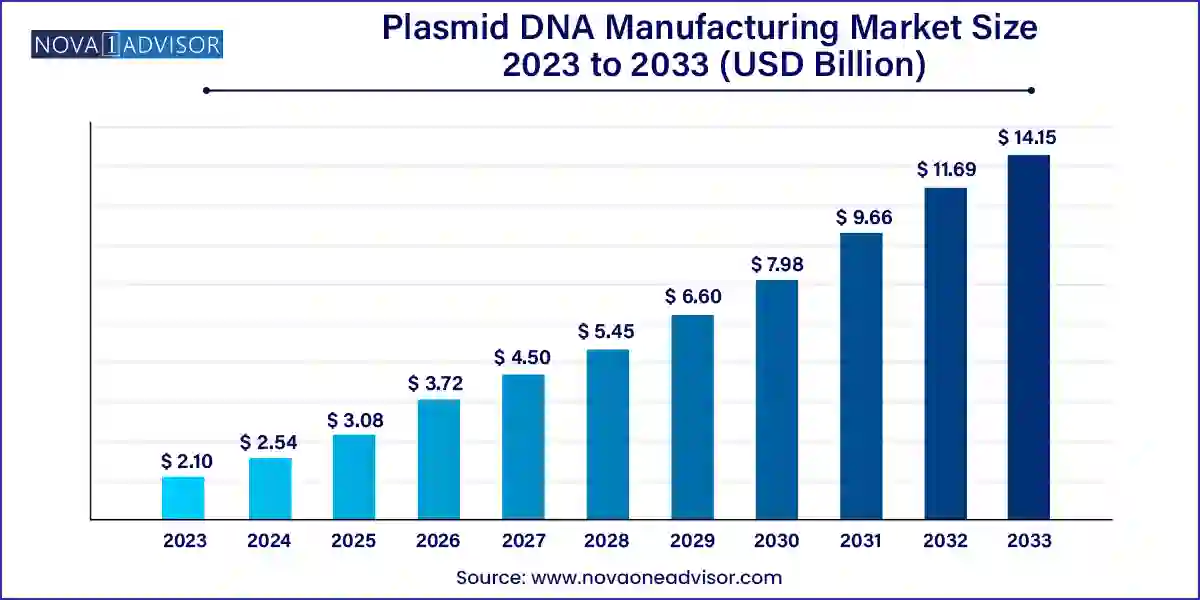

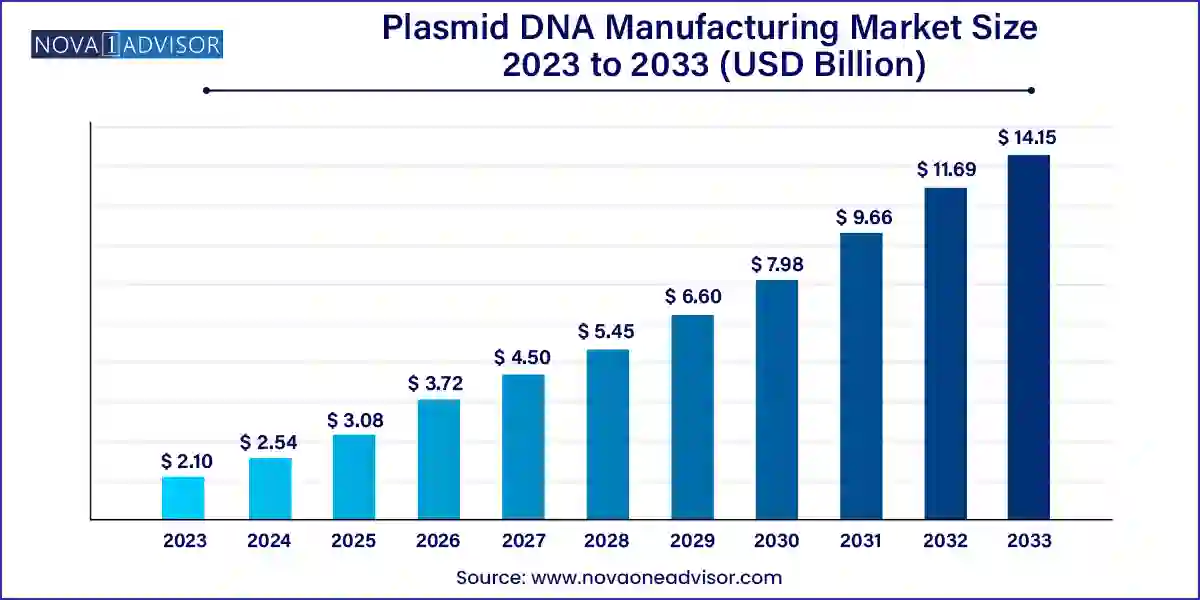

Plasmid DNA Manufacturing Market Size and Growth

The global plasmid DNA manufacturing market size was valued at USD 2.10 billion in 2023 and is anticipated to reach around USD 14.15 billion by 2033, growing at a CAGR of 21.02% from 2024 to 2033.

