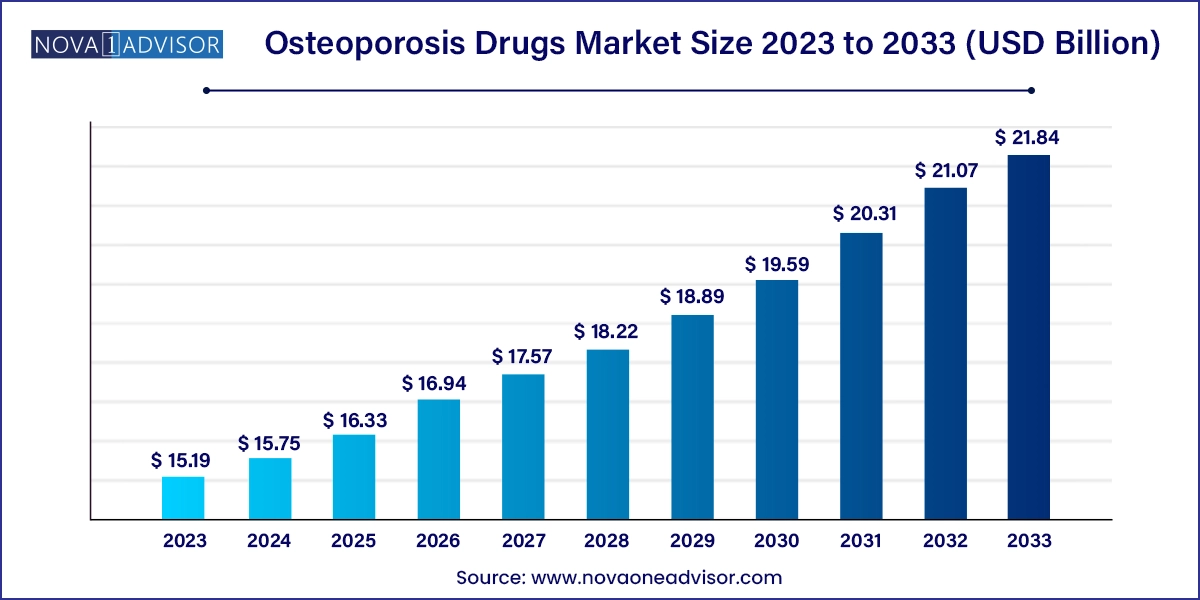

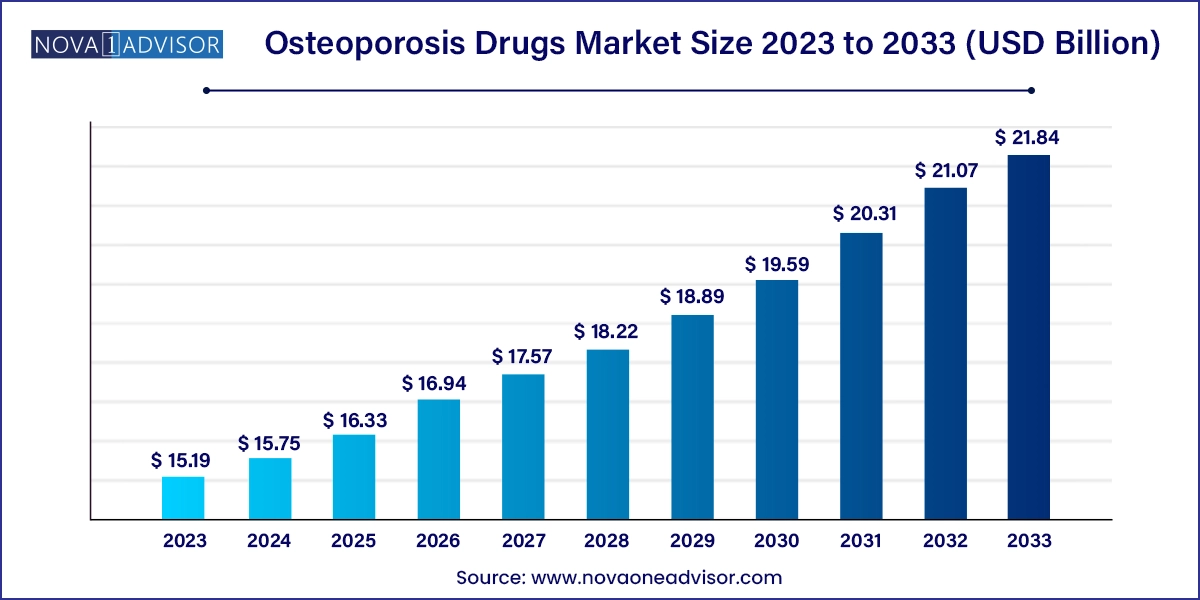

Osteoporosis Drugs Market Size and Growth 2024 to 2033

The global osteoporosis drugs market size was valued at USD 15.19 billion in 2023 and is anticipated to reach around USD 21.84 billion by 2033, growing at a CAGR of 3.7% from 2024 to 2033.

Osteoporosis Drugs Market Key Takeaways

- Branded drugs held the dominant share of the product segment in 2023. The dominant share can be attributed to extensive utilization of bisphosphates, rank ligand inhibitors for the treatment of osteoporosis, possessing high efficacy

- Generics are expected to witness at a lucrative CAGR owing to consistent patent expiries over the coming years as well as high clinical urgency for inexpensive medication in the emerging economies

- In 2023, North America accounted for the largest share in the global osteoporosis drugs market owing to the presence of established companies extensively involved in the commercialization of branded therapeutics

- Asia Pacific is anticipated to grow at an exponential CAGR as a consequence of favorable government initiatives promoting information pertaining to osteoporosis care

- The key participants are employing sustainability strategies promoting the adoption of osteoporosis therapeutics to gain competitive advantage. For instance, Actavis Inc. announced to acquire Warner Chilcott PLC in order to widen their product portfolio

Market Overview

Osteoporosis, a metabolic bone disorder characterized by decreased bone mass and microarchitectural deterioration, is among the most prevalent non-communicable diseases affecting aging populations worldwide. The osteoporosis drugs market is a crucial sector within the broader pharmaceutical and bone health arena, playing a vital role in reducing the risk of fractures, improving mobility, and enhancing quality of life, especially in postmenopausal women and elderly individuals.

This market encompasses a wide array of pharmacological therapies ranging from antiresorptive agents, such as bisphosphonates and selective estrogen receptor modulators (SERMs), to anabolic treatments like parathyroid hormone analogs and RANK ligand inhibitors. The goal of these treatments is twofold: to inhibit bone resorption and stimulate new bone formation. With an increasing global geriatric population, a surge in sedentary lifestyles, and rising awareness about bone density management, the market has experienced steady growth over the past decade.

According to the International Osteoporosis Foundation (IOF), over 200 million people globally are affected by osteoporosis, leading to more than 8.9 million fractures annually. In women over 50, the lifetime risk of a fracture due to osteoporosis is greater than the combined risk of breast, uterine, and ovarian cancers. As a result, preventive, diagnostic, and therapeutic approaches are evolving rapidly to address this burgeoning healthcare burden. Governments and healthcare institutions across North America, Europe, and Asia-Pacific are promoting early diagnosis and treatment adherence, further boosting demand for osteoporosis drugs.

The pharmaceutical pipeline for osteoporosis is becoming increasingly diversified, with next-generation monoclonal antibodies and dual-action drugs entering advanced clinical trials. Simultaneously, generic drug formulations are making treatment more accessible, especially in developing countries. Digital adherence technologies, telehealth platforms, and AI-driven bone density monitoring are being integrated into osteoporosis management programs, marking a new era of patient-centric care.

Major Trends in the Market

-

Shift Toward Anabolic Therapies: There is growing preference for bone-building drugs like RANK ligand inhibitors and parathyroid hormone analogs, especially in patients with severe or recurrent fractures.

-

Rising Demand for Once-Yearly or Monthly Dosage Forms: To improve adherence, pharmaceutical companies are introducing injectable formulations that reduce the frequency of dosing.

-

Increased Generic Drug Penetration: Generic versions of bisphosphonates and calcitonin are gaining traction due to affordability, especially in middle-income economies.

-

Integration of Digital Health Tools: Use of mobile apps and smart pill dispensers is improving medication adherence among elderly patients.

-

Focus on Postmenopausal Osteoporosis: Targeted therapies for women over 50 are being prioritized, with enhanced awareness programs and screening initiatives.

-

Emerging Research in Bone Regeneration: Investigations into stem-cell based therapy and RNA-targeting drugs for osteoporosis are growing, reflecting the next frontier in treatment innovation.

-

Regional Pharma Partnerships: Collaborations between Western pharmaceutical companies and local manufacturers in Asia and Latin America are expanding global access to osteoporosis therapeutics.

Osteoporosis Drugs Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 15.75 Billion |

| Market Size by 2033 |

USD 21.84 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.7% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Drug class, type, distribution channel, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Amgen Inc.; Eli Lilly and Company; Merck & Co., Inc.; Novartis AG; Pfizer Inc.; GlaxoSmithKline plc.; Radius Health, Inc.; UCB S.A.; Teva Pharmaceutical Industries Ltd.; Roche Holding AG |

Market Driver: Aging Population and Fracture Risk

The most compelling driver of the osteoporosis drugs market is the global rise in aging populations, particularly in developed and emerging economies. As the risk of osteoporosis increases sharply with age especially in postmenopausal women demographic trends are directly fueling market demand. In nations like Japan, Germany, Italy, and the United States, a significant proportion of the population is over the age of 60, with many already experiencing low bone mineral density.

This aging phenomenon is accompanied by a rise in osteoporosis-related fractures, particularly hip, vertebral, and wrist fractures, which often lead to prolonged hospital stays, loss of independence, or even premature death. For instance, it is estimated that in the U.S. alone, osteoporosis causes approximately two million fractures annually, costing the healthcare system over $20 billion. Pharmaceutical intervention plays a critical role in reducing this fracture burden by preserving bone strength and minimizing bone loss progression. As a result, healthcare providers are increasingly prescribing both first-line and advanced osteoporosis medications to at-risk patients.

Market Restraint: Side Effects and Medication Adherence

A significant restraint in the osteoporosis drugs market is poor medication adherence and concerns about drug-related side effects. Many patients discontinue therapy prematurely due to gastrointestinal issues associated with oral bisphosphonates, flu-like symptoms from intravenous drugs, or fears over rare side effects such as osteonecrosis of the jaw (ONJ) and atypical femoral fractures.

Adherence rates drop significantly after the first year of treatment, often leading to suboptimal outcomes and increased fracture risk. Elderly patients may also struggle with polypharmacy, leading to confusion and dosage non-compliance. Moreover, limited reimbursement in some regions for newer drugs like RANK ligand inhibitors discourages their widespread use. These factors collectively hinder the long-term success of treatment programs and reduce the commercial performance of osteoporosis drugs unless addressed through patient education, simplified regimens, and insurance policy reforms.

Market Opportunity: Biologics and Personalized Therapies

A notable market opportunity lies in the expansion of biologic drugs and the development of personalized osteoporosis treatments. With greater understanding of the molecular pathways regulating bone turnover, pharmaceutical companies are designing targeted therapies that go beyond the one-size-fits-all approach. Drugs like denosumab (Prolia), a RANK ligand inhibitor, are transforming the landscape by offering potent anti-resorptive action with a favorable side-effect profile.

Osteoporosis Drugs Market By Drug Class Trends & Insights

Branded drugs dominated the osteoporosis drug class segment, owing to their superior efficacy, robust clinical trial data, and aggressive marketing strategies. Pharmaceuticals such as Prolia, Evenity, and Forteo enjoy strong brand recognition among healthcare professionals. These drugs often incorporate advanced delivery mechanisms or dual-action pharmacodynamics, making them suitable for patients with severe osteoporosis or those at high risk of fractures. Branded drugs are especially dominant in North America and Western Europe, where reimbursement coverage is favorable and patient preference leans toward proven, regulated therapies.

On the other hand, generic drugs represent the fastest-growing segment, fueled by patent expiries of major bisphosphonates and hormone analogs, such as alendronate and calcitonin. Generics offer cost-effective alternatives, which are especially crucial in developing nations with limited healthcare budgets. With rising awareness and insurance coverage in countries like India, Brazil, and parts of Southeast Asia, generic drug use is expanding rapidly. Governments and health organizations are promoting generic prescriptions to increase osteoporosis treatment coverage, making this segment a powerful growth engine for the future.

Osteoporosis Drugs Market By Type Insights &Trends

Bisphosphonates dominated the osteoporosis drug type segment, historically serving as the cornerstone of osteoporosis management due to their proven effectiveness in reducing hip and vertebral fractures. Drugs like alendronate and risedronate are widely prescribed as first-line treatments and are available in both branded and generic forms. Their affordability, coupled with decades of clinical usage, ensures continued dominance. Physicians often rely on bisphosphonates for newly diagnosed cases, particularly in postmenopausal women, and in resource-constrained settings where biologics may not be accessible.

However, RANK ligand inhibitors are the fastest-growing type, thanks to superior efficacy and convenience in dosing. Denosumab, administered subcutaneously every six months, offers a patient-friendly alternative to daily or weekly oral medications. This advantage is especially important for elderly individuals who may have trouble swallowing pills or remembering frequent doses. With mounting clinical evidence and global approvals, RANK ligand inhibitors are rapidly gaining market share and reshaping osteoporosis treatment algorithms worldwide.

Osteoporosis Drugs Market By Distribution Channel Insights

Hospital pharmacies currently dominate the distribution channel segment, reflecting the fact that many osteoporosis drugs, particularly injectables like Prolia and Forteo, require medical supervision and are initiated during hospital visits or post-fracture care. Hospitals are also key points of diagnosis through bone mineral density (BMD) testing, leading to immediate drug initiation. Furthermore, inpatient care facilities often handle cases of osteoporotic fractures, making hospital pharmacies an essential link in the treatment continuum.

Online pharmacies are emerging as the fastest-growing distribution channel, driven by the rise of digital health platforms and home-based care. With growing internet literacy among caregivers and improved e-commerce logistics, patients can now order osteoporosis medications and receive automated refill reminders. The COVID-19 pandemic accelerated this shift, as patients sought contactless prescription services. Many telemedicine platforms now integrate prescription fulfillment, offering a seamless experience from diagnosis to drug delivery.

Osteoporosis Drugs Market By Regional Insights

North America dominates the global osteoporosis drugs market, supported by advanced healthcare infrastructure, high awareness levels, and a large geriatric population. The United States, in particular, accounts for a significant share of the global revenue, owing to widespread use of branded biologics and routine BMD screenings. Medicare and private insurers provide coverage for many osteoporosis medications, facilitating early treatment. Ongoing R&D by industry leaders like Amgen, Eli Lilly, and Radius Health further enhances the region’s leadership. Additionally, public health campaigns and fracture liaison services are helping identify and treat high-risk patients more effectively than ever before.

Asia-Pacific is the fastest-growing region in the osteoporosis drugs market, propelled by demographic transitions, increasing urbanization, and healthcare reforms. Countries like China and India are witnessing rapid aging, with millions at risk of osteoporotic fractures. Government initiatives to promote early screening and local production of generic osteoporosis drugs are boosting access. Japan, with its long life expectancy, leads in osteoporosis research and biologic adoption. Meanwhile, South Korea and Australia are expanding reimbursement frameworks, allowing more patients to access cutting-edge therapies. As regional pharma partnerships grow, Asia-Pacific is set to emerge as a critical revenue contributor in the coming decade.

Osteoporosis Drugs Market Top Key Companies:

- Amgen Inc.

- Eli Lilly and Company

- Merck & Co., Inc.

- Novartis International AG

- Pfizer Inc.

- GlaxoSmithKline plc

- Radius Health, Inc.

- UCB S.A.

- Teva Pharmaceutical Industries Ltd.

- Roche Holding AG

Osteoporosis Drugs Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Osteoporosis Drugs market.

By Drug Class

By Type

- Bisphosphonates

- Parathyroid Hormone

- Calcitonin

- Selective Estrogen Inhibitor Modulator

- Rank Ligand Inhibitor

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)