Pharmaceutical Contract Manufacturing And Research Services Market Size and Research

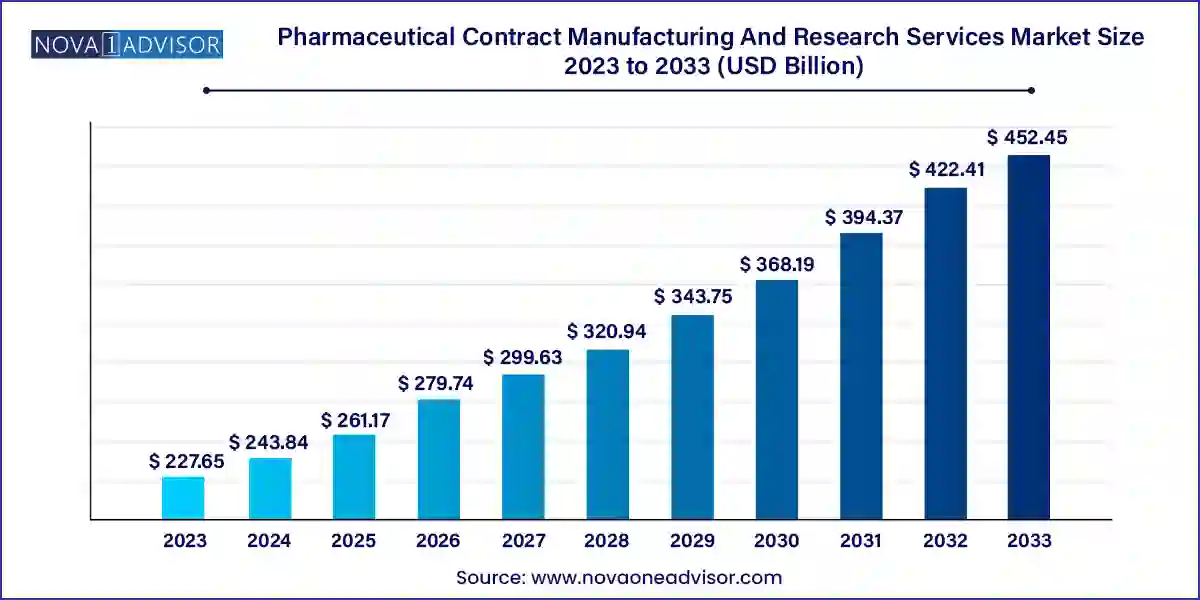

The pharmaceutical contract manufacturing and research services market size was exhibited at USD 227.65 billion in 2023 and is projected to hit around USD 452.45 billion by 2033, growing at a CAGR of 7.11% during the forecast period 2024 to 2033.

Key Takeaways:

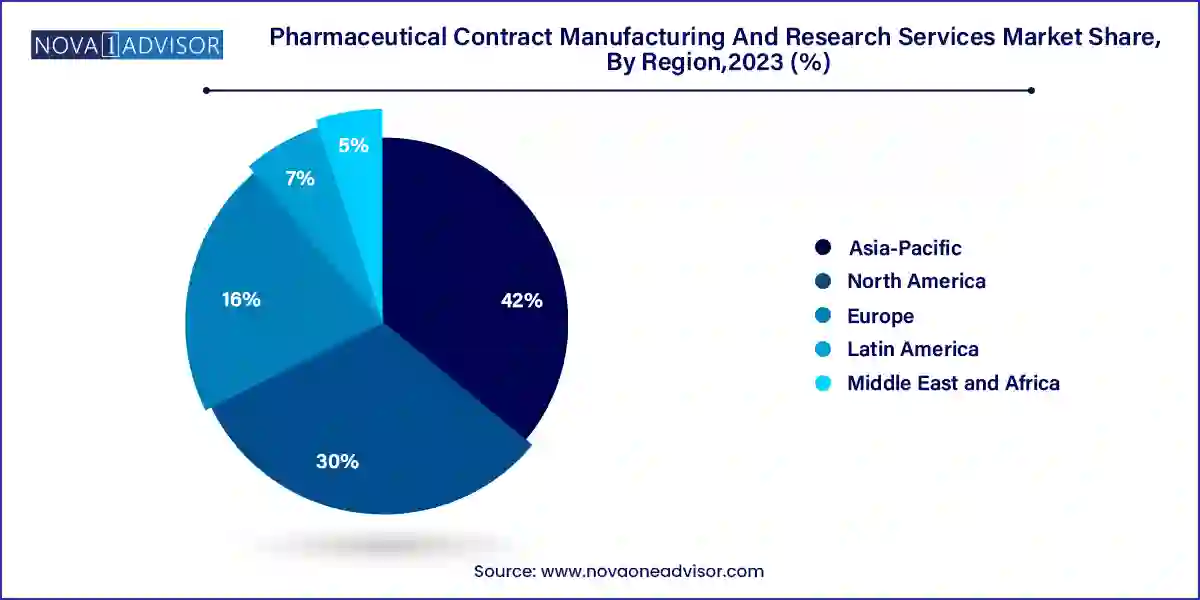

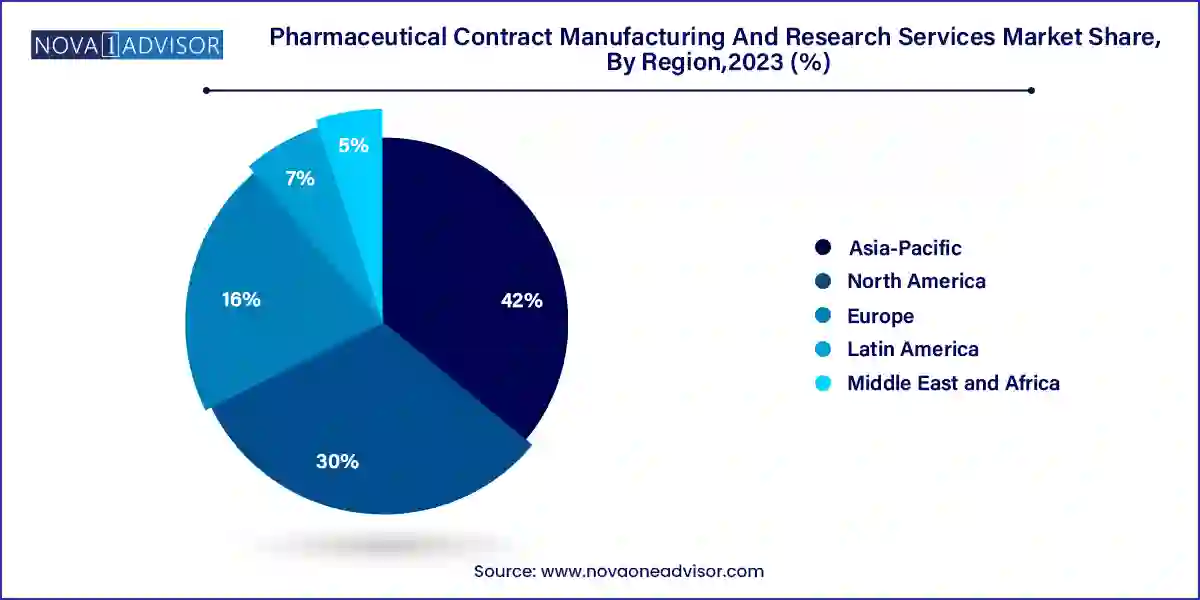

- Asia Pacific dominated the market with a revenue share of over 42.0% in 2023 and is projected to grow at a significant rate over the forecast period.

- The Latin American market is anticipated to witness substantial growth over the forecast period

