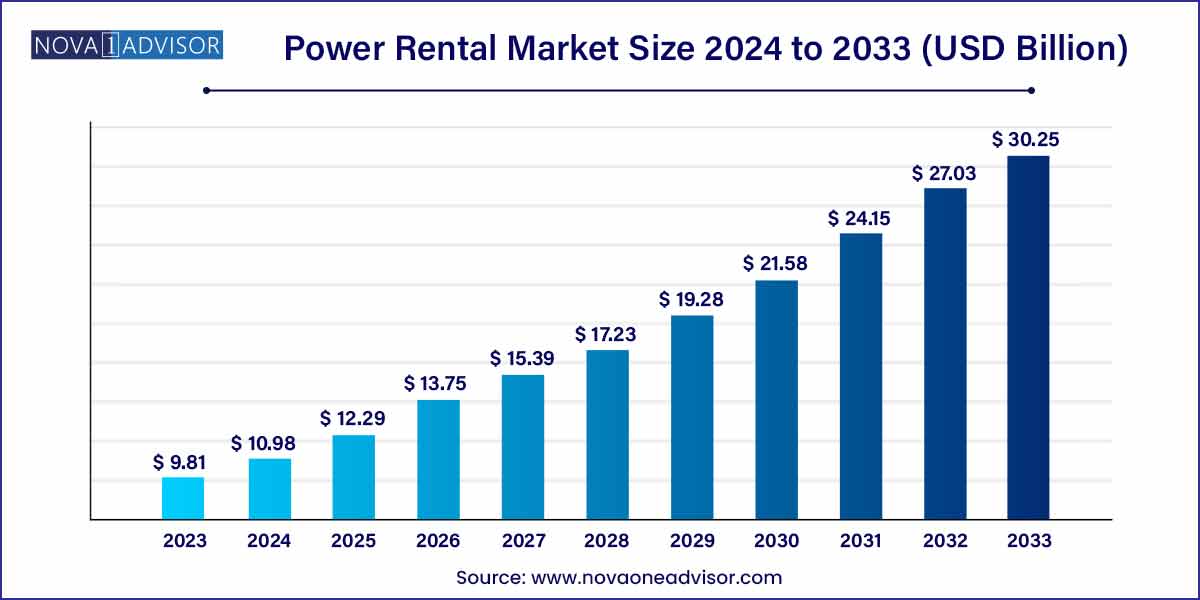

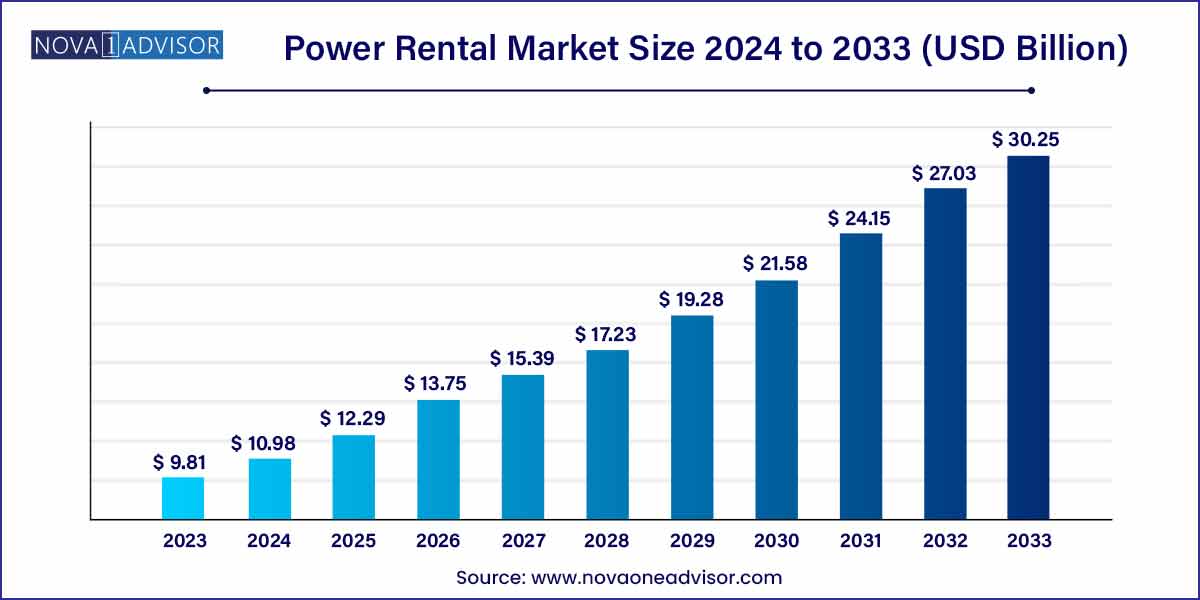

The global power rental market size was exhibited at USD 9.81 billion in 2023 and is projected to hit around USD 30.25 billion by 2033, growing at a CAGR of 11.92% during the forecast period of 2024 to 2033.

Key Takeaways:

- The Asia-Pacific power rental market size reached US$ 2.10 billion in 2023.

- Based on the application, the continuous load segment will dominate the global power rental market in 2023.

- Based on fuel, the diesel segment accounted for 81% of revenue in 2023.

- Based on the end user, the mining segment dominated the global power rental market in 2023.

Power Rental Market: Overview

The Power Rental Market plays a pivotal role in ensuring uninterrupted electricity supply across a wide range of industries, events, and emergency scenarios. Power rental services involve the leasing of temporary power solutions, such as diesel or gas generators, to meet immediate, short-term, or seasonal energy demands. The market is increasingly seen as a flexible and cost-effective option compared to investing in permanent power infrastructure, particularly in industries like construction, oil & gas, mining, manufacturing, and large-scale events.

With the rising incidence of grid failures, frequent natural disasters, rapid urbanization, and burgeoning infrastructure projects, the demand for rental power solutions is soaring globally. Furthermore, the trend toward more sustainable energy sources, technological advancements in hybrid generators, and the rising popularity of eco-friendly and gas-based power rental solutions are reshaping market dynamics. Despite challenges such as stringent environmental regulations and the impact of fluctuating fuel prices, the Power Rental Market is projected to witness robust growth in the years ahead.

Power Rental Market Growth

The power rental is a renting of generator, whether they operate on diesel or gas. It provides fully functional power equipment as well as a variety of components for use in power plants. Furthermore, it provides organizations with flexibility, speed, and cost-effectiveness while dealing with power outages. The purpose of rental power services is to help stabilize utility power networks while also providing additional energy to industry and communities. As a result, it has a wide range of applications in the mining, building and construction, oil and gas industries.

