North America Non-energy Based Aesthetic Treatment Market Size and Trends

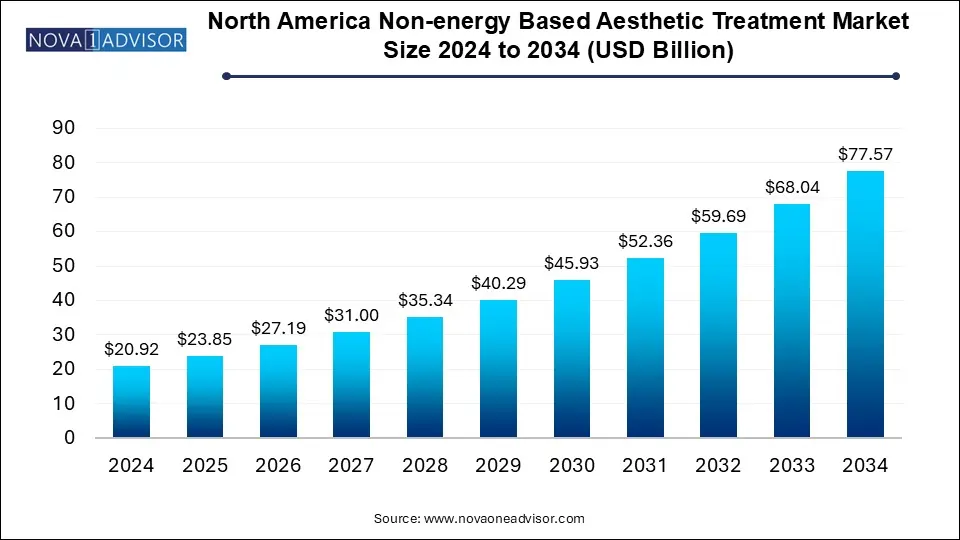

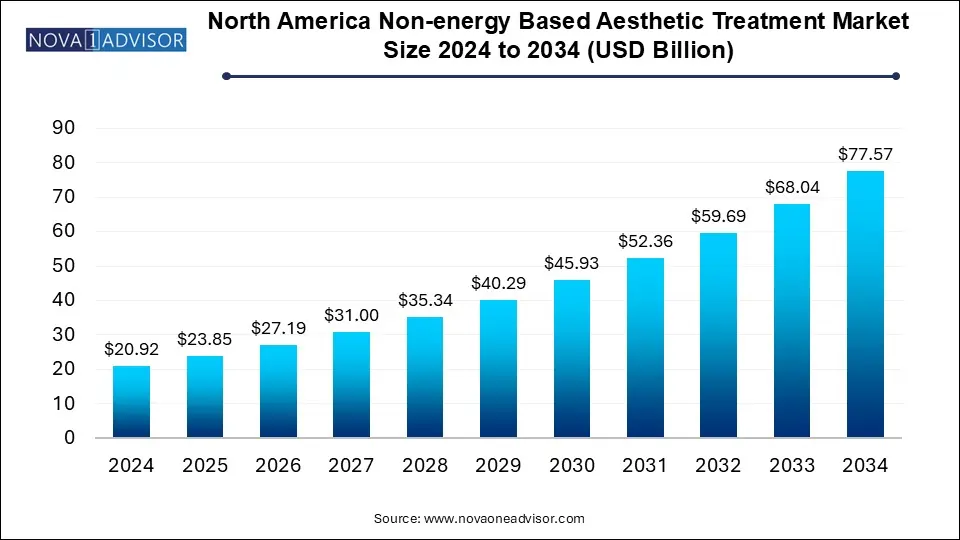

The North America non-energy Based aesthetic treatment market size was exhibited at USD 20.92 billion in 2024 and is projected to hit around USD 77.57 billion by 2034, growing at a CAGR of 14.0% during the forecast period 2025 to 2034.

North America Non-energy Based aesthetic Treatment Market Key Takeaways:

- The injectables segment held the largest share of more than 85.1% in 2024 and is also anticipated to expand at a healthy CAGR of 14.1% from 2025 to 2034.

- The skin rejuvenation segment is expected to witness a lucrative growth rate of 13.4% during the forecast period.

- Med spa forms the largest end-user, with a share of around 35.0% in 2024.

- The traditional spa segment is expected to witness lucrative growth of 14.6% during the forecast period.

- The U.S. is the predominant region for the North America non-energy-based aesthetic treatment market, with a share of 85.3% in 2024.

- Canada is expected to witness a lucrative growth rate of 13.4% during the forecast period.

Market Overview

The North America non-energy based aesthetic treatment market has witnessed transformative growth over the past decade, emerging as a vital component of the region’s burgeoning cosmetic and dermatologic care landscape. Unlike energy-based treatments that involve lasers, radiofrequency, or ultrasound technologies, non-energy based treatments encompass procedures such as injectables (e.g., botulinum toxin, dermal fillers), skin rejuvenation (chemical peels, microneedling), and microdermabrasion. These procedures offer minimally invasive alternatives to surgical interventions, aligning with patient preferences for safer, quicker, and cost-effective solutions.

Several social and demographic factors are contributing to this market’s expansion. Increasing aesthetic consciousness across younger and older demographics, rising disposable incomes, the normalization of cosmetic enhancements in social and professional settings, and social media’s influence have collectively fostered robust demand. According to the American Society for Aesthetic Plastic Surgery (ASAPS), injectable treatments continue to top the chart in terms of procedure volume in both the U.S. and Canada. Additionally, dermatologists and med spas are increasingly incorporating these treatments into their offerings to meet the evolving needs of aesthetic-focused clientele.

The market is further buoyed by ongoing advancements in treatment formulations and techniques. Patients now benefit from longer-lasting injectables, improved safety profiles, and personalized regimens tailored to individual skin types and goals. As consumers seek natural-looking results with minimal downtime, non-energy based aesthetic procedures stand as a compelling choice, reinforcing North America's leadership in global aesthetic medicine.

Major Trends in the Market

-

Rise in Preventative Aesthetic Treatments Among Millennials and Gen Z: Younger populations are opting for procedures like botulinum toxin injections not just for correction but for prevention, delaying visible signs of aging.

-

Preference for Natural-Looking Enhancements: Patients now demand subtle enhancements rather than dramatic changes, prompting clinics to adopt newer filler techniques and microdosing botulinum toxin strategies.

-

Growth in Male Aesthetic Participation: More men are seeking non-surgical enhancements, especially botulinum toxin injections and dermal fillers, to maintain a competitive edge in professional environments.

-

Bundled Aesthetic Treatments: Clinics and spas are offering package-based treatments that combine multiple non-energy based procedures, encouraging client retention and greater spending per session.

-

Innovation in Injectable Formulations: Companies are launching advanced fillers and neurotoxins with extended longevity, improved texture, and reduced migration risk.

Report Scope of North America Non-energy Based aesthetic Treatment Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 23.85 Billion |

| Market Size by 2034 |

USD 77.57 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 14.0% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Procedure, End-use, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America |

| Key Companies Profiled |

Allergan plc. (AbbVie); Gal derma; Merz Pharma; LPG SYSTEMS; NeoGenesis, Inc.; Oxygenceuticals; Genesis Bio systems, Inc.; Revance Therapeutics, Inc.; Ipsen Pharma; Sun Eva Medical, Inc.; Mesoestetic Pharma Group SL |

Key Market Driver: Increasing Demand for Minimally Invasive Procedures

One of the strongest drivers of the North American non-energy based aesthetic treatment market is the heightened consumer preference for minimally invasive procedures that offer fast, effective results with little to no downtime. Patients across all age groups, particularly in urban and high-income brackets, seek treatments that do not disrupt daily life. Procedures such as hyaluronic acid fillers, botulinum toxin, and microneedling can typically be performed in under an hour with visible outcomes appearing in days or even immediately.

According to the American Society of Plastic Surgeons, botulinum toxin injections saw a year-on-year rise of over 8% in 2023 alone, reflecting the enduring demand for non-surgical facial enhancements. A significant portion of this growth stems from working professionals and social media influencers who value facial aesthetics as part of their personal brand. Furthermore, the ease of accessibility and growing number of trained injectors—across med spas, dermatology clinics, and plastic surgery offices—has contributed to making these treatments a mainstream choice for cosmetic enhancement.

Key Market Restraint: Risk of Unregulated and Unqualified Administration

Despite the market's robust growth, a prominent restraint is the increasing occurrence of non-energy based treatments being administered by unqualified or undertrained personnel. The proliferation of med spas and “pop-up” aesthetic services—often outside clinical settings—has resulted in an uptick in adverse events such as overfilling, asymmetry, and severe complications like vascular occlusion. The lack of consistent regulatory oversight across the U.S. and Canada exacerbates the problem, especially as demand outpaces the development of professional standards.

Furthermore, the marketing of aesthetic treatments as “quick and easy” can mislead consumers, causing them to underestimate the medical expertise required. This not only jeopardizes patient safety but also tarnishes public confidence in otherwise highly effective and safe procedures. Educating patients and enforcing stricter guidelines around the administration of injectables and skin rejuvenation techniques are critical to mitigating this challenge and preserving market credibility.

Key Market Opportunity: Expansion of Aesthetic Services in Primary and HCP-Owned Clinics

An exciting growth opportunity lies in the integration of non-energy based aesthetic treatments into primary care and healthcare professional (HCP)-owned clinics. With physicians increasingly diversifying into aesthetic medicine—either as full-time practitioners or as part of multi-disciplinary practices—the accessibility and professionalism of services are expanding. Family doctors, dermatologists, and even dentists are pursuing aesthetic certifications and incorporating injectables, chemical peels, and microneedling into their service offerings.

This shift is bolstered by the trust patients have in licensed medical professionals, as well as the opportunity for HCPs to offer aesthetic treatments during routine appointments, such as wellness checks or dermatologic evaluations. In rural and suburban areas, where med spas may be sparse, this approach bridges a significant service gap and enables patient-centered care with the assurance of clinical oversight. For product manufacturers and training organizations, this represents a strategic channel for growth and education.

North America Non-energy Based aesthetic Treatment Market By Procedure Insights

Injectables dominated the North America non-energy based aesthetic treatment market in terms of both volume and revenue. Botulinum toxin and dermal fillers, including hyaluronic acid and calcium hydroxylapatite, are the cornerstones of facial rejuvenation. These treatments are widely recognized for their efficacy in reducing wrinkles, restoring volume, and enhancing facial contours. The fast procedure time, quick recovery, and growing social acceptance have made injectables a routine part of many individuals' beauty regimens. Additionally, ongoing innovation—such as the development of long-acting fillers and combination therapies—continues to elevate the attractiveness of injectables to both patients and practitioners.

Hyaluronic acid and botulinum toxin remain the fastest-growing sub-segments within injectables. Hyaluronic acid fillers, favored for their safety, reversibility, and natural hydration effect, are now used in a wide range of applications, from lip enhancement to under-eye rejuvenation. Botulinum toxin, meanwhile, has evolved beyond wrinkle treatment to address issues like bruxism, migraine relief, and facial asymmetry. The younger demographic is also increasingly adopting these treatments as preventive measures against aging signs, a trend supported by social media endorsements and beauty influencers.

Skin rejuvenation is emerging as a fast-expanding segment, especially among those hesitant to try injectables. Chemical peels, microdermabrasion, and microneedling offer skin resurfacing and collagen-boosting benefits with minimal invasion. Microneedling, in particular, has seen explosive growth due to its versatility and compatibility with platelet-rich plasma (PRP) and other topicals. It is increasingly being adopted by dermatology clinics and med spas as a holistic skin wellness procedure, particularly among patients looking to treat acne scars, hyperpigmentation, and enlarged pores.

