North America Wheelchair Market Size and Trends

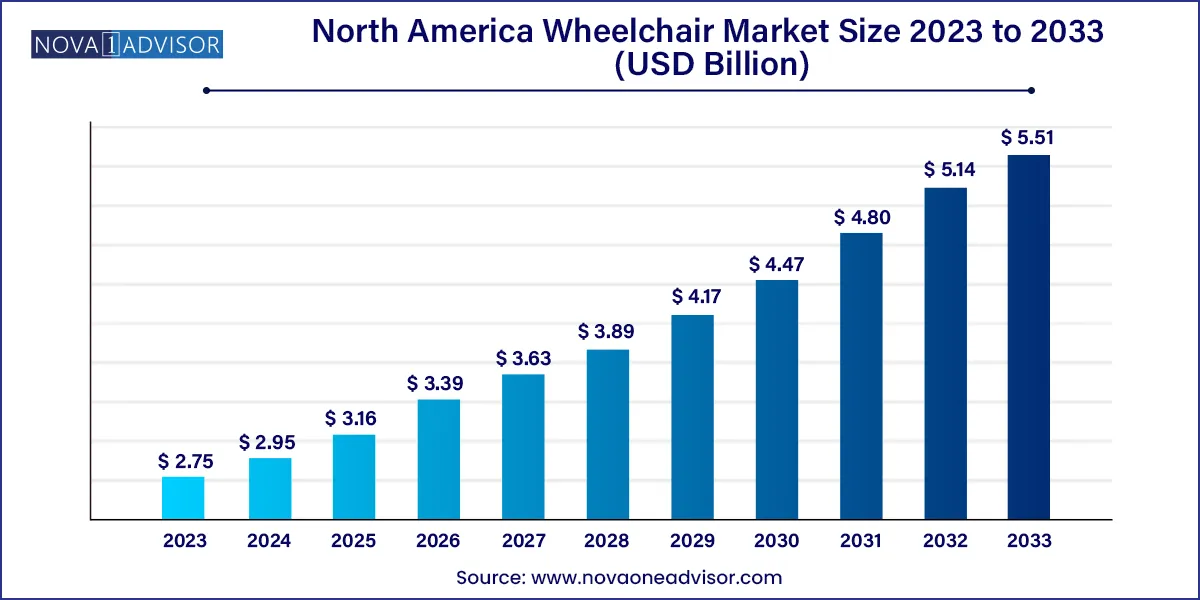

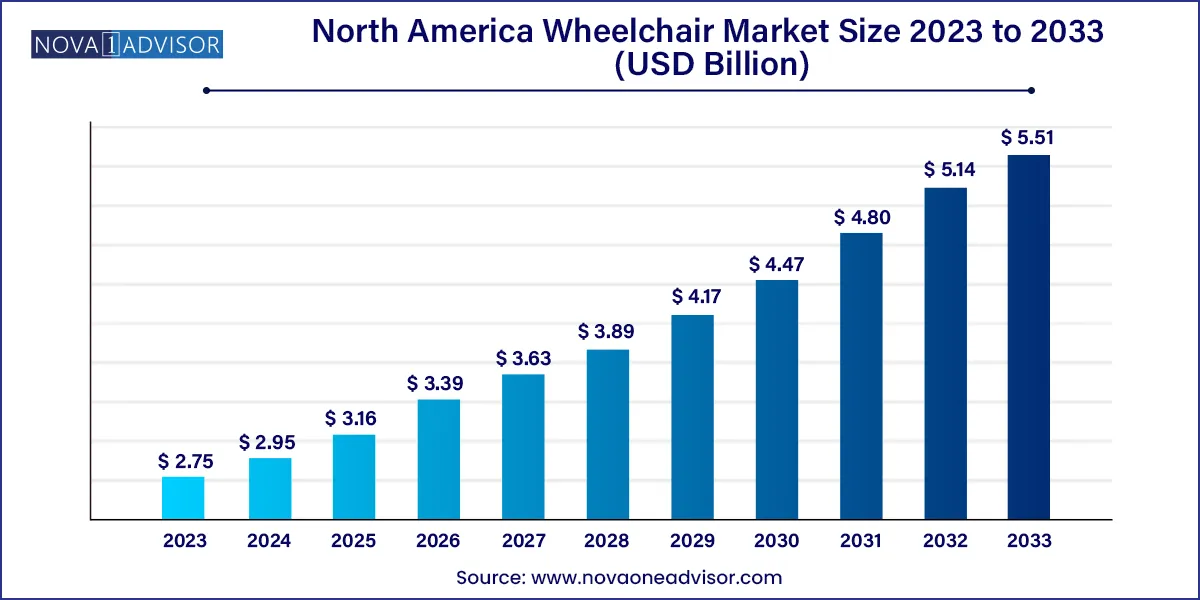

The North America wheelchair market size was exhibited at USD 2.75 billion in 2023 and is projected to hit around USD 5.51 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2024 to 2033.

