North America Legal Cannabis Market Size and Research

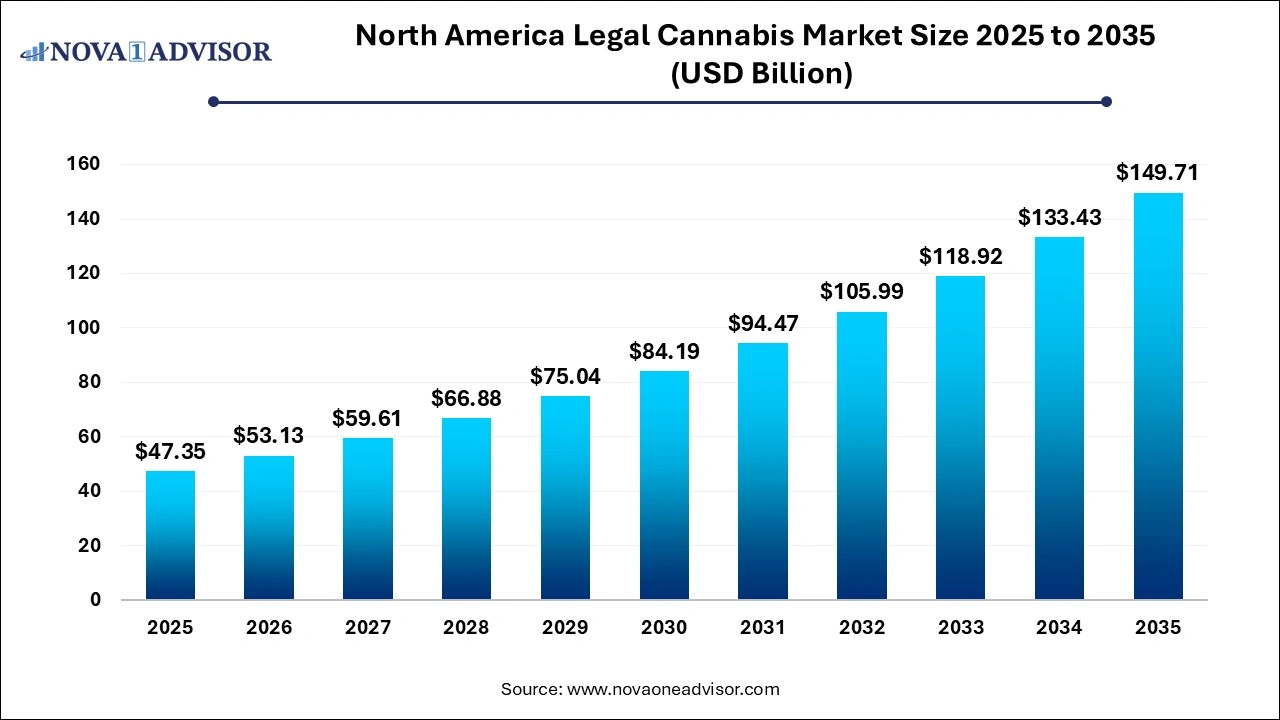

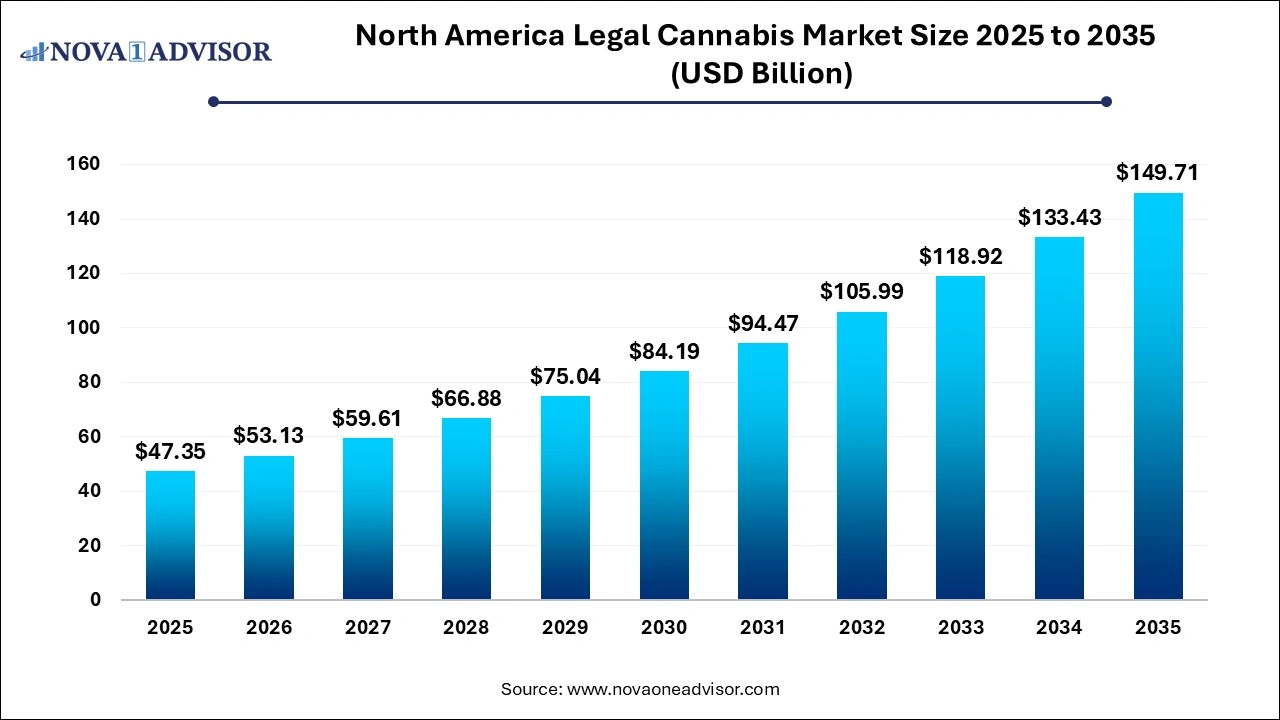

The North America legal cannabis market size was exhibited at USD 47.35 billion in 2025 and is projected to hit around USD 149.71 billion by 2035, growing at a CAGR of 12.2% during the forecast period 2026 to 2035.

North America Legal Cannabis Market Key Takeaways:

- By source, the marijuana segment dominated the market in 2025 and is anticipated to witness the fastest growth with a CAGR of 12.92% over the forecast period.

- By derivatives, the CBD segment dominated the market with a revenue share of 64.6% in 2025.

- By cultivation, the indoor cultivation segment held the largest market share of 54.5% in 2025.

- By end use, the recreational use segment dominated the market with revenue share of 67.0% in 2025.

Market Overview

The legal cannabis market in North America has emerged as one of the most dynamic and rapidly evolving sectors in recent years. With significant legal reforms across the United States and Canada, the industry has witnessed exponential growth, driven by shifting societal attitudes, medical endorsements, and recreational acceptance. The market includes various cannabis-based products derived from both marijuana and hemp sources, targeting medical, recreational, and industrial applications.

