North America Disposable Endoscopes Market Size and Trends 2026 to 2035

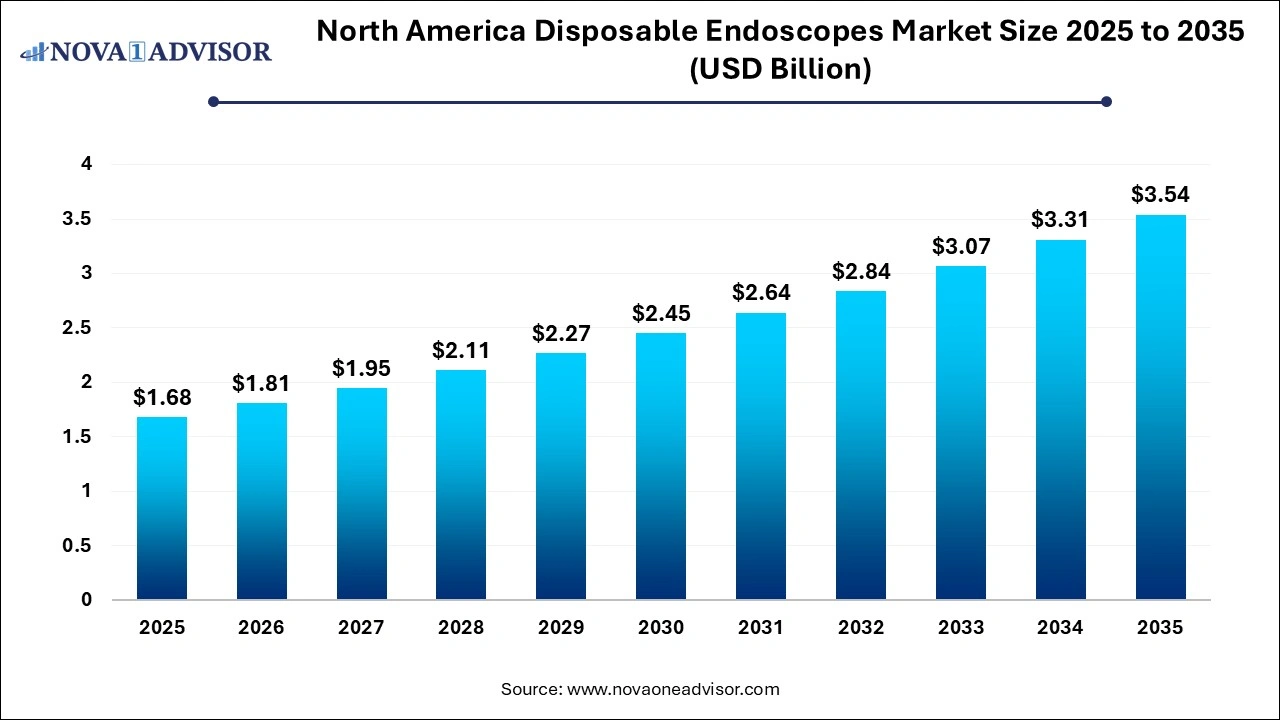

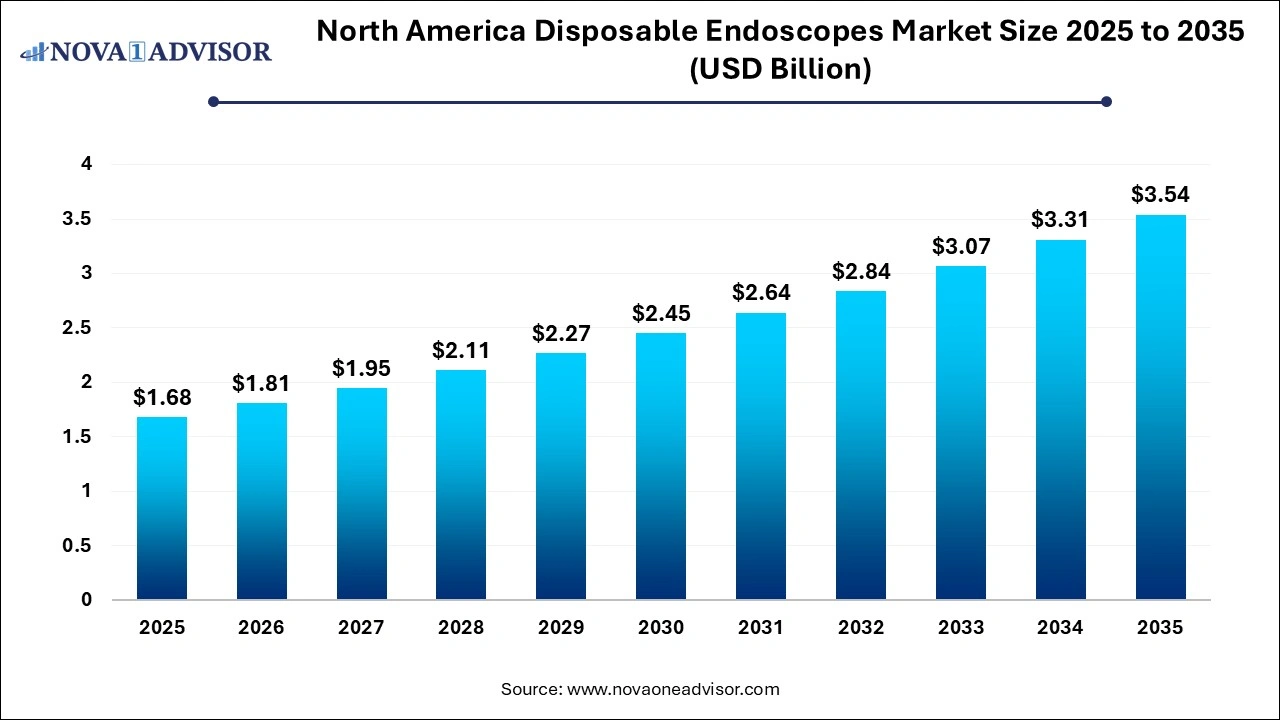

The North America disposable endoscopes market size was exhibited at USD 1.68 billion in 2025 and is projected to hit around USD 3.54 billion by 2035, growing at a CAGR of 7.74% during the forecast period 2026 to 2035. The increasing demand for minimally invasive surgeries, rising concerns about infection control, and advancements in disposable