Key Takeaways:

- The manual product segment dominated the market with a revenue share of more than 61.1% in 2023.

- The electric product segment is anticipated to witness a lucrative growth rate of over 6.8% from 2023 to 2033.

- The adult category type segment dominated the market with the largest revenue share of over 69.1% in 2023.

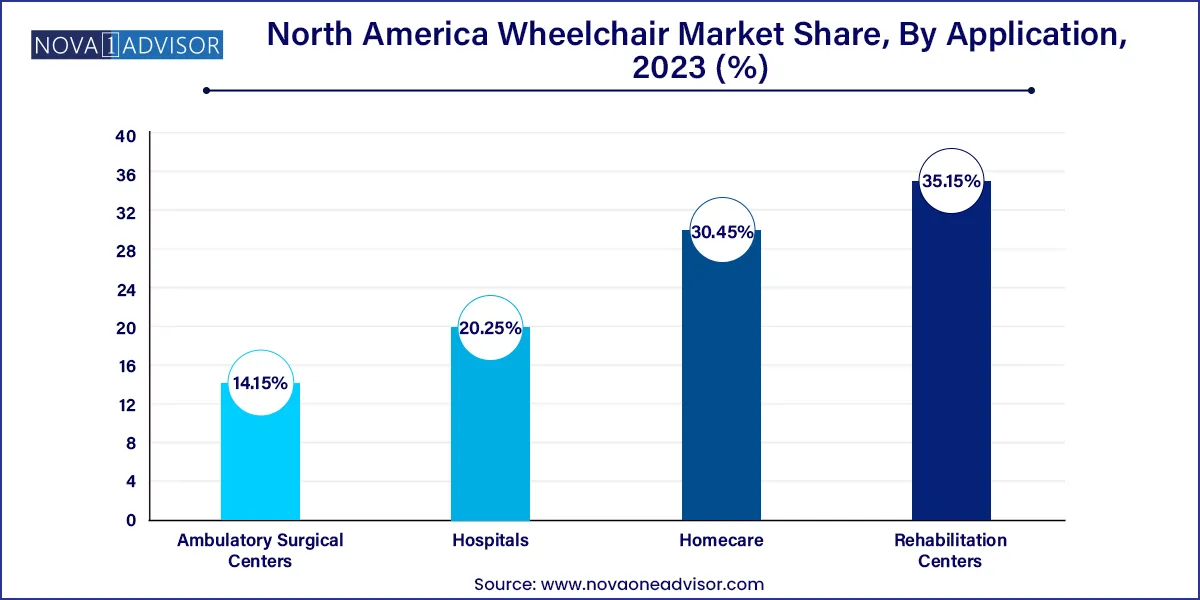

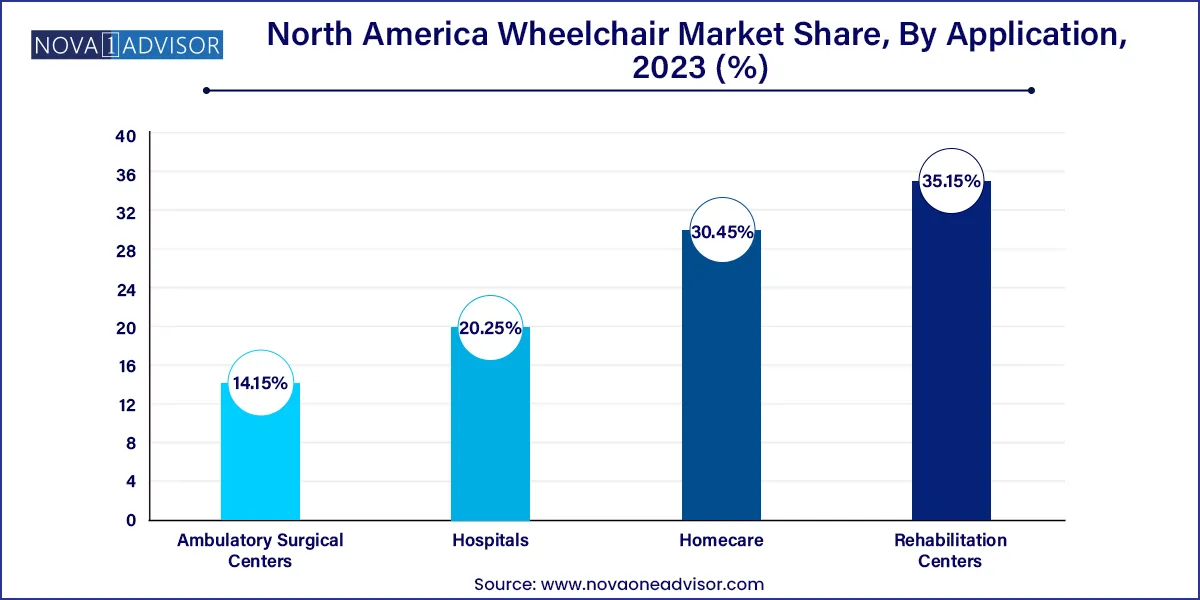

- The rehabilitation centers application segment led the market in 2023 with the largest revenue share of more than 35.15%.