In Canada, the landmark legalization of recreational cannabis in October 2018 under the Cannabis Act established a fully regulated national framework. The U.S. market, while still under federal prohibition, has seen a wave of state-level legalizations, with over 35 states legalizing medical cannabis and 23 allowing recreational use as of 2025. Hemp-derived products, especially CBD, were federally legalized in the U.S. through the 2018 Farm Bill, further opening the market for industrial and wellness applications.

Consumer demand has grown across age groups and demographics, supported by increased product availability, diversified formats (edibles, tinctures, topicals, vapes), and a surge in awareness around cannabis for wellness, pain management, and stress relief. Cannabis has now evolved from a niche cultural phenomenon to a mainstream, regulated industry with significant investment, retail innovation, and scientific advancement.

Major Trends in the Market

-

Normalization of Cannabis for Wellness: Products aimed at sleep, anxiety, and pain relief are entering mainstream wellness aisles.

-

Product Innovation in Edibles and Beverages: Companies are expanding into fast-acting edibles and cannabis-infused functional drinks.

-

Integration with Digital Health and E-commerce: Online dispensaries, delivery apps, and digital ID verification are improving accessibility.

-

Rise of Craft and Artisanal Cannabis Brands: Consumer preference is shifting toward small-batch, premium, and organic strains.

