North America Healthy Snack Chips Market Size and Research

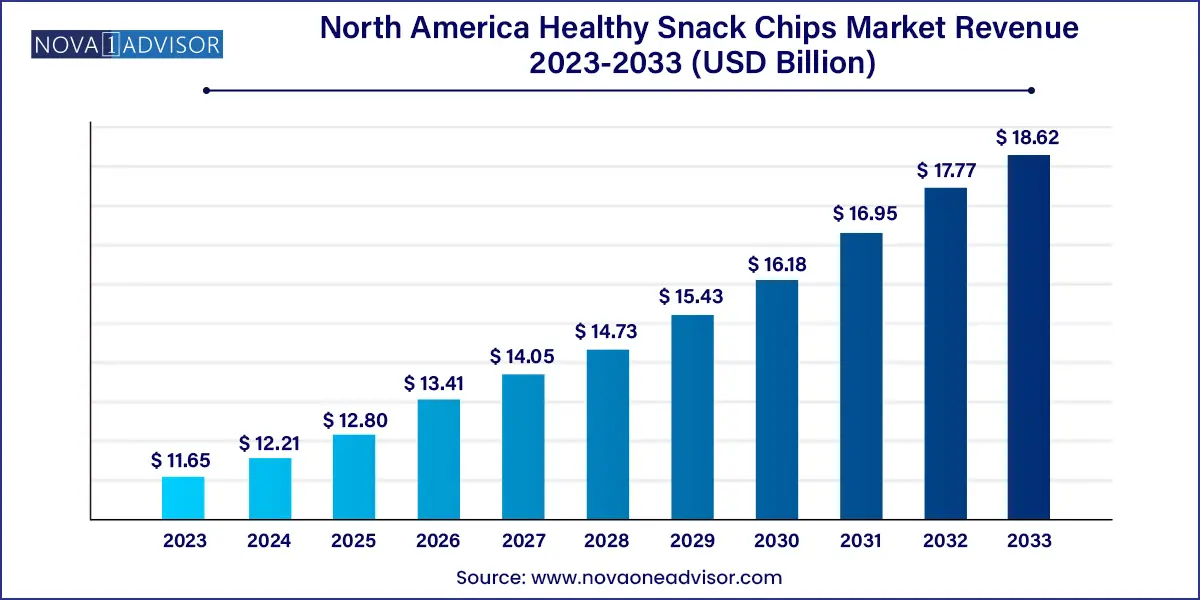

The North America healthy snack chips market size was exhibited at USD 11.65 billion in 2023 and is projected to hit around USD 18.62 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2024 to 2033.

North America Healthy Snack Chips Market Key Takeaways:

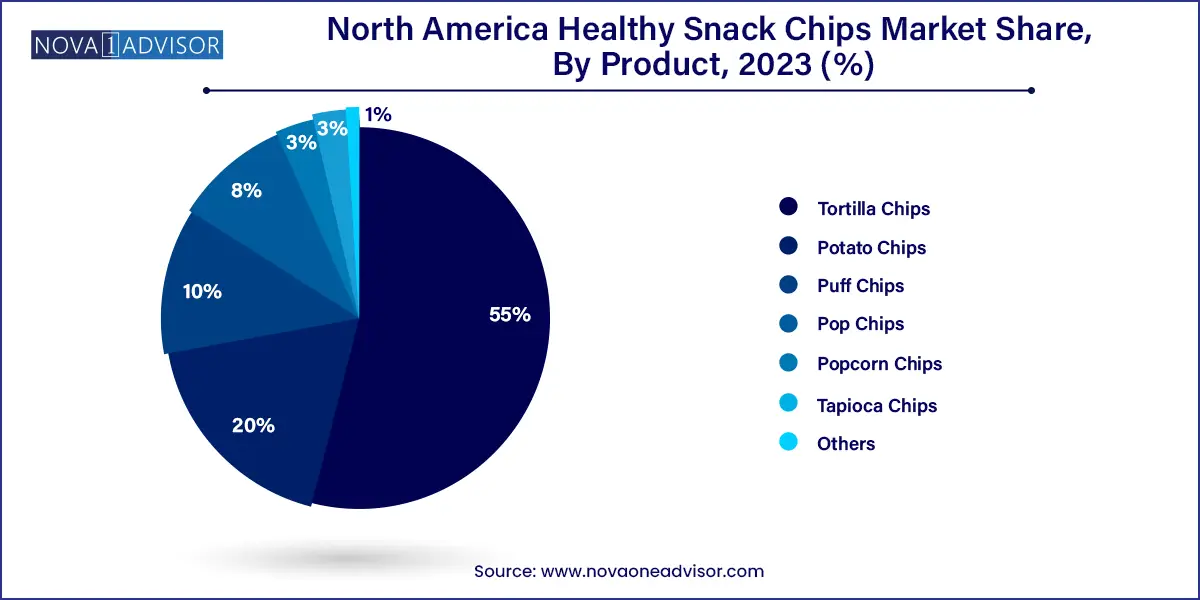

- The tortilla chips accounted for the largest revenue share of around 55% in 2023.

- The potato chips industry is projected to grow at a CAGR of 5.5% from 2024 to 2033.

Market Overview

The North America healthy snack chips market has emerged as a vibrant and fast-evolving sector within the broader functional and clean-label food landscape. As consumers across the United States, Canada, and Mexico increasingly prioritize health, convenience, and taste, the snack food category—traditionally associated with indulgence and guilt—is undergoing a fundamental transformation. A new generation of snack chips, made from nutrient-rich ingredients and marketed as better-for-you alternatives to conventional fried or salted products, is now occupying significant retail shelf space.

Driven by heightened awareness about the adverse effects of excessive sodium, saturated fats, and artificial additives, consumers are shifting toward snacks that provide nutritional value without compromising on flavor and crunch. These evolving preferences have opened the floodgates for innovation in the chip segment. From protein-packed puff chips and baked sweet potato slices to lentil, chickpea, quinoa, and cauliflower-based chips, the healthy snack chip segment is breaking the mold of traditional snack architecture.

The growth of this market is being catalyzed by key demographic shifts, including the rising population of health-conscious millennials, fitness enthusiasts, and parents seeking healthier options for children. Additionally, the post-pandemic focus on immunity and clean eating has led to strong demand for products with simple, recognizable ingredients, high fiber content, and functional benefits. Manufacturers are responding with non-GMO, gluten-free, organic, and plant-based claims to tap into these health and wellness priorities.

Retail channels have also adapted, with health food sections in mainstream supermarkets expanding their healthy chip offerings. E-commerce platforms are playing a critical role in brand discovery and product education, particularly for emerging D2C brands offering unique chip formats and subscription models. As the market matures, it’s no longer just about replacing regular chips with healthier ones—it's about creating a new, flavorful snacking experience rooted in both indulgence and nourishment.

Major Trends in the Market

-

Clean Label and Minimal Ingredients: Consumers are gravitating toward products with fewer ingredients, no artificial preservatives, and a clear emphasis on whole-food components.

-

Plant-Based and Grain-Free Options: Rise of veganism and gluten intolerance has led to increased demand for chips made from legumes, vegetables, and ancient grains.

-

Functional Nutrition Integration: Brands are fortifying chips with protein, probiotics, or fiber to appeal to the fitness and health optimization segments.

-

Air-Popped and Baked Innovations: Consumers are actively avoiding deep-fried options, creating opportunities for baked, dehydrated, and popped chip technologies.

-

Portion Control Packaging: Single-serve packs with calorie transparency are gaining popularity among office workers and dieters seeking convenient yet mindful snacking.

-

Global and Gourmet Flavors: The North American palate is expanding to include chip flavors inspired by global cuisines—like Korean BBQ, Mediterranean herbs, or Indian spices.

-

Sustainability and Ethical Sourcing: Eco-conscious consumers are drawn to brands that use sustainably farmed ingredients and compostable or recyclable packaging.

