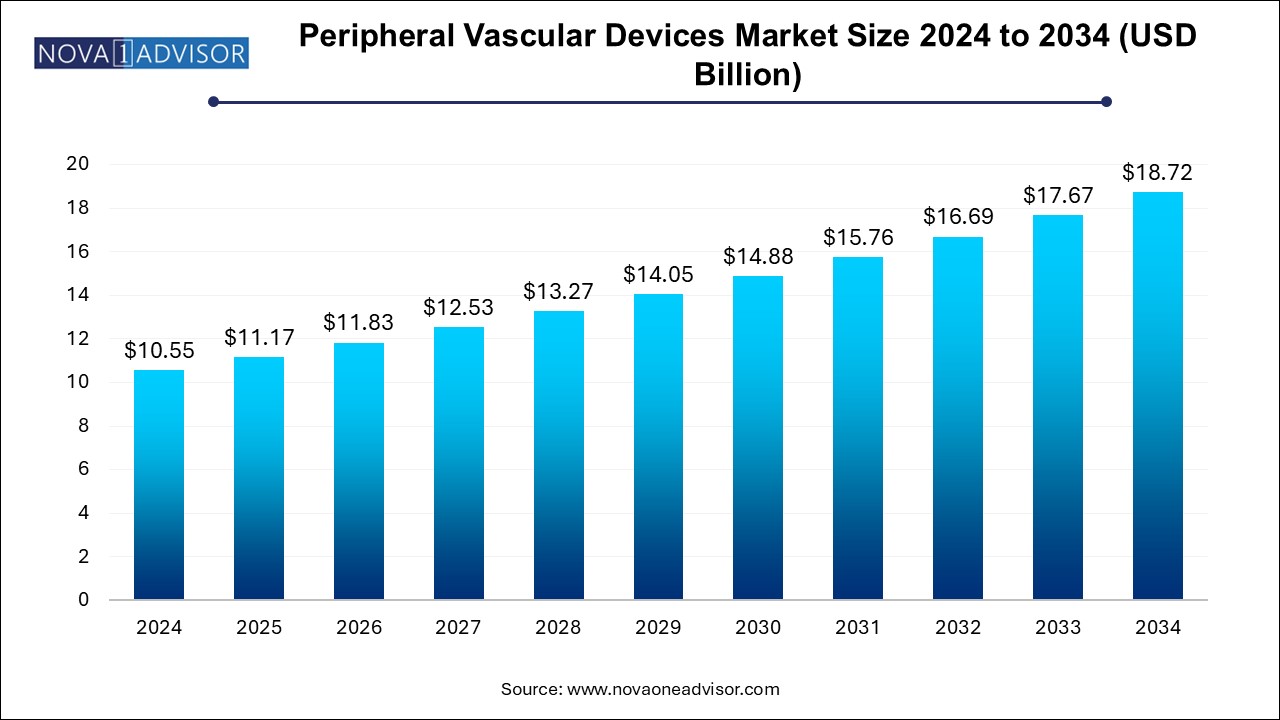

The peripheral vascular devices market size was exhibited at USD 10.55 billion in 2024 and is projected to hit around USD 18.72 billion by 2034, growing at a CAGR of 5.9% during the forecast period 2024 to 2034.

The peripheral vascular devices market plays an essential role in the global healthcare landscape, offering critical solutions for the diagnosis and treatment of vascular conditions outside of the heart and brain, particularly those affecting arteries and veins in limbs and the abdomen. Peripheral vascular diseases, including peripheral artery disease (PAD), aneurysms, deep vein thrombosis, and chronic venous insufficiency, have seen rising prevalence due to aging populations, increasing rates of diabetes, and sedentary lifestyles worldwide.

Peripheral vascular devices encompass a wide range of instruments, including stents, balloons, catheters, plaque modification tools, and vascular closure systems. These technologies facilitate procedures such as angioplasty, endovascular aneurysm repair (EVAR), thrombectomy, and atherectomy, significantly improving patient outcomes and reducing the need for invasive surgeries.

Technological innovations such as drug-coated balloons, bioresorbable scaffolds, and next-generation stent grafts are reshaping the market, offering enhanced efficacy, improved safety profiles, and longer-term vessel patency. The expansion of minimally invasive endovascular techniques, combined with growing physician awareness and patient preference for less traumatic interventions, continues to fuel market growth globally.

The COVID-19 pandemic initially posed challenges, disrupting elective procedures and hospital workflows. However, the post-pandemic recovery has accelerated investments into vascular care infrastructure, bringing the peripheral vascular devices market into renewed focus.

Rise of Drug-coated Balloons and Drug-eluting Stents: Improved vessel healing and reduced restenosis rates drive adoption.

Advancements in Thrombectomy and Atherectomy Devices: Devices capable of efficient clot removal and plaque modification are gaining popularity.

Integration of Imaging with Catheters: Intravascular ultrasound (IVUS) and optical coherence tomography (OCT) catheters enable precise diagnosis and targeted therapy.

