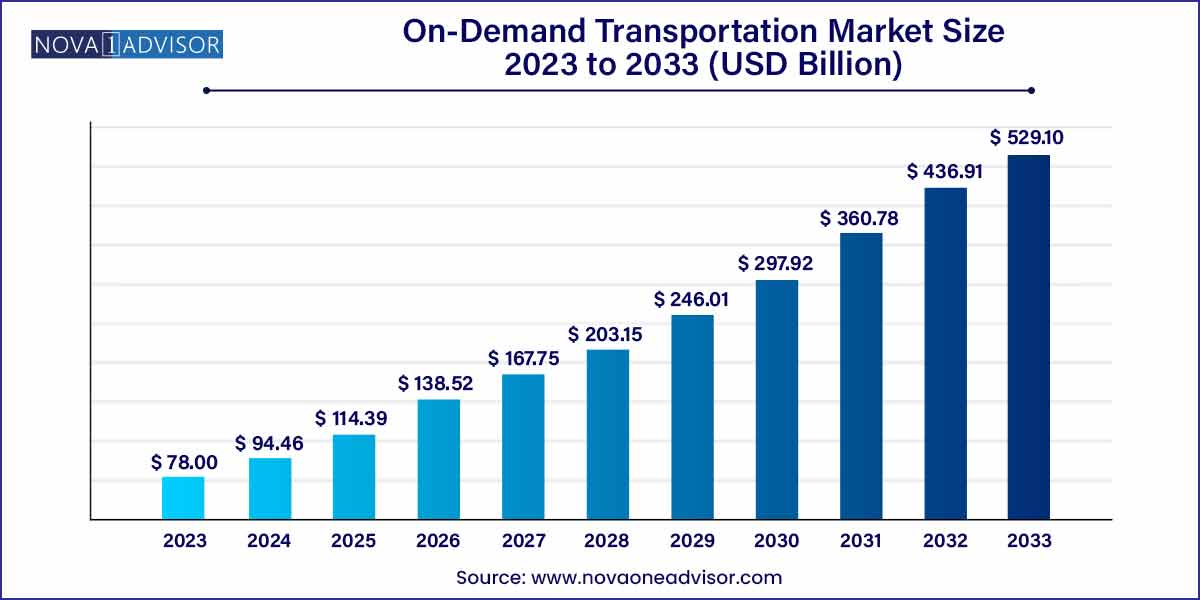

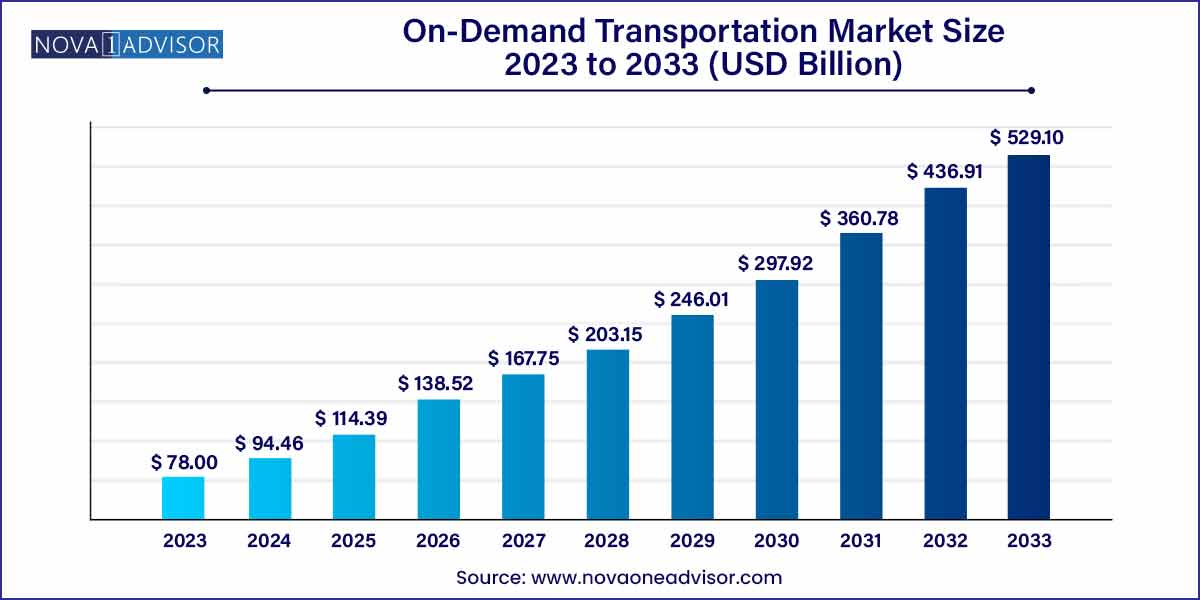

The global on-demand transportation market size was exhibited at USD 78.00 billion in 2023 and is projected to hit around USD 529.10 billion by 2033, growing at a CAGR of 21.1% during the forecast period of 2024 to 2033.

