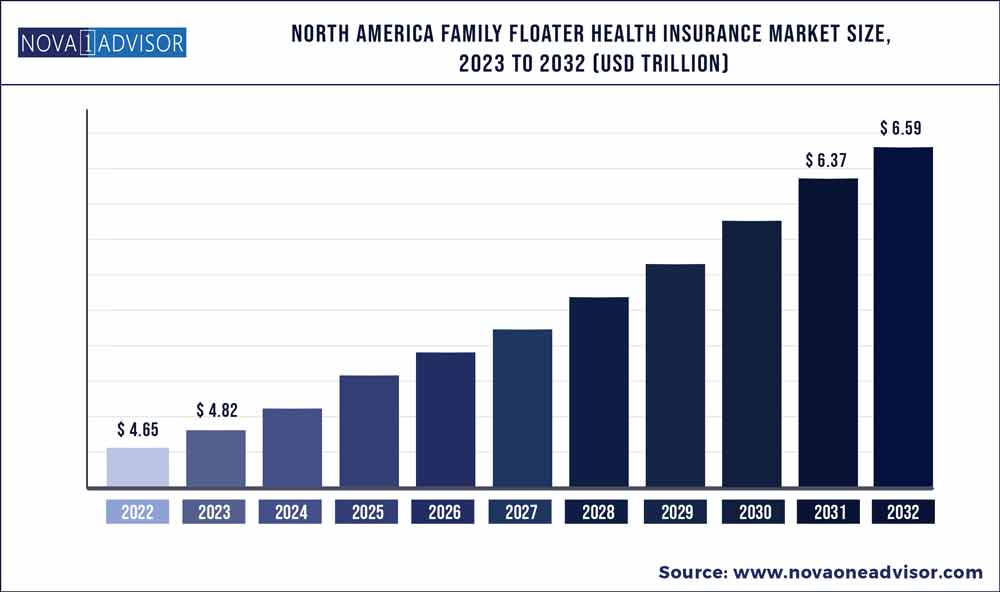

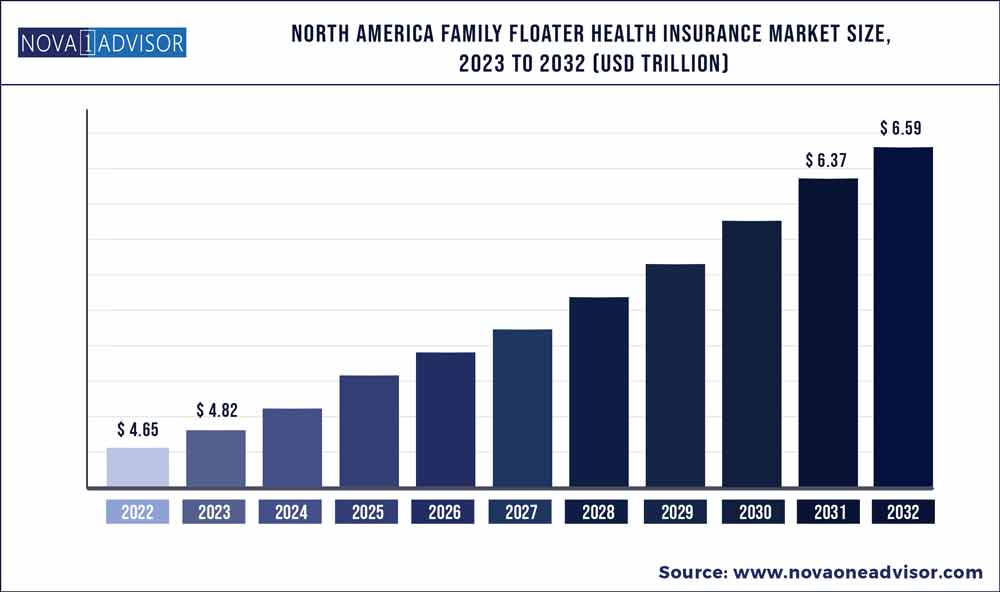

The North America family floater health insurance market size was exhibited at USD 4.65 trillion in 2022 and is projected to hit around USD 6.59 trillion by 2032, growing at a CAGR of 3.55% during the forecast period 2023 to 2032.

Key Takeaways:

- Private segment dominated the market with largest revenue share in 2022 owing to large number of people opting for private health insurance in order to avail better healthcare facilities and services.

- Plan that covers Immediate family members segment accounted for highest market share in 2022 owing to wide variety of products available for this segment.

- Adults segment held the higher market share in 2022 due to higher adoption of family floater health insurance policies among individuals of this age group.

- A shift towards online sales like website and aggregators to purchase policies is leading to higher adoption of health insurance plans.

- U.S. dominated the market due to presence of large number of insurers and higher adoption rate among the population.

- China represents lucrative growth opportunities with increasing number of people opting for private health insurance to avail additional benefits covered by these plans.

North America Family Floater Health Insurance Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 4.82 trillion |

| Market Size by 2032 |

USD 6.59 trillion |

| Growth Rate From 2023 to 2032 |

CAGR of 3.55% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Type, Plan type, Demographics, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

| Key Companies Profiled |

Cigna; Bupa; Now Health International; Kaiser Foundation Grp; Anthem; Inc. (Now Elevance Health); The IHC Group; Health Partners Group Ltd; Providence Health Plan; Harvard Pilgrim Health Care, Inc.; Sunlife Financial and Manulife |

The increasing cost of healthcare and rising awareness are among the major factors that are leading to the rising demand for health insurance. Moreover, the introduction of new products and technologies in the healthcare sector, promoting the adoption of innovative procedures and marketing strategies by insurance providers to attract more customers, is also driving the growth of the market.

