Ocular Implants Market Size and Growth

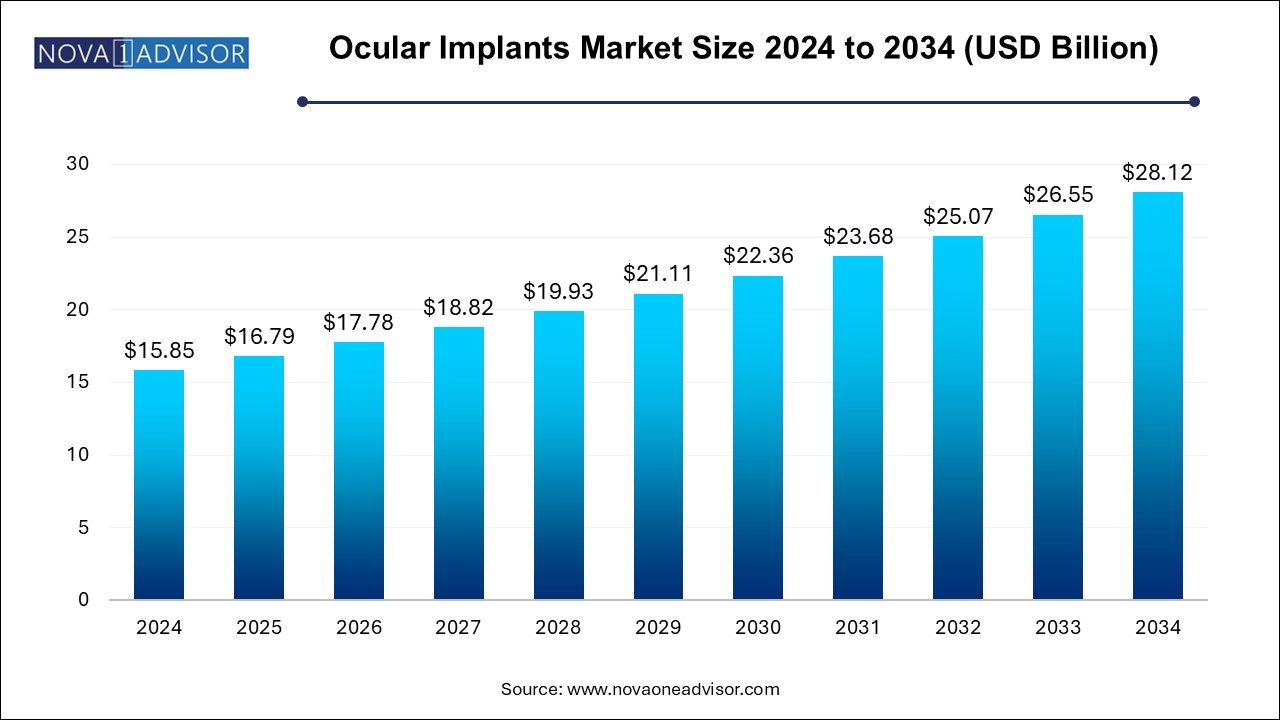

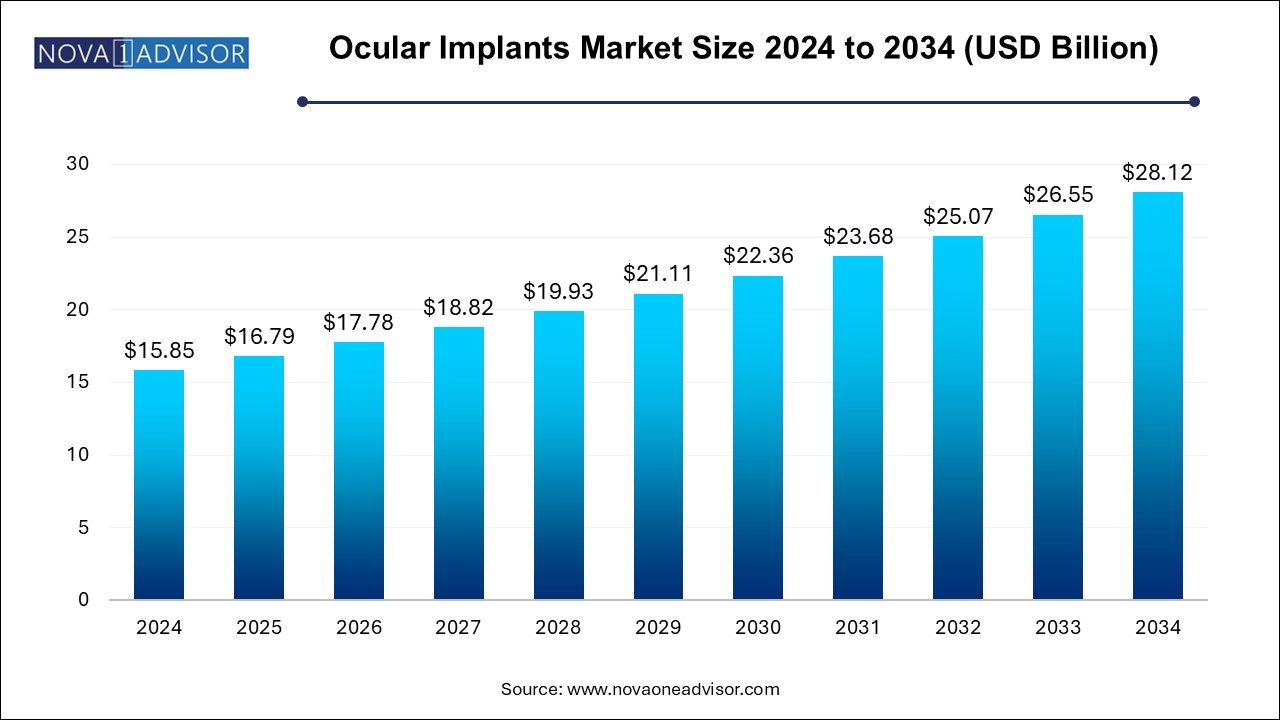

The ocular implants market size was exhibited at USD 15.85 billion in 2024 and is projected to hit around USD 28.12 billion by 2034, growing at a CAGR of 5.9% during the forecast period 2024 to 2034. The growth of the ocular implants market can be linked to rising awareness of corrective surgical procedures for the eye, ongoing advancements in surgical technology, innovative product launches and increasing incidences of eye disorders, especially in the aging population.

Ocular Implants Market Key Takeaways:

- The glaucoma implants segment dominated the market, accounting for over 29% of the revenue share in 2024.

- The intraocular lens segment is expected to register significant growth over the forecast period

- The glaucoma surgery segment dominated the market with a revenue share of around 33.92% in 2024

