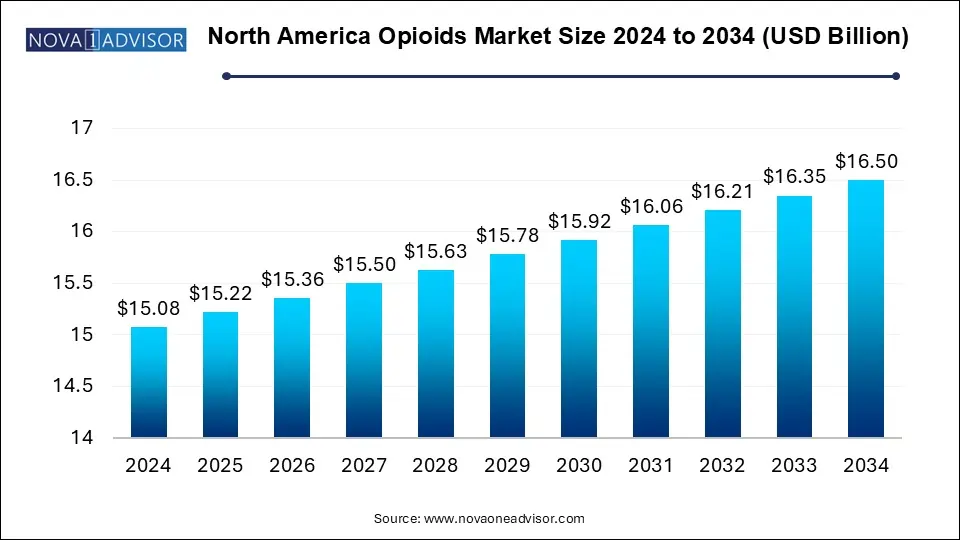

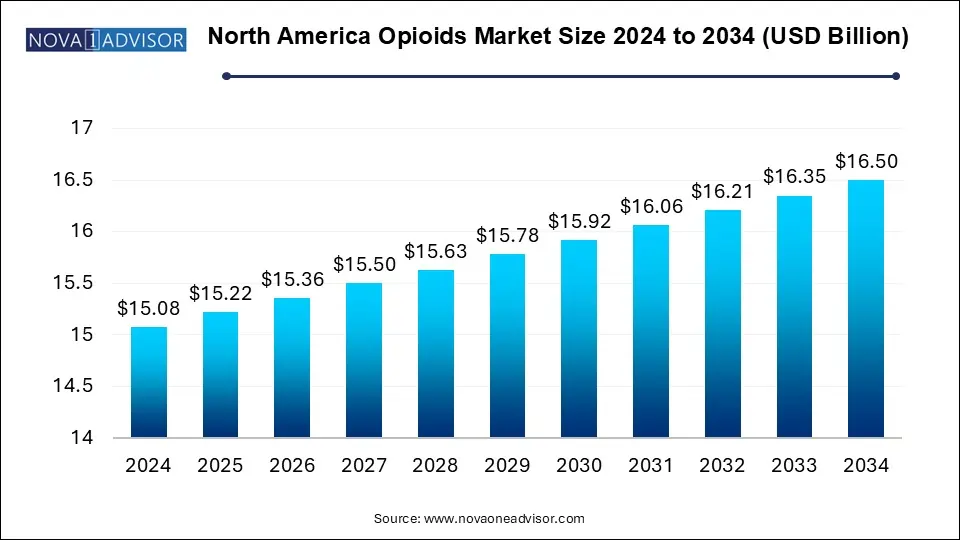

North America Opioids Market Size and Growth

The North America opioids market size was exhibited at USD 15.08 billion in 2024 and is projected to hit around USD 16.5 billion by 2034, growing at a CAGR of 0.9% during the forecast period 2025 to 2034.

North America Opioids Market Key Takeaways:

- The pain relief segment dominated the market with the largest revenue share in 2024

- The ER/long-acting opioids segment dominated the market with the highest revenue share of 54.0% in 2024 and is expected to grow at the fastest CAGR of 1.1% over the forecast period.

- The anesthesia segment is estimated to register the fastest growth rate during the forecast period

- The U.S. dominated the market with the highest revenue share of 95.6% in 2024.

Market Overview

The North America opioids market remains one of the most complex, controversial, and closely monitored pharmaceutical sectors globally. Opioids, a class of drugs derived from the opium poppy or synthesized analogs, are primarily used for pain management, anesthesia, and in some cases, cough and diarrhea suppression. While their efficacy in treating moderate to severe pain is well recognized, their potential for misuse, dependency, and overdose has made them the focus of intense scrutiny and reform in recent years.

The region has long been a leader in opioid prescription and consumption, particularly in the United States. According to the Centers for Disease Control and Prevention (CDC), the U.S. saw nearly 75% of all drug overdose deaths in 2021 involving an opioid, highlighting the dual nature of opioids as both essential medicines and public health threats. Canada, while experiencing comparatively lower overdose rates, also struggles with opioid misuse and has enacted policy reforms to manage its impact.

