Operating Room Equipment Market Size and Research

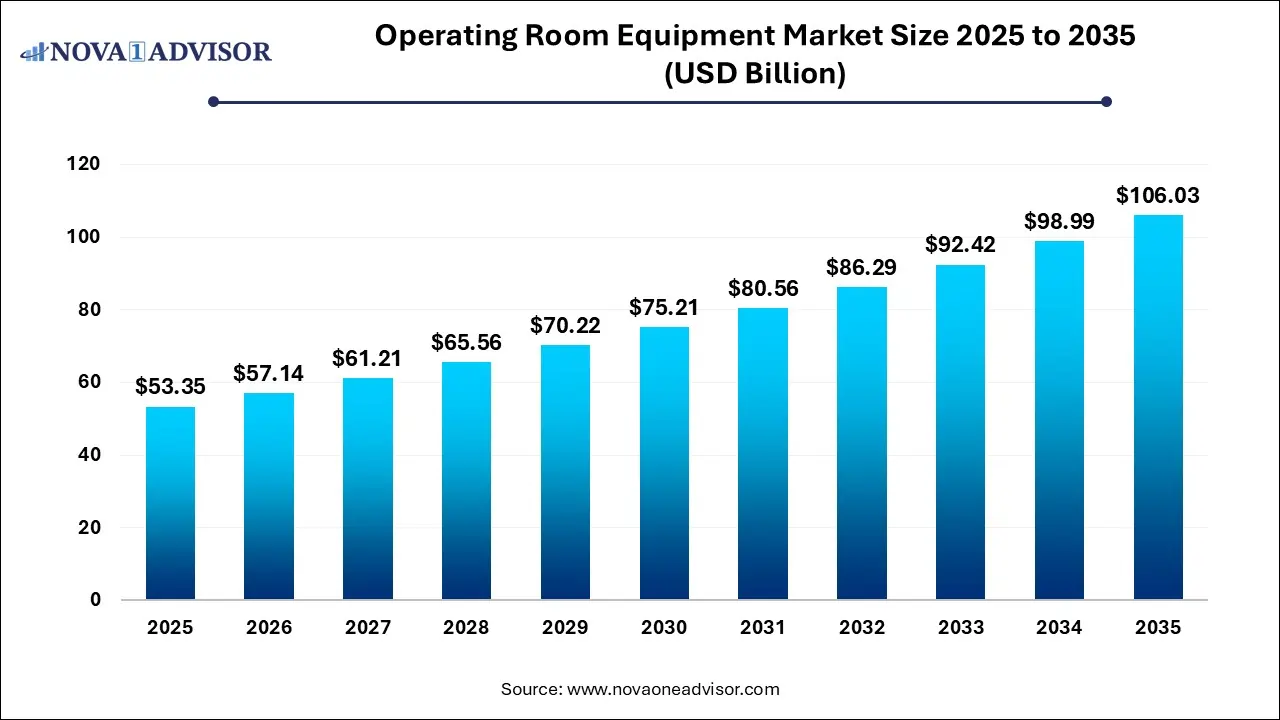

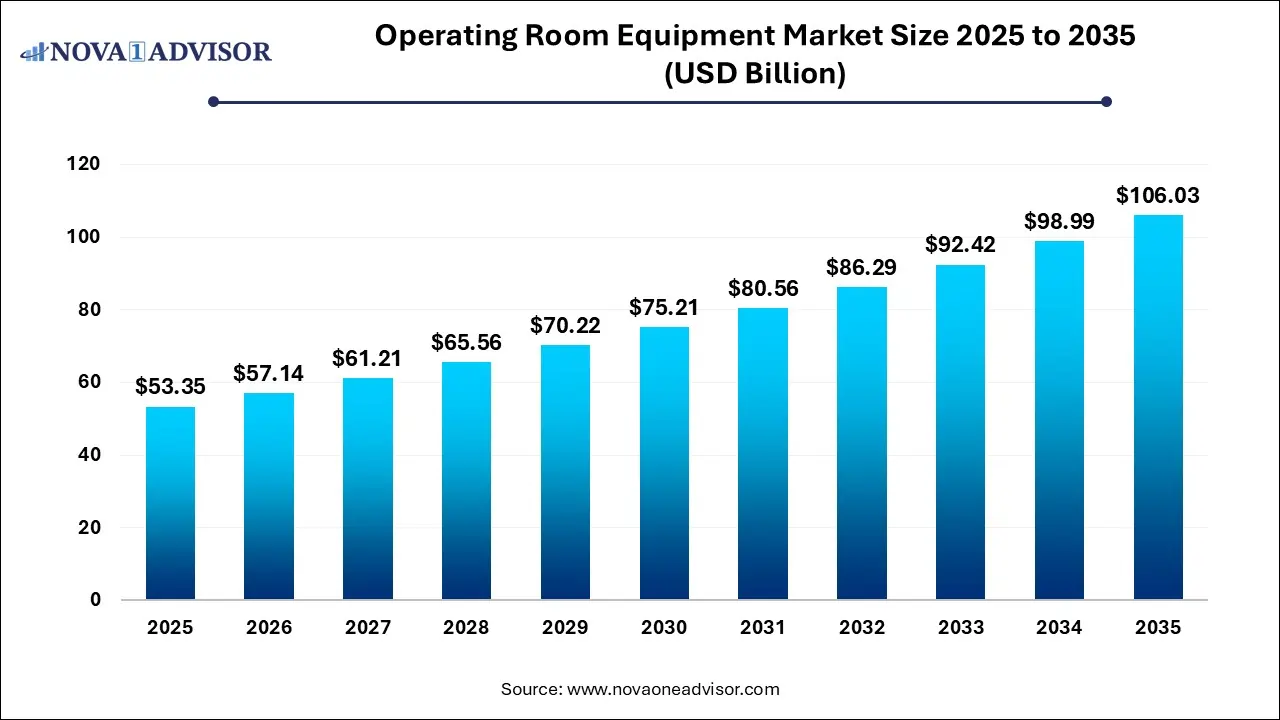

The Operating room equipment market size was exhibited at USD 53.35 billion in 2025 and is projected to hit around USD 106.03 billion by 2035, growing at a CAGR of 7.11% during the forecast period 2026 to 2035.

Key Takeaways:

- The anaesthesia segment dominated the market in 2025 and accounted for the largest revenue share of 55%.

- The hospital management systems segment held the largest share of 75% in 2025

- North America operating room equipment market dominated the global industry in 2025 and accounted for the largest revenue share of 37%.

Market Overview

The operating room (OR) serves as the epicenter of surgical procedures in hospitals and surgical centers, where precision, hygiene, and advanced technology converge to ensure successful patient outcomes. As surgical techniques have become more specialized and technologically intensive, the equipment used in these spaces has evolved significantly from basic lighting and mechanical tables to highly integrated systems with digital interfaces, real-time imaging, and automated control systems.

The global operating room equipment market encompasses a broad array of products, including anesthesia machines, electrosurgical devices, endoscopes, imaging systems, OR tables and lights, and patient monitoring tools. Driven by increasing surgical volumes, a surge in chronic disease prevalence, the rising geriatric population, and technological innovations, the demand for advanced OR infrastructure has grown rapidly.

The shift toward minimally invasive and robot-assisted surgeries, rising investments in hospital infrastructure, and the introduction of hybrid ORs are transforming operating rooms from conventional setups to multifunctional, tech-enabled environments. As healthcare systems around the world focus on patient safety, surgical precision, and workflow efficiency, the operating room equipment market is expected to witness robust growth throughout the forecast period.

Major Trends in the Market

-

Integration of Hybrid Operating Rooms: ORs now combine traditional surgical capabilities with real-time imaging (MRI, CT, fluoroscopy), enabling precision and multidisciplinary procedures.

-

Growth in Minimally Invasive Surgeries: Surgeons increasingly prefer endoscopic and laparoscopic techniques, driving demand for high-definition surgical imaging and advanced endoscopes.

-

IoT and Smart OR Systems: The use of interconnected devices and digital platforms allows seamless data exchange, enhancing surgical planning and reducing procedural errors.

-

Automation and AI Integration: Automated OR lights, voice-controlled systems, and AI-based surgical guidance tools are beginning to influence complex surgeries.

-

Rising Demand for Ambulatory Surgical Centers (ASCs): ASCs are adopting modular and compact OR equipment to meet the demand for outpatient procedures.

-

Increased Emphasis on Infection Control: Demand is rising for antimicrobial surfaces, laminar airflow systems, and disposable equipment to combat hospital-acquired infections (HAIs).

-

Global Push for Health Infrastructure Modernization: Developing nations are upgrading their surgical infrastructure, creating new demand for OR equipment.

-

Surge in Geriatric Surgeries: Orthopedic, cardiac, and neurological surgeries are growing among elderly patients, necessitating advanced OR setups tailored to comorbid needs.

Report Scope of Operating Room Equipment Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 57.14 Billion |

| Market Size by 2035 |

USD 106.03 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.11% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Koninklijke Philips N.V; Medtronic; Getinge AB; Stryker; Siemens Healthineers AG; GE HealthCare; Steris; Skytron LLC; Drägerwerk AG & Co. KGaA; Baxter International Inc. |

Market Driver: Increasing Global Surgical Volume

One of the most compelling drivers of the operating room equipment market is the steady increase in surgical procedures worldwide. According to the World Health Organization, approximately 313 million surgeries are performed globally each year—a figure expected to rise with the aging population and the growing prevalence of chronic diseases such as cancer, cardiovascular disorders, and obesity. For instance, orthopedic procedures such as joint replacements and spinal surgeries are surging, especially in older adults.

This increase necessitates a higher number of well-equipped operating rooms with advanced surgical imaging, anesthesia systems, and precision tools. Furthermore, governments and private healthcare providers are investing in new hospitals and upgrading existing ORs to meet demand. In the U.S., the rise of outpatient surgery is also creating new avenues for OR equipment makers. Whether for a laparoscopic appendectomy or a complex cardiac intervention, modern OR environments demand highly coordinated, integrated, and safe equipment systems.

Market Restraint: High Capital and Maintenance Costs

Despite the evident need, the market faces a substantial restraint in the form of high initial investment and ongoing maintenance costs. Setting up an advanced operating room can cost millions of dollars, particularly if it includes hybrid imaging equipment, robotic surgical systems, and integrated digital platforms. For example, a fully equipped hybrid OR may cost between $2 million and $4 million, depending on its complexity and the type of imaging modalities used.

This poses a challenge, especially in developing countries and smaller healthcare facilities where budget constraints often limit procurement. Additionally, the costs associated with equipment servicing, calibration, software updates, and training personnel further burden healthcare institutions. These expenses can hinder market expansion in resource-limited regions, even where surgical need is growing. Vendors are now exploring leasing models and modular setups to mitigate this barrier and broaden their customer base.

Market Opportunity: Emergence of Smart Operating Rooms

The emergence of smart operating rooms (Smart ORs) presents a promising opportunity for stakeholders in the market. These digitally integrated ORs utilize real-time data, surgical video feeds, and AI-driven decision support tools to improve intraoperative outcomes. Features such as centralized control panels, automated OR lighting, integrated imaging displays, and robotic arms help improve surgical precision, reduce procedure time, and minimize human error.

Smart ORs also allow remote collaboration and teaching, making them valuable tools for training and consultation. Hospitals and surgical centers are adopting these technologies to align with value-based care models that prioritize patient safety and operational efficiency. Vendors that offer interoperability between devices, secure cloud-based storage for surgical data, and scalable smart OR solutions are well-positioned to capitalize on this opportunity.

