Pulse Oximeter Market Size and Trends

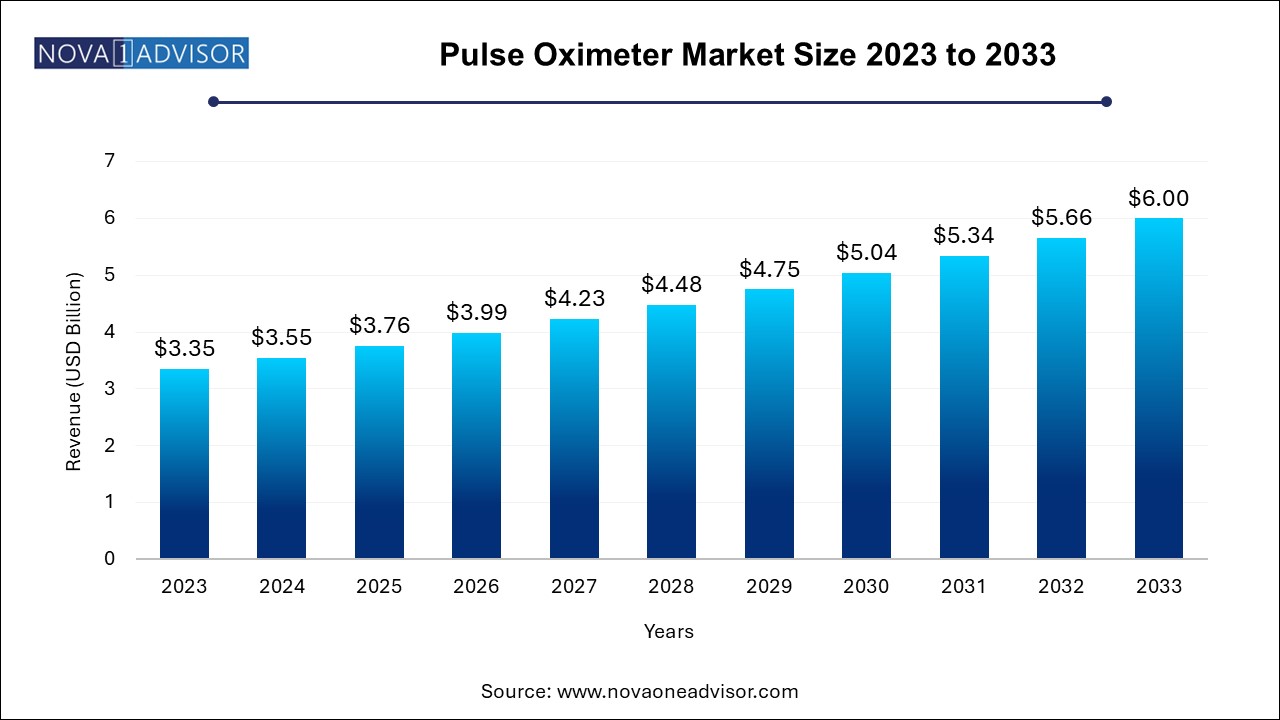

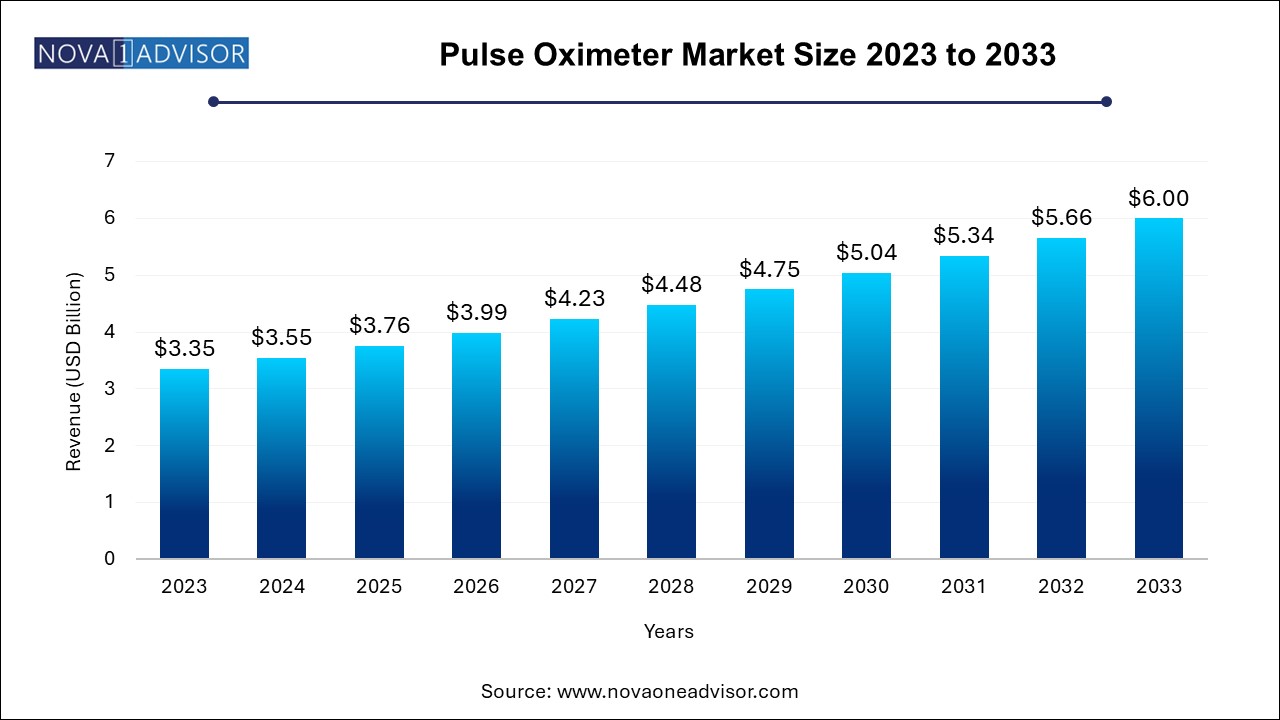

The global pulse oximeter market size was exhibited at USD 3.35 billion in 2023 and is projected to hit around USD 6.0 billion by 2033, growing at a CAGR of 6.0% during the forecast period 2024 to 2033.

Pulse Oximeter Market Key Takeaways:

- The monitors segment dominated the market and accounted for the largest share of 65.0% of the global revenue in 2023.

- The tabletop/bed side pulse oximeter segment dominated the market, with the largest share of 58.2% in 2023.

- The portable pulse oximeter segment is expected to grow at the fastest CAGR over the forecast period.

- The adult segment dominated the market, with the largest share of 62.6% in 2023.

- The pediatric segment is expected to grow significantly over the forecast period.

- The hospitals segment dominated the market, with the largest share of 42.8% in 2023.

- The home care segment is expected to grow at the fastest CAGR over the forecast period.

- North America dominated the pulse oximeter market with a revenue share of 39.4% in 2023.

Market Overview

The pulse oximeter market has gained substantial traction over the past decade, especially in light of the global COVID-19 pandemic, which brought non-invasive oxygen monitoring into the spotlight. Pulse oximeters are essential diagnostic tools that measure blood oxygen saturation (SpOâ‚‚) and pulse rate through a sensor placed on thin parts of the body like fingers or earlobes. These devices play a critical role in the early detection of hypoxemia, especially in respiratory illnesses, intensive care, and anesthesia monitoring.

