North America Laser Tattoo And Striae Removal Market Size and Growth

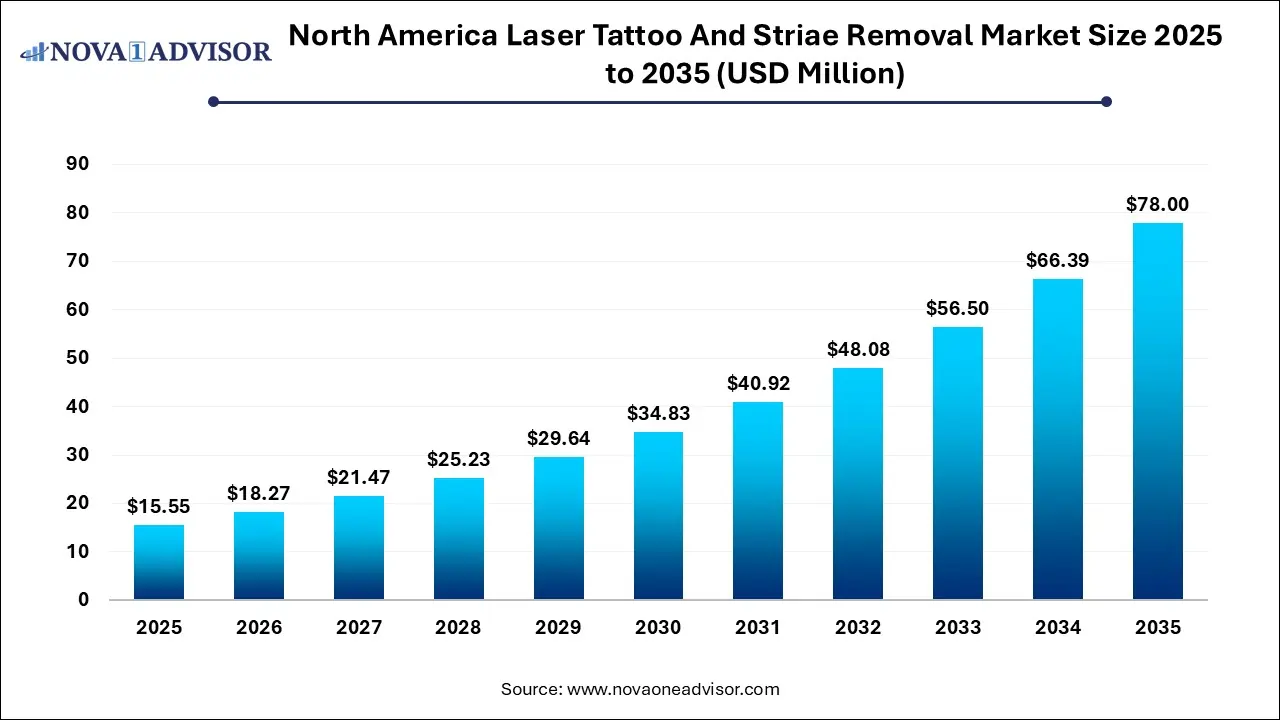

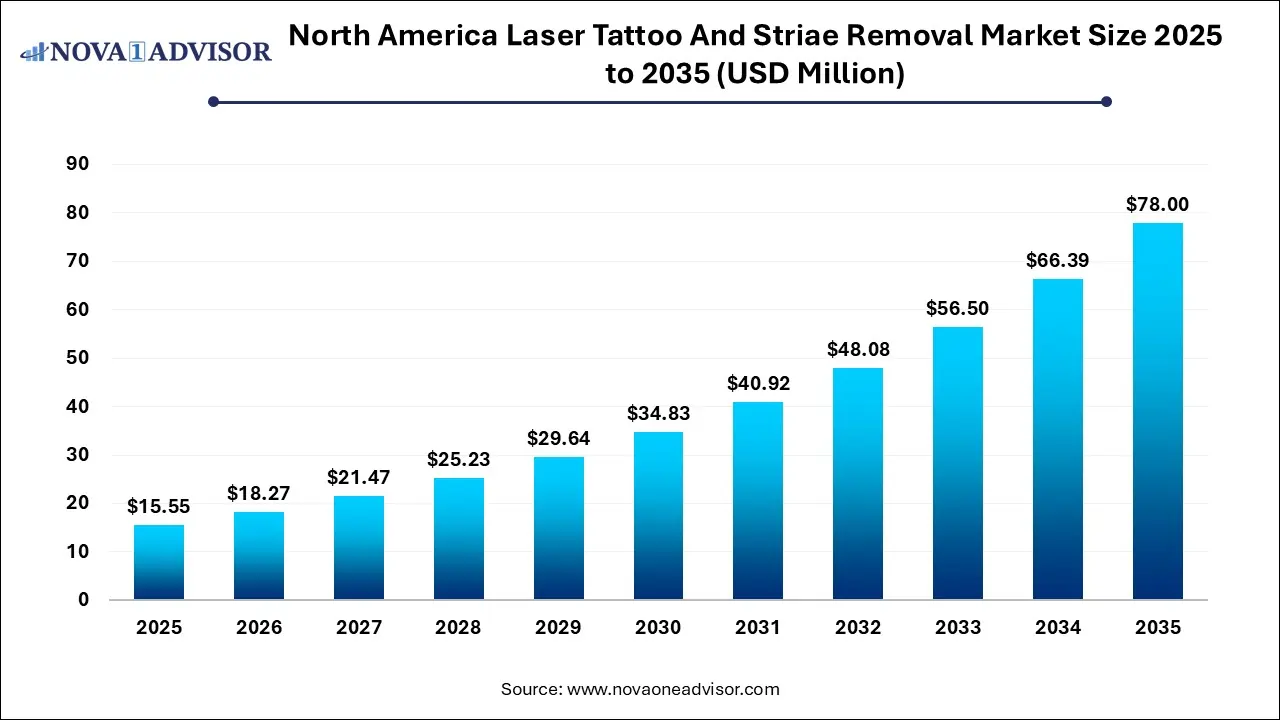

The North America laser tattoo and striae removal market size was exhibited at USD 15.55 million in 2025 and is projected to hit around USD 78.00 million by 2035, growing at a CAGR of 17.5% during the forecast period 2026 to 2035.

Key Takeaways:

- The laser tattoo removal held the maximum revenue share of over 63% of the market in 2025.