-

E-commerce Growth and D2C Models: Online platforms are enabling niche and emerging brands to connect directly with health-focused communities.

Report Scope of North America Healthy Snack Chips Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 12.21 Billion |

| Market Size by 2033 |

USD 18.62 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico |

| Key Companies Profiled |

General Mills, Inc.; BFY Brands; Frito-Lay North America, Inc.; Deep River Snacks; The Kellogg Company; Mission Foods; Tastemorr Snacks; Shearer’s Foods; Herr’s Food, Inc.; Snyder’s-Lance, Inc. |

Market Driver: Rising Health Consciousness and Demand for Nutritional Snacking

The most powerful driver fueling the growth of the healthy snack chips market in North America is the surge in health-conscious lifestyles and nutritional awareness among consumers. With the prevalence of obesity, heart disease, and lifestyle-related ailments rising in the region, there’s a growing rejection of traditional snack foods high in trans fats, salt, and empty calories. Instead, consumers are seeking snack options that align with their dietary preferences—whether it's high protein, low carb, vegan, gluten-free, or keto.

This health-centric shift is evident across demographic groups, but especially pronounced among millennials and Gen Z. These consumers are increasingly scrutinizing ingredient labels, using mobile apps to track macros, and aligning food purchases with fitness goals and personal values. Consequently, healthy chip products made with lentils, sweet potatoes, cassava, or kale—boasting attributes like low glycemic index, high fiber, or plant-based protein—are in high demand. Brands that successfully communicate both health and taste benefits are thriving in this environment, and retailers are expanding healthy snack aisles in response.

Market Restraint: High Price Points and Consumer Skepticism

Despite its upward trajectory, the healthy snack chips market faces a notable restraint: high price sensitivity and consumer skepticism regarding claims. Most better-for-you chips come with a premium price tag due to the cost of specialty ingredients, small-batch production, or sustainability commitments. While health-conscious consumers may be willing to pay more for quality, this limits penetration in mainstream or price-sensitive markets, especially in regions where conventional chips dominate shelf space and consumer habits.

Additionally, consumer trust in health claims can be fragile. Some brands have faced criticism for “greenwashing” or making unsubstantiated functional claims. Labels like "natural" or "organic" can be vague and open to interpretation. Unless supported by clinical evidence or third-party certifications, claims like “immune-boosting” or “gut-friendly” can trigger regulatory scrutiny or consumer backlash. Brands must walk a fine line between marketing innovation and authenticity, ensuring transparency and education to maintain credibility.

Market Opportunity: Diversification into Niche Health and Functional Needs

An exciting opportunity within the North American healthy snack chips market lies in product diversification to serve niche health needs. As personalized nutrition gains traction, consumers are not just looking for low-calorie or low-fat options—they’re demanding snacks tailored to specific health outcomes. This includes chips fortified with collagen for skin health, turmeric or ginger for anti-inflammatory support, adaptogens for stress relief, or prebiotics and probiotics for digestive health.

Brands that embrace this trend are able to tap into emerging dietary tribes—like keto, paleo, FODMAP, or intermittent fasting—each with unique nutritional requirements. Moreover, innovations in food science are making it easier to integrate functional ingredients without compromising taste or texture. The crossover between snacking and supplementation is blurring, opening doors to chips that do more than just satisfy cravings—they support wellness journeys. This convergence of taste and function will be a key lever for market expansion in the coming years.

North America Healthy Snack Chips Market By Product Insights

Tortilla chips dominated the product segment, owing to their wide acceptance, cultural integration, and versatility in both traditional and health-conscious diets. Originally rooted in Mexican cuisine, tortilla chips have found their way into snack routines across North America. Their adaptability in incorporating healthy ingredients—such as blue corn, sprouted grains, or cassava—has made them a strong player in the healthy snack segment. Brands like Late July and Siete Foods have popularized organic and grain-free tortilla chips that meet gluten-free and vegan needs while maintaining taste and crunch. Additionally, tortilla chips lend themselves well to innovative flavoring with herbs, spices, and even superfood dustings like spirulina or beetroot powder.

