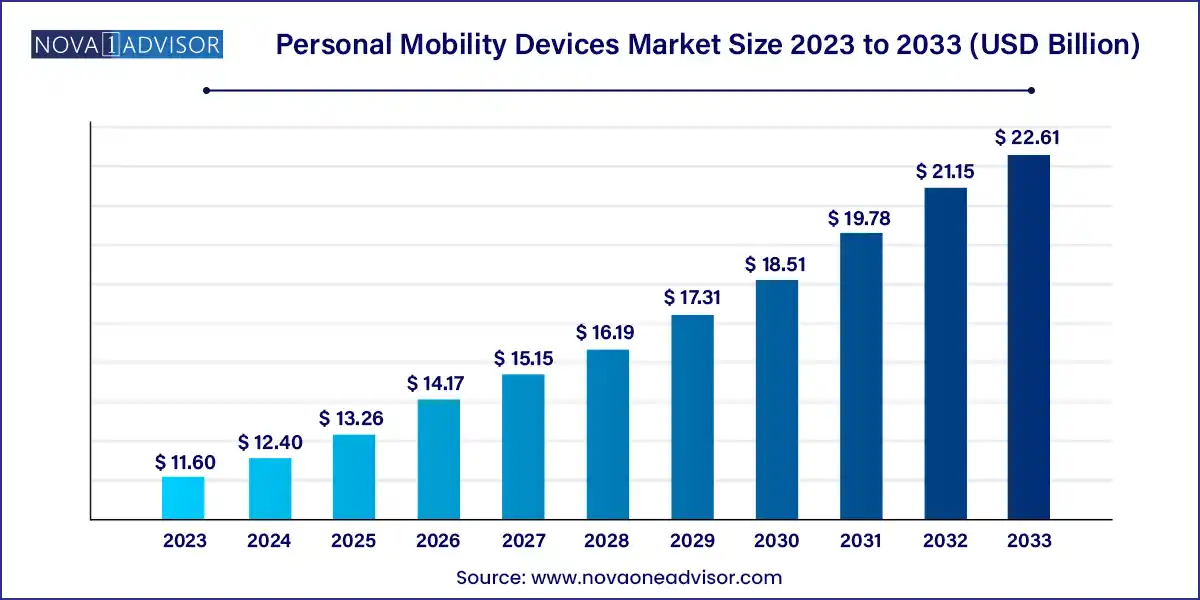

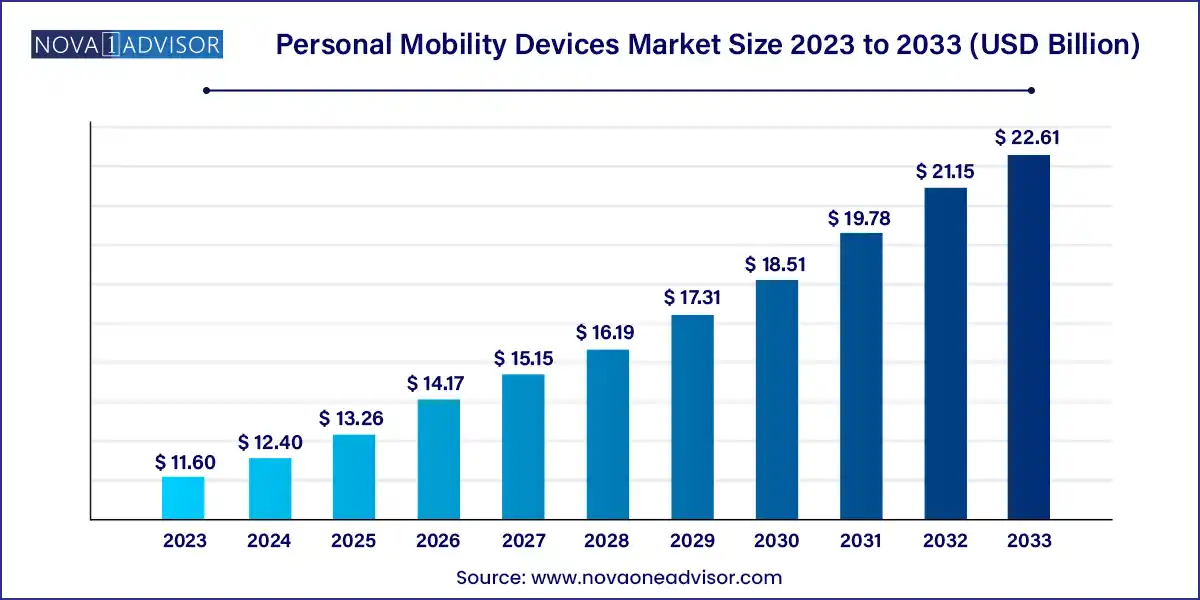

The global personal mobility devices market size was exhibited at USD 11.60 billion in 2023 and is projected to hit around USD 22.61 billion by 2033, growing at a CAGR of 6.9% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America dominated the overall personal mobility devices market in 2023 with a revenue share of 38.0%.

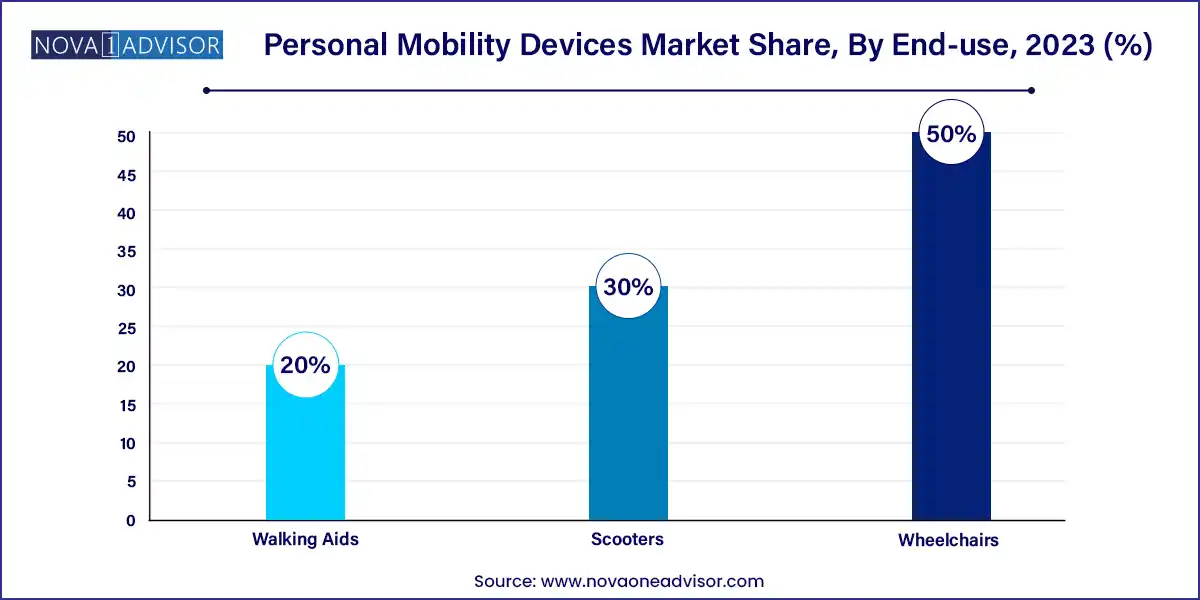

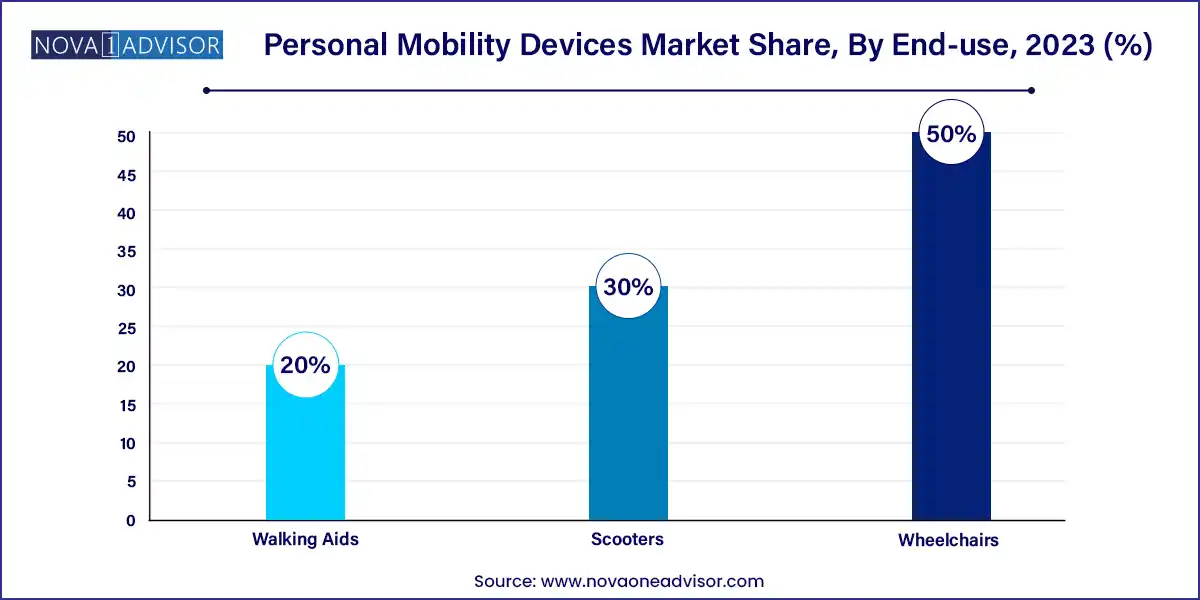

- The wheelchair segment dominated the market for personal mobility devices and accounted for the largest revenue share of over 50.0% in 2023.

