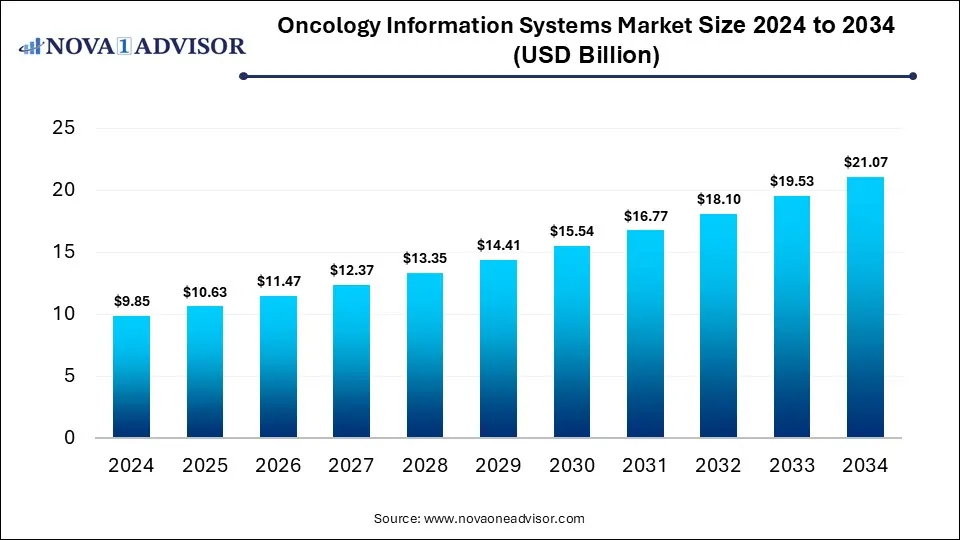

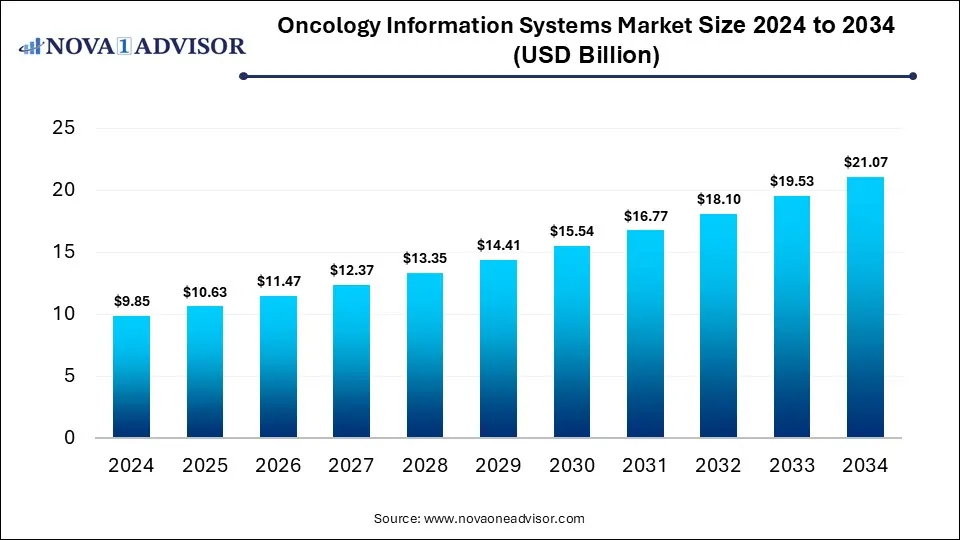

The global oncology information systems market size is calculated at USD 9.85 billion in 2024, grows to USD 10.63 billion in 2025, and is projected to reach around USD 21.07 billion by 2034, growing at a CAGR of 7.9% from 2025 to 2034. The market is growing due to increasing demand for efficient cancer care management and rising adoption of digital platforms that streamline treatment, data integration, and patient monitoring.

- North America dominated the oncology information systems market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product & services, the solution segment led the market with the largest revenue share in 2024 and is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the medical oncology segment held the largest market share in 2024.

- By application, the surgical oncology segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end use, the hospital & diagnostic imaging centers segment held the highest market share in 2024.

- By end use, the ablation care centers and cancer care centers segment is expected to grow at the fastest CAGR in the market during the forecast period.