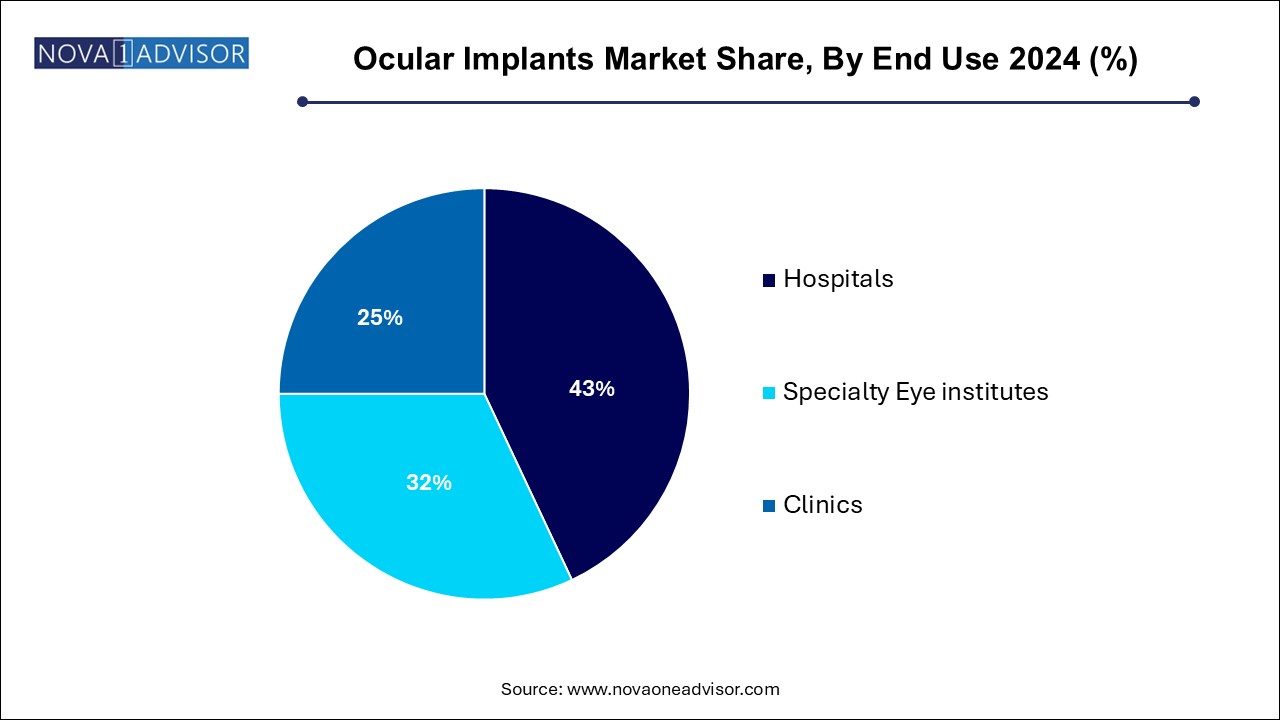

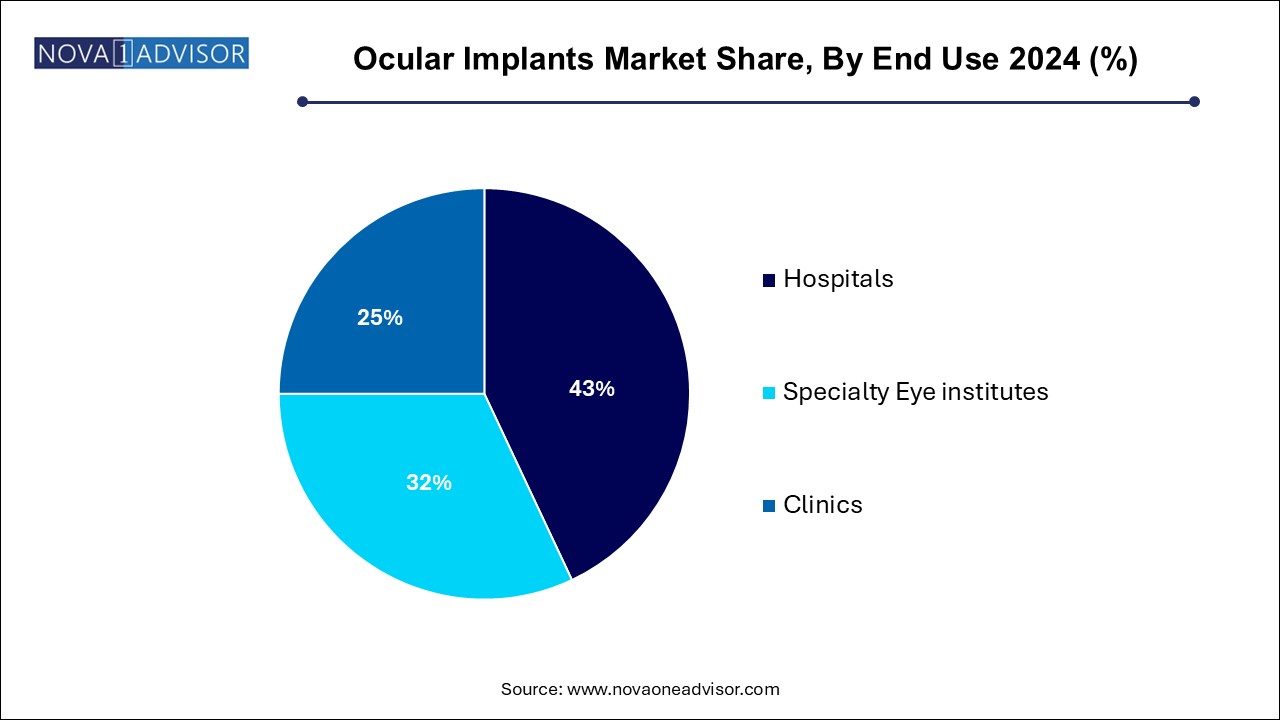

- The hospitals segment held the largest revenue share in 2024, accounting for more than 43.0% of the market share.

- North America ocular implants market dominated the overall global market and accounted for 36.78% of revenue share in 2024.

Market Overview

The ocular implants market represents a rapidly advancing segment of the ophthalmic devices industry, driven by a growing global burden of eye diseases, rising geriatric population, and significant technological innovations. Ocular implants are medical devices surgically inserted into the eye to restore vision, replace damaged structures, or deliver targeted therapeutics. These implants are used across various ophthalmic applications, including cataract surgery, glaucoma management, retinal disorders, cosmetic procedures, and orbital reconstruction.

Among the most widely used implants are intraocular lenses (IOLs)—implanted during cataract surgery to replace the eye’s natural lens. With cataract surgeries being one of the most common procedures globally, demand for advanced IOLs, such as toric and multifocal lenses, continues to escalate. Other important categories include glaucoma drainage devices, corneal inlays and onlays, orbital implants used after enucleation, and ocular prostheses designed for cosmetic restoration in visually impaired or post-traumatic patients.

The market's growth trajectory is underpinned by the increasing prevalence of age-related macular degeneration (AMD), glaucoma, and diabetic retinopathy, alongside a surge in elective procedures for vision correction and cosmetic enhancement. In addition, emerging drug-delivery implants offer promising avenues for treating chronic eye diseases more efficiently, reducing the need for repetitive injections.

Technological advancements such as biocompatible materials, minimally invasive surgical techniques, bioengineered implants, and smart implants with integrated drug delivery systems are reshaping the landscape. Furthermore, increased access to ophthalmic care in developing regions, backed by government initiatives and nonprofit organizations, is expanding the patient base and driving market expansion across geographies.

Major Trends in the Market

-

Increasing adoption of premium IOLs, such as multifocal and extended depth-of-focus (EDOF) lenses, to improve post-cataract visual outcomes.

-

Advancements in glaucoma drainage devices, including minimally invasive glaucoma surgery (MIGS) implants.

-

Growing use of bioresorbable materials and polymers, enhancing patient safety and comfort.

-

Rising popularity of cosmetic ocular prosthetics and implants for aesthetic rehabilitation in trauma or oncology patients.

-

Integration of drug-eluting implants to reduce intraocular pressure and treat chronic posterior segment disorders.

-

Rapid expansion of ocular implant production in Asia Pacific, driven by growing domestic demand and manufacturing capabilities.

-

Surge in personalized and 3D-printed ocular implants, enabling better anatomical fit and faster healing.

-

Increase in outpatient ophthalmic procedures, fueling demand for compact, quick-implant systems.

-

Strong focus on R&D and FDA approvals for innovative retinal and corneal implants addressing previously unmet needs.

Report Scope of Ocular Implants Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 16.79 Billion |

| Market Size by 2034 |

USD 28.12 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 5.9% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Alcon, Inc., Bausch + Lomb., Carl Zeiss AG, Johnson & Johnson Services, Inc., STAAR SURGICAL, MORCHER GmbH and Glaukos Corporation. |

Market Driver: Growing Global Burden of Vision Impairment and Aging Population

The principal driver of the ocular implants market is the growing global burden of vision impairment, particularly among the elderly population. According to the World Health Organization (WHO), over 2.2 billion people globally have some form of vision impairment, and a significant portion of these cases are either preventable or treatable through surgical interventions using ocular implants.

As the global population ages, age-associated conditions such as cataracts, glaucoma, and AMD are becoming increasingly prevalent. Cataract remains the leading cause of blindness, particularly in older adults, and cataract surgeries—requiring intraocular lens implantation—are being performed at record volumes. Similarly, with the increase in glaucoma cases, demand for shunts and drainage devices is surging. As a result, healthcare providers and governments are allocating greater resources toward vision care, boosting surgical procedure volumes and thereby fueling demand for ocular implants across the spectrum of applications.

Market Restraint: High Cost of Premium Implants and Limited Access in Developing Regions

Despite significant medical benefits, a notable restraint in the ocular implants market is the high cost of advanced implantable devices, which limits access for patients in low- and middle-income countries (LMICs). Premium IOLs, drug-delivery implants, and cosmetic prosthetics are often not covered by public health insurance or basic healthcare packages, making them inaccessible to many who require them.

Moreover, in regions with underdeveloped healthcare infrastructure, shortages of trained ophthalmologists and surgical facilities further restrict access to ocular implant procedures. These gaps create disparities in treatment outcomes and hinder broader adoption of implantable technologies. Without substantial efforts in affordability, reimbursement frameworks, and infrastructure development, the benefits of ocular implants may remain concentrated in high-income regions.

Market Opportunity: Development of Next-Generation Smart and Drug-Eluting Implants

A compelling opportunity in the ocular implants market lies in the development of smart and drug-eluting implants that combine mechanical functionality with controlled therapeutic delivery. Chronic conditions such as glaucoma and posterior segment diseases require sustained drug administration, often through monthly or bi-weekly injections. Drug-eluting ocular implants can reduce this burden, enhance patient compliance, and improve outcomes.

Companies are actively developing biodegradable intravitreal implants, microelectromechanical systems (MEMS), and responsive hydrogel-based implants that release medication in response to intraocular pressure or temperature changes. These innovations are gaining traction among clinicians aiming to minimize invasive interventions and provide personalized ocular care. The opportunity is further amplified by rising R&D investments and regulatory bodies supporting accelerated pathways for breakthrough ophthalmic devices.

Ocular Implants Market By Product Insights

Intraocular lenses (IOLs) dominate the ocular implants market, primarily due to the high volume of cataract surgeries globally. Traditional monofocal IOLs are gradually being replaced by advanced designs like toric, multifocal, and accommodative lenses, which correct presbyopia and astigmatism while improving near and distance vision. The availability of foldable and preloaded IOLs has streamlined surgical workflows and enhanced safety profiles, increasing their appeal among both surgeons and patients.

Glaucoma implants are the fastest growing product category, driven by the rising prevalence of glaucoma, particularly among the aging population. These implants, including aqueous shunts and minimally invasive glaucoma surgery (MIGS) devices, offer long-term intraocular pressure control and are often used when medications or laser treatments fail. MIGS implants are gaining momentum due to their reduced complication rates and faster recovery times, with several new entrants receiving regulatory approvals in recent years.

Ocular Implants Market By Application Insights

The glaucoma surgery segment dominated the market with a revenue share of around 33.92% in 2024, Supported by the increasing need for effective intraocular pressure management. Surgical interventions using glaucoma drainage devices and shunts are commonly performed in patients with moderate to severe glaucoma. Innovations in biocompatible implant coatings, valved implants, and implantable pressure sensors have improved outcomes and reduced the need for repeat interventions.

Drug delivery is the fastest growing application, as new intravitreal implants are developed to deliver corticosteroids, anti-VEGF drugs, and anti-inflammatory agents. These devices help reduce the treatment burden for chronic retinal diseases like diabetic macular edema and wet AMD, which typically require frequent injections. Controlled-release implants, including biodegradable options, are becoming increasingly popular among ophthalmologists and patients alike.

Ocular Implants Market By End Use Insights

The hospitals segment held the largest revenue share in 2024, accounting for more than 43.0% of the market share, due to the availability of comprehensive ophthalmic surgical setups, especially in urban centers. Multispecialty hospitals perform a wide array of implant procedures—from cataract surgeries to complex glaucoma and oculoplastic interventions—under advanced infrastructure and post-operative care protocols. Their purchasing power also enables the use of premium implants and technologies.

Specialty eye institutes are the fastest growing end users, especially in high-growth regions such as Asia Pacific and Latin America. These centers, often focused exclusively on ophthalmology, offer highly specialized services including cosmetic implants, advanced lens surgeries, and customized prosthetics. The rise of day-care eye centers and increasing insurance coverage for elective eye procedures are further enhancing the segment's growth potential.

Ocular Implants Market By Regional Insights

North America ocular implants market dominated the overall global market and accounted for 36.78% of revenue share in 2024, supported by a well-established healthcare system, high procedural volumes, and early adoption of advanced technologies. The United States, in particular, witnesses millions of cataract surgeries each year, and Medicare coverage ensures broad accessibility to IOLs and other implants. Moreover, leading companies such as Alcon, Johnson & Johnson Vision, and Bausch + Lomb are headquartered in the region, contributing to constant innovation and product availability.

