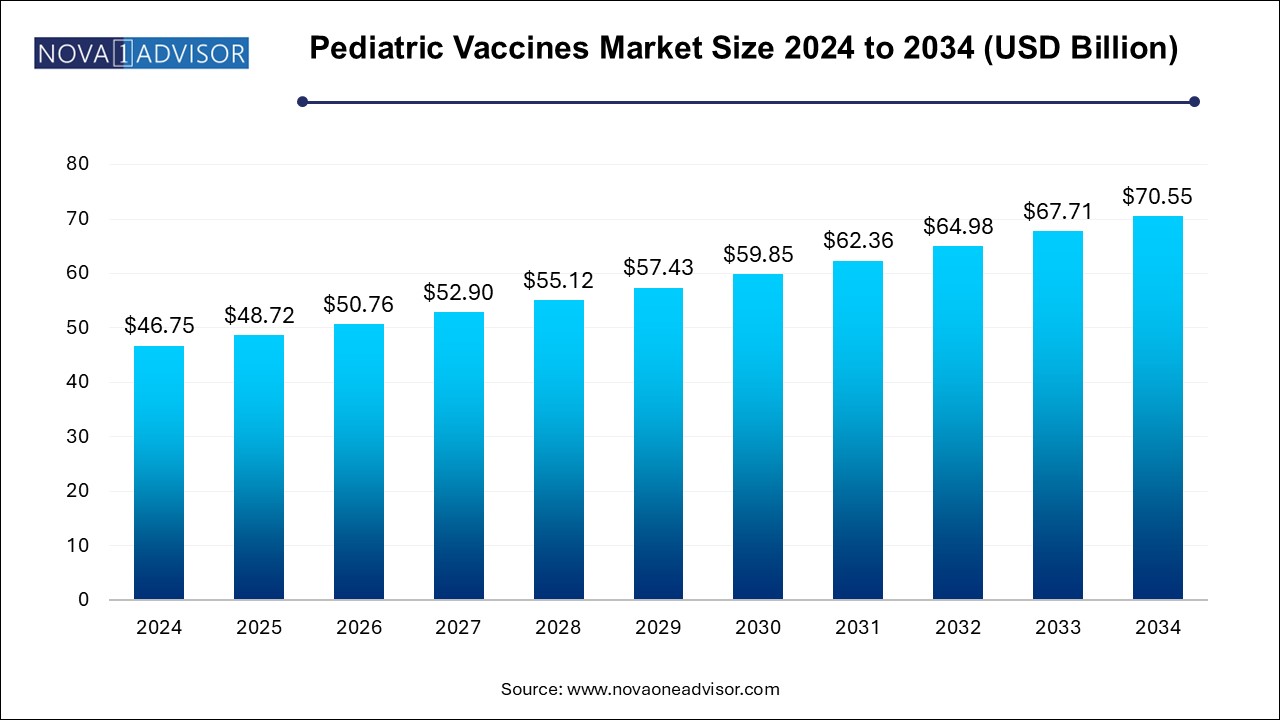

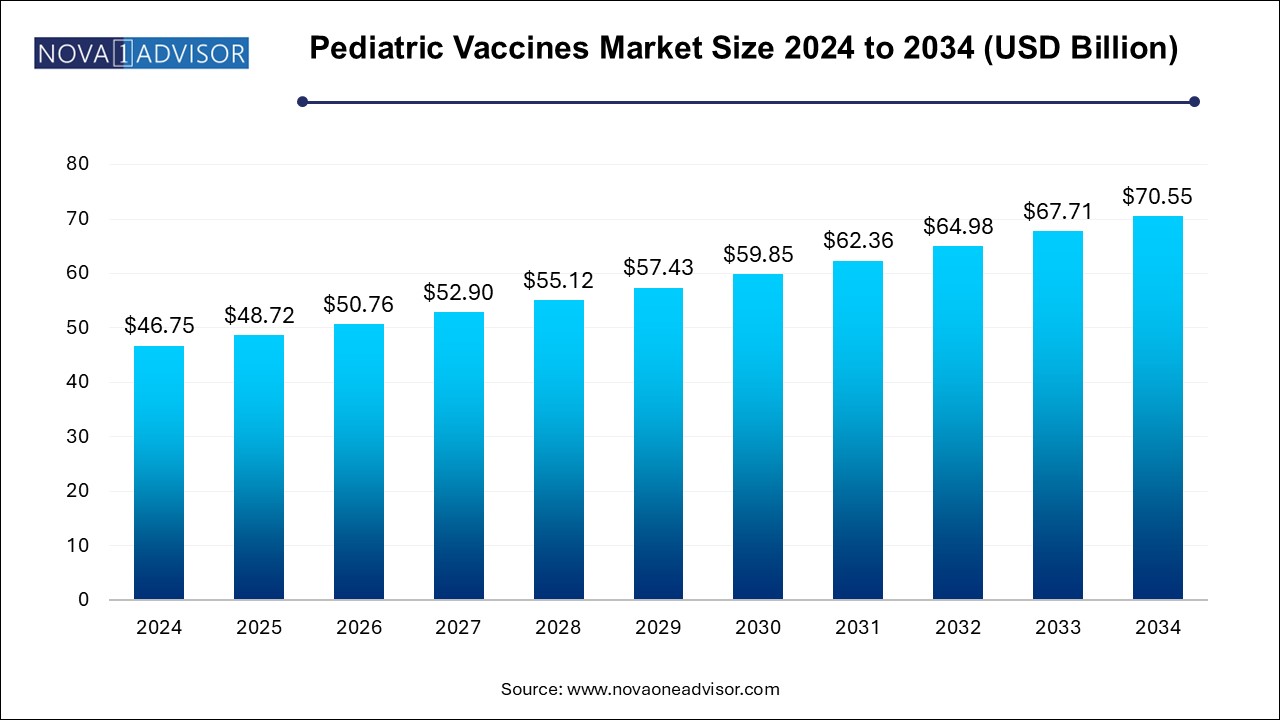

Pediatric Vaccines Market Size and Growth

The pediatric vaccines market size was exhibited at USD 46.75 billion in 2024 and is projected to hit around USD 70.55 billion by 2034, growing at a CAGR of 4.2% during the forecast period 2025 to 2034.

