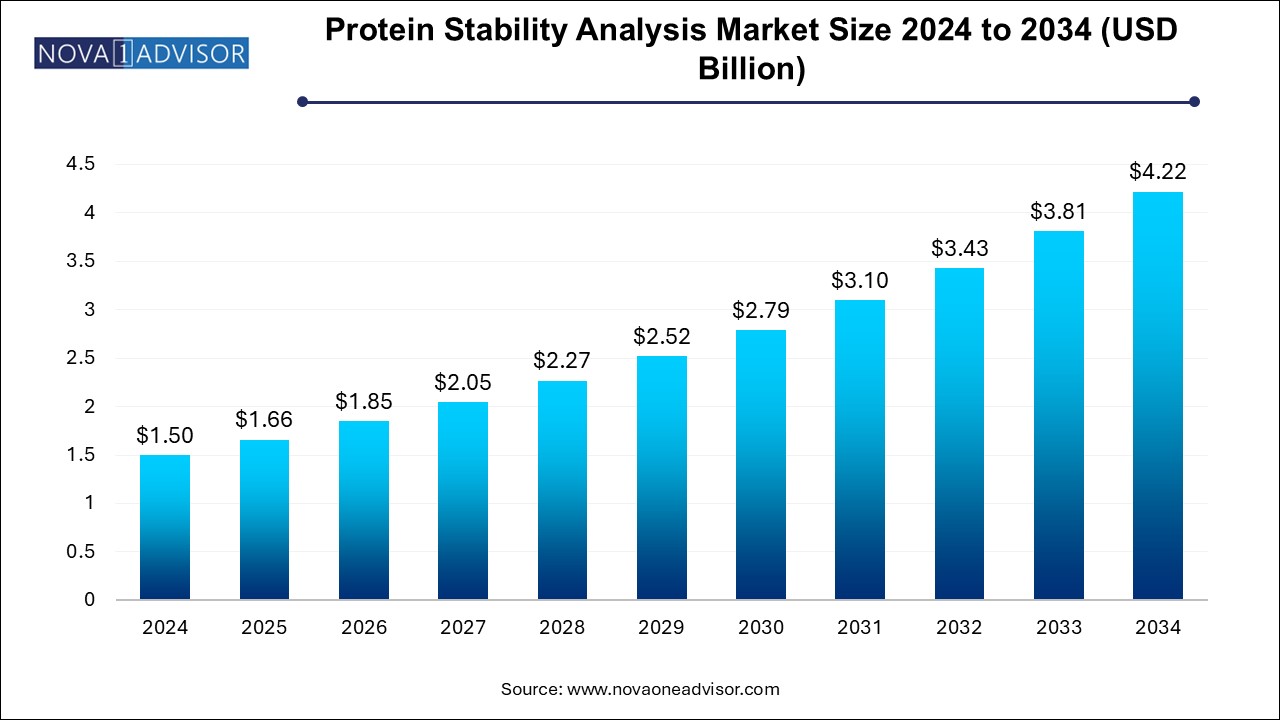

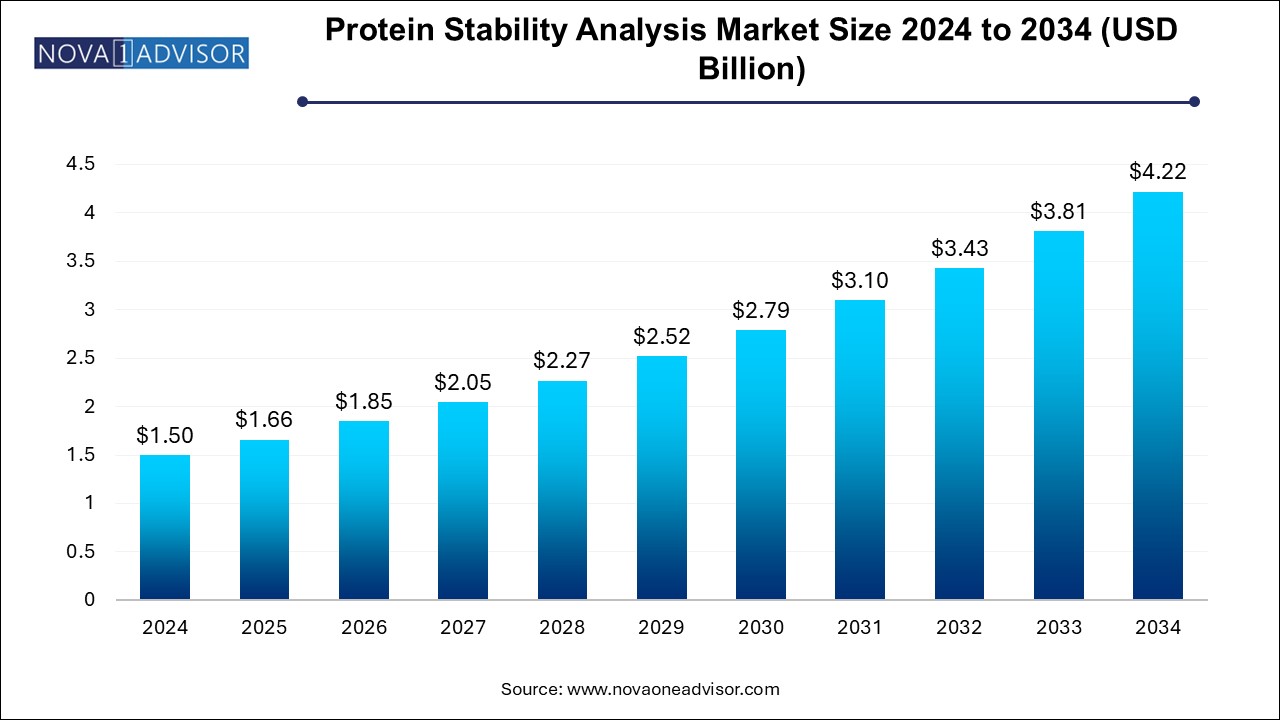

Protein Stability Analysis Market Size and Growth

The protein stability analysis market size was exhibited at USD 1.50 billion in 2024 and is projected to hit around USD 4.22 billion by 2034, growing at a CAGR of 10.9% during the forecast period 2024 to 2034.

Protein Stability Analysis Market Key Takeaways:

- The reagents and assay kits segment dominated the protein stability analysis market in 2024 .

- Differential Scanning Calorimetry (DSC) occupied the largest revenue share in the market for protein stability analysis in 2024.

- North America accounted for the largest share in the global market for protein stability analysis in 2024.

Market Overview

The protein stability analysis market plays a critical role in the broader biopharmaceutical and life sciences industries. Protein stability analysis refers to a range of techniques used to determine the physical and chemical integrity of proteins under various environmental conditions. This data is essential for drug development, vaccine formulation, biotherapeutic production, and academic research.

Protein therapeutics—such as monoclonal antibodies, enzymes, vaccines, and fusion proteins—are sensitive biomolecules prone to denaturation, aggregation, or loss of function. Analyzing and ensuring their stability is crucial for maintaining efficacy, safety, and shelf-life. Consequently, stability studies are mandatory components of regulatory filings to agencies like the FDA and EMA.