- The U.S. dominated the market and accounted for the largest revenue share of 90.9% in 2023.

Market Overview

The North America wheelchair market is a dynamic and vital segment of the broader mobility aids industry, providing critical support for individuals with disabilities, chronic health conditions, and age-related mobility challenges. With increasing awareness of accessibility rights and an aging population, the market is experiencing robust demand for advanced mobility solutions. Technological innovation, policy support for assistive devices, and rising healthcare expenditure are contributing to the steady growth of the sector.

Wheelchairs in North America are increasingly tailored to meet the needs of diverse users—ranging from manual and sports models for active individuals to sophisticated electric variants equipped with posture correction, connectivity features, and smart controls. Key users include not only elderly populations but also younger individuals affected by spinal cord injuries, muscular dystrophy, multiple sclerosis, and other conditions that impact mobility.

In addition to home use, demand is rising in healthcare institutions such as hospitals, ambulatory surgical centers (ASCs), and rehabilitation clinics. Government initiatives to expand Medicare and Medicaid coverage, along with the Americans with Disabilities Act (ADA), have fostered innovation and accessibility in public spaces. The market is also benefiting from the rise in bariatric-friendly models, modular customization options, and portable lightweight designs.

Major Trends in the Market

-

Rapid adoption of electric wheelchairs with AI-driven navigation and remote control features

-

Integration of lightweight, foldable designs for increased portability and travel convenience

-

Growth in pediatric wheelchair innovations with postural support and custom fit

-

Increasing use of IoT-enabled wheelchairs with diagnostic and tracking capabilities

-

Demand surge in sports and recreational wheelchairs due to greater inclusivity in athletic programs

-

Partnerships between healthcare facilities and manufacturers to provide rental and leasing services

-

Focus on sustainability in wheelchair production using recyclable and eco-friendly materials

-

Advancements in battery technology enabling longer usage time and reduced charging frequency

Report Scope of The North America Wheelchair Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.95 Billion |

| Market Size by 2033 |

USD 5.51 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Category Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America |

| Key Companies Profiled |

Carex Health Brands, Inc.; DeVilbiss Healthcare LLC; GF Health Products, Inc.; Invacare Corporation; Medline Industries, Inc.; Sunrise Medical; Karman Healthcare, Inc.; Quantum Rehab; Numotion; Pride Mobility Products Corp.; Sermax Mobility Ltd. |

Key Market Driver: Aging Population and Rising Disability Prevalence

The most significant driver of the North America wheelchair market is the growing elderly population and increasing prevalence of mobility-impairing conditions. According to the U.S. Census Bureau, by 2030, all baby boomers will be over the age of 65, dramatically expanding the senior demographic in the U.S. and Canada. Aging naturally correlates with rising incidences of osteoporosis, arthritis, and neurodegenerative conditions that hinder independent movement.

Additionally, the region sees a consistent rate of spinal cord injuries, strokes, and surgeries resulting in temporary or long-term disability. Veterans and accident survivors constitute a growing user base for both manual and powered wheelchairs. As the healthcare system shifts toward at-home care, the need for ergonomic, durable, and technologically enhanced wheelchairs is increasing sharply.

Key Market Restraint: High Cost of Electric and Advanced Wheelchairs

Despite increasing demand, the market faces a substantial restraint in the form of high costs associated with electric and technologically advanced wheelchairs. While manual wheelchairs remain affordable and are often covered by basic insurance plans, powered models with tilt, recline, or standing capabilities can cost several thousand dollars. Customization for specific disabilities further drives up expenses.

In many cases, insurance coverage does not fully reimburse users for high-end models, creating financial barriers. This cost challenge is especially acute for pediatric patients, who outgrow wheelchairs and require frequent upgrades. Though used and refurbished markets offer some relief, they lack the reliability and custom-fit offered by new devices, thereby restricting broad access.

Key Market Opportunity: Technological Integration and Smart Wheelchair Development

One of the most exciting opportunities in the North America wheelchair market lies in technological integration, particularly in the development of smart wheelchairs. These advanced mobility aids are equipped with sensors, GPS navigation, fall prevention systems, and even brain-machine interface (BMI) capabilities that enable mobility through neural commands.

