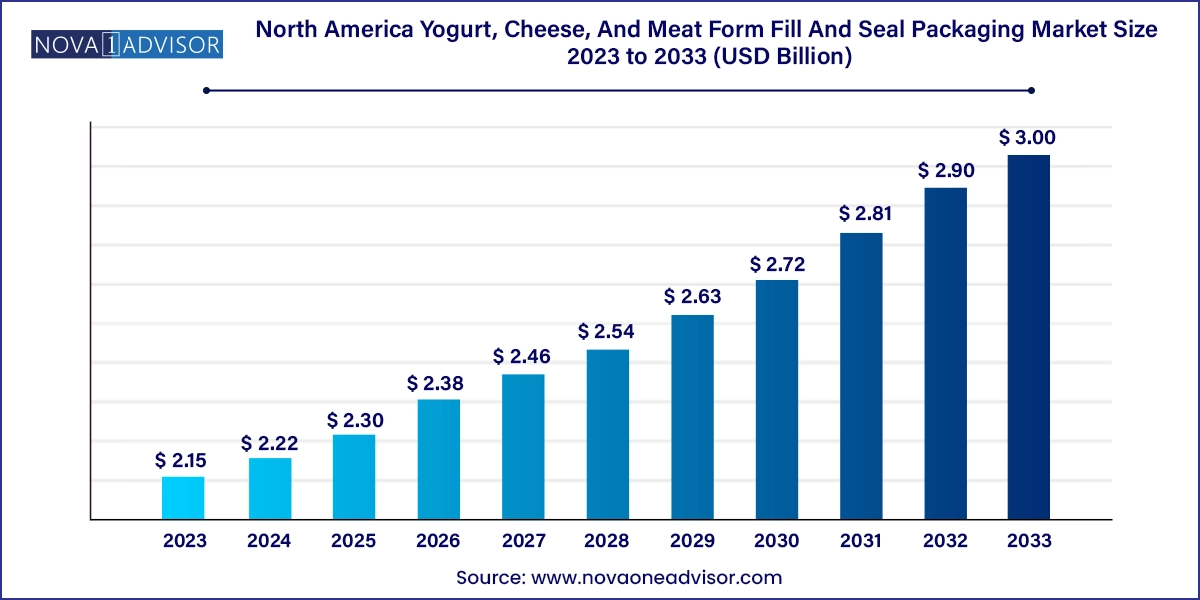

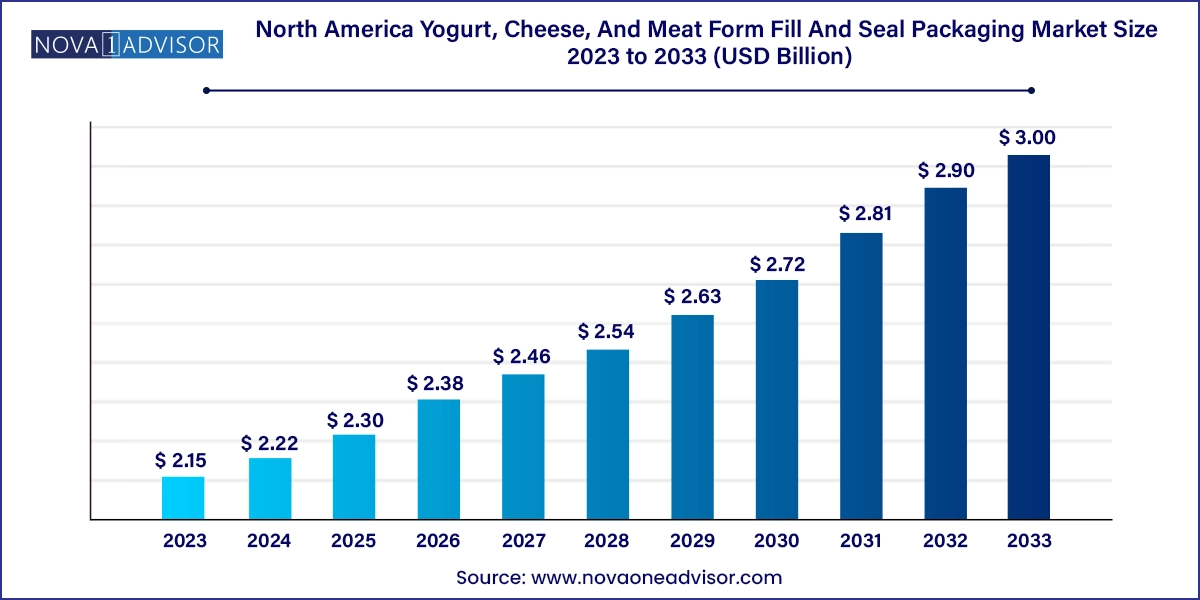

The North America yogurt, cheese, and meat form fill and seal packaging market size was exhibited at USD 2.15 billion in 2023 and is projected to hit around USD 3.00 billion by 2033, growing at a CAGR of 3.4% during the forecast period 2024 to 2033.

Key Takeaways:

- Polyethylene terephthalate (PET) dominated the overall market with a revenue share of over 33.0% in 2023.

- The polypropylene (PP) segment, on the other hand, is expected to grow at the fastest CAGR of 3.5% during the forecast period.

