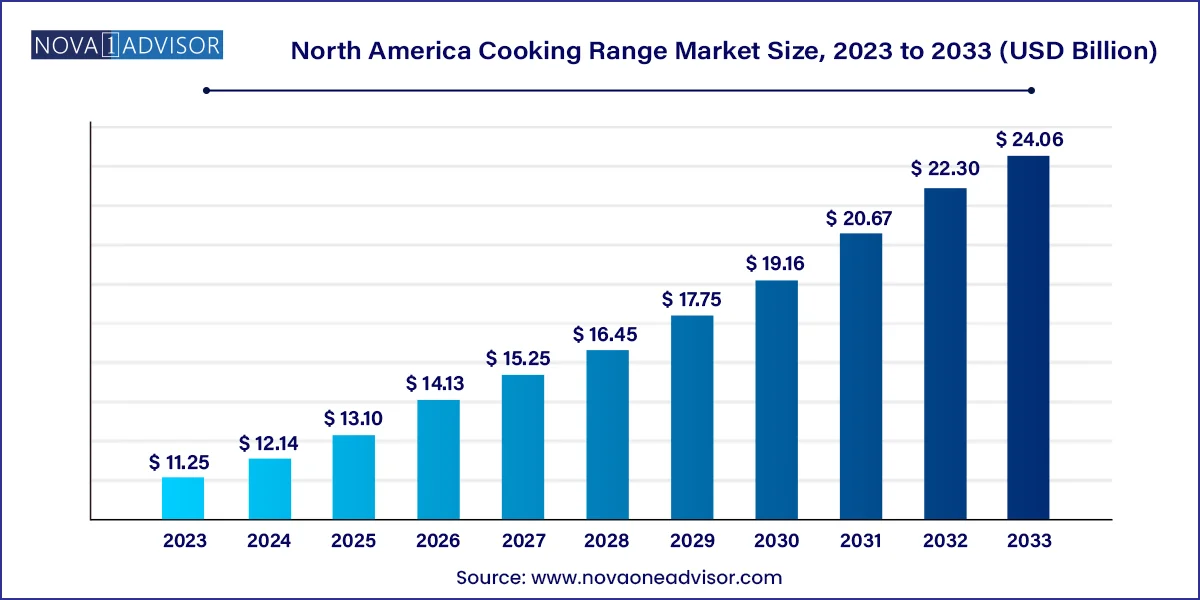

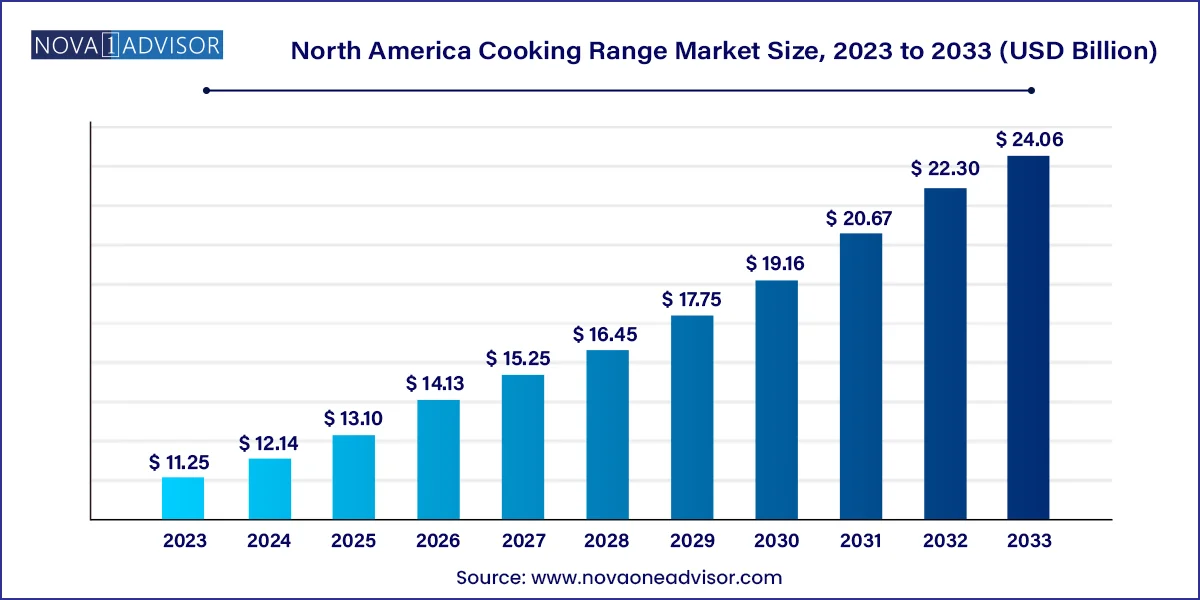

North America Cooking Range Market Size and Growth

The North America cooking range market size was exhibited at USD 11.25 billion in 2023 and is projected to hit around USD 24.06 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

North America Cooking Range Market Key Takeaways:

- Based on fuel type, the gas cooking range segment led the market with the largest revenue share of 46.09% in 2023.

- The induction cooking ranges segment is projected to grow at the fastest CAGR of 10.1% from 2024 to 2033.

- Based on size, the 30 inch segment held the market with the largest revenue share of 50.83% in 2023.

- The 36 inch segment is expected to grow at the fastest CAGR of 9.6% from 2024 to 2033.

- Based on installation, the free-standing segment led the market with the largest revenue share of 70.12% in 2023.

- The slide-in cooking ranges segment is projected to register at the fastest CAGR of 9.3% from 2024 to 2033.

- Based on distribution channel, the home improvement stores segment led the market with the largest revenue share of 38.28% in 2023.

- The online distribution channel segment is expected to grow at the fastest CAGR of 8.8% from 2024 to 2033.

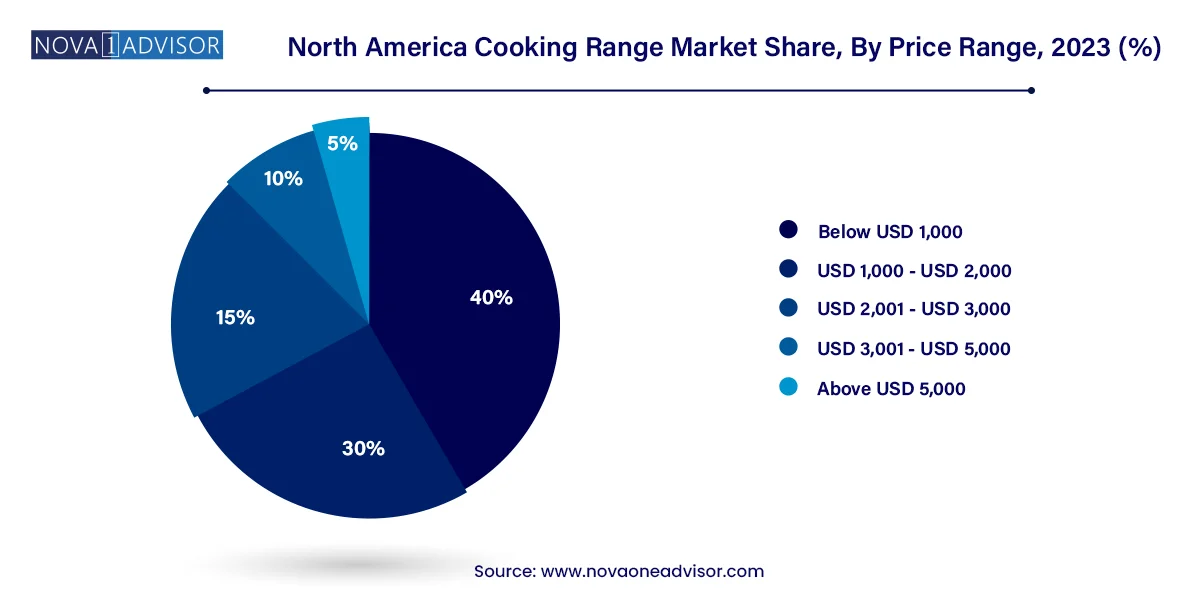

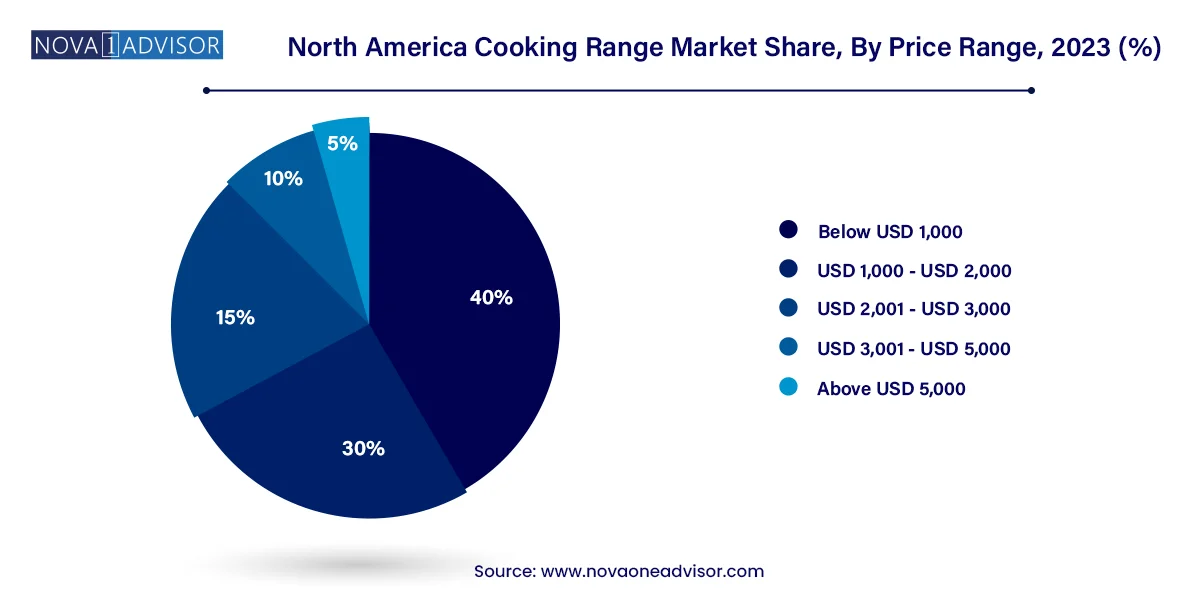

- Based on price range, the cooking ranges below USD 1,000 segment led the market with the largest revenue share of 40.0% in 2023.

- The cooking ranges priced USD 2,001 - USD 3,000 segment is expected to grow at the fastest CAGR of 10.3% from 2024 to 2033.

Market Overview

The North America cooking range market is undergoing a transformative evolution, fueled by technological advancements, changing consumer preferences, and heightened emphasis on kitchen aesthetics. Traditionally seen as a functional component of domestic and commercial kitchens, cooking ranges have evolved into smart, multifunctional, and energy-efficient appliances. Whether powered by gas, electricity, or induction, modern cooking ranges are engineered to offer convenience, precision, and connectivity—shaping a dynamic and competitive marketplace in both the United States and Canada.

Consumer lifestyles in North America are heavily intertwined with home cooking, culinary experimentation, and appliance personalization. Cooking ranges, therefore, are not only utilitarian devices but also statements of culinary ambition and design sensibility. The shift towards modular kitchens, increased home ownership, and a surge in at-home dining post-pandemic have dramatically increased the demand for high-performance and aesthetically integrated cooking ranges.

Leading manufacturers are now offering smart ranges with Wi-Fi controls, auto-shut features, guided cooking interfaces, and compatibility with virtual assistants like Amazon Alexa and Google Assistant. Additionally, sustainability and energy efficiency are key concerns shaping consumer behavior, with ENERGY STAR-rated appliances and induction ranges gaining traction. Whether it's a compact 20-inch electric range for a studio apartment or a luxury dual-fuel 36-inch slide-in model for a suburban villa, the North America cooking range market caters to a wide spectrum of user needs and budgets.

Major Trends in the Market

-

Integration of Smart Technology and IoT Features: Wi-Fi-enabled cooking ranges with mobile app control and voice assistant compatibility are rapidly gaining popularity.

-

Rising Demand for Induction and Dual-Fuel Ranges: Consumers are increasingly seeking faster, cleaner, and more energy-efficient cooking methods.

-

Growth in Premium and Luxury Cooking Ranges: High-end ranges with built-in convection, touchscreens, and stylish finishes are becoming kitchen centerpieces.

-

Compact and Modular Kitchen Solutions: Increase in demand for 20- and 24-inch ranges in urban settings and apartments.

-

Sustainability Focus and Energy Efficiency: Brands are pushing ENERGY STAR-certified models and recyclable packaging to appeal to eco-conscious consumers.

-

Customization and Aesthetic Variety: Availability of custom finishes (matte black, stainless steel, navy blue) and color-matching for cohesive kitchen décor.

-

Rise in E-commerce and Direct-to-Consumer Sales: Online platforms provide greater product visibility, reviews, and purchase convenience.

-

Bundling of Appliances in Home Renovation Projects: Cooking ranges are often bundled with hoods, microwaves, and dishwashers in complete kitchen packages.

Report Scope of North America Cooking Range Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 12.14 Billion |

| Market Size by 2033 |

USD 24.06 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Fuel Type, Size, Installation, Distribution Channel, Price Range, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada |

| Key Companies Profiled |

BSH Hausgeräte GmbH; Miele & Cie. KG; Whirlpool Corporation; Electrolux AB; Haier; Samsung; Sub-Zero Group, Inc.; Smeg S.p.A; LG Electronics; Viking Range, LLC; Big Chill; Elmira Stove Works; Lacanche; La Cornue; AGA Rangemaster Limited; Galanz Americas Limited Company |

Market Driver: Surge in Home Cooking and Kitchen Renovation Activities

One of the most influential drivers of the North America cooking range market is the increase in home cooking and kitchen remodeling initiatives, particularly since the onset of the COVID-19 pandemic. With dining out limited and safety concerns heightened, consumers turned to their kitchens as both practical and emotional centers of the home. This shift triggered a massive rise in demand for high-performance cooking appliances that enable meal customization, experimentation, and gourmet-style preparation.

Even as lockdowns lifted, the trend of home cooking remained embedded in lifestyle changes. In 2023, U.S. home improvement spending exceeded $450 billion, with kitchen upgrades leading the charge. Cooking ranges are central to such renovations, with consumers favoring models that blend visual appeal with precision performance. As more homeowners prioritize aesthetics and functionality, cooking ranges with integrated smart sensors, dual ovens, and steam-cleaning capabilities are becoming kitchen staples, driving sustained demand.

Market Restraint: High Cost of Premium and Smart Cooking Ranges

Despite growing demand, cost remains a significant barrier to broader market penetration, especially for smart and premium cooking ranges. Advanced features such as touch displays, smart connectivity, dual-fuel capability, and convection systems often push prices well beyond $2,000—making them less accessible to budget-conscious households and renters. Additionally, installation costs for slide-in or larger units can be high, particularly in homes that require gas line conversions or custom cabinetry modifications.

Moreover, consumers may hesitate to adopt newer technologies due to perceived complexity or concerns over durability. While tech-savvy users embrace IoT-enabled appliances, older demographics or first-time buyers may prefer traditional models. This results in a slower adoption rate for higher-priced segments, thereby limiting potential growth among middle-income households and price-sensitive regions.

Market Opportunity: Growth in Smart and Connected Appliance Ecosystem

An expanding smart home ecosystem across North America presents a significant opportunity for manufacturers of cooking ranges. Consumers are increasingly investing in interconnected appliances that offer convenience, energy monitoring, and real-time control. Smart cooking ranges equipped with app-based notifications, self-diagnostic tools, and personalized cooking presets fit naturally into this ecosystem.

Startups and established brands alike are launching models that sync with recipe apps, auto-adjust cooking temperatures, and provide voice command capabilities. This integration enhances user experience while offering energy savings and improved safety. Furthermore, smart cooking ranges enable remote diagnostics and over-the-air software updates, reducing after-sales service costs and increasing brand stickiness. As smart home adoption climbs, particularly among millennials and new homeowners, connected cooking ranges are poised to become a standard feature in modern kitchens.

North America Cooking Range Market By Fuel Type Insights

Based on fuel type, the gas cooking range segment led the market with the largest revenue share of 46.09% in 2023. Largely due to their precise heat control, high cooking temperatures, and widespread infrastructure compatibility. Preferred by professional chefs and culinary enthusiasts, gas ranges offer instant flame adjustments and visual feedback. In the U.S., where many homes already have natural gas connections, these models remain a top choice. Additionally, newer designs with sealed burners, cast iron grates, and integrated griddles enhance appeal among residential buyers.

The induction cooking ranges segment is projected to grow at the fastest CAGR of 10.1% from 2024 to 2033. Owing to their energy efficiency, safety features, and sleek design. Induction ranges use electromagnetic technology to heat cookware directly, reducing heat loss and cook time. They are ideal for households seeking a cleaner, safer cooking experience—particularly those with children or limited ventilation. Their rise is fueled by growing awareness of electric alternatives amid decarbonization initiatives and city ordinances discouraging gas use in new construction. As price points gradually decline and cookware compatibility improves, induction ranges are expected to capture significant market share.

North America Cooking Range Market By Size Insights

Based on size, the 30 inch segment held the market with the largest revenue share of 50.83% in 2023. Whether for single-family homes or condos, this size fits most cabinetry and meets the average household’s cooking needs. It is widely available in all fuel types and price tiers, from basic electric coil models to high-end dual-fuel systems. Most promotional bundles and retail floor displays feature 30-inch units, reflecting their widespread acceptance.

The 36 inch segment is expected to grow at the fastest CAGR of 9.6% from 2024 to 2033. Particularly among premium buyers and remodelers seeking commercial-style performance. These ranges often feature six burners, spacious ovens, and advanced features such as steam assist, sous vide, or griddle integration. They are popular in luxury homes, custom kitchens, and among consumers who frequently host or cook large meals. Though pricier and requiring more space, they align with the trend of elevating home cooking to gourmet standards.

North America Cooking Range Market By Installation Insights

Based on installation, the free-standing segment led the market with the largest revenue share of 70.12% in 2023. These models are self-contained, have finished sides, and can be placed between cabinets or against walls—making them ideal for mass housing developments, rental properties, and consumers seeking simple appliance upgrades. They are also easier to relocate during kitchen remodels, which boosts their appeal in temporary housing or modular kitchens.

The slide-in cooking ranges segment is projected to register at the fastest CAGR of 9.3% from 2024 to 2033. Designed to blend seamlessly with countertops, these ranges offer a built-in look without custom cabinetry. Their front-facing controls and continuous cooktops contribute to a sleek aesthetic and ergonomic advantage. Builders and interior designers favor slide-in models for open-concept kitchens and integrated appliance suites, driving their rapid adoption.

North America Cooking Range Market By Distribution Channel Insights

Based on distribution channel, the home improvement stores segment led the market with the largest revenue share of 38.28% in 2023. As retailers like Home Depot, Lowe’s, and RONA offer extensive in-store appliance showrooms, delivery services, and bundled deals. These retailers attract DIY homeowners and contractors alike, facilitating comparison shopping and quick replacements during renovations. Their ability to offer installation and extended warranties further cements their leadership.

The online distribution channel segment is expected to grow at the fastest CAGR of 8.8% from 2024 to 2033. E-commerce platforms like Amazon, Best Buy, and direct-to-consumer brand sites offer detailed specifications, customer reviews, and virtual design tools. COVID-19 accelerated this shift, with brands now investing heavily in digital storefronts, AR-powered product visualization, and flexible return policies.

North America Cooking Range Market By Price Range Insights

Based on price range, the cooking ranges below USD 1,000 segment led the market with the largest revenue share of 40.0% in 2023. These ranges often include stainless steel finishes, convection ovens, and dual-burner flexibility. They are common in both new builds and appliance replacement cycles, appealing to a broad demographic.

The cooking ranges priced USD 2,001 - USD 3,000 segment is expected to grow at the fastest CAGR of 10.3% from 2024 to 2033. particularly for dual-fuel, 36-inch, and smart-enabled models. These ranges target upscale remodels, culinary enthusiasts, and consumers upgrading as part of luxury home purchases. Brands differentiate themselves in this category through build quality, aesthetic variety, and proprietary technologies—capturing higher margins and brand loyalty.

Country Insights

United States

The U.S. represents the largest market for cooking ranges in North America, fueled by a combination of new home construction, kitchen remodeling projects, and a deeply rooted cooking culture. With diverse household types—from studio apartments in New York to suburban homes in Texas—there’s consistent demand across all fuel types and sizes. The U.S. market also leads in smart cooking range adoption, with manufacturers offering Wi-Fi integration, app-controlled features, and smart diagnostics as standard in many models.

Additionally, government programs promoting energy efficiency, such as ENERGY STAR rebates, encourage consumers to upgrade older units to more sustainable alternatives. Urban regulations in cities like San Francisco are also encouraging the switch from gas to electric or induction ranges, influencing market dynamics regionally.

Canada

Canada’s cooking range market is growing steadily, characterized by a balanced mix of gas and electric units, and an increasing tilt toward induction ranges in metropolitan areas. Cold weather climates and longer indoor cooking seasons contribute to strong appliance usage, while growing eco-consciousness drives interest in energy-efficient models. Major cities like Toronto and Vancouver exhibit high demand for modern, space-saving designs and smart-enabled units.

Canadian consumers are also strongly influenced by safety and warranty coverage, prompting purchases from established, reputable brands. Retailers such as Canadian Tire and The Brick play a major role in appliance distribution, while online sales continue to expand, supported by bilingual product information and government energy incentives.

Some of the prominent players in the North America cooking range market include:

- BSH Hausgeräte GmbH

- Miele & Cie. KG

- Whirlpool Corporation

- Electrolux AB

- Haier

- Samsung

- Sub-Zero Group, Inc.

- Smeg S.p.A

- LG Electronics

- Viking Range, LLC

- Big Chill

- Elmira Stove Works

- Lacanche

- La Cornue

- AGA Rangemaster Limited

- Galanz Americas Limited Company

North America Cooking Range Market Recent Developments

-

March 2024 – Whirlpool Corporation unveiled its new “W Collection Smart Slide-In Ranges” across North America, featuring adaptive cooking technology and app-guided recipes.

-

January 2024 – Samsung announced upgrades to its Bespoke line in the U.S., including dual-fuel and induction ranges with customizable panels and smart cooktop features.

-

November 2023 – LG launched its “ProBake Convection+ Induction Range” in Canada, targeting eco-conscious consumers with enhanced energy savings and auto-clean features.

-

August 2023 – GE Appliances introduced a line of commercial-style 36-inch dual-fuel ranges designed for high-end residential kitchens in the U.S.

-

June 2023 – Bosch Home Appliances expanded its U.S. production facility to meet growing demand for electric and induction cooking ranges.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America cooking range market

Fuel Type

- Gas Cooking Range

- Electric Cooking Range

- Dual Fuel Cooking Range

- Induction Cooking Range

Size

- 20 Inches

- 24 Inches

- 30 Inches

- 36 Inches

- Others

Installation

- Free-Standing

- Slide-In

- Others

Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Home Improvement Stores

- Online

- Others

Price Range

- Below USD 1,000

- USD 1,000 - USD 2,000

- USD 2,001 - USD 3,000

- USD 3,001 - USD 5,000

- Above USD 5,000

Country