Another element fueling the expansion of the North America family floater health insurance market is the rising prevalence of chronic diseases. Financially, the treatment of chronic illnesses like cancer and heart disease can be very difficult for patients and their families. Hence, a lot of people choose health insurance to avoid the sudden stress of having to pay a large sum of money for hospitals and other medical bills. The CDC estimates that individuals with chronic diseases and mental health disorders are responsible for 90% of the $3.8 trillion annual healthcare costs in the country. The report also notes that a sizeable part of spending on public insurance goes toward treating chronic illnesses.

Also, families are choosing family floater health insurance policies more frequently, which is propelling market expansion. These policies are an affordable way to cover a person's immediate family or extended family under one policy, where the money insured is split among all family members. It is therefore the best choice, especially for nuclear families.

Moreover, an increasing expansion by private players through the launch of new products or policies in the region is also promoting the growth of the market. A high number of individuals in the region are opting for private health insurance for their families despite a significant population being covered under government healthcare schemes. This is to get themselves higher coverage or include treatment procedures that are not covered by government insurance policies.

Type Insights

Based on type, the North America family floater health insurance market was dominated by the private segment in 2022. This is because more people are choosing to purchase private insurance coverage to close the gap, cover ailments, and access services that are not covered by public health care. In the United States, private health insurance remained more common than public insurance, with 66.5% and 34.8% coverage respectively, according to the 2022 Census.

However, with an increased focus on healthcare, the public sector is also experiencing significant growth in the region. According to the U.S. Census 2021 estimates, 7.9% of full-time, year-round workers received public health insurance, which was an increase of 1.8 percentage points from 2020. The number of year-round employees who work fewer than full-time hours and have public insurance rose by 1.6 percentage points to 22.6% over this period.

Plan Type Insights

The plan that covers immediate family members accounted for a higher share of the market in 2022, due to the wide availability of family floater plans for nuclear families or immediate family members. In addition, most insurance companies do not recommend a family floater plan that includes parents aged 60 and above, as there are higher chances that the sum insured may not be enough. Additionally, including dependent parents who are over 60 years would also rack up the premium, as the premium is based on the oldest member of the family covered.

The extended family insurance covers parents and parents-in-law, along with the immediate family members. However, in most cases, it is advisable to purchase an individual plan for senior citizens, as they are more prone to developing chronic diseases. Covering them with an individual plan is highly recommended as family floater may not be sufficient, which will lead to an increase in out-of-pocket spending.

Demographic Insights

The adult segment held the highest market share in 2022, owing to the increasing adoption of family floater plans by young couples. As the family floater plan covers dependent children only up to the age of 18, this plan is mainly purchased by young couples who can seek a cover for themselves and for their dependent children under one umbrella at a lower premium.

Senior adults may also opt for a family floater; however, family floaters are not so popular among senior adults. But they may still purchase a family floater at a higher premium cost because it will still be lower as compared to individual insurance plans for each family member.

Country Insights

The U.S. accounted for the highest market share in 2022 and dominated the North America family floater health insurance market. This is because of the presence of market leaders, and continuous advancements in healthcare technologies that promote various advanced medical procedures in the country. Moreover, higher adoption of health insurance policies in the country to lower the risk and decrease the out-of-pocket spending on healthcare are some of the key factors driving the growth of the market in the region.

Canada is anticipated to undergo significant growth in the forecast period due to the increasing demand for supplementary health insurance plans. This is because these cover healthcare costs that are not covered by public health plans, such as prescription drugs, dental, vision, hospitalization, and other services. With the growing number of insurers in the country, the market is further representing lucrative growth opportunities. According to Canadian Life and Health Insurance Association (CLHIA), currently, Canada is home to more than 128 private health insurance providers.

Key Companies & Market Share Insights

As an attempt to broaden their presence and availability of products, key players in the market are focusing on carrying out various strategies such as partnerships and collaborations, the launch of new products, investments in local insurance companies, etc.

Moreover, companies are entering into partnerships with healthcare professionals and organizations to create awareness regarding various chronic diseases and to create an additional benefit for members. For instance, in February 2023, Providence Health Plan partnered with Interwell Health to drive earlier interventions and education for members with Chronic Kidney Disease. The partnership aims to better coordinate the care of members through Interwell Health's leading network of local nephrologists committed to driving results in new value-based care agreements. Some prominent players in the North America family floater health insurance market include:

- Cigna

- Bupa

- Now Health International

- Kaiser Foundation Grp

- Anthem, Inc. (Now Elevance Health)

- The IHC Group

- Health Partners Group Ltd

- Providence Health Plan

- Harvard Pilgrim Health Care, Inc.

- Sunlife Financial

- Manulife

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the North America Family Floater Health Insurance market.

By Type

By Plan Type

- Immediate Family Members

- Extended Family Members

By Demographics

By Country

- U.S.

- Northeast

- Midwest

- South

- West

- Canada

- Newfoundland and Labrador (NL)

- Prince Edward Island (PE)

- Nova Scotia (NS)

- New Brunswick (NB)

- Quebec (QC)

- Ontario (ON)

- Manitoba (MB)

- Saskatchewan (SK)

- Alberta (AB)

- British Columbia (BC)

- Other (territories)