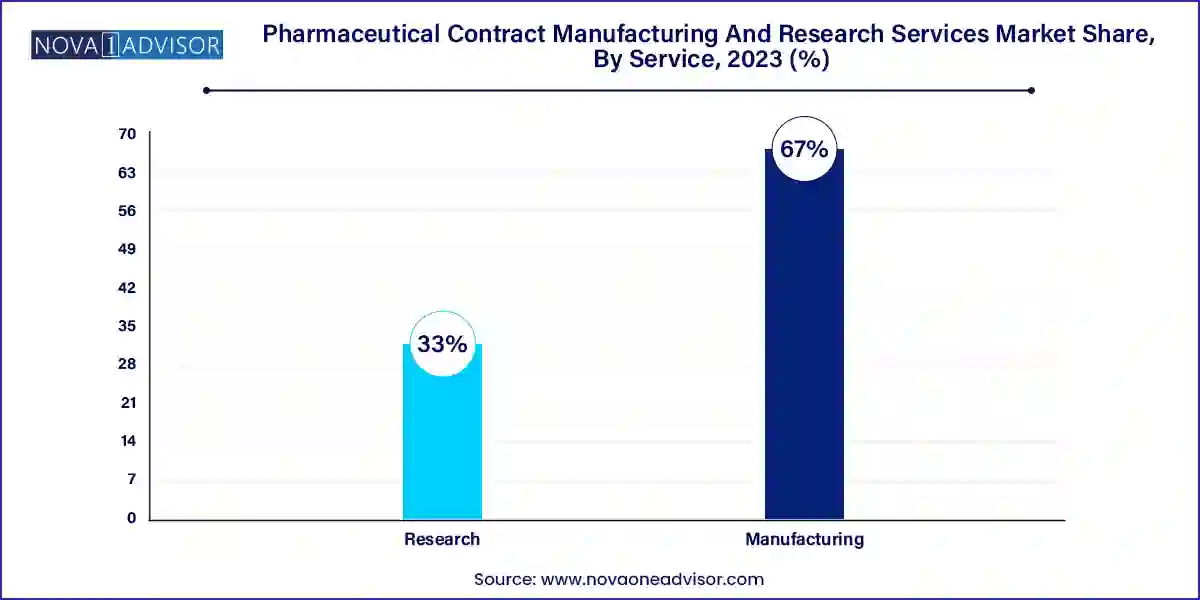

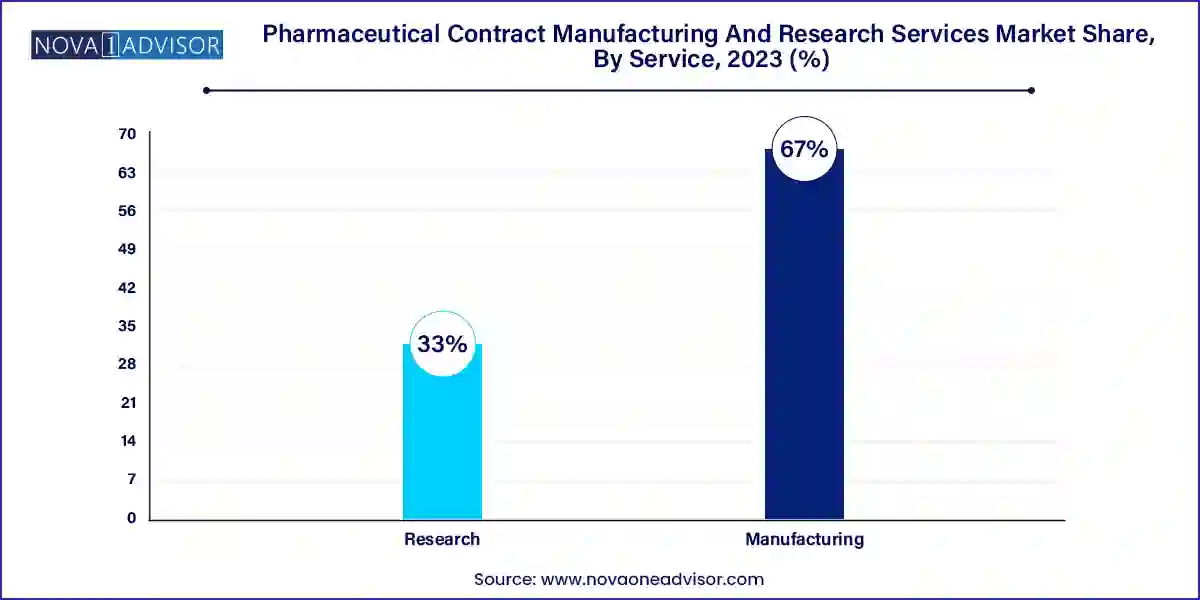

- The manufacturing segment held the largest revenue share of over 67.0% in 2023.

- Finished dose formulations are anticipated to expand at the fastest CAGR of 7.6% over the forecast period.

Market Overview

The Pharmaceutical Contract Manufacturing and Research Services Market has become an indispensable part of the global pharmaceutical value chain. As pharmaceutical companies increasingly prioritize core competencies like innovation and commercialization, they are outsourcing non-core functions—particularly manufacturing and research to Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs). This shift is not merely cost-driven; it's also strategic, allowing companies to scale quickly, accelerate time-to-market, manage risk, and maintain regulatory compliance in an ever-complex landscape.

The market comprises a wide array of services including Active Pharmaceutical Ingredient (API) production, formulation development, packaging, preclinical and clinical research, and specialty services in fields like oncology, neuroscience, and vaccines. The demand for these services is intensifying due to a combination of factors rising R&D expenditures, the boom in biologics and biosimilars, increased regulatory scrutiny, and the need for operational flexibility.

