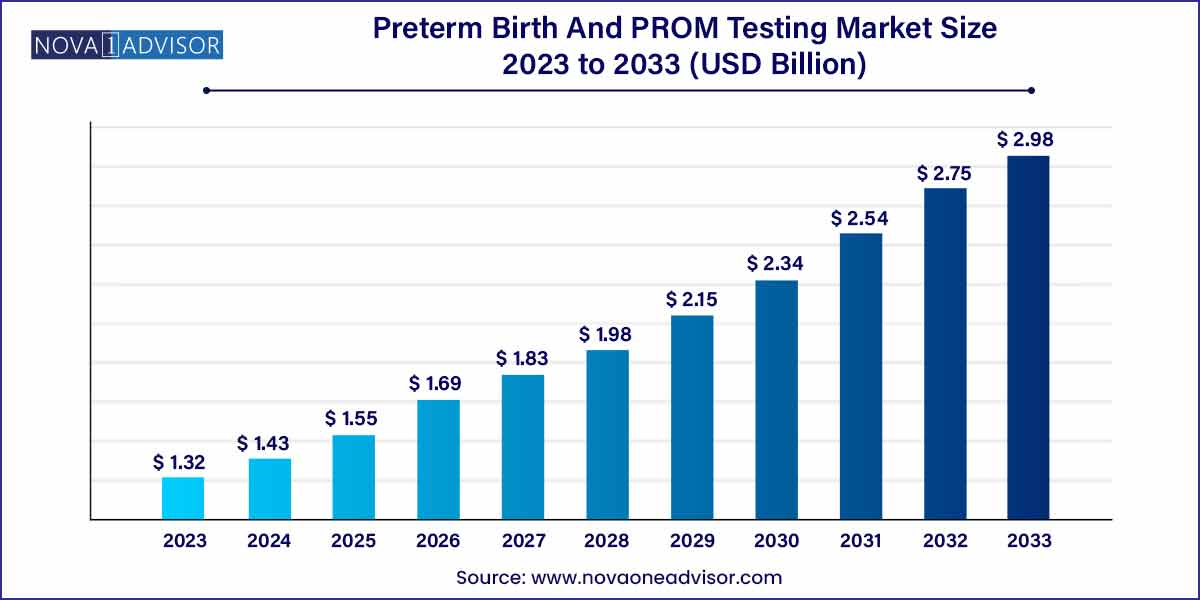

The global preterm birth and PROM testing market size was exhibited at USD 1.32 billion in 2023 and is projected to hit around USD 2.98 billion by 2033, growing at a CAGR of 8.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- In 2023, the ultrasound segment held 31.61% of the global preterm birth and PROM testing market.

- The preterm labor segment held 44.0% of market share in 2023 and is anticipated to have a similar trend in the forecasted period.

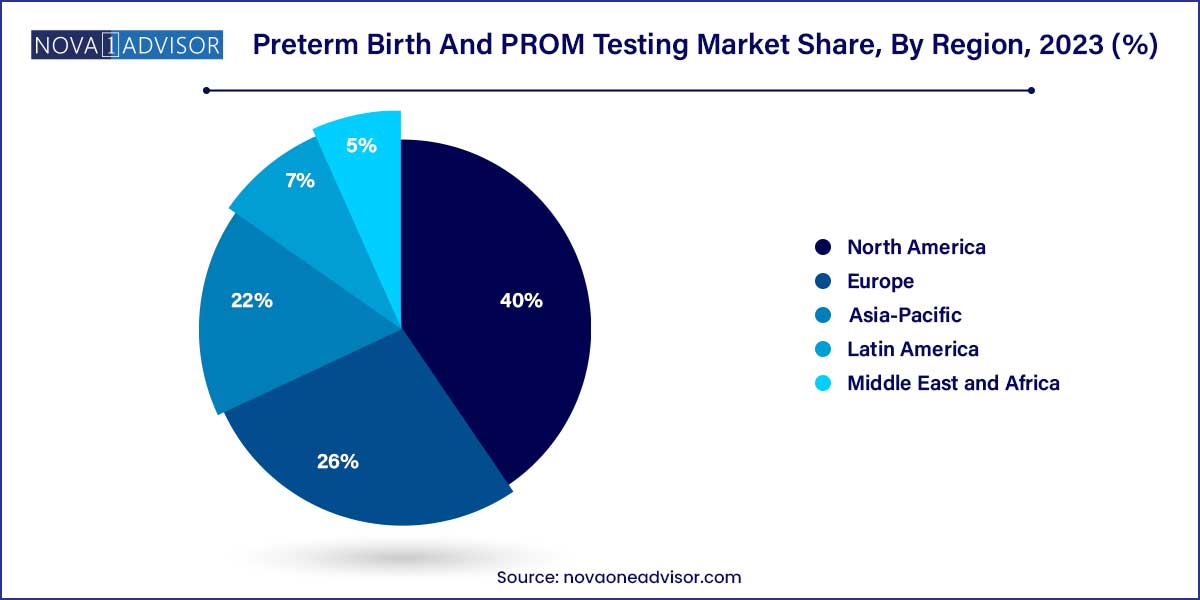

- North America captured the largest revenue share of 40.0% of preterm birth and PROM testing market in 2023.

Preterm Birth And PROM Testing Market: Overview

The Preterm Birth and PROM (Premature Rupture of Membranes) Testing market is becoming an increasingly vital part of maternal-fetal healthcare. Preterm birth, defined as delivery before 37 weeks of gestation, remains a leading cause of neonatal morbidity and mortality worldwide. PROM, the rupture of the amniotic sac before the onset of labor, is a major risk factor for preterm delivery, infections, and complications. Effective diagnostic tools for early detection of risks associated with preterm labor and PROM are crucial for timely intervention, improving clinical outcomes, and reducing healthcare costs.

Technological advances in biochemical marker testing, ultrasound imaging, and immunoassays have greatly enhanced the accuracy and efficiency of early diagnosis. Furthermore, growing awareness about maternal and neonatal health, government initiatives promoting prenatal care, and rising rates of high-risk pregnancies due to factors like increased maternal age and multiple pregnancies are boosting market growth.

As healthcare providers and policymakers emphasize early detection and intervention, innovations in biomarker assays, bedside diagnostic tools, and non-invasive tests are shaping a dynamic and rapidly expanding market landscape.

Preterm Birth And PROM Testing Market Growth

The growth of the Preterm Birth and Premature Rupture of Membranes (PROM) Testing Market is underpinned by several key factors. Firstly, increasing awareness and understanding of the serious health implications associated with preterm births drive the demand for advanced diagnostic solutions. Technological advancements in diagnostic techniques, including innovative imaging and biochemical methods, contribute significantly to the market's growth, enhancing the accuracy and early detection of preterm labor and PROM. Furthermore, a rising global prevalence of preterm births, particularly in high-risk regions, propels the demand for reliable testing options. Collaborative efforts between healthcare organizations, research institutions, and industry players also play a pivotal role in driving research and development initiatives, fostering the introduction of cutting-edge technologies to the market. As regulatory frameworks evolve to ensure the safety and efficacy of testing products, the market is poised for sustained growth, presenting both challenges and opportunities for stakeholders in the field of maternal and neonatal healthcare.

Preterm Birth And PROM Testing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.32 Billion |

| Market Size by 2033 |

USD 2.98 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Test Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Qiagen N.V.; Hologic, Inc.; Cooper Surgical Inc.; Abbott; Medixbiochemica; Sera prognostics; Clinical Innovations; LLC, Biosynex; NX Prenatal; Inc., IQ Products. |

Market Dynamics

The Preterm Birth and Premature Rupture of Membranes (PROM) Testing Market exhibit dynamic and robust market dynamics, with a notable focus on market size and growth trends. The increasing prevalence of preterm births globally, coupled with a growing awareness of the associated health risks, propels the demand for effective diagnostic solutions. The market is witnessing a substantial rise in investments in research and development, leading to the introduction of innovative testing methodologies and technologies. Key players in the market are strategically focusing on mergers, acquisitions, and partnerships to expand their product portfolios and geographical presence. Additionally, the market is influenced by evolving healthcare infrastructures, reimbursement policies, and regulatory frameworks, all of which contribute to shaping the landscape of preterm birth and PROM testing.

- Technological Advancements:

Technological advancements play a pivotal role in shaping the dynamics of the Preterm Birth and PROM Testing Market. Ongoing innovations in diagnostic techniques, such as advanced imaging modalities and sophisticated biochemical markers, enhance the accuracy and efficiency of early detection for preterm labor and PROM. The integration of artificial intelligence (AI) and machine learning algorithms further refines diagnostic capabilities, providing healthcare professionals with valuable insights. Moreover, continuous research and development efforts are fostering the introduction of novel testing solutions, addressing the evolving needs of maternal and neonatal healthcare. As technological breakthroughs continue to drive progress, market stakeholders are poised to capitalize on these advancements, ensuring a dynamic and competitive landscape in the realm of preterm birth and PROM testing.

Market Restraint

The Preterm Birth and Premature Rupture of Membranes (PROM) Testing Market faces significant restraint due to regulatory challenges. Stringent regulatory requirements and varying approval processes across different regions can hinder the timely introduction of new diagnostic products to the market. Compliance with regulatory standards is crucial for ensuring the safety and efficacy of testing solutions, but the complexity of navigating diverse regulatory landscapes poses a barrier for manufacturers. Achieving regulatory approval involves substantial investments of time and resources, delaying the availability of advanced diagnostic technologies and potentially limiting the market's growth potential.

Cost constraints represent a notable restraint in the preterm Birth and PROM testing markets. The development and deployment of sophisticated diagnostic technologies often involve high research and production costs. These expenses may be passed on to end-users, creating challenges in accessibility, especially in resource-limited healthcare settings. Additionally, reimbursement policies and coverage limitations can impact the affordability of these tests for patients. As a result, the adoption of advanced preterm birth and PROM testing solutions may be impeded, particularly in regions where healthcare budgets are constrained. Addressing cost-related challenges becomes crucial for market stakeholders to ensure widespread access to innovative testing options and foster market growth.

Market Opportunity

- Global Healthcare Initiatives and Awareness Programs:

A significant opportunity within the Preterm Birth and Premature Rupture of Membranes (PROM) Testing Market lies in global healthcare initiatives and awareness programs. Increasing efforts by governments, non-profit organizations, and healthcare agencies to raise awareness about the importance of early detection and management of preterm births create a favorable environment for market growth. Collaborative campaigns and educational initiatives can drive the demand for advanced testing solutions, encouraging expectant mothers to undergo routine screenings. Strategic partnerships between market players and public health entities can capitalize on these opportunities to promote comprehensive prenatal care, ultimately expanding the market reach and addressing the global burden of preterm births.

- Integration of Point-of-Care Testing (POCT) Solutions:

The integration of Point-of-Care Testing (POCT) solutions presents a promising opportunity in the Preterm Birth and PROM Testing Market. The demand for rapid and on-the-spot diagnostic solutions is growing, especially in settings with limited access to sophisticated laboratory infrastructure. POCT technologies enable timely and convenient testing, providing healthcare professionals with real-time results at the bedside. Market players investing in the development of portable and user-friendly POCT devices for preterm birth and PROM testing can tap into unmet needs, particularly in resource-constrained regions. The adoption of POCT solutions aligns with the trend towards decentralized healthcare, opening avenues for market expansion and improved accessibility to testing services.

Market Challenges

- Limited Awareness and Education:

A prominent challenge in the Preterm Birth and Premature Rupture of Membranes (PROM) Testing Market is the limited awareness and education surrounding the risks and consequences of preterm births. In many regions, expectant mothers may not be fully informed about the importance of early detection and testing for preterm labor and PROM. This lack of awareness can lead to delayed or inadequate prenatal care, hindering the effectiveness of testing initiatives. Market stakeholders face the challenge of developing and implementing comprehensive awareness campaigns to educate both healthcare providers and the general population, thereby fostering a proactive approach towards preterm birth prevention and timely testing.

- Economic Disparities and Access to Testing:

Economic disparities pose a significant challenge in the Preterm Birth and PROM Testing Market, affecting access to testing services. In regions with limited healthcare infrastructure and resources, affordability becomes a critical barrier for expectant mothers seeking preterm birth and PROM testing. High testing costs, coupled with inadequate insurance coverage, can result in unequal access to advanced diagnostic solutions. Addressing economic disparities requires innovative pricing models, strategic collaborations, and advocacy for improved healthcare policies to ensure that all pregnant individuals, regardless of their financial situation, have equal access to essential testing services. Overcoming economic challenges is pivotal for the widespread adoption of testing solutions and the reduction of preterm birth-related complications globally.

Segments Insights:

Test Type Insights

Pelvic exams dominated the test type segment in 2023, as they remain a standard and essential method for assessing cervical dilation, effacement, and fetal station, critical for diagnosing preterm labor. Despite technological advances, physical examination remains integral to initial risk assessment and triage decisions in clinical settings, especially in resource-limited areas.

However, biochemical marker testing is anticipated to experience the fastest growth during the forecast period. Tests based on biomarkers like fetal fibronectin (fFN), PAMG-1, and Interleukin (IL)-6 offer higher predictive value, allowing clinicians to stratify patients based on risk and tailor interventions accordingly. The rising preference for evidence-based, objective diagnostic methods and increased investments in biomarker research are driving this segment's rapid expansion.

Application Insights

PROM (Premature Rupture of Membranes) dominated the application segment in 2023. PROM testing, including pooling, nitrazine, ferning, and immunoassay tests, is widely adopted due to the critical need for timely detection and management to prevent complications like chorioamnionitis and neonatal infections.

Preterm labor testing, however, is expected to register the fastest growth. As healthcare providers seek to reduce preterm birth rates and associated neonatal intensive care costs, there is growing emphasis on early identification of women at risk of spontaneous preterm labor. Increasing availability of rapid, sensitive diagnostic tests and evolving clinical guidelines recommending their use are accelerating growth in this application segment.

Regional Insights

North America, led by the United States, accounted for the largest share of the Preterm Birth and PROM Testing market in 2024. Several factors contribute to this dominance, including high healthcare expenditure, advanced healthcare infrastructure, high prevalence of preterm births, and strong awareness regarding prenatal and maternal-fetal health.

The presence of key market players like Hologic, Inc., Abbott Laboratories, and Qiagen, combined with robust regulatory support from agencies like the FDA, ensures rapid adoption of innovative diagnostic solutions. Additionally, insurance coverage for prenatal testing and established newborn screening programs further fuel market growth in this region.

Asia-Pacific is forecasted to witness the fastest growth over the coming years. Factors such as a large and growing pregnant population, rising disposable incomes, increasing awareness of maternal health, and government-led initiatives targeting maternal and neonatal mortality reduction are driving the market.

Countries like China, India, and Japan are investing heavily in modernizing healthcare infrastructure, and international health organizations are promoting programs for early detection and management of pregnancy complications. As accessibility to advanced diagnostics improves, the Asia-Pacific region presents vast untapped potential for market expansion.

Some of the prominent players in the Preterm birth and PROM testing markets include:

- Qiagen N.V.

- Hologic, Inc.

- Cooper Surgical Inc.

- Abbott

- Medixbiochemica

- Sera Prognostics

- Clinical Innovations, LLC

- Biosynex

- NX Prenatal, Inc.

- IQ Products

Recent Developments

-

March 2025: Hologic, Inc. announced FDA approval for its new high-sensitivity fetal fibronectin assay designed to predict preterm birth risk more accurately within 7 days.

-

February 2025: Abbott Laboratories launched a rapid point-of-care PAMG-1 immunoassay device, "AmnioSure Plus," aimed at streamlining PROM detection in emergency settings.

-

December 2024: Qiagen entered into a collaboration with a leading maternal health research consortium to develop a multiplex biomarker panel for early prediction of preterm labor.

-

October 2024: Biosynex SA expanded its maternal health diagnostics portfolio by acquiring a patent for a novel non-invasive fetal membrane rupture detection test.

-

August 2024: NX Prenatal Inc. secured Series C funding to accelerate commercialization of its "NeXosome™" predictive blood test for early detection of preterm birth risks.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global preterm birth and PROM testing market.

Test Type

- Pelvic exam

- Ultrasound

- Biochemical Markers

-

- Interleukin (IL)-6

- C-Reactive Protein (CRP)

- IL-1, IL-2, IL-8, TNF-a

- Corticotropin-Releasing Hormone (CRH)

- Alpha-fetoprotein (AFP)

- Uterine Monitoring

- Nitazine Test

- Ferning Test

- Pooling

- PAMG-1 Immunoassay

- IGFBP Test

- Fetal Fibronectin (fFN)

- Others

Application

- PROM

- Preterm Labor

- Chorioamnionitis

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)