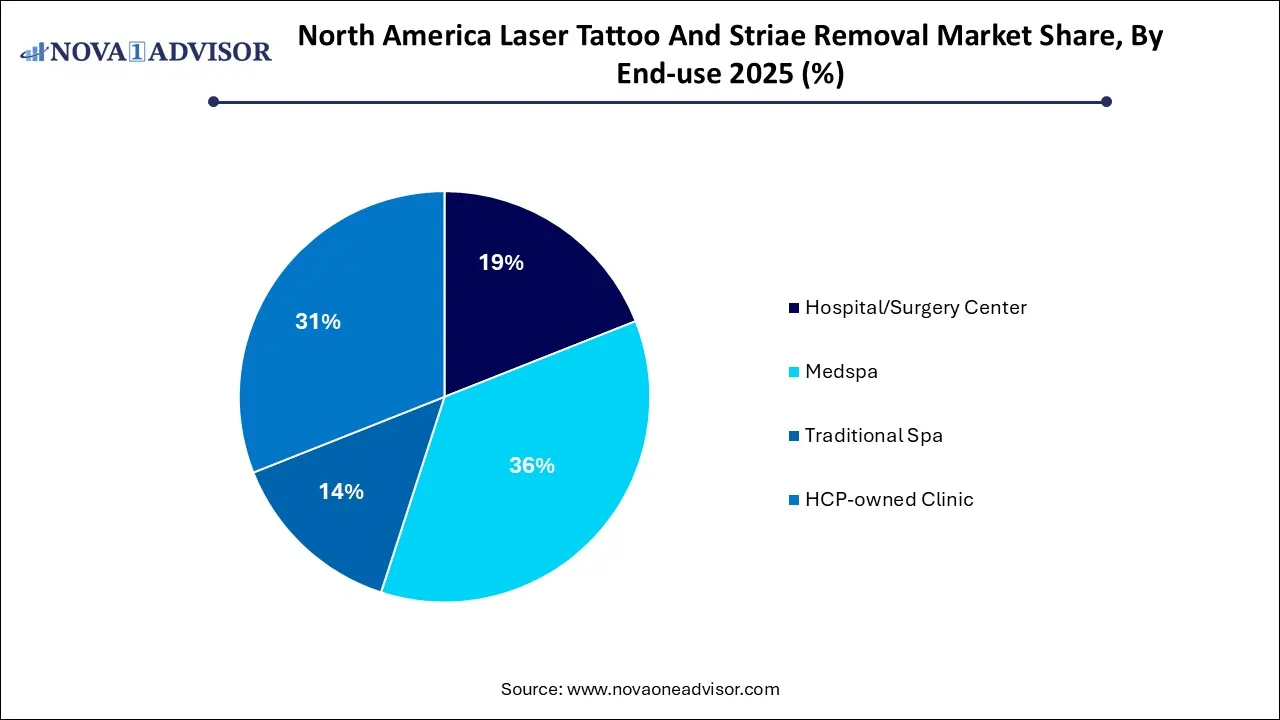

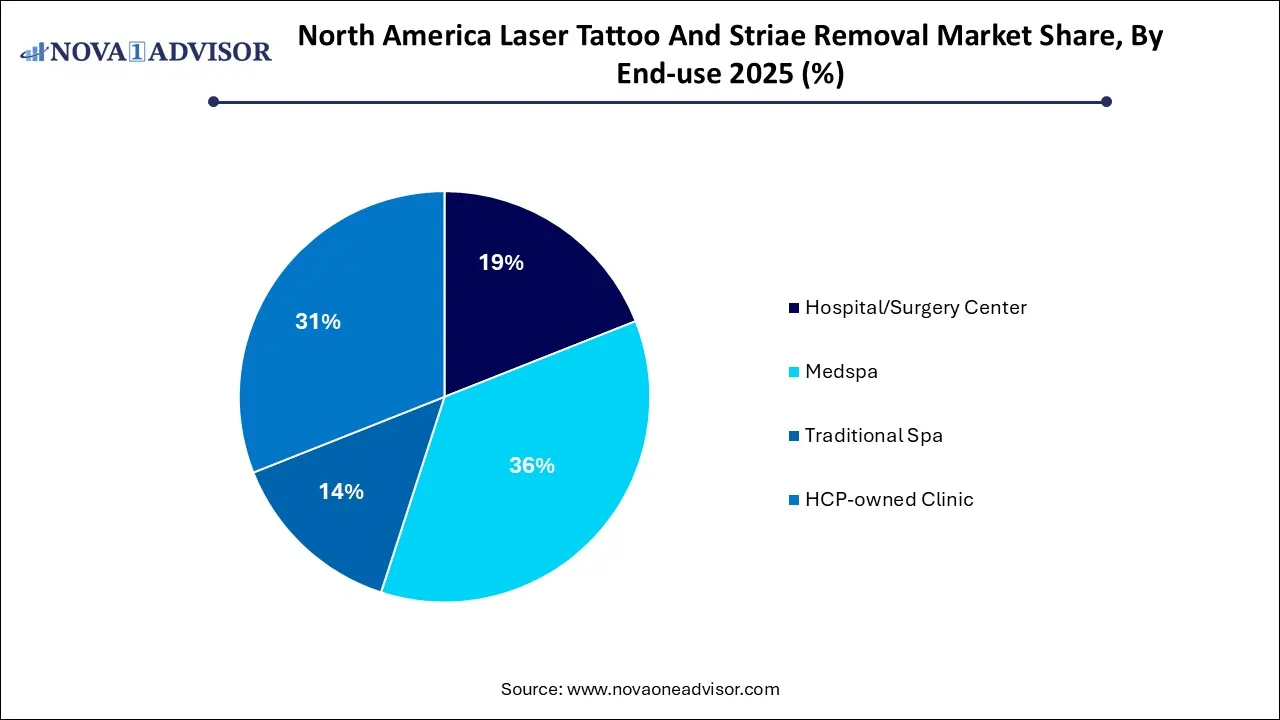

- The MedSpa end-use segment held the highest market share of 36.0% in 2025.