Plasmid DNA Manufacturing Market Key Takeaways

- North America held the largest market share of 42.22% of the global market in 2023.

- Asia Pacific is anticipated to register the fastest CAGR of 22.57% from 2024 to 2033

- The pre-clinical therapeutics segment is expected to witness the fastest CAGR of 23.60% from 2024 to 2033.

- The clinical therapeutics segment held the largest market share of 55.19% in 2023.

- The cell & gene therapy segment held the largest market share of 55.33% in 2023.

- The DNA vaccines segment is expected to witness the fastest CAGR of 23.66% from 2024 to 2033.

- The cancer segment held the largest market share of 42.55% in 2023 and is expected to witness the fastest CAGR of 22.78% from 2024 to 2033.

- The growing prevalence of cancer is expected to positively influence the regional market throughout the forecast period.

- The GMP grade segment held the largest market share of 86.19% in 2023.

Market Overview

The Plasmid DNA (pDNA) Manufacturing Market is an essential and rapidly expanding segment of the global biotechnology and pharmaceutical ecosystem. Plasmid DNA acts as a foundational element in gene therapy, cell therapy, DNA vaccines, and immunotherapy, as it serves as a vehicle to deliver therapeutic genetic material into target cells. With the growing global focus on precision medicine, personalized treatments, and advanced therapeutic platforms, the demand for high-quality plasmid DNA has increased substantially.

Plasmid DNA is manufactured using bacterial fermentation and purification technologies, and depending on the end-use, it must meet stringent quality standards such as research-grade (R&D) or Good Manufacturing Practice (GMP) grade for clinical applications. Its role has become particularly critical with the rise of genetic engineering, where pDNA is used not only as a therapeutic agent but also as a critical raw material for mRNA production, viral vector production (e.g., AAV, lentivirus), and CAR-T therapies.

The market is experiencing an exceptional growth trajectory, driven by clinical advancements, increasing R&D funding, and recent regulatory approvals of pDNA-based therapies and vaccines. As of 2024, the global plasmid DNA manufacturing market is estimated at USD 950 million, and it is projected to grow at a CAGR of over 14% through 2030, reaching an expected valuation of over USD 2.2 billion. Demand is driven by a mix of academic research, clinical pipelines in cell and gene therapy, and commercial vaccine development efforts.

Major Trends in the Market

-

Rise in Demand for GMP-Grade Plasmid DNA: As clinical trials progress into late stages, the demand for high-purity, GMP-compliant plasmid DNA is surging.

-

Expansion of CDMO Capabilities: Contract development and manufacturing organizations are scaling up plasmid DNA manufacturing to support global biopharma clients.

-

Integration into mRNA Vaccine Production: Plasmid DNA serves as a key template for in vitro transcription in mRNA vaccine workflows.

-

Mini Circle and Supercoiled Plasmid DNA: Innovations in plasmid design, such as minicircle and supercoiled DNA, are gaining favor for better transfection efficiency.

-

Automation and Closed-System Bioreactors: Manufacturers are adopting scalable and automated systems to maintain consistency and reduce contamination.

-

Geographic Diversification of Manufacturing Sites: Companies are building facilities in North America, Europe, and Asia to reduce supply chain risk.

-

Custom Manufacturing and Modular Kits: Tailor-made pDNA constructs for CRISPR, shRNA, and synthetic biology applications are becoming mainstream.

-

Sustainability and Cost Reduction Initiatives: Bioprocessing advancements aim to lower plasmid production costs while maintaining high yields.

Plasmid DNA Manufacturing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 2.54 Billion |

| Market Size by 2033 |

USD 14.15 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 21.02% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Grade, development phase, application, disease, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); Kaneka Corp.; Nature Technology; Cell and Gene Therapy Catapult; Eurofins Genomics; Lonza; Luminous BioSciences, LLC; Akron Biotech |

Market Driver: Rapid Expansion of Gene and Cell Therapy Pipelines

The principal driver for the plasmid DNA manufacturing market is the exponential growth of the gene and cell therapy development pipeline, spanning preclinical to commercial stages. Plasmid DNA serves as the molecular template in these therapies, enabling the insertion of therapeutic genes into vectors or directly into host cells. As more gene therapies receive regulatory approval and move toward commercialization, demand for large-scale, clinical-grade plasmid DNA production is increasing.

For instance, CAR-T cell therapies like Kymriah and Yescarta depend on viral vectors that are themselves manufactured using plasmids as core starting materials. Similarly, AAV and lentiviral vectors used in gene therapy for rare diseases and inherited disorders require plasmids for capsid production, genome transfer, and regulatory functions. The surge in Investigational New Drug (IND) applications globally particularly in oncology and rare diseases translates directly into rising plasmid DNA production volumes.

In 2023 alone, over 2,000 gene therapy trials were active worldwide, and nearly every one of them required specialized pDNA constructs. The demand is further amplified by the growing interest in personalized medicine and the increasing number of biotech startups specializing in nucleic acid-based therapies.

Market Restraint: Manufacturing Complexity and Quality Control Challenges

Despite its promise, the plasmid DNA manufacturing industry is constrained by technical complexity, long production cycles, and the stringent quality control requirements necessary to meet regulatory standards. Producing plasmid DNA involves upstream fermentation using genetically engineered E. coli, followed by a multi-step downstream purification process that must eliminate bacterial endotoxins, host cell proteins, and residual genomic DNA.

These steps are resource-intensive, time-consuming, and require sophisticated bioprocessing infrastructure and trained personnel. Moreover, the final product must be highly pure and supercoiled to ensure effective transfection, which is difficult to achieve consistently at scale. Variability in plasmid yields, contamination risks, and lot-to-lot inconsistencies can delay clinical programs and result in batch rejections.

Additionally, as the field matures, regulatory agencies are becoming more stringent in their expectations, requiring detailed documentation on raw materials, traceability, vector backbone design, and GMP compliance. These regulatory burdens increase costs and limit the number of facilities capable of high-quality plasmid production, potentially creating bottlenecks in therapeutic supply chains.

Market Opportunity: Demand for In-House and Hybrid Manufacturing Models

A significant opportunity lies in the emergence of hybrid and in-house plasmid DNA manufacturing models. Traditionally, biopharma companies have relied heavily on CDMOs for plasmid production. However, with increasing clinical demand, intellectual property concerns, and regulatory expectations around product traceability, companies are beginning to invest in building in-house capabilities or partnering in hybrid models with modular flexibility.

Hybrid manufacturing allows therapy developers to manage plasmid quality, timelines, and innovation directly, while still outsourcing certain steps like large-scale fermentation or fill-finish processes. This model offers improved cost control, speed, and agility particularly in advanced therapy medicinal product (ATMP) pipelines where plasmid production timelines can be rate-limiting.

Companies that provide turnkey plasmid manufacturing platforms encompassing software, hardware, and regulatory support will play a critical role in enabling this decentralization. In addition, compact bioreactor systems, single-use disposable kits, and AI-based quality control tools are empowering smaller companies and research institutions to establish controlled in-house plasmid production environments.

Plasmid DNA Manufacturing Market By Development Phase Insights

Pre-clinical therapeutics development remains the dominant phase, accounting for the majority of plasmid demand, particularly in exploratory and safety studies for novel gene therapy and DNA vaccine candidates. Biopharma companies often require multiple small-batch, R&D-grade plasmids for target validation, vector design, and animal model testing. This segment drives significant volume but at relatively lower margins.

Conversely, marketed therapeutics is the fastest-growing segment, fueled by recent regulatory approvals of DNA-based products. As therapies reach the commercial stage, the volume and quality of plasmid DNA required increases significantly. Commercial manufacturing demands GMP-grade pDNA in large volumes, and suppliers must implement long-term supply agreements, batch consistency protocols, and scalable quality systems. With more gene therapies expected to receive FDA and EMA approval in the next five years, this segment will see rapid expansion.

Plasmid DNA Manufacturing Market By Application Insights

Cell and gene therapy applications dominate the market, accounting for over 60% of total pDNA demand. Plasmids are integral to the production of viral vectors used in CAR-T, AAV-based, and lentivirus-based gene therapies. They encode essential genetic components, including therapeutic genes, viral backbones, and packaging signals. With hundreds of gene therapy trials in progress, demand from this segment remains strong.

However, DNA vaccines are the fastest-growing application, propelled by the success of nucleic acid platforms during the COVID-19 pandemic. Companies like Inovio and Takis Biotech have developed DNA vaccines for SARS-CoV-2, HPV, Zika, and Lassa fever, validating the platform’s scalability and safety. DNA vaccines are cost-effective, heat-stable, and easier to manufacture than traditional or mRNA vaccines, making them especially suitable for global immunization programs in developing regions.

Plasmid DNA Manufacturing Market By Disease Insights

Cancer remains the leading disease indication, due to the volume of oncology-related gene therapies and immunotherapies in development. CAR-T cells, oncolytic viruses, and cancer vaccines rely heavily on plasmids for gene delivery and vector manufacturing. The flexibility of plasmid DNA allows for rapid engineering of cancer-targeted therapies, particularly for hematological malignancies and solid tumors.

Genetic disorders represent the fastest-growing disease segment, as plasmid-based therapies for conditions like Duchenne muscular dystrophy, cystic fibrosis, and spinal muscular atrophy progress through clinical pipelines. These therapies often involve AAV vectors or non-viral delivery methods powered by plasmid constructs. As rare disease drug development receives increasing regulatory and financial support, the demand for tailored, high-purity pDNA will continue to surge.

Plasmid DNA Manufacturing Market By Grade Insights

R&D-grade plasmid DNA currently dominates the market, primarily due to its widespread use in early-stage research, preclinical development, vaccine prototyping, and non-clinical applications. Academic institutions, contract research organizations (CROs), and biotechs leverage R&D-grade plasmids for proof-of-concept studies, gene editing research, and non-human trials. These plasmids require lower regulatory compliance, are quicker to produce, and are more cost-effective than GMP-grade equivalents.

However, GMP-grade plasmid DNA is the fastest-growing segment, driven by the increasing number of therapies progressing into clinical trials and regulatory submissions. GMP-grade pDNA must adhere to strict quality standards related to purity, sterility, and documentation. Companies like Aldevron, VGXI, and Catalent have expanded their GMP manufacturing facilities to meet this growing demand. In February 2024, Aldevron announced the expansion of its GMP plasmid production site in North Dakota, citing increased clinical and commercial requests from gene therapy developers.

Plasmid DNA Manufacturing Market By Regional Insights

North America, particularly the United States, dominates the global plasmid DNA manufacturing market, accounting for the largest share in terms of both demand and production. The region hosts a dense concentration of biotechnology firms, CDMOs, academic institutions, and clinical research centers. Companies such as Aldevron, VGXI, Thermo Fisher Scientific, and Catalent have established large-scale, GMP-compliant pDNA production facilities across the U.S.

Supportive regulatory frameworks from the FDA, consistent investment in life sciences infrastructure, and robust funding for cell and gene therapy R&D ensure sustained demand. In 2024, Aldevron expanded its Fargo facility to support increased clinical and commercial demand, underlining the region’s role as a global hub for plasmid production.

Asia-Pacific is emerging as the fastest-growing region, driven by expanding biotech ecosystems in China, South Korea, India, and Singapore. Governments in these countries are prioritizing self-reliance in vaccine and gene therapy development, leading to investments in plasmid DNA production capabilities. The region benefits from lower production costs, increasing regulatory harmonization, and a rapidly growing clinical research base.

Chinese biopharma companies are developing in-house GMP pDNA facilities, while international CDMOs are setting up regional hubs to serve the Asian market. Moreover, Asia-Pacific countries are seeing a surge in DNA vaccine trials and licensing agreements, further accelerating local demand for high-quality plasmid production.

Plasmid DNA Manufacturing Market Top Key Companies:

- Charles River Laboratories

- VGXI, Inc.

- Danaher (Aldevron)

- Kaneka Corp.

- Nature Technology

- Cell and Gene Therapy Catapult

- Eurofins Genomics

- Lonza

- Luminous BioSciences, LLC

- Akron Biotech

Recent Developments

-

February 2024 – Aldevron announced the expansion of its GMP plasmid DNA manufacturing facility in North Dakota, aiming to increase capacity for clinical and commercial-scale gene therapy production.

-

January 2024 – VGXI, Inc. revealed the completion of its new headquarters and manufacturing site in Texas, tripling its production capacity for pDNA and mRNA-related raw materials.

-

December 2023 – Thermo Fisher Scientific launched a next-generation plasmid DNA purification platform, targeting higher yield and lower endotoxin content for gene therapy clients.

-

November 2023 – Andelyn Biosciences signed strategic partnerships with gene therapy startups to provide integrated viral vector and plasmid manufacturing services under GMP conditions.

-

October 2023 – Catalent invested $30 million in expanding its gene therapy manufacturing facility in Maryland, with a focus on end-to-end solutions including plasmid production.

Plasmid DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Plasmid DNA Manufacturing market.

By Grade

By Development Phase

- Pre-Clinical Therapeutics

- Clinical Therapeutics

- Marketed Therapeutics

By Application

- DNA Vaccines

- Cell & Gene Therapy

- Immunotherapy

- Others

By Disease

- Infectious Disease

- Cancer

- Genetic Disorder

- Others

By Regional

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)