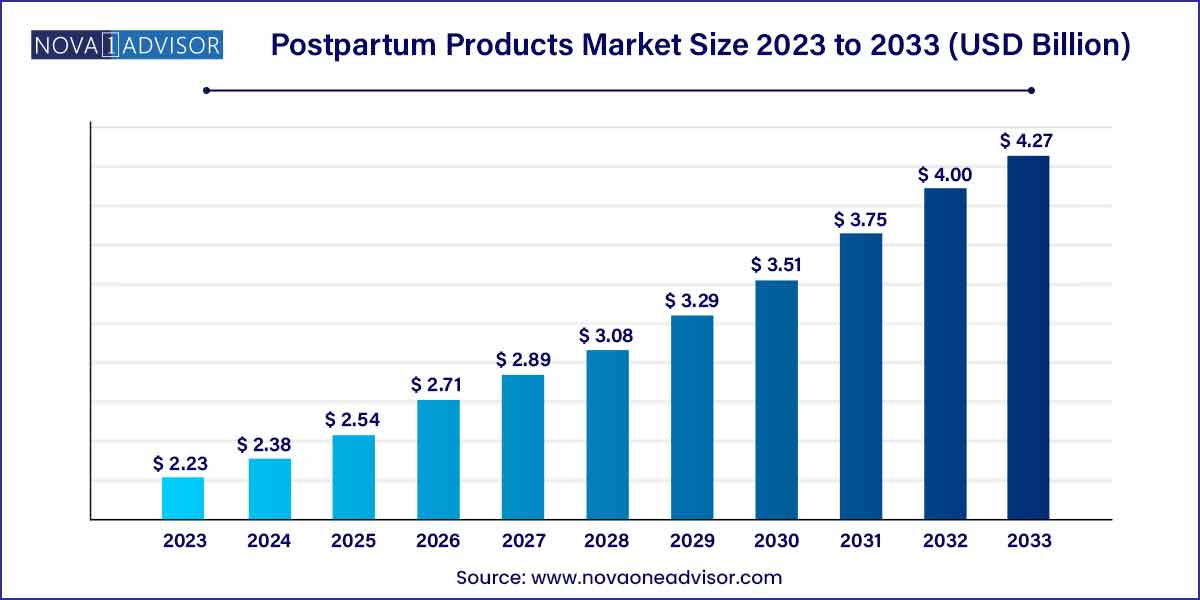

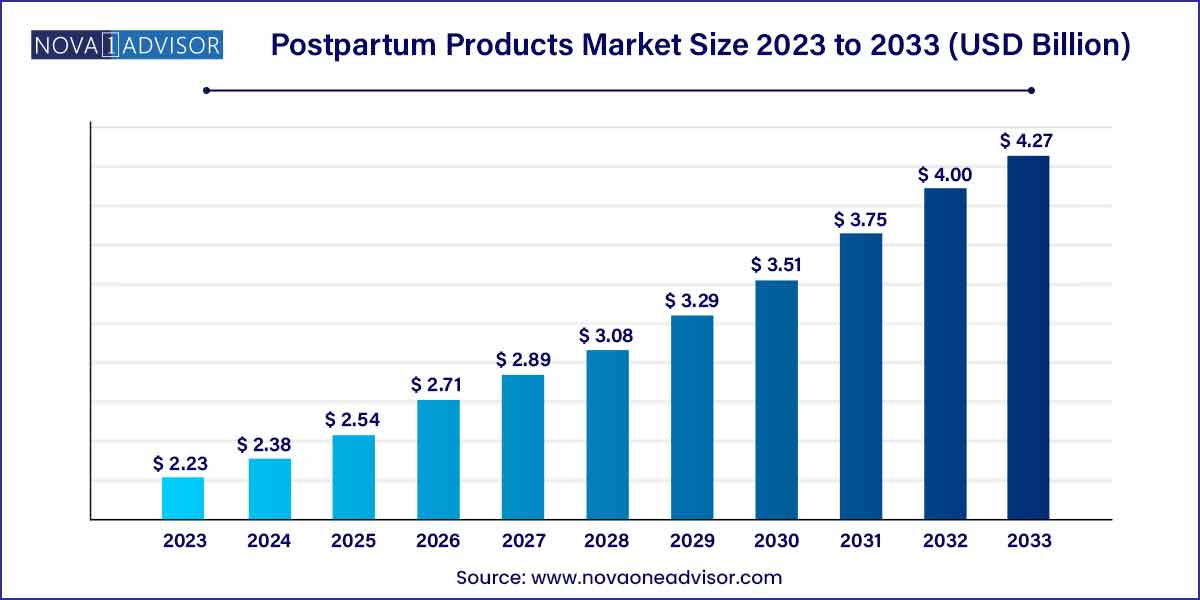

The global postpartum products market size was exhibited at USD 2.23 billion in 2023 and is projected to hit around USD 4.27 billion by 2033, growing at a CAGR of 6.7% during the forecast period of 2024 to 2033.

Key Takeaways:

- The breastfeeding accessories segment dominated the overall market in terms of revenue as of 2023, with a share of 88.01%.

- Among all distribution channels, hospital pharmacy held the largest share of the market in terms of revenue as of 2023, with a share of 40.0%.

- Asia Pacific dominated the overall postpartum product market with a share of 42.79% in 2023.

Market Overview

The Postpartum Products Market has gained remarkable significance in the broader maternal healthcare sector. Postpartum, or the period immediately after childbirth, often demands specialized care, including management of lactation, perineal healing, mental well-being, and physical recovery. Postpartum products are designed to support women during this crucial phase by addressing diverse needs such as breastfeeding, wound care, body shaping, and hygiene.

An increase in the global birth rate, rising awareness about postpartum health, expanding healthcare access in developing countries, and a cultural shift towards more open discussions about maternal health are major factors propelling this market. Moreover, the evolution of e-commerce platforms and the growth of women-centric health tech startups have made postpartum products more accessible to new mothers across different socio-economic backgrounds.

Leading companies such as Medela, Lansinoh Laboratories, Frida Mom, and Edgewell Personal Care are investing heavily in product innovation, targeting both physical recovery and emotional wellness. With healthcare providers increasingly recommending postpartum support solutions, the market outlook remains highly promising.

Major Trends in the Market

-

Growth of Natural and Organic Postpartum Products: Increasing consumer preference for chemical-free, hypoallergenic options.

-

Expansion of E-Commerce and Direct-to-Consumer Sales: Empowering niche brands and broadening product accessibility.

-

Integration of Technology in Breastfeeding Accessories: Smart pumps and app-enabled lactation trackers gaining traction.

-

