North America Urinary Tract Infection Testing Market Size and Research

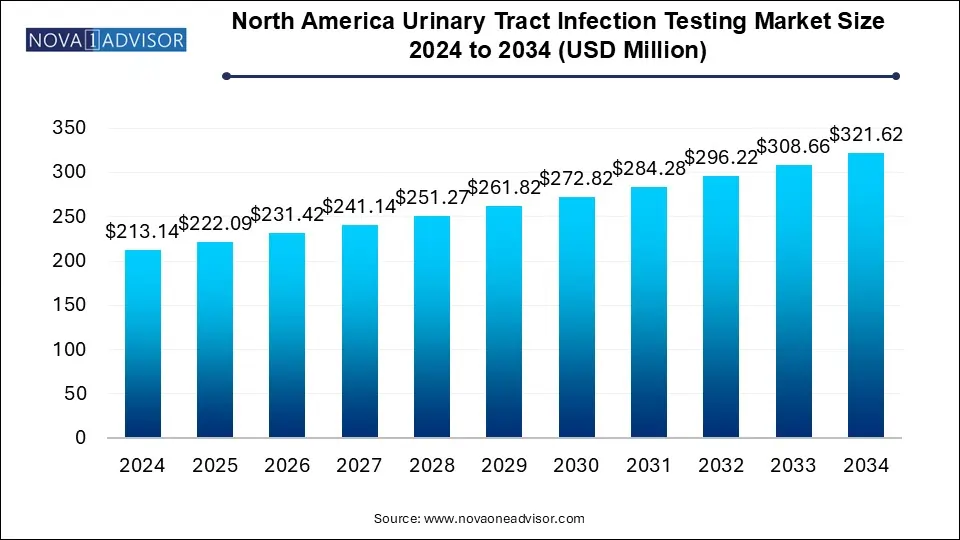

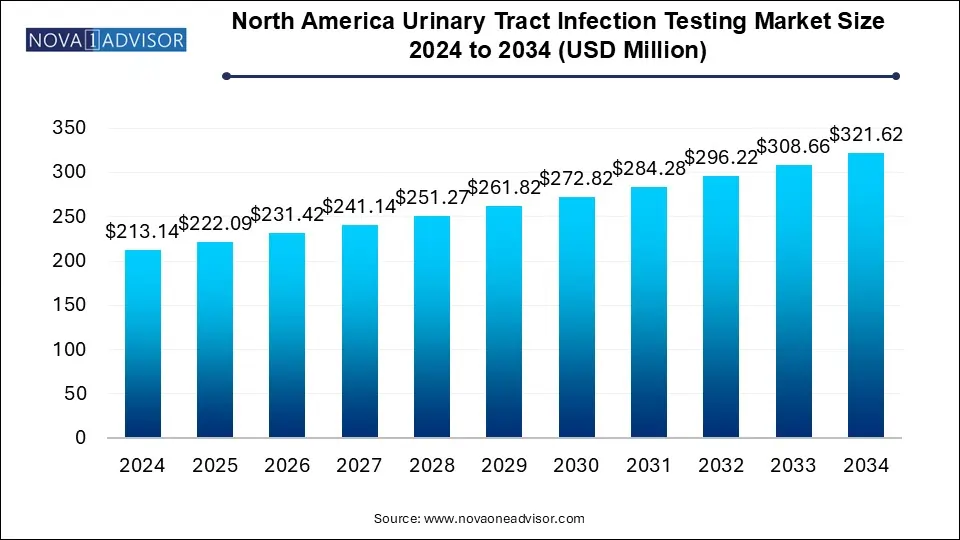

The North America urinary tract infection testing market size was exhibited at USD 213.14 million in 2024 and is projected to hit around USD 321.62 million by 2034, growing at a CAGR of 4.2% during the forecast period 2025 to 2034.

North America Urinary Tract Infection Testing Market Key Takeaways:

- The cystitis segment accounted for the largest revenue share of 41.41% in 2024

- The pyelonephritis segment is expected to witness the fastest CAGR over the forecast period.