While originally confined to hospital settings, pulse oximeters have now become commonplace in home care, sports medicine, and even consumer wellness. A combination of rising respiratory disorders, technological advancements, and awareness around remote health monitoring has fueled a new wave of growth. Increased penetration of wearable health devices and integration with smartphones and telemedicine platforms further extend the utility of pulse oximeters beyond traditional medical settings.

Post-COVID-19, demand for portable and user-friendly oximeters has remained strong as populations continue to seek proactive health management. Even in developing regions, governments are promoting pulse oximetry in rural clinics and primary health centers to strengthen early intervention capabilities, particularly for pediatric pneumonia and chronic obstructive pulmonary disease (COPD). Thus, the pulse oximeter market has evolved from a specialized clinical tool to a broad-spectrum health device with global relevance.

Major Trends in the Market

-

Surge in Home-use and Portable Devices: Rising demand for fingertip and wearable oximeters due to increased health awareness and remote monitoring.

-

Integration with Smartphones and Mobile Apps: Bluetooth-enabled oximeters that sync with mobile apps for real-time health tracking.

-

Use in Sports and Fitness Monitoring: Athletes and fitness enthusiasts use wearable pulse oximeters to monitor oxygen levels during high-performance activities.

-

Government Mandates in Pediatric Care: WHO recommendations for mandatory SpOâ‚‚ monitoring in pneumonia diagnosis among children.

-

Technological Innovations in Sensors: Advances in multi-wavelength sensors, improving accuracy in low-perfusion and dark skin tones.

-

Expansion into Emerging Economies: Market penetration growing in Asia-Pacific and Africa due to public health initiatives.

-

Adoption of AI in Data Interpretation: Smart algorithms are being embedded in oximeters to detect anomalies and predict health conditions.

-

Shift toward Continuous Monitoring Solutions: Increasing demand for devices suited for long-term monitoring in ICUs and for chronic illness patients.

Report Scope of Pulse Oximeter Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.55 Billion |

| Market Size by 2033 |

USD 6.00 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Type, Age Group, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Medtronic; Masimo; Koninklijke Philips N.V.; GE HealthCare; Nonin; NIHON KOHDEN CORPORATION; ICU Medical, Inc.; OSI Systems, Inc.; CONTEC MEDICAL SYSTEMS CO., LTD; Drägerwerk AG & Co. KGaA |

Key Market Driver: Rising Burden of Respiratory Diseases and Aging Population

A leading driver in the pulse oximeter market is the escalating prevalence of respiratory disorders globally, combined with a rapidly aging population. Conditions like asthma, COPD, interstitial lung diseases, and even post-viral complications require consistent oxygen monitoring for timely medical intervention. For instance, in the United States alone, more than 16 million people are diagnosed with COPD, with millions more undiagnosed. Pulse oximetry helps in early detection of exacerbations and avoids hospitalizations.

Additionally, elderly populations are particularly susceptible to silent hypoxia—where low blood oxygen occurs without noticeable symptoms. For home-based elderly care, pulse oximeters have become a staple in daily vitals monitoring. As chronic conditions become more prevalent, both institutional and home healthcare providers are integrating pulse oximetry as a routine diagnostic measure, sustaining demand for devices across use settings.

A critical restraint in the pulse oximeter market is inconsistency in measurement accuracy, particularly among patients with dark skin tones or those with poor peripheral perfusion. Multiple studies, including those by the FDA and academic institutions, have highlighted a higher error margin in oxygen saturation readings in people with darker pigmentation, raising concerns about equitable diagnostic outcomes.

Additionally, external factors such as motion artifacts, nail polish, cold extremities, or poor device calibration can distort readings. These limitations not only affect clinical decision-making but can also erode consumer trust, particularly for home-use devices. As a result, regulatory scrutiny is increasing, with agencies now requiring manufacturers to provide broader demographic validation data, potentially slowing product approvals.

Key Market Opportunity: Growth of Remote Patient Monitoring and Telemedicine

The rapid expansion of remote patient monitoring (RPM) and telemedicine services presents a substantial opportunity for the pulse oximeter market. As healthcare systems shift toward value-based care and decentralized models, continuous and non-invasive monitoring tools like pulse oximeters are becoming central to home-based diagnostics.

Companies are capitalizing on this trend by offering oximeters that sync with cloud platforms, electronic health records, and mobile applications. This allows clinicians to receive real-time data and intervene early in case of deteriorating vitals. Chronic disease management programs, particularly for post-COVID recovery, cardiac rehabilitation, or sleep apnea monitoring, have started to include connected pulse oximeters as part of bundled care offerings.

Pulse Oximeter Market By Component Insights

Sensors dominate the market due to their role as the core component of pulse oximeters, whether integrated or modular. The photodetector and light-emitting diode (LED) assembly embedded in the sensors measure SpOâ‚‚ and pulse rate, making them indispensable across all device types. Advances in miniaturization and sensor materials have enabled the development of fingertip and wearable oximeters with enhanced accuracy. Demand for disposable sensors has also increased, particularly in hospital and emergency settings to reduce cross-contamination risks.

Monitors represent the fastest-growing segment, especially in clinical and ICU environments where continuous vital monitoring is required. These include tabletop or bedside units used for patient observation in operating rooms, critical care units, and recovery wards. New-generation monitors are now being designed with multi-parameter capabilities and touchscreen interfaces, appealing to both developed and emerging healthcare settings seeking value in compact yet powerful solutions.

Pulse Oximeter Market By Type Insights

Portable pulse oximeters dominate the global market, particularly the fingertip variant, which is favored for its convenience, affordability, and ease of use. These are commonly found in home care settings, emergency kits, and general wellness products. Their lightweight, battery-operated design makes them ideal for quick spot-checking of oxygen saturation levels. During the COVID-19 crisis, fingertip oximeters became household essentials in many countries, driving an unprecedented surge in demand.