The rising development of biologics and biosimilars, expanding R&D pipelines, growing investments in precision medicine, and the increased emphasis on quality control are major drivers for the protein stability analysis market. Innovations in analytical techniques, such as high-throughput screening, advanced calorimetry, and AI-driven data interpretation, are significantly enhancing the accuracy, speed, and scalability of stability studies.

Furthermore, partnerships between biotech firms, contract research organizations (CROs), and academic institutions are broadening access to cutting-edge stability technologies, thus driving market expansion globally.

Major Trends in the Market

-

Shift Toward High-throughput and Automated Stability Screening: Improving speed and reducing labor costs in protein characterization.

-

Integration of AI and Machine Learning: Enhancing predictive analytics for protein behavior under different conditions.

-

Development of Label-free Stability Analysis Technologies: Innovations like label-free DSF expanding assay flexibility.

-

Increased Outsourcing to CROs and CDMOs: Growing reliance on specialized service providers for stability testing.

-

Expansion of Stability Studies Beyond Biologics: Including cell and gene therapies, mRNA vaccines, and biosimilars.

-

Adoption of Microfluidics and Nanocalorimetry: Improving sensitivity and reducing sample volume requirements.

-

Rising Regulatory Stringency: Stronger global regulatory focus on stability data for drug approvals.

-

Focus on Multi-parametric Analysis: Combining different techniques (e.g., DSC with DLS) to deliver more comprehensive protein profiles.

Report Scope of Protein Stability Analysis Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.66 Billion |

| Market Size by 2034 |

USD 4.22 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 10.9% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Technique, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc; Enzo Biochem, Inc.; PerkinElmer Inc.; NanoTemper; GE Healthcare; HORIBA, Ltd.; Malvern Panalytical Ltd.; Agilent Technologies, Inc.; SETARAM Instrumentation; Unchained Labs; Waters Corporation; Applied Photophysics Ltd. |

Key Market Driver: Surge in Biologics and Biosimilars Development

The most powerful driver propelling the protein stability analysis market is the growing development of biologics and biosimilars.

Biologics have become one of the fastest-growing segments in pharmaceuticals, addressing complex diseases like cancer, autoimmune disorders, and rare genetic conditions. However, proteins are inherently unstable, and minor changes in temperature, pH, ionic strength, or mechanical stress can lead to aggregation, degradation, or loss of bioactivity.

Rigorous stability profiling using techniques like differential scanning calorimetry (DSC), spectroscopy, and chromatography is essential throughout drug development spanning discovery, formulation, production, and post-approval surveillance. With a strong global pipeline of monoclonal antibodies, therapeutic enzymes, vaccines, and biosimilars, demand for robust and scalable protein stability analysis solutions is surging exponentially.

Key Market Restraint: High Cost and Complexity of Advanced Instrumentation

A significant restraint facing the protein stability analysis market is the high cost and operational complexity of advanced analytical instruments.

Technologies like DSC, DLS, and advanced mass spectrometry require substantial capital investments, sophisticated infrastructure, and skilled operators. Small- and medium-sized biotechnology companies, startups, and academic labs may find it financially challenging to adopt and maintain these systems.

Moreover, interpreting the vast datasets generated from multi-parametric analyses demands specialized bioinformatics expertise. The complexity in integrating stability data into decision-making processes, coupled with financial constraints, often slows down adoption rates, particularly in emerging economies.

Key Market Opportunity: Rising Demand for Stability Analysis in Gene and mRNA-based Therapies

An emerging and transformative opportunity lies in the growing demand for stability analysis in gene therapies and mRNA-based therapeutics.

Unlike traditional biologics, mRNA vaccines (such as COVID-19 vaccines) and gene therapies involve nucleic acids, viral vectors, or engineered proteins that are often even more sensitive to environmental stressors. Stability analysis tools originally developed for proteins are being adapted and enhanced to address these new modalities.

Companies that innovate in providing comprehensive stability solutions spanning proteins, nucleic acids, lipid nanoparticles, and viral vectors—are poised to capitalize on the next wave of biopharma development. Tailored assay kits, miniaturized high-throughput systems, and hybrid analytical platforms are at the forefront of this opportunity.

Protein Stability Analysis Market By Product Insights

Reagents and assay kits dominate the product segment, owing to their critical role in executing protein stability studies across various techniques like fluorescence spectroscopy, chromatography, and thermal scanning. High demand for reproducible, validated assay kits ensures standardized results, particularly in regulated environments like clinical trial testing and biomanufacturing quality control.

Software solutions are growing fastest, reflecting the need for efficient data analysis, predictive modeling, and visualization of complex stability datasets. AI-driven software that can predict protein aggregation propensity, optimize formulation conditions, and automate reporting is becoming a key differentiator in both academic and commercial settings.

Protein Stability Analysis Market By Technique Insights

Spectroscopy dominates the technique segment, widely used for monitoring secondary and tertiary structural changes in proteins during stress conditions. Circular dichroism (CD), UV-visible spectroscopy, and fluorescence spectroscopy are common, offering rapid, non-destructive, and sensitive analysis of protein conformational stability.

Dynamic light scattering (DLS) is growing fastest, especially for detecting protein aggregation and particle size distribution with high sensitivity. DLS is indispensable in early formulation development, ensuring minimal aggregation, a critical quality attribute for therapeutic proteins and vaccines.

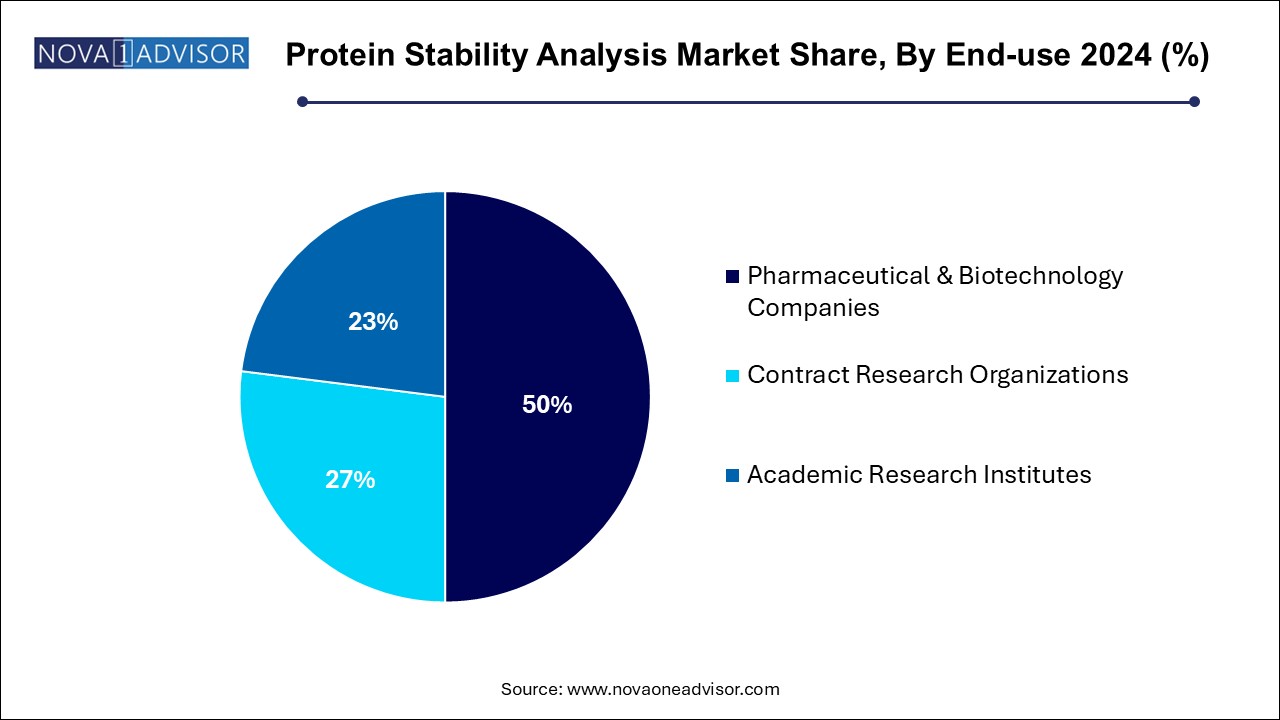

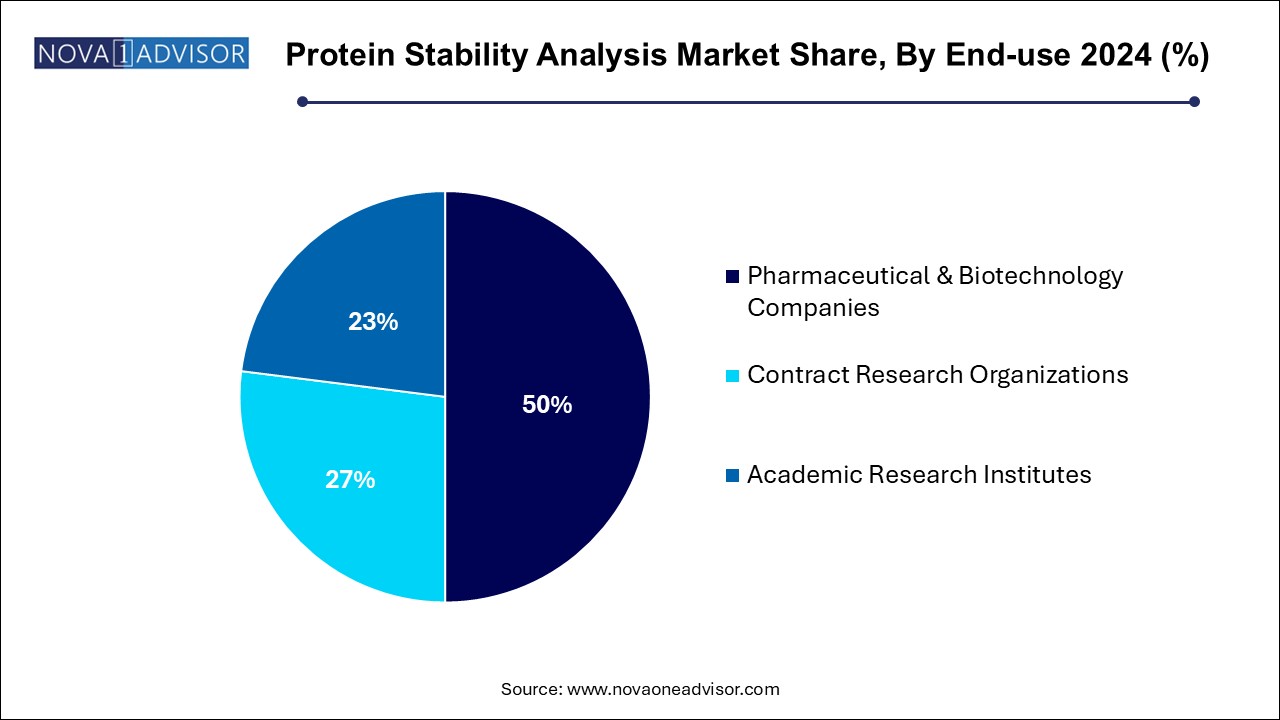

Protein Stability Analysis Market By End-use Insights

Pharmaceutical and biotechnology companies dominate the end-use segment, being the largest consumers of protein stability analysis solutions across R&D, clinical development, and commercial manufacturing. Biopharma giants extensively invest in in-house analytical capabilities to meet regulatory demands and optimize product stability.

Contract research organizations (CROs) are growing fastest, fueled by the trend toward outsourcing specialized analytical services. CROs offer cost-effective, scalable, and expertise-driven stability testing, enabling small and mid-sized biotechs to focus their resources on core research activities while ensuring regulatory compliance.

Protein Stability Analysis Market By Regional Insights

North America holds the largest market share, propelled by a mature biopharmaceutical industry, substantial R&D investments, and a highly developed regulatory environment. The United States, in particular, is a hub for protein therapeutics development, housing major players like Amgen, Genentech, and Pfizer.

Advanced academic research institutions, government funding (e.g., NIH grants), and supportive regulatory agencies (e.g., FDA) create a strong ecosystem for protein stability innovation. Additionally, the presence of leading analytical technology providers like Thermo Fisher Scientific, Waters Corporation, and Agilent Technologies further consolidates North America’s leadership.

Asia-Pacific is the fastest-growing region, driven by rapid pharmaceutical market expansion, increasing R&D investments, growing biologics manufacturing hubs, and regulatory harmonization initiatives.

China, India, Japan, and South Korea are aggressively expanding their biotech and biopharma industries, creating enormous demand for protein stability analysis services and technologies. Government programs promoting biopharmaceutical innovation, along with growing collaborations between Asian biotech firms and Western CROs, contribute significantly to regional market acceleration.

Furthermore, the rising focus on biosimilars and cost-effective biologics production in Asia-Pacific ensures a sustained demand trajectory for protein stability analysis platforms.

Some of the prominent players in the protein stability analysis market include:

- Thermo Fisher Scientific, Inc;

- Enzo Biochem, Inc.

- PerkinElmer Inc.

- NanoTemper

- GE Healthcare

- HORIBA, Ltd.

- Malvern Panalytical Ltd.

- Agilent Technologies, Inc.

- SETARAM Instrumentation

- Unchained Labs

- Waters Corporation

- Applied Photophysics Ltd.

Recent Developments

-

March 2025: Thermo Fisher Scientific launched a new high-throughput differential scanning fluorimetry (DSF) platform designed for formulation screening of biologics.

-

February 2025: Waters Corporation announced a strategic collaboration with a leading AI startup to develop predictive analytics software for protein stability modeling.

-

January 2025: Agilent Technologies introduced a new integrated DLS system with enhanced sensitivity for aggregation detection in mRNA vaccines and viral vectors.

-

December 2024: NanoTemper Technologies released an upgraded MicroScale Thermophoresis (MST) instrument optimized for fast and low-sample volume stability measurements.

-

November 2024: Malvern Panalytical expanded its Zetasizer family with the Zetasizer Ultra Plus, offering faster multi-modal stability analysis for proteins, nanoparticles, and polymers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the protein stability analysis market

By Product

- Reagents and Assay Kits

- Instruments

- Consumables and Accessories

- Software

- Service

By Technique

- Chromatography

- Spectroscopy

- Differential Scanning Calorimetry (DSC)

- Differential Scanning Fluorimetry (DSF)

- Dynamic Light Scattering (DLS)

- Others

By End-use

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Academic Research Institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)