Moreover, the surge in personalized medicine, complex therapeutics, and advanced drug delivery technologies is shifting expectations from CMOs and CROs. Pharmaceutical sponsors are now seeking end-to-end solutions, long-term partnerships, and innovative capabilities rather than just capacity outsourcing. This evolution is driving consolidation in the industry, with large service providers acquiring niche firms to offer integrated services under a single umbrella.

COVID-19 further demonstrated the strategic importance of contract services. Rapid vaccine development, clinical trial acceleration, and supply chain disruptions reinforced the critical role of agile and globally networked partners. Moving forward, the market is expected to expand significantly, supported by digital transformation, emerging markets, and the transition toward outcome-based healthcare delivery.

Major Trends in the Market

-

End-to-End Integrated Services: Sponsors increasingly prefer vendors that can handle everything from preclinical studies to commercial-scale manufacturing.

-

Specialization in Biologics and Cell & Gene Therapy: Advanced biologics are driving demand for specialized CMOs/CROs with high-containment, cold chain, and complex manufacturing expertise.

-

Rise of Oncology-Focused Research Services: Oncology remains the dominant therapeutic area in global clinical trials, fueling specialized oncology CROs and biomarker research.

-

AI and Digital Tech in R&D: CROs are adopting AI for protocol design, patient recruitment, and trial monitoring, drastically improving speed and accuracy.

-

Flexible and Modular Manufacturing Facilities: CMOs are building multi-purpose, modular facilities to accommodate changing demand across different dosage forms and molecules.

-

Quality Compliance and Regulatory Expertise: Increasing regulatory scrutiny from FDA, EMA, and regional bodies is elevating the need for partners with strong compliance records.

-

Emerging Market Contracting: Asia-Pacific, especially India and China, is becoming a cost-effective and quality-competitive hub for both research and manufacturing services.

-

Strategic Collaborations and M&As: Partnerships between pharmaceutical giants and CDMO/CRO firms are rising to secure capacity, enhance pipeline efficiency, and ensure global supply.

Report Scope of Pharmaceutical Contract Manufacturing And Research Services Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 243.84 Billion |

| Market Size by 2033 |

USD 452.45 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Key Companies Profiled |

Catalent; Pharmaceutical Product Development LLC; AbbVie; Baxter BioPharma Solutions; Patheon; Grifols International, S.A.; Dalton Pharma Services; Boehringer Ingelheim Biopharmaceuticals GmbH; Lonza AG |

Market Driver: Increasing Outsourcing by Pharmaceutical and Biotech Companies

One of the primary drivers of the pharmaceutical contract manufacturing and research services market is the increased outsourcing by pharmaceutical and biotechnology firms to optimize operational efficiency and focus on core innovation. As drug development becomes more expensive and competitive, companies are turning to CMOs and CROs to reduce capital investment in infrastructure, de-risk their operations, and access specialized technologies.

Outsourcing allows firms to quickly scale their production capabilities, adapt to global demand fluctuations, and reduce time-to-market. This is especially valuable in the case of startups or virtual biotech firms that lack the resources for in-house development or manufacturing. Moreover, big pharma companies are increasingly divesting their manufacturing sites and entering long-term agreements with external partners to enhance supply chain agility and responsiveness to regulatory changes.

Market Restraint: IP and Data Security Concerns

A critical restraint in the market is intellectual property (IP) and data security concerns. As pharmaceutical and biotech companies outsource sensitive components of drug development such as proprietary formulations, molecular data, and clinical trial designs they expose themselves to risks related to IP theft, data breaches, and competitive leakage.

While most large CMOs and CROs operate under strict confidentiality agreements and robust compliance frameworks, geopolitical tensions, varying international IP laws, and differing cybersecurity standards introduce uncertainty, particularly in cross-border collaborations. These concerns are especially prominent when outsourcing to developing regions where legal enforcement might be inconsistent. Such issues may lead companies to limit outsourcing to non-core functions or select only trusted global vendors with strong compliance reputations.

Market Opportunity: Expansion in Biopharmaceutical and Specialty Drug Development

An exciting growth opportunity lies in the expanding development of biopharmaceuticals and specialty drugs, including monoclonal antibodies, cell and gene therapies, and advanced delivery systems. These therapies require unique manufacturing conditions such as sterile environments, cryogenic storage, and small-batch capabilities—which are not available in traditional manufacturing setups.

CMOs and CROs that invest in these capabilities are positioned to capture significant market share, especially as large pharmaceutical firms increasingly partner with niche players to develop complex biologics. Furthermore, advancements in recombinant technology, personalized medicine, and biomarker-based trials are creating an ecosystem where specialist service providers can thrive by offering customized solutions, regulatory guidance, and advanced analytics. As the biologics pipeline expands globally, so does the opportunity for targeted contract services.

