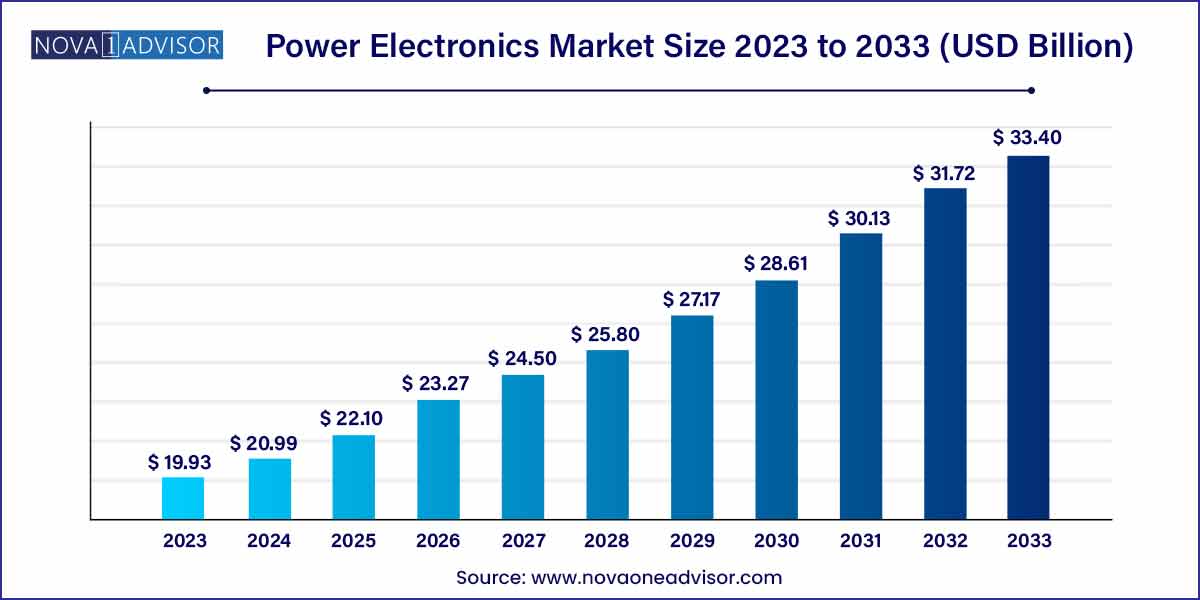

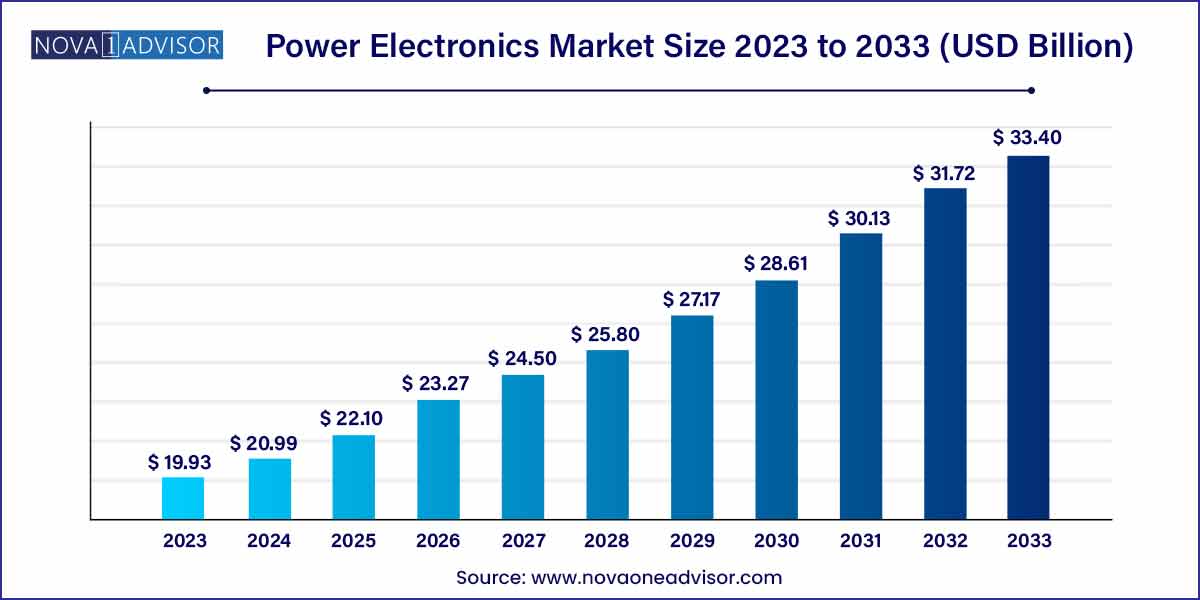

The global power electronics market size was exhibited at USD 19.93 billion in 2023 and is projected to hit around USD 33.40 billion by 2033, growing at a CAGR of 5.3% during the forecast period of 2024 to 2033.

