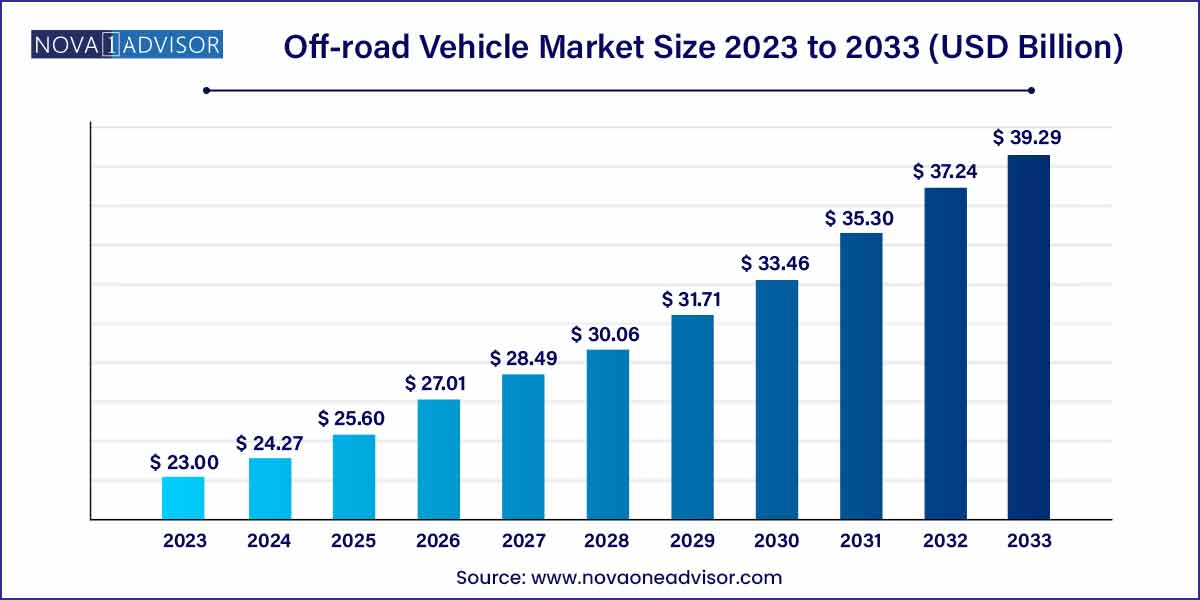

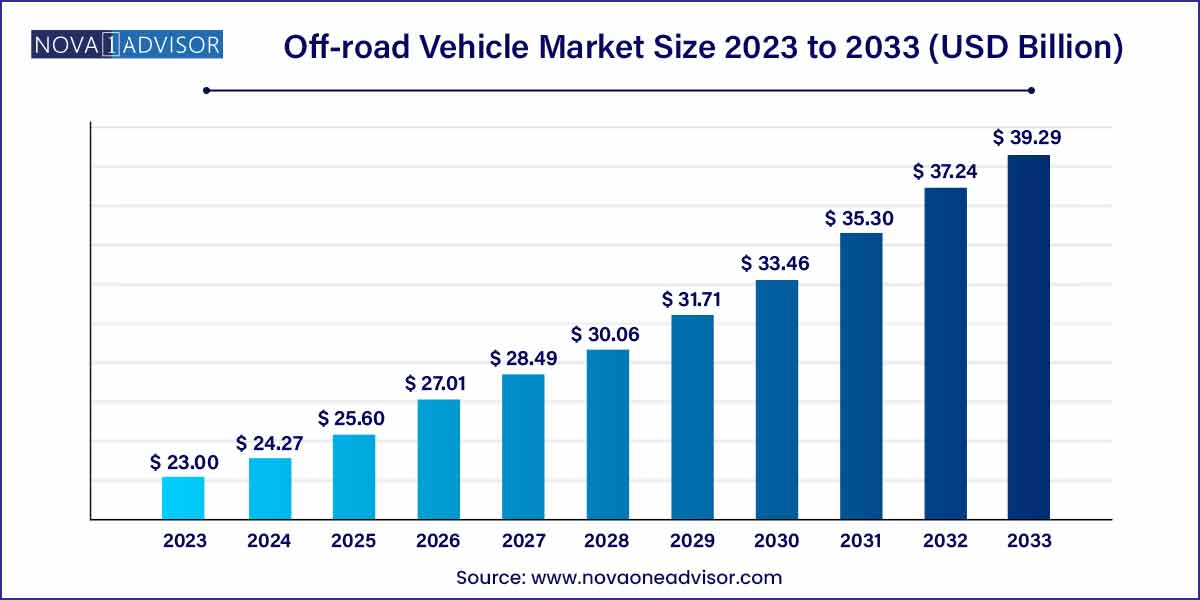

The global off-road vehicle market size was exhibited at USD 23.0 billion in 2023 and is projected to hit around USD 39.29 billion by 2033, growing at a CAGR of 5.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- The North American region accounted for the largest share of more than 65% of the global revenue in 2023.