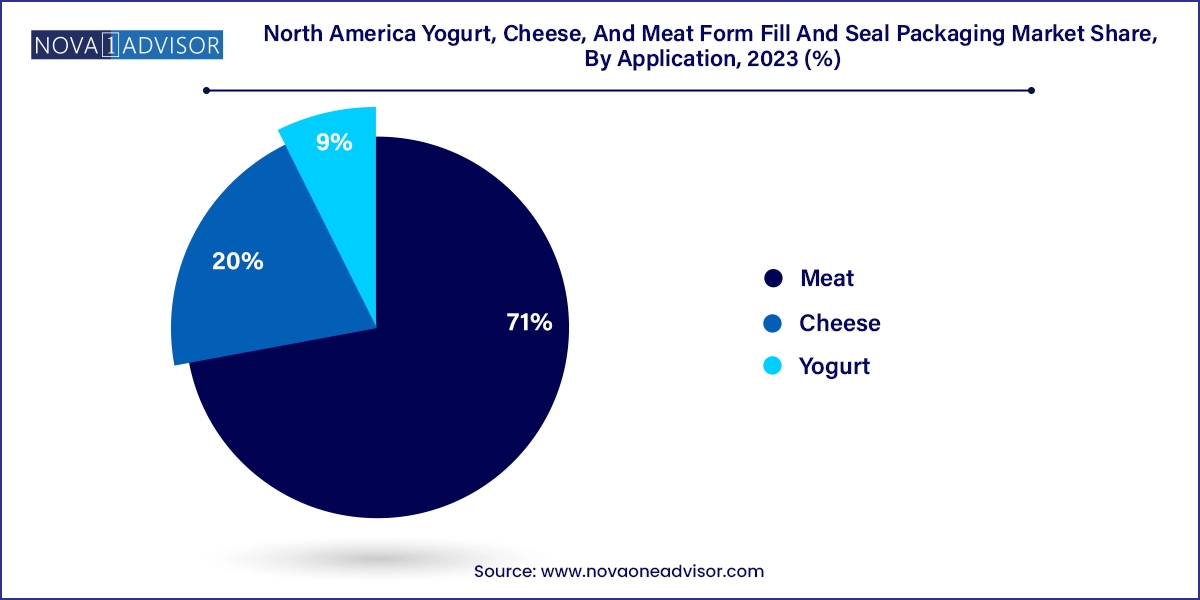

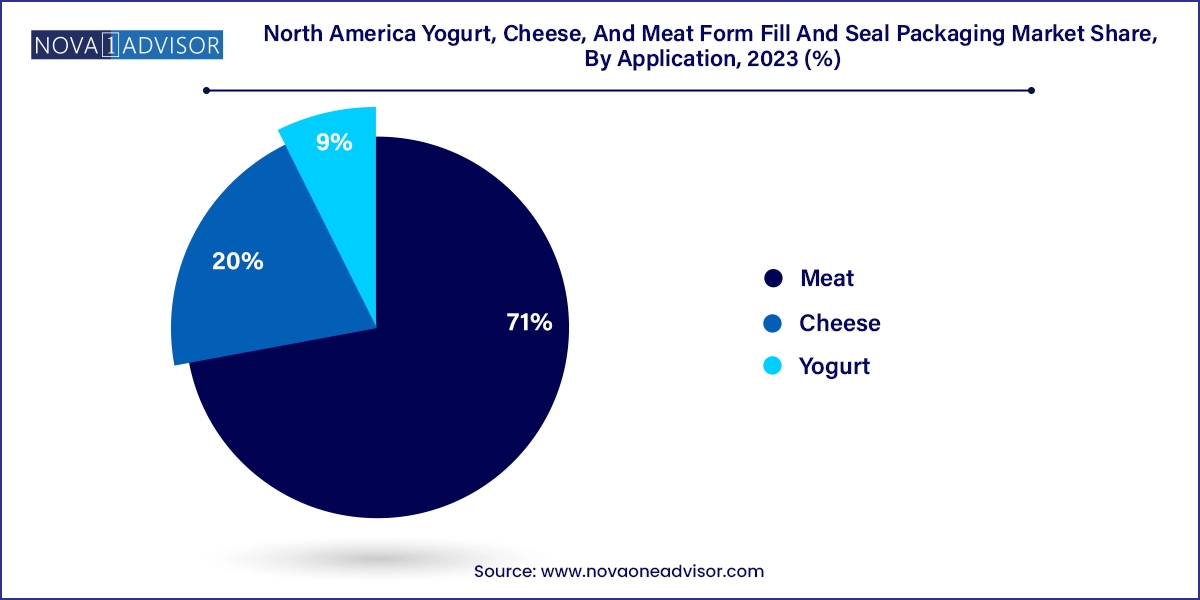

- The meat segment dominated with the largest revenue share of over 71.0% in 2023.

- The yogurt application segment is projected to progress at the fastest CAGR of 4.4% over the forecast period.

- The films & wraps segment dominated the market and accounted for the largest revenue share of over 42.0% in 2023.

Market Overview

The North America Yogurt, Cheese, and Meat Form Fill and Seal (FFS) Packaging Market is witnessing a significant shift, driven by increasing automation in food packaging, evolving consumer preferences for hygienic and tamper-proof food products, and the demand for longer shelf life without the use of preservatives. FFS packaging systems have revolutionized food product containment by integrating forming, filling, and sealing processes into one continuous and efficient mechanism—delivering productivity, cleanliness, and consistency.

The market is supported by a well-developed dairy and meat processing industry, increasing demand for convenient single-serve packs, and the need for packaging that aligns with sustainability and material efficiency goals. North American food processors are increasingly turning to FFS systems to handle large volumes of yogurt, sliced or shredded cheese, and fresh or processed meat products in a cost-effective manner.

With the rise in on-the-go consumption, health-conscious snacking, and cold-chain logistics, FFS packaging offers versatility across product formats and retail channels. Both vertical and horizontal FFS systems are in widespread use across packaging lines for products ranging from Greek yogurt in sealed cups, to string cheese in pouches, and vacuum-sealed meats in barrier films.

Major Trends in the Market

-

Rise in Ready-to-Eat and Snackable Dairy Products: Consumers are opting for portion-controlled, resealable, and travel-friendly formats in yogurt and cheese.

-

Integration of Barrier Films in Meat Packaging: Films with high oxygen and moisture barriers are increasingly used to preserve meat quality and reduce spoilage.