Key Takeaways:

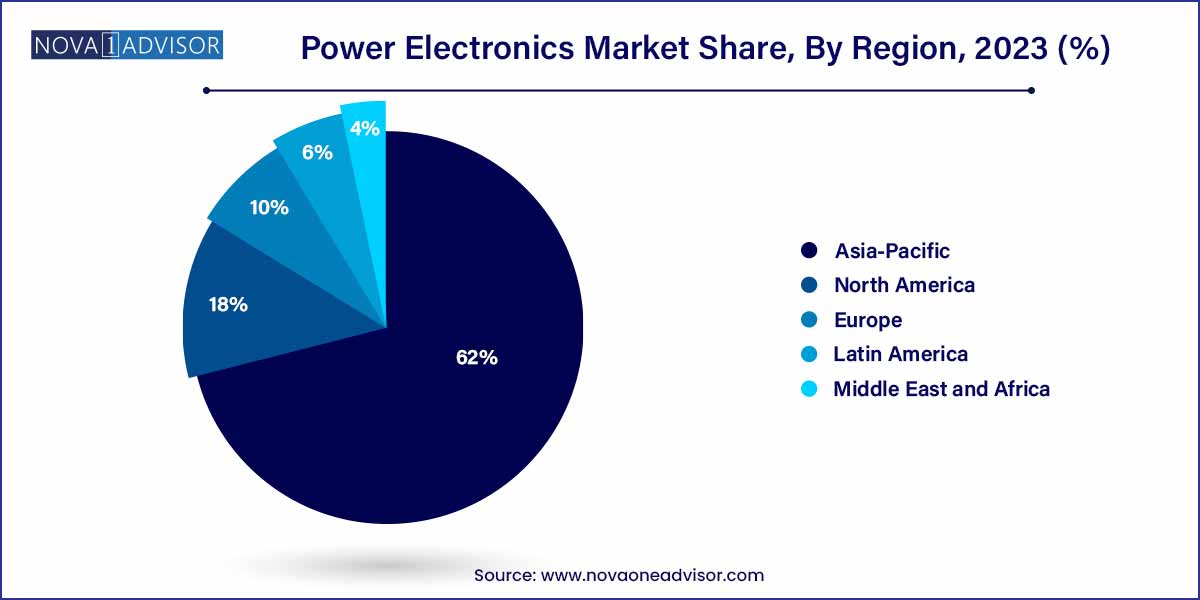

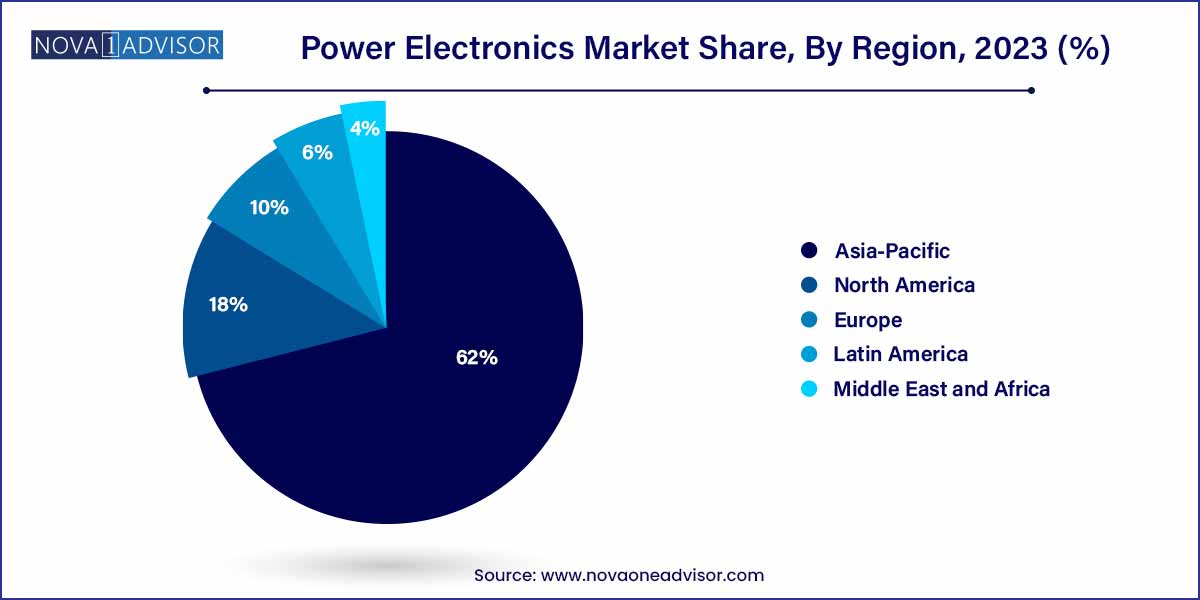

- Asia Pacific contributed more than 62% of revenue share in 2023.

- Based on the device, the discrete segment accounted for 65% of the revenue share in 2023.

- By material, the silicon segment will hold the major market share in 2023.

- By material, the sapphire segment is anticipated to grow at the fastest CAGR during the projected period.

- By application, the aerospace & defense segment held the highest revenue share in 2023.

- By application, the automotive segment is anticipated to grow at the fastest CAGR over the projected period.

- By device, the discrete segment will hold the largest revenue share in 2023.

Power Electronics Market: Overview

The Power Electronics Market has become an indispensable pillar for modern technology-driven industries, spanning from consumer electronics to electric vehicles (EVs), industrial automation, renewable energy integration, aerospace, and telecommunications. Power electronics deal with the conversion, control, and conditioning of electric power through semiconductor devices. The evolution of technologies like Silicon Carbide (SiC) and Gallium Nitride (GaN) has significantly improved the performance, efficiency, and reliability of power electronic systems.

The growing emphasis on energy-efficient solutions, the accelerated adoption of EVs, and the global renewable energy boom have created a fertile ground for power electronics' exponential growth. Devices like discrete components, modules, and integrated circuits (ICs) are increasingly being optimized for smaller size, higher switching frequency, and greater energy efficiency. Governments worldwide are also supporting this growth through incentives for clean energy and infrastructure upgrades.

The competitive landscape is fiercely dynamic, with players investing heavily in R&D and strategic mergers and acquisitions to consolidate their market presence. Companies like Infineon Technologies, Mitsubishi Electric, and STMicroelectronics are at the forefront, pushing technological innovations to cater to both mature and emerging applications.

Power Electronics Market Growth

