North America And Europe Preclinical Medical Device Testing Services Market Size and Growth

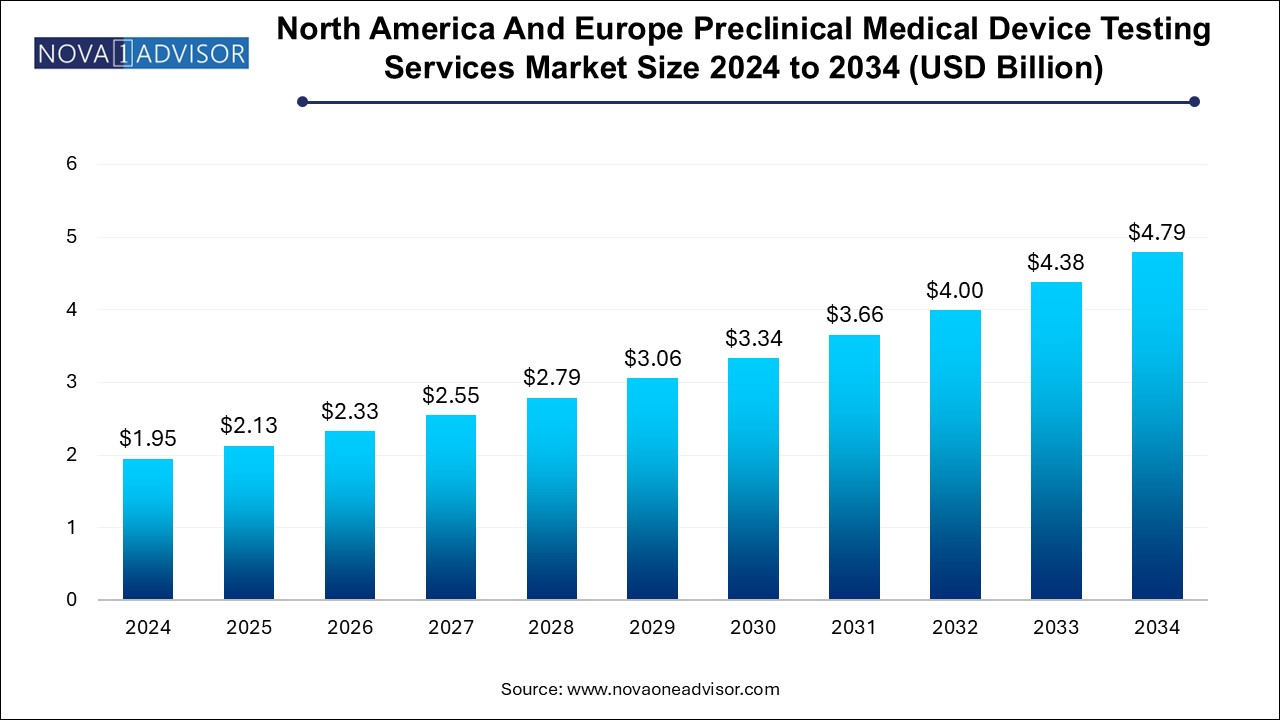

The North America and Europe preclinical medical device testing services market size was exhibited at USD 1.95 billion in 2024 and is projected to hit around USD 4.79 billion by 2034, growing at a CAGR of 9.4% during the forecast period 2024 to 2034.

North America And Europe Preclinical Medical Device Testing Services Market Key Takeaways:

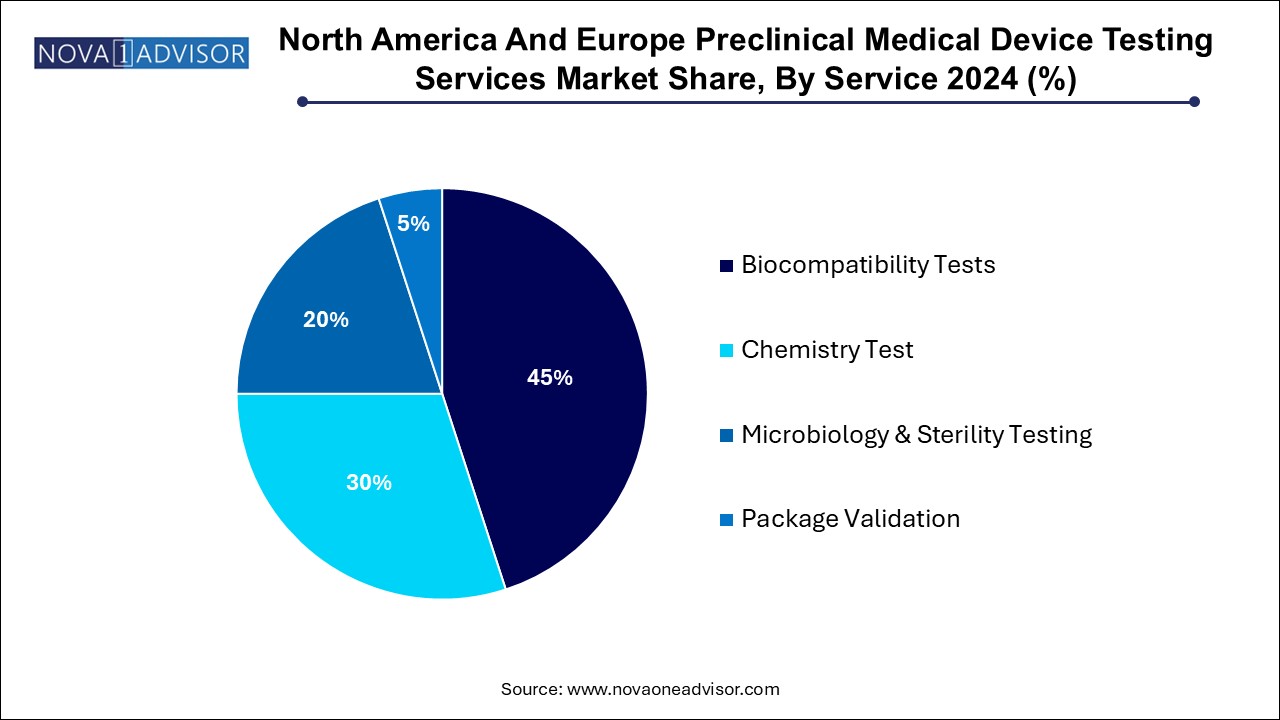

- In 2024, the biocompatibility tests segment dominated the market, accounting for a revenue share of 45.0%.

- The chemistry test segment is expected to rise with the fastest CAGR of 9.6% in the forecast period.

- North America preclinical medical device testing services marketdominated in 2024 with a larger share of 55.0%.

Market Overview

The North America and Europe preclinical medical device testing services market serves as a foundational pillar in ensuring the safety, efficacy, and compliance of innovative medical technologies before they enter human trials. This market plays a vital role in validating medical devices for regulatory submission, particularly to agencies such as the U.S. FDA and European Medicines Agency (EMA), both of which mandate rigorous testing standards under frameworks like ISO 10993 and MDR (Medical Device Regulation).

Medical devices from surgical implants and vascular stents to drug-delivery systems and diagnostic platforms must undergo extensive preclinical evaluation to identify potential biological, chemical, or microbiological risks. These evaluations include biocompatibility testing, sterilization validation, endotoxin assessments, microbiological safety, and package integrity analysis, among others. Preclinical testing ensures that devices are not only mechanically functional but also safe for the human body in terms of immune response, toxicity, and contamination risk.

In recent years, a surge in innovation, especially in minimally invasive devices, wearable health technologies, and combination products (e.g., drug-eluting stents), has driven demand for preclinical services. Additionally, the increasing pace of start-ups, venture-funded medtech firms, and contract manufacturers entering the ecosystem has led to a growing reliance on third-party testing organizations, which offer the infrastructure and regulatory expertise needed to accelerate time-to-market.

North America and Europe are the global frontrunners in this market, driven by strong R&D infrastructure, presence of key regulatory bodies, well-established medical device industries, and a robust ecosystem of contract research organizations (CROs), laboratories, and regulatory consultants specializing in preclinical testing. These regions are also home to major medtech hubs such as Boston, Minneapolis, and the Medicon Valley in Northern Europe, where innovation in diagnostics, robotics, and implantables is booming.