endoscope technology are driving the North American disposable endoscopes market.

North America Disposable Endoscopes Market Key Takeaways:

- The gastrointestinal endoscopes segment dominated the market with revenue share of 56.6% in 2025.

- The laparoscopes segment is expected to witness fastest CAGR growth during the forecast period.

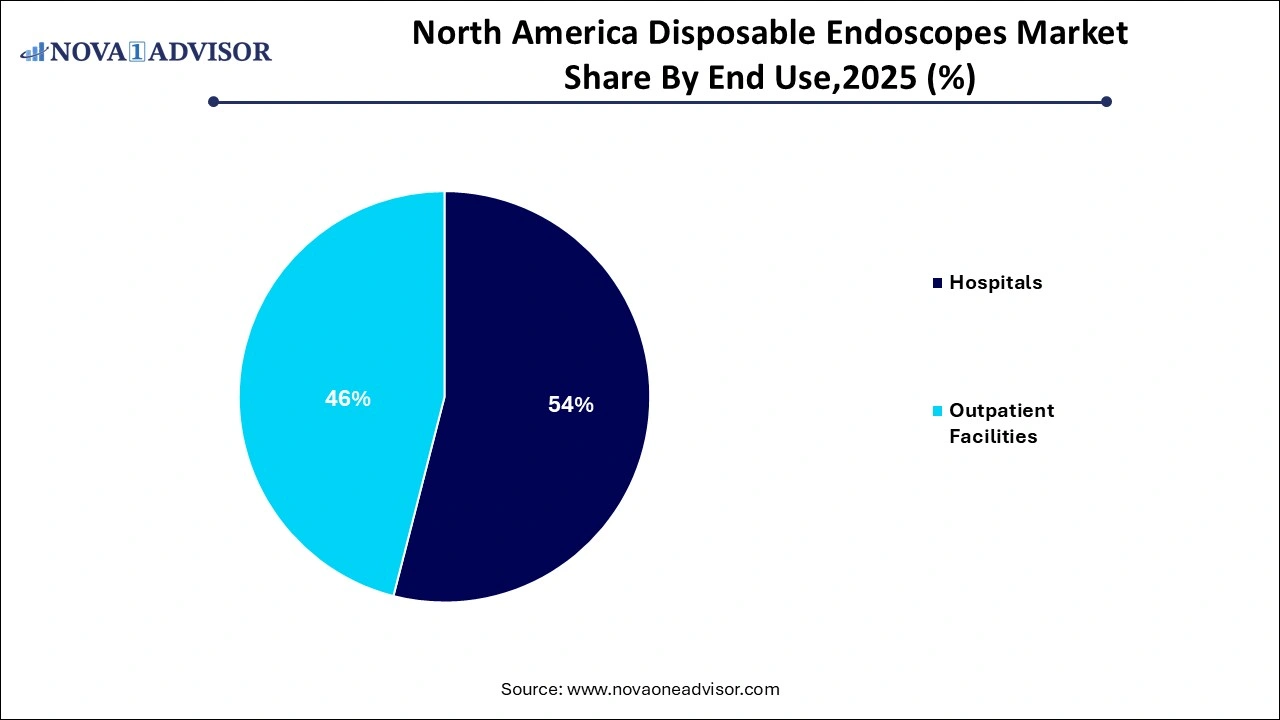

- The outpatient facilities’ segment dominated the market in 2025 and accounted for the largest revenue share of 46%.

