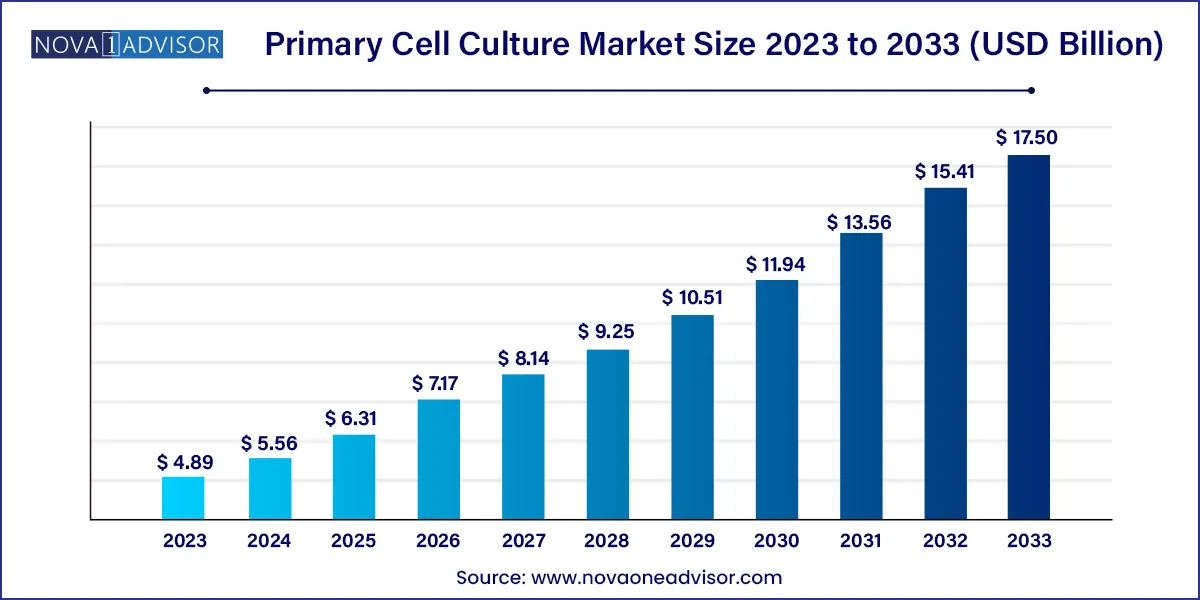

The global primary cell culture market size was exhibited at USD 4.89 billion in 2023 and is projected to hit around USD 17.50 billion by 2033, growing at a CAGR of 13.6% during the forecast period of 2024 to 2033.

Key Takeaways:

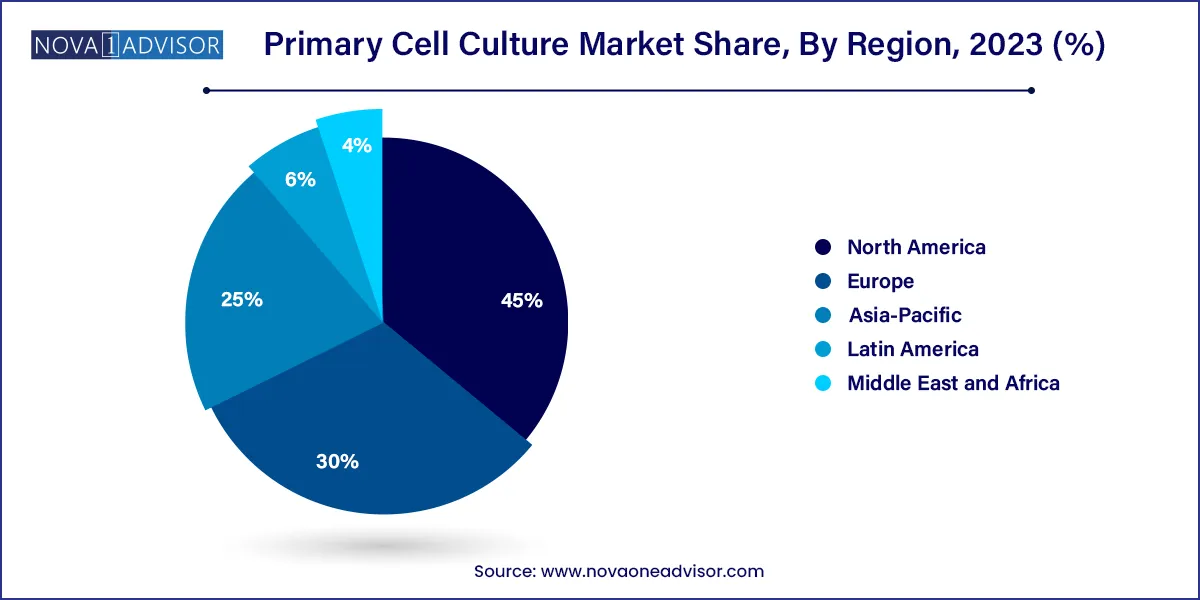

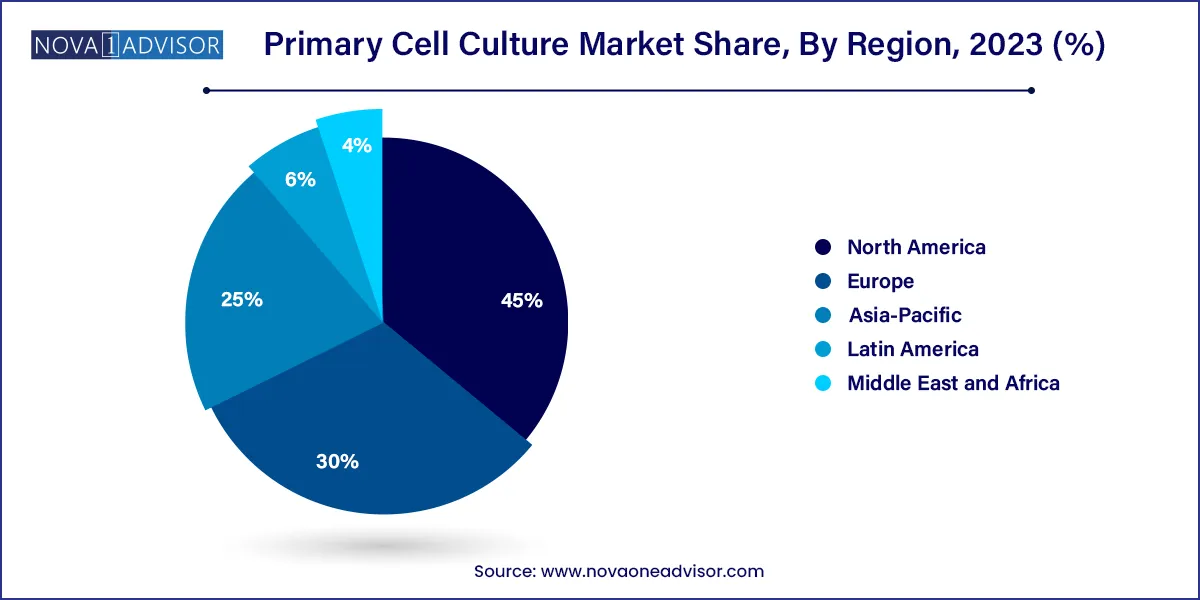

- North America dominated the market with a share of 45.0% in 2023.

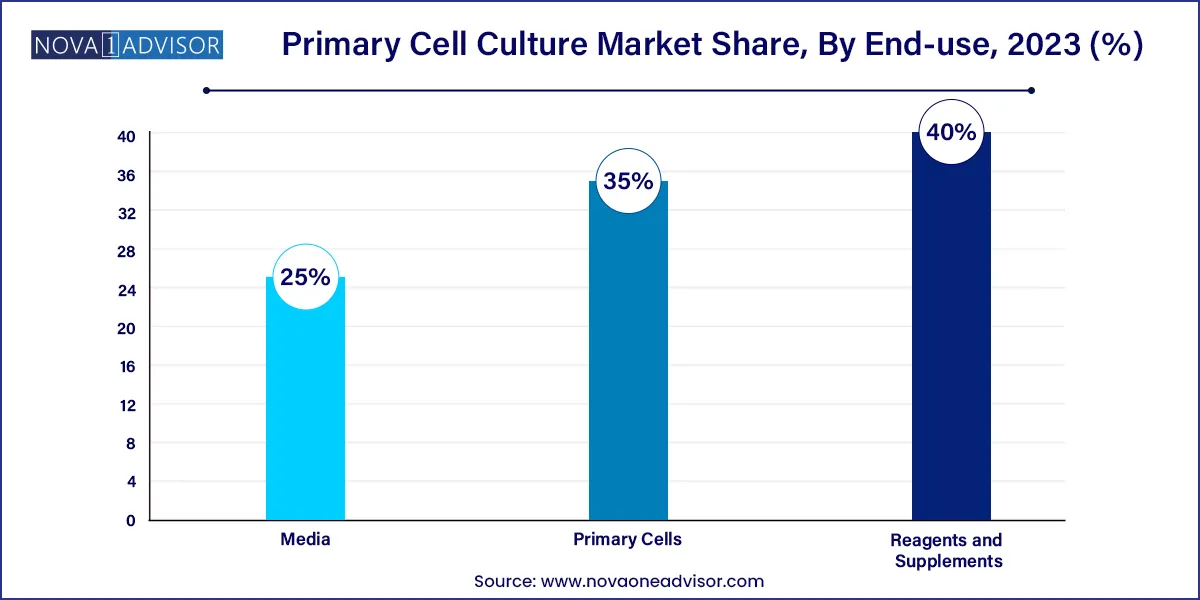

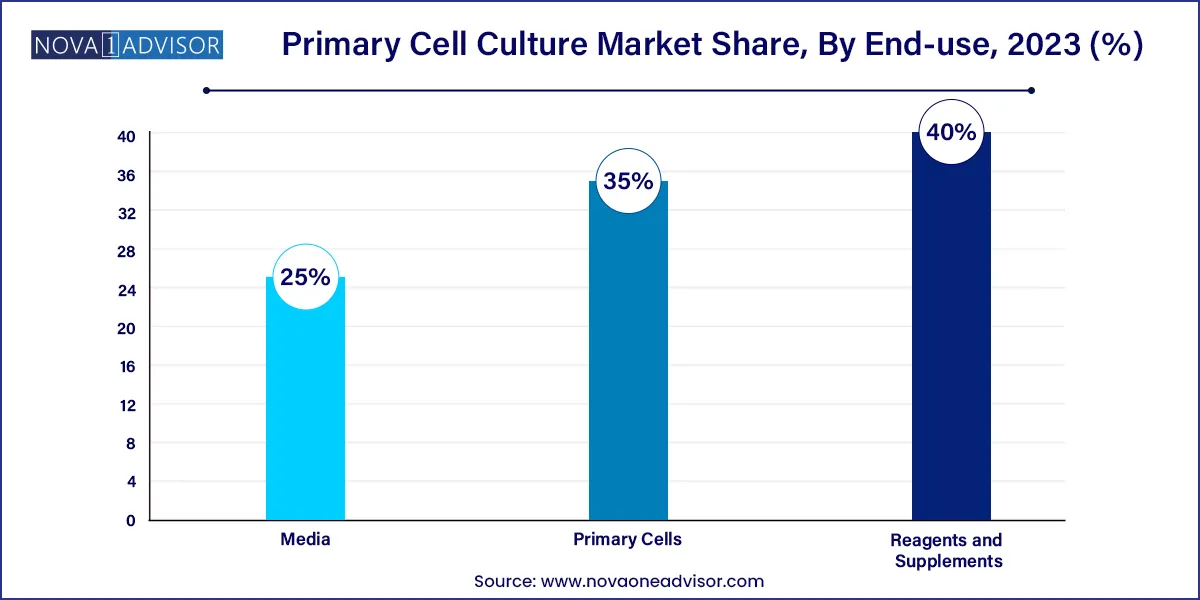

- The reagents and supplements segment held the largest share of 40.0% in 2023.

- The enzymatic degradation segment accounted for the largest revenue share in 2023.

- The animal cells segment dominated the market in 2023.

- The cell & gene therapy development segment dominated the market in 2023.

Market Overview

The Primary Cell Culture Market represents one of the most vital components of the life sciences and biomedical research ecosystem. Primary cell culture involves the direct extraction and cultivation of cells from living tissues either human or animal to preserve their physiological, genetic, and biochemical properties for short-term experimental use. Unlike immortalized or transformed cell lines, primary cells more accurately replicate in vivo cellular behavior, making them indispensable for predictive disease modeling, toxicity testing, and therapeutic development.

This market has experienced significant growth in recent years due to the increasing focus on cell-based research in drug discovery, cancer biology, regenerative medicine, and personalized healthcare. Primary cells provide enhanced reliability and relevance when evaluating drug responses, enabling better preclinical screening of potential therapeutics. Their application has expanded from traditional areas like virology and immunology to frontier domains including cell and gene therapy, organoids, and stem cell biology.

The market’s evolution is also driven by advances in isolation techniques, specialized culture media, and reagent kits that simplify the handling of fragile primary cells. Rising investments from both public institutions and private biopharma companies further amplify research output and clinical adoption.

As biological complexity takes center stage in healthcare innovation, the primary cell culture market is expected to remain a foundation for discovery and development across multiple life sciences disciplines.

Major Trends in the Market

-

Increased use of human-derived primary cells over animal cells for enhanced translational value in therapeutic screening.

-

Rising demand for customized media and supplements specific to cell types such as endothelial, nerve, and stem cells.

-

Expansion of enzymatic degradation techniques for more efficient and viable cell isolation from complex tissues.

-

Growing focus on 3D cell culture and co-culture systems, integrating primary cells to mimic physiological tissue microenvironments.

-

Emergence of xeno-free, serum-free, and chemically defined reagents, especially for clinical-grade and GMP-compliant applications.

-

Proliferation of primary cells in vaccine development, particularly for viral vector research and COVID-19 variant surveillance.

-

Integration of AI and machine learning tools in optimizing cell culture conditions and predicting cell behavior in vitro.

-

Increasing partnerships between research institutions and biotech firms to commercialize rare and specialty primary cell lines.

Primary Cell Culture Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.56 Billion |

| Market Size by 2033 |

USD 17.50 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 13.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Separation Method, Cell Type, Application Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Merck; Thermo Fisher Scientific, Inc.; Danaher; Lonza; PromoCell GmbH; Corning Incorporated; FUJIFILM Irvine Scientific, Inc.; Mattek; Axol Bioscience Ltd.; ATCC |

Key Market Driver: Increasing Investment in Cell & Gene Therapy Development

One of the primary market drivers is the surging investment in cell and gene therapy development, which requires high-fidelity, functional cells for product testing, optimization, and production. Primary cells, particularly stem cells, immune cells (e.g., T cells, dendritic cells), and endothelial cells, are central to the development of therapies for oncology, autoimmune disorders, and rare genetic conditions.

The production of CAR-T therapies, for instance, relies heavily on the isolation and expansion of primary T cells from patients. Similarly, gene editing using CRISPR-Cas9 technology is often tested on primary cells to assess efficacy and off-target effects. Because these cells retain their natural biological functions, they serve as superior models for evaluating the safety and effectiveness of therapeutic candidates. As clinical pipelines continue to diversify, the need for validated and ethically sourced primary cells is only expected to grow.

Key Market Restraint: Limited Lifespan and Batch Variability of Primary Cells

Despite their biological advantages, the primary cell culture market is significantly restrained by the limited lifespan and inherent variability of primary cells. Unlike immortalized cell lines, primary cells can only divide a finite number of times before entering senescence or losing their phenotypic characteristics. This makes reproducibility a persistent challenge, particularly in high-throughput screening and long-term studies.

Additionally, batch-to-batch differences, even when cells are isolated from the same tissue type, can introduce experimental inconsistencies. Variations in donor genetics, age, and health status further complicate standardization. Moreover, the isolation and culture of primary cells require more advanced skill sets and infrastructure, increasing time and cost. These issues necessitate greater investment in standardized protocols, automated handling systems, and high-quality reagent kits to unlock the market’s full potential.

Key Market Opportunity: Rise in Personalized Medicine and Patient-Derived Cell Models

A major opportunity for the market lies in the growing emphasis on personalized medicine, where patient-derived primary cells can be used for precision diagnostics, drug testing, and treatment planning. By culturing cells from a patient’s own tissue or blood sample, researchers can model disease behavior and test drug responses in a genetically matched system—an approach gaining traction in oncology, rare diseases, and pharmacogenomics.

For example, primary tumor cells extracted from biopsy samples are now used to evaluate chemotherapy sensitivity, immune evasion mechanisms, and genetic mutations. Similarly, neuronal primary cultures derived from iPSCs or post-mortem samples are applied in neurodegenerative disease modeling. This growing trend, supported by biobanks, organ-on-a-chip platforms, and co-culture systems, is expected to dramatically increase the demand for high-quality, reproducible primary cell resources in both research and clinical settings.

By Product

Primary cells dominated the product segment, reflecting their essential role in experimental biology and translational medicine. Among these, blood-derived and stem cells are in high demand due to their wide applicability in immunology, oncology, and regenerative medicine. Endothelial and nerve cells are also widely used for vascular biology and neuroscience research. Their physiological relevance offers unparalleled insights into cellular responses, particularly in toxicology and infection modeling.

However, reagents and supplements are expected to grow fastest, driven by the growing complexity of primary cell culture and the need for optimized environments. Growth factors, sera, cytokines, and attachment solutions are essential for supporting the viability and proliferation of fragile cell types. The shift toward serum-free and animal-free supplements has created opportunities for suppliers to innovate with chemically defined kits that reduce variability while maintaining functionality.

By Separation Method

Enzymatic degradation dominated the separation methods, especially the use of enzymes like trypsin, collagenase, and dispase to isolate viable cells from solid tissues. These enzymes break down extracellular matrix components, facilitating efficient cell release without significantly compromising cell viability. This method is particularly preferred for isolating cells from complex tissues like nerve, muscle, and bone.

Meanwhile, mechanical separation methods are gaining momentum, especially in research labs focusing on simple tissue systems or when enzyme-free protocols are desired. Although they may yield fewer viable cells, these methods offer more control over cell harvesting, reduce enzyme-induced stress, and are compatible with delicate cells such as those from prenatal or developmental sources.

By Cell Type

Human cells held the majority share, owing to their greater relevance in clinical applications, disease modeling, and regulatory compliance. These cells, particularly those derived from blood, skin, and fat tissue, are commonly used in oncology, regenerative medicine, and cosmetic testing.

Animal cells are also widely used, particularly in academic settings and early-stage research, where cost and availability are critical considerations. Rodent-derived cells, for example, are a staple in neuroscience and toxicology studies. However, the ethical shift toward human-relevant models is likely to tilt the long-term growth trajectory in favor of human-derived cell cultures.

By Application

Cell and gene therapy development emerged as the largest application segment, reflecting the explosive growth in advanced therapies that rely on high-quality primary cells. These include CAR-T cell therapies, CRISPR gene editing platforms, and stem cell transplants. The ability of primary cells to closely mimic patient physiology makes them indispensable in preclinical safety and efficacy evaluations.

Vaccine production is among the fastest-growing segments, especially in the wake of global pandemic preparedness efforts. Vero cells, primary monkey kidney cells, and human blood-derived cells have been widely used for viral culture, mRNA development, and antigen screening. The focus on adaptable platforms that can rapidly scale in response to emerging pathogens has boosted the need for robust, well-characterized primary cells.

By Regional Insights

North America currently dominates the primary cell culture market, led by the United States’ highly developed biopharmaceutical ecosystem and robust academic research infrastructure. Institutions such as Harvard, MIT, and the NIH fund a significant share of global cell-based research, while biotech giants like Thermo Fisher Scientific, Lonza, and ATCC are headquartered in the region. The region benefits from strong regulatory frameworks, a growing pipeline of gene and cell therapies, and widespread adoption of advanced culture tools.

Additionally, North America’s leadership in personalized medicine initiatives, particularly the All of Us Research Program, has fueled the demand for patient-derived cells and custom culture environments. This strong combination of funding, infrastructure, and innovation continues to sustain regional dominance.

Asia-Pacific is the fastest-growing regional market, supported by rising investments in healthcare, biotechnology, and contract research. Countries like China, India, Japan, and South Korea are ramping up capabilities in vaccine development, regenerative medicine, and basic cellular research. Government initiatives such as China's "National Stem Cell Project" and India’s “Biotech Innovation Mission” are fostering local cell culture production and driving international collaborations.

Furthermore, the growing footprint of CROs and CMOs in the region has increased the outsourcing of cell-based assays, toxicology tests, and GMP-grade primary cell culture. Asia-Pacific's expanding academic network and increasing focus on translational medicine make it a focal point for future market growth.

Recent Developments

-

In February 2025, Thermo Fisher Scientific launched a new line of xeno-free primary human skeletal muscle cells and media kits, designed for regenerative medicine and drug screening.

-

Lonza Group AG expanded its cell therapy portfolio in January 2025, unveiling new primary T-cell isolation and activation reagents for CAR-T therapy developers.

-

In December 2024, PromoCell GmbH introduced an upgraded primary endothelial cell culture system, optimized for angiogenesis and cardiovascular research.

-

ATCC (American Type Culture Collection) partnered with a U.S.-based biobank in November 2024 to distribute rare primary cell types for rare disease modeling.

-

In October 2024, Merck KGaA (MilliporeSigma) announced its investment in an automated platform for large-scale primary stem cell expansion, addressing demand from cell therapy developers.

Some of the prominent players in the Primary cell culture market include:

- Thermo Fisher Scientific, Inc.

- Lonza

- Merck

- Corning Incorporated

- Danaher

- PromoCell GmbH

- ATCC

- FUJIFILM Irvine Scientific, Inc.

- Mattek

- Axol Bioscience Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global primary cell culture market.

Product

-

- Fat

- Blood

- Nerve

- Bone

- Endothelial

- Skin

- Muscle

- Stem

- Others

-

- Attachment Solution

- Buffers and salts

- Freezing Media

- Sera

- Growth factors and cytokines

-

- Fat cells media

- Blood cells media

- Nerve cells media

- Bone cells media

- Endothelial cells media

- Skin cells media

- Muscle cell media

- Stem cells media

- Others

Separation Method

- Explant Method

- Enzymatic Degradation

-

- Trypsin

- Collagenase

- Protease

- Pronase

- Dispase

- Hyaluronidase

- Neuraminidase

- Elastase

- DNase

- Papain

- Accutase

- Others

- Mechanical Separation

- Others

Cell Type

Application

- Cell & Gene Therapy Development

- Vaccine Production

- Model System

- Virology

- Prenatal Diagnosis

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)