-

Growth of Industrial Hemp in Construction and Textiles: Hemp is increasingly used in biodegradable plastics, fabrics, and building materials.

-

Focus on Sustainability in Cultivation: Growers are adopting energy-efficient LED lighting, water recycling, and soil regeneration techniques.

-

Expansion of Medical Cannabis Research: Ongoing clinical trials are validating cannabis use in conditions like PTSD, epilepsy, and Alzheimer’s.

Report Scope of North America Legal Cannabis Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 53.13 Billion |

| Market Size by 2035 |

USD 149.71 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 12.2% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Source, Derivatives, Cultivation, End use, and Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America |

| Key Companies Profiled |

Canopy Growth Corporation, Charlotte's Web, Inc., Aurora Cannabis Inc., Tilray Brands, The Cronos Group, Jazz Pharmaceuticals, Inc., Sundial Growers, Medipharm Labs, NuLeaf Naturals, LLC, Irwin Naturals |

A key driver of the North American cannabis market is the gradual and widespread legalization of both recreational and medical cannabis across states and provinces. In the United States, the tide has turned toward broader acceptance, with multiple states such as New York, New Jersey, and Virginia legalizing recreational use in recent years. Meanwhile, Canada remains a global leader with full-scale federal legalization that has fostered innovation, compliance frameworks, and robust consumer safety systems.

These reforms have catalyzed investment, job creation, and taxation benefits, encouraging state and provincial governments to continue liberalizing cannabis laws. Regulatory bodies such as Health Canada and state-level Cannabis Control Boards are creating licensing structures, product standards, and advertising codes that boost consumer trust. The legal framework has also allowed cannabis to enter mainstream retail environments, medical clinics, and wellness platforms, ensuring sustainable market growth.

Market Restraint: Federal Restrictions and Banking Limitations in the U.S.

Despite strong growth, a significant restraint in the U.S. market is the continued federal illegality of cannabis, classified as a Schedule I substance under the Controlled Substances Act. This legal conflict prevents interstate commerce, limits clinical research, and restricts financial institutions from serving cannabis-related businesses due to anti-money laundering laws.

As a result, many cannabis businesses in the U.S. are forced to operate on a cash-only basis, increasing operational risk and impeding access to traditional banking services. Moreover, advertising restrictions and lack of uniform taxation policies create challenges in marketing and scaling operations. Until federal reform is enacted, these regulatory discrepancies will continue to hinder the full potential of the U.S. cannabis market.

Market Opportunity: Mainstream Retail Integration and CPG Partnerships

An emerging opportunity lies in the integration of cannabis into mainstream retail and consumer packaged goods (CPG) partnerships. Major beverage, beauty, and food companies are exploring CBD and THC-infused product lines, leveraging existing distribution and brand recognition to accelerate market penetration.

Cannabis-infused beverages such as sparkling waters, energy drinks, and teas—are particularly promising, with companies like Canopy Growth and Tilray partnering with CPG giants to develop shelf-stable, precisely dosed products. Retailers like CVS and Walgreens already stock hemp-based topicals, and as laws evolve, more mainstream channels may begin offering low-THC and CBD wellness products.

This convergence between cannabis and conventional retail promises to expand market access, elevate branding, and introduce consistent quality control measures, attracting a broader consumer base and enhancing industry legitimacy.

North America Legal Cannabis Market By Sources Insights

Marijuana-derived products currently dominate the North American cannabis market, particularly in the recreational and medical segments. Cannabis flowers and oils are widely sold in dispensaries across legal states and provinces. With high THC content and well-established demand, marijuana products constitute the bulk of revenue for major producers. In Canada, dried flower sales account for a significant portion of total cannabis revenue, especially in recreational markets.

Hemp-based cannabis products, particularly hemp-derived CBD, are the fastest-growing segment. Following the U.S. Farm Bill of 2018, which legalized hemp cultivation, CBD products have flooded the health and wellness sector. Hemp CBD is now found in skincare, nutraceuticals, beverages, and pet supplements. Meanwhile, industrial hemp is gaining traction in bioplastics, paper, and textile applications. This segment appeals to a broader demographic, including consumers seeking therapeutic benefits without psychoactive effects.