- Based on product type, the three-wheeler segment accounted for the largest share of more than 47% in 2023.

Off-road Vehicle Market: Overview

The off-road vehicle (ORV) market encompasses a diverse range of vehicles designed for rugged, unpaved, and challenging terrains. These vehicles, including all-terrain vehicles (ATVs), utility terrain vehicles (UTVs), snowmobiles, and three-wheelers, cater to recreational, military, agricultural, and utility applications. ORVs have evolved significantly over the years, blending robustness with technological sophistication to offer superior safety, performance, and versatility across multiple industries.

The increasing popularity of outdoor recreational activities, growing agricultural mechanization, expanding military applications, and the rise in adventure sports tourism have fueled the demand for off-road vehicles globally. Furthermore, advancements in electric powertrains, GPS integration, and rider-assistance technologies are reshaping the landscape, making off-road vehicles more accessible and efficient. As environmental sustainability becomes a higher priority, the market is also witnessing the emergence of electric and hybrid ORVs, opening new avenues for innovation and market expansion.

Off-road Vehicle Market Growth

The off-road vehicle market is experiencing robust growth driven by several key factors. One prominent factor is the increasing demand for recreational activities and outdoor adventures, fueled by a growing affinity for exploration and adrenaline-fueled experiences. Additionally, the rising interest in off-road sports and events is amplifying the appeal of off-road vehicles among enthusiasts and spectators alike. Moreover, the availability of higher disposable income and a willingness to invest in leisure pursuits are further propelling market expansion. Furthermore, the utility-driven applications of off-road vehicles in industries such as agriculture, construction, and military sectors contribute significantly to market growth. With advancements in vehicle performance, safety features, and eco-friendly technologies, consumers are increasingly drawn to off-road vehicles, driving sustained growth in this dynamic market segment.

Off-road Vehicle Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 23.00 Billion |

| Market Size by 2033 |

USD 39.29 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Arcimoto; Arctic Cat Inc. (Textron Inc.); ARGO; BRP; Deere & Company; DRR USA; Electra Meccanica; Harley-Davison, Inc.; HISUN; Honda Motor Co., Ltd.; Italika; Kawasaki Heavy Industries; Kymco; Moto Avanzada Sa de Cv; Polaris Inc.; Segway Technology Co., Ltd. (Ninebot Inc.); SSR Motorsports; Taiga Motors Inc.; Yamaha Motor Co., Ltd.; Zhejiang Chunfeng Power Co., Ltd. (CFMOTO) |

Off-road Vehicle Market Dynamics

- Shifting Consumer Preferences:

The dynamics of the off-road vehicle market are strongly influenced by shifting consumer preferences. With a growing desire for outdoor adventures and recreational activities, there is an increasing demand for off-road vehicles that offer both performance and versatility. Consumers are seeking vehicles that can navigate challenging terrain while also providing comfort, safety, and advanced features. Moreover, customization options are becoming increasingly important as consumers look to personalize their vehicles to match their individual preferences and lifestyle.

- Technological Advancements:

Another significant dynamic shaping the off-road vehicle market is the rapid pace of technological advancements. Manufacturers are continuously innovating to enhance vehicle performance, safety, and connectivity. Advancements in propulsion systems, including electric and hybrid technologies, are gaining traction as consumers prioritize sustainability and environmental responsibility. Additionally, the integration of advanced navigation systems, connectivity features, and telematics is enhancing the overall off-road driving experience.

Off-road Vehicle Market Restraint

- Regulatory Complexities and Compliance Requirements:

One of the primary restraints affecting the off-road vehicle market is the presence of regulatory complexities and compliance requirements. Governments and regulatory bodies impose strict guidelines regarding vehicle emissions, safety standards, and usage regulations, which manufacturers must adhere to. These regulations often vary between regions and can pose challenges for manufacturers in terms of product development, certification, and market entry. Additionally, evolving environmental regulations aimed at reducing carbon emissions and preserving natural habitats may further restrict the use of off-road vehicles in certain areas, limiting market growth opportunities and increasing operational costs for manufacturers.

Another significant restraint facing the off-road vehicle market is environmental concerns associated with vehicle usage. Off-road vehicles are often perceived as contributors to environmental degradation due to factors such as noise pollution, habitat disturbance, and soil erosion. As awareness of environmental issues continues to grow, there is mounting pressure on manufacturers to develop more eco-friendly and sustainable vehicles. Additionally, restrictions on access to off-road trails and designated recreation areas may impact the market by limiting the availability of suitable environments for off-road driving activities.

