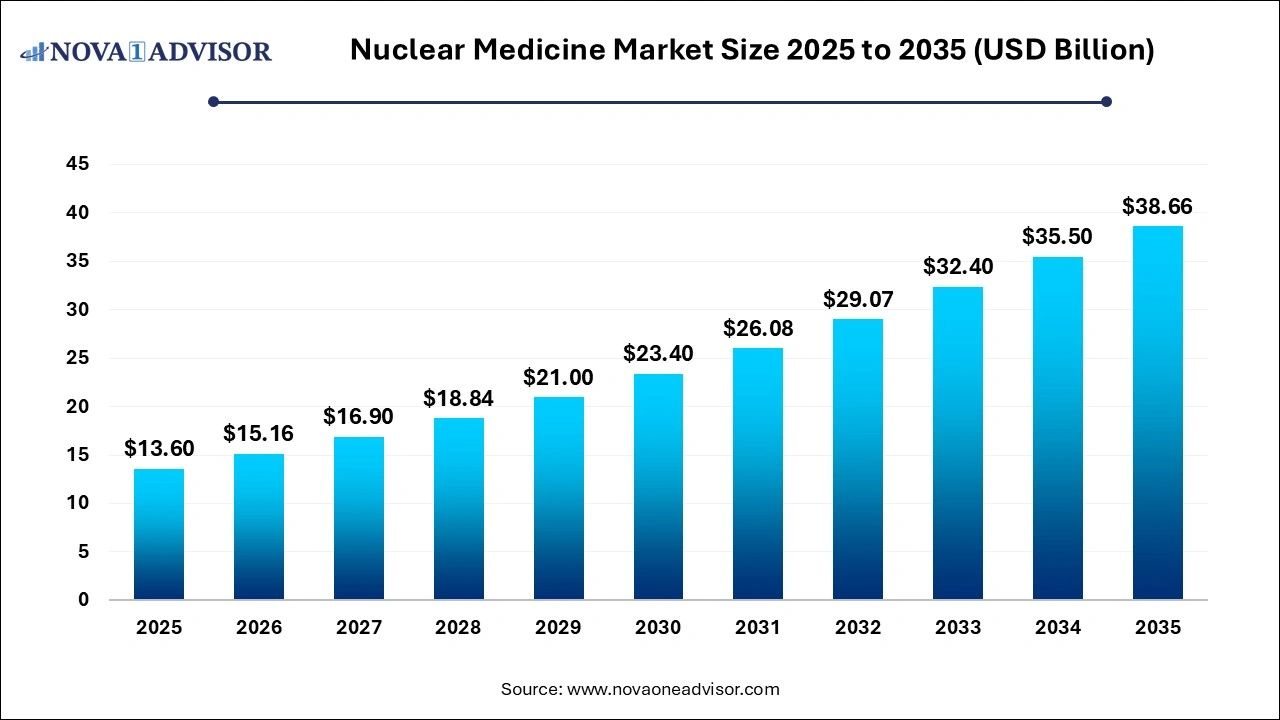

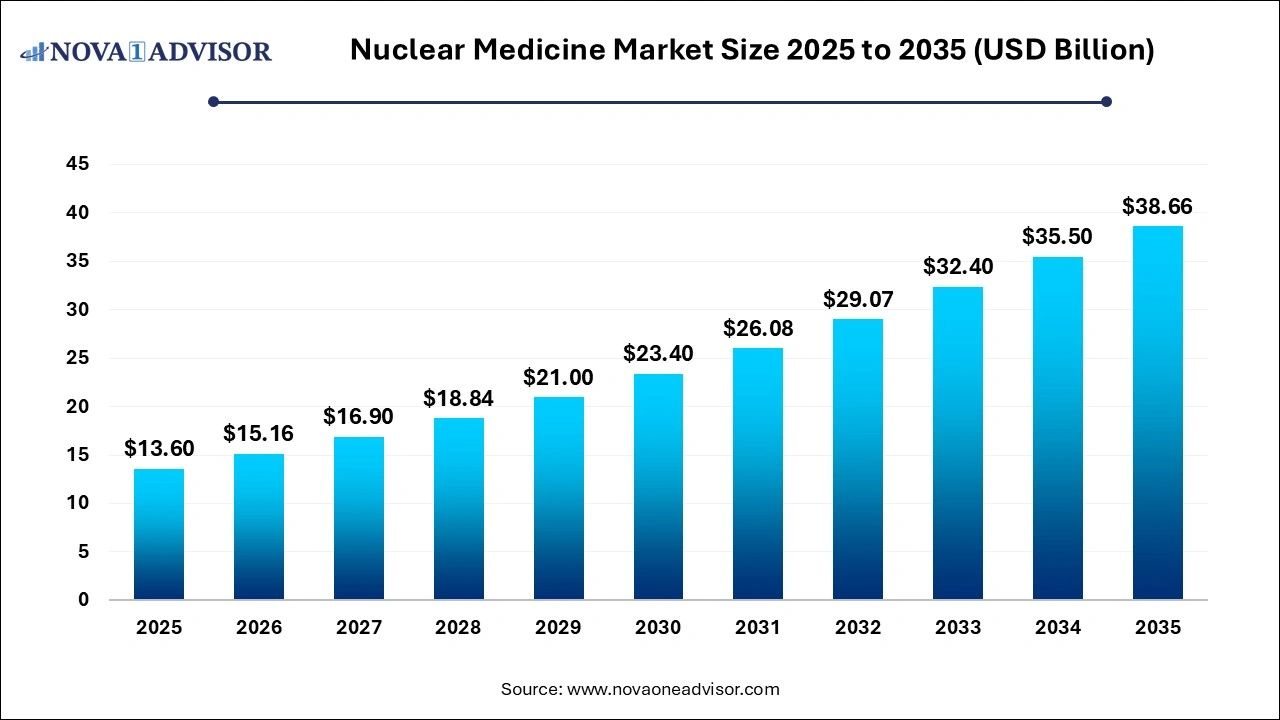

Nuclear Medicine Market Size and Growth 2026 to 2035

The global nuclear medicine market size was estimated at USD 13.60 billion in 2025 and is expected to be worth around USD 38.66 billion by 2035, poised to grow at a compound annual growth rate (CAGR) of 11.01% during the forecast period 2026 to 2035.

Nuclear Medicine Market Key Takeaways

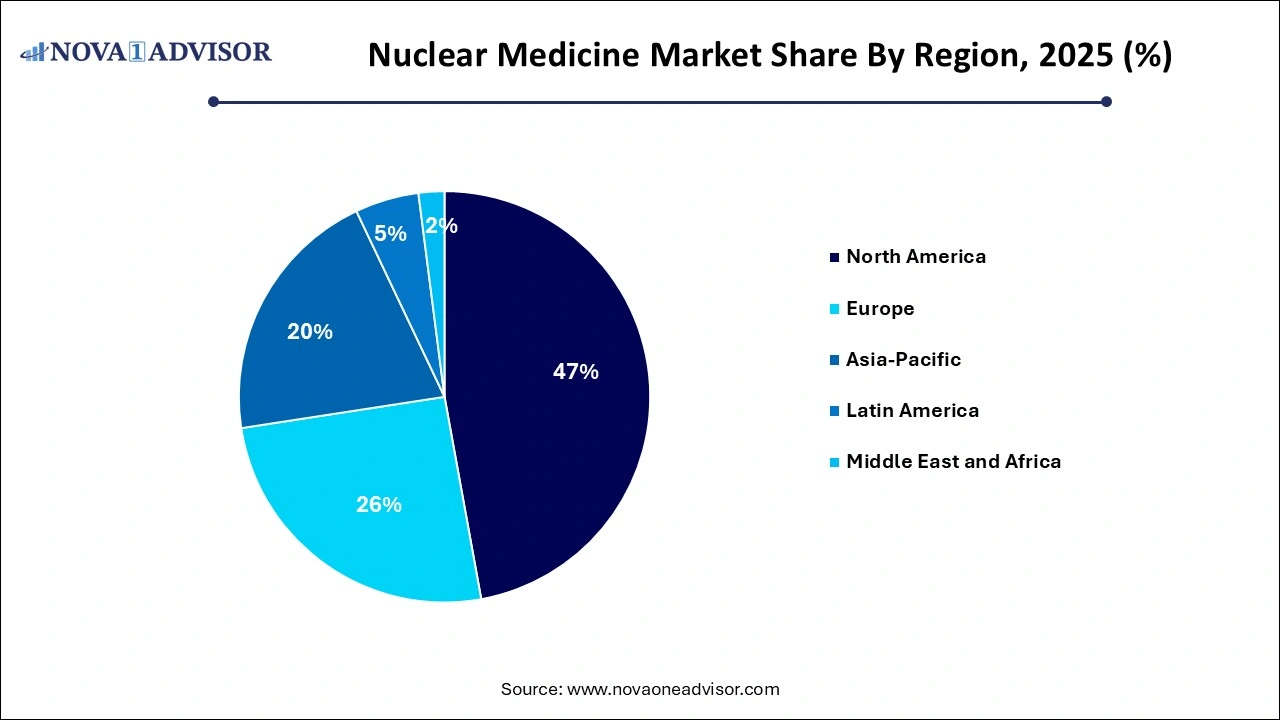

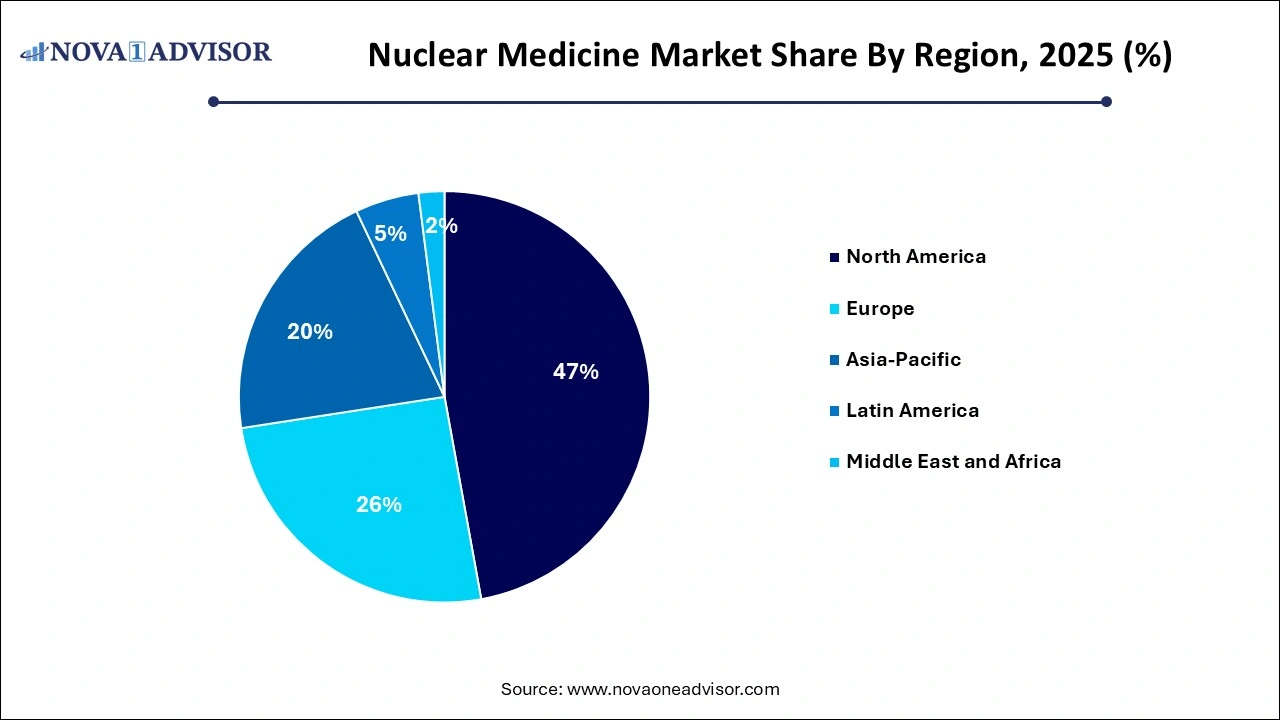

- North America dominated the market with a revenue share of 47.14% in 2025 and is anticipated to grow at a significant rate over the forecast period.

- Asia Pacific region is expected to witness strong growth from 2026 to 2035.

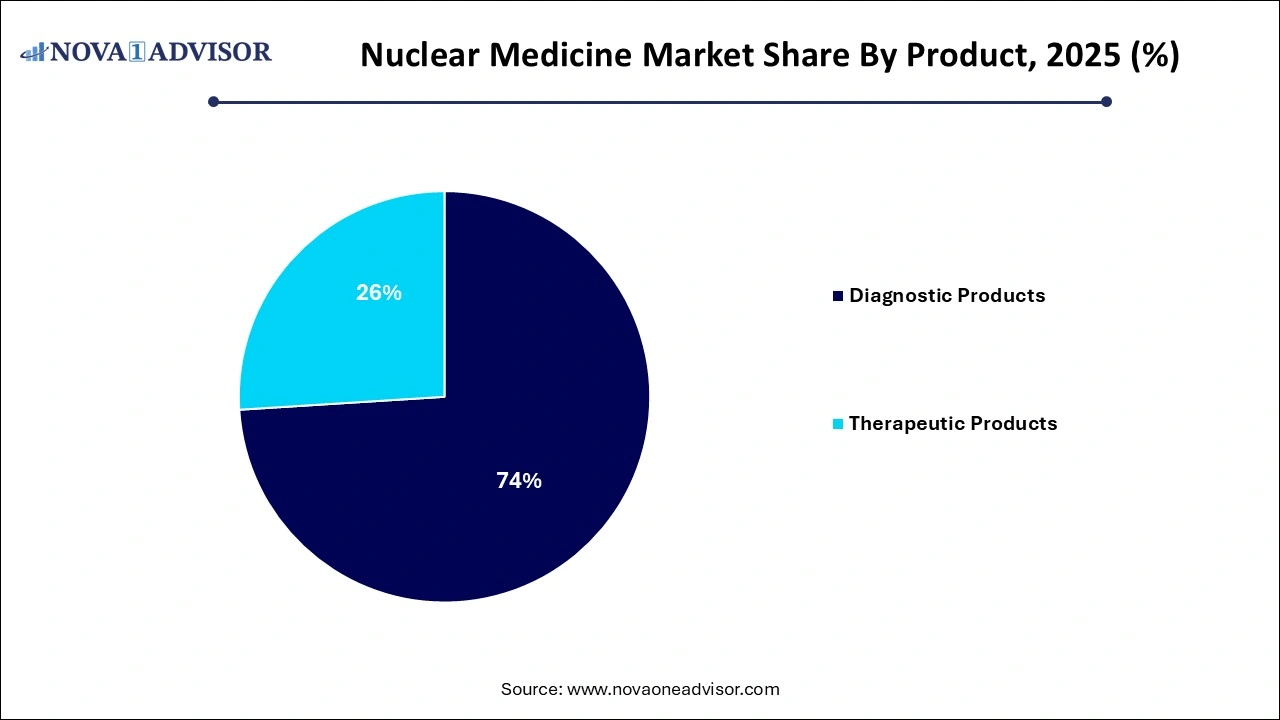

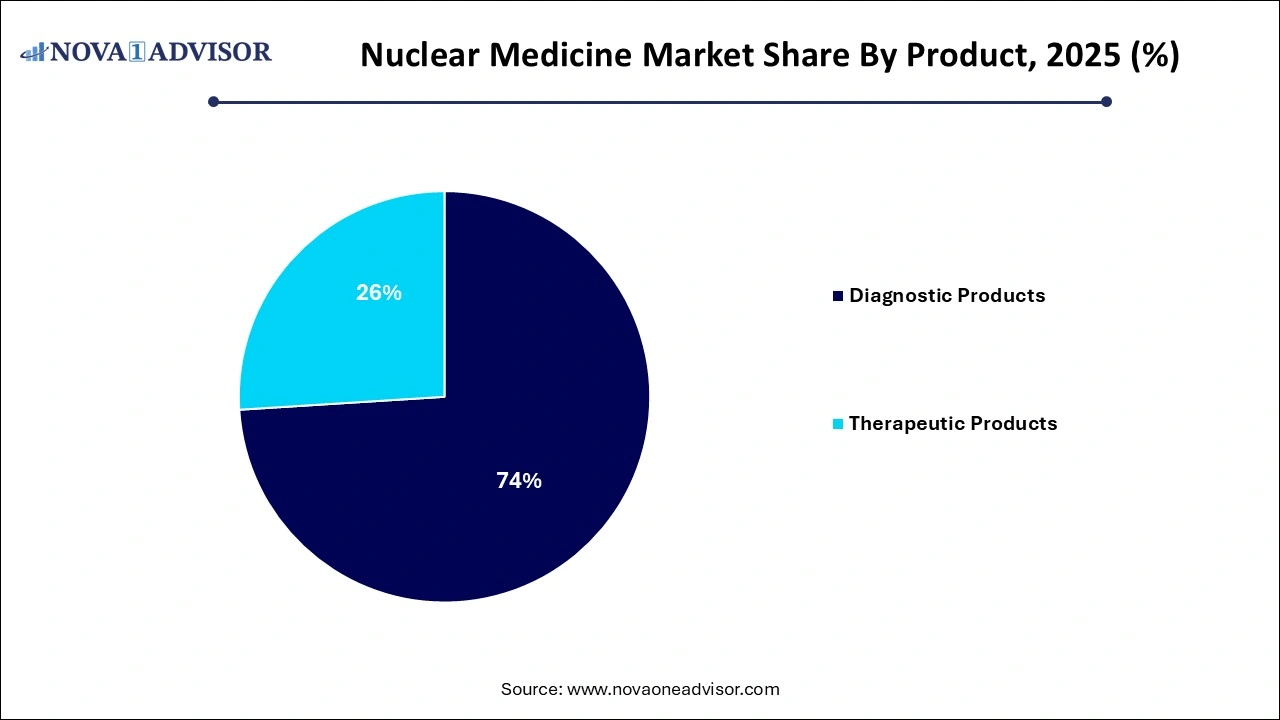

- The diagnostic product segment held the highest market share of 74% in 2025.

- The oncology segment accounted largest market share of around 41.65% in 2025.

- The cardiology segment is expected to witness high growth over the forecast period.

- Based on end-use, hospitals segment dominated the nuclear medicine market in 2025.

- The hospitals segment is expected to grow at a CAGR of 13.8% during the forecast period.

Nuclear Medicine Market Overview

The Nuclear Medicine Market is a transformative domain within the global healthcare industry, merging nuclear technology with molecular diagnostics and targeted therapy. It involves the use of radiopharmaceuticals—radioactive substances administered to patients for either diagnostic imaging or therapeutic purposes. Unlike conventional imaging, nuclear medicine reveals not just anatomical structures but also physiological and metabolic activity, enabling early diagnosis and precise disease management.

Nuclear medicine plays a pivotal role in the detection and treatment of critical illnesses such as cancer, cardiovascular diseases, neurological disorders, and endocrine abnormalities. It includes diagnostic modalities such as Single Photon Emission Computed Tomography (SPECT) and Positron Emission Tomography (PET), alongside therapeutic applications like radioligand therapy, brachytherapy, and targeted alpha or beta therapies.

Market dynamics are shaped by growing disease prevalence, aging demographics, expanding applications in oncology and cardiology, and advances in radiochemistry. Regulatory approvals for novel isotopes and the integration of artificial intelligence (AI) in imaging interpretation are further enriching the field. Moreover, rising investments in healthcare infrastructure, particularly in emerging economies, have amplified demand for advanced nuclear medicine solutions.

However, this market is not without challenges supply chain vulnerabilities of short-lived isotopes, regulatory hurdles, and limited access in low-resource regions continue to affect expansion. Despite these obstacles, the market is experiencing robust growth, driven by increasing clinical adoption and evolving technological capabilities that continue to redefine modern diagnostics and therapy.

Major Trends in the Nuclear Medicine Market

-

Theranostics Revolution: Simultaneous diagnosis and therapy through radiopharmaceuticals (e.g., Gallium-68 for imaging and Lutetium-177 for treatment) is transforming oncology protocols.

-

Rise of PET Imaging over SPECT: PET offers superior resolution and quantification, prompting a gradual transition from traditional SPECT in many clinical settings.

-

Expansion of Radioligand Therapy (RLT): RLTs targeting prostate cancer, neuroendocrine tumors, and bone metastases are gaining regulatory approvals and clinical traction.

-

AI and Machine Learning Integration: Advanced algorithms are increasingly being used for image interpretation, radiation dose optimization, and personalized treatment planning.

-

Mini-Cyclotron and Generator Installations: Compact cyclotron facilities and isotope generators are proliferating to support localized production and reduce reliance on centralized supply chains.

-

Growth in Brachytherapy Use: Brachytherapy, involving localized radiation implants, is resurging due to its effectiveness in treating prostate, cervical, and breast cancers with minimal invasiveness.

-

Public-Private Research Collaborations: Governments and private firms are forming partnerships to develop next-generation radiopharmaceuticals and overcome production bottlenecks.

-

Regulatory Harmonization: Efforts by global agencies to streamline nuclear medicine regulatory processes are supporting faster clinical adoption and innovation.

Nuclear Medicine Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 15.16 Billion |

| Market Size by 2035 |

USD 38.66 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.01% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By Application, By End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Eckert & Ziegler; Mallinckrodt; GE Healthcare; Jubilant Life Sciences Ltd.; Nordion (Canada), Inc.; Bracco Imaging S.P.A.; IRE, the Australian Nuclear Science and Technology Organization; NTP Radioisotopes SOC Ltd.; Eczacıbaşı-Monrol; Lantheus Medical Imaging, Inc.; Cardinal Health |

Nuclear Medicine Market Dynamics

Driver

Rising Global Burden of Cancer and Cardiovascular Diseases

One of the strongest drivers of growth in the nuclear medicine market is the increasing global burden of cancer and cardiovascular diseases (CVDs). With over 19 million new cancer cases reported globally in 2023, the need for early detection and effective treatment has never been more urgent. Likewise, cardiovascular diseases account for nearly one-third of global deaths, underscoring the importance of timely and accurate diagnostics.

Nuclear medicine has revolutionized the management of both these disease categories. PET and SPECT imaging are used to assess tumor metabolism, cardiac perfusion, and neuronal activity, providing early diagnostic capabilities that other imaging modalities often miss. Therapies using isotopes like Iodine-131 for thyroid cancer or Lutetium-177 for neuroendocrine tumors are offering new hope to patients with metastatic or resistant forms of cancer. As clinical guidelines increasingly incorporate nuclear medicine procedures, its usage continues to expand across health systems worldwide.

Restraint

Supply Chain Limitations and Isotope Shortages

Despite its potential, the nuclear medicine market faces a key limitation: supply chain disruptions and isotope shortages. Most radioisotopes have very short half-lives some lasting only minutes or hours requiring immediate and localized production or rapid distribution. For example, Technetium-99m, the most commonly used isotope in SPECT imaging, is derived from Molybdenum-99, which is produced in only a handful of reactors globally. Shutdowns or maintenance at these reactors can severely disrupt the supply chain.

Furthermore, stringent handling protocols, complex regulatory approvals, and limited availability of trained personnel make logistics more challenging. In developing nations, these constraints are often compounded by lack of investment and infrastructure, making it difficult to access life-saving nuclear diagnostic and therapeutic services.

Opportunity

Advancements in Alpha Therapy and Personalized Oncology

A major opportunity for market expansion lies in the development of alpha-emitting radiopharmaceuticals and their integration into personalized oncology protocols. Alpha particles offer highly localized cytotoxicity, damaging cancer cells while sparing surrounding healthy tissue. Isotopes like Actinium-225 and Radium-223 are being explored for treatment-resistant cancers such as prostate, leukemia, and bone metastases.

In parallel, personalized oncology treatment tailored to an individual’s tumor biology is aligning seamlessly with nuclear medicine. Theranostic pairs allow clinicians to first map tumor receptor expression using diagnostic radiopharmaceuticals (e.g., Gallium-68) and then deliver targeted therapy using matched therapeutic isotopes (e.g., Lutetium-177). This dual utility enhances precision, minimizes systemic toxicity, and enables real-time treatment monitoring, setting the stage for future growth in personalized, non-invasive cancer management.

Nuclear Medicine Market Segmental Insights

By Product Insights

Diagnostic products dominate the nuclear medicine market, especially those used in SPECT and PET imaging. SPECT remains widely used due to its affordability and established clinical integration, with Technetium-99m being the most commonly employed isotope. It is used in over 70% of nuclear imaging procedures, including cardiac perfusion, bone scans, and renal imaging. F-18 in PET imaging is pivotal in oncology for detecting metabolic activity in tumors, aiding both staging and monitoring.

Therapeutic products are the fastest-growing, driven by the rising success of targeted radionuclide therapies. Among beta emitters, Lutetium-177 and Iodine-131 are widely used for neuroendocrine tumors and thyroid cancer, respectively. Meanwhile, alpha emitters like Radium-223 are gaining attention for their high-energy, low-penetration characteristics that effectively treat bone metastases. Brachytherapy is also resurging, especially in prostate and cervical cancer care, thanks to isotopes like Iodine-125 and Cesium-131, offering a minimally invasive and localized treatment option.

Therapeutic products are the fastest-growing, driven by the rising success of targeted radionuclide therapies. Among beta emitters, Lutetium-177 and Iodine-131 are widely used for neuroendocrine tumors and thyroid cancer, respectively. Meanwhile, alpha emitters like Radium-223 are gaining attention for their high-energy, low-penetration characteristics that effectively treat bone metastases. Brachytherapy is also resurging, especially in prostate and cervical cancer care, thanks to isotopes like Iodine-125 and Cesium-131, offering a minimally invasive and localized treatment option.

By Application Insights

Oncology holds the dominant share of nuclear medicine applications, given the modality’s ability to detect early-stage tumors, assess metastasis, and guide targeted treatment. PET imaging using F-18-FDG (fluorodeoxyglucose) has become a gold standard for diagnosing lung, breast, and colorectal cancers. In therapeutic care, radioligand therapy with Lutetium-177 has shown promising results in prostate and neuroendocrine tumors.

Cardiology is emerging as the fastest-growing application, primarily through myocardial perfusion imaging with SPECT and PET. These procedures detect ischemia, infarction, and viability, assisting cardiologists in diagnosing coronary artery disease and guiding revascularization decisions. The increasing prevalence of CVDs, alongside aging populations and unhealthy lifestyles, is pushing this segment forward, especially in North America and Europe.

By End-Use Insights

Hospitals and clinics dominate the end-use segment, primarily due to their access to nuclear medicine departments, comprehensive facilities, and compliance with radioactive material handling regulations. Larger hospitals are equipped with both PET/CT and SPECT/CT scanners and are the principal centers for therapeutic radiopharmaceutical administration, especially for cancer patients.

Diagnostic centers are the fastest-growing end-users, driven by the rise of outpatient services and investments in standalone imaging facilities. These centers often operate with greater efficiency and offer quicker appointment scheduling. With the integration of teleradiology and cloud-based image sharing, diagnostic centers are extending their reach and partnering with hospitals and oncology centers to support multidisciplinary care.

Nuclear Medicine Market Regional Insights

North America leads the nuclear medicine market, bolstered by a sophisticated healthcare ecosystem, high diagnostic imaging rates, and strong regulatory frameworks. The U.S. is home to many of the industry’s leading players and academic institutions conducting groundbreaking research in nuclear oncology, neurology, and cardiology. Furthermore, favorable reimbursement models and the presence of multiple production sites for key isotopes give North America a distinct advantage.

In the U.S., the FDA has fast-tracked several radiopharmaceutical approvals, such as Pluvicto (Lutetium-177 PSMA therapy) and Illuccix (Gallium-68 PSMA PET agent), enhancing clinical integration. Advanced imaging infrastructure and trained professionals further facilitate the rapid adoption of emerging nuclear therapies and diagnostics.

Asia-Pacific is the fastest-growing region, driven by rapid healthcare modernization, expanding insurance coverage, and rising cancer incidence. Countries like China, India, and Japan are investing heavily in nuclear medicine facilities and cyclotron installations. Japan already has a mature infrastructure, while China is emerging as a hub for radiopharmaceutical production and clinical trials.

Asia-Pacific is the fastest-growing region, driven by rapid healthcare modernization, expanding insurance coverage, and rising cancer incidence. Countries like China, India, and Japan are investing heavily in nuclear medicine facilities and cyclotron installations. Japan already has a mature infrastructure, while China is emerging as a hub for radiopharmaceutical production and clinical trials.

Government support, such as India’s Make-in-India initiative for radiopharmaceutical self-reliance, and expanding private sector participation are bridging the access gap in this region. Additionally, the increasing prevalence of metabolic and cardiovascular diseases, alongside an aging population, is accelerating clinical adoption of nuclear diagnostics and therapies across APAC nations.

Recent Developments

-

March 2025: Novartis AG expanded global access to its FDA-approved radioligand therapy Pluvicto (Lu-177-PSMA) for advanced prostate cancer by partnering with oncology networks in Europe and Asia-Pacific.

-

January 2025: GE Healthcare announced the acquisition of Zionexa, a France-based biotech firm specializing in PET imaging biomarkers for breast cancer, to bolster its oncology diagnostics pipeline.

-

November 2024: Telix Pharmaceuticals received regulatory approval in Japan for its PSMA-PET imaging agent Illuccix, accelerating its expansion into the Asia-Pacific market.

-

September 2024: Eckert & Ziegler launched a new high-purity Lutetium-177 production line in Germany to meet rising global demand for targeted radiopharmaceutical therapies.

-

June 2024: Curium and Cardinal Health formed a strategic alliance to improve radiopharmaceutical distribution in North America, focusing on timely delivery of short half-life isotopes.

Top Companies in the Nuclear Medicine Market

- GE Healthcare

- Jubilant Life Sciences Ltd

- Nordion (Canada), Inc.

- Bracco Imaging S.P.A

- The institute for radioelements (IRE)

- NTP Radioisotopes SOC Ltd.

- The Australian Nuclear Science and Technology Organization

- Eczacıbaşı-Monrol

- Lantheus Medical Imaging, Inc

- Eckert & Ziegler

- Mallinckrodt

- Cardinal Health

Nuclear Medicine Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the Nuclear Medicine market.

By Product

- Diagnostic Products

- SPECT

- TC-99m

- TL-201

- GA-67

- I-123

- Other SPECT Products

- PET

- F-18

- SR-82/RB-82

- Other PET products

- Therapeutic Products

-

- Alpha Emitters

- RA-223

- Others

- Beta Emitters

- I-131

- Y-90

- SM-153

- Re-186

- Lu-117

- Other Beta Emitters

- Brachytherapy

- Cesium-131

- Iodine-125

- Palladium-103

- Iridium-192

- Other Brachytherapy Products

By Application

- Cardiology

- Neurology

- Oncology

- Thyroid

- Lymphoma

- Bone Metastasis

- Endocrine Tumor

- Others

By End-use

- Hospitals & Clinics

- Diagnostic Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Therapeutic products are the fastest-growing, driven by the rising success of targeted radionuclide therapies. Among beta emitters, Lutetium-177 and Iodine-131 are widely used for neuroendocrine tumors and thyroid cancer, respectively. Meanwhile, alpha emitters like Radium-223 are gaining attention for their high-energy, low-penetration characteristics that effectively treat bone metastases. Brachytherapy is also resurging, especially in prostate and cervical cancer care, thanks to isotopes like Iodine-125 and Cesium-131, offering a minimally invasive and localized treatment option.

Therapeutic products are the fastest-growing, driven by the rising success of targeted radionuclide therapies. Among beta emitters, Lutetium-177 and Iodine-131 are widely used for neuroendocrine tumors and thyroid cancer, respectively. Meanwhile, alpha emitters like Radium-223 are gaining attention for their high-energy, low-penetration characteristics that effectively treat bone metastases. Brachytherapy is also resurging, especially in prostate and cervical cancer care, thanks to isotopes like Iodine-125 and Cesium-131, offering a minimally invasive and localized treatment option. Asia-Pacific is the fastest-growing region, driven by rapid healthcare modernization, expanding insurance coverage, and rising cancer incidence. Countries like China, India, and Japan are investing heavily in nuclear medicine facilities and cyclotron installations. Japan already has a mature infrastructure, while China is emerging as a hub for radiopharmaceutical production and clinical trials.

Asia-Pacific is the fastest-growing region, driven by rapid healthcare modernization, expanding insurance coverage, and rising cancer incidence. Countries like China, India, and Japan are investing heavily in nuclear medicine facilities and cyclotron installations. Japan already has a mature infrastructure, while China is emerging as a hub for radiopharmaceutical production and clinical trials.