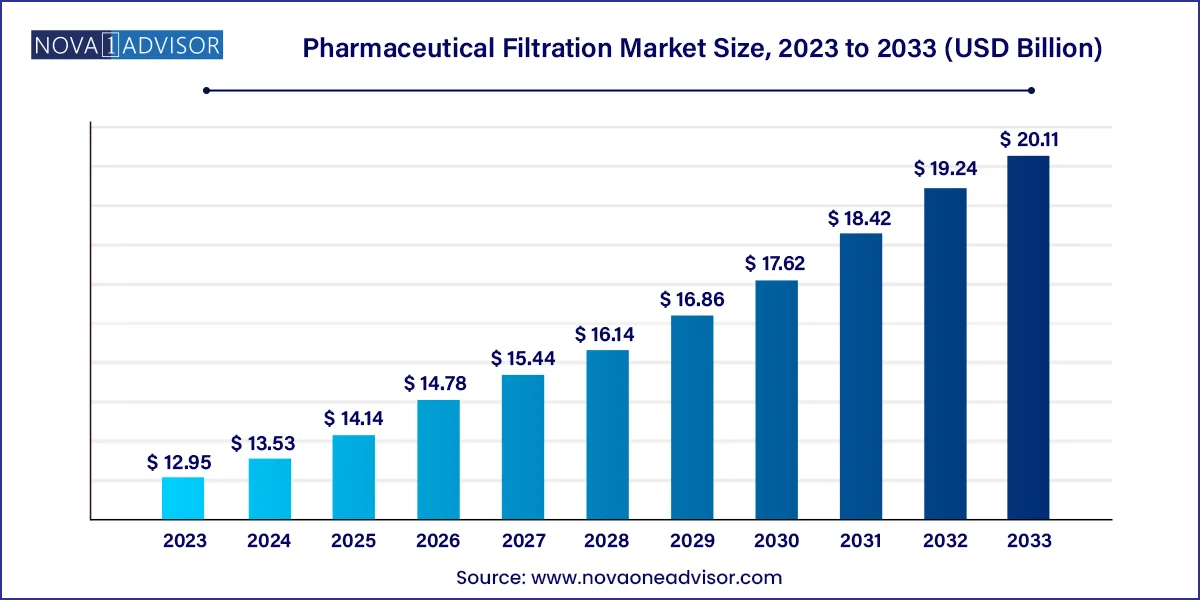

The global Pharmaceutical Filtration market size was estimated at USD 12.95 billion in 2023 and is expected to be worth around USD 20.11 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 4.5% during the forecast period 2024 to 2033.

Pharmaceutical Filtration Market Key Takeaways

- In 2023, North America dominated the industry with a revenue share of 45.19%.

- Asia Pacific is anticipated to register the highest CAGR of 14.48% during the forecast period.

- In the product segment, membrane filters held the largest market share of 29.08% in 2023 and are expected to grow at the fastest CAGR of 9.33% from 2024 to 2033.

- The single-use system is also expected to grow at a significant CAGR of 8.15% during the forecast period.

- The microfiltration segment held the largest share of 37.41% in 2023.

- The nanofiltration segment is estimated to grow at the fastest CAGR of 10.30% during the forecast period.

- The sterile type segment held the largest share of 57.79% of the market in 2023.

- The non-sterile type of segment is estimated to grow at a CAGR of 7.85% from 2024 to 2033.

- The final product processing segment held the largest share of 43.55% in 2023.

- The cell separation segment is estimated to grow at a CAGR of 8.14% during 2024-2033.

- The manufacturing scale of operations held a dominant share of 67.95% in the year 2023.

- The research and development scale segment is estimated to grow at the fastest CAGR of 11.41% during the forecast period.

Pharmaceutical Filtration Market Overview

The pharmaceutical filtration market is a critical pillar of biopharmaceutical manufacturing, ensuring product sterility, purity, and quality across all stages of drug development and production. Filtration processes are employed extensively in removing particulates, microorganisms, and unwanted substances from liquid or gas drug formulations. Whether used for sterile filtration of injectable products, cell separation, air purification in cleanrooms, or virus removal in bioprocessing filtration is indispensable to modern pharmaceutical operations.

The market has experienced significant growth in recent years, driven by the rise of biologics, personalized medicine, and global vaccination campaigns. Biopharmaceutical companies, contract manufacturing organizations (CMOs), and research labs rely on advanced filtration systems to comply with stringent regulatory standards enforced by authorities like the FDA, EMA, and WHO. Additionally, the shift towards single-use technologies, especially in small-batch or personalized drug production, has revolutionized filtration workflows, reducing cross-contamination and turnaround times.

With innovation accelerating in the development of monoclonal antibodies (mAbs), mRNA vaccines, cell and gene therapies, and recombinant proteins, the demand for highly specialized, high-throughput, and sterile filtration systems is set to expand dramatically across the globe.

Major Trends in the Market

-

Shift Toward Single-use Systems (SUS): Pharma companies are embracing disposable filters to reduce cleaning validation time, cost, and contamination risk.

-

High Demand for Biopharmaceutical Filtration: The rise in biosimilars, vaccines, and antibody therapies is pushing filtration systems designed for high molecular weight compounds.