Startups and established players alike are investing in AI-enabled wheelchairs that can navigate autonomously, detect obstacles, and adapt to environmental conditions. These innovations have transformative potential, especially for users with high-level spinal cord injuries or progressive neuromuscular diseases. The adoption of such technologies also opens up new partnerships with healthcare systems and smart home ecosystems, paving the way for fully integrated mobility solutions.

North America Wheelchair Market By Product Insights

Manual wheelchairs currently dominate the North American market, largely due to their cost-effectiveness, wide availability, and ease of maintenance. They are preferred in hospitals, temporary care facilities, and home settings where users have residual upper-body strength or support. With improved materials like aluminum and carbon fiber, even manual chairs now offer lightweight, durable solutions suited for short-term and long-term use.

Electric wheelchairs are the fastest-growing product segment, fueled by increased demand for user independence and technological innovation. Advanced models offer terrain adaptation, voice activation, reclining and tilting mechanisms, and programmable controls. These features are especially valuable to users with severe motor disabilities or complex medical needs. Additionally, insurance providers are beginning to recognize the long-term benefits of such devices in reducing caregiver burden and hospital readmissions.

North America Wheelchair Market By Category Type Insights

Adult wheelchairs dominate the market, serving the largest user base of elderly and adult individuals with mobility impairments. The segment spans from basic transport chairs to high-end powered devices. Ongoing enhancements in seat ergonomics, postural support, and customization continue to drive adoption. The growing elderly population in the U.S. and Canada ensures consistent demand in this category.

Pediatric wheelchairs are a rapidly growing segment, driven by increasing awareness around early mobility interventions for children with congenital or acquired disabilities. Pediatric models now incorporate adjustable components to grow with the child, improved postural support, and aesthetic customization to boost user confidence. Public and nonprofit programs aimed at inclusive education and sports access have further fueled the uptake of pediatric wheelchairs.

North America Wheelchair Market By Application Insights

Homecare remains the dominant application segment, as more users prefer to remain in familiar environments while managing chronic mobility issues. Lightweight folding manual chairs and compact powered wheelchairs are commonly used for in-home transportation. The growth of home healthcare services and aging-in-place strategies have accelerated demand in this segment.

Rehabilitation centers represent the fastest-growing application area, as post-operative and injury-related rehabilitation increasingly involves short- and long-term wheelchair use. These facilities require highly adaptable and durable wheelchairs with positioning options, often rotating them among multiple patients. Demand in rehabilitation settings is being driven by increased emphasis on early mobilization protocols and customized therapy regimens.

North America Wheelchair Market By Regional Insights

The United States leads the North American wheelchair market, backed by a strong healthcare system, high insurance coverage for durable medical equipment (DME), and ongoing innovation in assistive technologies. The presence of several domestic manufacturers and distributors enables rapid availability and service support. Urban and suburban demand is particularly high due to population density and better infrastructure accessibility.

Canada is also witnessing steady market growth, especially in provinces offering comprehensive public healthcare programs that cover mobility devices for eligible citizens. Canadian innovation in sustainable materials and pediatric wheelchair design is gaining recognition. Government programs such as the Assistive Devices Program (ADP) in Ontario are helping to boost adoption by providing subsidies and support for eligible users.

Some of the prominent players in the North America wheelchair market include:

- Carex Health Brands, Inc.

- DeVilbiss Healthcare LLC

- GF Health Products, Inc.

- Invacare Corporation

- Medline Industries, Inc.

- Sunrise Medical

- Karman Healthcare, Inc.

- Quantum Rehab

- Numotion

- Pride Mobility Products Corp.

- Sermax Mobility Ltd.

Recent Developments

-

March 2025: Permobil launched its new “Explorer Series” all-terrain electric wheelchair designed for active outdoor use with GPS tracking and joystick customization.

-

February 2025: Invacare Corporation introduced a pediatric wheelchair line with expandable seat frames and smart posture sensors for improved comfort and growth adaptability.

-

December 2024: Sunrise Medical acquired a U.S.-based rehabilitation seating solutions company to strengthen its integrated offerings for hospitals and long-term care facilities.

-

October 2024: Ki Mobility launched a carbon fiber manual wheelchair model, improving durability and reducing total weight for ease of transportation.

-

August 2024: Quantum Rehab enhanced its Q-Logic 3 electronics platform to enable voice control and cloud-based diagnostics for electric wheelchairs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America wheelchair market.

Product

Category Type

Application

- Homecare

- Hospitals

- Ambulatory Surgical Centers

- Rehabilitation Centers

Regional