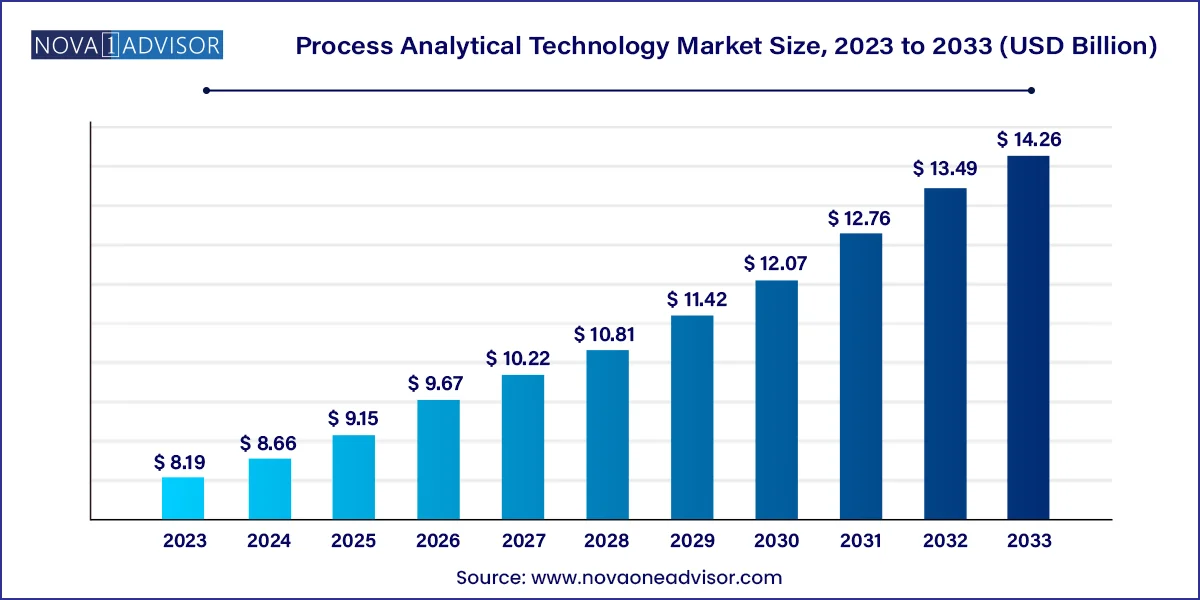

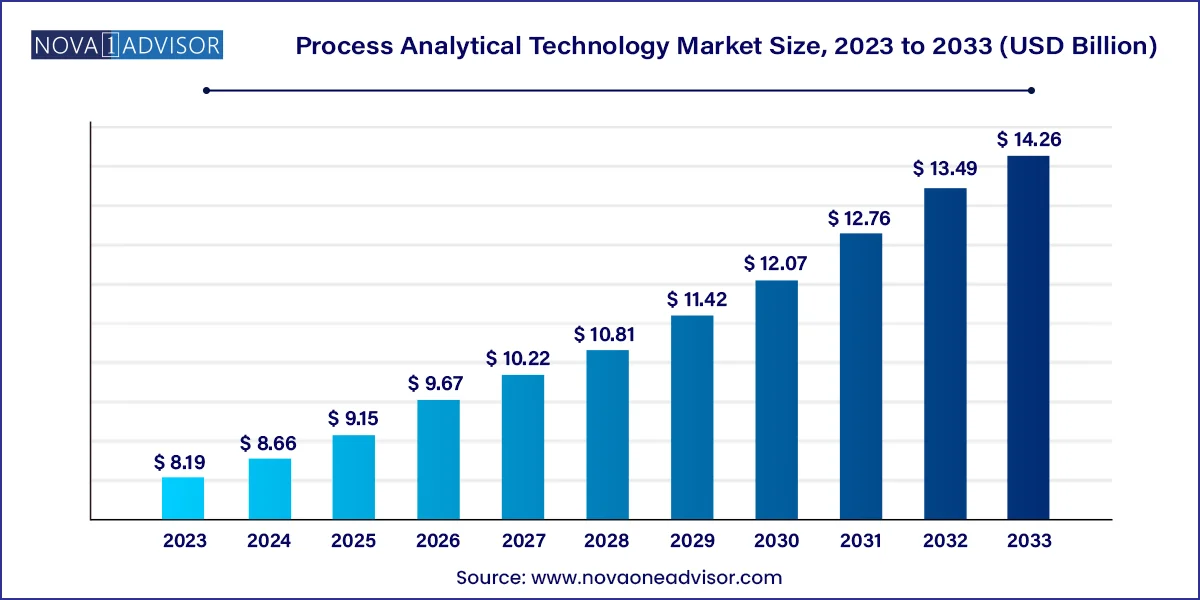

Process Analytical Technology Market Size and Growth Forecast 2024-2033

The global process analytical technology market size was valued at USD 8.19 billion in 2023 and is anticipated to reach around USD 14.26 billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Process Analytical Technology Market Key Takeaways

- North America process analytical technology market dominated the market with a share of 38.19% in 2023

- The by Product, Analyzers held a dominant share of 30.17% in 2023.

- The sensors and probes segment is expected to grow at a CAGR of 5.5% over the forecast period.

- The by Technique, Spectroscopy held the largest share in 2023.

- Chromatography is anticipated to grow at a CAGR of 5.6% over the forecast period.

- The by Monitoring Method, In-line dominated the market with a share of 42.14% in 2023.

- The on-line segment is expected to grow at a CAGR of 6.4% during the forecast period.

- The by Application , The small molecules segment dominated the market in 2023.

- The large molecules segment is expected to grow rapidly during the forecast period.

- The by End Use , Pharmaceutical and biotechnology companies held majority of the market share in 2023.

- CMOs and CDMOs are projected to witness a CAGR of 7.1% during the forecast period.

Market Overview

Process Analytical Technology (PAT) represents a transformative framework in modern pharmaceutical and chemical manufacturing, designed to improve product quality and optimize production efficiency through timely measurements of critical quality and performance attributes. Developed as a strategic initiative by the U.S. FDA in 2004, PAT has grown into a global cornerstone for quality-by-design (QbD) methodologies, facilitating real-time process control and continuous manufacturing.

At its core, PAT combines analyzers, sensors, software, and data analytics to monitor, control, and optimize bioprocesses and manufacturing environments. This market finds profound relevance in industries like pharmaceuticals, biotechnology, food processing, petrochemicals, and advanced materials, where even minor deviations in process parameters can lead to significant product losses or regulatory setbacks.

With the increasing complexity of drug formulations, rising demand for biologics, and regulatory emphasis on real-time release testing (RTRT), the PAT market is gaining widespread traction. In the wake of the COVID-19 pandemic, biopharma manufacturers experienced firsthand the limitations of conventional batch processes and began integrating PAT tools to support adaptive, continuous manufacturing environments.

As bioprocessing becomes more sophisticated—particularly in gene therapy, vaccine production, and cell-based therapies—the adoption of PAT systems is proving essential to ensuring reproducibility, compliance, and product integrity. Governments and regulatory bodies are also encouraging investments in PAT to improve manufacturing transparency and resilience.

Major Trends in the Market

-

Shift Toward Continuous Manufacturing: Adoption of PAT tools is accelerating in continuous processing, reducing cycle times and improving scalability.

-

Integration of AI and Machine Learning: AI-powered data analytics is being embedded into PAT systems to provide predictive insights and automate anomaly detection.

-

Miniaturization and Portability of Analyzers: Compact PAT tools enable real-time quality monitoring directly on production floors or mobile units.

-

Rise of Multivariate Data Analysis (MVDA): Advanced analytics software is enabling operators to monitor multiple variables simultaneously, enhancing process understanding.

-

Surge in Biologics Manufacturing: The complexity of biologics and biosimilars drives higher adoption of PAT to ensure consistent quality and yield.

-

Cloud-based PAT Platforms: Remote data access and scalable cloud infrastructures are supporting collaborative process monitoring and diagnostics.

-

Regulatory Push for Real-Time Release Testing (RTRT): Regulatory support from FDA and EMA is pushing companies to implement PAT-based RTRT practices.

-

PAT in CDMO Operations: Contract development and manufacturing organizations (CDMOs) are integrating PAT to meet client expectations for transparency and compliance.

Process Analytical Technology Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 8.66 Billion |

| Market Size by 2033 |

USD 14.26 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.7% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, technique, monitoring method, application, end use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Danaher Corporation (Ab Sciex LLC); Bruker Corporation; PerkinElmer, Inc.; ABB Ltd.; Carl Zeiss AG (Zeiss Group); Emerson Electric Co.; Mettler-Toledo; Shimadzu Corporation; Sartorius AG; Hamilton Company; Repligen Corporation |

Market Driver: Increasing Demand for Quality by Design (QbD) and Real-Time Monitoring

One of the primary drivers of the PAT market is the growing industry shift from quality control (QC) to quality assurance (QA), spearheaded by the adoption of the Quality by Design (QbD) paradigm. QbD emphasizes understanding the process and controlling it in real-time to ensure consistent product quality, rather than relying solely on end-product testing. PAT tools are integral to this approach, enabling manufacturers to track critical quality attributes (CQAs) and critical process parameters (CPPs) in real-time.

In pharmaceutical manufacturing, this translates to better yield, fewer batch failures, and reduced production costs. For example, a biologics manufacturer can use inline Raman spectroscopy to monitor protein folding during fermentation, triggering corrective actions instantly if deviations occur. As a result, the integration of PAT systems improves compliance with regulatory expectations while enhancing operational efficiency and product quality.

Market Restraint: High Implementation Cost and Integration Complexity

Despite its benefits, one of the major constraints in the widespread adoption of PAT systems is the high cost of implementation and integration into legacy systems. Small and mid-sized enterprises (SMEs) often lack the capital or expertise to retrofit their existing manufacturing setups with PAT tools, which can involve significant expenditure on new hardware, software, training, and validation protocols.

Moreover, integrating PAT with existing manufacturing execution systems (MES) and laboratory information management systems (LIMS) can be technologically demanding. Disparate data formats, lack of interoperability, and the need for highly specialized personnel for calibration and validation increase the time and resource investment. These complexities often deter companies from early adoption, especially in cost-sensitive or fragmented manufacturing environments.

Market Opportunity: Expanding Use of PAT in Biopharmaceutical Manufacturing

The booming biopharmaceutical sector presents a massive opportunity for the PAT market, particularly in the production of monoclonal antibodies, cell therapies, gene therapies, and RNA-based therapeutics. Unlike small-molecule drugs, biologics are highly sensitive to process variations, requiring tighter control and deeper process understanding to ensure batch consistency.

PAT tools like NIR and Raman spectroscopy are ideal for monitoring critical parameters such as pH, dissolved oxygen, metabolite concentrations, and cell density in real-time. Companies are now integrating PAT early in process development to streamline scale-up and reduce time-to-market. The growth of modular biomanufacturing facilities and personalized medicine is further catalyzing demand for adaptable, real-time monitoring tools that can be deployed across diverse environments.

Process Analytical Technology Market By Product Insights

Analyzers dominated the product segment, accounting for the largest revenue share owing to their critical role in measuring physical and chemical parameters. Spectroscopic analyzers, in particular, are indispensable in pharmaceutical and chemical process control. These tools are used for real-time monitoring of reaction kinetics, product purity, and impurity profiles. Their ability to deliver immediate insights without the need for offline sampling makes them invaluable for continuous and batch processes alike. Major players like Agilent, Bruker, and Thermo Fisher have introduced highly sensitive and miniaturized analyzers that can be directly embedded into production lines.

Software & services is the fastest-growing segment, driven by the need for advanced data analytics and system integration. As PAT generates massive volumes of real-time data, software platforms that offer visualization, multivariate analysis, and cloud-based access are becoming essential. Companies are also investing in service offerings like system calibration, predictive maintenance, and AI-powered analytics to derive actionable insights from PAT data. Vendors such as Sartorius and Waters are expanding their offerings in this domain through partnerships and proprietary software development.

Process Analytical Technology Market By Technique Insights

Spectroscopy is the most dominant technique, with NIR, Raman, and Mass Spectroscopy leading the way. These techniques allow non-invasive, non-destructive, and highly specific measurements of critical quality attributes. For example, Raman spectroscopy is widely used for inline monitoring of crystallization and reaction progress in pharmaceutical synthesis. NIR spectroscopy helps track moisture and blend uniformity in tablet production. These capabilities make spectroscopy a cornerstone of real-time process control.

Chromatography is the fastest-growing technique, especially liquid chromatography, due to its high-resolution separation capabilities. In biopharma, chromatography is essential for protein purification and impurity profiling, where PAT tools are integrated to assess column performance, elution profiles, and load capacities. As continuous chromatography gains momentum, inline monitoring via PAT tools is becoming indispensable.

Process Analytical Technology Market By Monitoring Method Insights

On-line monitoring holds the largest share, as it enables near real-time data acquisition without disrupting the production process. On-line PAT systems are extensively used in both chemical and biopharmaceutical applications to analyze intermediate products and detect deviations early. These systems help in maintaining consistent product quality and reducing material waste.

In-line monitoring is the fastest-growing method, particularly in continuous manufacturing environments. In-line tools offer immediate feedback and allow direct control actions based on real-time data. This approach is especially valuable in the production of biologics, where conditions like pH, temperature, and metabolite concentrations need to be tightly regulated throughout the process. ABB and Sartorius are among the key providers of integrated in-line PAT systems.

Process Analytical Technology Market By Application Insights

Small molecules lead the application segment, as the production of traditional pharmaceuticals still dominates the global drug market. PAT tools are widely deployed in small molecule synthesis for real-time monitoring of reaction completeness, impurity levels, and crystallization parameters. Process analytical tools help reduce batch-to-batch variability and optimize yields.

Large molecules are the fastest-growing application, thanks to the rapid expansion of biologics and biosimilars. The complexity and sensitivity of these macromolecules necessitate real-time monitoring and precise control of process parameters. PAT tools ensure consistent expression levels, product quality, and purity, reducing the risk of downstream failures and regulatory non-compliance.

Process Analytical Technology Market By End Use Insights

Pharmaceutical & biotechnology companies are the leading end-users, driven by regulatory mandates and competitive pressure to accelerate product development cycles. These companies deploy PAT across R&D, scale-up, and full-scale manufacturing to support quality-by-design approaches and RTRT compliance. Investments in smart manufacturing are further increasing PAT adoption.

CMOs and CDMOs are the fastest-growing end-users, as they increasingly act as innovation partners for large biopharma firms. To meet stringent client expectations, CDMOs are integrating PAT systems into their operations to offer transparency, flexibility, and accelerated timelines. This trend is especially pronounced in North America and Asia-Pacific, where outsourcing is on the rise.

Process Analytical Technology Market By Regional Insights

North America dominates the global PAT market, supported by a strong biopharmaceutical sector, early regulatory initiatives, and the presence of leading technology providers. The U.S. FDA's PAT framework has been instrumental in encouraging adoption across pharmaceutical manufacturing. Companies like Thermo Fisher, Agilent, and Danaher are headquartered in the region and continue to innovate in real-time analytics, spectroscopy, and cloud-based PAT platforms. Furthermore, the growth of continuous manufacturing pilots and FDA's RTRT push have provided a conducive environment for PAT deployment.

Asia-Pacific is the fastest-growing region, driven by rising pharmaceutical production, expansion of CDMO facilities, and increasing government support for advanced manufacturing. China and India are establishing themselves as biopharma manufacturing hubs, while countries like South Korea and Japan are investing heavily in smart factory initiatives. The need to meet global quality standards is propelling PAT adoption across both local and multinational manufacturing sites.

Process Analytical Technology Market Top Key Companies:

- Thermo Fisher Scientific Inc.

- Repligen Corporation

- Bruker Corporation

- Agilent Technologies, Inc.

- ABB Ltd.

- Danaher Corporation (Ab Sciex LLC)

- PerkinElmer, Inc.

- Emerson Electric Co.

- Sartorius AG

- Mettler-Toledo

- Shimadzu Corporation

- Hamilton Company

- Carl Zeiss AG (Zeiss Group)

Process Analytical Technology Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Process Analytical Technology market.

By Product

- Analyzers

- Sensors & Probes

- Samplers

- Software & Services

By Technique

- Spectroscopy

- NIR Spectroscopy

- Raman Spectroscopy

- NMR Spectroscopy

- Mass Spectroscopy

- Others

- Chromatography

- Liquid Chromatography

- Gas Chromatography

- Particle Size Analysis

- Electrophoresis

- Others

By Monitoring Method

- On-line

- In-line

- At-line

- Off-line

By Application

- Small Molecules

- Large Molecules

- Manufacturing Applications

- Other Applications

By End Use

- Pharmaceutical & Biotechnology Companies

- CROs

- CMOs & CDMOs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)