The growth of the power electronics market is propelled by various factors contributing to its expansion. One significant driver is the increasing adoption of electric vehicles (EVs) worldwide, fueled by growing environmental concerns and advancements in battery technology. Additionally, the rising deployment of renewable energy sources, such as solar and wind power, drives demand for power electronics in efficient energy conversion and management. Furthermore, the proliferation of Internet of Things (IoT) devices and smart technologies necessitates compact and energy-efficient power electronics solutions for seamless connectivity and operation. Advancements in semiconductor technology, particularly the adoption of wide-bandgap materials like silicon carbide (SiC) and gallium nitride (GaN), enhance the performance and efficiency of power electronic devices. Moreover, the Industry 4.0 revolution and automation trends stimulate the demand for power electronics in industrial applications, including robotics, motor drives, and factory automation systems. Overall, these growth factors underscore the pivotal role of power electronics in driving innovation and sustainability across diverse industries.

Power Electronics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 19.93 Billion |

| Market Size by 2033 |

USD 33.40 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Material,By Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

ABB Group, Fuji Electric Co, Infineon Technologies AG, Microsemi Corporation, Mitsubishi, Renesas Electronics Corporation, Rockwell Automation, STMicroelectronics, Texas Instruments Incorporated, Toshiba Corporation. |

Power Electronics Market Dynamics

- Shift towards Wide-Bandgap Semiconductors:

A significant dynamic in the power electronics market is the ongoing shift towards wide-bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN). These materials offer superior performance characteristics compared to traditional silicon-based semiconductors, including higher efficiency, faster switching speeds, and increased power density. As a result, manufacturers are increasingly adopting SiC and GaN-based power electronic devices in various applications, ranging from electric vehicles to renewable energy systems and industrial automation.

- Integration of Power Modules:

Another significant dynamic shaping the power electronics market is the integration of power modules with advanced features and functionalities. Manufacturers are focusing on developing power modules that incorporate components such as insulated gate bipolar transistors (IGBTs), diodes, and gate drivers into a single package. These integrated power modules offer benefits such as simplified system design, reduced footprint, and improved thermal management. Additionally, advanced power modules may include features like fault protection, intelligent control algorithms, and built-in diagnostics, enhancing reliability and performance.

Power Electronics Market Restraint

One of the primary restraints affecting the power electronics market is cost constraints associated with the adoption of advanced technologies and materials. While wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) offer superior performance and efficiency, they often come at a higher manufacturing cost compared to traditional silicon-based counterparts. This cost differential poses a barrier to mass adoption, particularly in price-sensitive markets such as consumer electronics and automotive. Additionally, the development and implementation of advanced packaging techniques and thermal management solutions to enhance the reliability and performance of power electronics components contribute to overall production costs.

- Reliability and Durability Concerns:

Another significant restraint in the power electronics market is the challenge of ensuring the reliability and durability of components, especially in harsh operating environments and high-temperature conditions. Power electronics devices are subjected to various stresses, including thermal cycling, voltage spikes, and electromagnetic interference, which can degrade performance and lead to premature failures. Ensuring robustness and longevity requires rigorous testing, quality assurance protocols, and the use of materials and manufacturing processes capable of withstanding demanding operating conditions. However, achieving high levels of reliability without significantly increasing costs remains a considerable challenge for manufacturers.

Power Electronics Market Opportunity

- Emerging Applications in Renewable Energy:

The rapid expansion of renewable energy installations presents significant opportunities for the power electronics market. As governments and industries worldwide prioritize decarbonization and transition towards sustainable energy sources, there is a growing demand for power electronics solutions to facilitate the integration of solar, wind, and other renewable energy sources into the grid. Power electronics devices play a crucial role in efficiently converting and managing power generated from renewable sources, as well as enabling grid stabilization, voltage regulation, and energy storage. Moreover, advancements in power electronics technology, such as the adoption of wide-bandgap semiconductors and advanced control algorithms, enhance the performance and reliability of renewable energy systems.

- Electrification of Transportation:

The ongoing electrification of transportation represents a significant opportunity for the power electronics market. With increasing concerns about air pollution, energy security, and climate change, governments and automotive manufacturers are accelerating the adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) as a cleaner and more sustainable alternative to internal combustion engine vehicles. Power electronics components, such as inverters, converters, and onboard chargers, are integral to the propulsion systems and charging infrastructure of electric and hybrid vehicles. Additionally, the deployment of electric buses, trucks, and other commercial vehicles further expands the market for power electronics solutions in the transportation sector. Manufacturers can capitalize on this opportunity by developing high-performance, energy-efficient power electronics devices optimized for automotive applications, as well as partnering with automakers and infrastructure providers to support the widespread adoption of electric transportation.

Power Electronics Market Challenges

- Supply Chain Disruptions:

One of the significant challenges facing the power electronics market is supply chain disruptions. The global supply chain for power electronics components and materials is complex, involving multiple suppliers, manufacturers, and distributors across various regions. Disruptions such as shortages of critical materials, geopolitical tensions, natural disasters, and transportation disruptions can impact the availability of key components and raw materials, leading to delays in manufacturing and delivery schedules. Moreover, the COVID-19 pandemic highlighted vulnerabilities in the supply chain, with lockdowns, trade restrictions, and labor shortages disrupting production and distribution channels.

Compliance with stringent regulatory standards and certifications poses a significant challenge for power electronics manufacturers. The power electronics industry is subject to various regulations and standards related to product safety, electromagnetic compatibility (EMC), energy efficiency, and environmental sustainability. Achieving compliance with these regulations requires extensive testing, documentation, and certification processes, which can be time-consuming and costly. Additionally, regulatory requirements vary across different regions and markets, further complicating compliance efforts for global manufacturers.

Segments Insights:

Material Insights

Silicon dominated the material segment within the power electronics market in 2024. Silicon-based semiconductors have been the backbone of the industry for decades, favored for their mature technology, cost-effectiveness, and widespread application across consumer electronics, industrial devices, and automotive components. Silicon devices like IGBTs and MOSFETs are highly reliable and form a significant share of traditional applications. Despite emerging alternatives, silicon remains crucial, particularly in applications where ultra-high performance is not critical but cost and stability are paramount.

Silicon Carbide (SiC) is emerging as the fastest-growing material segment. With remarkable attributes such as higher voltage capabilities, superior thermal conductivity, and higher switching efficiency, SiC-based devices are revolutionizing power electronics, particularly in EVs, industrial motor drives, and renewable energy systems. Tesla, for instance, incorporated SiC inverters in its Model 3, setting a trend that other manufacturers are now following. The growing emphasis on reducing energy losses and extending device lifespan is propelling SiC's rapid growth trajectory.

Application Insights

Consumer Electronics dominated the application segment in 2024. The ever-growing demand for smartphones, laptops, tablets, wearable devices, and home appliances has fueled the need for efficient, compact power management solutions. Power electronics are integral to battery management, fast charging, and thermal control in these devices. Companies like Qualcomm and MediaTek are innovating in integrated power solutions to support the high-performance requirements of modern consumer electronics.

Automotive is the fastest-growing application segment, primarily driven by the electrification of vehicles. The shift from internal combustion engines to electric and hybrid powertrains necessitates advanced power electronics for battery management systems, onboard chargers, inverters, and motor drives. In 2024, automotive companies like General Motors and Volkswagen announced massive investments in EVs, boosting demand for high-efficiency, compact, and thermally resilient power devices.

Device Insights

Discrete devices dominated the device segment within the power electronics market in 2024. Discrete components such as diodes, transistors, and thyristors are fundamental to basic circuit designs and are widely utilized across consumer electronics, industrial equipment, and power supplies. Their cost-effectiveness, ease of integration, and mature supply chains ensure their steady dominance, especially in conventional low to medium power applications.

Modules are the fastest-growing device category, particularly in high-power applications like industrial motor drives, renewable energy systems, and electric vehicle powertrains. Power modules offer benefits like reduced system size, improved thermal performance, and simplified assembly. Companies like Infineon and Mitsubishi Electric are aggressively innovating in module packaging technologies, including advanced cooling solutions and 3D integration, further propelling this segment's growth.

Region Insights

Asia-Pacific dominated the global power electronics market in 2024. The region's dominance is attributed to the presence of leading semiconductor manufacturers, rapid industrialization, aggressive renewable energy targets, and booming consumer electronics and automotive sectors. Countries like China, Japan, South Korea, and Taiwan are technological powerhouses investing heavily in R&D and manufacturing infrastructure. In particular, China's "Made in China 2025" policy prioritizes semiconductor self-sufficiency, further driving regional market expansion. Major players such as Toshiba, Rohm Semiconductor, and Mitsubishi Electric maintain strong footprints in Asia-Pacific.

North America is the fastest-growing region in the power electronics market, fueled by the electrification of transportation, expansion of renewable energy, and modernization of grid infrastructure. In 2024, the U.S. federal government reinforced its commitment to EV adoption through new subsidies and stringent emissions regulations. Moreover, collaborations between tech giants and energy firms for smart grid solutions are accelerating the deployment of advanced power electronics. Companies such as Texas Instruments and Cree (Wolfspeed) are leading innovation efforts in this region.

Recent Developments

-

March 2024: Infineon Technologies launched its new CoolSiC™ MOSFET 650 V product family, designed for energy-efficient industrial and automotive applications.

-

January 2024: STMicroelectronics expanded its Gallium Nitride (GaN) wafer production facilities in Tours, France, aiming to address surging demand in automotive and industrial sectors.

-

February 2024: Mitsubishi Electric announced the development of a new ultra-compact power module with enhanced cooling features for EV applications.

-

April 2024: Texas Instruments introduced a new line of automotive-qualified SiC MOSFETs aimed at enhancing vehicle range and charging efficiency in EVs.

-

March 2024: Wolfspeed (formerly Cree) inaugurated its new 200mm SiC fab in New York State, the world's largest dedicated SiC facility, to bolster supply for next-generation power applications.

Some of the prominent players in the power electronics market include:

- ABB Group

- Fuji Electric Co

- Infineon Technologies AG

- Microsemi Corporation

- Mitsubishi

- Renesas Electronics Corporation

- Rockwell Automation

- STMicroelectronics

- Texas Instruments Inc.

- Toshiba Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global power electronics market.

By Material

- Sapphire

- Silicon

- Gallium Nitride

- Silicon Carbide

- Others

By Application

- Consumer Electronics

- Industrial

- ICT

- Aerospace & Defense

- Automotive

- Others

By Device

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)