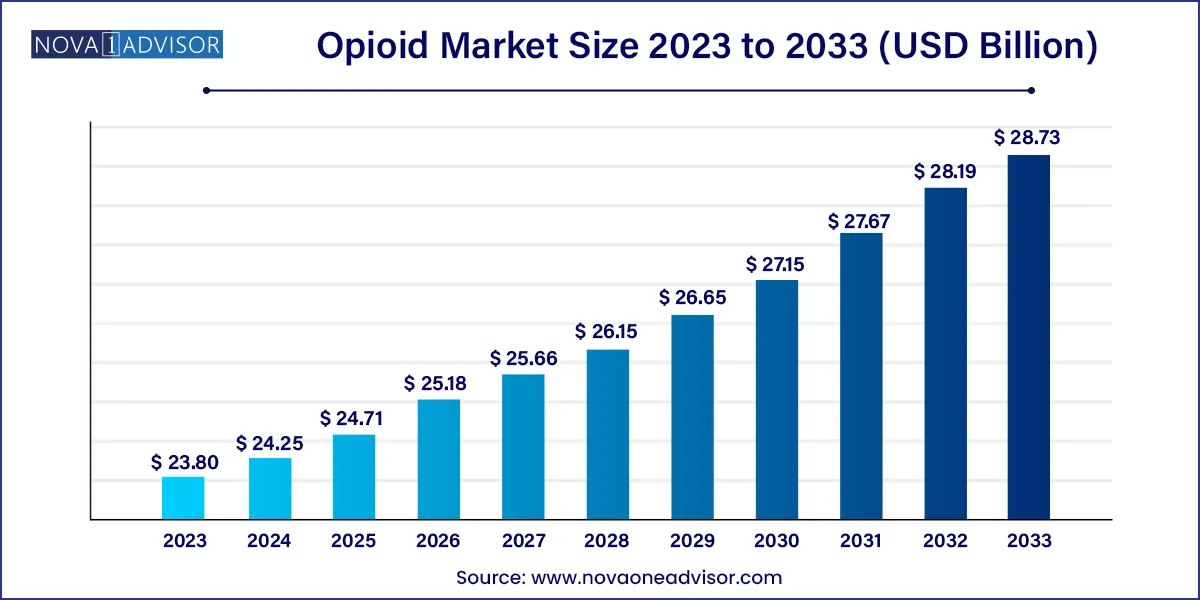

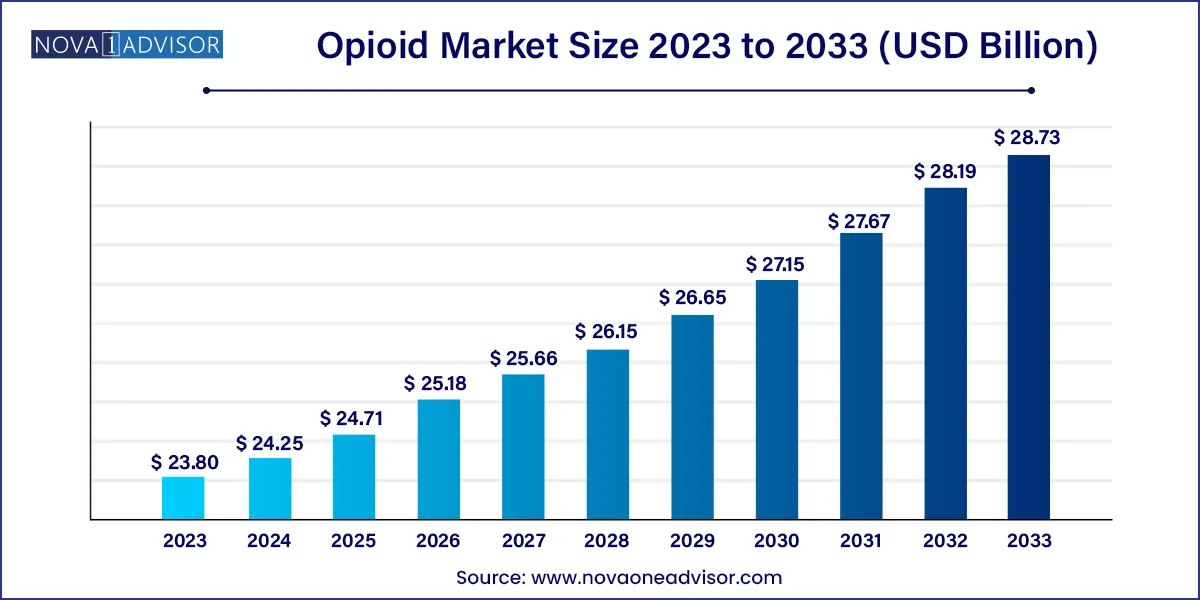

The global opioid market size was exhibited at USD 23.80 billion in 2023 and is projected to hit around USD 28.73 billion by 2033, growing at a CAGR of 1.9% during the forecast period 2024 to 2033.

Key Takeaways:

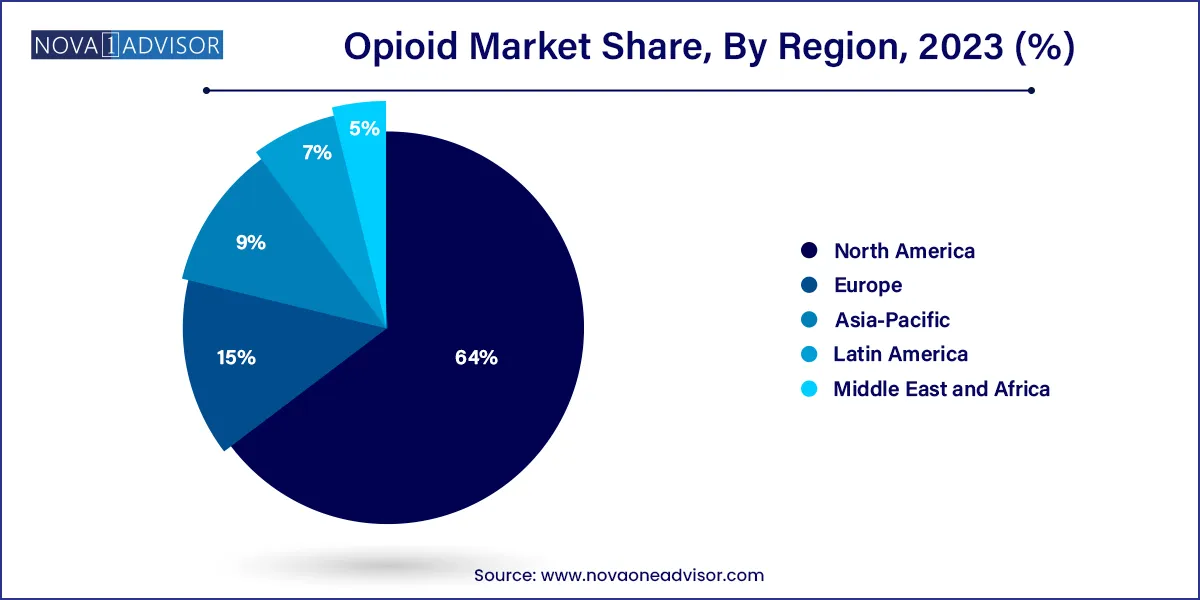

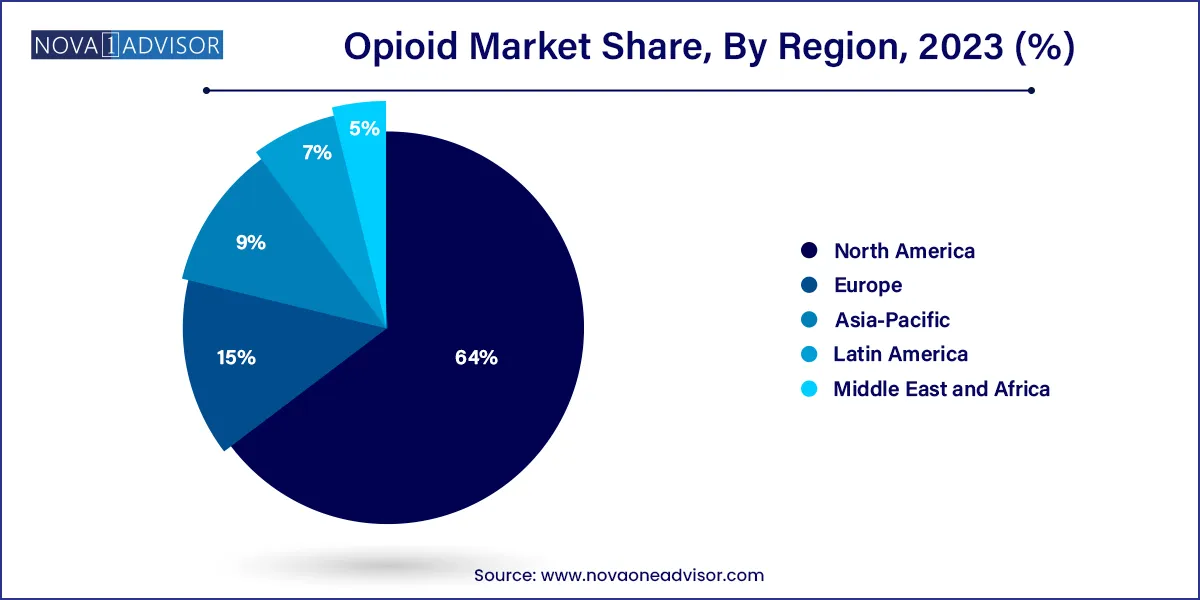

- North America dominated the market and accounted for the largest revenue share of 64.0% in 2023.

- The ER/long-acting opioids segment accounted for the largest revenue share of 54.2% in 2023

- The pain relief segment accounted for the largest revenue share of 66.4% in 2023.

- The injectable segment accounted for the largest revenue share of 54.1 in 2023

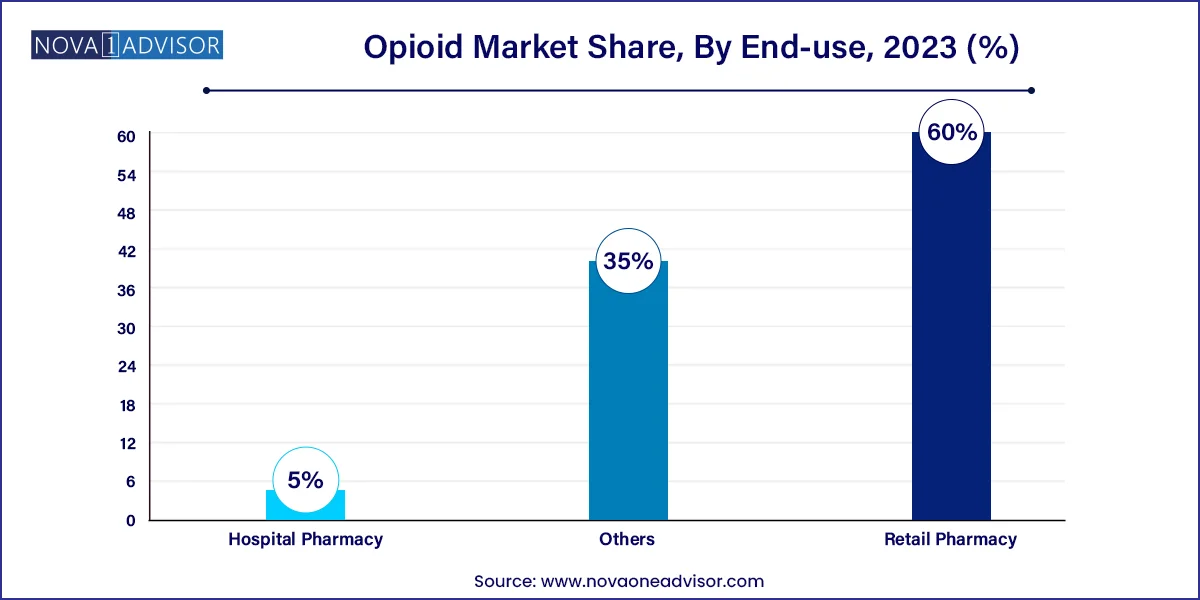

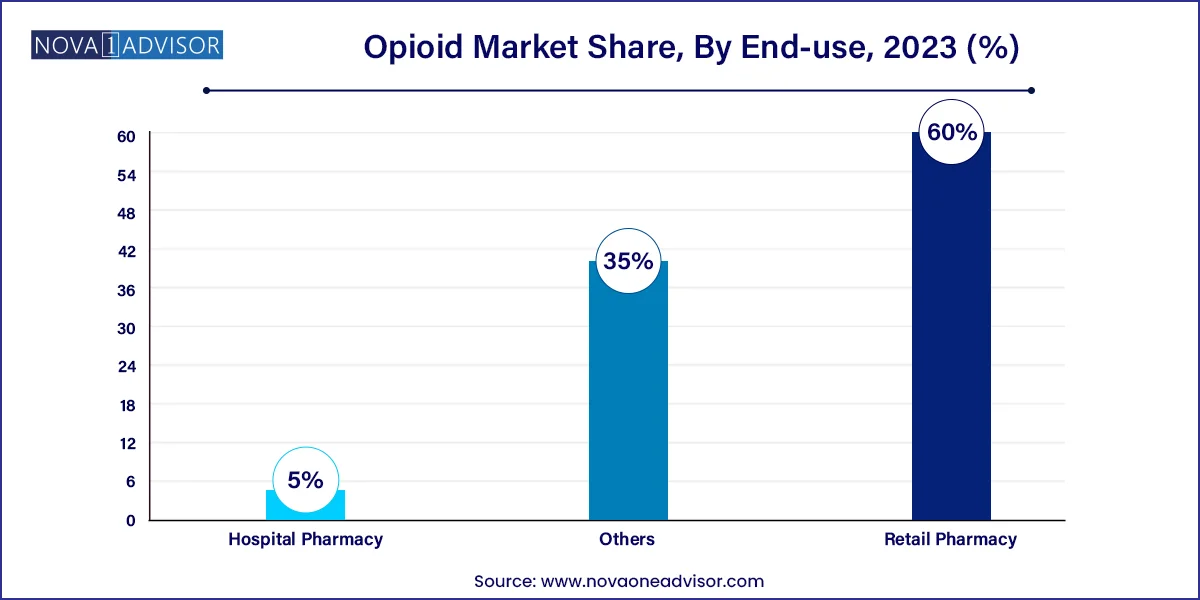

- The retail pharmacy accounted for the largest revenue share of 60.0% in 2023.

Market Overview

The global opioids market plays a central role in modern pain management, surgical procedures, palliative care, and anesthesia. Opioids powerful analgesic substances that act on the nervous system are prescribed for acute and chronic pain, severe trauma, post-surgical recovery, cancer-related pain, and end-of-life care. They include drugs such as morphine, oxycodone, hydrocodone, fentanyl, and codeine, and are available in both immediate-release (IR) and extended-release (ER) formulations.

Despite the rising global emphasis on alternative therapies and regulatory scrutiny due to the opioid epidemic particularly in North America opioids remain indispensable in medical settings, especially for managing moderate to severe pain. In surgical wards, ICUs, and palliative care units, opioids are routinely administered due to their unmatched efficacy.

However, the market landscape is undergoing significant change. Regulatory bodies are pushing for tighter control, prescription monitoring programs are being implemented, and healthcare providers are under increasing pressure to balance the legitimate need for pain relief against the potential for misuse. This has led to a bifurcated market one part seeing growth in controlled clinical usage, and the other experiencing a decline due to policy interventions.

The global opioids market is further influenced by emerging technologies such as abuse-deterrent formulations, transdermal delivery systems, and opioid agonist-antagonist combinations designed to prevent misuse. Additionally, with the global burden of chronic diseases, trauma, and surgeries rising especially in aging populations the demand for reliable pain management continues to fuel the medical use of opioids.

Major Trends in the Market

-

Growth in Extended-Release (ER) Formulations: ER opioids are increasingly used in chronic pain management to reduce dosing frequency and improve compliance.

-

Development of Abuse-Deterrent Formulations (ADF): Pharmaceutical companies are investing in tamper-resistant technologies to curb opioid misuse.

-

Regulatory Tightening Across Developed Markets: Countries are implementing strict prescription monitoring and drug rescheduling to prevent overprescription and addiction.

-

Rising Use of Opioids in Oncology and Palliative Care: Cancer-related pain remains a major application area for both short- and long-acting opioids.