North America Legal Cannabis Market By Derivatives Insights

THC (Tetrahydrocannabinol) remains the dominant derivative due to its psychoactive properties and high demand in recreational markets. THC levels are a key marketing and pricing factor in cannabis flower, vape, and edible products. Dispensaries prominently label THC content, and consumers often select products based on desired intensity and effect profile.

CBD (Cannabidiol) is the fastest-growing derivative, driven by its adoption in wellness, anti-inflammatory, anti-anxiety, and skincare applications. CBD does not cause intoxication, making it appealing for daytime use and broader demographic groups including seniors and first-time users. CBD's growth has expanded beyond dispensaries into e-commerce, health food stores, and pharmacies.

North America Legal Cannabis Market By Cultivation Insights

Greenhouse cultivation leads the market, offering a balance between environmental control and cost-efficiency. Many large producers in Canada and the U.S. operate advanced greenhouses that leverage natural light while maintaining temperature and humidity standards through automation. These facilities allow for high yields and standardized production across seasons.

Indoor cultivation, however, is the fastest-growing segment due to the demand for high-quality, premium-grade cannabis. Indoor growing enables year-round production with precise control over lighting, nutrients, and genetics. Craft producers and boutique brands often use indoor setups to cultivate unique strains with higher cannabinoid and terpene content, catering to connoisseur consumers and medical patients requiring consistent potency.

North America Legal Cannabis Market By End Use Insights

Recreational use accounts for the majority of market share, particularly in U.S. states and Canadian provinces with established adult-use programs. Consumers use cannabis for stress relief, social experiences, and wellness routines. Sales spikes are observed around holidays, weekends, and post-pandemic relaxation events, indicating strong recreational demand.

Medical cannabis use is expanding rapidly, particularly for chronic conditions such as cancer-related pain, multiple sclerosis, PTSD, and epilepsy. Physicians are increasingly prescribing cannabis where conventional therapies fall short. Additionally, the development of standardized dosages, clinical trials, and education programs is boosting physician and patient confidence in medical cannabis for long-term care.

Country-Level Analysis – United States and Canada

United States

In the U.S., the cannabis industry is booming despite the lack of federal legalization. States like California, Colorado, and Michigan are leading in terms of revenue and licensed dispensaries. The introduction of social equity programs, state tax incentives, and medical-to-recreational transitions are shaping market maturity. The SAFER Banking Act and federal rescheduling discussions remain at the center of market speculation.

Consumer demand is evolving toward edibles, vapes, and wellness-infused beverages. High taxation and oversupply in some states (e.g., Oregon) have caused pricing pressures, but innovation and branding continue to attract venture capital and institutional investment.

Canada

Canada’s federally legalized framework provides a more unified regulatory environment. Licensed producers (LPs) like Tilray and Canopy Growth have expanded into export markets and developed diversified product portfolios. Ontario and Alberta represent the largest consumer markets, with thousands of retail stores operating under provincial licenses.

The Canadian market is now focusing on product differentiation, retail experience, and international exports. Challenges include regulatory restrictions on advertising and packaging, which companies are navigating through digital engagement and education campaigns.

Some of the prominent players in the North America legal cannabis market include:

North America Legal Cannabis Market Recent Developments

-

March 2025: Tilray Brands, Inc. announced a strategic acquisition of a California-based edibles company to expand its U.S. recreational footprint.

-

February 2025: Canopy Growth received FDA approval for a clinical trial exploring CBD efficacy in treating chronic insomnia, boosting credibility in the medical space.

-

January 2025: Curaleaf Holdings launched its first line of cannabis-infused beverages in the U.S., targeting wellness-conscious consumers with low-dose THC options.

-

December 2024: Aurora Cannabis entered a multi-year agreement with a German pharmaceutical firm to supply GMP-certified medical cannabis for European distribution.

-

November 2024: Trulieve opened its 200th dispensary in the U.S., signaling aggressive retail expansion and vertical integration.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the North America legal cannabis market

By Sources

-

- Flowers

- Oil and Tinctures

By Cultivation

- Indoor Cultivation

- Greenhouse Cultivation

- Outdoor Cultivation

By Derivatives

By End Use

-

- Cancer

- Chronic Pain

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-Traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

- Recreational Use

- Industrial Use

By Region