Key Takeaways:

- The e-hailing services is estimated to be the fastest-growing segment over the forecast period.

- Micro mobility offers numerous benefits such as reduced fuel consumption and flexible mobility.

- Based on region, the market has been segmented into North America, Europe, Asia Pacific, and Rest of the World (RoW).

On-Demand Transportation Market: Overview

The on-demand transportation market has transformed the way individuals access mobility services, offering flexibility, convenience, and efficiency beyond traditional ownership models. Leveraging digital platforms, mobile applications, and real-time data, on-demand transportation enables users to book vehicles, bicycles, or scooters at their convenience for short- or long-distance travel.

Factors such as rapid urbanization, changing consumer preferences towards shared mobility, the growing penetration of smartphones and internet connectivity, and environmental concerns regarding private vehicle ownership are significantly driving market expansion. As cities become smarter and more congested, on-demand mobility solutions, including e-hailing, car-sharing, micro-mobility, and station-based mobility, are evolving from alternatives to necessities, fundamentally reshaping the urban transportation landscape.

On-Demand Transportation Market Growth

The growth of the on-demand transportation market is fueled by several key factors. Firstly, technological advancements, including the widespread adoption of smartphones and GPS tracking, have enabled the seamless integration of transportation services into digital platforms, enhancing convenience and accessibility for users. Additionally, changing consumer behavior, characterized by a growing preference for flexibility and convenience, has driven the demand for on-demand transportation solutions. Furthermore, environmental concerns and the push for sustainable mobility options have prompted a shift towards shared transportation modes, such as ride-sharing and bike-sharing, contributing to market expansion. Moreover, regulatory adaptations to accommodate emerging transportation models and ensure safety and fairness have fostered a conducive environment for market growth. Overall, these factors collectively propel the on-demand transportation market forward, promising continued expansion and innovation in the years to come.

On-Demand Transportation Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 78.00 Billion |

| Market Size by 2033 |

USD 529.10 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 21.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service Type, Vehicle Type, Regional |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

(IBM); BMW Group; Daimler Group; Ford Motor Company; General Motor Company; Gett, Inc.; and Robert Bosch GmbH. |

On-Demand Transportation Market Dynamics

- Technological Innovation:

The on-demand transportation market is deeply influenced by continuous technological advancements. With the widespread adoption of smartphones, GPS tracking, and advanced data analytics, transportation services have been seamlessly integrated into digital platforms. These technologies have not only revolutionized the way users book, track, and pay for transportation but have also enabled the emergence of innovative solutions such as ride-hailing and micro-mobility. As technology continues to evolve, with developments in areas like autonomous vehicles and smart infrastructure, the on-demand transportation market is expected to witness further disruption and transformation.

- Changing Consumer Behavior:

A fundamental driver of growth in the on-demand transportation market is the shifting behavior of consumers, particularly in urban areas. With increasing urbanization and a desire for convenience, flexibility, and cost-effectiveness, consumers are increasingly turning to on-demand transportation services as viable alternatives to traditional modes of transportation. This trend is particularly pronounced among younger demographics and urban dwellers who prioritize access over ownership. As consumer preferences continue to evolve, on-demand transportation companies must adapt their offerings to meet changing demands, driving further innovation and expansion in the market.

On-Demand Transportation Market Restraint

One of the significant restraints facing the on-demand transportation market is the complex and evolving regulatory landscape. As on-demand transportation platforms disrupt traditional transportation models, they often encounter regulatory hurdles related to safety standards, labor rights, pricing transparency, and fair competition. Navigating these regulations can be challenging for companies, leading to increased compliance costs, operational complexities, and potential legal risks. Moreover, varying regulatory frameworks across different regions and jurisdictions further complicate matters, hindering the seamless expansion of on-demand transportation services and creating uncertainty for stakeholders.

Another key restraint for the on-demand transportation market is the high operational costs associated with running and scaling transportation platforms. These costs include driver incentives, vehicle maintenance, insurance premiums, marketing expenses, and technology investments. While on-demand transportation companies strive to optimize efficiency and achieve economies of scale, they often face pressure to balance competitive pricing with profitability. Moreover, fluctuations in fuel prices, labor costs, and insurance premiums can impact operational expenses, posing challenges to sustainable growth and profitability in the long term.

On-Demand Transportation Market Opportunity

- Expansion into Underserved Markets:

One significant opportunity within the on-demand transportation market lies in expanding services into underserved rural and emerging urban markets. While on-demand transportation has seen considerable growth in major metropolitan areas, there remain vast opportunities to penetrate less densely populated regions where access to traditional transportation infrastructure may be limited. By leveraging technology and innovative business models, on-demand transportation companies can provide much-needed mobility solutions to these underserved communities, unlocking new revenue streams and expanding their user base.

- Collaboration and Partnerships:

Another promising opportunity for the on-demand transportation market is the exploration of strategic collaborations and partnerships with other stakeholders, including public transit agencies, local governments, and mobility service providers. By forging alliances, on-demand transportation companies can enhance the overall mobility ecosystem, improve last-mile connectivity, and address urban transportation challenges more effectively. Collaborations may involve integrating on-demand services with public transit systems, sharing data to optimize traffic management, or jointly investing in infrastructure projects.

On-Demand Transportation Market Challenges

One of the primary challenges confronting the on-demand transportation market is navigating regulatory uncertainty and evolving compliance requirements. As disruptive technologies and business models continue to reshape the transportation landscape, regulators are tasked with balancing innovation with public safety, labor rights, and fair competition. This often results in a patchwork of regulations that vary across jurisdictions, creating complexity and ambiguity for on-demand transportation companies.

- Safety and Security Concerns:

Ensuring the safety and security of both passengers and drivers represents another significant challenge for the on-demand transportation market. While on-demand platforms implement various safety measures, such as background checks, driver training programs, and in-app safety features, incidents of accidents, assaults, and other safety-related issues can still occur. Moreover, the decentralized nature of on-demand transportation, with independent contractors providing services through digital platforms, presents unique challenges in enforcing safety standards and accountability.

Segments Insights:

Service Type Insights

E-hailing services dominated the on-demand transportation market in 2024, driven by their unmatched convenience, affordability, and widespread availability across urban centers globally. Companies like Uber, Lyft, Ola, and Didi Chuxing have revolutionized personal transportation by offering smartphone-based, real-time ride bookings, making point-to-point travel easier than ever before. The popularity of e-hailing is supported by expanding driver networks, dynamic pricing models, and loyalty programs, further embedding these services into daily urban life.

However, car-sharing services are the fastest-growing segment. Car-sharing platforms such as Zipcar, Getaround, and Turo cater to consumers who seek the flexibility of using a vehicle without the financial burden of ownership. With pay-per-use models, users can rent vehicles by the hour or day for specific needs. As environmental awareness grows and urban car ownership becomes less desirable, car-sharing is increasingly recognized as a sustainable, economical solution, especially among urban millennials and young professionals.

Vehicle Type Insights

Four-wheeler vehicles dominated the on-demand transportation market, primarily because e-hailing and car rental services heavily depend on standard passenger cars, sedans, and SUVs. Four-wheelers offer greater comfort, safety, luggage capacity, and suitability for both short commutes and inter-city travel, making them the preferred choice for most consumers. Companies continue investing in expanding four-wheeler fleets, including luxury and electric vehicle models, to attract diverse customer bases.

Conversely, micro-mobility solutions are the fastest-growing vehicle type segment, fueled by rising consumer interest in last-mile transportation options like e-scooters, e-bikes, and shared bicycles. Urban congestion, combined with environmental sustainability goals, has made micro-mobility a highly attractive alternative for short-distance travel. Companies such as Lime, Bird, and Spin are expanding aggressively across global cities, providing eco-friendly, convenient transport solutions tailored to urban landscapes.

Regional Insights

North America dominated the on-demand transportation market in 2024, driven by strong consumer adoption of ride-hailing, car-sharing, and micro-mobility services. The United States and Canada host major industry players like Uber, Lyft, Zipcar, and Bird, supported by mature digital infrastructure, high smartphone penetration, and an innovation-friendly regulatory environment. North America's dense urban population centers, combined with consumer willingness to embrace new mobility solutions, cement its leadership position.

Asia-Pacific is the fastest-growing region, fueled by massive urbanization, growing middle-class populations, and an increasingly tech-savvy demographic. China, India, Japan, and Southeast Asian countries are witnessing explosive growth in e-hailing and micro-mobility services. Domestic giants such as Didi Chuxing (China), Ola (India), and Grab (Southeast Asia) dominate their respective markets, offering localized solutions and expanding into adjacent services like food delivery and financial payments. Government investments in smart city initiatives further accelerate mobility innovation across the region.

Some of the prominent players in the On-demand transportation market include:

- (IBM)

- BMW Group

- Daimler Group

- Ford Motor Company

- General Motor Company

- Gett, Inc.

- Robert Bosch GmbH.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global on-demand transportation market.

Service Type

- E-Hailing

- Car Sharing

- Car Rental

- Station-Based Mobility

Vehicle Type

- Four Wheeler

- Micro Mobility

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)