North America Oxygen Concentrators Market Size and Growth

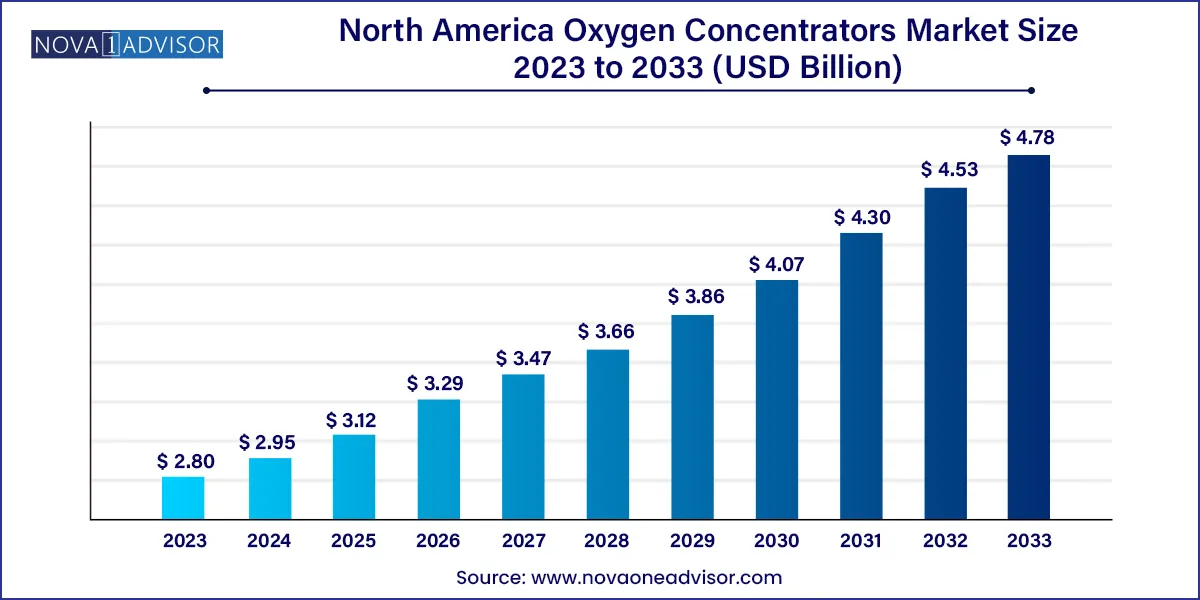

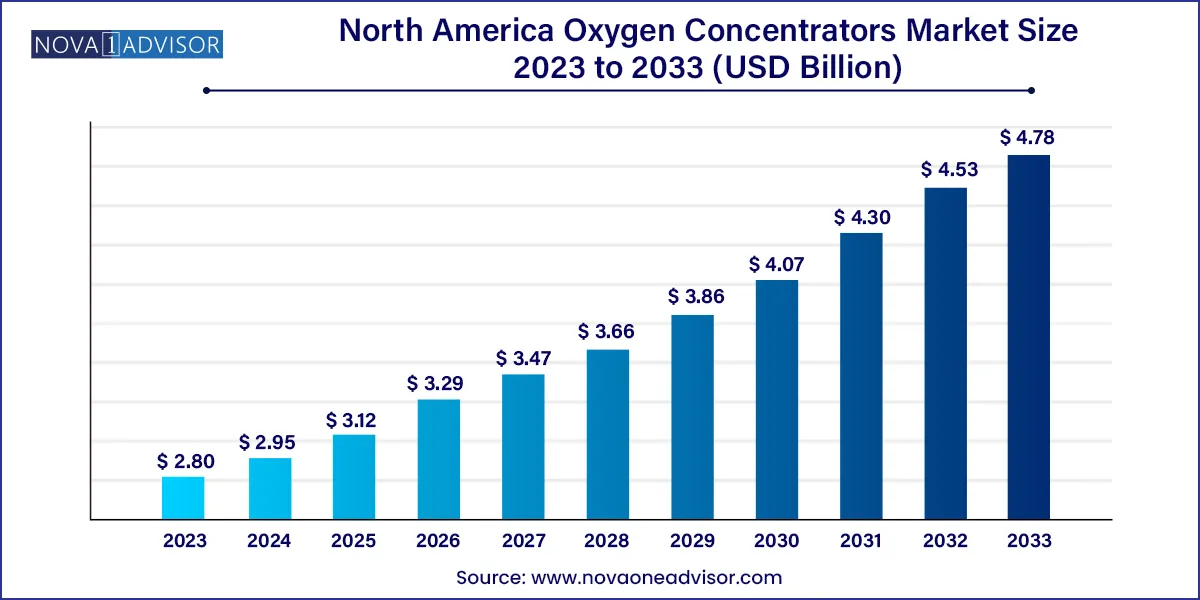

The North America oxygen concentrators market size was exhibited at USD 2.80 billion in 2023 and is projected to hit around USD 4.78 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2024 to 2033.