North America Non-energy Based aesthetic Treatment Market By End-Use Insights

Med spas held the dominant position in the end-use segment, owing to their accessibility, luxury-oriented branding, and broad menu of aesthetic treatments. Med spas strike a balance between clinical expertise and spa-like experiences, drawing in a clientele that values both professionalism and relaxation. With extended evening and weekend hours, loyalty programs, and aesthetic consultants, med spas appeal to busy professionals and offer a more approachable alternative to hospitals or surgical centers. Their rapid expansion across urban centers and affluent suburbs continues to boost market penetration.

HCP-owned clinics are expected to be the fastest-growing end-use segment, as more licensed healthcare professionals integrate aesthetic services into their practice. These clinics benefit from patient trust and offer a medicalized setting that reassures clients, particularly first-time patients. Furthermore, HCPs can leverage their diagnostic expertise to recommend tailored aesthetic solutions based on patient history, skin type, or underlying health conditions. With increasing access to professional aesthetic training and partnerships with product manufacturers, these clinics are poised to expand significantly, especially in areas underserved by med spas.

North America Non-energy Based aesthetic Treatment Market By Regional Insights

United States

The United States leads the North American non-energy based aesthetic treatment market by a wide margin, driven by advanced healthcare infrastructure, high aesthetic awareness, and a large consumer base willing to spend on appearance-related enhancements. In the U.S., the aesthetic industry is supported by a strong ecosystem of manufacturers, professional organizations, and a well-established network of aesthetic clinics. Leading U.S.-based companies like AbbVie (Botox) and Revance Therapeutics are continuously investing in product development and clinician training, ensuring a dynamic and responsive market environment.

Cultural shifts have also played a role in market growth. The increased visibility of aesthetic procedures on social platforms like Instagram and TikTok has destigmatized these treatments, making them more mainstream across various age groups and income levels. Regulatory support, coupled with expanded insurance coverage for medically indicated uses of injectables (such as TMJ or chronic migraines), has further broadened adoption. The U.S. continues to serve as a trendsetter in aesthetic practices, influencing both product innovation and global consumer preferences.

Canada

Canada, while smaller in market size, is witnessing accelerated growth, particularly in metropolitan areas like Toronto, Vancouver, and Montreal. Canadian consumers increasingly seek subtle, “enhancement not alteration” outcomes, which align well with the offerings of non-energy based treatments. Regulatory oversight by Health Canada ensures high safety standards, fostering patient trust in licensed providers.

The rise of licensed nurse injectors and expansion of med spas across urban and suburban areas are supporting Canada’s growth trajectory. Moreover, Canadian aesthetics training institutes are now offering internationally accredited programs, further professionalizing the industry. While slower to adopt than the U.S., Canada’s market is catching up rapidly, driven by evolving beauty standards and greater accessibility to professional aesthetic care.

Some of the prominent players in the North America non-energy Based aesthetic treatment market include:

Recent Developments

-

AbbVie (March 2025) announced the launch of a next-generation botulinum toxin formulation under its Botox brand, offering faster onset and longer duration, addressing patient demand for fewer annual treatments.

-

Revance Therapeutics (January 2025) revealed positive results from Phase 3 clinical trials for its hyaluronic acid filler portfolio, showing superior longevity compared to current market standards.

-

Prollenium Medical Technologies (February 2025), a Canadian company, expanded its Revanesse Versa+ filler line across the U.S. and Canada, introducing a new facial contouring formulation aimed at professionals seeking highly moldable and precise injection outcomes.

-

Allergan Aesthetics (October 2024) launched a multi-channel digital education platform for certified injectors across North America, enhancing skills development and fostering responsible administration of non-surgical aesthetic products.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America non-energy Based aesthetic treatment market

By Procedure

-

- Botulinum Toxin

- Calcium Hydroxyl Apatite

- Hyaluronic Acid

- Polymer Filler

- Collagen

-

- Chemical Peel

- Microdermabrasion

- Micro Needling

By End-Use

- Hospital/Surgery Center

- Med Spa

- Traditional Spa

- HCP Owned Clinic

By Regional