Major Trends in the Market

-

Shift Toward Outsourced Testing Models: Small and mid-sized device manufacturers are increasingly outsourcing preclinical testing to specialized CROs to reduce costs and accelerate timelines.

-

Adoption of In Vitro and Alternative Testing Methods: To reduce animal usage and meet ethical expectations, labs are embracing 3D tissue models and cell-based assays.

-

Increasing Regulatory Complexity: The introduction of EU MDR and updates to ISO 10993 standards are pushing companies to invest more in preclinical validation.

-

Sterilization Method Innovation: Newer methods like X-ray sterilization and advanced gamma-irradiation are gaining adoption, especially for sensitive biomaterials.

-

AI and Automation in Testing Workflows: Smart lab management systems and automated sterility platforms are enhancing throughput and reproducibility.

-

Expansion of Biocompatibility Profiles: There's growing focus on systemic toxicity, genotoxicity, and long-term implantation effects due to evolving device complexity.

-

Rise in Antimicrobial Testing Demand: With infections linked to implants and catheters, demand for microbial adhesion and biofilm testing has increased.

Report Scope of North America And Europe Preclinical Medical Device Testing Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.13 Billion |

| Market Size by 2034 |

USD 4.79 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 9.4% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Service, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe |

| Key Companies Profiled |

SGS SA; Toxikon Inc.; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group Plc; WUXI APPTEC; TÜV SÜD AG; Sterigenics International LLC; Nelson Labs; North American Science Associates; Inc.; American Preclinical Services; Charles River Laboratories International, Inc. |

Market Driver: Growth in Minimally Invasive and Implantable Devices

The proliferation of minimally invasive and implantable medical devices has emerged as a key driver for the preclinical medical device testing services market in North America and Europe. Devices such as stents, orthopedic implants, pacemakers, biosensors, and catheters are being increasingly used in chronic disease management, cardiovascular surgeries, and neurological interventions. These devices often require complex materials like polymers, ceramics, and metal alloys—each with specific interaction profiles within biological environments.

For example, a drug-eluting stent must not only maintain structural integrity and perform its vascular function but also ensure its polymer coating and embedded drug do not cause long-term toxicity or immune reaction. Such devices undergo comprehensive testing that includes biocompatibility, sterility, endotoxin, and leachables/extractables assessments.

As these devices are often left inside the body for extended periods, they necessitate chronic implantation studies, sensitization evaluations, and degradation behavior testing. Regulatory agencies have raised the bar for these tests, requiring robust data for approval, thereby propelling demand for high-quality, standardized preclinical testing services across the U.S. and Europe.

Market Restraint: Cost and Time Constraints for Startups and SMEs

Despite the crucial role of preclinical testing, one of the notable restraints in this market is the high cost and lengthy timelines associated with comprehensive preclinical evaluations. For small and medium-sized enterprises (SMEs), which form a significant portion of medtech innovators, these requirements can be financially and operationally burdensome.

A full suite of ISO 10993 biocompatibility tests alone can cost upwards of $100,000 and take several months to complete. When added to other sterilization validations, microbiological studies, and package integrity tests, the cumulative preclinical budget can run into several hundred thousand dollars often representing a significant chunk of a startup’s funding round.

Moreover, long lead times at popular CROs due to limited capacity can delay project timelines. Delays in obtaining test slots, coordinating with regulatory consultants, and addressing test failures or retesting can severely impact product launch schedules. While outsourcing provides flexibility, the lack of real-time visibility into testing processes and costs often makes it difficult for smaller firms to forecast budgets and manage compliance.

Market Opportunity: Rising Demand for Package Validation and Simulation Services

A growing opportunity in the market lies in the expansion of packaging validation and transport simulation services, particularly driven by regulatory scrutiny over device packaging integrity and real-world transport conditions. Medical devices, especially sterile, implantable, or single-use items, must remain contamination-free and structurally intact throughout their shelf life and distribution journey.

Regulatory bodies like the FDA and EMA have issued more stringent guidelines on transport stress testing, accelerated aging, packaging seal strength, and barrier integrity. This has created a surge in demand for packaging tests that replicate drop, vibration, compression, and thermal cycling conditions. CROs and testing labs are increasingly offering customized packaging validation programs tailored to the material, sterilization method, and shelf life of each product.

In addition, sustainable packaging innovation such as biodegradable polymers and recyclable materials requires new types of validation protocols. These trends have opened the door for labs offering simulation chambers, high-precision data analytics, and packaging consultancy services to support compliance and product differentiation.

North America And Europe Preclinical Medical Device Testing Services Market By Service Insights

Biocompatibility testing continues to dominate the service landscape in both North America and Europe. Governed by ISO 10993 standards, these tests are mandatory for nearly all Class II and III devices and determine the biological response of the body to the device or its components. Services include cytotoxicity, sensitization, irritation, systemic toxicity, genotoxicity, implantation, and hemocompatibility testing. Labs such as NAMSA and Eurofins Scientific have built extensive portfolios around these services, offering tailored testing regimes based on device classification and material complexity. The rise in long-term implants and hybrid materials has only increased the complexity and consequently, the demand for biocompatibility testing.

In contrast, sterilization validation and related services are the fastest-growing segment. Devices designed for invasive or implantable use must be thoroughly validated for sterilization efficacy, residual levels, and potential material degradation. EO gas sterilization is still the most common, but alternative methods like gamma irradiation, e-beam, and X-ray sterilization are growing in use due to pressure to reduce EO emissions and process time. CROs now offer accelerated sterilization validation, dose auditing, and parametric release testing services, especially for high-throughput manufacturers. The rising demand for disposable devices and growing concerns around hospital-acquired infections (HAIs) further support this segment’s momentum.

Country-Level Analysis: U.S., Germany, and U.K. Lead in Testing Innovation

In North America, the United States dominates the preclinical testing services landscape, home to industry-leading labs like NAMSA, Charles River, and WuXi AppTec. The country’s robust FDA regulatory structure and high concentration of medical device manufacturers particularly in Minnesota, California, and Massachusetts have driven strong local demand for testing services. The rise of medtech startups and high R&D investments further reinforce the U.S.'s leadership position. Additionally, the U.S. is a key innovator in developing next-generation sterilization methods and in vitro alternatives to animal testing.

In Europe, Germany and the United Kingdom are the frontrunners. Germany, with its advanced engineering expertise and a dense network of medical device companies in Baden-Württemberg and Bavaria, continues to prioritize rigorous device validation. TÜV SÜD and BSI also contribute to Europe's regulatory rigor through their Notified Body roles. Meanwhile, the U.K.’s strength lies in microbiology and package validation services, backed by public health-focused institutions and a rapidly digitalizing healthcare ecosystem. Brexit-induced regulatory shifts have also driven companies to enhance their independent testing capabilities to maintain EU and U.K. certifications simultaneously.

Some of the prominent players in the North America and Europe preclinical medical device testing services market include:

- SGS SA

- Toxikon, Inc.

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group Plc

- WUXI APPTEC

- TÜV SÜD AG

- Sterigenics International LLC

- Nelson Labs

- North American Science Associates, Inc.

- American Preclinical Services

- Charles River Laboratories International, Inc.

North America And Europe Preclinical Medical Device Testing Services Market Recent Developments

-

March 2025: NAMSA announced the launch of a new rapid testing platform for ISO 10993 cytotoxicity and irritation testing, reducing turnaround times by 40%.

-

January 2025: Charles River Laboratories expanded its Massachusetts testing facility, adding 25,000 square feet of preclinical device testing space.

-

December 2024: Eurofins Medical Device Testing collaborated with a European biotech startup to develop AI-based predictive models for endotoxin detection.

-

October 2024: WuXi AppTec launched advanced e-beam sterilization validation services at its St. Paul, Minnesota facility, catering to polymer-heavy device portfolios.

-

August 2024: Toxikon Europe (now part of Labcorp) began offering accelerated pyrogen and bioburden testing protocols, targeting rapid market entry for Class III implants.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America and Europe preclinical medical device testing services market

By Service

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Testing

-

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test and Validation

-

-

- Ethylene Oxide (EO) gas sterilization

- Gamma-irradiation

- E-beam sterilization

- X-ray sterilization

-

- Antimicrobial Activity Testing

- Others

By Regional