The oncology information systems (OIS) is a specialized software platform designed to manage, track, and integrate clinical, administrative, and treatment information for cancer care, supporting workflows in medical, surgical, and radiation oncology. The growth of oncology information systems market is fueled by the shift towards personalized cancer therapies, rising clinical trial activities, and the need for precise data analytics in oncology research. Expanding adoption, emphasis on value-based healthcare models, and collaboration between healthcare providers and IT vendors also support market expansion. Additionally, growing awareness about early cancer detection and patient engagement solutions accelerates system adoption worldwide.

- In May 2024, Elekta AB introduced its enhanced oncology information system, Elekta ONE, designed to unify radiation therapy planning, patient scheduling, and AI-driven decision support, improving workflow efficiency across cancer care facilities.(Source: https://www.elekta.com/)

- In March 2024, RaySearch Laboratories launched RayCare 6A, an updated oncology information system that strengthens adaptive radiation therapy capabilities and ensures better integration with external imaging and treatment platforms. (Source: https://www.raysearchlabs.com/)

AI is reshaping the market by boosting interoperability between platforms, optimizing resource utilization, and enhancing imaging analysis accuracy. It supports faster integration of clinical trial data, improves remote monitoring capabilities, and aids in reducing medical errors. Additionally, AI-driven automation helps healthcare providers manage growing cancer caseloads more effectively, leading to cost savings and improved operational efficiency, which in turn accelerates system adoption across healthcare facilities.

- For Instance, In January 2024, Siemens Healthineers finalized the acquisition of Intelligencia.AI to strengthen its oncology information system portfolio by adding predictive modeling and machine learning features to its software solutions. (Source: https://www.siemens-healthineers.com/)

| Report Attribute |

Details |

| Market Size in 2025 |

USD 10.63 Billion |

| Market Size by 2034 |

USD 21.07 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.9% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product & Services, Application, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Accuray Incorporated,Elekta, BrainLab, DOSIsoft SA, FLATIRON HEALTH, RaySearch Laboratories, Oracle (Cerner Corporation), Koninklijke Philips N.V., Varian Medical Systems, Inc. (Siemens Healthineers). |

Market Dynamics

Driver

Rising Prevalence of Cancer Worldwide

The increasing global cancer incidence fuels demand for oncology information systems as hospitals and clinics seek solutions to improve operational efficiency, reduce treatment errors, and support personalized care. High patient loads and complex therapy regimens make digital platforms essential for scheduling, monitoring outcomes, and ensuring compliance with clinical guidance, thereby driving market growth.

- For Instance, In September 2025, Lucknow’s Kalyan Singh Cancer Institute installed a 3D digital mammography unit to improve early breast cancer detection and reduce diagnostic errors. (Source: https://timesofindia.indiatimes.com/)

Restraint

High Cost of Implementation and Maintenance

The oncology information systems market faces restraint from the substantial upfront expenses associated with existing hospital IT infrastructure and ensuring compliance with regulatory standards. Recurring costs for cybersecurity, software updates, and specialized personnel further discourage adoption. This financial barrier is particularly challenging for resource-limited healthcare centers, delaying digital transformation in oncology services and limiting the widespread deployment of advanced information systems despite their clinical benefits.

Opportunity

Expansion of Telemedicine and Remote Patient Monitoring

Telemedicine and remote patient monitoring offer a promising opportunity in the oncology information systems market by facilitating virtual consultations, follow-up, and symptom tracking. This reduces the burden on healthcare facilities, lowers travel costs for patients, and ensures continuous engagement in treatment plans. When integrated with oncology information systems, these tools enable better data management, timely alerts for complications, and improved coordination between specialists, expanding market potential and supporting more efficient patient-centeric cancer care delivery.

- For Instance, In February 2025, the RECOVER project launched an AI-driven remote monitoring system for gastrointestinal cancer patients, enabling early complication detection and improved care coordination. (Source: https://www.researchgate.net/)

Segmental Insights

What made the Solution Segment Dominant in the Oncology Information Systems Market in 2024?

The solution segment dominated the oncology information systems market in 2024 because it provides comprehensive tools for data management, regulatory compliance, and patient engagement. These solutions reduce administrative burdens, enhance collaboration among multidisciplinary teams, and support real-time monitoring of treatment outcomes. Their adaptability across hospital sizes and care settings makes them highly attractive to healthcare providers, driving rapid adoption and positioning this segment for the highest CAGR during the forecast period.