- The U.S. dominated the market with a revenue share of over 84% in 2025 is expected to showcase a significant CAGR in the forecast period.

Market Overview

The North America Laser Tattoo and Striae Removal Market has witnessed a transformative surge over the past decade, driven by evolving aesthetics preferences, increased awareness around skin health, and technological advances in dermatological laser treatments. Laser-based procedures, once niche and limited to specialized clinics, have now become widely accessible across medspas, dermatology clinics, and aesthetic surgery centers throughout the region. From celebrities removing once-trendy tattoos to postpartum women seeking striae (stretch mark) removal, demand has never been higher.

Tattoo removal using Q-switched or picosecond lasers has seen rapid acceptance, largely due to changing social attitudes, corporate workplace norms, and the emergence of advanced inks and tattooing styles requiring better removal technologies. At the same time, striae (stretch marks), caused by pregnancy, rapid weight gain or loss, and adolescence growth spurts, have become a primary aesthetic concern for both men and women. Consumers are increasingly opting for non-invasive or minimally invasive laser treatments over topical creams or surgical options.

North America, particularly the United States and Canada, offers fertile ground for this market due to high disposable income, a cultural emphasis on aesthetics, and a flourishing cosmetic dermatology sector. According to dermatologists, patients often seek combination treatments that not only target removal but also promote collagen production and skin texture restoration. As awareness of non-surgical cosmetic interventions rises, the laser tattoo and striae removal market is evolving from a reactive need into a proactive lifestyle service.

Major Trends in the Market

-

Emergence of Picosecond Laser Technology: Picosecond lasers offer shorter pulse durations and are more effective at breaking down tattoo pigments and treating deeper dermal lesions like striae.

-

Rise in Combination Therapy Demand: Patients are opting for bundled packages combining laser, microneedling, and PRP (platelet-rich plasma) for more comprehensive skin rejuvenation.

-

Growth of Gender-Neutral Aesthetic Services: An increasing number of male patients are seeking tattoo and stretch mark removal, expanding the target demographic.

-

Mobile Laser Clinics and At-Home Consultations: Providers are experimenting with portable equipment and virtual consultations to bring services closer to patients.

-

Marketing via Social Media Influencers: Aesthetic centers are increasingly promoting their services through influencer partnerships on platforms like Instagram and TikTok.

-

Increase in Medical Tourism within North America: U.S. patients are traveling to Canadian clinics for more affordable laser treatments and vice versa.

-

Customization through AI-Based Skin Diagnostics: Clinics are using AI tools to tailor laser settings and protocols based on skin tone, depth of pigmentation, and scar age.

Report Scope of The North America Laser Tattoo and Striae Removal Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 18.27 Million |

| Market Size by 2035 |

USD 78.00 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 17.5% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Procedure, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America |

| Key Companies Profiled |

Toronto Cosmetic Clinic (TCC); MEDermis Laser Clinic; Schweiger Dermatology Group; Laser Centre of Orlando; York Medical Spa; AnewSkin Aesthetic Clinic; Medical Spa and The Ottawa Skin Clinic |

Market Driver: Rising Aesthetic Consciousness and Social Acceptance of Laser Procedures

A key market driver is the growing aesthetic consciousness among North American consumers, which has redefined personal grooming to include advanced cosmetic procedures like laser-based tattoo and stretch mark removal. The millennial and Gen Z populations, in particular, prioritize appearance enhancement as part of their self-care routine. Additionally, these generations are more open about undergoing aesthetic procedures, eliminating the stigma historically associated with cosmetic treatments.

This cultural shift has been accompanied by increased social media exposure, where idealized skin appearance is often portrayed as blemish-free and ink-free. Consequently, consumers are driven to rectify tattoo regrets, remove body art for professional reasons, or treat stretch marks after pregnancy or weight loss. Aesthetic clinics report a steady influx of first-time patients interested in skin correction, especially as procedures become safer, less painful, and quicker.