- The hospitals segment is anticipated to register a significant growth over the forecast period.

North America Disposable Endoscopes Market Overview

The North America disposable endoscopes market has seen rapid growth due to increasing preference for minimally invasive surgical procedures and the need to reduce the risk of cross-contamination and infections during medical procedures. Disposable endoscopes, used in a variety of applications such as gastrointestinal, urology, gynecology, and respiratory procedures, offer several advantages, including lower risk of infection, reduced sterilization costs, and convenience for healthcare providers. The market is further supported by technological advancements that enhance the performance and image quality of disposable endoscopes, making them increasingly popular in hospitals and outpatient facilities across the region.

Major Trends in the North America Disposable Endoscopes Market

- Technological Advancements: Continuous improvements in image resolution, flexibility, and ergonomics of disposable endoscopes.

- Increased Adoption in Outpatient Facilities: Growing use of disposable endoscopes in outpatient settings due to cost-effectiveness and convenience.

- Rising Preference for Minimally Invasive Surgeries: More patients and healthcare providers opting for minimally invasive procedures that use endoscopic devices.

- Regulatory Push for Safety: Increasing regulations around infection control in medical settings are driving the adoption of disposable endoscopes.

- Growing Demand for Gastrointestinal Procedures: Increased use of disposable endoscopes in gastrointestinal diagnostics, especially for procedures like colonoscopies.

Regulatory Shifts in North America Disposable Endoscopes Market

Regulatory agencies are focused on implementing stringent guidelines for ensuring patient safety in North America. Disposable endoscopes eliminate the risk of cross-contamination and possible infections which is driving their adoption in the region by healthcare professionals. Understanding the potential and improved patient outcomes, regulatory bodies like the U.S. Food and Drug Administration (FDA) is issuing 510 (k) clearances for innovative disposable endoscopes to accelerate their commercialization process. Continuous technological advancements such as use of novel materials and design is facilitating the development of more affordable, effective and safe for use disposable endoscopes. Moreover, easy to use designs with enhanced features and cost-effectiveness of single-use endoscopes is driving their adoption in outpatient settings and ambulatory centers.

Report Scope of North America Disposable Endoscopes Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 1.81 Billion |

| Market Size by 2035 |

USD 3.54 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.74% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Type, By End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America |

| Key Companies Profiled |

Olympus Corporation; Boston Scientific Corporation; PENTAX Medical (Hoya Corporation); FUJIFILM Holdings Corporation; Karl Storz GmbH & Co., KG; Stryker; Medtronic; Ambu A/S; STERIS plc. |

North America Disposable Endoscopes Market Dynamics

Driver

Rising Demand for Minimally Invasive Surgeries

The growing preference for minimally invasive surgeries is one of the key drivers of the disposable endoscopes market in North America. These procedures, which use small incisions and endoscopic techniques, offer several benefits such as reduced recovery time, minimal scarring, and lower risk of complications. As healthcare providers strive to meet the increasing patient demand for such procedures, disposable endoscopes have become essential tools. Since disposable endoscopes do not require sterilization, they ensure a higher level of hygiene and convenience for both patients and healthcare providers, which is particularly crucial for invasive surgeries in hospitals and outpatient centers.

Restraint

High Cost of Disposable Endoscopes

One of the main restraints in the North America disposable endoscopes market is the higher cost associated with these devices compared to reusable endoscopes. Disposable endoscopes, while offering benefits in terms of infection control and convenience, are often priced higher than reusable counterparts. The cost of regularly purchasing disposable endoscopes can add up over time, making it a concern for budget-conscious healthcare facilities. This can limit their widespread adoption, especially in smaller clinics and outpatient settings that may prefer reusable, cost-effective alternatives. As a result, healthcare providers must weigh the benefits of disposable endoscopes against the financial investment required.

Opportunity

Advancements in Endoscope Technology

Technological advancements present a significant opportunity for growth in the disposable endoscopes market. Innovations such as improved optics, better maneuverability, and enhanced image quality are making disposable endoscopes increasingly competitive with reusable models. Additionally, advancements in material science are leading to the development of stronger, more flexible endoscopes that offer better performance. These technological improvements not only increase the efficiency and outcomes of medical procedures but also help reduce the overall costs of using disposable endoscopes. As these devices continue to evolve, their adoption across various medical specialties will increase, creating growth opportunities for manufacturers and healthcare providers.