Wearable oximeters are the fastest-growing category, benefiting from the rising popularity of fitness trackers and health bands. Products such as the Fitbit Charge, Apple Watch, and Garmin Vivosmart have integrated SpOâ‚‚ monitoring into their offerings. These devices provide continuous, passive tracking of oxygen levels during sleep or physical exertion, helping identify patterns in respiratory performance. The convergence of medtech and consumer electronics continues to accelerate growth in this segment.

Pulse Oximeter Market By Age Group Insights

Adults make up the dominant segment of the pulse oximeter market, as respiratory diseases, chronic illnesses, and post-operative needs are more common in this demographic. From general health screening to outpatient management of conditions like sleep apnea, adults represent the primary user base for both home and hospital-grade oximeters.

Pediatric use is expanding rapidly, particularly in low- and middle-income countries where childhood pneumonia is a leading cause of mortality. WHO and UNICEF have recommended widespread adoption of pulse oximetry in pediatric triage, especially in rural clinics. Specialized pediatric sensors and small-sized fingertip devices are being developed to ensure accurate readings in neonates and young children.

Pulse Oximeter Market By End Use Insights

Hospitals continue to dominate end-use, driven by the need for continuous and reliable monitoring during surgeries, intensive care, and inpatient recovery. ICU and OR environments require bedside oximeters with alarms, data integration, and multi-day battery life. Hospitals also use oximetry for procedural sedation, respiratory therapy, and pain management, ensuring consistent demand across departments.

Home care is the fastest-growing segment, as patients with chronic illnesses and post-operative needs are increasingly being monitored at home. With the advent of compact and app-connected oximeters, patients can now regularly check their vitals and transmit data to clinicians for remote follow-up. The rise of home oxygen therapy for COVID-19 and COPD patients further reinforces this trend.

Pulse Oximeter Market By Regional Insights

North America dominates the pulse oximeter market, backed by a mature healthcare infrastructure, high chronic disease burden, and technological innovation. The U.S. and Canada both exhibit widespread use of pulse oximeters in hospitals, ambulatory settings, and homes. Regulatory frameworks like FDA approvals ensure product quality, while public health bodies advocate the routine use of pulse oximeters in managing chronic respiratory conditions.

Moreover, consumer interest in health monitoring has grown, with oximeter-enabled smartwatches becoming increasingly popular. Key players like Nonin Medical, Masimo, and Medtronic are headquartered in the region, facilitating strong product availability and after-sales support.

Asia Pacific is the fastest-growing region, driven by healthcare modernization, large populations, and rising prevalence of respiratory diseases. Countries like India and China have incorporated pulse oximeters into their rural health missions and school health programs. The pandemic spurred government and philanthropic distribution of oximeters to underserved areas, catalyzing long-term usage.

In urban markets, growing awareness and disposable income have led to increased adoption of wearable and fingertip devices for personal use. Additionally, Asia-Pacific serves as a manufacturing hub for several global players, which improves affordability and accessibility across the region.

Pulse Oximeter Market Recent Developments

-

March 2025: Masimo launched a next-gen wearable pulse oximeter, the Radius VSM™, offering multi-day battery life and integration with hospital systems.

-

February 2025: Nonin Medical received FDA clearance for its pediatric sensor designed to provide more accurate readings for children under five.

-

January 2025: Apple added expanded SpOâ‚‚ analytics and long-term trend tracking to its Health app, compatible with Apple Watch Series 8.

-

December 2024: Medtronic announced partnerships with Indian public hospitals to supply high-volume, low-cost fingertip oximeters under a social health initiative.

-

November 2024: Philips released a new cloud-based pulse oximetry dashboard integrated with its remote monitoring platform for chronic respiratory patients.

Some of the prominent players in the global pulse oximeter market include:

- Medtronic

- Masimo

- Koninklijke Philips N.V.

- GE HealthCare

- Nonin

- NIHON KOHDEN CORPORATION

- ICU Medical, Inc.

- OSI Systems, Inc.

- CONTEC MEDICAL SYSTEMS CO., LTD

- Drägerwerk AG & Co. KGaA

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pulse oximeter market

Component

Type

-

- Fingertip Pulse Oximeter

- Handheld Pulse Oximeter

- Wearable Pulse Oximeter

- Tabletop/Bed side Pulse Oximeter

Age Group

End Use

- Hospitals

- Home Care

- Outpatient Facilities

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa