North America Syringe Infusion Pumps Market Size and Trends

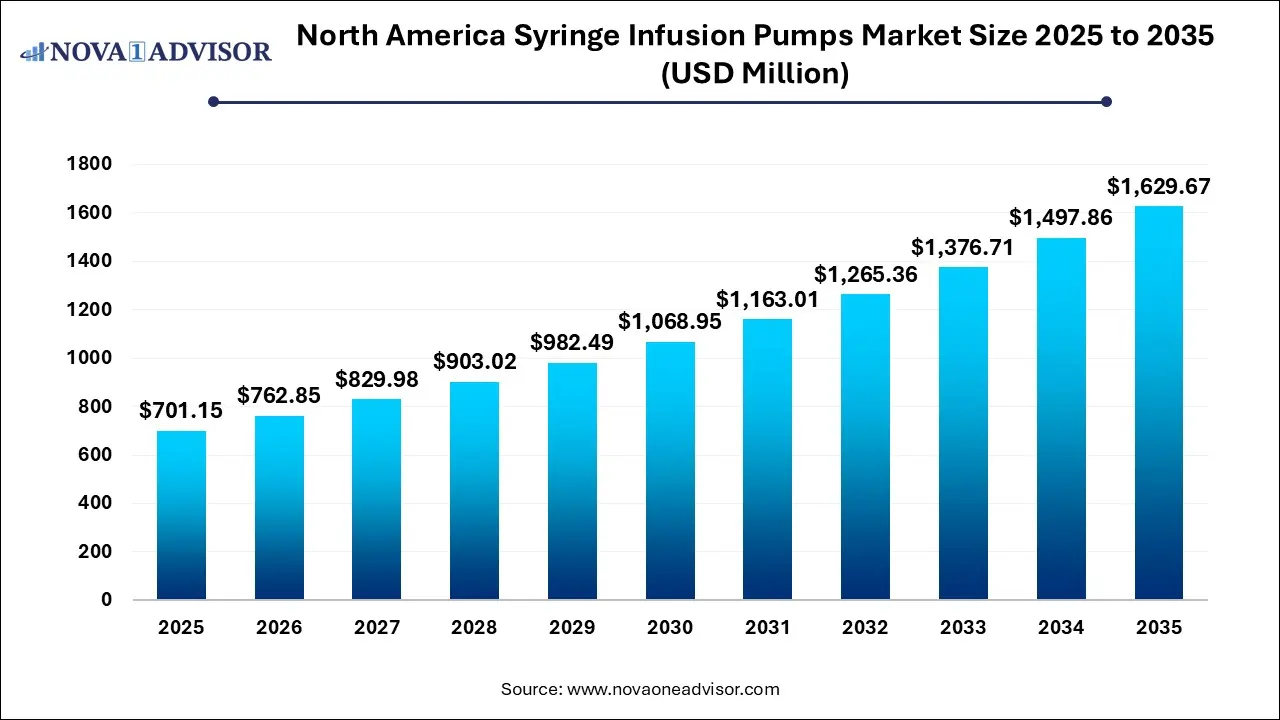

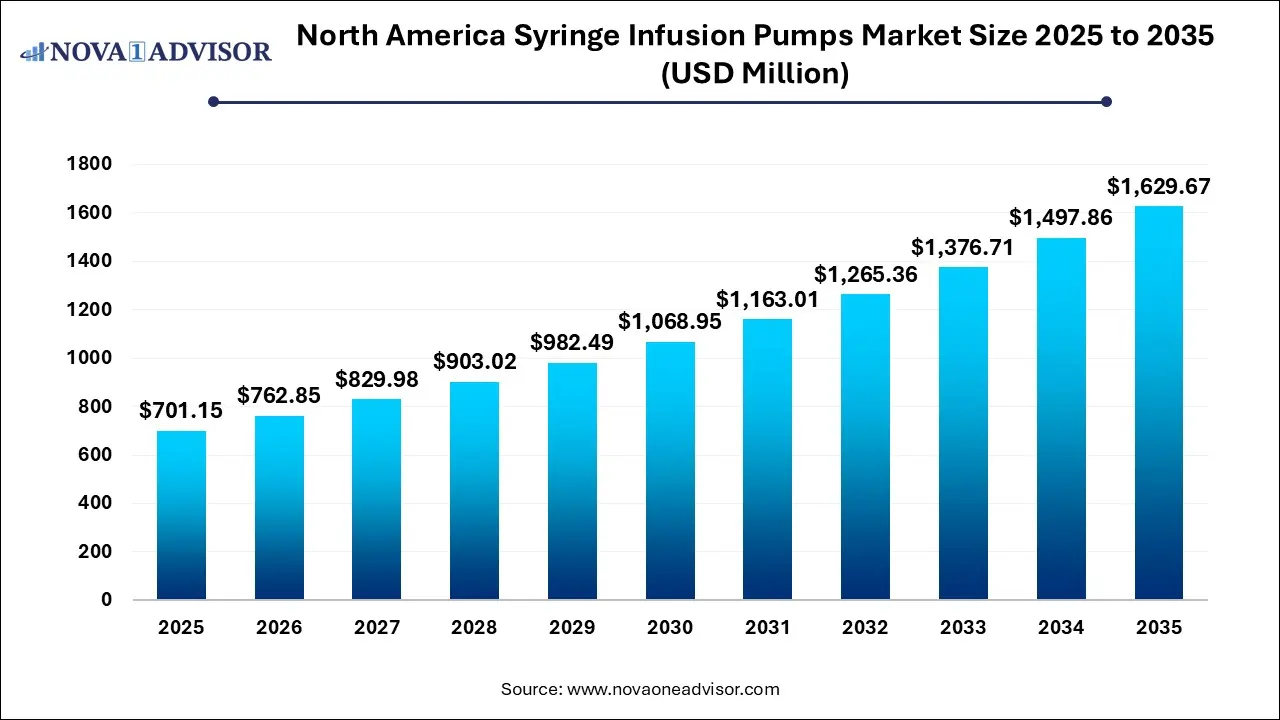

The North America syringe infusion pumps market size was exhibited at USD 701.15 million in 2025 and is projected to hit around USD 1,629.67 million by 2035, growing at a CAGR of 8.8% during the forecast period 2026 to 2035.

Key Takeaways:

- Pediatrics/neonatology dominated the market and accounted for a revenue share of 27% in 2025.

- Hospitals dominated the market and accounted for a revenue share of 42% in 2025.

- Homecare is projected to grow at the fastest CAGR of 8.9% over the forecast period.

Market Overview

The North America syringe infusion pumps market is an integral part of the region’s advanced medical device ecosystem, playing a vital role in the precision-controlled delivery of fluids, nutrients, and medications to patients. Syringe infusion pumps, distinct from volumetric pumps, allow highly accurate administration of small doses, making them particularly useful in intensive care, neonatal care, oncology, and pain management. These devices have become indispensable in clinical settings requiring continuous and patient-specific infusions, such as chemotherapy, anesthetic delivery, and post-operative recovery.

The regional market has witnessed consistent growth due to the rising burden of chronic diseases like cancer, diabetes, and gastrointestinal disorders, which necessitate long-term and complex drug administration protocols. Furthermore, the COVID-19 pandemic accelerated demand for advanced infusion systems, including syringe pumps, across emergency and intensive care units to manage ventilated patients requiring sedation and vasopressors. Post-pandemic, the market has continued to benefit from digital health trends, improved healthcare infrastructure, and the expansion of homecare services.

In North America, technological innovations have taken center stage in syringe pump development. From smart connectivity with EMRs (Electronic Medical Records) to integration with drug libraries and dose error reduction systems (DERS), the infusion landscape has significantly evolved. The emphasis has shifted from mere drug delivery to enhanced patient safety, remote monitoring, and compliance with stringent regulatory standards. Additionally, rising healthcare investments and a well-established reimbursement system in the U.S. and Canada are sustaining market momentum.

Major Trends in the Market

-

Smart Syringe Pumps Integration with EMRs: Increasing adoption of connected syringe pumps that communicate with hospital information systems and electronic health records for real-time data synchronization.

-

Personalized Drug Delivery Algorithms: Development of AI-based infusion protocols that tailor flow rates and dosages based on patient vitals, especially in oncology and critical care.

-

Miniaturization and Portability: Rise in demand for lightweight, portable syringe pumps, particularly for ambulatory and homecare use.

-

Automated Alarms and Safety Features: Integration of safety-enhancing features such as occlusion detection, flow rate verification, and anti-bolus mechanisms.

-

Growth in Disposable Syringe Pump Cartridges: Increased usage of single-use consumables for infection control and convenience.

-

Homecare Expansion with Remote-Controlled Infusions: Syringe pumps used in home settings now offer remote configuration and alerts, enabling physician oversight from afar.

-

Multi-channel Pumps for Pediatric and ICU Use: Introduction of pumps that can simultaneously administer multiple medications at varied rates to neonates and critical care patients.

Report Scope of North America Syringe Infusion Pumps Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 762.85 Million |

| Market Size by 2035 |

USD 1,629.67 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 8.6% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Disease Indication, End use, and Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America |

| Key Companies Profiled |

Baxter; B. Braun Medical Inc.; Fresenius Kabi AG; ICU Medical, Inc.; Micrel Medical Devices SA; Boston Scientific Corporation; BD; Terumo Corporation; Moog Inc.; IRadimed Corporation; CODAN Companies; ACROMED |

Market Driver: Rising Incidence of Cancer Requiring Chemotherapy

A significant driver of the North American syringe infusion pumps market is the escalating incidence of cancer and the increasing reliance on chemotherapy as a treatment modality. According to the American Cancer Society, over 1.9 million new cancer cases were estimated in the U.S. in 2024 alone. Chemotherapy requires the controlled, continuous delivery of cytotoxic drugs, which are best administered via syringe infusion pumps due to their high accuracy and ability to maintain low and steady flow rates. For example, in breast cancer patients undergoing continuous 5-fluorouracil infusions, syringe pumps minimize drug toxicity while maximizing efficacy. Moreover, these pumps can store pre-programmed dosage libraries for multiple chemotherapy regimens, reducing human error and ensuring precision.

As more hospitals implement oncology day-care units and outpatient infusion centers, the deployment of syringe pumps in these settings is becoming more standardized. Additionally, wearable infusion pumps for chemotherapy at home enabled by Bluetooth connectivity and automated dosage control are emerging as alternatives to hospital-based care, driving further adoption in this disease segment.

Market Restraint: Risk of Technical Failures and Drug Delivery Errors

Despite the advancements in safety and automation, technical malfunctions in syringe infusion pumps pose a critical restraint to market growth. Device errors such as occlusion, inaccurate flow rates, and user-interface misprogramming can lead to serious complications including drug overdoses, underdosing, or prolonged treatment interruptions. The U.S. Food and Drug Administration (FDA) has issued multiple warnings and recalls over the past decade due to such issues. For example, in 2022, a major U.S.-based pump manufacturer issued a Class I recall over a software defect causing incorrect dosage rates.

Such incidents not only endanger patient safety but also undermine provider confidence in infusion technologies. Regulatory compliance with stringent FDA and Health Canada guidelines demands continuous software updates, technician training, and equipment checks, all of which add operational burden and cost to healthcare facilities. As syringe pumps become more software-reliant, cybersecurity concerns and device interoperability also become growing areas of scrutiny.

Market Opportunity: Growth of Homecare and Ambulatory Infusion Services

An emerging opportunity in the syringe infusion pumps market lies in the expansion of home-based care and ambulatory infusion services. With rising healthcare costs and a growing preference for patient-centric care, many treatments traditionally administered in hospitals such as antibiotic therapy, insulin infusions, and palliative pain management are shifting to home environments. Syringe pumps designed for home use are compact, battery-operated, and equipped with remote-control functionality, allowing patients to receive therapy with minimal clinical supervision.

For instance, companies are now launching subscription-based home infusion kits where patients receive a pre-set pump with consumables delivered monthly, along with telehealth support. This is particularly useful for chronic conditions like Crohn’s disease or rheumatoid arthritis, which require periodic biologic drug delivery. As public and private insurers increase coverage for home-based infusion therapies, the demand for reliable and patient-friendly syringe pumps is expected to grow substantially across North America.

Segmental Analysis

By Disease Indication Outlook

The chemotherapy segment dominated the disease indication market due to the growing use of syringe pumps in oncology treatments requiring high precision. Chemotherapeutic agents, particularly those administered over extended periods (e.g., 24-hour continuous infusions), demand consistent dosing to maintain therapeutic levels and minimize systemic toxicity. In specialized oncology units across the U.S. and Canada, syringe pumps are configured with drug-specific settings and dose limits to enhance safety. The rising cases of colorectal, breast, and lung cancer have translated into higher infusion volumes and increased demand for multi-channel syringe pump systems. Additionally, the use of elastomeric and wearable pumps in outpatient chemotherapy settings has made infusion more accessible to patients, extending the segment's dominance.

The pediatrics/neonatology segment is the fastest-growing disease indication, propelled by the need for low-volume, high-precision drug administration in infants and neonates. Hospitals increasingly rely on syringe pumps to deliver antibiotics, parenteral nutrition, and anesthetics to newborns and pediatric ICU patients. These applications require error-free dosing, often as low as 0.1 mL/hr, where syringe pumps excel due to their accuracy. Technological enhancements, such as programmable dosing limits and integrated monitoring systems, have made syringe pumps safer and more reliable for pediatric use. Furthermore, the rising birth rate and NICU admissions in urban North American hospitals have accelerated procurement of pediatric infusion systems.

By End Use Outlook

Hospitals dominated the end-use segment, accounting for the largest revenue share in 2025. Hospitals represent the primary setting for critical care, oncology, surgery, and emergency medicine all areas where syringe infusion pumps are indispensable. Large tertiary-care institutions typically deploy fleets of pumps connected to centralized monitoring systems and electronic drug libraries. For example, the Cleveland Clinic and Mount Sinai have deployed thousands of interconnected pumps across departments, enabling smart alerts, centralized programming, and real-time analytics. Hospitals also benefit from staff training programs and IT support to manage device interoperability and error reduction.

Homecare is emerging as the fastest-growing end-use segment, largely fueled by the shift towards decentralized healthcare and patient preference for home treatments. Home infusion therapy for chronic pain, diabetes, and infections is gaining insurance support, and syringe pumps tailored for layperson use are being introduced with simplified controls, disposable cartridges, and mobile app integration. Companies are even offering 24/7 virtual nurse support for patients using home infusion kits. This segment's growth is further supported by aging populations, especially in the U.S., where patients with mobility or transportation challenges are increasingly opting for in-home care.

Country-Level Analysis

United States

The U.S. represents the dominant market for syringe infusion pumps in North America, contributing the majority of regional revenue. The country's strong healthcare infrastructure, high adoption of medical technologies, and presence of major pump manufacturers have contributed to this dominance. Leading hospitals and cancer centers routinely use advanced smart syringe pumps with integrated drug libraries and remote monitoring capabilities. The U.S. also has a highly structured reimbursement model under Medicare, Medicaid, and private insurers that covers infusion therapy across hospital and homecare settings.

Technological innovation, robust R&D activity, and frequent FDA approvals continue to strengthen the U.S. market. Moreover, the increasing prevalence of chronic illnesses, including cancer, diabetes, and gastrointestinal disorders, is driving pump adoption across urban and rural healthcare centers. The emphasis on reducing hospital stays and promoting ambulatory care is also contributing to higher demand for portable and remote-controlled syringe pumps.

Canada

Canada follows as a strong market in North America, with public health systems like Ontario Health and Alberta Health Services actively investing in infusion technologies. The adoption of syringe pumps is particularly high in neonatal and oncology departments. The Canadian government’s emphasis on improving access to rural healthcare services through mobile infusion clinics is also fostering demand.

Mexico

Mexico is an emerging market, with adoption primarily driven by private hospitals and specialty clinics in urban centers. However, limited reimbursement coverage and healthcare access disparities pose barriers. Despite this, the government’s healthcare modernization programs may open new opportunities for infusion pump deployment in the coming years.

Some of The Prominent Players in The North America syringe infusion pumps market Include:

Recent Developments

-

April 2025 – Baxter International Inc. announced the expansion of its “Spectrum IQ” smart pump platform to include a new syringe pump variant with cloud-based data integration and enhanced cybersecurity features tailored for U.S. hospitals.

-

February 2025 – Smiths Medical partnered with a Canadian telehealth provider to pilot remote syringe pump monitoring for oncology patients receiving chemotherapy at home.

-

November 2024 – B. Braun Medical Inc. launched the “Perfusor Space X” syringe pump series in the U.S., featuring dual-battery operation, touchscreen interface, and multi-lingual support for diverse clinical settings.

-

August 2024 – ICU Medical, Inc. completed an upgrade to its Plum 360 and Sapphire syringe pump lines, adding barcode medication administration (BCMA) integration for closed-loop medication management.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Disease Indication

- Chemotherapy

- Diabetes

- Gastroenterology

- Analgesia/Pain Management

- Pediatrics/Neonatology

- Hematology

- Others

By End Use

- Hospitals

- Homecare

- Others (ASC, Nursing Homes, Rehabilitation Centers)

By Country