-

Expanding Role in Emerging Economies: With improving healthcare infrastructure, access to essential opioid medications is increasing in Asia and Latin America.

-

Diversification of Routes of Administration: Innovations in transdermal patches, injectables, and buccal films are creating new avenues for delivery.

-

Integrated Opioid Stewardship Programs: Hospitals and health systems are launching comprehensive programs to optimize opioid prescribing and reduce harm.

Opioids Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 24.25 Billion |

| Market Size by 2033 |

USD 28.73 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 1.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, End-use, Region |

| Market Analysis (Terms Used) |

Product, Application, Route Of Administration, Distribution Channel, Region |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Purdue Pharma L.P.; Johnson & Johnson Services, Inc.; Hikma Pharmaceuticals PLC; Pfizer, Inc.; AbbVie Inc.; Sanofi; Sun Pharmaceutical Industries Ltd; Grünenthal |

Market Driver: High Prevalence of Chronic and Acute Pain Conditions

The rising prevalence of chronic pain disorders from arthritis, fibromyalgia, and lower back pain to post-operative and cancer-related pain is a major market driver. According to the CDC, over 50 million U.S. adults suffer from chronic pain, with a significant portion relying on opioid medication for relief when other treatments fail.

Similarly, the growing number of surgical interventions worldwide increases the demand for effective post-operative analgesia. Opioids are often the mainstay in these cases due to their rapid onset and profound pain-relieving effects. Furthermore, in trauma care and emergency settings, opioids remain critical for stabilizing patients.

In palliative care, particularly in oncology, opioids are considered the gold standard for managing breakthrough and intractable pain. With global cancer incidence rising, opioids are increasingly prescribed in hospice and home-care settings, ensuring patient comfort in terminal stages.

Market Restraint: Regulatory Restrictions and Abuse Potential

One of the most significant restraints on the global opioids market is the intensifying regulatory environment and societal backlash against opioid misuse. The opioid crisis in North America particularly in the U.S. has highlighted the risks of addiction, overdose, and death associated with opioid overprescription.

Regulatory agencies such as the FDA and DEA in the U.S., Health Canada, and similar bodies in Europe have introduced strict guidelines, monitoring systems, and drug rescheduling laws to curb excessive opioid use. These include prescription drug monitoring programs (PDMPs), quantity limits, and physician education requirements.

As a result, physicians may become hesitant to prescribe opioids, even in cases where they are clinically indicated. This “opiophobia” can lead to undertreatment of pain, especially in non-cancer patients or those in resource-limited settings. Combined with increasing litigation and public scrutiny, this regulatory push acts as a double-edged sword necessary for safety but challenging for legitimate medical access.

Market Opportunity: Expansion in Emerging Markets and Palliative Care

While opioid use is plateauing or declining in several Western countries, emerging markets present significant growth opportunities. Many countries in Asia, Africa, and Latin America have traditionally had low opioid consumption rates due to regulatory barriers, limited healthcare access, and cultural stigmas.

However, the WHO has emphasized improving access to opioids for essential medical needs, particularly in cancer and end-of-life care. Governments are now updating narcotics regulations to align with global palliative care initiatives. For example, India’s amended NDPS Act has simplified opioid access for registered medical institutions.

With healthcare infrastructure improving and chronic disease prevalence rising, these regions are expected to witness increased opioid demand for surgeries, cancer pain, trauma, and post-ICU recovery. International aid programs, NGOs, and pharmaceutical collaborations are further catalyzing this transition offering a new frontier for global market expansion.

By Product

Immediate-release (IR) opioids currently dominate the product segment, due to their wide use in acute pain management, trauma care, and post-operative settings. Medications like morphine, oxycodone, hydrocodone, and fentanyl in IR formulations are fast-acting, offering quick relief in emergency scenarios. IR opioids are frequently prescribed in hospitals, ambulatory centers, and dental surgeries, contributing to high demand. They also serve as the starting point in titrating pain relief for new patients before transitioning to ER formulations.