Off-road Vehicle Market Opportunity

- Rising Demand for Electric Off-Road Vehicles:

An emerging opportunity in the off-road vehicle market lies in the rising demand for electric off-road vehicles. With increasing concerns about environmental sustainability and the transition towards cleaner energy sources, there is growing interest in electric-powered off-road vehicles. These vehicles offer several advantages, including reduced emissions, quieter operation, and lower maintenance costs. Manufacturers that invest in developing electric off-road vehicles stand to capitalize on this shifting consumer preference and gain a competitive edge in the market.

- Expansion of Off-Road Vehicle Rental and Subscription Services:

Another promising opportunity in the off-road vehicle market is the expansion of rental and subscription services. As the cost of purchasing off-road vehicles continues to rise, many consumers are opting for rental or subscription-based models as a more affordable and flexible alternative. This trend is particularly prevalent among occasional users or those who prefer to try different vehicles without committing to ownership. By offering rental and subscription services, manufacturers and rental companies can tap into a broader customer base and generate additional revenue streams.

Off-road Vehicle Market Challenges

- Regulatory Compliance and Environmental Restrictions:

A significant challenge facing the off-road vehicle market is navigating regulatory compliance and environmental restrictions. Governments around the world impose stringent regulations on vehicle emissions, safety standards, and land usage, which can significantly impact the design, manufacturing, and usage of off-road vehicles. Compliance with these regulations often requires substantial investment in research and development to meet evolving standards, as well as ongoing monitoring and adaptation to remain compliant. Moreover, environmental restrictions, such as limitations on access to off-road trails and protected areas, pose additional challenges for manufacturers and enthusiasts alike.

- High Initial Costs and Maintenance Expenses:

Another notable challenge in the off-road vehicle market is the high initial costs and ongoing maintenance expenses associated with owning and operating these vehicles. Off-road vehicles are often priced higher than traditional passenger vehicles due to their specialized design, components, and capabilities. Additionally, the rugged nature of off-road driving can lead to increased wear and tear on vehicle components, necessitating regular maintenance and repairs. These expenses can be prohibitive for some consumers, especially those on a tight budget or those who are not prepared for the long-term costs associated with ownership.

Segments Insights:

Product Type Insights

All-Terrain Vehicles (ATVs) dominated the off-road vehicle market in 2024, owing to their versatility, affordability, and widespread recreational and utility applications. ATVs are popular among adventure enthusiasts for trail riding, hunting, and racing. In addition, industries like agriculture and forestry utilize ATVs for quick, maneuverable transportation across rugged terrains. Their lightweight structure, relative ease of handling, and cost-effectiveness compared to larger ORVs make them highly accessible to a broad consumer base.

Meanwhile, Utility Terrain Vehicles (UTVs) are the fastest-growing segment. UTVs offer enhanced carrying capacity, passenger comfort, and advanced safety features compared to traditional ATVs, making them highly suitable for both recreational and commercial use. Sectors like agriculture, construction, and military increasingly prefer UTVs for tasks requiring heavy hauling, equipment transport, and personnel movement. Modern UTVs equipped with climate-controlled cabins, electric powertrains, and GPS navigation are expanding their appeal beyond traditional markets.

Regional Insights

North America dominated the off-road vehicle market in 2024, driven by a strong culture of outdoor recreation, extensive trail networks, and a high number of off-road vehicle events and competitions. The U.S. and Canada collectively account for the largest share of ATV, UTV, and snowmobile sales. States such as Michigan, California, and Colorado, along with Canadian provinces like Quebec and British Columbia, are leading hubs for ORV enthusiasts.

Moreover, North America's robust agricultural and forestry sectors, combined with military applications, sustain continuous demand for utility-focused off-road vehicles. Manufacturers like Polaris Industries and BRP (Bombardier Recreational Products) are headquartered in the region, further cementing its leadership position.

Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, growing disposable incomes, and increasing interest in adventure tourism. Countries such as China, Japan, India, and Australia are witnessing rising ORV adoption for both recreational and utility purposes. Government investments in developing off-road parks, trail systems, and tourism infrastructure are catalyzing market expansion. Additionally, the growth of agriculture and construction sectors in emerging economies supports the uptake of utility ORVs.

Some of the prominent players in the Off-road vehicle market include:

- Arcimoto

- Arctic Cat Inc. (Textron Inc.)

- ARGO

- BRP

- Deere & Company

- DRR USA

- Electra Meccanica

- Harley-Davison, Inc.

- HISUN

- Honda Motor Co., Ltd.

- Italika

- Kawasaki Heavy Industries

- KYMCO

- MOTO AVANZADA SA DE CV

- Polaris Inc.

- Segway Technology Co., Ltd. (Ninebot Inc.)

- SSR Motorsports

- Taiga Motors Inc.

- Yamaha Motor Co., Ltd.

- Zhejiang Chunfeng Power Co., Ltd. (CFMOTO)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global off-road vehicle market.

Product Type

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)