Pop chips and puff chips are the fastest-growing segments, largely due to their perceived lightness and innovative processing methods. Pop chips, made using high-temperature air rather than oil frying, appeal to consumers looking to cut calories and fats without losing the chip experience. Puff chips—crafted from chickpeas, lentils, or pea protein—offer an entirely new snacking texture and are often positioned as protein-rich, gut-friendly, or kid-safe options. Their growth is also being driven by the rise in alternative grain and legume use, addressing allergen sensitivities and dietary exclusions.

Country Insights

United States

The U.S. is the undisputed leader in the North America healthy snack chips market, backed by a vast retail ecosystem, influential wellness culture, and deep-rooted snacking habits. The growth of brands like Hippeas, Popchips, and Rhythm Superfoods reflects a strong consumer base willing to explore and invest in functional snacking alternatives. American consumers are particularly receptive to bold flavors, macro-nutrient benefits, and social impact claims. Major retailers like Whole Foods and Target have expanded their natural and organic snack sections, while Costco and Walmart have started featuring premium healthy chip brands in bulk offerings. U.S.-based innovation also benefits from direct-to-consumer momentum, allowing new brands to bypass retail bottlenecks and educate audiences online.

Canada

Canada is following closely behind the U.S., with an educated and health-conscious population, especially in urban areas like Toronto, Vancouver, and Montreal. Canadian consumers place a high value on product transparency and organic certifications. The bilingual labeling laws and tighter regulatory frameworks ensure higher trust in product claims. Retailers such as Loblaws and Sobeys have added extensive health-focused snack aisles, and local Canadian brands are emerging with innovations in lentil- and kale-based chips. Importantly, the climate of trust in regulatory oversight and consumer willingness to pay for clean-label products makes Canada a fertile market for functional chip innovation.

Mexico

Mexico represents an emerging market in this space, where traditional snacking culture—centered on tortilla chips and street-style snacks—is gradually intersecting with rising health awareness. Urban millennials and health-conscious parents are exploring baked and fortified chip options, and major Mexican supermarket chains like Superama and Chedraui are expanding their health food sections. However, price sensitivity remains a challenge. Affordable healthy chips with local ingredients (e.g., amaranth, plantains, and nopal cactus) are gaining traction. Cross-border influences from U.S. brands and digital wellness trends are accelerating market exposure in Mexico, suggesting strong long-term potential.

North America Healthy Snack Chips Market Recent Developments

-

January 2025: Hippeas launched its new Vegan Cheddar Chickpea Puffs in Single-Serve Multipacks, aimed at school lunchboxes and portion-controlled snacking.

-

February 2025: Siete Family Foods introduced a limited-edition Spicy Mango Lime Grain-Free Tortilla Chip, targeting Latin flavor enthusiasts during Hispanic Heritage Month promotions.

-

March 2025: Popchips unveiled its Protein-Packed Pop Line, made with pea protein and fortified with essential amino acids, targeting the fitness and active lifestyle demographic.

-

January 2025: LesserEvil Snacks released its first ayurvedic-inspired popcorn chips infused with turmeric and black pepper, combining cultural heritage with functional wellness.

-

February 2025: Late July Organic Snacks debuted a 100% Compostable Chip Bag, reinforcing its sustainability mission while introducing a new line of air-popped quinoa chips.

Some of the prominent players in the North America healthy snack chips market include:

- General Mills, Inc.

- BFY Brands

- Frito-Lay North America, Inc.

- Deep River Snacks

- The Kellogg Company

- Mission Foods

- Tastemorr Snacks

- Shearer’s Foods

- Herr’s Food, Inc.

- Snyder’s-Lance, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America healthy snack chips market

Product

- Tortilla Chips

- Pop Chips

- Popcorn Chips

- Puff Chips

- Potato Chips

- Tapioca Chips

- Others

Regional