- The instruments segment accounted for the largest revenue share of 60.36% in 2024

- The reference laboratories segment held the largest revenue share of 27.0% in 2024.

- The urogynecologists segment is expected to witness the fastest CAGR over the forecast period.

- The U.S. dominated the North American market for urinary tract infection testing in 2024 with 90.47% of the revenue share.

Market Overview

The North America Urinary Tract Infection (UTI) Testing Market is a vital segment of the region’s diagnostic landscape, driven by the high prevalence of UTIs, advancements in rapid diagnostics, and growing public awareness about early detection. UTIs are among the most common bacterial infections in the region, affecting millions annually, particularly women, older adults, and individuals with comorbidities such as diabetes or immunodeficiency disorders. The testing market encompasses a broad range of products and services aimed at accurately diagnosing the type and severity of UTIs to inform timely and effective treatment.

The increasing burden of UTIs in North America can be attributed to several demographic and healthcare-related factors. Aging populations, increased catheter usage in hospitals, sedentary lifestyles, and antibiotic resistance are all contributing to the growing incidence. According to the Urology Care Foundation, at least 10 in 25 women and 3 in 25 men in the United States will have a UTI during their lifetime. This prevalence underscores the importance of efficient diagnostic protocols and has spurred significant demand for both point-of-care testing and laboratory-based solutions.

Diagnostic laboratories, hospitals, and clinics are steadily adopting advanced testing tools, such as multiplex PCR assays, microfluidic platforms, and biosensor-integrated devices, to enhance the accuracy and speed of UTI detection. Moreover, home-based urine testing kits and telemedicine platforms are playing a growing role in remote UTI diagnosis and monitoring, especially since the COVID-19 pandemic accelerated digital healthcare adoption. The convergence of clinical needs, patient preferences, and technological innovation positions the North American UTI testing market for sustained growth over the next decade.

Major Trends in the Market

-

Adoption of Point-of-Care UTI Diagnostics: Rapid, easy-to-use devices are being adopted in emergency rooms and clinics to deliver real-time UTI diagnosis without the need for lab processing.

-

Integration of AI and Machine Learning in Urine Testing: AI-powered diagnostic platforms are being developed to interpret dipstick test results or culture growth patterns, improving diagnosis accuracy.

-

Rising Preference for Home Testing Kits: Consumers are increasingly turning to over-the-counter and app-integrated home kits for early UTI detection, especially in the U.S.

-

Shift Toward Molecular Diagnostics: PCR-based testing for UTIs is gaining traction due to its precision and ability to identify resistant strains.

-

Collaborations Between Diagnostic Firms and Telehealth Providers: Companies are partnering with telemedicine platforms to enable at-home sample collection and diagnosis.

-

Focus on Antimicrobial Stewardship: Accurate diagnostics are being emphasized to reduce the misuse of antibiotics, a major concern in recurrent UTI management.

-

Technological Innovations in Urine Culture Systems: Automated systems are being implemented in hospital laboratories to enhance the throughput of UTI testing.

Report Scope of North America Urinary Tract Infection Testing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 222.09 Million |

| Market Size by 2034 |

USD 321.62 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 4.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Product, End-use, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America |

| Key Companies Profiled |

QIAGEN; Accelerate Diagnostics, Inc.; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation; Siemens Healthcare GmbH; Randox Laboratories Ltd.; Thermo Fisher Scientific, Inc.; bioMérieux SA; T2 Biosystems, Inc. |

Market Driver: High Prevalence and Recurrence Rates of UTIs

The single most compelling driver in the North American UTI testing market is the high incidence and recurrence rate of UTIs, particularly among women and the elderly. More than half of women will experience a UTI in their lifetime, and around 20–30% of those will suffer recurrent infections. UTIs are a leading cause of outpatient visits and antibiotic prescriptions in the United States, making accurate and timely diagnostics a clinical imperative.

This high prevalence is further intensified in specific populations, including pregnant women, patients with indwelling catheters, and individuals with diabetes. The Centers for Disease Control and Prevention (CDC) has reported a substantial increase in hospital-acquired urinary tract infections, further emphasizing the need for diagnostic solutions that can be deployed both in hospital settings and primary care environments. Early detection helps prevent complications like pyelonephritis or urosepsis, thus supporting the growing use of sophisticated testing tools.

Market Restraint: Lack of Awareness and Misdiagnosis

A key restraint affecting the market is the lack of awareness among patients and even healthcare providers about the full spectrum of UTI symptoms and types. Symptoms such as fatigue, confusion (in elderly patients), or pelvic discomfort are often misattributed to other conditions, resulting in delayed or inappropriate treatment. Additionally, asymptomatic bacteriuria particularly common in older adults and pregnant women can go undetected without proper screening protocols.

Misdiagnosis also results from the reliance on non-specific or outdated methods such as dipstick testing, which may not detect all infections or accurately determine antibiotic resistance. Inaccurate diagnosis leads to either overtreatment or undertreatment, undermining patient outcomes and contributing to antimicrobial resistance. Overcoming this challenge requires not only technological improvements but also broader education and training initiatives within the healthcare ecosystem.

Market Opportunity: Growth of Telehealth and At-Home Diagnostic Solutions

The increasing integration of digital health technologies and home-based care models offers a transformative opportunity for the UTI testing market. Post-pandemic, telehealth adoption surged across North America, leading to a parallel rise in demand for diagnostic tools that can be used remotely. This has created fertile ground for the development and marketing of at-home UTI testing kits that can deliver fast, accurate results with teleconsultation support.

Companies are introducing app-based testing platforms that guide patients through the urine collection and analysis process, often using smartphone-integrated diagnostics. These solutions are particularly valuable for rural or underserved communities, where access to urologists or laboratories may be limited. With regulatory support and consumer interest aligning, the at-home testing segment is poised to expand rapidly, unlocking new revenue streams and improving public health outcomes.

North America Urinary Tract Infection Testing Market By Type Insights

Cystitis is the dominating segment by type in the North American UTI testing market, primarily due to its high prevalence among adult women. Cystitis, characterized by inflammation of the bladder, often results from bacterial infection and is responsible for the majority of UTI diagnoses. The typical symptoms—frequent urination, burning sensation, and pelvic pain—prompt patients to seek immediate medical care, leading to a high volume of testing. Diagnostic tools, ranging from dipsticks to PCR-based tests, are commonly used in urgent care and primary settings for cystitis detection. Moreover, healthcare providers are increasingly focusing on personalized therapy based on antibiotic susceptibility testing for recurrent cases.

Pyelonephritis is the fastest-growing segment owing to the serious complications associated with delayed or misdiagnosed infections. Pyelonephritis, an upper urinary tract infection affecting the kidneys, can lead to sepsis and hospitalization if not accurately detected and treated early. With rising awareness among clinicians and increasing use of imaging and lab-based diagnostics, this segment is witnessing growing attention. Emergency departments and hospitals are enhancing their protocols to include rapid diagnostic tools for early pyelonephritis detection, especially among high-risk populations such as immunocompromised individuals and pregnant women.

North America Urinary Tract Infection Testing Market By Product Insights

Consumables dominate the product segment, including dipsticks, test strips, urine culture media, and reagents. These products are the most frequently used diagnostic tools, given their affordability, accessibility, and routine application across various clinical settings. Most outpatient and point-of-care diagnostics for UTIs rely on consumables due to their speed and ease of use. Recurrent UTI patients, elderly individuals, and catheterized patients undergo frequent testing, driving the demand for high-volume, disposable consumables that meet hygiene and performance standards.

Instruments are the fastest-growing product segment driven by technological innovation in urine analysis and culture systems. Automated urinalysis instruments, biosensor devices, and molecular diagnostic platforms are gaining momentum in reference laboratories and hospitals. These tools offer enhanced accuracy, high throughput, and integration with laboratory information systems (LIS). For instance, digital urinalysis analyzers capable of scanning thousands of samples per day are increasingly used in large healthcare networks across the U.S., contributing to rapid segment growth.