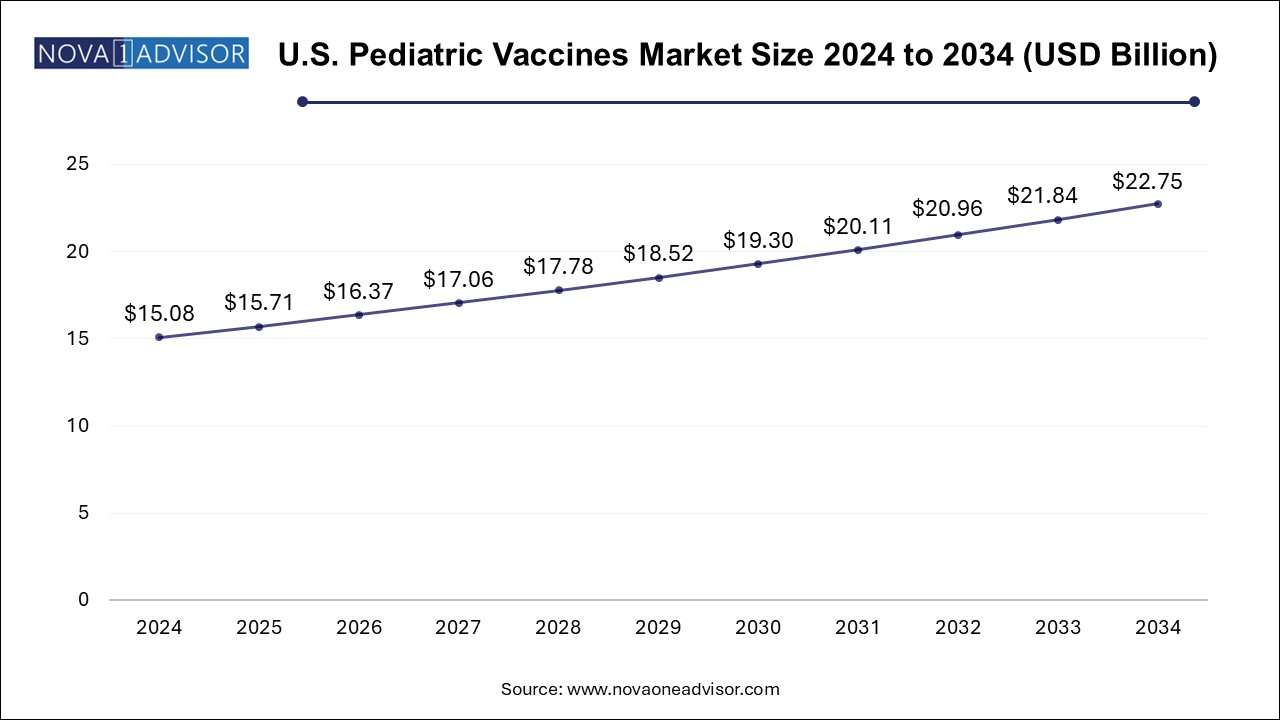

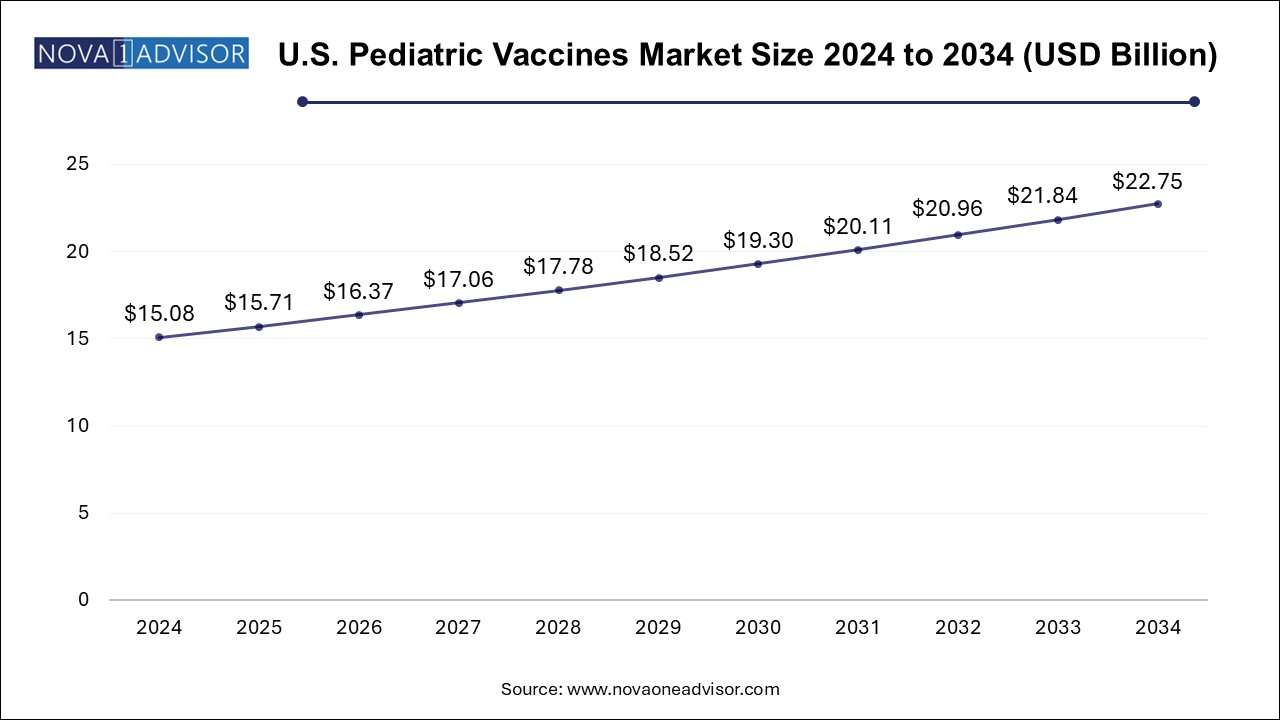

U.S. Pediatric Vaccines Market Size and Growth 2025 to 2034

The U.S. pediatric vaccines market size is evaluated at USD 15.08 billion in 2024 and is projected to be worth around USD 22.75 billion by 2034, growing at a CAGR of 3.8% from 2025 to 2034.

North America emerged as the dominant region in the Pediatric Vaccines Market, driven by high healthcare spending, strong government mandates, and rapid adoption of novel technologies. The United States has a well-established immunization program supported by the CDC and American Academy of Pediatrics (AAP), ensuring near-complete vaccine coverage. Moreover, the presence of leading vaccine manufacturers such as Pfizer, Moderna, and Merck has led to rapid innovation and timely supply. The region also has strong public support for routine vaccinations, despite occasional pockets of hesitancy.

Conversely, Asia Pacific is expected to be the fastest-growing region, supported by demographic trends, rising healthcare infrastructure, and strong governmental support. Countries like China and India have large birth cohorts and are making significant investments in nationwide immunization drives. India’s Mission Indradhanush and China’s Expanded Program on Immunization have successfully added new vaccines to public schedules, including rotavirus and PCV. Additionally, the presence of major generic and vaccine manufacturers in the region contributes to cost-effective vaccine production and export, further enhancing regional growth prospects.