Key Takeaways:

- The Portable Oxygen Concentrators (POCs) segment dominated the market and accounted for a revenue market share of 53.8% in 2023.

- The segment is projected to witness the fastest growth rate of 7.3% over the forecast period.

- The continuous flow segment accounted for the largest revenue share of 61.7% in the market in 2023.

- The pulse flow technology segment is expected to experience the fastest CAGR of 5.7% during the forecast period.

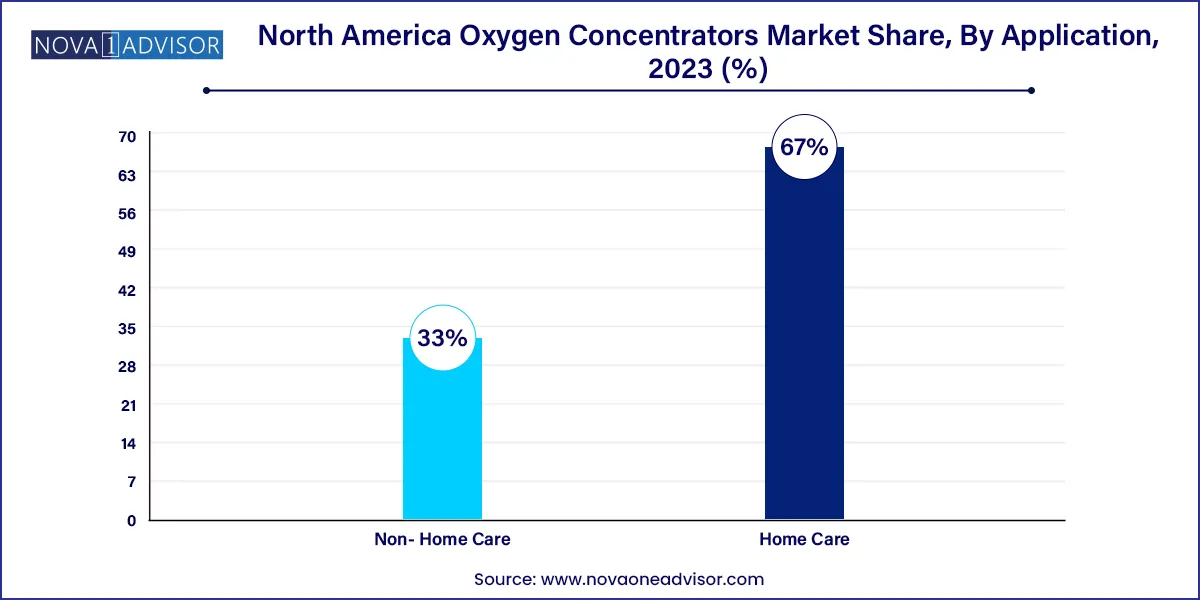

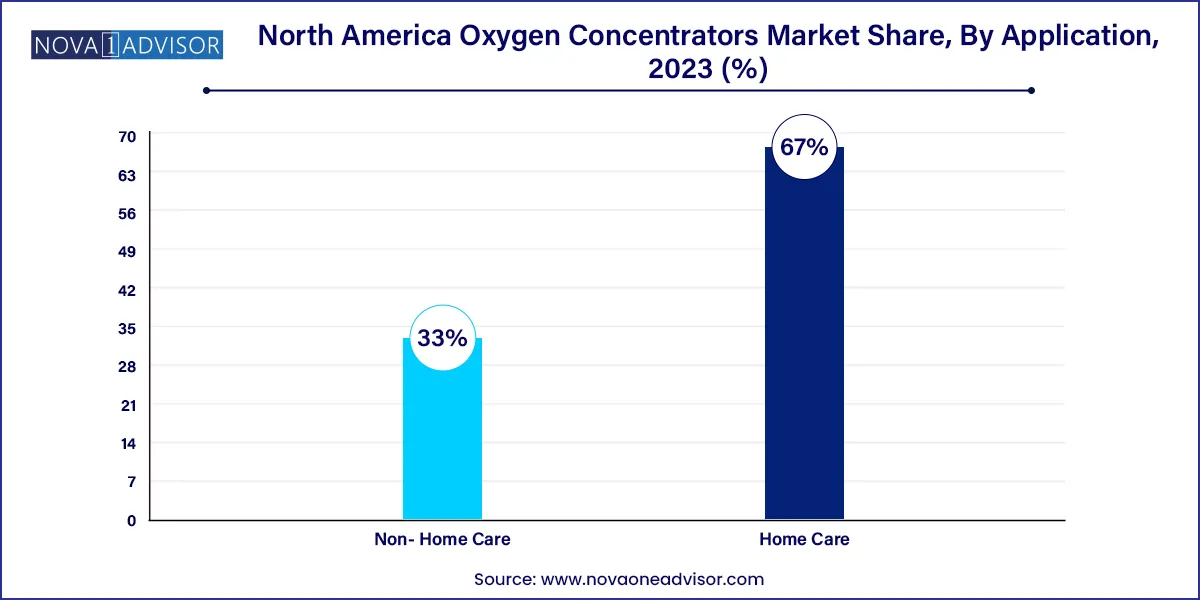

- The home care application segment dominated the market in 2023 and accounted for a significant share of 67.0% of the overall revenue.

- The segment is also projected to register the fastest growth rate of 6.3% during the forecast period.

Market Overview

The North America oxygen concentrators market is witnessing substantial growth, propelled by rising chronic respiratory diseases, aging demographics, and an increasing shift toward home-based healthcare solutions. Oxygen concentrators, which extract and purify oxygen from ambient air, are critical medical devices for patients suffering from conditions like chronic obstructive pulmonary disease (COPD), asthma, sleep apnea, and COVID-19-induced respiratory distress. Unlike traditional oxygen tanks that require regular refills, concentrators offer a continuous, sustainable source of medical-grade oxygen, improving patient independence and quality of life.

Over the past few years, the demand for oxygen concentrators in North America has expanded beyond clinical settings into homes, nursing facilities, and emergency care environments. The COVID-19 pandemic, in particular, highlighted the indispensable role of these devices in managing hypoxemia outside hospitals, especially during ICU shortages. This increased awareness has catalyzed both consumer and institutional investment in oxygen delivery technology.

The North American market benefits from advanced healthcare infrastructure, established reimbursement frameworks, and an ecosystem of domestic manufacturers and importers. With regulatory agencies like the U.S. FDA streamlining emergency approvals, the market has become more agile and responsive. Technological innovations such as smaller form factors, lithium-ion batteries, and smart connectivity are further driving product adoption. As respiratory disease prevalence continues to rise in aging populations, and healthcare systems move toward value-based models, the market for oxygen concentrators is expected to see steady and sustained growth.