Shift Toward Outpatient and Ambulatory Procedures: Minimally invasive vascular interventions increasingly conducted in outpatient settings.

Development of Bioresorbable Vascular Scaffolds: Innovation in fully biodegradable devices aims to eliminate long-term implant complications.

Growing Use of Embolic Protection Devices: Protecting downstream vessels during high-risk interventions is gaining prominence.

Rise in Chronic Total Occlusion (CTO) Devices: Specialized guidewires and crossing devices for complex occlusions are expanding rapidly.

Regional Expansion of Endovascular Aneurysm Repair (EVAR): EVAR procedures rising notably in emerging economies due to improved access and training.

| Report Coverage | Details |

| Market Size in 2025 | USD 11.17 Billion |

| Market Size by 2034 | USD 18.72 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 5.9% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Abbottt; Koninklijke Philips N.V.; Edward Lifesciences Corporation; Medtronic; Teleflex Incorporated; Cook Group; Cordis; Boston Scientific Corporation; W. L. Gore & Associates, Inc.; Biotronik; BD; Terumo Corporation |

The increasing global burden of peripheral arterial disease (PAD) is one of the most significant drivers propelling the peripheral vascular devices market. According to estimates from the American Heart Association (AHA), PAD affects over 200 million people worldwide, with many cases remaining undiagnosed until critical symptoms emerge.

PAD, characterized by atherosclerotic blockages in the lower extremity arteries, leads to pain, mobility limitations, and in severe cases, limb ischemia requiring amputation. Minimally invasive interventions such as balloon angioplasty, stenting, and atherectomy have become essential therapeutic options for PAD, driving consistent demand for vascular devices.

Moreover, rising awareness campaigns, advances in early diagnosis, and an aging population further amplify the need for effective peripheral interventions, ensuring sustained market growth in the coming years.

While technological innovation continues to advance rapidly, the stringent regulatory frameworks and complex reimbursement structures present significant barriers to market expansion. Obtaining regulatory approvals from agencies like the FDA or the European Medicines Agency (EMA) demands extensive clinical trials, data collection, and financial resources.

Furthermore, reimbursement rates for peripheral interventions vary widely between regions and procedures. In many cases, healthcare systems are slow to update reimbursement schedules to reflect the value provided by newer technologies such as drug-coated balloons or advanced thrombectomy devices. These reimbursement gaps can deter hospitals and ambulatory centers from adopting cutting-edge solutions, restraining broader market penetration.

A promising growth opportunity exists in the expansion of peripheral vascular devices into emerging economies such as China, India, Brazil, and Southeast Asian countries. These regions are experiencing an alarming rise in non-communicable diseases (NCDs) like diabetes and cardiovascular disease, major risk factors for vascular conditions.

Governments in these nations are investing heavily in improving healthcare infrastructure, increasing physician training programs, and implementing screening initiatives for early detection of PAD and venous diseases. Furthermore, international companies are entering strategic partnerships, localizing production, and offering more affordable product lines tailored to the economic realities of emerging markets. As awareness and access improve, emerging economies are poised to be major contributors to future market growth.

Peripheral stents dominate the type segment, serving as the cornerstone of endovascular interventions for occlusive vascular disease. Iliac, femoral, carotid, and renal artery stents provide mechanical support to arteries post-angioplasty, maintaining vessel patency and restoring blood flow. Drug-eluting stents have further revolutionized outcomes by minimizing restenosis risks. Their versatility across a range of vascular territories ensures their dominant market share.

Plaque modification devices, including atherectomy and thrombectomy tools, are the fastest-growing segment, reflecting the rising need for specialized intervention in complex lesions. With the global population aging and disease complexity increasing, operators require tools that not only reopen blocked vessels but also effectively remove calcific plaques or thrombus without damaging arterial walls. Technological advancements in directional, rotational, and laser atherectomy systems are catalyzing adoption, particularly for heavily calcified or long-segment occlusions.

Peripheral arterial disease (PAD) remains the dominant application, accounting for a substantial proportion of peripheral interventions worldwide. PAD-related procedures primarily involve angioplasty, stenting, and atherectomy of lower limb arteries, addressing symptoms like claudication and critical limb ischemia. Increasing screening rates and physician awareness programs are driving early interventions, ensuring continuous demand for PAD-focused devices.

Venous diseases, such as deep vein thrombosis (DVT) and chronic venous insufficiency (CVI), are emerging as the fastest-growing application area. Innovations in venous stents, filters, and thrombectomy devices are transforming the therapeutic landscape. With greater emphasis on reducing hospital readmissions and preventing venous thromboembolism (VTE) complications, the adoption of specialized venous interventions is accelerating.