However, Extended-release (ER) opioids are the fastest-growing subsegment, particularly for patients with chronic pain conditions that require sustained analgesia. ER formulations such as OxyContin (ER oxycodone) and Duragesic (fentanyl patch) offer longer durations of effect, reduce the need for frequent dosing, and improve patient adherence. These are increasingly used in cancer care, severe arthritis, and palliative settings. Additionally, the development of abuse-deterrent ER opioids with crush-resistant or injection-resistant technologies is further driving segment growth.

By Application

Pain relief is the dominant application, accounting for the largest share across both IR and ER product categories. This includes both nociceptive and neuropathic pain arising from injuries, surgeries, chronic illnesses, and cancer. The global burden of pain-related disability and workplace absenteeism has reinforced the need for effective analgesia, cementing opioids as a cornerstone treatment.

De-addiction is the fastest-growing application, with drugs such as methadone, buprenorphine, and naltrexone used in opioid replacement therapy (ORT). With millions suffering from opioid use disorder (OUD), governments and public health systems are investing in medication-assisted treatment (MAT) programs, rehabilitation centers, and jail diversion initiatives. This shift toward harm reduction and recovery-based models is driving the medical use of specific opioids for addiction management.

By Route of Administration

Oral administration leads the market, due to convenience, patient compliance, and the dominance of tablet and capsule formulations in outpatient care. Oral opioids are prescribed for both acute and chronic pain, and include popular brands like Percocet, Vicodin, and MS Contin.

However, injectable opioids are growing steadily, particularly in inpatient, surgical, and ICU settings. They offer rapid onset, titratable dosing, and are preferred in patients who are NPO (nothing by mouth), or when immediate relief is critical. Fentanyl, morphine, and hydromorphone injections are frequently used in ERs and for anesthesia induction.

By Distribution Channel Insights

Hospital pharmacies dominate the distribution channel segment, due to the high volume of surgical, trauma, and cancer-related prescriptions originating in hospitals. These settings also include palliative care wards and ICUs where opioid titration and monitoring are critical.

Retail pharmacies are the fastest-growing channel, particularly in countries with strong prescription drug frameworks. Patients with chronic pain conditions often obtain monthly refills at retail outlets. In markets like the U.S., strict monitoring and e-prescriptions ensure compliance, enabling continued access through retail networks.

By Regional Insights

North America remains the largest opioids market, largely due to historical overprescription, high surgical volumes, and established palliative care practices. Despite recent crackdowns on opioid misuse, the U.S. and Canada still account for a disproportionately large share of the world’s medical opioid consumption. The presence of major players like Purdue Pharma, Johnson & Johnson, and Pfizer, along with advanced healthcare infrastructure, supports the region’s dominance.

Asia-Pacific is the fastest-growing regional market, driven by healthcare system modernization, demographic shifts, and regulatory reforms improving access to essential medicines. Countries like India, China, Japan, and South Korea are expanding surgical capabilities, cancer care, and trauma services—all of which rely on opioid analgesia. Government initiatives to improve end-of-life care and WHO-aligned drug policy reforms are opening up significant market potential in the region.

Some of the prominent players in the Opioid market include:

- Purdue Pharma L.P.

- Johnson & Johnson Services, Inc.

- Hikma Pharmaceuticals PLC

- Pfizer, Inc.

- AbbVie Inc.

- Sanofi

- Sun Pharmaceutical Industries Ltd

- Grünenthal

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global opioid market.

Product

-

- Immediate- Release/Short-Acting Opioid by Product

-

-

- Codeine

- Oxycodone

- Hydrocodone

- Fentanyl

- Morphine

- Hydroxymorphone

- Oxymorphone

- Propoxyphene

- Other IR

-

- Immediate- Release/Short-Acting Opioid by Application

-

-

- Pain relief

- Anesthesia

- Cough Suppression

- Diarrhea Suppression

- De-addiction

-

- Extended-Release/Long-Acting Opioid by Product

-

-

- Codeine

- Oxycodone

- Hydrocodone

- Fentanyl

- Morphine

- Hydroxymorphone

- Oxymorphone

- Propoxyphene

- Other IR

-

- Extended-Release/Long-Acting Opioid by Application

-

-

- Pain relief

- Anesthesia

- Cough Suppression

- Diarrhea Suppression

- De-addiction

Application

- Pain relief

- Anesthesia

- Cough Suppression

- Diarrhea Suppression

- De-addiction

Route of Administration

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)