Furthermore, the demand extends beyond urban centers. Suburban and even rural clinics in North America are witnessing rising demand due to improved affordability, financing options, and targeted marketing by service providers. As aesthetic wellness becomes mainstream, laser removal procedures are expected to see sustained adoption across socioeconomic strata.

Market Restraint: High Treatment Costs and Lack of Insurance Coverage

Despite technological advances and rising demand, high procedural costs remain a notable barrier to widespread adoption. Tattoo removal typically requires 5–10 sessions depending on ink density and skin type, with each session costing $150 to $500 or more. Similarly, striae removal often involves multiple laser treatments spaced weeks apart, costing hundreds to thousands of dollars cumulatively. For many patients, the overall price point places these procedures in the discretionary spending category.

Compounding this issue is the lack of insurance coverage, since these procedures are considered cosmetic and not medically necessary. This limits access for a large portion of the population, especially younger individuals and low-to-middle-income groups who are among the most interested in tattoo and striae correction. Clinics must often rely on package discounts or in-house financing plans to mitigate this cost sensitivity.

Moreover, the lack of insurance or governmental subsidy means there is limited regulatory pressure on pricing, leading to inconsistencies across clinics and geographies. This lack of pricing transparency can deter prospective patients who are uncertain about the full scope of commitment both financial and procedural.

Market Opportunity: Expansion into Male Demographics and Postpartum Care

A compelling opportunity exists in expanding laser tattoo and striae removal services into traditionally under-targeted segments—namely men and postpartum women. The male aesthetic market in North America is experiencing unprecedented growth, with rising interest in body image optimization and grooming. Tattoo removal for professional rebranding, aesthetic preference changes, or military enlistment compliance has surged among male clients.

Simultaneously, postpartum striae removal is becoming a core offering in medspas and obstetric-linked clinics. As women seek to restore their pre-pregnancy bodies, striae treatment is often bundled with other services like skin tightening or hormonal skin correction. Providers who target this group through maternal health campaigns, social media, and bundled discounts are well-positioned to tap into a steadily growing clientele base.

Both of these groups are underserved by traditional marketing strategies and can represent a significant revenue boost for clinics willing to customize messaging, consultation processes, and follow-up care programs. The broader societal shift toward inclusive and personalized aesthetic care enhances this opportunity further.

North America Laser Tattoo and Striae Removal Market By Procedure Insights

Laser Tattoo Removal dominated the North American market in 2024, driven by its broad applicability across age groups, increasing tattoo regret cases, and a cultural shift toward professional aesthetics. The use of Q-switched and picosecond lasers enables targeted pigment breakdown, even for multicolored or deeply embedded inks. Tattoo removal clinics report rising volumes, particularly among individuals in their 30s and 40s revisiting decisions made in early adulthood. Moreover, tattoo removal has found utility among individuals preparing for specific events like weddings, religious conversions, or military enlistment. The rise of laser technology that minimizes scarring and pigmentation issues has further cemented the appeal of this segment.

Laser Striae Removal is emerging as the fastest-growing procedure, especially due to its relevance in postpartum aesthetics and body sculpting journeys. Clinics now routinely promote stretch mark removal as part of wellness packages, offering bundled services that include laser resurfacing, collagen induction, and post-treatment skincare kits. The non-invasive nature of modern lasers such as fractional CO2 and Erbium:YAG makes striae treatment more tolerable and effective, especially for new or pigmented stretch marks. Young mothers, fitness enthusiasts, and individuals undergoing body transformation surgeries are frequent consumers of this procedure. Providers report higher retention and referral rates from striae patients due to visible results and emotional satisfaction.

North America Laser Tattoo and Striae Removal Market By End-use Insights

Medspas dominated the end-use segment, owing to their accessibility, client-centric approach, and integration of multiple non-surgical aesthetic services under one roof. Medspas often combine tattoo and striae removal with skincare, anti-aging, and wellness therapies, appealing to a broader clientele. With competitive pricing, flexible scheduling, and shorter consultation processes, medspas are particularly popular among millennials and working professionals. Their strong social media presence and influencer collaborations make them a powerful driver of awareness and demand for laser services. Additionally, the emergence of franchise-based medspa chains allows for standardized services and broader geographic coverage.