Market Overview

The Personal Mobility Devices Market has evolved from a basic healthcare necessity into a sophisticated sector driven by technological innovation, lifestyle shifts, and demographic trends. These devices which include walking aids, wheelchairs, and mobility scooters serve a vital role in enabling independence and improving quality of life for individuals with mobility impairments due to age, injury, or chronic conditions such as arthritis and neurological disorders.

The rapid aging of the global population is perhaps the most significant underlying force behind the market’s sustained expansion. As per the United Nations, by 2030, one in six people globally will be aged 60 years or older. This demographic cohort is particularly prone to degenerative joint diseases and reduced physical agility, necessitating assistive mobility devices. In parallel, rising incidences of disability from accidents and lifestyle diseases including obesity and diabetes are increasing the demand for devices that support movement, posture control, and everyday independence.

Additionally, increased awareness and a growing emphasis on inclusive infrastructure such as wheelchair-accessible spaces and public transport have supported the market. Technological enhancements such as smart navigation, lightweight materials, foldability, and even IoT connectivity in newer devices are drawing a younger demographic of users as well, particularly those seeking temporary post-surgical recovery tools or mobility aid following sports injuries.

Major Trends in the Market

-

Technological Advancements and Smart Features: Newer models of scooters and powered wheelchairs are now being equipped with GPS, obstacle avoidance, and voice control capabilities, enhancing usability for tech-savvy consumers.

-

Growth in Home Healthcare: The rising preference for home care over long-term hospitalization has created demand for comfortable, user-friendly mobility aids suitable for domestic environments.

-

Personalization and Ergonomic Design: Consumers increasingly demand customized mobility devices tailored to their body type, condition, and preferences in terms of aesthetics, materials, and controls.

-

Eco-friendly and Lightweight Materials: There is growing adoption of aluminum, carbon fiber, and other durable yet lightweight materials in mobility devices to improve maneuverability and reduce physical strain on users.

-

Rise of e-Commerce and DTC Models: Companies are increasingly leveraging digital platforms to market and distribute mobility devices directly to consumers, reducing middlemen and expanding their reach.

-

Insurance Coverage and Government Support: Expanding reimbursement policies for personal mobility aids, particularly in North America and Europe, are facilitating affordability and access.

Personal Mobility Devices Market Report Scope

Market Driver: Aging Global Population

The most prominent driver in the personal mobility devices market is the growing elderly population, which brings with it an increased demand for assistive devices. Age-related musculoskeletal conditions such as osteoporosis, arthritis, and Parkinson's disease affect millions globally, causing progressive mobility limitations. Personal mobility devices such as rollators, wheelchairs, and electric scooters play a pivotal role in maintaining autonomy for this group. For instance, in Japan one of the most aged societies in the world there's been a consistent surge in the use of premium rollators and powered wheelchairs, prompting manufacturers to design more compact, motor-assisted devices that cater to the unique living conditions of seniors in urban environments.

Market Restraint: High Cost of Advanced Devices

Despite innovation and increased demand, high cost remains a considerable restraint, especially for powered devices like electric scooters and smart wheelchairs. These devices often come with advanced navigation systems, battery packs, and sensor technologies that significantly raise their price point, limiting access for low-income and uninsured populations. In emerging economies where insurance coverage is minimal or nonexistent, the cost barrier is particularly acute. Moreover, ongoing maintenance, battery replacement, and service costs for these devices often go unaccounted for in reimbursement schemes, adding further financial burden to users.

Market Opportunity: Rising Demand for Portable and Foldable Devices

The modern consumer values portability and ease of storage, opening up a substantial opportunity in foldable and travel-friendly mobility devices. This trend aligns with increasing urbanization, where users in compact living spaces need devices that can be easily stored or transported. Airlines and public transit systems are also becoming more accommodating, encouraging users to invest in collapsible or modular devices. Manufacturers that can create lightweight, user-assembled models with high battery efficiency and compact storage capacity are likely to find growing success among both elderly users and younger, mobility-impaired consumers looking for greater independence.

Segments Insights:

By Product Insights

Walking aids dominated the market in terms of unit sales, largely due to their cost-effectiveness, ease of use, and suitability for a broad range of mobility impairments. Within this category, rollators — particularly low-cost rollators — are widely used by the elderly for indoor and outdoor support. These models typically include ergonomic handgrips, braking systems, and baskets or trays, making them practical for daily errands. Canes and crutches remain essential in post-operative rehabilitation and short-term use cases, contributing to the segment’s stability across hospitals and outpatient settings.

At the same time, premium rollators are projected to grow at the fastest rate due to their superior features, enhanced stability, and focus on design aesthetics. These high-end devices often include shock-absorbing wheels, foldable frames, and built-in seating, enabling users to navigate longer distances with confidence. They are gaining popularity among aging baby boomers in affluent regions such as North America and Europe who are increasingly focused on maintaining mobility without compromising lifestyle or dignity.

Wheelchairs also hold a significant share of the market, with manual wheelchairs dominating this segment due to their affordability and widespread use in both clinical and homecare settings. These devices are essential not only for the elderly but also for patients recovering from spinal injuries, stroke, and surgeries. Manual wheelchairs offer independence and are particularly useful in institutions with staff support. Their cost-effectiveness continues to drive demand in emerging regions.

However, powered wheelchairs represent the fastest-growing segment, driven by aging consumers with severe physical limitations who require motorized assistance. These wheelchairs are now being integrated with advanced steering systems, customizable seating, and even connectivity for caregivers. The increasing focus on disability inclusion and the development of accessible infrastructure in cities is further accelerating adoption. Moreover, products like Permobil's F5 Corpus, which offers a standing function and Bluetooth-enabled controls, exemplify the technological evolution in this segment.

Mobility scooters, while slightly less prevalent in hospital environments, are gaining popularity in urban settings and senior communities. They combine the comfort of seating with the convenience of a vehicle for short-range travel, often replacing cars for elderly individuals living in retirement communities or suburban areas. The market is seeing a shift towards three-wheeled scooters for better maneuverability, and models with swappable batteries to extend usage without significant downtime.

By Regional Insights

North America currently dominates the personal mobility devices market, led primarily by the United States. The region's dominance is driven by its aging population, robust healthcare infrastructure, high adoption of assistive technologies, and comprehensive reimbursement programs. Medicare and private insurance providers cover various categories of personal mobility devices, encouraging early adoption and replacement of outdated models. Additionally, strong consumer awareness and high disposable income levels contribute to the demand for premium mobility solutions. Companies such as Invacare Corporation, Pride Mobility, and Sunrise Medical have established robust distribution networks and service channels across North America, ensuring widespread accessibility.

In contrast, Asia-Pacific is emerging as the fastest-growing region, fueled by a combination of demographic and economic factors. Rapid aging in countries like Japan, South Korea, and China is creating unprecedented demand for mobility aids. Government initiatives, such as China’s Healthy China 2030 policy and India’s Accessible India Campaign, are focusing on building supportive infrastructure and offering subsidies for assistive technology. Moreover, a rising middle class and expanding health insurance coverage are making mobility devices more accessible. Local startups and global players are both investing in the region, launching cost-effective, durable models tailored to Asian terrain and climatic conditions.

Some of the prominent players in the Personal mobility devices market include:

- Drive DeVilbiss Healthcare

- GF Health Products, Inc.

- Invacare Corporation

- Carex Health Brands, Inc.

- Kaye Products, Inc.

- Briggs Healthcare

- Medline Industries, Inc.

- NOVA Medical Products

- Performance Health

- Rollz International

Recent Developments

-

In January 2025, Sunrise Medical announced a strategic acquisition of Oracing, a Spanish manufacturer of sports wheelchairs and adaptive cycling equipment, aiming to expand its product offerings and enhance its presence in Europe’s premium wheelchair segment.

-

In October 2024, Invacare Corporation launched its "AVIVA FX" powered wheelchair with smart navigation and obstacle detection systems, designed specifically for high-functioning users with complex mobility needs.

-

In July 2024, Drive DeVilbiss Healthcare expanded its production facility in Pennsylvania to meet rising demand for its folding rollator models in North America, particularly in light of supply chain disruptions affecting imports.

-

In May 2024, Pride Mobility introduced a new generation of lightweight scooters featuring modular battery systems and customizable seating, targeting urban consumers seeking portability and aesthetic flexibility.

-

In March 2024, Ottobock unveiled a smart wheelchair prototype equipped with IoT sensors and a mobile app interface that tracks usage metrics and alerts caregivers of unusual activity, reflecting the trend toward remote monitoring and connected care.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global personal mobility devices market.

Product

-

-

- Premium Rollators

- Low-Cost Rollators

-

- Others (Canes, Crutches, and Walkers)

-

- Manual wheelchairs

- Powered Wheelchairs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)