In the event of a power outage, the use of power leasing equipment is predicted to expand, propelling the global power rental market growth. During periods of power outage, power rental systems meet the needs of a wide range of industries by providing backup power to keep operations running. The factors fueling the demand for continuous power supply in the gas and oil and mining industries, as well as the growing need for electrification and rural power delivery. The grid stabilization is required due to ageing electricity infrastructure.

The mining industry is major use of rental power. Due to mining sites are not connected to the grid, they rely on generator sets that have been hired on a temporary basis. The rental generators are in modest demand in manufacturing businesses when the existing power supply system, such as purchased generator sets, has to be maintained, or when there is a need for extra power during peak load demand, or when there is a brief outage. As a result, sectors with poor grid power supplies are heavily reliant on the power rental market’s expansion.

Most firms prefer to rent rather than buy a new generator to save money. Furthermore, projects from diverse sectors range from one site to the next and are spread across different regions. Rather of hauling one’s generator between locations, renting for different locations appears to be more convenient and cost-effective. The high cost of purchasing new generators, as well as huge growth in numerous industries such as construction, oil and gas are driving the power rental market. However, the power rental market growth is likely to be constrained by the expansion of power distribution networks and the increased development of renewable energy projects.

Power Rental Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.81 Billion |

| Market Size by 2033 |

USD 30.25 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.92% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Fuel, Application, End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Pump Power Rental, Global Power Supply, Jassim Transport & Stevedoring Co. K.S.C.C., Newburn Power Rental Ltd., ProPower Rental, Shenton Group, Modern Hiring Service, United Rentals, FG Wilson, APR Energy. |

Power Rental Market Dynamics

- Increasing Demand for Uninterrupted Power Supply:

In an era where industries are highly reliant on continuous and reliable power supply, the demand for power rental services has surged. Industries such as manufacturing, construction, telecommunications, and events require uninterrupted power to ensure seamless operations. Factors such as aging grid infrastructure, extreme weather events, and rapid urbanization contribute to power instability, leading businesses to seek temporary power solutions. Power rental companies play a crucial role in providing generators, transformers, and other equipment to meet short-term or emergency power needs.

- Technological Advancements Driving Efficiency and Sustainability:

The power rental market is witnessing rapid technological advancements aimed at enhancing equipment efficiency and sustainability. Smart monitoring systems and remote diagnostics enable real-time monitoring of equipment performance, predictive maintenance, and troubleshooting, minimizing downtime and maximizing uptime. Additionally, the integration of hybrid and renewable energy solutions, such as solar-diesel hybrid generators and battery storage systems, caters to the growing demand for eco-friendly power solutions. These technological innovations not only improve the environmental footprint of power rental operations but also offer cost savings and energy independence to businesses.

Power Rental Market Restraint

- Regulatory Challenges and Compliance Issues:

The power rental market is subject to various regulatory frameworks and compliance requirements imposed by governmental bodies and environmental agencies. Compliance with emission standards, noise regulations, and safety protocols adds complexity and cost to power rental operations. Additionally, navigating diverse regulatory landscapes across different regions and countries poses challenges for multinational rental companies. Non-compliance with regulatory requirements can result in fines, legal liabilities, and reputational damage for rental providers.

- Volatility in Fuel Prices and Availability:

Fuel constitutes a significant operational cost for power rental companies, particularly those relying on diesel generators. Fluctuations in fuel prices and availability, driven by geopolitical factors, market demand, and supply chain disruptions, pose challenges for rental providers in maintaining pricing stability and profitability. Moreover, dependency on fossil fuels exposes power rental companies to risks associated with environmental pollution and carbon emissions, further exacerbating sustainability concerns. While advancements in alternative fuel technologies offer potential solutions, their widespread adoption remains limited by infrastructure constraints and cost considerations.

Power Rental Market Opportunity

- Rising Demand for Remote Power Solutions:

The increasing need for power in remote and off-grid locations presents a significant opportunity for the power rental market. Remote areas lacking access to traditional power infrastructure, such as rural communities, construction sites, and remote industrial facilities, require temporary power solutions to support operations. Power rental companies can capitalize on this opportunity by offering mobile and modular power solutions tailored to the specific needs of remote environments. Moreover, advancements in renewable energy technologies, such as solar and wind power, enable the deployment of off-grid power systems, providing sustainable and cost-effective energy solutions to remote areas.

- Growing Trend Towards Decentralized Power Generation:

The shift towards decentralized power generation presents a significant growth opportunity for the power rental market. With the increasing adoption of distributed energy resources, including microgrids, cogeneration systems, and energy storage solutions, businesses and communities are seeking flexible and scalable power solutions that can be deployed closer to the point of consumption. Power rental companies can leverage this trend by offering rental services for distributed power generation equipment, such as modular generators, battery storage systems, and combined heat and power (CHP) units. By providing on-site power generation solutions, rental providers enable businesses to enhance energy resilience, reduce grid dependency, and optimize energy costs. Additionally, the integration of smart grid technologies and demand response programs further enhances the value proposition of decentralized power generation, creating new revenue streams for power rental companies.

Power Rental Market Challenges

- Intense Market Competition and Price Pressure:

The power rental market is characterized by intense competition among a multitude of players, ranging from global rental companies to regional providers and specialized niche players. This competitive landscape often leads to price pressures as companies vie for market share and seek to attract customers. As a result, power rental companies may face challenges in maintaining profitability while offering competitive pricing to clients. Additionally, commoditization of power rental services further exacerbates price pressure, making it difficult for companies to differentiate themselves based solely on price. To address this challenge, power rental companies must focus on value-added services, customer relationships, and operational efficiency to maintain a competitive edge in the market.

- Logistical and Operational Challenges:

The logistical and operational complexities associated with power rental services pose significant challenges for rental providers. Transporting heavy equipment, such as generators and transformers, to remote or inaccessible locations can be logistically challenging and costly. Moreover, installation, commissioning, and maintenance of power rental equipment require specialized expertise and resources, adding to operational complexities. Furthermore, ensuring timely delivery and availability of equipment during peak demand periods or emergencies requires effective planning and inventory management. Additionally, factors such as adverse weather conditions, regulatory requirements, and site-specific constraints further compound operational challenges for power rental companies. To overcome these challenges, rental providers must invest in robust logistics and supply chain management systems, as well as skilled personnel and technical capabilities to deliver reliable and efficient power rental services.

Segments Insights:

Application Insights

Standby Load applications dominated the market, fulfilling critical requirements for backup power during grid outages or maintenance activities. Industries that cannot afford operational disruptions, such as data centers, hospitals, and financial institutions, rely heavily on standby rental generators. For example, during power outages caused by winter storms in Texas (2021), numerous organizations turned to standby rental solutions to maintain business continuity, highlighting the critical role of this segment.

Continuous Load applications are growing rapidly, particularly in sectors like mining, oil & gas, and remote construction sites where consistent power is needed for extended periods. Continuous rental power solutions are ideal for operations in regions lacking permanent grid infrastructure. With the expansion of mining activities in Africa and oil exploration projects in Latin America, the demand for continuous load rental solutions is expected to experience a significant rise.

Fuel Insights

Diesel dominated the fuel segment in the Power Rental Market, accounting for the highest market share. Diesel generators are renowned for their robustness, high energy density, ease of transportation, and quick deployment. These features make diesel-based rental solutions the default choice for critical industries like construction, oil & gas, and mining, especially in remote areas where grid connectivity is poor. For instance, during emergency recovery operations after natural disasters like hurricanes in the U.S., diesel generator rentals have proven indispensable in providing immediate relief.

Natural Gas is the fastest-growing fuel segment, driven by the global push toward cleaner energy sources. Gas-powered generators emit significantly fewer pollutants compared to their diesel counterparts and are increasingly being adopted in urban settings with strict emission norms. Additionally, regions with abundant natural gas reserves, like North America, are witnessing a sharp uptick in natural gas-based rental solutions. The lower operating cost and reduced carbon footprint further amplify the attractiveness of this segment.

End User Insights

The Construction sector dominated the end-user segment, driven by the sector's inherent need for reliable, flexible power solutions throughout the project lifecycle. Construction sites often lack immediate access to permanent electricity infrastructure, making rental generators essential for powering equipment, lighting, and temporary facilities. Major projects such as the Qatar World Cup stadiums and Dubai Expo 2020 utilized extensive rental power setups during construction phases.

The Events segment is growing at the fastest rate, fueled by the resurgence of public events, concerts, festivals, and exhibitions post-pandemic. Event organizers prioritize reliable, noiseless, and sometimes eco-friendly power solutions to ensure seamless execution. Rental companies are offering tailored solutions, including hybrid power systems and silent generators, to meet the unique demands of event setups, boosting the rapid growth of this segment.

Regional Analysis

The Middle East and Africa (MEA) region dominated the Power Rental Market, owing to its vast oil & gas operations, numerous construction projects, and frequent power grid instability. Countries like Saudi Arabia, UAE, Nigeria, and South Africa are among the largest consumers of rental power solutions. For example, massive projects like NEOM in Saudi Arabia and the expansion of oil exploration activities across African nations have driven significant demand for temporary power setups.

Asia-Pacific is the fastest-growing regional market, supported by rapid industrialization, urbanization, and infrastructure development across China, India, Indonesia, and Vietnam. The region's frequent grid instability issues, combined with the high pace of commercial and residential development, has escalated the need for power rental services. Additionally, the increasing trend of large-scale events and industrial exhibitions in Asia-Pacific further fuels demand for temporary power solutions.

Some of the prominent players in the power rental market include:

- Pump Power Rental

- Global Power Supply

- Jassim Transport & Stevedoring Co. K.S.C.C.

- Newburn Power Rental Ltd.

- ProPower Rental

- Shenton Group

- Modern Hiring Service

- United Rentals

- FG Wilson

- APR Energy

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global power rental market.

By Fuel

By Application

- Continuous Load

- Standby Load

- Peak Load

By End User

- Mining

- Construction

- Utility

- Events

- Manufacturing

- Oil & Gas

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)