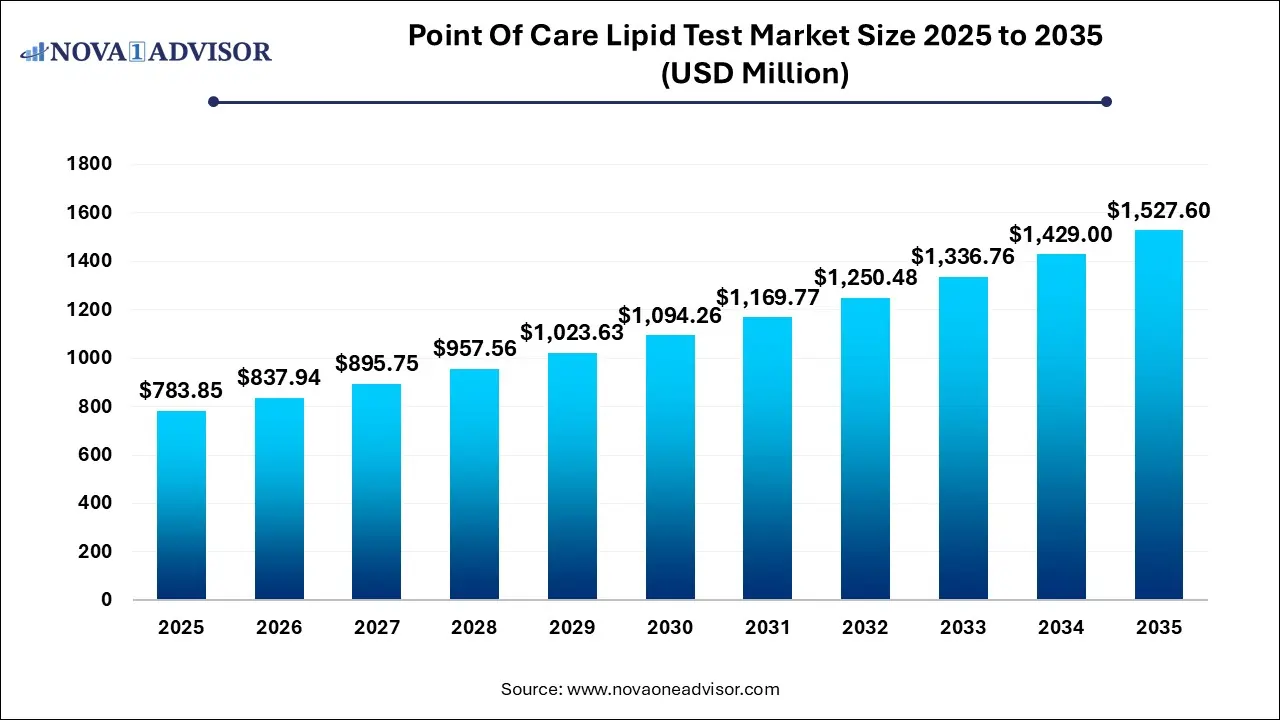

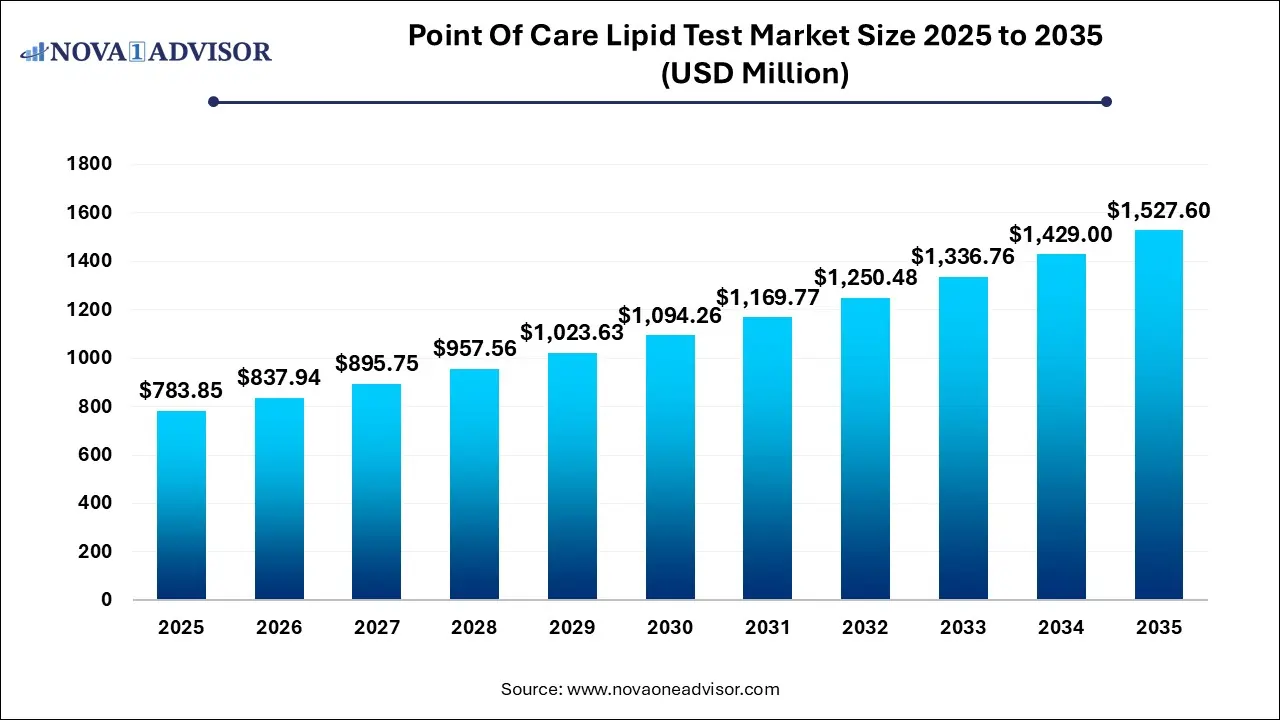

Point Of Care Lipid Test Market Size and Growth

The Point Of Care Lipid Test Market size was exhibited at USD 783.85 million in 2025 and is projected to hit around USD 1527.6 million by 2035, growing at a CAGR of 6.9% during the forecast period 2026 to 2035.

Key Takeaways:

- Consumables dominated the global market and accounted for the largest revenue share of 62% in 2025.

- Hyperlipidemia held the largest revenue share of 47% in 2025.

- Lipid and lipoprotein disorders dominated the global point-of-care lipid test market with the largest revenue share of 39% in 2025.

- The hospitals segment held the dominant position in the market and accounted for the largest revenue share of 34% in 2025

- North America point of care lipid test market dominated the global market and accounted for the largest revenue share of 44% in 2025.

Market Overview

The Point of Care (POC) Lipid Test Market has emerged as a pivotal sub-sector in diagnostics, enabling rapid and accessible measurement of lipid profiles such as total cholesterol, HDL, LDL, and triglycerides at or near the site of patient care. These tests circumvent the traditional laboratory setting, significantly reducing turnaround time from days to minutes and facilitating timely clinical decision-making.

With the increasing prevalence of cardiovascular diseases (CVDs), diabetes, and metabolic syndrome conditions intrinsically linked to lipid imbalances the demand for rapid lipid screening tools is rising. Point of care lipid testing is extensively used in primary care clinics, pharmacies, emergency departments, and even community health campaigns, especially in underserved and rural areas where access to centralized labs is limited. These tests support both screening and ongoing monitoring, making them essential tools for preventive healthcare.

The market growth is further fueled by technological advancements, such as multi-analyte analyzers, microfluidics integration, Bluetooth connectivity, and AI-driven risk scoring. Moreover, rising healthcare awareness, decentralized testing preferences post-COVID-19, and the global shift toward personalized medicine have bolstered the appeal of POC lipid diagnostics.

Major Trends in the Market

- Rise in at-home lipid testing solutions enabled by connected devices and eHealth platforms.

- Integration of POC devices with telehealth ecosystems for remote monitoring and data sharing.

- Increasing adoption of portable analyzers in pharmacies to support preventive screenings.

- Transition toward single-use consumables with improved biosensors to ensure hygiene and accuracy.

- Development of multi-analyte POC platforms that combine lipid tests with glucose, HbA1c, and CRP.

- Miniaturization and AI incorporation in diagnostic devices for better patient management and predictive insights.

- Public-private collaborations aimed at community-based cholesterol screening programs in low-resource settings.

- Growing focus on regulatory compliance and digital traceability through barcode-enabled test cartridges.

Report Scope of Point Of Care Lipid Test Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 837.94 Million |

| Market Size by 2035 |

USD 1527.6 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 6.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Application, Disease Indication, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Callegari Sinocare Inc.; Abbott Laboratories; MiCoBio; Nova Biomedical Corporation; VivaChek Biotech (Hangzhou) Co., Ltd.; F. Hoffmann-La Roche Ltd.; Menarini Group; SD Biosensor, Inc. |

Market Driver: Increasing Cardiovascular Disease Burden

A major driver propelling the POC lipid test market is the increasing prevalence of cardiovascular diseases (CVDs) globally. According to the World Health Organization, CVDs are responsible for over 17.9 million deaths annually, with dyslipidemia being a leading modifiable risk factor. Lipid testing, particularly LDL and total cholesterol levels, plays a critical role in assessing and managing CVD risk.

The growing aging population, sedentary lifestyle trends, poor dietary habits, and increasing incidence of obesity further escalate this burden. Point of care lipid testing provides a proactive means for clinicians to identify at-risk patients early, make quick therapeutic adjustments, and monitor treatment outcomes—especially in primary care or outpatient settings. The speed, convenience, and cost-effectiveness of POC tests make them an attractive tool for preventive cardiology.

Market Restraint: Limited Sensitivity Compared to Centralized Lab Analyzers

Despite their growing adoption, POC lipid testing devices often face criticism for lower sensitivity and specificity compared to centralized laboratory-based analyzers. While they offer quick and convenient results, variations in sample handling, operator technique, and environmental conditions (e.g., temperature) can influence test accuracy.

This limitation is particularly crucial in high-stakes clinical decisions where precision is vital. Physicians in tertiary care settings may still prefer lab-based testing for initial diagnosis or therapeutic titration. Moreover, regulatory challenges in validating newer POC platforms for multiple biomarkers and standardization concerns across regions hinder broader market penetration.

Market Opportunity: Expansion in Emerging Economies

Emerging economies present a significant opportunity for the POC lipid test market, particularly in Asia Pacific, Latin America, and parts of the Middle East & Africa. These regions face a dual burden of underdiagnosed chronic diseases and limited healthcare infrastructure. Point of care lipid tests, which require minimal training and no sophisticated lab equipment, are well-suited to address these gaps.

For instance, in India and Brazil, public health programs have begun incorporating portable lipid screening tools in mobile health vans and rural clinics. Governments and NGOs are increasingly investing in decentralized care models, making affordability and ease-of-use key purchasing criteria. Manufacturers that focus on low-cost, high-accuracy POC solutions can leverage this market segment while also contributing to disease burden reduction.

Segmental Analysis

By Product Outlook

The instruments segment accounted for the largest share in the product outlook due to its critical role in enabling accurate and repeatable testing in clinical and home environments. Portable lipid analyzers are the foundation of POC testing, enabling real-time interpretation of sample results. Their dominance is reinforced by continual innovations in design, automation, connectivity, and multi-test capabilities. Devices such as the CardioChek and Cholestech LDX have set industry benchmarks for reliability and integration.

In contrast, the consumables segment is expected to witness the fastest growth, driven by increasing test volumes and growing use in recurring monitoring. Single-use cartridges, strips, and reagents, which accompany each test, represent a recurring revenue stream for manufacturers. With growing emphasis on hygiene and biosafety, especially post-pandemic, disposable consumables are becoming indispensable in both clinical and non-clinical settings. Moreover, advancements in biosensor technologies are enhancing sensitivity and shelf-life, contributing to consumable market expansion.

By Application Outlook

The hyperlipidemia segment dominates the application landscape due to its widespread prevalence and direct link with cardiovascular risk. Hyperlipidemia affects millions globally and is often asymptomatic, making routine screening essential. Point of care lipid tests are commonly used for early detection and treatment monitoring, especially in populations at high risk due to obesity, family history, or diabetes.

Meanwhile, the fastest-growing segment is familial hypercholesterolemia (FH)—a genetic disorder that remains significantly underdiagnosed. The increasing awareness of FH's role in premature heart disease has prompted health authorities to recommend early screening using lipid tests, even among children and young adults. POC testing tools are increasingly being integrated into school and workplace wellness programs as a means to detect inherited lipid abnormalities quickly.

By Disease Indication Outlook

The lipid and lipoprotein disorders segment leads the disease indication category, given its broad coverage and relevance to primary and secondary prevention strategies. Conditions such as mixed dyslipidemia, elevated LDL-C, and low HDL-C levels account for a major share of lipid testing globally. POC devices are extensively used for both baseline assessments and therapeutic monitoring in these patients.

On the other hand, diabetes mellitus is the fastest-growing indication due to its strong association with dyslipidemia. Diabetic patients often exhibit an atherogenic lipid profile, making regular lipid monitoring crucial. POC lipid tests offer convenience in integrated diabetes management settings, especially in diabetes clinics, endocrinology practices, and community care centers. The dual management of glycemic and lipid parameters through compact analyzers further boosts market demand in this segment.

By End-Use Outlook

Hospitals are the leading end-user segment, as they routinely perform lipid tests in emergency, cardiology, and endocrinology departments. The need for rapid test results in high-pressure environments like emergency rooms or surgical pre-assessment areas makes POC lipid testing highly valuable. Additionally, inpatient lipid screening helps manage secondary prevention strategies post-cardiovascular events.

In contrast, research and diagnostic laboratories represent the fastest-growing segment, particularly those involved in clinical trials, epidemiological studies, and remote testing services. These labs increasingly employ POC lipid devices in mobile settings and pop-up clinics. The rise in decentralized testing initiatives and personalized health research has created demand for flexible, scalable lipid testing platforms outside the traditional hospital infrastructure.

By Regional Analysis

North America holds the largest share of the point of care lipid test market due to high awareness of cardiovascular risk factors, robust healthcare infrastructure, and widespread adoption of preventive screening practices. In the U.S., lipid testing is a routine part of annual health exams, and POC devices are increasingly available in pharmacies, retail clinics, and corporate wellness centers.

The presence of key players like Abbott, Roche Diagnostics, and PTS Diagnostics, coupled with favorable reimbursement policies and strong regulatory oversight, has accelerated product innovation and trust. Moreover, North America leads in integrating POC diagnostics with electronic health records (EHRs), enhancing clinical decision-making and patient compliance.

Asia Pacific is projected to witness the highest CAGR in the forecast period due to its growing population, rising burden of chronic diseases, and improving healthcare access. Countries like China, India, and Thailand are experiencing a surge in obesity and metabolic syndromes, necessitating scalable lipid screening solutions.

Governments in the region are increasingly promoting early diagnosis and mobile health platforms, creating a fertile environment for POC lipid testing adoption. Moreover, local manufacturers are producing cost-effective devices tailored to resource-limited settings. Collaborations with international diagnostic firms have also boosted technology transfer and localization, contributing to Asia Pacific’s rapid market expansion.

Some of The Prominent Players in The Point Of Care Lipid Test Market Include:

Recent Developments

- February 2025 – Abbott Laboratories launched a next-gen version of its Afinion POC analyzer with enhanced lipid and HbA1c testing modules designed for retail pharmacy environments.

- October 2024 – PTS Diagnostics announced a partnership with a U.S.-based pharmacy chain to deploy CardioChek analyzers across over 1,000 retail locations for customer wellness programs.

- August 2024 – F. Hoffmann-La Roche Ltd. received CE Mark approval for its cobas® pulse system that now includes lipid testing as part of its comprehensive POC diagnostic menu.

- May 2024 – Nova Biomedical expanded its presence in Southeast Asia through distributor agreements aimed at deploying StatStrip® analyzers in rural health initiatives for lipid and glucose testing.

- January 2024 – SD Biosensor (South Korea) introduced a portable multi-analyte POC device targeting lipid, glucose, and uric acid testing for the Asian and African markets under its “Smartcare” initiative.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Point Of Care Lipid Test Market

By Product

By Application

- Hyperlipidemia

- Hypertriglyceridemia

- Tangier Disease

- Hyperlipoproteinemia

- Familial Hypercholesterolemia

- Others

By Disease Indication

- Lipid and Lipoprotein Disorders

- Atherosclerosis

- Liver and Renal Diseases

- Diabetes Mellitus

- Others

By End-use

- Hospitals

- Clinics

- Research and Diagnostic Laboratories

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)