Focus on Mental Health and Emotional Wellness: Introduction of postpartum care kits addressing anxiety and depression.

-

Rise in Disposable and Single-Use Products: Convenience-driven solutions for busy new mothers.

-

Increasing Demand for Hospital-Grade Breastfeeding Equipment: Reflecting growing focus on professional lactation support.

-

Customization and Subscription Models: Personalized postpartum care boxes delivered monthly.

Postpartum Products Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.23 Billion |

| Market Size by 2033 |

USD 4.27 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Sales Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Koninklijke Philips N.V., Medela LLC, Newell Brands, AMEDA, NUBY, May born Group Limited, Edge well Personal Care, Handi-Craft Company (Dr. Brown’s), Artsana S.P.A, Medline. |

Key Market Driver

Rising Awareness About Postpartum Health and Increasing Healthcare Recommendations

One of the primary drivers boosting the postpartum products market is the growing awareness of postpartum recovery as an essential aspect of maternal healthcare. Governments, hospitals, NGOs, and healthcare providers are increasingly promoting postpartum wellness as critical to preventing complications like mastitis, infections, pelvic floor dysfunction, and postpartum depression. For instance, in March 2024, the American College of Obstetricians and Gynecologists updated its guidelines to emphasize a "fourth trimester" care approach, encouraging postpartum visits focused not only on physical recovery but also on mental and emotional health. Such initiatives are driving demand for supportive postpartum solutions.

Key Market Restraint

High Cost of Premium Postpartum Products

While awareness and demand are rising, the high cost of quality postpartum products—especially hospital-grade breast pumps, organic nipple care creams, and perineal healing kits—can be prohibitive for many women, particularly in low- and middle-income countries. Limited insurance coverage for postpartum needs, coupled with the lack of governmental subsidies for non-essential maternity products, further exacerbates accessibility challenges. This cost barrier may lead women to either delay or forego purchasing specialized products, restricting market penetration, particularly in price-sensitive markets.

Key Market Opportunity

Emergence of Subscription-Based and Bundled Postpartum Care Packages

A major opportunity lies in the growth of postpartum subscription services offering curated recovery kits. These kits, bundled with breastfeeding accessories, perineal care essentials, and mental health support tools, allow for seamless, affordable postpartum support over several months. Startups offering customizable care boxes tailored to C-section recovery, breastfeeding journeys, or mental health support are rapidly gaining market traction. In February 2024, a popular U.S.-based subscription company expanded into Europe, citing a 35% year-over-year growth rate, showcasing the global potential of this model.

Product Insights

Breastfeeding Accessories

Breastfeeding Accessories dominated the product segment in 2024. The growing emphasis on breastfeeding—supported by initiatives from organizations like WHO and UNICEF—has driven strong demand for high-quality accessories. Breast pumps, nipple care products, and storage solutions have become essential for nursing mothers, particularly those balancing breastfeeding with return-to-work schedules. Among breastfeeding accessories, breast pads and nipple care products, such as soothing balms and hydrogel pads, are witnessing robust sales.

Breast milk Storage & Feeding solutions are growing fastest, driven by the rise of working mothers and the need to store and transport expressed milk hygienically. In March 2024, Lansinoh introduced a new eco-friendly breast milk storage system designed to reduce plastic waste, reflecting the trend toward sustainable parenting.

Perineal Cooling Pads

Perineal Cooling Pads are becoming increasingly popular, addressing an often-overlooked aspect of postpartum recovery. These pads help reduce perineal swelling, discomfort, and promote healing after vaginal delivery. Increased advocacy for holistic postpartum care by midwives and obstetricians is driving demand for these soothing solutions.

Others

Other postpartum products include maternity support belts, body shaping garments, sitz baths, and postpartum herbal teas, each contributing significantly to maternal recovery and comfort. As wellness trends intersect with maternity care, these categories are expected to expand.

Sales Channel Insights

Hospital Pharmacy (Inpatient)

Hospital Pharmacy sales dominated the sales channel segment. Hospitals often provide or recommend postpartum products during inpatient stays, particularly breastfeeding equipment, perineal care kits, and pain management solutions. In many cases, insurance reimbursements for hospital-grade breast pumps also flow through hospital pharmacies, boosting their share.

E-Commerce is the fastest-growing sales channel

The explosive growth of online platforms has transformed postpartum product distribution. E-commerce enables wide-ranging product choices, easy comparisons, and doorstep deliveries—critical benefits for recovering new mothers. Platforms such as Amazon, specialty websites like Aeroflow Breastpumps, and brand-specific stores have witnessed sharp growth. In February 2024, Frida Mom reported a 40% increase in direct-to-consumer sales through its online store compared to the previous year, underlining the power of digital retail.

Regional Insights

North America dominated the global postpartum products market in 2024. The United States accounts for a significant share, supported by strong healthcare infrastructure, high awareness levels, supportive breastfeeding laws, and proactive government initiatives such as "The Maternal Health Quality Improvement Act" enacted in 2023. Product innovation, high disposable income, and a focus on maternal mental health also reinforce North America's leadership.

Asia-Pacific is the fastest-growing region. Rapid urbanization, improving healthcare access, rising middle-class income levels, and changing cultural attitudes toward postpartum care are fueling market expansion. Countries like China, India, Japan, and South Korea are witnessing increased demand for maternity and postpartum wellness products. In March 2024, China's National Health Commission announced plans to promote postpartum care centers ("Yuesao") nationwide, further stimulating market opportunities.

Some of the prominent players in the postpartum products market include:

- Koninklijke Philips N.V.

- Medela LLC

- Newell Brands

- Ameda

- NUBY

- May born Group Limited

- Edge well Personal Care

- Handi-craft Company (Dr. Brown’s)

- Artsana S.P.A

- Medline

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global postpartum products market.

Product

- Breastfeeding Accessories

-

- Breast Pads

- Nipple Care Products

- Breast Shells

- Breast milk Preparation & Cleaning Products

- Breast milk Storage & Feeding

- Other Accessories

- Perineal Cooling Pads

- Others

Sales Channel

- Hospital Pharmacy (Inpatient)

- Retail Store

- E-Commerce

- Wholesaler/Distributor

- Direct Purchase

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)