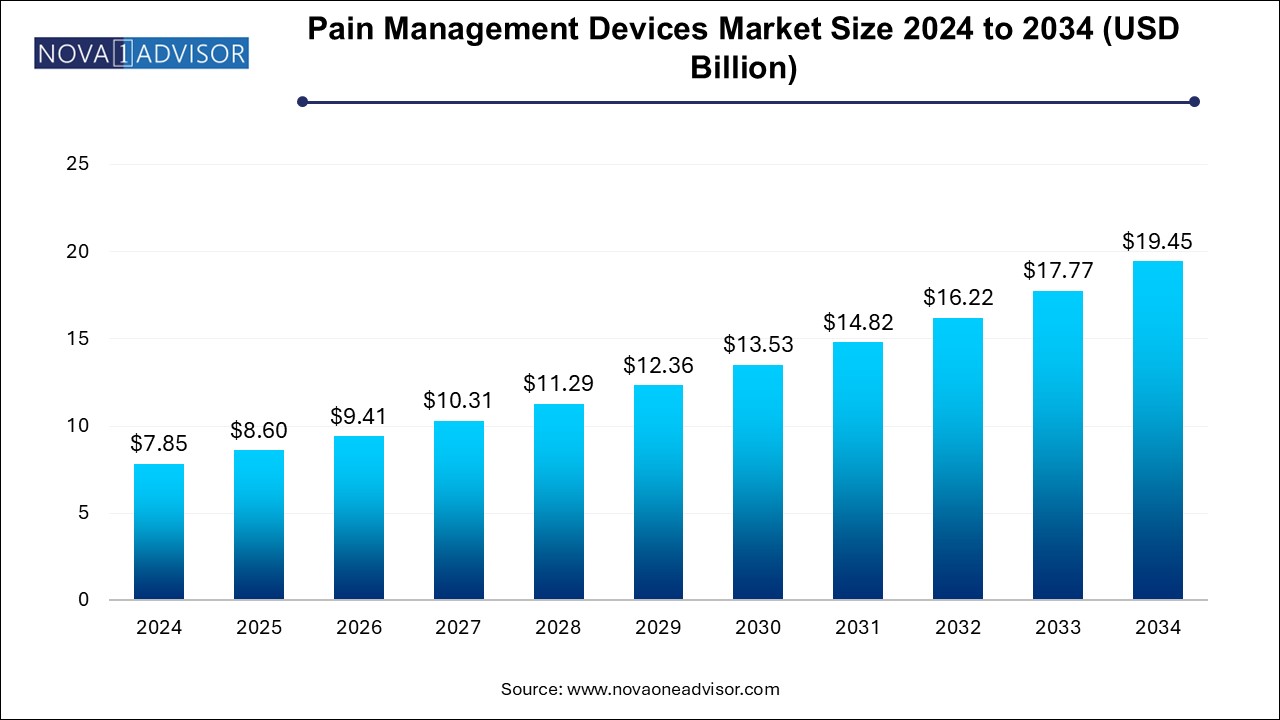

The pain management devices market size was exhibited at USD 7.85 billion in 2024 and is projected to hit around USD 19.45 billion by 2034, growing at a CAGR of 9.5% during the forecast period 2024 to 2034.

The Pain Management Devices Market is experiencing significant growth as global demand rises for non-opioid, technology-driven solutions to address chronic and acute pain. Pain, both as a standalone condition and as a symptom of various diseases, represents a major public health concern impacting millions worldwide. While pharmaceutical therapies have historically dominated the treatment landscape, increasing concerns about opioid addiction, long-term side effects, and drug resistance have prompted a shift toward device-based alternatives.

Pain management devices offer targeted, minimally invasive, and often non-pharmacological solutions for chronic pain conditions such as neuropathic pain, musculoskeletal disorders, migraines, cancer-related pain, and trauma injuries. These devices range from electrical nerve stimulation technologies like TENS and spinal cord stimulators to infusion pumps, radiofrequency ablation units, and deep brain stimulators. The market is highly diversified and tailored to meet both hospital-based interventions and outpatient or home-based care settings.

Technological advancements, including wireless neurostimulators, wearable TENS units, and smartphone-integrated pain tracking systems, are expanding accessibility and improving patient compliance. Additionally, supportive regulatory frameworks, favorable reimbursement policies (particularly in North America and Europe), and an aging global population suffering from arthritis and post-operative pain are driving adoption.

The market is also benefiting from growing awareness of rehabilitative care and physiotherapy, particularly for managing pain in chronic orthopedic and neurological conditions. With increasing focus on patient-centric, cost-effective, and long-term pain control, device-based pain management is rapidly transitioning from a niche to a mainstream therapeutic option.

Shift Toward Non-Opioid Solutions: Growing public health concern over opioid dependence is driving the demand for device-based pain therapies.

Wearable and Home-Based Devices: Portable and user-friendly devices like TENS units are gaining popularity for managing chronic pain at home.

Advancement in Neuromodulation Technologies: Next-generation spinal cord and deep brain stimulators with adaptive stimulation algorithms are entering the market.

Integration with Digital Health Platforms: Pain tracking, remote monitoring, and telehealth are being integrated with devices for personalized care.

Reimbursement Expansion for Neurostimulators: Insurers in North America and Europe are increasingly covering neuromodulation for back and nerve pain.

Increased Use in Palliative and Cancer Pain Care: Devices like infusion pumps are becoming essential in managing intractable pain in cancer patients.

Focus on Minimally Invasive Procedures: Outpatient adoption of radiofrequency ablation and nerve blocks is rising in pain clinics.

AI-Powered Pain Management Platforms: Artificial intelligence is being used to optimize device programming and pain response predictions.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.60 Billion |

| Market Size by 2034 | USD 19.45 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 9.5% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | B Braun Melsungen AG; Baxter;Boston Scientific Corporation or its affiliates; Nevro Corp.; Enovis; OMRON Healthcare INC; Medtronic; ICU Medical Inc; Abott; Stryker; Stimwave LLC; |

A primary driver of the pain management devices market is the escalating incidence of chronic pain conditions, affecting quality of life and increasing healthcare costs. According to the WHO, over 1.5 billion people worldwide suffer from chronic pain, with conditions such as low back pain, osteoarthritis, diabetic neuropathy, post-surgical pain, and fibromyalgia becoming more prevalent due to aging populations, sedentary lifestyles, and comorbidities like obesity and diabetes.

As pharmaceutical interventions often provide temporary relief and carry risks of addiction or adverse effects, patients and providers are turning to devices that offer sustainable, targeted pain relief with fewer systemic side effects. For example, spinal cord stimulators are increasingly used for failed back surgery syndrome (FBSS), while infusion pumps are critical in oncology for pain palliation. The clinical and economic burden of chronic pain is creating strong demand for safe, effective, and long-term device-based solutions.

Despite their therapeutic advantages, many pain management devices come with high initial costs, which may hinder adoption, particularly in low- and middle-income countries or among uninsured patient populations. Devices like implantable neurostimulators or infusion pumps often require surgical implantation and continuous follow-up care, adding to the cost burden.

Although reimbursement policies in developed markets mitigate this to some extent, lack of universal coverage, especially for newer or outpatient-use devices, can limit accessibility. Furthermore, limited availability of skilled healthcare professionals trained in device implantation and programming also restricts growth in certain regions. Cost-related barriers remain a challenge that manufacturers must address through pricing strategies, leasing models, or tech innovations that reduce manufacturing and maintenance costs.

A compelling opportunity lies in the integration of wearable pain management technologies with telemedicine and digital platforms. The surge in remote patient monitoring, catalyzed by the COVID-19 pandemic, has made home-based management of chronic conditions a preferred option. Devices like wireless TENS units, Bluetooth-enabled neurostimulators, and cloud-connected infusion pumps allow continuous pain monitoring and real-time data sharing with clinicians.

This trend aligns with the increasing demand for personalized and patient-centric care. For example, mobile apps that record pain episodes, analyze trends, and adjust stimulation parameters remotely are gaining traction. These innovations improve treatment adherence, reduce clinic visits, and provide clinicians with actionable insights. As value-based care models take precedence, wearable and digital pain solutions are poised to play a key role in chronic disease management strategies globally.

Neurostimulation devices dominate the product segment, especially spinal cord stimulators (SCS), due to their effectiveness in treating chronic neuropathic pain, particularly in the back and limbs. These devices modulate pain signals by delivering electrical impulses to spinal nerves, offering relief in conditions unresponsive to other therapies. Spinal cord stimulators are widely used for failed back surgery syndrome, complex regional pain syndrome (CRPS), and peripheral neuropathy. Major players like Boston Scientific and Medtronic have introduced programmable, MRI-compatible, and rechargeable devices that are seeing increasing adoption in outpatient surgical centers and hospitals.

Electrical stimulators particularly TENS units are the fastest-growing sub-segment, due to their affordability, portability, and approval for home use. TENS units are increasingly prescribed for musculoskeletal pain, labor pain, and post-surgical recovery. Their non-invasive nature and minimal side effects make them ideal for elderly patients and those seeking alternatives to long-term medication. The growing availability of compact, smartphone-controlled TENS units is attracting tech-savvy consumers interested in managing pain autonomously.

Musculoskeletal pain holds the largest share, driven by the high prevalence of conditions like arthritis, back pain, fibromyalgia, and sports injuries. Pain management devices are widely used in orthopedic rehabilitation and physiotherapy, especially in elderly populations and physically active individuals. TENS units, ultrasound devices, and RF ablation are commonly used in outpatient settings to treat these conditions with minimal intervention.

Cancer pain is among the fastest-growing application areas, as device-based management is increasingly employed in palliative care and end-of-life support. Intrathecal and external infusion pumps deliver opioids and anesthetics directly into the spinal fluid, enabling better pain control with lower systemic exposure. Given the global rise in cancer incidence and survival rates, pain control has become an essential part of oncology care pathways.

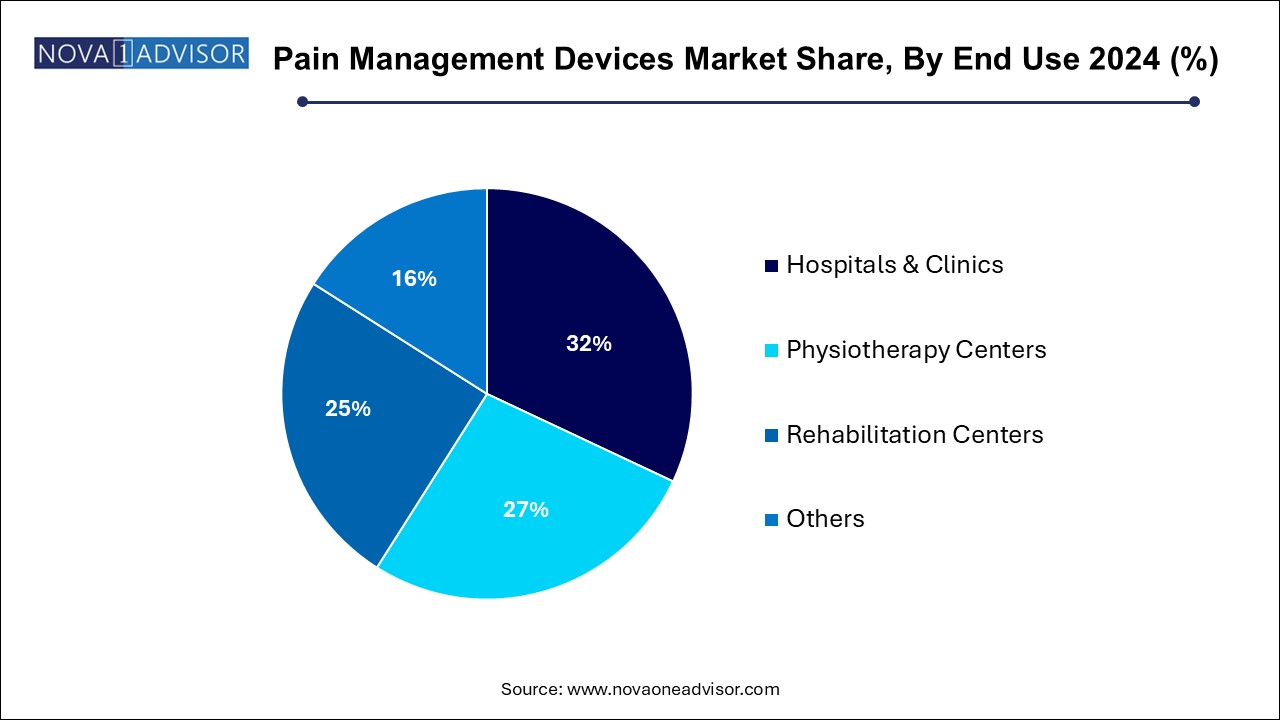

Hospitals and clinics dominate the end-user segment, owing to the complexity of certain device-based procedures such as neurostimulator implantation, ablation, and infusion pump programming. These settings also house pain management specialists, interventional radiologists, and anesthesiologists equipped to offer multidisciplinary care.

Rehabilitation centers and physiotherapy facilities are witnessing the fastest growth, as demand surges for non-invasive, therapy-based pain control in chronic musculoskeletal and post-traumatic pain. These centers utilize TENS units, muscle stimulators, and portable RF ablation systems, providing an ideal bridge between inpatient treatment and home care.

North America leads the global pain management devices market, driven by high healthcare expenditure, robust reimbursement infrastructure, and advanced healthcare technologies. The U.S. accounts for the largest share, supported by favorable FDA approvals, strong insurance coverage, and a high prevalence of chronic pain. The CDC reports that approximately 50 million Americans suffer from chronic pain, with back pain and arthritis being the most common.

Additionally, the region is home to major market players such as Medtronic, Abbott, and Boston Scientific, who frequently launch innovative neuromodulation devices. Clinical integration of digital health platforms, increasing adoption of ambulatory care, and the presence of specialized pain clinics further reinforce North America’s market dominance.

Asia-Pacific is the fastest-growing regional market, attributed to increasing chronic disease prevalence, aging populations, rising healthcare investments, and expanding awareness about non-opioid pain treatments. Countries like China, India, Japan, and South Korea are experiencing a surge in orthopedic and neurological conditions, including post-surgical pain, diabetic neuropathy, and osteoarthritis.

Governments and private healthcare providers are investing in rehabilitation centers and pain clinics, particularly in urban areas. While the high cost of advanced devices poses a challenge, local manufacturers and public health initiatives are driving growth through affordable alternatives and partnerships. Rising medical tourism in countries like India and Thailand is also contributing to procedural adoption of pain management technologies.

April 2025: Medtronic announced the commercial launch of Intellis™ with AdaptiveStim, a spinal cord stimulator with AI-based real-time stimulation adjustment, for patients with chronic low back pain.

February 2025: Boston Scientific received CE mark approval for its WaveWriter Alpha™ Spinal Cord Stimulator System, integrating Bluetooth and remote programming features for European markets.

December 2024: Abbott launched its NeuroSphere™ Virtual Clinic globally, enabling remote therapy adjustments for its chronic pain and movement disorder neurostimulation platforms.

October 2024: Stimwave Technologies received FDA clearance for its new Freedom-8 PNS System, a minimally invasive peripheral nerve stimulator for lower limb neuropathic pain.

July 2024: The Indian government included radiofrequency ablation procedures for chronic back pain in its Ayushman Bharat health scheme, expanding access to advanced pain management devices for underserved populations.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pain management devices market

By Product

By Application

End Use

By Regional