Pharmaceutical Contract Manufacturing And Research Services Market By Service Insights

Manufacturing services dominate the overall market, driven by the high demand for large-scale production of APIs, bulk drugs, and finished dosage formulations. Pharmaceutical companies increasingly depend on CMOs for flexible production models that help manage shifting pipeline priorities and regulatory requirements. Within this category, API and bulk drug production remains the largest contributor due to the consistent global demand for active compounds across generics, specialty drugs, and over-the-counter medicines. CMOs with high-containment capabilities and regulatory-compliant infrastructure continue to attract long-term partnerships from pharma giants.

Advanced drug delivery formulations and packaging are the fastest-growing manufacturing segments, fueled by the demand for sustained-release drugs, targeted therapies, and patient-friendly formats such as transdermal patches and pre-filled syringes. Similarly, packaging services have evolved beyond simple labeling to include tamper-evidence technologies, smart packaging, and cold chain-enabled logistics. These features are increasingly important for biologics and specialty drugs requiring stringent handling conditions. Service providers investing in automation, serialization, and global track-and-trace capabilities are seeing increased client retention and expanded contracts.

Pharmaceutical Contract Manufacturing And Research Services Market By Regional Insights

Asia-Pacific is the fastest-growing regional market, fueled by a blend of cost-effective production, skilled workforce availability, and increasing local demand for pharmaceutical innovation. India and China, in particular, have become global hubs for contract manufacturing and research due to their regulatory improvements, GMP-certified facilities, and expansive API production ecosystems. Companies like Wuxi AppTec (China) and Syngene International (India) have emerged as leading global players.

The region is also experiencing a boom in clinical trials, as sponsors seek access to large, treatment-naïve populations, faster recruitment, and growing regulatory alignment with global standards. Japan, South Korea, and Australia contribute to the region’s strong clinical research capacity, especially in oncology and rare diseases. Investments in biologics and vaccine development in Asia-Pacific are further propelling demand for high-end contract services, cementing its role as a vital node in global pharmaceutical outsourcing.

North America leads the pharmaceutical contract manufacturing and research services market, owing to its concentration of pharmaceutical companies, advanced regulatory infrastructure, and technological leadership. The U.S. in particular houses major pharma players, including Pfizer, Merck, Amgen, and Eli Lilly, which regularly outsource manufacturing and clinical trial operations to domestic and international partners. The presence of globally recognized CDMOs and CROs such as Thermo Fisher Scientific, Catalent, and Charles River Laboratories reinforces the region’s leadership.

Additionally, the regulatory rigor of the U.S. FDA has raised the bar for global service providers, making North America a gold standard in contract services. The region also benefits from strong academic-industry collaborations and early adoption of digital and decentralized clinical trial technologies. With the growing pipeline of complex biologics and a robust generics market, North America continues to set the tone for innovation and scale in this sector.

Some of the prominent players in the Pharmaceutical contract manufacturing and research services market include:

- Catalent

- Pharmaceutical Product Development LLC

- AbbVie

- Baxter BioPharma Solutions

- Patheon

- Grifols International, S.A.

- Dalton Pharma Services

- Boehringer Ingelheim Biopharmaceuticals GmbH

- Lonza AG

Recent Developments

-

February 2025: Catalent announced the expansion of its Maryland facility to increase biologics drug substance production capacity, targeting the growing demand for gene and cell therapy manufacturing.

-

November 2024: Charles River Laboratories acquired a European CRO specializing in oncology and rare disease trials, enhancing its early-phase clinical research capabilities in precision medicine.

-

September 2024: Lonza signed a multi-year manufacturing deal with a leading mRNA vaccine developer to support both clinical and commercial-scale production.

-

July 2024: Thermo Fisher Scientific opened a new sterile fill-finish facility in Singapore to support global supply chains for injectable biologics and vaccines.

-

May 2024: Syngene International signed a strategic collaboration with a U.S.-based biotech company to provide end-to-end development and manufacturing services for a novel immunotherapy pipeline.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the pharmaceutical contract manufacturing and research services market

Service

-

- API/Bulk Drugs

- Advanced Drug Delivery Formulations Packaging

- Packaging

- Finished Dose Formulations

-

-

- Solid Formulations

- Liquid Formulations

- Semi-solid Formulations

-

- Oncology

- Vaccines

- Inflammation & Immunology

- Cardiology

- Neuroscience

- Others

Regional

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa