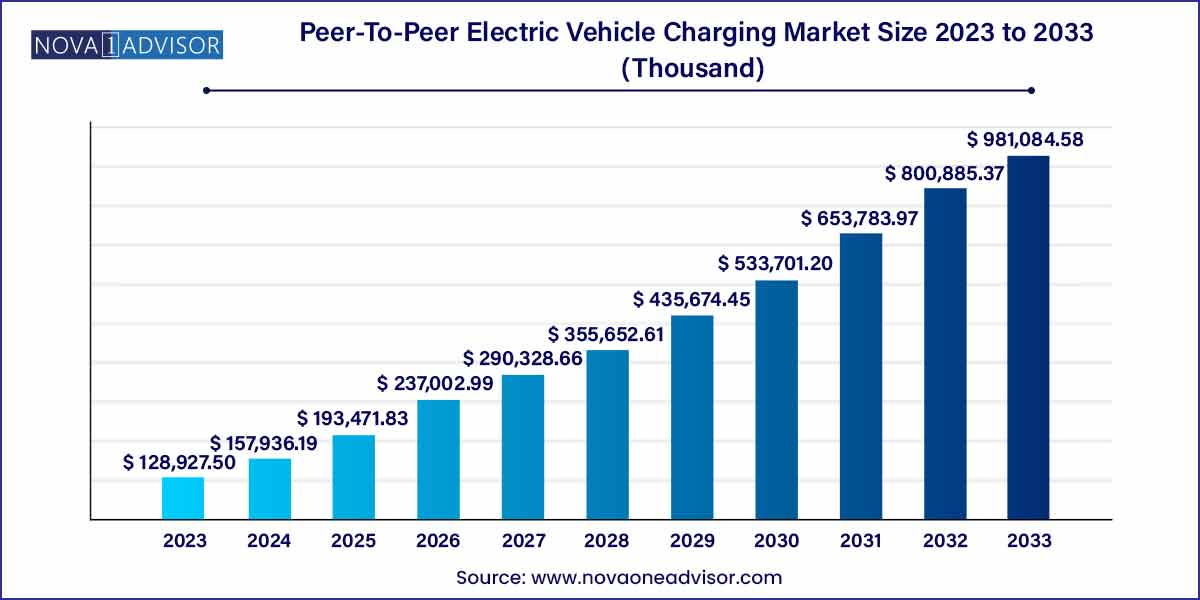

The global peer-to-peer electric vehicle charging market size was exhibited at USD 128,927.5 thousand in 2023 and is projected to hit around USD 981,084.58 thousand by 2033, growing at a CAGR of 22.5% during the forecast period of 2024 to 2033.

Key Takeaways:

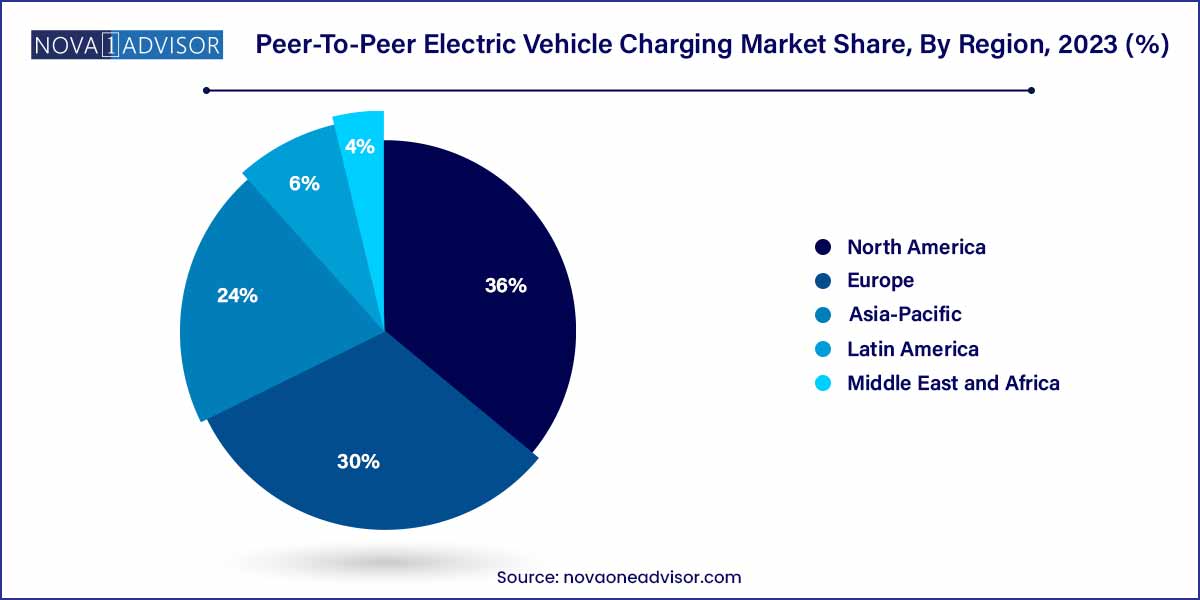

- The North American region dominated the peer-to-peer electric vehicle charging market and accounted for over 36.0% of the global revenue in 2023.

- The level 2 segment dominated the market in 2021 and accounted for more than 73.0% of the global revenue in 2023.

- The residential segment led the market and accounted for more than 62.0% of the global revenue in 2023.

Peer-To-Peer Electric Vehicle Charging Market by Overview

The Peer-to-Peer (P2P) Electric Vehicle (EV) Charging Market is revolutionizing how EV owners access and share charging infrastructure. P2P EV charging enables private individuals and businesses to offer their personal or commercial charging stations to other EV drivers, creating a decentralized network that complements traditional public charging facilities. This model addresses critical gaps in current infrastructure by leveraging underutilized private chargers, especially in residential areas, workplaces, and urban centers.

Driven by the growing adoption of EVs, smart city initiatives, and the increasing need for flexible and accessible charging options, the P2P charging market is gaining momentum globally. Mobile apps and platforms enable users to locate, reserve, and pay for charging sessions seamlessly, democratizing EV charging infrastructure. Companies such as EVmatch, ChargePoint, and Airbnb-like platforms for chargers are leading innovation, making charging more accessible, affordable, and efficient.

As cities aim to reduce congestion and pollution, and as EV ownership continues its rapid growth, peer-to-peer models are poised to play a critical role in expanding EV charging availability without massive public investment.

Peer-To-Peer Electric Vehicle Charging Market Growth

The growth of the Peer-To-Peer (P2P) Electric Vehicle Charging market is driven by several key factors. Firstly, the rising adoption of electric vehicles (EVs) worldwide is fueling demand for innovative charging solutions. P2P charging offers a decentralized approach, leveraging existing infrastructure and enabling greater accessibility to charging facilities. Additionally, the cost-effectiveness of P2P charging appeals to EV owners, who can monetize their charging stations during idle periods, thereby offsetting ownership costs. Moreover, the flexibility and convenience offered by P2P charging platforms, in terms of pricing, scheduling, and location, contribute to their growing popularity among EV users. As sustainability becomes increasingly important, the optimization of existing infrastructure through P2P charging aligns with environmental goals, further driving market growth. Overall, these factors underscore the significant potential of P2P electric vehicle charging to reshape the future of transportation and contribute to the evolution of sustainable mobility.

Peer-To-Peer Electric Vehicle Charging Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 128,927.5 Thousand |

| Market Size by 2033 |

USD 981,084.58 Thousand |

| Growth Rate From 2024 to 2033 |

CAGR of 22.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Charger Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Chargepoint Inc.; ClipperCreek, Inc.; Enel X; EVBox; EV Meter; Greenlots; has·to·be gmbh; innogy; Power Hero; Webasto Group. |

Peer-To-Peer Electric Vehicle Charging Market Dynamics

The dynamics of the Peer-To-Peer (P2P) Electric Vehicle Charging market are significantly influenced by its role in enhancing accessibility to charging infrastructure. P2P charging platforms utilize privately-owned stations, thereby expanding the reach of charging facilities beyond traditional public networks. This decentralized approach not only addresses the scarcity of charging points in certain areas but also offers greater convenience to EV owners by providing access to charging options closer to their locations. As a result, the accessibility factor drives the adoption of P2P charging solutions, contributing to the market's growth and expansion.

Another pivotal dynamic shaping the Peer-To-Peer (P2P) Electric Vehicle Charging market is its inherent cost-effectiveness. EV owners can leverage P2P charging platforms to monetize their charging stations during idle periods, effectively offsetting the cost of EV ownership. This mutually beneficial arrangement allows station owners to generate additional income while providing affordable charging options to EV users. By optimizing the utilization of existing infrastructure and minimizing the need for costly investments in new charging infrastructure, P2P charging offers a financially sustainable solution for both station owners and EV drivers. As a result, the cost-effectiveness of P2P charging drives its adoption and contributes to the overall growth of the market.

Peer-To-Peer Electric Vehicle Charging Market Restraint

- Infrastructure Limitations:

One significant restraint affecting the Peer-To-Peer (P2P) Electric Vehicle Charging market is the reliance on existing infrastructure. While P2P charging platforms leverage privately-owned charging stations to expand accessibility, the availability of such infrastructure remains limited in certain regions. This constraint hinders the scalability of P2P charging networks, particularly in areas with sparse charging infrastructure or low EV adoption rates. Additionally, the compatibility and standardization of charging equipment pose challenges, as different charging station types may not be interoperable with all EV models.

Another significant restraint facing the Peer-To-Peer (P2P) Electric Vehicle Charging market relates to regulatory hurdles and policy uncertainties. The evolving regulatory landscape surrounding electric vehicle charging, including safety standards, grid integration requirements, and tariff regulations, presents challenges for P2P charging platforms. Compliance with diverse regulatory frameworks across different jurisdictions adds complexity to the operation of P2P charging networks and may deter potential stakeholders, such as station owners and EV users, from participating. Moreover, unclear or inconsistent regulations regarding energy sales, taxation, and liability may create legal uncertainties, impacting the willingness of stakeholders to engage in P2P charging transactions.

Peer-To-Peer Electric Vehicle Charging Market Opportunity

- Market Expansion in Emerging Economies:

One notable opportunity in the Peer-To-Peer (P2P) Electric Vehicle Charging market lies in the expansion into emerging economies. As electric vehicle adoption gains momentum globally, emerging markets present significant growth potential due to their increasing urbanization, rising disposable incomes, and growing environmental awareness. P2P charging solutions can address the infrastructure challenges faced by these regions by leveraging existing resources and offering cost-effective charging options. Moreover, the flexibility and scalability of P2P charging platforms make them well-suited for diverse market environments, enabling rapid deployment and adaptation to local needs.

- Integration with Smart Grid Technologies:

Another promising opportunity for the Peer-To-Peer (P2P) Electric Vehicle Charging market lies in the integration with smart grid technologies. P2P charging platforms can leverage advanced grid management systems, demand-response mechanisms, and renewable energy integration to optimize the utilization of charging infrastructure and enhance grid stability. By coordinating charging schedules based on grid conditions, electricity prices, and user preferences, P2P charging networks can mitigate peak demand, reduce energy costs, and promote the efficient use of renewable energy sources. Furthermore, the integration of vehicle-to-grid (V2G) capabilities enables bidirectional energy flows between EVs and the grid, creating additional revenue streams for EV owners and grid operators.

Peer-To-Peer Electric Vehicle Charging Market Challenges

- User Adoption and Awareness:

One of the significant challenges facing the Peer-To-Peer (P2P) Electric Vehicle Charging market is user adoption and awareness. While P2P charging platforms offer numerous benefits, including accessibility, cost-effectiveness, and flexibility, many EV owners may be unaware of these solutions or hesitant to participate due to unfamiliarity or perceived complexities. Lack of awareness about P2P charging options and their benefits can hinder market growth and limit the utilization of existing charging infrastructure. Additionally, EV owners may have concerns about reliability, security, and payment mechanisms associated with P2P charging transactions, further inhibiting adoption.

- Interoperability and Standardization:

Another key challenge in the Peer-To-Peer (P2P) Electric Vehicle Charging market is interoperability and standardization of charging infrastructure. The lack of uniformity in charging protocols, connector types, and communication standards across different EV models and charging stations complicates the seamless integration and operation of P2P charging networks. EV owners may encounter compatibility issues when trying to access P2P charging stations, leading to inefficiencies, inconvenience, and frustration. Moreover, the absence of standardized billing and payment systems for P2P charging transactions can create barriers to interoperability and hinder market growth. Addressing these challenges requires industry collaboration, regulatory initiatives, and technological advancements to establish common standards, protocols, and certification schemes for P2P charging infrastructure.

Segments Insights:

Charger Type Insights

Level 2 chargers dominated the charger type segment in 2024. Level 2 chargers offer a good balance between cost, speed, and accessibility, making them ideal for P2P models where overnight or several-hour stays are common. Private homes, apartments, and workplaces typically install Level 2 chargers, providing enough charge for daily driving needs. Hosts offering Level 2 chargers can cater to a broader audience without requiring expensive infrastructure upgrades.

Level 1 chargers are still growing, especially in certain markets. Although slower, Level 1 chargers (using standard 120V outlets) are widely available in North America and are suitable for drivers needing overnight charging or top-ups at destinations like Airbnb rentals. As awareness grows and affordability remains critical, Level 1 P2P networks will continue expanding, especially in suburban and rural areas where long-term parking is common.

Application Insights

Private Homes dominated the residential application segment. Homeowners with installed EV chargers are increasingly opening their chargers for public use during daytime hours or while away from home. Platforms like EVmatch have seen strong growth among homeowners willing to share their charging stations for extra income. In urban neighborhoods where public charging stations are scarce, private home-based P2P chargers offer a convenient and often cheaper alternative.

Apartments are the fastest-growing residential sub-segment. With EV adoption rising among renters, demand for accessible apartment-based chargers is soaring. Property managers and tenants are installing shared or private chargers and listing them on P2P platforms. In January 2024, a leading U.S. apartment complex operator partnered with a P2P charging network to monetize underused charging spaces, creating a new revenue stream.

Regional Insights

North America dominated the peer-to-peer EV charging market in 2024. The U.S., in particular, benefits from high EV adoption rates, widespread home charger ownership, and entrepreneurial ecosystems promoting shared economy models. California leads the charge, with robust incentives for residential chargers and strong urban demand for flexible charging solutions. Platforms like PlugShare and EVmatch have established solid user bases, reflecting the region's maturity.

Europe is the fastest-growing region. The European Green Deal, aggressive decarbonization targets, and government support for EV infrastructure are propelling rapid growth. Countries like the Netherlands, Germany, France, and the UK are seeing a surge in P2P charger listings. In February 2024, the European Union launched a pilot grant program supporting decentralized EV charging initiatives, encouraging peer-to-peer platforms to expand their operations across multiple member states.

Some of the prominent players in the Peer-to-peer electric vehicle charging market include:

- Chargepoint Inc.

- ClipperCreek, Inc.

- Enel X

- EVBox

- EV Meter

- Greenlots

- has·to·be gmbh

- innogy

- Power Hero

- Webasto Group

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global peer-to-peer electric vehicle charging market.

Charger Type

Application

-

- Destination Charging Station

- Fleet Charging Station

- Workplace Charging Station

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)