-

Sustainability-Led Innovation: Bio-based films, recyclable PET structures, and mono-material laminates are gaining adoption to reduce landfill waste.

-

Growth of Automated and Intelligent Packaging Lines: Food processors are investing in FFS machines with AI-based defect detection and smart temperature control.

-

Demand for Custom Pouch Designs and Flexible Packs: Flexible pouches with spouts, zippers, and easy-tear features are replacing rigid containers.

-

Increased Co-Packaging Activity: Smaller brands are leveraging third-party FFS solutions to reduce CAPEX and access professional-grade packaging.

-

Migration Toward Clean-Label Packaging: Transparent and minimalistic packaging materials that showcase product freshness are gaining traction in yogurt and cheese.

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.22 Billion |

| Market Size by 2033 |

USD 3.00 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Product, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; Mexico |

| Key Companies Profiled |

WINPAK LTD.; Huhtamaki Oyj; Berry Global Inc.; Amcor plc; Transcontinental Inc.; Harpak Ulma; ProAmpac; Sealed Air; Smurfit Kappa; Scholle IPN; Polytainers Inc.; Tetra Pak |

Key Market Driver: Rising Demand for Shelf-Stable and Safe Protein-Based Products

A major driver for this market is the growing demand for protein-rich, ready-to-consume, and microbiologically safe food products, particularly meat and dairy-based snacks. With consumers increasingly turning to high-protein diets, products like Greek yogurt, string cheese, and packaged deli meats have seen strong growth. FFS packaging supports these trends by ensuring:

-

Extended shelf life through the use of vacuum sealing or MAP (Modified Atmosphere Packaging).

-

Leak-proof packaging, maintaining hygiene and preventing cross-contamination.

-

Portion control and portability, aligning with modern on-the-go lifestyles.

Food safety regulations in the U.S. and Canada such as those enforced by the USDA and CFIA also necessitate the use of tamper-proof and hermetically sealed packaging, all of which FFS systems are designed to deliver.

Key Market Restraint: High Capital Expenditure and Material Waste Management

One notable restraint for smaller processors and start-ups in this market is the high initial investment required to install and maintain FFS machinery. Vertical and horizontal FFS machines with integrated sealing, forming, and weighing modules can cost hundreds of thousands of dollars, making them less accessible to artisanal and regional processors.

Another challenge is the management of film waste and environmental compliance. While efficient, traditional multilayer FFS films often contain non-recyclable laminates or aluminum coatings, which complicate disposal and run counter to state-level EPR (Extended Producer Responsibility) mandates increasingly being rolled out in the U.S. and Canada.

This has created pressure on packaging vendors to offer sustainable film options without compromising barrier performance a technological challenge that adds cost and requires longer development cycles.

Key Market Opportunity: Sustainable Packaging Integration in FFS Systems

The biggest opportunity emerging in this market lies in the integration of sustainable materials and circular economy practices in FFS packaging formats. Brands and packaging providers are exploring the use of:

-

Mono-material recyclable films (e.g., 100% PP or PE-based laminates)

-

Compostable bioplastics made from starch or cellulose for cheese and yogurt pouches

-

Lightweight trays and seal films for meat products that reduce plastic by up to 50%

This transition aligns with retailers’ packaging goals (such as Walmart’s “zero waste” pledge) and with consumer demands for eco-conscious packaging. Moreover, regulatory changes, including Canada’s plastic ban roadmap and U.S. state-level plastic taxes, are likely to accelerate innovation and adoption.

For equipment manufacturers, there is an opportunity to develop flexible FFS systems compatible with a wider range of film structures, including those with varying melt behaviors, tensile strength, and optical clarity.

Material Insights

Polyethylene (PE) dominates the FFS material segment, owing to its widespread use in meat and cheese packaging, especially where seal integrity and moisture resistance are essential. LDPE and LLDPE are commonly used in film and pouch layers due to their flexibility and ability to form high-quality hermetic seals under varying temperature ranges. Meat processors favor PE for vacuum pouches, thermoforming films, and skin packs that conform tightly to cuts of meat while preventing freezer burn.

Polypropylene (PP) is the fastest-growing material, particularly in yogurt cups and microwavable cheese snack packs. Its higher melting point, chemical resistance, and ability to withstand retort processing make PP ideal for FFS applications that require pasteurization, reheating, or sterilization. Additionally, with increasing focus on recyclable mono-material solutions, PP’s compatibility with mechanical recycling streams gives it a future-proof edge in sustainability-driven product lines.

Application Insights

Yogurt dominates the application segment, driven by the enormous variety in flavor profiles, product sizes, and brand competition in the U.S. and Canada. With Greek yogurt, organic yogurt, and lactose-free variants multiplying on supermarket shelves, FFS packaging is crucial for high-speed production, reliable seal integrity, and brand customization. Yogurt cups, in particular, benefit from digital printing and in-line label application during FFS processing, giving marketers high flexibility in design.

Meat is the fastest-growing application, particularly in vacuum-packed and shelf-stable formats. The rise in protein-centric diets, demand for pre-portioned meat cuts, and the popularity of charcuterie snack packs are propelling the use of FFS packaging in this segment. Meat processors use high-barrier thermoforming and sealing films to extend shelf life, minimize odor transmission, and support logistics. Many companies are now combining MAP with vertical FFS lines to package sliced turkey, salami, and cooked chicken in flexible containers.

Product Insights

Cups hold the largest share in the product category, mainly due to the sheer volume of yogurt packaged in pre-formed or form-fill-seal plastic cups. These cups are designed for both spoonable and drinkable yogurts, often paired with over-lid seals or snap-on caps. The dairy industry in the U.S. continues to rely heavily on cup-based FFS systems for mass-market distribution, including multi-pack yogurt offerings at retailers like Costco, Walmart, and Kroger.

Pouches are the fastest-growing product type, favored for their lightweight nature, lower material usage, and adaptability to resealable designs. Cheese sticks, shredded cheese, and single-serve meat snacks are increasingly being offered in stand-up pouches with zippers or easy-tear notches. These are not only consumer-friendly but also reduce packaging-related shipping costs for processors and brands. Meat jerky and shelf-stable deli slices are prime examples of the pouch revolution.

Country Insights

United States

The U.S. is the dominant market for FFS packaging in dairy and meat due to its well-established food processing industry, strict food safety standards, and demand for convenience packaging. Major players like Danone North America, Kraft Heinz, Hormel, and Chobani heavily rely on FFS systems for yogurt, cheese sticks, deli slices, and pre-cooked meats. The U.S. also leads in automation adoption, with several facilities integrating robotic packers and AI-based QC modules into their FFS lines.

Canada

Canada has a growing FFS adoption rate, particularly among its organic dairy and grass-fed meat producers. With government backing for food innovation hubs and sustainability grants, Canadian processors are exploring biodegradable films and energy-efficient FFS equipment. Yogurt brands such as Liberté and Olympic Dairy have been early adopters of innovative packaging formats, including multi-layer barrier cups made from recyclable PP.

Mexico

Mexico is experiencing growth in both yogurt and meat packaging, driven by rising consumer incomes and the expansion of retail cold chain infrastructure. Regional dairies are adopting compact vertical FFS lines to meet demand for affordable single-serve yogurts and shelf-stable cheese spreads. The meat sector is seeing growth in marinated cuts and ready-to-cook sausages, necessitating thermoformable films with high sealing strength and puncture resistance.

- WINPAK LTD.

- Huhtamaki Oyj

- Berry Global Inc.

- Amcor plc

- Transcontinental Inc.

- Harpak Ulma

- ProAmpac

- Sealed Air

- Smurfit Kappa

- Scholle IPN

- Polytainers Inc.

- Tetra Pak

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America yogurt, cheese, and meat form fill and seal packaging market

Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Others

Product

- Pouches

- Cups

- Films & Wraps

- Trays & Containers

Application

Country