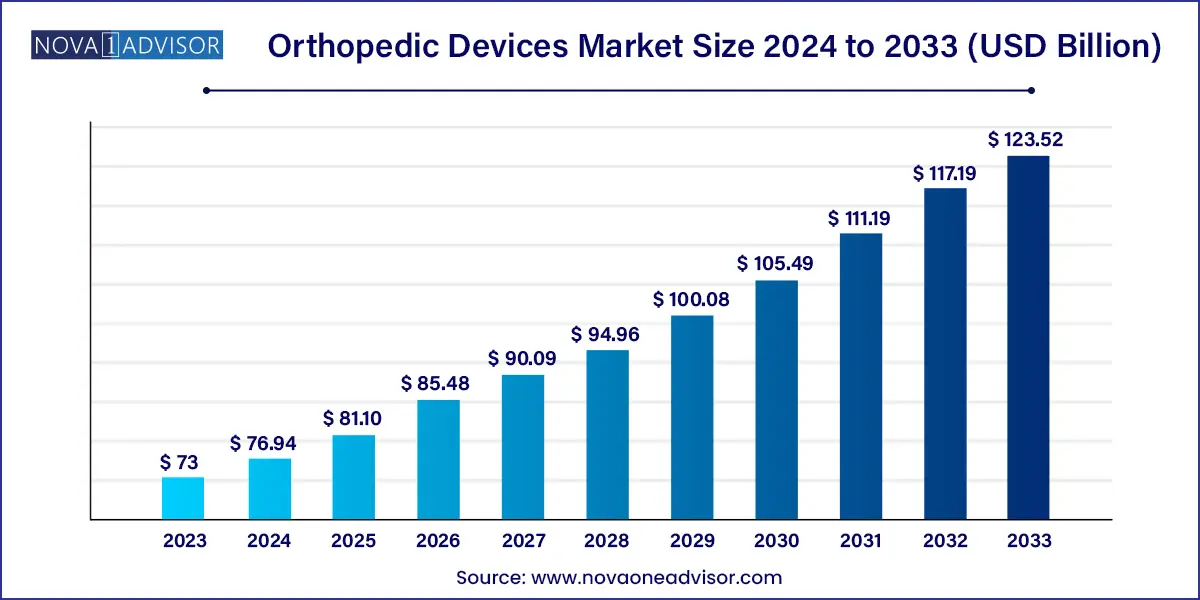

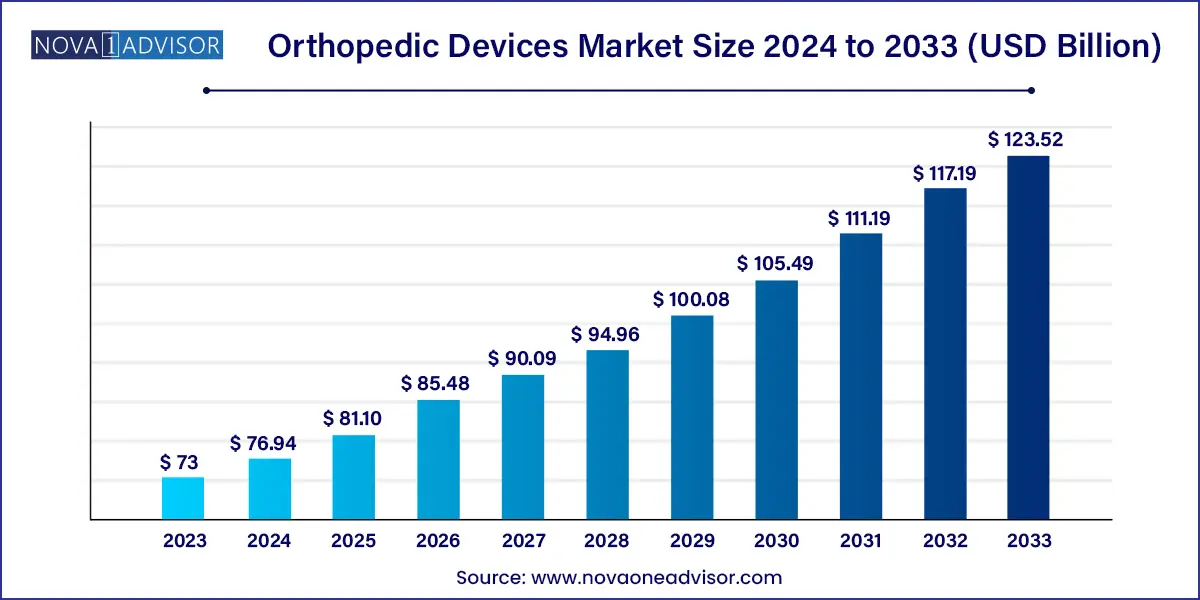

The global orthopedic devices market size was exhibited at USD 73.00 billion in 2023 and is projected to hit around USD 123.52 billion by 2033, growing at a CAGR of 5.4% during the forecast period of 2024 to 2033.

Key Takeaways:

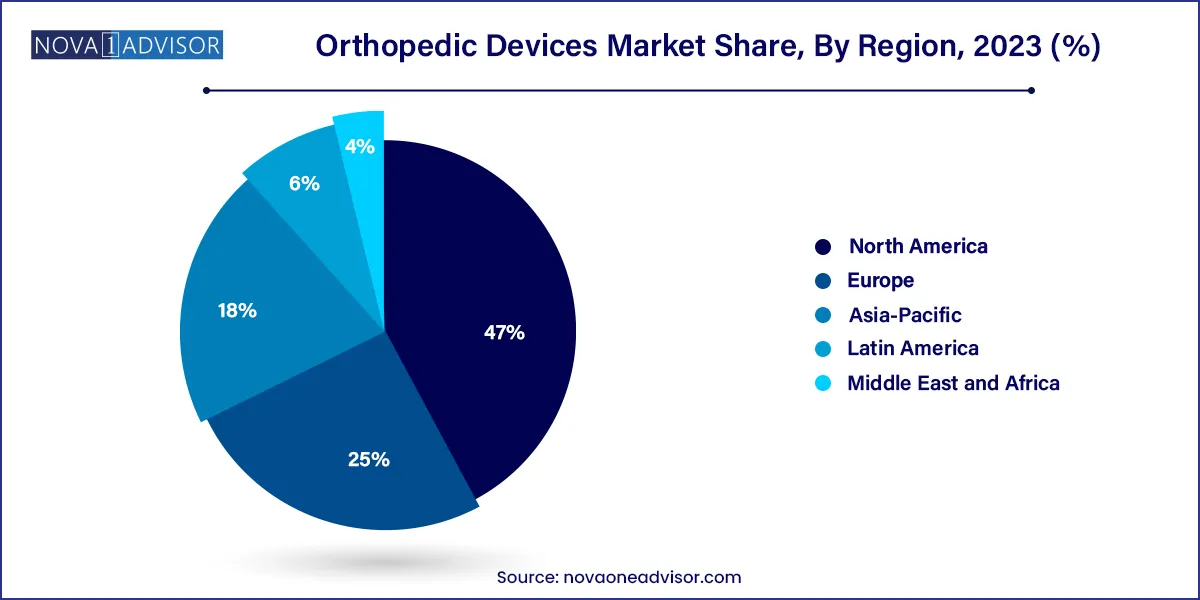

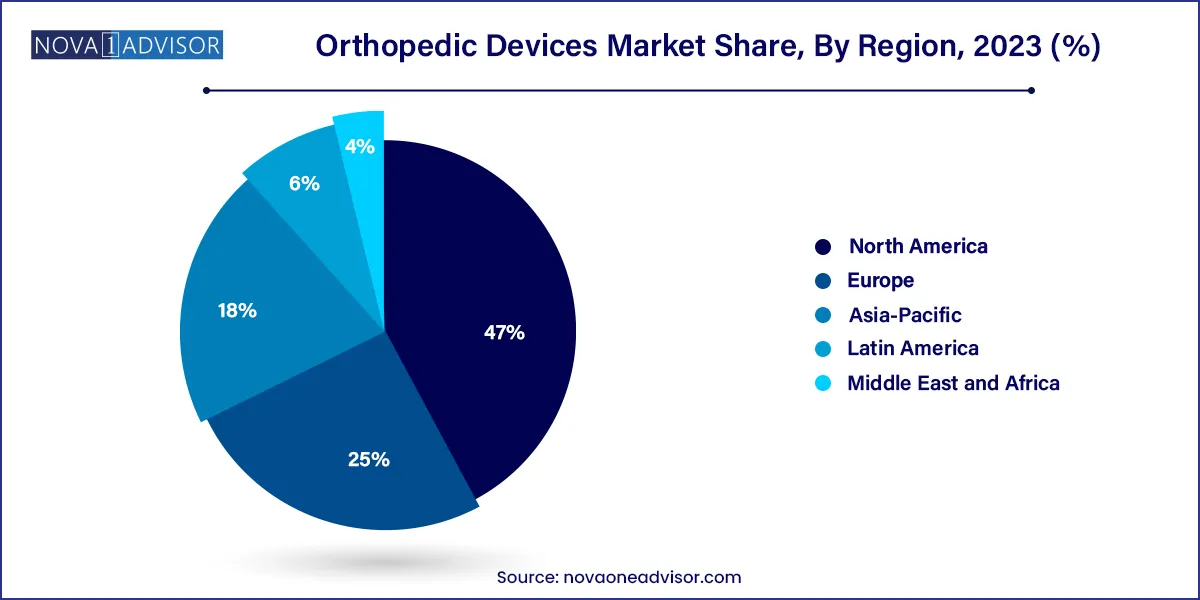

- North America led the global market for orthopedic devices with a market share of 47.0% in 2023.

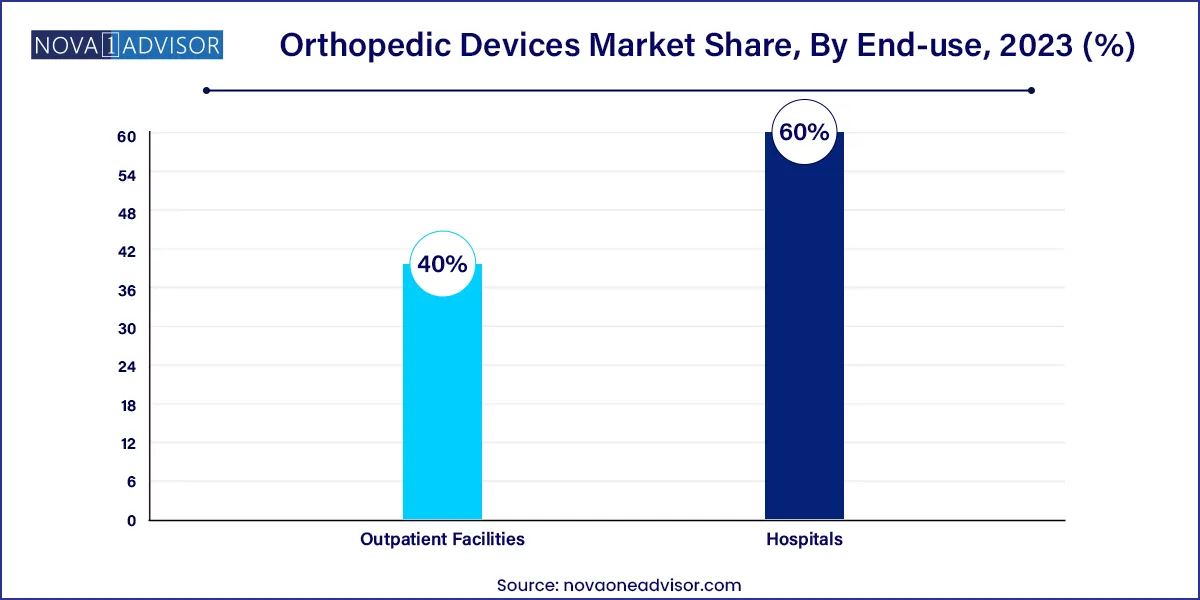

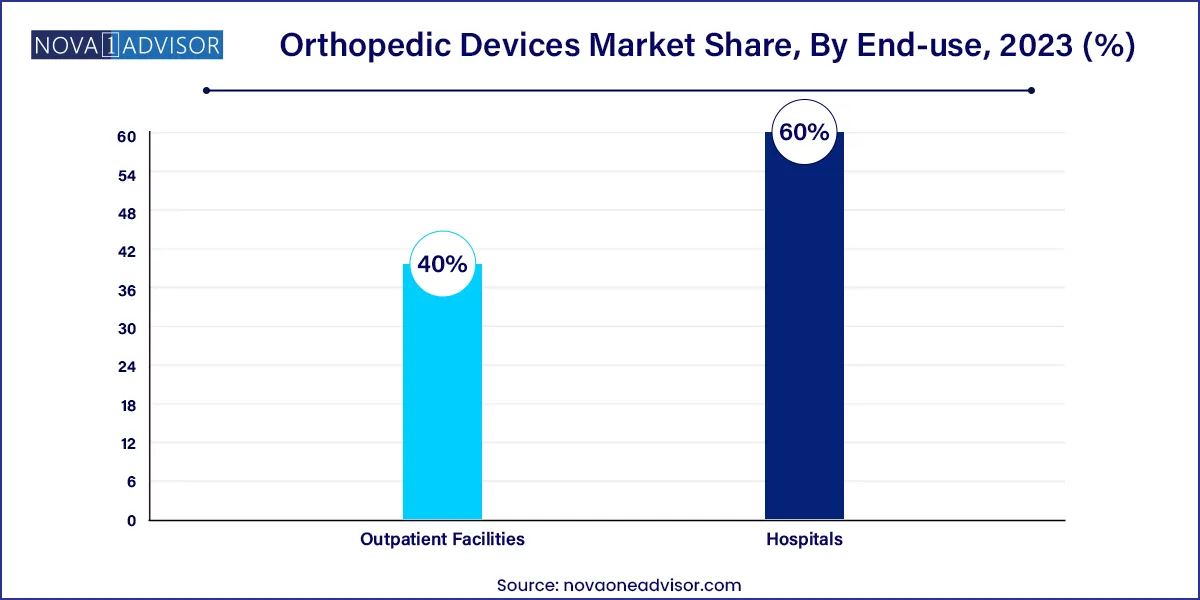

- The hospital segment held the majority share of the market in 2023.

Market Overview

The orthopedic devices market represents a pivotal segment within the global medical devices industry, encompassing a broad spectrum of instruments, implants, and support systems used to manage musculoskeletal disorders. These disorders include fractures, degenerative joint diseases like osteoarthritis, congenital deformities, sports injuries, and spine-related conditions. Orthopedic devices play a vital role in restoring mobility, alleviating pain, and improving the quality of life for millions of patients worldwide.

Driven by an aging global population, increasing incidences of orthopedic conditions, and technological advancements, the market is experiencing sustained growth. The World Health Organization estimates that by 2050, the global population aged 60 years and above will double to 2.1 billion, significantly elevating the burden of orthopedic ailments. Joint reconstruction surgeries, spine surgeries, and fracture management are becoming increasingly common, especially in developed nations with high rates of sedentary lifestyles and obesity.

Orthopedic devices range from traditional mechanical tools like screwdrivers and clamps to high-tech implants designed with bioengineered materials and 3D-printed structures. Emerging technologies such as robotic-assisted orthopedic surgery, smart implants, and personalized orthopedic solutions are revolutionizing the way orthopedic care is delivered. Furthermore, there is growing awareness and adoption of minimally invasive surgical techniques, which reduce recovery times and hospital stays, thus supporting outpatient orthopedic procedures.

Major Trends in the Market

-

Rising Preference for Minimally Invasive Surgery (MIS): Surgeons and patients are opting for MIS approaches that reduce blood loss, lower infection risks, and speed up recovery.

-

Integration of Robotics and AI: Robotic-assisted surgeries are becoming standard in orthopedic procedures, providing enhanced precision, reduced variability, and better clinical outcomes.

-

3D Printing of Orthopedic Implants: Personalized implants using 3D printing allow for custom-fit prosthetics that align with patient-specific anatomy.

-

Surge in Sports-related Injuries: Increased sports participation, especially among youth and aging populations, is fueling demand for orthopedic braces, implants, and repair devices.

-

Shift Toward Outpatient Facilities: Technological innovations are facilitating orthopedic surgeries in ambulatory settings, reducing hospital dependency.

-

Adoption of Biodegradable Implants: Development of implants that naturally dissolve in the body without the need for removal surgery is gaining momentum.

-

Global Rise in Spine-related Disorders: Spinal implants and devices are experiencing rapid innovation due to the growing prevalence of spine degeneration and deformities.

Orthopedic Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 73.00 Billion |

| Market Size by 2033 |

USD 123.52 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

NuVasive, Inc; Medtronic; Stryker; Zimmer Biomet; Smith+Nephew; Aesculap Implant Systems, LLC (B.Braun); CONMED Corporation; DePuy Synthes (Johnson & Johnson); Enovis (DJO, LLC) |

Market Driver: Increasing Geriatric Population and Associated Orthopedic Conditions

The foremost driver of the orthopedic devices market is the steady rise in the aging population globally. Elderly individuals are highly susceptible to orthopedic conditions such as osteoarthritis, spinal degeneration, and hip fractures. According to the International Osteoporosis Foundation, osteoporosis affects over 200 million people globally, with older adults being the most vulnerable group.

This demographic trend directly correlates with the growing demand for joint reconstruction surgeries, spinal implants, and fracture fixation systems. For example, the demand for hip and knee replacements has skyrocketed in countries like the U.S., Germany, and Japan. Companies are now investing in advanced implants with improved longevity and biomechanical performance to cater to the needs of active seniors. Moreover, healthcare systems are being increasingly tailored to provide orthopedic rehabilitation, outpatient surgery centers, and mobility aids designed for the elderly, further boosting market growth.

Market Restraint: High Cost of Orthopedic Devices and Procedures

Despite the technological innovations and clinical efficacy of orthopedic devices, their high costs continue to be a major barrier to adoption, especially in low- and middle-income regions. The cost of orthopedic implants such as joint replacements or spinal fusion devices can run into thousands of dollars. When coupled with surgical expenses, hospitalization, rehabilitation, and follow-up, the financial burden becomes significant for uninsured or underinsured patients.

This cost barrier limits access to orthopedic care in price-sensitive markets like Africa, parts of Asia, and Latin America. Even in developed nations, increasing healthcare costs have led to scrutiny from insurance providers and governments regarding the cost-effectiveness of orthopedic interventions. The high price also affects public healthcare institutions that operate within strict budget constraints, hindering procurement and implementation of advanced orthopedic solutions.

Market Opportunity: Expansion of Outpatient Orthopedic Surgical Centers

The shift from inpatient to outpatient orthopedic surgeries presents a substantial growth opportunity for market players. Outpatient surgical centers are gaining traction due to their cost-effectiveness, efficiency, and reduced infection risks. This model is particularly attractive for elective orthopedic procedures like arthroscopy, ACL reconstruction, and joint resurfacing.

Technological advancements in anesthesia, imaging, and surgical tools have made it feasible to perform complex orthopedic procedures in ambulatory settings. In the U.S., for instance, nearly 50% of total joint replacements are expected to be performed on an outpatient basis by 2026. Companies offering portable devices, quick-recovery implants, and compact surgical kits are well-positioned to benefit from this trend. Moreover, outpatient centers also allow for better scheduling and resource optimization, which aligns with value-based healthcare models.

Segments Insights:

End-use Insights

Hospitals dominate the end-use segment due to the availability of advanced surgical infrastructure, experienced orthopedic surgeons, and comprehensive post-operative care. Most high-risk and complex orthopedic surgeries, such as joint replacements and spinal corrections, are still conducted in hospital settings. Public and private hospitals are increasingly investing in state-of-the-art operating rooms with robotic systems, driving demand for sophisticated orthopedic devices.

Outpatient facilities are growing at the fastest rate, supported by favorable reimbursement policies and patient preference for shorter hospital stays. Devices tailored for outpatient procedures—such as portable drills, rapid fixation implants, and single-use kits—are experiencing high uptake. The convenience, lower infection risk, and reduced cost associated with outpatient care make this segment particularly attractive for minor surgeries and follow-ups.

Regional Insights

North America is the dominant region in the orthopedic devices market, led by the U.S., which has a mature healthcare system, advanced surgical technologies, and a high prevalence of orthopedic conditions. The region benefits from strong reimbursement frameworks, robust R&D, and early adoption of innovative products such as robotic-assisted systems and AI-driven diagnostic tools. Companies such as Zimmer Biomet, Stryker, and Johnson & Johnson are headquartered in the U.S. and actively drive innovation and global exports.

Asia-Pacific is the fastest-growing region, fueled by rising healthcare investments, growing medical tourism, and increasing awareness of orthopedic health. Countries like India, China, and South Korea are experiencing a surge in joint replacement surgeries, spine procedures, and trauma care. Rapid urbanization, an expanding middle class, and improved access to insurance are further boosting demand. Moreover, governments in these regions are investing in localized manufacturing to reduce dependence on imports, opening avenues for both global and regional players.

Recent Developments

-

In February 2025, Stryker Corporation launched its Triathlon® Hinge Knee System, designed to offer greater flexibility and stability for patients undergoing complex knee replacement.

-

In December 2024, Zimmer Biomet announced a strategic partnership with Hospital for Special Surgery (HSS) to advance research in robotic joint replacement surgery.

-

In October 2024, Medtronic unveiled the Mazor™ Robotic Guidance System 2.0, enhancing its spine surgery portfolio with improved navigation and AI-based planning.

-

In August 2024, Smith+Nephew acquired CartiHeal, an Israeli developer of cartilage regeneration devices, to expand its sports medicine and orthopedic business.

-

In June 2024, DePuy Synthes (Johnson & Johnson) introduced its VELYS™ Digital Surgery platform in Europe, marking a key move in digital orthopedic surgical tools.

Some of the prominent players in the orthopedic devices market include:

- NuVasive, Inc

- Medtronic

- Stryker

- Zimmer Biomet

- Smith+Nephew

- Aesculap Implant Systems, LLC (B.Braun)

- CONMED Corporation.

- DePuy Synthes (Johnson & Johnson)

- Enovis (DJO, LLC).

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global orthopedic devices market.

Product

- Drill Guides

- Guide Tubes

- Implant Holder

- Custom Clamps

- Distractor

- Screwdrivers

- Accessories

-

- Lower Extremity Implants

- Dental Implants

- Spinal Implants

- Upper Extremity Implants

End-use

- Hospitals

- Outpatient Facilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)