The region also benefits from a strong network of specialty ophthalmology centers and academic institutions that conduct clinical trials for new ocular implant technologies. Patient awareness and demand for premium and elective procedures—such as toric IOLs and aesthetic implants—are higher compared to other regions, further reinforcing North America's market dominance.

Asia Pacific is the fastest growing region in the ocular implants market, driven by rising awareness of eye health, an aging population, and improving access to surgical care. Countries like China, India, Japan, and South Korea are expanding their ophthalmic infrastructure and investing heavily in public eye care programs. For example, India’s National Programme for Control of Blindness (NPCB) supports free cataract surgeries and implant distribution across rural and semi-urban populations.

In addition, Asia Pacific is emerging as a manufacturing hub for IOLs and other implants, offering cost-competitive alternatives to global brands. With increasing support from NGOs and public-private partnerships, more patients in emerging economies are gaining access to advanced ocular procedures—boosting regional growth and market potential.

What is Driving the Growth of Japan’s Ocular Implants Market?

Japan is anticipated to witness the fastest growth in Asia Pacific region over the forecast period. The country’s rapidly aging population is leading high prevalence of eye conditions such as diabetic retinopathy glaucoma and cataracts creating the need ocular implants such as intraocular lenses (IOLs) for cataract surgery. Continuous advancements in designing and sourcing innovative materials for IOLs as well as increased emphasis on improving surgical outcomes with innovative methods for enhancing patient satisfaction are bolstering the market growth. Micro-invasive glaucoma surgery (MIGS) devices are driving the adoption of glaucoma implants. Furthermore, innovations like personalized prosthetic eyes by utilizing technologies like 3D printing, supportive government initiatives and increased research collaborations area contributing to the market growth.

Key Innovations Shaping the Future of Ocular Implants Market

Evolving trends in the ocular implants market are fuelled by changing consumer needs, increased awareness and acceptance of these implants, rising disposable incomes and increasing eye disease burden, further creating lucrative growth opportunities for businesses in this arena. Advanced intraocular lens (IOL) technologies such as multifocal IOLs, toric IOLs, extended depth of focus (EDOF) IOLs, accommodative IOLs, light adjustable lenses (LALs) as well as development of presbyopia-correcting IOLs and corneal inlays are enhancing optimal outcomes for patients. Sophisticated surgical procedures such as Femtosecond Laser-Assisted Cataract Surgery (FLACS), Optical Coherence Tomography (OCT) imaging, Intraoperative Aberrometry (ORA) and enhanced control of fluid dynamics in phacoemulsification are improving the safety, efficiency and reliability of these procedures. Increased research activities focused on using biocompatible materials and advancing drug delivery systems as well as availability of customizable ocular prosthetics are transforming patient lives.

Some of the prominent players in the ocular implants market include:

- Alcon, Inc.

- Bausch + Lomb.

- Carl Zeiss AG

- Johnson & Johnson Services, Inc.

- STAAR SURGICAL

- MORCHER GmbH

- Glaukos Corporation.

Ocular Implants Market Recent Developments

- In March 2025, Neurotech Pharmaceuticals, an innovator of sustained drug delivery system for chronic retinal conditions, received the FDA approval for an allogeneic encapsulated cell therapy implant, revakinagene taroretcel (Encelto), the first treatment for adults with idiopathic macular telangiectasia (MacTel) type 2 which is a rare, progressive neurodegenerative disease leading to loss of central vision and functional impairment.

- In January 2025, Bausch + Lomb Corporation, a globally leading eye health company, commercially launched the enVista Aspire monofocal and toric intraocular lenses (IOLs) in the European Union (EU), after successfully securing the CE mark toward the end of the last year.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the ocular implants market

By Product

- Intraocular Lens

- Corneal Implants

- Orbital Implants

- Glaucoma Implants

- Ocular Prosthesis

- Others

By Application

- Glaucoma Surgery

- Oculoplasty

- Drug Delivery

- Age related Macular Degeneration

- Aesthetic Purpose

By End Use

- Hospitals

- Specialty Eye institutes

- Clinics

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)