- For Instance, In December 2024, Varian, part of Siemens Healthineers, obtained U.S. FDA 510(k) clearance for its RapidArc Dynamic treatment planning system, enabling its commercial use in radiation therapy. (Source: https://www.siemens-healthineers.com/)

How did Medical Oncology Dominate the Oncology Information Systems Market in 2024?

The medical oncology segment led the market in 2024 due to the growing emphasis on outpatient cancer care and chronic management of hematologic and solid tumors. Hospitals and clinics increasingly rely on oncology information systems to coordinate multidisciplinary teams, schedule treatments, and monitor patient progress over long-term therapy cycles. The segment's dominance is further supported by rising awareness of early intervention, expansion of cancer care programs, and demand for streamlined workflow solutions in medical oncology settings.

The surgical oncology segment is projected to register the fastest CAGR because hospitals are increasingly focusing on integrated surgical care pathways and precise operative planning. Oncology information systems support inventory management, surgical scheduling, and interdisciplinary communication, enhancing efficiency in complex procedures. Rising demand for specialized cancer surgeries and, expansion of surgical postoperative follow-up, are driving healthcare providers to adopt these systems rapidly, fueling the growth of the market.

Why the Hospital & Diagnostic Imaging Centers Segment Dominated the Oncology Information Systems Market in 2024?

The hospital & diagnostic imaging centers segment led the market in 2024 due to their role as primary hubs for advanced cancer care and early diagnosis. These centers adopt oncology information systems to manage high patient volumes, coordinate multiple treatment modalities, and maintain detailed medical records. Increasing demand for integrated imaging solutions, expansion of cancer screening programs, and the need for seamless data sharing across departments have driven rapid systems adoption, securing this segment's largest market share.

The ablation care centers and cancer care centers segment is projected to grow fastest as more specialized facilities emerge to provide focused, high-quality oncology services. These centers increasingly implement oncology information systems to manage patient records, optimize treatment schedules, and streamline reporting for regulatory compliance. Growing investments in dedicated cancer care infrastructure, rising patient preference for specialized treatment centers, and the need for efficient coordination of complex therapies are driving rapid adoption in this segment during the forecast period.

Regional Insights

How is North America contributing to the Expansion of the Oncology Information Systems Market?

North America led the market because of its well-established hospital networks and high patient access to specialized cancer care. The region benefits from strong collaborations between healthcare providers and IT companies, rapid adoption of advanced treatment planning tools, and a focus on improving clinical outcomes through data-driven decision-making. Rising prevalence of cancer, coupled with reimbursement support for digital health solutions, has further accelerated system deployment, securing the region’s largest revenue share in 2024.

- For Instance, In January 2024, a PubMed Journal article reported that the U.S. was projected to see 2 million new cancer cases and approximately 611,720 cancer-related deaths during the year. (Source: https://acsjournals.onlinelibrary.wiley.com/)

How is Asia-Pacific Accelerating the Oncology Information Systems Market?

Asia-Pacific is projected to grow at the fastest CAGR because of the increasing number of private cancer care centers, rising demand for efficient patient management, and rapid digitization of healthcare services. The region is witnessing greater adoption of cloud-based and AI-enabled oncology information systems to handle growing patient loads. Additionally, favorable government policies, expanding health insurance coverage, and partnerships with international technology vendors are accelerating market penetration, making Asia-Pacific a key growth hotspot during the forecast period.

- Accuray Incorporated

- Elekta

- BrainLab

- DOSIsoft SA

- FLATIRON HEALTH

- RaySearch Laboratories

- Oracle (Cerner Corporation)

- Koninklijke Philips N.V.

- Varian Medical Systems, Inc. (Siemens Healthineers).

- In August 2024, the Connecticut Proton Therapy Center adopted RayCare from RaySearch Laboratories AB alongside the IBA ProteusONE compact proton therapy system to enhance its cancer treatment platform. (Source: https://www.prnewswire.com/)

- In January 2024, RaySearch Laboratories released RayStation 2024A, improving treatment planning workflows and offering integration with their oncology analytics platform, RayIntelligence, for enhanced clinical insights. (Source: https://www.raysearchlabs.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Oncology Information Systems market.

By Products & Services

-

- Patient Information Systems

- Treatment Planning Systems

By Application

- Medical Oncology

- Radiation Oncology

- Surgical Oncology

By End-use

- Hospitals and Diagnostic Imaging Centers

- Ablation Care Centers and Cancer Care Centers

- Government Institutions

- Research Facilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

List of Tables

- Table 1: Global Oncology Information Systems Market Size (USD Billion) by Products & Services, 2024–2034

- Table 2: Global Oncology Information Systems Market Size (USD Billion) by Application, 2024–2034

- Table 3: Global Oncology Information Systems Market Size (USD Billion) by End-use, 2024–2034

- Table 4: North America Market Size (USD Billion) by Products & Services, 2024–2034

- Table 5: North America Market Size (USD Billion) by Application, 2024–2034

- Table 6: North America Market Size (USD Billion) by End-use, 2024–2034

- Table 7: U.S. Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 8: Canada Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 9: Mexico Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 10: Europe Market Size (USD Billion) by Products & Services, 2024–2034

- Table 11: Europe Market Size (USD Billion) by Application, 2024–2034

- Table 12: Germany Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 13: France Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 14: UK Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 15: Italy Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 16: Asia Pacific Market Size (USD Billion) by Products & Services, 2024–2034

- Table 17: Asia Pacific Market Size (USD Billion) by Application, 2024–2034

- Table 18: China Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 19: Japan Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 20: India Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 21: South Korea Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 22: Southeast Asia Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 23: Latin America Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 24: Brazil Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 25: Middle East & Africa Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 26: GCC Countries Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 27: Turkey Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Table 28: Africa Market Size (USD Billion) by Products & Services & Application, 2024–2034

- Figure 1: Global Market Share by Products & Services, 2024

- Figure 2: Global Market Share by Application, 2024

- Figure 3: Global Market Share by End-use, 2024

- Figure 4: North America Market Share by Products & Services, 2024

- Figure 5: North America Market Share by Application, 2024

- Figure 6: North America Market Share by End-use, 2024

- Figure 7: U.S. Market Share by Products & Services, 2024

- Figure 8: U.S. Market Share by Application, 2024

- Figure 9: Canada Market Share by Products & Services, 2024

- Figure 10: Canada Market Share by Application, 2024

- Figure 11: Mexico Market Share by Products & Services, 2024

- Figure 12: Mexico Market Share by Application, 2024

- Figure 13: Europe Market Share by Products & Services, 2024

- Figure 14: Europe Market Share by Application, 2024

- Figure 15: Germany Market Share by Products & Services, 2024

- Figure 16: Germany Market Share by Application, 2024

- Figure 17: France Market Share by Products & Services, 2024

- Figure 18: France Market Share by Application, 2024

- Figure 19: UK Market Share by Products & Services, 2024

- Figure 20: UK Market Share by Application, 2024

- Figure 21: Italy Market Share by Products & Services, 2024

- Figure 22: Italy Market Share by Application, 2024

- Figure 23: Asia Pacific Market Share by Products & Services, 2024

- Figure 24: Asia Pacific Market Share by Application, 2024

- Figure 25: China Market Share by Products & Services, 2024

- Figure 26: China Market Share by Application, 2024

- Figure 27: Japan Market Share by Products & Services, 2024

- Figure 28: Japan Market Share by Application, 2024

- Figure 29: India Market Share by Products & Services, 2024

- Figure 30: India Market Share by Application, 2024

- Figure 31: South Korea Market Share by Products & Services, 2024

- Figure 32: South Korea Market Share by Application, 2024

- Figure 33: Southeast Asia Market Share by Products & Services, 2024

- Figure 34: Southeast Asia Market Share by Application, 2024

- Figure 35: Latin America Market Share by Products & Services, 2024

- Figure 36: Latin America Market Share by Application, 2024

- Figure 37: Brazil Market Share by Products & Services, 2024

- Figure 38: Brazil Market Share by Application, 2024

- Figure 39: Middle East & Africa Market Share by Products & Services, 2024

- Figure 40: Middle East & Africa Market Share by Application, 2024

- Figure 41: GCC Countries Market Share by Products & Services, 2024

- Figure 42: GCC Countries Market Share by Application, 2024

- Figure 43: Turkey Market Share by Products & Services, 2024

- Figure 44: Turkey Market Share by Application, 2024

- Figure 45: Africa Market Share by Products & Services, 2024

- Figure 46: Africa Market Share by Application, 2024