lights offer long-term cost savings due to reduced energy consumption and longer lifespans, the initial purchasing and installation costs are considerably higher than traditional HID or fluorescent lights. This becomes especially challenging in competitive markets where profit margins are tight, and ROI is a key concern. For growers who operate under narrow financial constraints or who are experimenting with cultivation, the cost barrier may lead them to opt for less efficient solutions, thereby limiting the penetration of high-tech lighting solutions.

Market Opportunity: Smart Grow Lights and Automation Integration

An emerging and lucrative opportunity in the market lies in the integration of smart grow lights with automation and environmental monitoring systems. As the cannabis industry becomes more data-driven, the demand for intelligent grow solutions is soaring. These systems allow cultivators to control and optimize lighting conditions remotely using mobile or cloud platforms, offering flexibility and precision that traditional setups cannot provide.

Smart grow lights equipped with IoT sensors can automatically adjust light intensity, duration, and spectrum in response to real-time plant needs, growth stages, and ambient conditions. This not only enhances yield and plant health but also significantly reduces energy consumption by avoiding over-lighting. For commercial cannabis producers aiming for consistency and regulatory compliance, such solutions enable scalable, repeatable, and efficient operations. The growing popularity of these smart technologies represents a major opportunity for lighting manufacturers and agri-tech companies entering the cannabis sector.

North America Cannabis Grow Lights Market By Product Insights

Light-emitting diode (LED) lights dominated the product segment and are projected to witness the fastest growth during the forecast period. LEDs have transformed the cannabis cultivation landscape in North America, providing growers with an efficient, long-lasting, and low-heat solution that supports better crop yields. The customizability of LEDs to emit specific light spectrums enhances different stages of plant growth, from vegetative to flowering. Additionally, their lower power consumption and reduced need for HVAC systems make them cost-effective in the long run, despite the high initial investment. Several cultivators have transitioned from traditional HID setups to LEDs, leading to a significant market shift in favor of LED lighting systems.

On the other hand, ceramic metal-halide (CMH) lights are emerging as a preferred alternative for mid-sized growers who seek a balance between cost and performance. CMH lights offer broader spectral output compared to traditional HID and are valued for their high color rendering index (CRI), which supports healthier and more potent cannabis plants. Fluorescent lights, particularly T5 and CFL lamps, are typically favored in the early stages of plant growth or by hobbyist growers, while HID lights, especially high-pressure sodium (HPS) and metal-halide variants, are still used by large-scale growers due to their affordability and intensity. However, the industry’s growing focus on energy efficiency is steadily shifting momentum toward LED and CMH technologies.

North America Cannabis Grow Lights Market By Cultivation Insights

Indoor cultivation dominated the cannabis grow lights market, primarily due to the precision it offers in terms of environmental control. In North America, where regulatory zoning laws often restrict outdoor cannabis farming, indoor setups offer the safest and most compliant method for cannabis growth. Controlled environments allow for year-round production cycles, protection against pests and weather fluctuations, and tighter control over quality, potency, and strain characteristics. Indoor cultivation is particularly prevalent in urban areas or regions with harsh climates, where growers rely entirely on grow lights for photosynthesis. Consequently, lighting systems, especially LEDs, play a critical role in sustaining the indoor cannabis cultivation model.

Greenhouse cultivation is, however, the fastest-growing segment, driven by the need to combine the best of natural sunlight and artificial lighting. Greenhouses offer cultivators an energy-efficient solution by supplementing sunlight with grow lights during low-light periods or seasons. This hybrid model reduces energy expenses while maintaining high yields, making it attractive for medium to large-scale commercial operations. As sustainability becomes a priority, and states like California and British Columbia encourage green practices, greenhouse setups using supplemental LED and CMH lighting are expected to grow rapidly. This trend has been further accelerated by advancements in transparent solar panels and climate control technologies.

Country Insights

United States

The U.S. holds the largest share of the North America cannabis grow lights market. The country’s evolving regulatory landscape, with over 20 states having legalized recreational cannabis and more allowing medical marijuana, has catalyzed the rapid expansion of cultivation facilities. Indoor and greenhouse cannabis farming is thriving in states like California, Colorado, and Oregon, where large-scale production demands sophisticated lighting systems. Furthermore, American companies are heavily investing in R&D to develop smart and energy-efficient grow lights that align with sustainability goals and state energy policies.

Canada

Canada’s cannabis cultivation industry has matured significantly since the legalization of recreational marijuana in 2018. With licensed producers operating in both urban indoor setups and expansive greenhouses, demand for varied grow lighting technologies continues to rise. Canadian growers prioritize full-spectrum LEDs and CMH lights for consistent crop quality, especially for medical-grade cannabis. Government incentives for energy conservation and sustainable agriculture further drive the adoption of advanced lighting systems across the country.

Mexico

Mexico is an emerging player in the cannabis grow lights market, following the decriminalization of cannabis for personal use and the push toward regulatory frameworks for industrial cultivation. Though commercial cannabis cultivation is in its infancy, favorable climatic conditions paired with greenhouse infrastructures offer immense potential. The anticipated legalization of recreational cannabis and foreign investments in grow infrastructure are likely to drive future demand for supplemental lighting systems, especially in indoor and greenhouse farming models.

North America Cannabis Grow Lights Market Recent Developments

-

Fluence by OSRAM announced in January 2025 a strategic partnership with a large Canadian cannabis producer to supply high-efficiency LED lighting solutions for its new cultivation facility in Ontario. The deal underscores Fluence's expanding footprint in the Canadian market.

-

Signify (formerly Philips Lighting) revealed in October 2024 the launch of its next-generation GrowWise control system, tailored for cannabis cultivation, offering programmable lighting spectrums and AI-powered crop modeling tools to support growers in the U.S.

-

Gavita (a Hawthorne Gardening Company brand) partnered with a cannabis operator in California in September 2024 to implement a large-scale hybrid lighting system combining LED and HPS technologies across multiple greenhouses.

-

Heliospectra AB, in November 2024, introduced a fully integrated light control system for North American cannabis growers, enabling dynamic light responses based on real-time environmental monitoring data.

Some of the prominent players in the North America cannabis grow lights market include:

- Koninklijke Philips N.V.

- Valoya

- Heliospectra

- Kind LED Grow Lights

- VIVOSUN

- California LightWorks

- Biological Innovation and Optimization Systems, LLC

- ViparSpectra

- Mars Hydro

- Hydrobuilder.com

- Hydrofarm

- Active Grow

- Thrive Agritech

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America cannabis grow lights market

Product

- Light-emitting diode (LED) Lights

- High-intensity discharge (HID) Lamps/Lights

-

- High Pressure Sodium Bulbs

- Metal-halide (MH) Lights

-

- T5 Fluorescent Grow Lights/Lamps

- Compact Fluorescent Light/ Lamp (CFL)

- Ceramic metal-halide (CMH) Lights

Cultivation

- Indoor Cultivation

- Greenhouse Cultivation

Country