North America Electronic Health Records Market Size and Trends

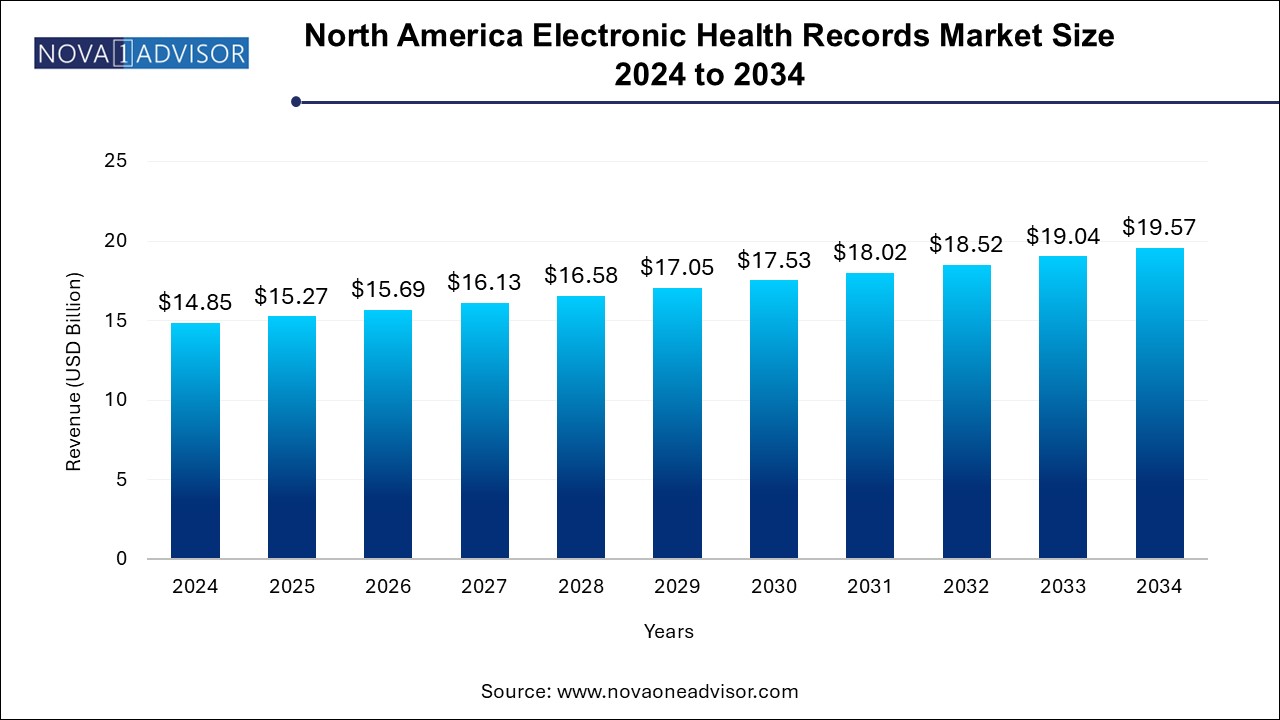

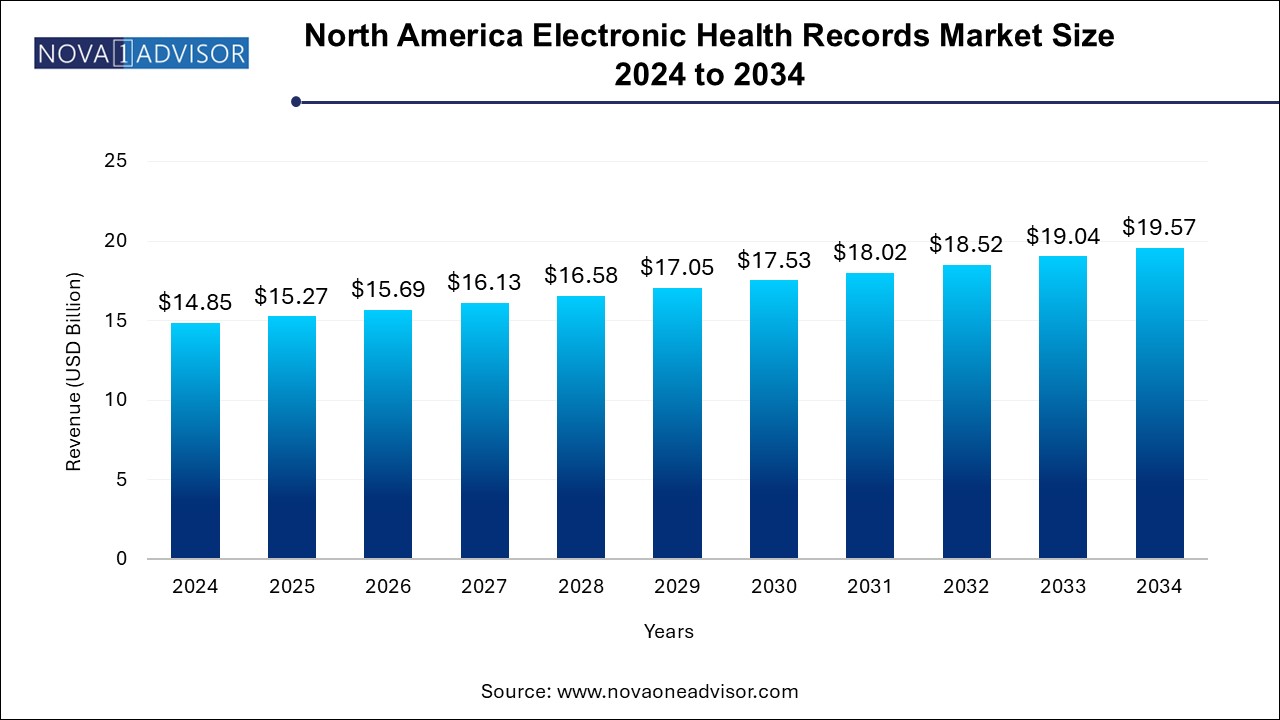

The North America electronic health records market size was exhibited at USD 14.85 billion in 2024 and is projected to hit around USD 19.57 billion by 2034, growing at a CAGR of 2.8% during the forecast period 2024 to 2034. The increasing demand for healthcare digitization and government incentives for adopting electronic health records are key drivers of the EHR market in North America.

North America Electronic Health Records Market Key Takeaways:

- The web/cloud-based EHR segment dominated the market in 2024 with a market share of 84.0% and is anticipated to grow at the fastest rate during the forecast period.

- However, the on-premises EHR segment is expected to grow significantly during the forecast period.

- The acute segment dominated the market in 2024 with a market share of 46.03%.

- The post-acute segment is expected to grow at the fastest rate during the forecast period.

- The professional services segment dominated the market in 2024 with a market share of 32.33% and is expected to grow at the fastest rate during the forecast period.

- The hospital use segment dominated the market in 2024 with a market share of 52.96%.

- The ambulatory use segment is expected to grow at the fastest growth rate during the forecast period.

- The cardiology segment dominated the market in 2024 with a market share of 9.45% and is expected to grow at the fastest rate during the forecast period.

Market Overview

The North America Electronic Health Records (EHR) market is experiencing substantial growth as healthcare providers increasingly shift towards digital solutions for managing patient information. EHRs provide a digital version of a patient's medical history, improving the quality of care by facilitating seamless sharing of health data across providers. This shift is fueled by the need to streamline healthcare workflows, enhance patient outcomes, and reduce operational costs. With the adoption of EHRs, healthcare organizations can improve efficiency, reduce errors, and enhance communication among medical teams. Additionally, government regulations and incentives in North America, especially in the U.S., are playing a vital role in accelerating the widespread use of EHR systems.

Major Trends in the Market

- Cloud-based EHR Solutions: Increasing preference for cloud-based EHR systems due to their cost-effectiveness, scalability, and ease of access.

- Interoperability Advancements: Enhanced focus on ensuring that EHR systems can share data seamlessly across various platforms and healthcare providers.

- Artificial Intelligence Integration: Growing integration of AI to automate tasks such as data entry and assist in diagnostic processes.

- Patient-Centered EHR Systems: Increasing emphasis on EHR systems that enhance patient engagement and empower patients to access and manage their health records.

- Government Regulations and Incentives: Ongoing government incentives, particularly in the U.S., that encourage the adoption of EHRs to improve healthcare delivery.

Report Scope of North America Electronic Health Records Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 15.27 Billion |

| Market Size by 2034 |

USD 19.57 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 2.8% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Type, Business Model, Application, End use, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

AdvancedMD, Inc.; CureMD Healthcare; eClinicalWorks; Epic Systems Corporation; GE Healthcare; Greenway Health, LLC; McKesson Corporation; NXGN Management, LLC.; Oracle; TruBridge (CPSI); Veradigm LLC |

Driver: Government Incentives for EHR Adoption

Government incentives, particularly through initiatives like the Health Information Technology for Economic and Clinical Health (HITECH) Act in the U.S., have significantly driven the adoption of electronic health records in North America. These incentives have provided financial support for healthcare providers to transition from paper-based systems to EHRs. This initiative has not only increased the adoption rate but also enhanced the overall efficiency and accuracy of healthcare operations. Additionally, as part of the Affordable Care Act (ACA), the U.S. government has emphasized the importance of EHR systems for reducing healthcare costs, improving care coordination, and enhancing data security. Such governmental efforts are essential for the continued growth of the EHR market in the region.

Restraint: High Implementation Costs

One of the significant restraints hindering the rapid adoption of EHR systems in North America is the high implementation cost. While the long-term benefits of EHRs, such as improved patient care and reduced administrative costs, are clear, the initial cost of implementing these systems remains a major barrier for many healthcare organizations. Small and mid-sized healthcare providers, in particular, face challenges in terms of financing and resource allocation for EHR implementation. Furthermore, the costs associated with training staff, integrating existing systems, and ensuring ongoing maintenance can add to the financial burden. As a result, many healthcare organizations are hesitant to fully adopt EHR systems due to concerns about the initial investment required.

Opportunity: Adoption of Cloud-based EHR Solutions

The adoption of cloud-based EHR systems presents a significant opportunity in North America’s healthcare industry. Cloud-based EHR solutions provide flexibility, scalability, and cost-effectiveness, making them an attractive option for healthcare providers. These systems eliminate the need for expensive on-premise infrastructure, reduce maintenance costs, and allow for seamless updates and data storage. With cloud-based solutions, healthcare providers can access patient data from anywhere, improving care coordination and operational efficiency. Moreover, the scalability of cloud-based solutions allows healthcare organizations to expand their systems as needed, catering to the growing demands of modern healthcare. As more healthcare organizations look for cost-effective and flexible solutions, the cloud-based segment of the EHR market is expected to experience rapid growth.

North America Electronic Health Records Market By Product Insights

The web/cloud-based EHR segment dominated the market in 2024 with a market share of 84.0% and is anticipated to grow at the fastest rate during the forecast period. The shift from traditional on-premise systems to cloud-based solutions has been gaining momentum due to their affordability, scalability, and ease of access. These cloud-based systems allow healthcare providers to store patient data securely and access it from any location, which is crucial for ensuring continuity of care across various facilities. Additionally, cloud solutions offer the advantage of automatic updates and seamless data backup, ensuring that healthcare organizations stay compliant with evolving regulations and best practices. As healthcare providers continue to embrace digital transformation, the demand for cloud-based EHR solutions is expected to increase rapidly

Pie Graph 0

Despite the dominance of cloud-based EHR systems, the on-premise EHR segment is experiencing growth, particularly among larger healthcare institutions that have more robust IT infrastructure and require tighter control over their data. These systems are preferred by organizations that prioritize data security and privacy, as the on-premise model allows full control over the storage and management of patient information. The on-premise EHR segment is seeing increasing adoption in regions with strict data protection laws, where healthcare providers need to ensure compliance with privacy regulations. As such, this segment is expected to grow steadily over the forecast period.

North America Electronic Health Records Market By Type Insights

The acute segment dominated the market in 2024 with a market share of 46.03%. Driven by the growing adoption of EHR systems to enhance clinical, financial, and administrative efficiency. This shift is also influenced by the increasing need to improve hospital information systems. Additionally, the transition from volume-based care to value-based care has further fueled the demand for hospital EHR solutions. The continuous integration of digital technologies in hospitals reflects a broader trend toward more efficient and effective healthcare delivery.

The ambulatory segment is the fastest-growing segment due to the increasing number of outpatient facilities and the growing trend toward value-based care. Ambulatory EHR systems are specifically designed for outpatient settings such as clinics, physician offices, and urgent care centers. These systems allow healthcare providers to manage patient records efficiently, reduce administrative burdens, and improve patient outcomes by providing real-time access to health data. The expansion of outpatient services, particularly in primary care, is driving the rapid growth of the ambulatory EHR market. This trend is expected to continue as healthcare systems shift toward more outpatient-focused models of care.

North America Electronic Health Records Market By Business Model Insights

The professional services segment dominated the market in 2024 with a market share of 32.33% and is expected to grow at the fastest rate during the forecast period. The professional services leverage healthcare organizations to design and implement EHR systems more effectively, leading to improved patient outcomes, better resource utilization, and enhanced decision-making based on health data. Moreover, the continuous development in the professional services EHR business model in North America, leads to the segment's growth. For instance, in January 2021, the U.S. Orthopedic Alliance (USOA) and Veradigm LLC entered into a strategic partnership. This partnership aims to help orthopedic practices scale more quickly & increase the use of EHRs, provide evidence-based guidelines to support evolving clinical protocols, and use value-based care analytics to link the entire community.