Market Overview

The Pediatric Vaccines Market has become one of the most critical pillars of global public health infrastructure, contributing significantly to the prevention of childhood diseases and the reduction of infant mortality. Pediatric vaccines are biologically prepared substances that stimulate a child’s immune system to recognize and combat pathogens like bacteria and viruses. They are typically administered during the first few years of life to ensure early protection against infectious and potentially life-threatening diseases.

The rising global population of children under the age of five, coupled with government-mandated immunization schedules, has sustained a high demand for pediatric vaccines worldwide. Organizations such as the World Health Organization (WHO), Gavi, the Vaccine Alliance, UNICEF, and various country-level health departments have prioritized pediatric immunization programs to address preventable diseases such as measles, diphtheria, whooping cough, and polio. These initiatives have led to robust procurement and distribution systems across developed and developing countries alike.

Major Trends in the Market

-

Introduction of combination vaccines: Rising preference for multivalent vaccines that reduce the number of injections and visits required, enhancing compliance and comfort.

-

mRNA and DNA vaccine innovation: Advancements in genetic vaccine technology, initially popularized during the COVID-19 pandemic, are now being explored for pediatric use.

-

Growing public-private partnerships: Governments and private firms are increasingly collaborating to fund research, streamline supply chains, and ensure vaccine equity.

-

Cold chain modernization: Increased investment in cold storage infrastructure to improve vaccine accessibility, especially in low-income and rural regions.

-

Rise of needle-free delivery systems: Nasal sprays, oral drops, and microneedle patches are being developed to address needle phobia in children.

-

Inclusion of non-traditional indications: Development of pediatric vaccines targeting allergies, certain types of cancers, and lifestyle diseases is underway.

-

Digital health integration: Use of mobile apps and digital registries for vaccination tracking and reminders, aiding in compliance and follow-ups.

-

Boost in travel and seasonal vaccines: Increasing demand for flu, rotavirus, and travel-specific vaccines due to higher mobility and climate variations.

Report Scope of Pediatric Vaccines Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 48.72 Billion |

| Market Size by 2034 |

USD 70.55 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 4.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Technology, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

AstraZeneca, Sanofi , GSK plc, Pfizer, Inc., Zydus Group, Indian Immunologicals Ltd., Serum Institute of India Pvt. Ltd., Panacea Biotec, SINOVAC , BIO-MED |

Market Driver: Expanding Government Immunization Programs

A key driver propelling the Pediatric Vaccines Market is the global expansion of immunization programs supported by national governments and international bodies. Programs like the Expanded Programme on Immunization (EPI) by WHO and the Immunization Agenda 2030 aim to ensure that every child has access to life-saving vaccines. Government mandates requiring school-entry immunizations have also contributed to near-universal pediatric vaccine coverage in many high- and middle-income countries.

For instance, India’s Universal Immunization Programme (UIP) has grown significantly, now offering vaccines against more than a dozen diseases, including newer additions such as the pneumococcal conjugate vaccine (PCV). Similarly, the U.S. Centers for Disease Control and Prevention (CDC) updates its immunization schedule annually to reflect emerging health priorities. Such widespread adoption ensures consistent demand, provides funding guarantees, and encourages pharmaceutical manufacturers to continue innovation and supply.

Despite the proven efficacy of pediatric vaccines, the market faces challenges from rising vaccine hesitancy fueled by misinformation and skepticism. In both developed and developing nations, a portion of the population remains reluctant to vaccinate children due to concerns over safety, side effects, or mistrust in pharmaceutical companies and health authorities.

The spread of anti-vaccine narratives, particularly on social media platforms, has had a measurable impact on immunization coverage rates. The reemergence of diseases like measles in parts of Europe and North America has been partially attributed to communities opting out of vaccination. Public health agencies are now allocating significant resources toward educational campaigns to combat misinformation. Nonetheless, persistent hesitancy poses a risk to herd immunity and presents a critical restraint for market growth, especially in regions with limited healthcare outreach.

Market Opportunity: Development of Vaccines for Pediatric Cancer and Rare Diseases

While infectious disease prevention remains the core of pediatric vaccines, emerging opportunities lie in the development of vaccines targeting pediatric cancers and rare genetic conditions. Recent strides in immunotherapy have demonstrated that vaccines can play a preventive or therapeutic role in managing childhood leukemia, neuroblastoma, and brain tumors.