Major Trends in the Market

-

Surge in Home-Based Care Adoption: Home healthcare continues to grow due to aging populations and increased post-acute care demand.

-

Miniaturization and Portability of Devices: Next-gen portable concentrators are lighter, battery-powered, and travel-friendly.

-

Smart Oxygen Delivery Systems: Integration of Bluetooth, apps, and real-time monitoring for dosage tracking and compliance.

-

COVID-19 Aftershock Demand: Long COVID syndrome and post-hospital recovery are fueling demand for long-term oxygen therapy (LTOT).

-

Government Procurement Programs: National stockpiling and public-private partnerships are ensuring oxygen device availability during health emergencies.

-

Battery Innovation: Devices with longer battery life and solar-charging options are enhancing mobility and usability.

-

Rental Models and Direct-to-Consumer Sales: Companies are offering rental and subscription models to increase affordability and access.

-

Focus on Lightweight Materials and Design: Ergonomically designed products are attracting elderly users for personal mobility and comfort.

Report Scope of The North America Oxygen Concentrators Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.95 Billion |

| Market Size by 2033 |

USD 4.78 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Technology, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America |

| Key Companies Profiled |

Inogen, Inc.; Respironics (a subsidiary of Koninklijke Philips N.V.); React Health (Respiratory Product Line from Invacare Corporation); Caire Medical (a subsidiary of NGK Spark Plug); DeVilbiss Healthcare (a subsidiary of Drive Medical); O2 Concepts; Nidek Medical Products, Inc. |

Market Driver – Rising Prevalence of Chronic Respiratory Disorders

One of the primary drivers for the North America oxygen concentrators market is the increasing burden of chronic respiratory conditions, particularly Chronic Obstructive Pulmonary Disease (COPD). According to the Centers for Disease Control and Prevention (CDC), over 16 million Americans are diagnosed with COPD, and millions more may be undiagnosed. It is the third leading cause of death in the United States. Oxygen therapy is a core component of COPD management, particularly in advanced stages, where blood oxygen levels drop significantly.