The EHR subscription model is more affordable for small and medium-sized healthcare organizations than licensed software, as it saves on additional costs such as license fees, regular upgrades, and device maintenance. The subscription model reduces the need for in-house IT staff, as the EHR service provider handles software installation, configuration, testing, operation, and upgrades. Furthermore, the subscription model is expected to continue growing in popularity due to its cost-effectiveness and ease of use for healthcare providers. For larger healthcare facilities, the annual subscription fees for leading EHR software such as Epic EHR can be higher, up to USD 500,000.

North America Electronic Health Records Market By End Use Insights

The hospital use segment dominated the market in 2024 with a market share of 52.96%. The segment's growth is driven bythe increased adoption of EHR in hospitals for improving clinical, financial, & administrative efficiency and the rising need for enhancing hospital information systems. Moreover, the shift from volume-based care to value-based care leads to increased hospital EHR demand. According to the Office of the National Coordinator for Health Information Technology (ONC), EHR adoption in U.S. hospitals increased from 9% in 2008 to 96% in 2021.

The ambulatory use segment is expected to grow at the fastest growth rate during the forecast period owing to the increase in need for seamless healthcare information exchange, technological advancements, increased adoption in developed markets, and government initiatives to improve patient health record portals. For instance, in 2021, nearly 87% of acute and ambulatory care facilities adopted enterprise-wide patient flow systems, with high adoption in critical areas, according to an article by the College of Healthcare Information Management Executives.

North America Electronic Health Records Market By Application Insights

The cardiology segment dominated the market in 2024 with a market share of 9.45% and is expected to grow at the fastest rate during the forecast period. As one of the most common and critical specialties, cardiology requires accurate and comprehensive patient data to make timely decisions about patient care. EHR systems used in cardiology help providers track patient histories, monitor ongoing treatments, and coordinate care among multiple specialists. The dominance of cardiology EHR systems is also driven by the high prevalence of cardiovascular diseases in North America, further increasing the demand for these solutions. As technology continues to improve, cardiology EHRs are becoming increasingly sophisticated, offering advanced features such as predictive analytics and integration with wearable devices for continuous patient monitoring.

The neurology segment is anticipated to grow significantly during the forecast period. This growth is driven by the rising incidence of neurological diseases, an increasing demand for high-quality healthcare services, and the widespread adoption of EHR software. Neurology-specific EHR systems, which often include specialized templates for common symptoms and diagnoses, streamline documentation processes and reduce the administrative burden on healthcare providers. As the healthcare industry continues to prioritize digital transformation, the demand for specialized EHR solutions tailored to the unique needs of neurology practices is anticipated to grow significantly in the market.

Some of the prominent players in the North America electronic health records market include:

The demand for EHR led to increased competition among companies in the North American electronic health records market. Key players in this market include eClinicalWorks, NXGN Management, LLC.; Epic Systems Corporation; GE Healthcare; Medidata, Veradigm LLC; Greenway Health, LLC, and NXGN Management LLC, among others. Furthermore, increasing industry consolidation activities such as partnership & collaboration, acquisitions, and mergers by the top market players, as well as growing initiatives in launching new services by key players, are also anticipated to increase their share in the market.Some of the few startup players includehc1, Kareo, Inc., and EverHealth Solutions Inc.

North America Electronic Health Records Market Recent Developments

-

January 2025: Cerner Corporation announced the release of its new cloud-based EHR system, designed to improve care coordination and streamline patient data management for ambulatory care settings.

-

December 2024: Allscripts Healthcare Solutions partnered with Google Cloud to integrate AI and machine learning into its EHR solutions, enhancing predictive analytics and decision-making in clinical settings.

-

November 2024: Epic Systems launched a new update to its EHR platform that includes advanced interoperability features to ensure seamless sharing of patient data across various healthcare providers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America electronic health records market

Product

- Web/ cloud-based EHR

- On-premise EHR

Type

- Acute

- Ambulatory

- Post-Acute

Business Model

- Licensed software

- Technology resale

- Subscriptions

- Professional services

- Others (Support & Maintenance, Managed Services, etc.)

Application

- Cardiology

- Neurology

- Radiology

- Oncology

- Mental & Behavioral Health

- Nephrology & Urology

- Gastroenterology

- Pediatrics

- General Medicine

- Physical Therapy & Rehabilitation

- Others

End Use

- Hospital

- Ambulatory surgical centers

- Other end user

Country