-

Integration of Automation and Digital Monitoring: Smart filtration systems with flow rate monitoring, pressure sensors, and data logging capabilities are in demand.

-

Customized Membrane Technologies: Tailor-made filters for specific applications such as viral clearance, protein purification, and aseptic processing are gaining traction.

-

Increase in Outsourcing and CMOs: Contract manufacturers are investing in scalable filtration technologies to support multiple client workflows.

-

Sustainability in Filter Design: Eco-friendly materials and energy-efficient filtration units are being developed in response to global sustainability goals.

-

Regulatory Pressure for Sterility Assurance: Global harmonization of cGMP practices has led to increased demand for validated and documented sterile filtration.

-

Use of Nanotechnology and Advanced Polymers: Innovations are enhancing pore uniformity, pressure tolerance, and chemical compatibility.

-

3D Printing for Customized Filter Holders: Precision printing is being explored for rapid prototyping and pilot-scale filtration solutions.

-

Surge in mRNA and Viral Vector Manufacturing: Emerging therapeutic modalities require high-performance filtration systems with viral retention capabilities.

Pharmaceutical Filtration Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 13.53 Billion |

| Market Size by 2033 |

USD 20.11 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.5% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, technique, type, application, scale of operation, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Eaton; Merck KGaA; Amazon Filters Ltd.; Thermo Fisher Scientific Inc; Parker Hannifin Corp; 3M; Sartorius AG.; Graver Technologies; Danaher; Meissner Filtration Products, Inc. |

Key Market Driver: Growing Biopharmaceutical Production and Sterility Standards

A primary driver of the pharmaceutical filtration market is the rapid expansion of biopharmaceutical production, which necessitates rigorous sterility and impurity control. The global biologics market including monoclonal antibodies, gene therapies, and recombinant proteins requires multi-step filtration to eliminate microorganisms, pyrogens, and cell debris.

Unlike small-molecule drugs, biologics are highly sensitive to changes in pressure, temperature, and pH, making specialized filtration solutions vital. For example, sterile filtration ensures that final drug products meet endotoxin limits, while virus filtration provides regulatory assurance for viral safety in mAb production.

Manufacturers are increasingly investing in integrated filtration solutions that can meet the demands of high-volume, high-purity production especially as new biologics enter clinical pipelines. Regulatory bodies have also intensified focus on aseptic processes, mandating validated filtration steps at both upstream and downstream stages, further boosting market demand.

Key Market Restraint: High Capital Investment and Validation Costs

Despite its essential role, the pharmaceutical filtration market faces constraints, most notably the high capital investment required for equipment procurement, qualification, and validation. Sophisticated membrane filters, sterile cartridges, and automated filtration skids can represent substantial upfront costs particularly for small or early-stage biotech firms.

Moreover, stringent regulatory standards necessitate extensive validation of filtration processes, including microbial retention, integrity testing, leachables/extractables assessments, and compatibility studies. These processes are not only time-consuming but also resource-intensive.

Frequent batch changes, especially in multiproduct facilities, further necessitate high filter turnover or the use of costly single-use components. While these systems reduce contamination risks, they also drive up recurring costs. As a result, organizations with limited budgets may be deterred from fully optimizing their filtration infrastructure, potentially limiting broader adoption.

Key Market Opportunity: Expansion of Cell & Gene Therapy Manufacturing

An exciting opportunity lies in the emergence of cell and gene therapy (CGT) manufacturing, where filtration plays a pivotal role in ensuring product safety and efficacy. CGTs involve the use of living cells and viral vectors, which require customized sterile filtration for purification, concentration, and removal of residual DNA, host cell proteins, and viruses.

Since these therapies are often manufactured in small, patient-specific batches, flexible, single-use, and modular filtration systems are ideal. Companies producing CAR-T therapies or AAV-based gene therapies must integrate multiple filtration steps to comply with global sterility and viral safety standards.

Vendors that can develop miniaturized, scalable filtration devices tailored for CGT pipelines—and provide documentation for rapid regulatory submission—stand to gain significantly. With hundreds of CGTs in late-stage development, this segment offers an immense and underexplored growth frontier within pharmaceutical filtration.

Product Insights

Membrane filters dominated the market in 2024. Membrane filters are widely used due to their versatility and effectiveness in microfiltration and sterilization. Among membrane types, PTFE and PVDF filters are favored for their chemical resistance and high flow rates, especially in final drug formulation, sterile filtration, and buffer preparation. MCE membranes are commonly used in quality control and microbiological testing.

Single-use systems are the fastest-growing product segment. These disposable filtration setups reduce contamination risk and eliminate the need for cleaning validation—particularly useful for CMOs and facilities managing multiple drug products. With the shift toward flexible manufacturing, especially in biologics and small-batch production, the adoption of single-use cartridges, capsules, and manifolds is rapidly expanding.

Technique Insights

Microfiltration dominated the technique segment. Microfiltration is essential for removing bacteria, suspended solids, and debris during drug manufacturing. It is widely used in sterile filtration, vaccine production, and cell harvesting processes. Its dominance is attributed to its broad applicability and cost-effectiveness.

Nanofiltration is projected to be the fastest-growing technique. Nanofiltration enables precise separation at the molecular level and is increasingly employed in antibody purification, hormone processing, and virus removal. The ability to retain small molecules while allowing solvents and salts to pass makes nanofiltration an attractive choice for biologics and complex drug formulations.

Type Insights

Sterile filtration dominated the type segment. As regulatory bodies demand stricter controls for injectable and parenteral drugs, sterile filtration has become a mandatory step across nearly all final product workflows. PTFE, PES, and PVDF membranes dominate this area.

Non-sterile filtration, while still essential, is used mainly in raw material filtration and media preparation. Although it accounts for a smaller share, it remains relevant in early manufacturing steps and general lab operations.

Application Insights

Final product processing led the market by application. This includes active pharmaceutical ingredient (API) filtration, sterile filtration, protein purification, formulation filling, and viral clearance. Final product filtration is critical to ensure that the drug delivered to patients is sterile, potent, and free from impurities.

Cell separation is expected to grow rapidly. This process is essential for biopharma applications such as vaccine production, monoclonal antibody development, and cell therapy. Advanced filtration tools, including tangential flow filters and pre-sterilized filter assemblies, are gaining ground in this space.

Scale of Operation Insights

Manufacturing scale operations accounted for the largest share. Large-scale facilities use multi-batch, high-throughput filtration systems for consistent, GMP-compliant output. This includes the use of capsule filters, bulk membrane skids, and disposable manifolds.

Research & development scale is the fastest-growing due to rising investment in clinical research, drug discovery, and pilot-scale production. Modular and small-volume filter systems are increasingly favored by biotech startups and academic institutions focused on niche biologics and personalized medicine.

Regional Insights

North America remains the global leader in pharmaceutical filtration, thanks to its established pharmaceutical infrastructure, presence of major biopharma players, and stringent regulatory landscape. The U.S. is home to key innovators such as Merck, Pfizer, and Amgen, all of which operate sophisticated, GMP-compliant facilities requiring validated filtration systems.

Additionally, public and private investment in biologics and vaccine development such as Operation Warp Speed and NIH grants have accelerated demand for sterile, high-performance filtration technologies in the region.

.webp)

Asia Pacific is the fastest-growing market, fueled by rapid pharmaceutical industrialization in countries like China, India, South Korea, and Singapore. Government initiatives to promote biosimilars, generic drugs, and vaccine self-sufficiency are creating substantial demand for filtration systems.

India’s push for “Make in India” in pharmaceuticals, China’s biopharma innovation drive, and increased FDI in Southeast Asia are drawing global manufacturers to localize operations. Additionally, growing awareness of cGMP and WHO guidelines is accelerating adoption of advanced, validated filtration in both public and private healthcare sectors.

Pharmaceutical Filtration Market Top Key Companies:

- Eaton.

- Merck KGaA

- Amazon Filters Ltd.

- Thermo Fisher Scientific Inc.

- Parker Hannifin Corp.

- 3M

- Sartorius AG.

- Graver Technologies

- Danaher.

- Meissner Filtration Products, Inc

Recent Developments

-

February 2025 – Merck Millipore introduced its Millipak® Gold sterile filter series designed to enhance downstream sterilization of biologics, with low protein binding and gamma compatibility.

-

December 2024 – Sartorius AG announced a $100 million expansion of its filtration membrane production site in Puerto Rico to meet growing demand in vaccine manufacturing.

-

November 2024 – Danaher Corporation (Pall Corporation) launched the KrosFlo® KR2i TFF system, a compact, automated ultrafiltration device aimed at small-scale mAb developers and gene therapy labs.

-

September 2024 – 3M Health Care collaborated with a leading Indian vaccine manufacturer to provide customized viral clearance filters for their COVID-19 and polio vaccine lines.

-

July 2024 – GE Healthcare Life Sciences rolled out an advanced AI-driven filter performance tracker, enabling predictive maintenance and batch analytics in pharmaceutical manufacturing.

Pharmaceutical Filtration Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharmaceutical Filtration market.

By Product

- Membrane Filters

- MCE Membrane Filters

- Coated Cellulose Acetate Membrane Filters

- PTFE Membrane Filters

- Nylon Membrane Filters

- PVDF Membrane Filters

- Other Membrane Filters

- Prefilters & Depth Media

- Glass Fiber Filters

- PTFE Fiber Filters

- Single-use Systems

- Cartridges & Capsules

- Filter Holders

- Filtration Accessories

- Others

By Technique

- Microfiltration

- Ultrafiltration

- Cross Flow Filtration

- Nanofiltration

- Others

By Type

By Application

- Final Product Processing

- Active Pharmaceutical Ingredient Filtration

- Sterile Filtration

- Protein Purification

- Vaccines And Antibody Processing

- Formulation And Filling Solutions

- Viral Clearance

- Raw Material Filtration

- Media Buffer

- Pre-filtration

- Bioburden Testing

- Cell Separation

- Water Purification

- Air Purification

By Scale of Operation

- Manufacturing Scale

- Pilot Scale

- Research & Development Scale

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.webp)