Pet Insurance Market Size Trends Analysis and Forecast till 2034

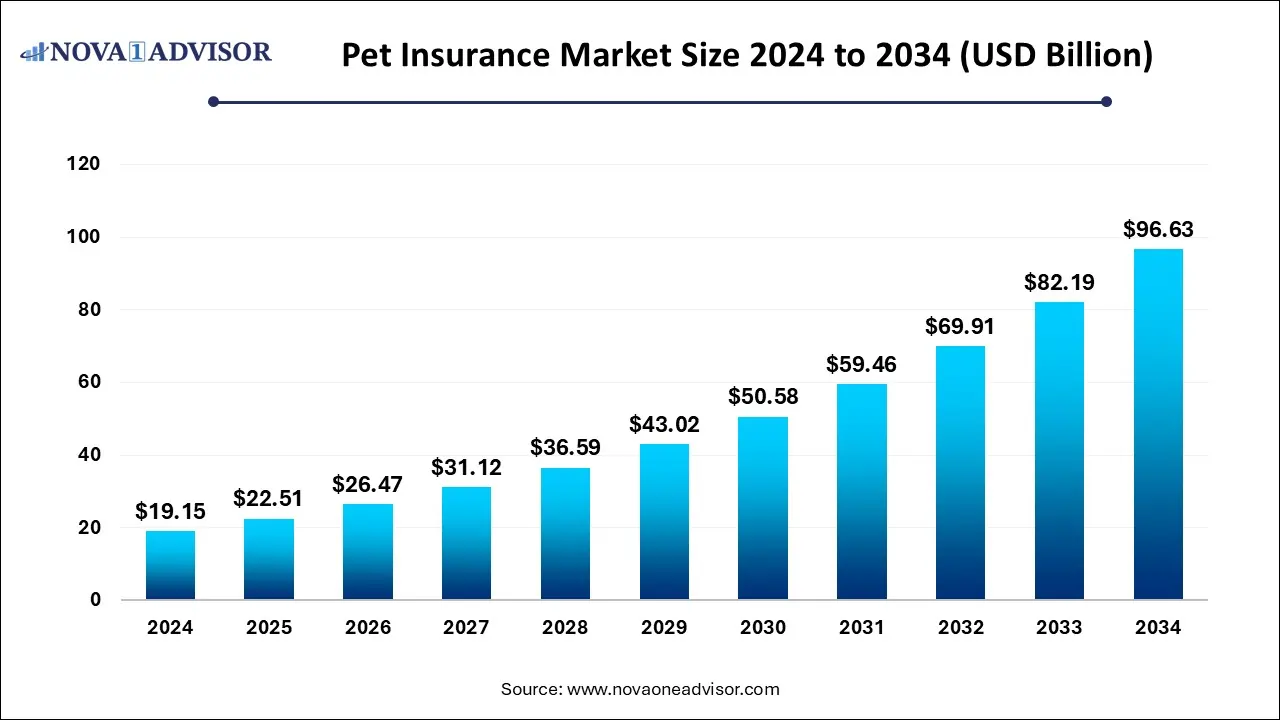

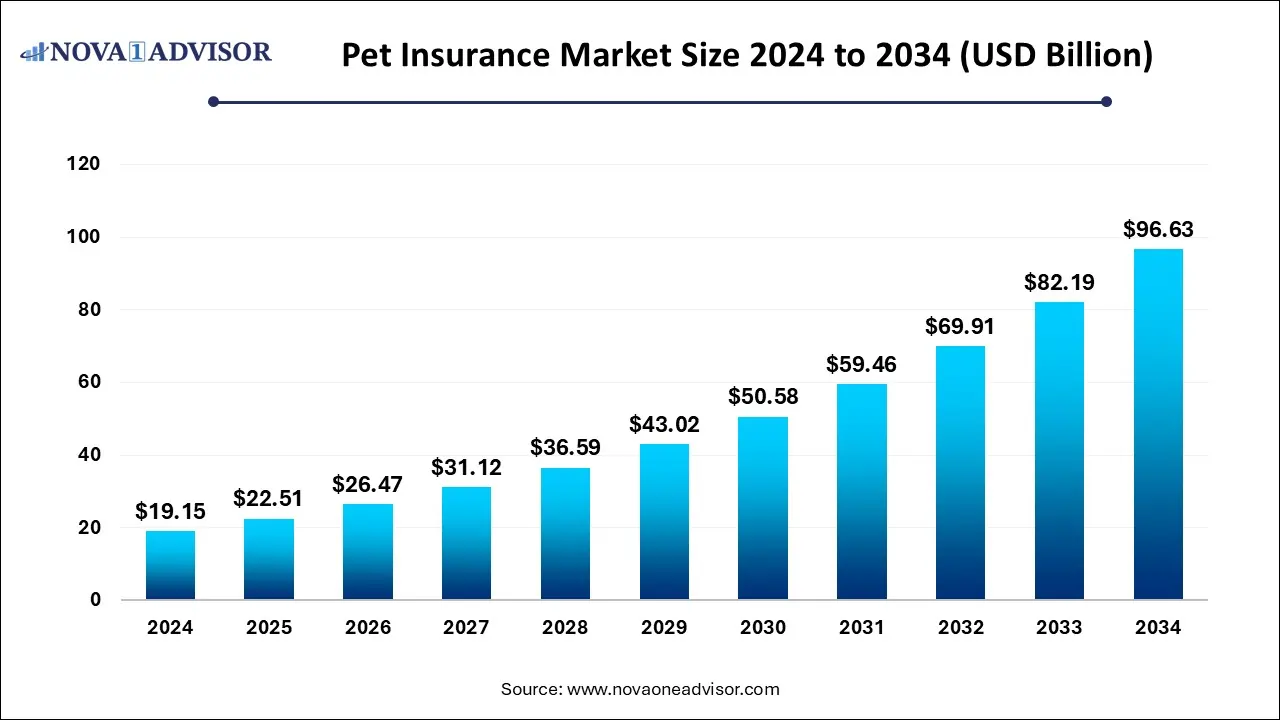

The global pet insurance market size was valued at USD 19.15 billion in 2024, and is predicted to be worth around USD 96.63 billion by 2034, registering a CAGR of 17.57% during the forecast period 2025 to 2034.

Pet Insurance Market Key Takeaways

- By coverage type, the accidents and illness segment dominated the market in 2024.

- By coverage type, the others segment is expected to have the fastest growth rate during the forecast period.

- By sales channel, the direct sales segment led the market this year.

- By sales channel, the others segment is seen to be the fastest growing as of this year.

- By animal type, the dogs segment dominated the market as of this year in 2024.

- By animal type, the cats segment is estimated to grow at the fastest rate.

- By region, North America held the largest market in 2024.

- By region, Asia-Pacific is seen to witness the fastest growth rate throughout the forecast period.

What Does Pet Insurance Industry Offer?

Pet insurance is a policy bought by pet owner that helps to lessen the overall costs of expensive veterinary bills. These policies are similar to health insurance coverage for human being. Pet insurance policies cover either entirely or a part of the medical expenses related to the pet. These insurance policies mainly cover dogs, cats, and horses, while coverage for more exotic animals is also available. Some insurance also includes routine care, general exams, preventative treatment, teeth cleaning, de-worming and even immunizations.

Growing pet adoption and the increasing prevalence of pet disorders is propelling this industry forward. Innovative insurance policies that cover pets of all ages, as well as multi-pet insurance policies that comprise numerous pets in a single plan are on the rise, attracting many consumers.

Market Trends in Pet Insurance Market:

- Pets are largely adopted by people for companionship purposes. There has been a shift in trend from pet owners to pet parents which indicates that pets are considered as a part of family these days.

Pet adoption is proven to assist in low blood pressure, depression and loneliness, thus increasing the number of pet adoptions and boosting the market growth.

- Companies worldwide are innovating multiple solution for their pet owners in order to enhance their policy process.

Rising technological advancements are pushing the market forward. Insurers are leveraging technology in order to streamline processes, and enhance customer experiences by providing more personalized and customizable coverage options.

- As advancements in veterinary medicine rise, it leads to more sophisticated and effective treatments for pets. Pet owners are willing to invest in the well-being of their animals, and insurance serves as a financial safety shield, ensuring that they can afford the best possible care without being burdened by heavy veterinary bills.

What is the Impact of AI in this field?

Pet insurance is one of the fastest-growing lines of insurance. Artificial intelligence (AI) offers various tools to help insurers find new ways to address challenges. AI tools and systems brings faster, smarter, and more consistent decision support all across the value chain.

Pet insurance has always relied on complex nuances like species, breed, age, medical history and lifestyle factors. AI helps to bring all these elements together in real time. Instead of relying only on broad breed averages, underwriters can now get personalized insights into a pet’s expected healthcare costs over time. This leads to more accurate risk assessments and reduced loss ratios. For customers, it means tailored policies which reflects the true health risks of their pet.

Additionally, a pet’s medical history can be a plethora of veterinary notes, lab results, invoices, and prior claims, sometimes being almost 20 or 30 pages long. Manually reviewing this information takes time, and risk indicators can potentially be overlooked. This is where AI comes into play. By scanning and structuring the entire medical journey, AI is able to easily extract most relevant signals, previous diagnoses, recurring treatments, surgeries or early markers of chronic disease. It provides the handler with a concise risk summary and all the necessary recommendations within minutes, making treatment and decision making faster and more efficient.

Report Scope of Pet Insurance Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 22.51 Billion |

| Market Size by 2034 |

USD 96.63 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 17.57% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Coverage, Animal, Sales Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Trupanion, Inc.; Deutsche Familienversicherung AG (DFV); Petplan (Allianz); Jab Holding Company; Direct Line; EQT Group; Lassie; Getsafe GmbH; Waggel Limited; Feather Insurance; Napo Limited; Tesco; Sainsbury Bank Plc; Fressnapf Holding SE; MetLife Services and Solutions, LLC; HDFC Ergo; Nationwide Mutual Insurance Company; Anicom Insurance; AliPay |

Market Dynamics

Driver

Increased Pet Adoption

Increased pet adoption for companionship is a key driving leading to market expansion. The market for pet insurance is expanding more and more as people become increasingly concerned about the health of their companion animals. This is due to a shift from being pet owners to now being pet parents. They are now frequently considered as family members. Adopting a pet is also proven to help with sadness, loneliness, depression, anxiety and low blood pressure, making their presence almost therapeutic.

The growing number of insurance companies providing extensive and flexible insurance policies is another key driver leading to market growth and development. Firms all over the world are launching tailor-made policies that have coverage for chronic diseases, preventive care and even alternative therapies such as acupuncture. Digitalization has also helped in streamlining the process of policy buying, claims handling and customer interaction through mobile apps and online portals.

Restraint

Lack of Awareness

Despite multiple growth factors, the market does have its fair share of restraints that could potentially hinder its development. Lack of awareness and understanding of pet insurance is one such challenge that is limiting the growth of market. This prevents potential customers from recognizing the benefits and value of pet insurance. Additionally, pet owners may not fully understand the benefits of pet insurance, such as financial protection against unexpected veterinary costs and coverage for preventive care. Lack of clear and transparent policy information is leading to slow market entry and growth.

Opportunity

Innovations in Pet Healthcare Technology

Advancements in pet healthcare technology, such as telemedicine and wearable devices are opening up new opportunities for the pet insurance market. Pet insurance products increasingly integrate with advanced technologies that can provide pet owners with more comprehensive and convenient coverage options, such as remote consultations, behavioral training and preventative care. In addition to that, pet insurance providers all over the world are seen increasingly capitalizing on this opportunity by expanding their presence in under developed markets and tailoring their products in order to meet the unique needs of pet owners in these regions.

Another significant opportunity boosting the pet insurance market forward is the rise in the number of businesses operating in the sector. New policy schemes for pets have been introduced due to increased player competition in order to establish a firm presence in the market. Several businesses now provide multi-pet insurance policies, which allow for the enrollment of numerous pets under a single policy. Various other providers are also providing discounts and deals in their pet insurance plans as this helps to keep customers and boost market growth even more.

Segmental Insights

By Coverage Insights

Which coverage segment dominated the market in 2024?