North America Urinary Tract Infection Testing Market By End-use Insights

Hospital Laboratories remain the leading end-user in the UTI testing ecosystem. These facilities offer comprehensive diagnostic capabilities, including culture, sensitivity testing, and molecular diagnostics. Hospital labs are particularly critical in detecting UTIs in complex or high-risk cases, such as those involving sepsis or multi-drug resistant infections. Equipped with high-throughput systems, these labs are integral to supporting both inpatient care and emergency diagnostics, especially in large urban hospitals across North America.

Urgent Care Centers are the fastest-growing end-use segment, reflecting changing consumer preferences and healthcare delivery models. Urgent care facilities offer convenient, walk-in services for non-life-threatening conditions like UTIs. The proliferation of such centers, particularly in suburban and semi-urban areas, has made UTI testing more accessible to a larger demographic. Their growing role in outpatient care, coupled with the availability of rapid testing kits, is driving this segment's expansion across both the U.S. and Canada.

Country Insights

United States

The United States leads the North American UTI testing market, accounting for the largest share in terms of volume and revenue. The high prevalence of UTIs, extensive healthcare infrastructure, and strong adoption of diagnostic technologies drive this dominance. According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), UTIs result in nearly 10 million doctor visits each year in the U.S., making it a top priority for diagnostics and treatment.

In addition to conventional testing methods, the U.S. is at the forefront of integrating AI and molecular diagnostics into mainstream healthcare. Major hospital systems and diagnostic labs are investing in advanced urinalysis systems, while startups are launching direct-to-consumer testing kits linked to telehealth platforms. Government initiatives aimed at combating antibiotic resistance are also promoting more accurate testing, fueling market growth further.

Canada

Canada is emerging as a rapidly growing UTI testing market, thanks to its focus on public health initiatives, preventive diagnostics, and equitable access to healthcare. The Canadian Urological Association has advocated for enhanced UTI awareness and timely diagnosis, particularly among women and elderly populations. Rural and Indigenous communities, where access to specialty care is limited, are benefiting from mobile health units and tele-diagnostics for UTI screening.

Canadian diagnostic companies are also innovating in the field of microfluidic-based UTI testing and collaborating with universities to develop cost-effective, portable testing solutions. Public healthcare reimbursement for laboratory testing makes it easier for patients to undergo routine diagnostics, particularly for recurrent infections. As digital health continues to gain traction, Canada is poised to play a vital role in expanding access to reliable UTI diagnostics across diverse patient groups.

Some of the prominent players in the North America urinary tract infection testing market include:

- QIAGEN

- Accelerate Diagnostics, Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation

- Siemens Healthcare GmbH

- Randox Laboratories Ltd.

- Thermo Fisher Scientific, Inc.

- bioMérieux SA

- T2 Biosystems, Inc.

Recent Developments

-

In March 2025, Thermo Fisher Scientific announced the expansion of its urine culture testing portfolio by launching a new high-throughput automated analyzer designed for use in hospital laboratories across North America.

-

In January 2025, Roche Diagnostics unveiled a partnership with a leading Canadian hospital to pilot its AI-powered urinalysis platform for early UTI detection in older adults.

-

In December 2024, Scanwell Health received U.S. FDA clearance for its smartphone-based at-home UTI test kit, which integrates with telehealth services for instant treatment recommendations.

-

In November 2024, Beckman Coulter introduced a new urinalysis reagent system compatible with their flagship DxU Iris analyzer, aimed at improving diagnostic yield in emergency departments.

-

In October 2024, BD (Becton, Dickinson and Company) launched a clinical trial in the U.S. to evaluate a next-generation point-of-care UTI test that delivers results in under 15 minutes.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America urinary tract infection testing market

By Type

- Urethritis

- Cystitis

- Pyelonephritis

By Product

By End-use

- General practitioners

- Urologists

- Urogynecologists

- Hospital Laboratories

- Reference Laboratories

- Hospital Emergency Departments

- Urgent Care

- Others

By Regional