Furthermore, the increasing incidence of asthma, pulmonary fibrosis, lung cancer, and post-COVID lung damage is driving the need for oxygen concentrators in both acute and long-term scenarios. With over 40 million people in North America living with some form of respiratory illness, demand for non-invasive, reliable oxygen therapy has become critical. The aging population is especially vulnerable—people over 65 are more likely to suffer from pulmonary complications, making them a key demographic for oxygen therapy adoption. This clinical need, combined with rising patient awareness and physician recommendation, is fueling sustained market growth.

Market Restraint – High Cost and Limited Reimbursement for Portable Devices

Despite growing demand, the high upfront cost of oxygen concentrators, especially portable models, remains a significant restraint. Premium portable concentrators can cost between $2,000 and $4,000, making them unaffordable for many patients without comprehensive insurance coverage. Although Medicare and some private insurers provide partial reimbursement for home oxygen therapy, the reimbursement is often limited to basic stationary units and may not cover advanced or travel-ready devices.

Additionally, rental and replacement costs, maintenance, and battery replacements can be financially burdensome for elderly patients or those on fixed incomes. While technological innovation has led to lighter, more efficient products, it has also resulted in increased prices, which limits access particularly in rural and underserved regions. For healthcare providers, the cost-benefit trade-off may dissuade them from offering these devices in bulk, further slowing down adoption in community care settings.

Market Opportunity – Expansion of Telemedicine and Remote Monitoring Integration

An emerging opportunity in the North American oxygen concentrators market is the integration of telehealth and smart monitoring features with oxygen therapy devices. With the rapid expansion of remote patient monitoring (RPM) platforms, especially in the U.S., oxygen concentrators are now being designed with Bluetooth connectivity, real-time data syncing, and app-based controls. These features allow patients to monitor their blood oxygen levels, flow rate, and device status while clinicians track adherence, performance, and adjust therapy remotely.

Companies such as Inogen and Philips Respironics are investing heavily in digital health integration. For example, smart concentrators can notify caregivers if a patient misses scheduled usage or experiences dangerously low oxygen saturation levels. As healthcare providers increasingly adopt RPM under value-based care models, these smart systems present new revenue streams and patient engagement tools. Additionally, integration with wearable technologies and voice assistant features may expand user-friendliness, particularly for elderly patients.

North America Oxygen Concentrators Market By Product Insights

Portable medical oxygen concentrators dominate the North American market, especially due to their increased demand in home healthcare and mobility-focused patient populations. These devices offer freedom of movement, enabling patients to maintain active lifestyles while receiving continuous oxygen therapy. The portability factor, combined with FAA approval for air travel and battery-powered designs, has made these units a preferred choice for long-term users. As more patients opt for home-based recovery following surgeries or chronic condition management, portable concentrators have seen steady adoption. Additionally, their popularity surged during the COVID-19 crisis, as many patients needed post-discharge oxygen support at home.

Fixed medical oxygen concentrators are the fastest-growing sub-segment within clinical and long-term care settings, particularly for patients with high oxygen demand who are mostly homebound or bedridden. These devices are typically more robust, capable of delivering higher flow rates, and come with fewer battery constraints. They are often used in conjunction with backup oxygen cylinders or as part of comprehensive respiratory therapy setups. Advances in noise reduction, energy efficiency, and compact design are also making stationary concentrators more attractive for semi-mobile patients and home healthcare providers.

North America Oxygen Concentrators Market By Technology Insights

Continuous flow technology dominates the segment, particularly among stationary units and high-need patients requiring uninterrupted oxygen delivery. This technology ensures a steady, unbroken flow of oxygen regardless of the patient’s breathing pattern, making it essential in cases of acute respiratory distress or severe COPD. Hospitals and long-term care facilities favor this system for critical cases, ensuring consistent oxygenation without reliance on patient breath patterns. Additionally, new continuous flow units are now quieter and more compact, increasing their applicability even in residential settings.