Segmental Analysis

Product Outlook

Surgical imaging systems held the dominant market share in 2025, owing to their indispensable role in visualizing internal anatomy during minimally invasive procedures. High-resolution imaging is essential in neurosurgery, orthopedic, and cardiovascular interventions. The growing popularity of intraoperative imaging technologies such as 3D fluoroscopy, mobile CT, and hybrid angiography further enhances the precision and safety of surgeries. Demand for imaging-enabled ORs has grown across major hospital chains and specialty clinics, especially for robotic-assisted procedures and cancer resections where real-time feedback is critical.

Electrosurgical devices are emerging as the fastest-growing product segment due to their efficiency in tissue cutting, coagulation, and reduced blood loss. Surgeons prefer these tools for minimally invasive procedures such as laparoscopic cholecystectomy or gynecologic surgeries. The development of devices with advanced energy sources like bipolar and ultrasonic technology has revolutionized surgical workflows. Moreover, these tools offer reduced operative time and fewer complications, aligning well with enhanced recovery after surgery (ERAS) protocols being adopted by hospitals worldwide.

End Use Outlook

Hospitals dominated the operating room equipment market in 2025 as the primary hub for complex surgical interventions requiring extensive infrastructure. Hospitals, especially tertiary care centers and academic medical institutions, conduct a wide range of procedures—from elective surgeries to emergency trauma care. Their higher capital expenditure budgets, dedicated surgical departments, and access to training resources make them the largest consumers of OR equipment. With trends like hybrid ORs and robotic systems gaining momentum, hospitals continue to be the frontline adopters of cutting-edge OR technology.

Ambulatory Surgery Centers (ASCs) represent the fastest-growing end-user segment, driven by the shift toward outpatient care. These centers cater to less complex, high-volume procedures that require quick patient turnover. ASCs demand OR equipment that is compact, mobile, and easy to maintain features that have led manufacturers to develop specialized product lines. With insurance companies favoring cost-effective care settings and patient preference for shorter hospital stays, ASCs are becoming critical markets for OR table systems, lighting units, and portable patient monitors.

Regional Analysis

North America led the global operating room equipment market in 2025, driven by robust healthcare infrastructure, a high volume of surgical procedures, and the rapid adoption of advanced OR technologies. The United States alone accounts for more than 50 million surgeries annually, necessitating continual investments in surgical tools, OR imaging, and smart infrastructure. Moreover, the presence of leading players such as Stryker, Medtronic, and Hill-Rom in the region contributes to early product launches and widespread market penetration. Federal and private insurance systems in the U.S. also support the procurement of advanced medical devices in both public and private hospitals.

Asia Pacific is projected to be the fastest-growing regional market over the forecast period, fueled by growing healthcare investments, rising surgical volumes, and government-led infrastructure expansion. Countries like China and India are constructing new hospitals at a rapid pace, often equipped with modern operating theaters. The rising middle-class population and increasing incidence of lifestyle-related diseases are contributing to higher demand for surgical procedures. Japan and South Korea, with their aging populations, are investing heavily in orthopedic and cardiovascular surgical infrastructure, creating substantial demand for patient monitoring, imaging, and electrosurgical tools.

Some of The Prominent Players in The Operating room equipment market Include:

Recent Developments

-

April 2025: Stryker Corporation launched its next-generation OR integration system, designed for smart workflows, with enhanced interoperability across surgical video, audio, and patient data systems.

-

March 2025: Hillrom (a Baxter company) unveiled a new line of ergonomic, customizable OR tables aimed at ambulatory and orthopedic centers, expanding its surgical product portfolio.

-

February 2025: Medtronic announced a partnership with Siemens Healthineers to co-develop hybrid OR solutions integrating surgical robotics and real-time imaging.

-

January 2025: Getinge AB opened a new manufacturing facility in Germany to meet growing demand for OR lights and sterile workflow solutions in Europe.

-

November 2024: Olympus Corporation acquired Veran Medical Technologies to enhance its surgical imaging and endoscopy capabilities, with a focus on minimally invasive procedures.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Anaesthesia

- Endoscopes

- Electro Surgical Devices

- Surgical Imaging

- OR Tables

- OR Lights

- Patient Monitoring

- Others

By End Use

- Hospitals

- Ambulatory Surgery Centers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)