Despite these challenges, the therapeutic need for opioids in cancer pain, palliative care, post-surgical recovery, and chronic pain conditions remains strong. The North American market is adapting by introducing abuse-deterrent formulations (ADFs), investing in de-addiction therapies, and diversifying opioid use in controlled clinical settings. The market, therefore, presents a paradox of restrained growth driven by innovation and demand, counterbalanced by regulatory restrictions and public health advocacy.

Major Trends in the Market

-

Rise of Abuse-Deterrent Formulations (ADFs): Pharmaceutical companies are increasingly developing opioids with properties that make them harder to misuse through snorting or injection.

-

Shift Toward Extended Release (ER) Products in Chronic Conditions: There is growing preference for long-acting opioids to manage long-term pain conditions while reducing dosing frequency.

-

Increased Focus on Non-opioid Alternatives: Pain management strategies are integrating physical therapy, non-opioid medications, and nerve block injections.

-

Surge in Demand for De-Addiction Therapies: With growing opioid misuse, the demand for drugs like buprenorphine and methadone in addiction treatment programs has expanded.

-

Government Crackdown on Prescription Practices: Regulatory oversight has become stricter, pushing providers to monitor and limit opioid prescriptions.

-

Digital Prescription Monitoring Programs (PDMPs): U.S. states and Canadian provinces have adopted digital tools to track opioid distribution and detect misuse patterns.

-

Opioids in Palliative and Cancer Care Are Gaining Policy Exceptions: Despite overall restrictions, policies increasingly support access for terminally ill patients requiring strong analgesics.

Report Scope of North America Opioids Market

One of the key drivers of the North America opioids market is the growing prevalence of chronic pain and cancer-related pain, particularly among aging populations. Chronic pain affects an estimated 50 million adults in the United States alone, with conditions such as osteoarthritis, neuropathic pain, lower back pain, and fibromyalgia becoming increasingly common. Cancer-related pain, both from the disease itself and the side effects of treatments like chemotherapy and surgery, also necessitates potent analgesics, often leaving opioids as the only effective solution.

Moreover, the aging demographic in both the U.S. and Canada is significantly contributing to the demand. Older adults frequently suffer from multiple co-morbidities, including degenerative joint diseases and malignancies, which require consistent pain management. In many cases, long-term opioid therapy—under clinical supervision—is the most effective method of ensuring comfort and quality of life. This medical necessity continues to fuel demand for safer, clinically supervised opioid use, particularly in long-acting formulations.

Market Restraint: Heightened Regulatory Scrutiny and Stigma

A major restraint in the opioids market is the tightening regulatory landscape and increasing societal stigma surrounding their use. Over the past decade, North America has witnessed an opioid epidemic that resulted in hundreds of thousands of deaths due to misuse, dependency, and overdose. This public health crisis has triggered a wave of legal actions, legislative reforms, and institutional changes, all aimed at curbing opioid overprescription and unauthorized use.

The implementation of Prescription Drug Monitoring Programs (PDMPs), limits on prescription quantities, and mandatory reporting systems have made it more difficult for physicians to prescribe opioids, even for legitimate pain cases. Simultaneously, patients using opioids for genuine needs often face suspicion or delays due to fear of dependency. These barriers not only restrict the market growth but also risk under-treatment of pain, especially in marginalized or elderly populations. Pharmaceutical companies are under greater pressure to justify their products, leading to increased development costs and reputational risk.

Market Opportunity: Growth in De-Addiction Therapies and Dual-Action Products

As the market evolves, one of the most promising opportunities lies in the expansion of de-addiction treatments and dual-action opioid products. The U.S. Substance Abuse and Mental Health Services Administration (SAMHSA) reports rising enrollment in opioid treatment programs, reflecting both the need and willingness to address dependency. This demand is fueling growth in medications such as buprenorphine, naltrexone, and methadone, as well as in behavioral health centers and digitally integrated treatment platforms.

In parallel, pharmaceutical innovation is focusing on dual-action products that provide analgesia while incorporating mechanisms to minimize misuse. These include combination drugs where opioids are paired with antagonists or abuse-deterrent matrices, enabling effective pain relief with reduced addiction risk. The market is also seeing growing interest in extended-release buprenorphine implants and injectables that allow long-term, supervised treatment. As public and private sectors align toward harm reduction, these products and services stand to redefine the market’s next growth phase.

North America Opioids Market By Application Insights

Pain relief is the dominant application segment, particularly in chronic and cancer-related pain. Within this category, post-operative pain and orthopedic pain contribute significantly to opioid prescriptions. After surgeries, especially orthopedic interventions like joint replacements, patients often require strong analgesics to recover comfortably. Opioids are also a mainstay in lower back pain and fibromyalgia, where alternatives often fail to provide sufficient relief. The continued need for pain control, particularly among elderly and post-trauma patients, ensures a stable market base.

De-addiction is the fastest-growing application, driven by increasing awareness of opioid use disorder and expansion of treatment programs. Medications like buprenorphine and methadone are becoming central to outpatient and residential treatment facilities. The U.S. federal government has provided substantial funding for Medication-Assisted Treatment (MAT) programs under the CARES Act and the SUPPORT for Patients and Communities Act. Canada’s provincial healthcare programs are also funding addiction services more robustly. The stigma around seeking help for addiction is gradually diminishing, encouraging higher uptake and sustained demand in this segment.

North America Opioids Market By Product Insights

Immediate Release (IR)/Short-acting opioids dominate the market due to their widespread use in acute pain scenarios such as post-operative care, injury, and emergency situations. Drugs like hydrocodone, oxycodone, and fentanyl are frequently prescribed for their rapid onset and high efficacy. IR opioids offer physicians the ability to titrate dosage based on patient response and are often used in initial treatment plans. These medications are prevalent in surgical wards, trauma centers, and outpatient facilities. Codeine, though less potent, remains common in cough formulations and milder pain relief, especially in Canada where it’s still used in combination therapies.

Extended Release (ER)/Long-acting opioids are the fastest-growing segment driven by the need for consistent pain management in chronic conditions. ER opioids such as methadone, buprenorphine, and ER oxycodone offer prolonged relief, often requiring fewer doses and reducing the risk of peak-trough effects. ER formulations are particularly suited to oncology and palliative care settings. Their controlled-release mechanisms make them less prone to abuse when compared to IR formulations. Moreover, the adoption of ADFs in ER opioids is gaining favor with regulators and providers alike, boosting their presence in formularies and long-term care plans.

North America Opioids Market By Regional Insights

The United States is the epicenter of the North American opioids market, both in terms of size and regulatory influence. Historically, the U.S. had the highest per capita opioid prescription rates globally, driven by aggressive pharmaceutical marketing and limited regulatory oversight in the 1990s and early 2000s. However, the resultant opioid crisis has fundamentally reshaped the market. The U.S. Food and Drug Administration (FDA) has tightened approval pathways and labeling requirements for new opioid formulations, and the Drug Enforcement Administration (DEA) has restricted production quotas for high-risk drugs.

Despite regulatory headwinds, the U.S. continues to show strong demand for opioid medications in cancer and surgical care. Additionally, investments in de-addiction medications and telehealth-integrated pain management services are expanding. Public-private partnerships are supporting research into next-generation opioids and pain alternatives. States like Ohio and Massachusetts are leading efforts to balance pain treatment and addiction prevention, serving as models for other regions. The U.S. remains a hub of innovation in opioid formulation, delivery systems, and addiction recovery therapies.

Canada is a growing but more conservative market in opioid use, characterized by stringent prescription policies and proactive harm reduction programs. The Canadian government has implemented robust controls through its Opioid Action Plan, including real-time prescription monitoring and supervised consumption sites. Health Canada supports the use of opioids primarily in cancer, palliative, and severe post-surgical pain, with a strong emphasis on non-opioid alternatives.

Nevertheless, demand for ER opioids and de-addiction therapies is growing. Provinces like British Columbia and Ontario have reported rising opioid overdose cases, prompting expanded access to buprenorphine and naloxone kits. Canada also supports domestic research into opioid alternatives and safer delivery methods, making it a critical contributor to North America’s collective response to opioid misuse. Pharmaceutical companies operating in Canada often pilot ADFs and other innovations here before expanding to broader markets.

Some of the prominent players in the North America opioids market include:

Recent Developments

-

In March 2025, Purdue Pharma reached a final settlement agreement in the U.S. bankruptcy case, reallocating over $8 billion to opioid recovery initiatives across various states.

-

In February 2025, Collegium Pharmaceutical received FDA approval for its abuse-deterrent, extended-release oxycodone formulation aimed at chronic pain patients.

-

In January 2025, Braeburn Pharmaceuticals launched a monthly injectable form of buprenorphine in select U.S. addiction treatment centers.

-

In December 2024, Teva Pharmaceuticals began trials for a next-generation ER morphine product with embedded tamper-resistant technology.

-

In November 2024, Apotex Inc. in Canada collaborated with a local university to explore nanoparticle-based opioid delivery systems to minimize systemic toxicity.

-

In October 2024, Mallinckrodt Pharmaceuticals secured an extension to distribute its ADF-enabled hydromorphone under a restricted distribution protocol approved by the FDA.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America opioids market

By Product

- Immediate Release/Short-acting Opioids

-

- Codeine

- Oxycodone

- Hydrocodone

- Fentanyl

- Morphine

- Hydroxymorphone

- Oxymorphone

- Propoxyphene

- Others

- Extended Release/Long-acting Opioids

-

- Oxycodone

- Hydrocodone

- Methadone

- Fentanyl

- Morphine

- Oxymorphone

- Tapentadol

- Buprenorphine

- Hydromorphone

- Others

By Application

-

- Cancer pain

- Post-Operative Care

- Lower Back Pain

- Orthopedic

- Neuropathic

- Fibromyalgia

- Anesthesia

- Cough Suppression

- Diarrhea Suppression

- De-Addiction

By Regional