Pulse flow technology is the fastest-growing, especially in the portable concentrator category. Pulse flow devices deliver oxygen only during inhalation, significantly conserving battery life and allowing for lighter, smaller devices. This technology is favored by mobile patients who need oxygen support during travel or outdoor activities. Pulse flow concentrators are particularly popular among younger patients and those with mild-to-moderate oxygen needs. Innovation in breath-detection sensors and dual-mode devices (offering both pulse and continuous modes) is further propelling this segment’s growth.

North America Oxygen Concentrators Market By Application Insights

Home care is the dominant application segment in the North American oxygen concentrators market, driven by the aging population, increased incidence of chronic conditions, and patient preference for recovery in familiar environments. The trend of hospital-to-home transitions, combined with Medicare support for home oxygen therapy, has solidified this segment's growth. Patients recovering from COVID-19, surgeries, and respiratory infections are increasingly prescribed oxygen therapy for home use. Companies are focusing on lightweight, user-friendly models tailored to elderly and disabled patients for this setting.

Non-home care settings are the fastest-growing, including ambulatory care centers, nursing homes, emergency medical services (EMS), and field hospitals. During the pandemic, oxygen concentrators were essential tools for emergency setups and mobile clinics. Moreover, outpatient centers are increasingly deploying concentrators to manage post-operative hypoxemia or short-term respiratory conditions without requiring hospital admission. As hospitals look to decongest beds and focus on acute cases, oxygen therapy in non-home, non-hospital settings is seeing expanded utility.

Country-Level Analysis

United States

The U.S. dominates the North American oxygen concentrators market, accounting for the lion’s share of total revenue. The country has a high prevalence of respiratory illnesses, with COPD affecting approximately 16 million Americans, and many more living with undiagnosed conditions. The U.S. Medicare system covers a wide range of oxygen therapy devices, making them accessible to a large elderly population. Furthermore, the U.S. is home to many global manufacturers, including Inogen, CAIRE Inc., and Philips Respironics (U.S. operations), ensuring strong domestic supply.

The surge in COVID-19-related hospital discharges requiring home oxygen accelerated demand across regions. Emergency declarations in 2020–2022 led to streamlined FDA authorizations under the EUA (Emergency Use Authorization), boosting innovation and rapid commercialization. U.S.-based companies also benefited from national stockpiling initiatives and partnerships with FEMA and state governments. With increasing home healthcare penetration and innovation, the U.S. is expected to maintain its leadership in the regional market.

Canada

Canada is the fastest-growing country in the North America oxygen concentrators market. Though smaller in population, Canada has seen rising awareness of respiratory health, particularly during the pandemic. The Canadian Thoracic Society has updated guidelines emphasizing home oxygen therapy for COPD and interstitial lung diseases. Additionally, provinces like Ontario and British Columbia offer reimbursement programs for oxygen therapy equipment under home and community care initiatives.

The Canadian market also benefits from close trade ties with U.S.-based manufacturers, ensuring timely access to advanced devices. The shift toward home-based care, along with federal support for aging-in-place policies, is accelerating demand for portable oxygen concentrators. As rural populations and long-term care centers demand scalable solutions, Canada is investing in decentralized healthcare, positioning itself for rapid market expansion.

Some of the prominent players in the North America oxygen concentrators market include:

- Inogen, Inc.

- Respironics (a subsidiary of Koninklijke Philips N.V.)

- React Health (Respiratory Product Line from Invacare Corporation)

- Caire Medical (a subsidiary of NGK Spark Plug)

- DeVilbiss Healthcare (a subsidiary of Drive Medical)

- O2 Concepts

- Nidek Medical Products, Inc.

Recent Developments

-

March 2025 – Inogen Inc. launched a next-gen portable oxygen concentrator, Inogen Rove 7, featuring Bluetooth-enabled tracking, extended battery life, and FAA compliance for air travel.

-

January 2025 – CAIRE Inc. partnered with Health Canada to expand its oxygen concentrator distribution in rural and Indigenous communities under a healthcare equity initiative.

-

November 2024 – Philips Respironics announced a software update for its connected concentrators, allowing real-time clinical alerts to remote physicians and care teams.

-

August 2024 – Drive DeVilbiss Healthcare expanded its North Carolina manufacturing facility to increase supply capacity for North America in preparation for future pandemic surges.

-

July 2024 – O2 Concepts introduced a solar-rechargeable oxygen concentrator prototype for off-grid use, targeting outdoor emergency response and climate-related disasters.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America oxygen concentrators market

Product

- Portable Medical Oxygen Concentrators

- Fixed Medical Oxygen Concentrators

Technology

- Continuous Flow

- Pulse Flow

Application

Regional