HCP-owned Clinics (healthcare practitioner-owned) are the fastest-growing sub-segment, especially in dermatology, gynecology, and plastic surgery practices. Physicians increasingly offer laser procedures as ancillary revenue streams, leveraging their medical credibility to attract discerning clients. These clinics tend to handle more complex cases, such as hypertrophic striae or tattoo-related scarring, where physician oversight is critical. Furthermore, patients perceive such settings as safer and more compliant with clinical standards, allowing clinics to charge premium fees. The integration of medical-grade equipment, real-time diagnostics, and post-procedure care differentiates HCP-owned clinics from traditional spas and general aesthetic centers.

North America Laser Tattoo and Striae Removal Market By Regional Insights

United States

The U.S. represents the lion’s share of the North America laser tattoo and striae removal market, bolstered by a high concentration of aesthetic centers, a beauty-conscious population, and widespread tattoo culture. Cities like Los Angeles, Miami, and New York lead in procedure volume, with growing traction in mid-sized cities and suburban locales. The presence of major equipment manufacturers, such as Cynosure and Cutera, also ensures ready access to cutting-edge technologies. Marketing campaigns led by celebrities and influencers have normalized aesthetic laser treatments, making them a common part of wellness spending.

The regulatory environment in the U.S. allows licensed aestheticians, under physician supervision, to perform laser procedures, broadening service access. As male grooming and wellness trends gain traction, more clinics are reporting double-digit growth in male clientele seeking tattoo lightening or full removal. Simultaneously, mommy makeover packages that include striae treatment are gaining popularity in cosmetic surgery practices, signaling a long-term trend.

Canada

In Canada, laser aesthetics is catching up rapidly, particularly in urban areas like Toronto, Vancouver, and Montreal. A more conservative but steadily growing market, Canada benefits from a strong dermatology infrastructure and rising acceptance of cosmetic treatments. Canadian consumers are highly informed and tend to prefer clinics with medical backing, giving an edge to HCP-owned facilities and premium medspas. Provincial regulations on aesthetic laser use are stricter, creating a more professionalized service landscape.

Additionally, cross-border medical tourism is emerging. U.S. patients from northern states are increasingly traveling to Canadian clinics for relatively affordable procedures, while Canadian clients cross into the U.S. for specialized or brand-promoted services. Government initiatives supporting women’s health and postpartum care indirectly support the striae removal segment in the country.

Some of the prominent players in the North America laser tattoo and striae removal market include:

- Toronto Cosmetic Clinic (TCC)

- MEDermis Laser Clinic

- Schweiger Dermatology Group

- Laser Centre of Orlando

- York Medical Spa

- AnewSkin Aesthetic Clinic

- Medical Spa and The Ottawa Skin Clinic

Recent Developments

-

In February 2025, Cynosure launched its next-generation PicoSure Pro, a picosecond laser platform with enhanced precision and reduced recovery time, targeted specifically at tattoo and striae treatments in medspas and clinics across the U.S. and Canada.

-

In January 2025, Lumenis entered a strategic partnership with a chain of Canadian dermatology clinics to introduce AI-assisted skin diagnostics integrated with its ResurFX fractional laser.

-

In December 2024, Cutera announced the expansion of its training academy in Miami, offering hands-on certification for North American professionals in tattoo and stretch mark removal using their enlighten laser series.

-

In November 2024, Astanza Laser rolled out a financing program for small U.S.-based medspas, aimed at increasing access to high-end tattoo removal technologies.

-

In October 2024, Fotona launched a campaign in partnership with leading OB-GYNs to promote postpartum striae removal, combining laser therapy with gynecological wellness services.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the North America laser tattoo and striae removal market

Procedure

- Laser Striae Removal

- Laser Tattoo Removal

End-use

- Hospital/Surgery Center

- Medspa

- Traditional Spa

- HCP-owned Clinic

Regional