North America Disposable Endoscopes Market Segmental Insights

By Type Insights

The gastrointestinal endoscopes segment dominated the market with revenue share of 56.6% in 2025. The increasing prevalence of gastrointestinal diseases, including colorectal cancer, irritable bowel syndrome (IBS), and other digestive disorders, has significantly contributed to the high demand for gastrointestinal endoscopy procedures. Disposable gastroscopes and colonoscopes offer critical advantages in reducing the risk of infection during diagnostic and therapeutic procedures. With the rising number of screenings and diagnostic tests for gastrointestinal issues, this segment remains the largest contributor to market revenue in North America. Furthermore, the increasing awareness of colon cancer screening is expected to continue driving growth in this segment.

The laparoscopes segment is expected to witness fastest CAGR growth during the forecast period. Laparoscopic surgery, used in various surgical specialties such as gynecology, urology, and general surgery, is becoming more popular due to its minimally invasive nature and reduced recovery times. Disposable laparoscopes are particularly in demand for outpatient procedures where convenience and infection control are critical. As the healthcare industry continues to focus on reducing costs while improving patient outcomes, disposable laparoscopes are gaining traction. The development of improved laparoscopic devices with enhanced image quality and flexibility is expected to further accelerate growth in this segment.

By End-use Insights

The outpatient facilities’ segment dominated the market in 2025 and accounted for the largest revenue share of 46%. These facilities, which handle less complex and lower-risk procedures, benefit greatly from the use of disposable endoscopes due to their cost-effectiveness, convenience, and minimal maintenance requirements. With the increasing shift towards outpatient surgeries and diagnostic procedures in North America, outpatient facilities are adopting disposable endoscopes for procedures like colonoscopies, gastroscopies, and bronchoscopy. The lower cost and reduced need for sterilization make disposable endoscopes an attractive option for outpatient centers looking to streamline operations and improve patient throughput.

The hospitals represent the fastest-growing segment in the disposable endoscopes market, being the primary centers for complex and high-risk procedures, and are the largest consumers of disposable endoscopes. The demand for these devices in hospitals is driven by the need to maintain high levels of infection control and patient safety during procedures like gastrointestinal surgeries, laparoscopy, and bronchoscopy. Hospitals often prefer disposable endoscopes due to the ease of use, reduced sterilization costs, and reduced risk of cross-contamination. As healthcare standards continue to prioritize patient safety, hospitals will remain the leading consumers of disposable endoscopes.

Country-Level Insights

North America is major region in the disposable endoscopes market. The market growth can be attributed to increased emphasis on infection control, rising prevalence of chronic diseases requiring endoscopy for diagnostic purposes and well-developed healthcare infrastructure.

U.S. Market Trends

U.S. is major contributor in the North America disposable endoscopes market. According to the National Institutes of Health (NIH), approximately 17.7 million gastrointestinal (GI) endoscopic procedures are performed every in the U.S. which contributes to 68% of all the endoscopic procedures performed. Rising concerns regarding hospital-acquired infections (HAIs), increased demand for minimally invasive surgical procedures, regulatory support, surging chronic disease burden and aging demographics are driving the market growth.

Canada Market Trends

Canada is witnessing significant growth in the North America disposable endoscopes market. The market growth is driven by rising focus on patient safety and infection control, ongoing technological innovations and increased demand for endoscopic procedures for various diagnostic purposes. Stringent healthcare regulations imposed by the Canadian government are pushing healthcare facilities to adopt disposable alternatives. Moreover, increased investments in expanding healthcare infrastructure and favourable reimbursement policies are fuelling the market expansion.

Some of the prominent players in the North America disposable endoscopes market include:

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S

- STERIS plc.

North America Disposable Endoscopes Market Recent Developments

- In November 2024, Verathon, a U.S.-based respiratory medtech company, a division of Roper Industries, introduced Spectrum QC eco, a first-of-a-kind single-use video laryngoscope. The device received an International Sustainability and Carbon Certification (ISCC) as its shell is made up of 80% bio-based plastics.

- In July 2024, Ambu, a maker of single-use endoscopy solutions, received the Food and Drug Administration’s 510 (k) clearance for its ureteroscopy solution, aScope 5 Uretero, a single-use digital flexible ureteroscope and aBox 2, the full-HD endoscopy system.

- In May 2024, Olympus, an international medical technology company, declared availability of its new all-in-one video processor and monitor, DVM-B2 Digital Video Monitor which can be used with single-use endoscopes for both bronchoscopy and ENT.

- In January 2024, Boston Scientific launched its single-use flexible cytoscope, VersaVue which will assist clinicians in diagnosing and treating urinary tract conditions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the North America disposable endoscopes market

Type

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Otoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Gastrointestinal Endoscopes

-

- Gastroscope (Upper GI Endoscope)

- Enteroscope

- Sigmoidoscope

- Duodenoscope

- Colonoscope

End-use

- Hospitals

- Outpatient facilities

Country