The accident and illness segment dominated the market in 2024. This dominance can be attributed to several critical factors, such as the high costs associated with veterinary treatments and diagnostics, the increasing population of companion animals and the growing awareness about the importance of pet insurance. Pet insurance companies typically offer accident and illness policies that provide comprehensive coverage for various conditions, including acute and chronic diseases, medications, diagnostic tests, and more.

The others segment is projected to experience the fastest growth. This The can be attributed to certain countries, such as Germany, Italy, France, Switzerland, Austria, and Spain, making it mandatory for pet owners to get pet liability insurance. Several insurers have enhanced their policy strategies, offering coverage for pet owners against both physical and material damages caused by pets.

Sales Channel Insights

Which sales channel led the market this year?

The direct sales channel segment led the market as of this year. Major pet insurance providers' significant adoption of direct sales strategies has been a driving factor. They cover chronic diseases, hereditary conditions, surgeries, hospital stays, and emergency care, making them an important option for pet owners who want to ensure their pets receive full medical attention.

The others segment, which contains animal care centers, veterinary clinics etc. is expected to grow at the fastest rate during the forecast period. This growth can be attributed to providers forging multi-pronged partnerships with companies from various sectors to enhance pet benefits and penetrate a larger market. This increased pet owners' access to high-quality and affordable healthcare offerings.

By Animal Insights

Which animal segment dominated the market this year?

The dogs segment held the largest market share in 2024. This can be attributed to the high adoption of dogs as pets across the globe. Most insured pets are dogs, accounting for about almost 80% of the insured population. They come with larger medical bills, more regular checkups with the specialist, and also risk of being harmed or passed down conditions. Golden Retrievers, German Shepherds, and Bulldogs can be at a higher risk for hip dysplasia, heart disease and joint issues. This leads to higher insurance adoption among dog owners, fueling this segment’s growth even more.

The cats segment is expected to grow at the fastest rate over the forecast period. This is largely due to the rising recognition of cats as integral family members, with owners increasingly willing to invest in their long-term health. Cats are prone to chronic conditions such as kidney disease, diabetes, and thyroid disorders, which often requires regular treatment and vet visits, thus making insurance an ideal option. Furthermore, insurers are now tailoring products to feline needs-such as coverage for hereditary conditions and wellness add-ons-which is helping the segment grow even more.

By Regional Analysis

Why is North America dominating the market?

North America dominated the pet insurance market during the forecast period. The region's robust pet industry, increased awareness of pet health, and a cultural inclination towards viewing pets as family members contribute to the high demand for this insurance which is propelling the pet insurance market demand. Well-established economies in countries like the U.S and Canada also lead to greater affordability and accessibility to insurance products. Moreover, the pet humanization trend coupled with a high level of pet ownership, drives the need for comprehensive coverage, making North America a key player and leader in today’s global market.

What are the advancements in Asia-Pacific?

Asia Pacific is expected to grow at the fastest rate throughout the forecast period. This is due to increased care for the well-being of pets. Additionally, there has also been a change in how people respect their pets and view them as family members worldwide. The region’s growth is also being driven due to rising disposable. Furthermore, the region is also home to an increasing number of companies entering the undeveloped market, thus fueling market expansion even more.

Top Key Players in Pet Insurance Market:

Recent Developments

- In July 2024, Governor Josh Shapiro signed pet insurance legislation HB 660 to protect pet parents who purchase pet insurance and address emergency medical costs in the U.S, particularly in Pennsylvania, New York, New Jersey and New Hampshire. This legislation will create a comprehensive legal framework for the sale, solicitation and negotiation of pet insurance policies within the state, leaving no space for hidden fees or any confusion of coverage.

- In February 2024, Tractive, the UK and Europe's largest pet wearables firm launched Tractive Pet Cover, its first insurance product in partnership with Ignite, which is a digital platform for insurance brokers and Covéa, a mutual insurance group. This comprehensive lifetime insurance is available to dog and cat owners in the UK. Here, customers will be able to manage their insurance policies online, including any mid-term adjustments and renewals on the Ignite platform.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pet insurance market.

By Coverage

- Accident & Illness

- Accident only

- Others

By Animal

By Sales Channel

- Agency

- Broker

- Direct

- Bancassurance

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)