Companies are also exploring vaccines designed to prevent or treat conditions such as Type 1 diabetes, certain allergies, and hereditary disorders. For example, experimental vaccines against RSV (Respiratory Syncytial Virus) have shown promise and may soon be included in pediatric schedules. As more rare and chronic conditions are understood at the genetic and immunologic level, vaccine-based interventions for non-communicable pediatric diseases present a promising frontier, unlocking new revenue streams for pharmaceutical developers.

Pediatric Vaccines Market By Type Insights

Multivalent vaccines dominated the Pediatric Vaccines Market in 2024, owing to their ability to provide protection against multiple diseases through a single shot. Vaccines like the DTaP-IPV-Hib-HepB (Hexavalent) significantly reduce the number of injections a child must receive, improving adherence and reducing clinic visits. Governments and pediatricians often favor such combination vaccines for their convenience, especially in immunization programs with tight schedules. Moreover, multivalent vaccines also help reduce logistical costs associated with distribution and storage.

Meanwhile, monovalent vaccines are witnessing steady growth in niche segments, particularly for diseases where targeted immunization is required or during outbreak scenarios. For instance, monovalent vaccines for rotavirus or hepatitis A are commonly administered in regions with endemic presence. The introduction of monovalent mRNA vaccines targeting RSV or COVID-19 variants in pediatric populations also suggests that this segment may gain traction in the coming years, especially for immunocompromised children who may not tolerate multivalent formulations.

Pediatric Vaccines Market By Application Insights

The MMR segment dominated the market, as the MMR vaccine remains a crucial part of nearly all global pediatric immunization schedules. The widespread prevalence of measles and mumps in low-vaccination zones, and the high transmissibility of these diseases, ensure a consistent demand for MMR vaccines. The WHO has prioritized measles elimination globally, with many countries targeting 95% MMR coverage, further solidifying this segment’s dominance.

Meanwhile, pediatric cancer vaccines represent the fastest-growing application segment, albeit from a smaller base. With the growing understanding of tumor-specific antigens and pediatric immune responses, experimental vaccines are being tested as both preventive and adjunct therapies. Notably, organizations such as St. Jude Children’s Research Hospital and biotech firms are actively engaged in developing immunotherapeutic vaccines for leukemia and brain tumors. These efforts, supported by funding from rare disease advocacy groups and pediatric oncology grants, are laying the groundwork for future market expansion in this niche.

Pediatric Vaccines Market By Technology Insights

Conjugate vaccines held the largest share in 2024, primarily due to their established safety and efficacy profiles in pediatric immunization. These vaccines, such as the pneumococcal conjugate vaccine (PCV13), have dramatically reduced the incidence of bacterial pneumonia and meningitis in children globally. Their ability to provoke a strong immune response even in infants makes them a cornerstone of early childhood immunization schedules.

On the other hand, mRNA-based platforms are emerging as the fastest-growing technology segment, catalyzed by the success of COVID-19 mRNA vaccines. Researchers are now leveraging this technology to develop pediatric versions of mRNA vaccines for diseases like influenza, RSV, and even cancer. These vaccines can be rapidly developed and modified in response to emerging variants or outbreaks, offering unmatched flexibility. Clinical trials evaluating the safety of mRNA vaccines in younger age groups are ongoing, with positive results expected to accelerate commercial launches in the near future.

Some of the prominent players in the pediatric vaccines market include:

Pediatric Vaccines Market Recent Developments

-

February 2025 – Pfizer announced positive Phase III results for its mRNA-based RSV vaccine in pediatric patients aged 6 months to 2 years, marking a major milestone in next-generation pediatric vaccines.

-

January 2025 – Moderna received FDA fast-track designation for its pediatric influenza mRNA vaccine candidate, showing promising immune response data in early trials.

-

October 2024 – Serum Institute of India launched a new low-cost pentavalent vaccine under the brand "Nivovax" aimed at improving access in sub-Saharan Africa.

-

September 2024 – Sanofi partnered with Bill & Melinda Gates Foundation to develop a next-gen measles vaccine targeting heat-stability and lower cold chain dependency.

-

August 2024 – GSK expanded its pediatric vaccine R&D facility in Belgium, with an investment of €200 million to accelerate work on conjugate and protein subunit platforms.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pediatric vaccines market

By Type

By Technology

- Live Attenuated Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- Toxoid Vaccines

- Conjugate Vaccines

- Others

By Application

- Infectious Disease

- Cancer

- Allergy

- Pneumococcal Diseases

- Influenza

- Measles, Mumps, and Rubella (MMR)

- Other Application

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)