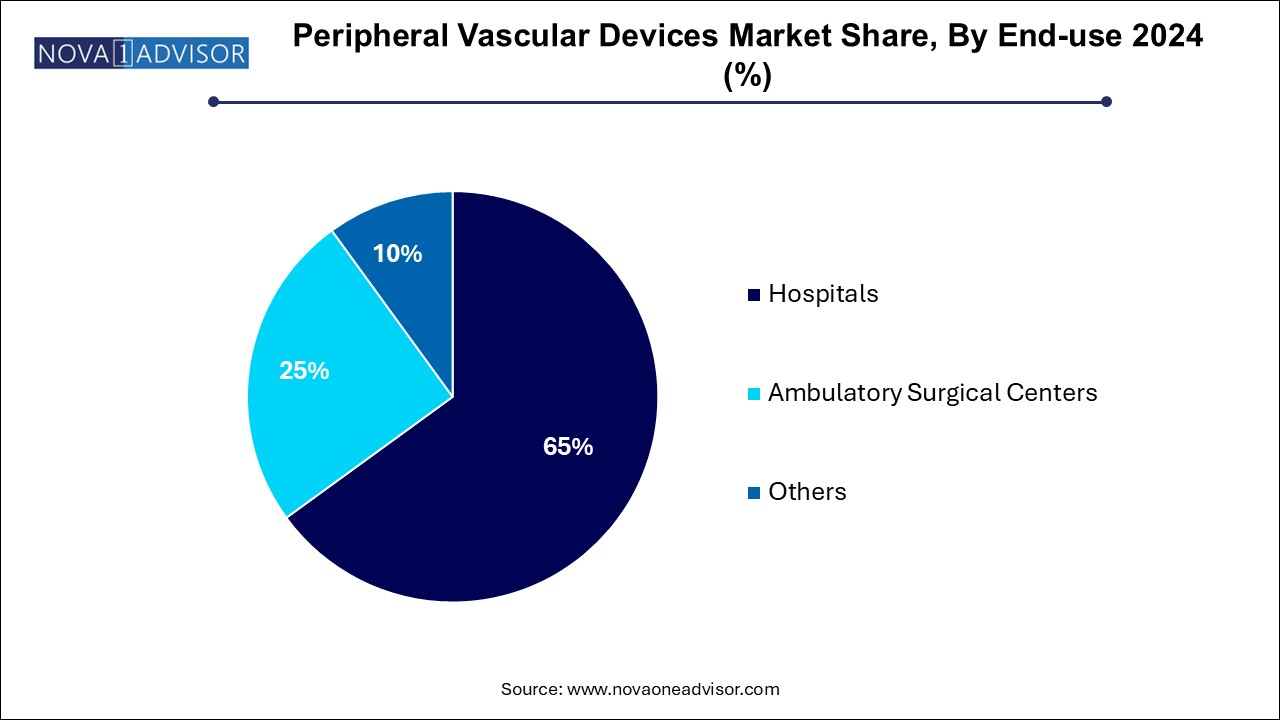

Hospitals dominate the end-use segment, as they handle the bulk of complex vascular interventions, including those requiring hybrid surgical suites, ICU backup, and multidisciplinary teams. Academic medical centers, tertiary care hospitals, and large cardiovascular institutes invest heavily in advanced endovascular equipment and staff training, cementing their dominance.

Ambulatory surgical centers (ASCs) are the fastest-growing end-use segment, propelled by healthcare cost containment initiatives and patient preference for minimally invasive, outpatient procedures. ASCs offer lower costs, high procedural volumes, and shorter recovery times. Peripheral devices designed for efficiency, rapid deployment, and reduced procedural complexity are finding strong traction in ASC settings.

North America leads the global peripheral vascular devices market, underpinned by a high burden of vascular diseases, advanced healthcare infrastructure, and rapid adoption of innovative technologies. The United States, in particular, sees robust demand driven by an aging population, rising diabetes rates, and favorable reimbursement frameworks.

Moreover, the presence of leading medical device companies like Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, and Cook Medical ensures widespread availability and continuous technological advancements. Strategic collaborations between device manufacturers, hospitals, and clinical researchers further enhance North America's leadership position.

Asia-Pacific is the fastest-growing region, reflecting rapid economic development, increasing healthcare investments, and rising awareness of vascular health. Countries like China, India, Japan, and South Korea are witnessing a surge in endovascular procedures as cardiovascular disease prevalence escalates.

Governments across Asia are promoting health insurance penetration, cardiovascular screening programs, and infrastructure expansion. Additionally, medical tourism, particularly for vascular interventions, is boosting regional procedural volumes. Multinational device manufacturers are increasingly focusing on Asia-Pacific through local partnerships, product launches, and manufacturing expansion.

March 2025: Medtronic plc launched its In.Pact Admiral drug-coated balloon in Japan for PAD treatment, receiving PMDA approval.

February 2025: Boston Scientific Corporation acquired a startup specializing in next-generation thrombectomy devices to expand its vascular intervention portfolio.

January 2025: Abbott Laboratories introduced a new ultra-thin strut peripheral stent designed for enhanced flexibility and deliverability.

December 2024: Cook Medical received FDA clearance for its latest drug-eluting peripheral stent optimized for superficial femoral artery lesions.

November 2024: Terumo Corporation announced the global launch of its low-profile PTA balloon catheter for treating infrapopliteal artery disease.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the peripheral vascular devices market

By Type

By Application

By End-use

By Regional