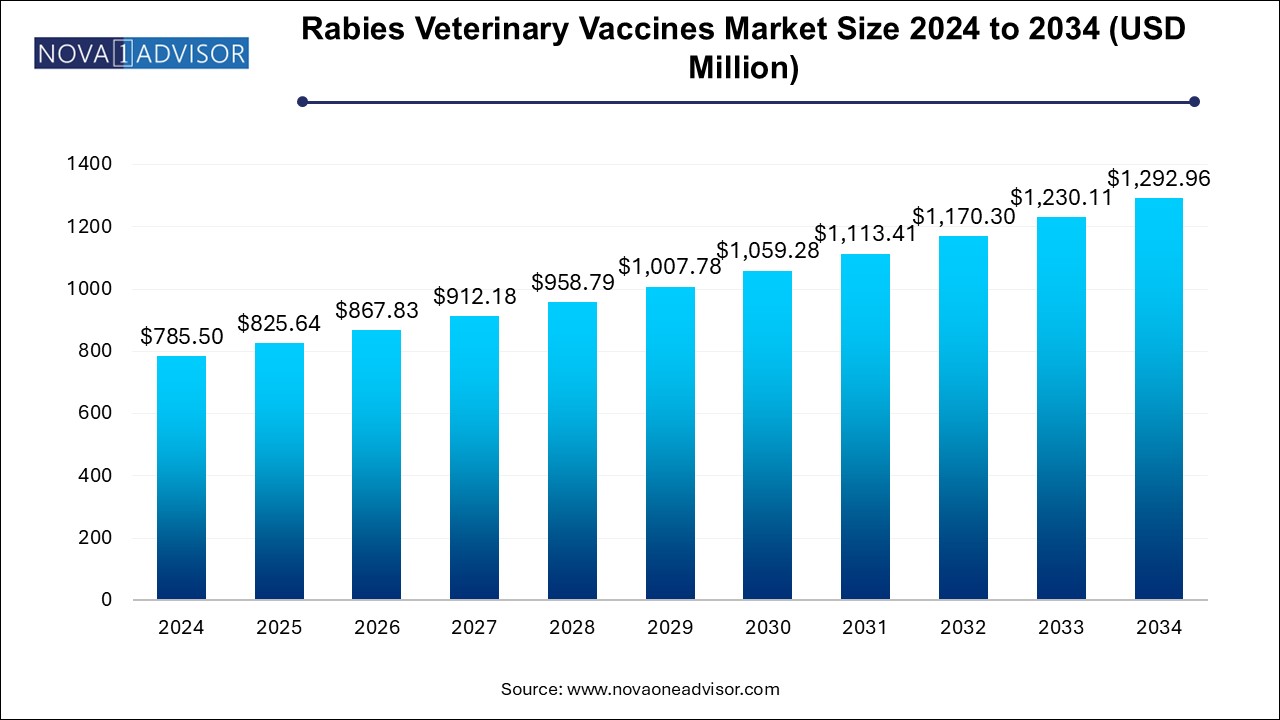

Rabies Veterinary Vaccines Market Size and Trends

The rabies veterinary vaccines market size was exhibited at USD 785.5 million in 2024 and is projected to hit around USD 1292.96 million by 2034, growing at a CAGR of 5.11% during the forecast period 2025 to 2034.

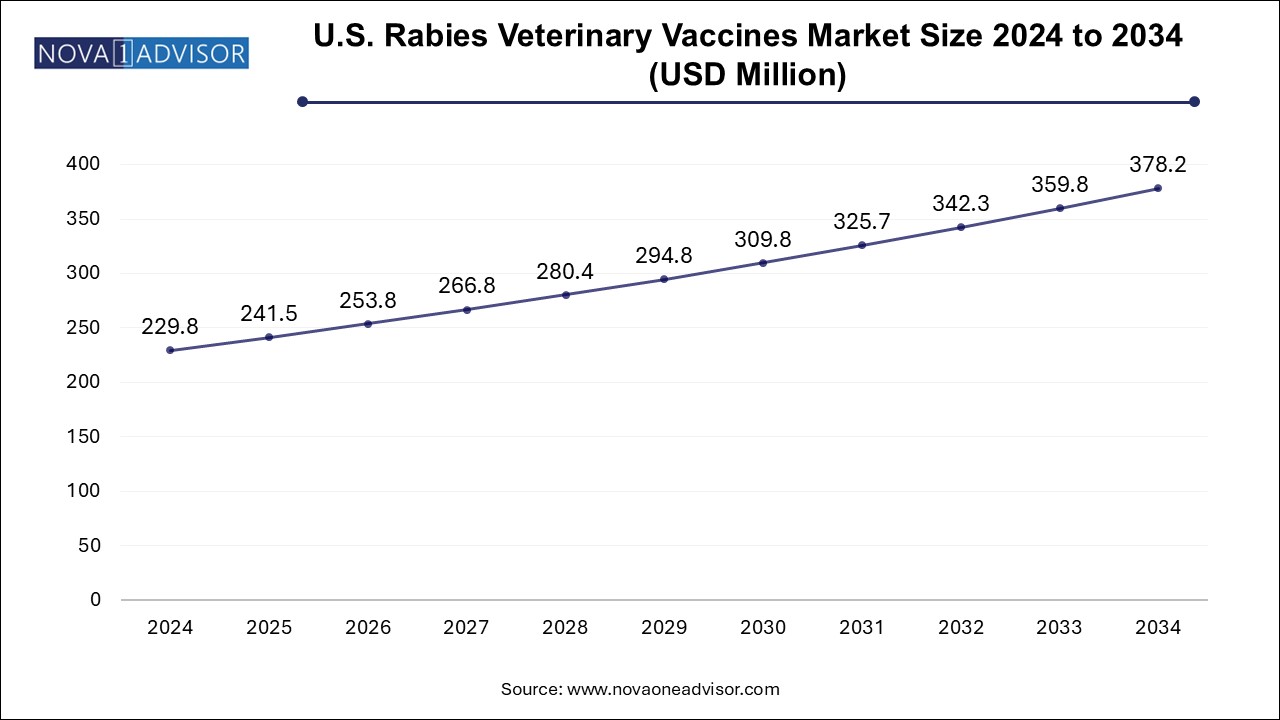

U.S. Rabies Veterinary Vaccines Market Size and Growth 2025 to 2034

The U.S. rabies veterinary vaccines market size is evaluated at USD 229.8 million in 2024 and is projected to be worth around USD 378.2 million by 2034, growing at a CAGR of 4.6% from 2025 to 2034.

The North America accounted for the largest market share in 2024, primarily due to robust regulatory frameworks, high pet ownership rates, and proactive public health infrastructure. The U.S. and Canada have long-standing mandatory rabies vaccination laws for pets, backed by strong enforcement and public awareness. These policies create a reliable and recurring demand for rabies vaccines. Moreover, the region is a hub for R&D in veterinary biologics, with major players headquartered or operating manufacturing facilities here.

Wildlife vaccination programs, particularly in the United States, also contribute significantly to market volume. Agencies such as the USDA Wildlife Services conduct extensive oral rabies vaccination (ORV) campaigns, especially in raccoon-dense regions and along borders to prevent cross-border disease spread. The availability of funding, advanced veterinary care systems, and well-established supply chains ensure North America’s continued dominance in the rabies vaccine space.

Asia Pacific is projected to be the fastest-growing region, owing to its high rabies burden and increasing policy-level interventions for disease control. Countries like India, China, Indonesia, and the Philippines have among the highest numbers of human rabies deaths annually, primarily due to dog bites. As part of the global 2030 elimination strategy, these nations are investing in mass dog vaccination drives, often supported by WHO, GAVI, and other global health agencies.

Moreover, economic development in the region is expanding access to veterinary services and improving cold chain infrastructure. The growth of organized pet care industries, particularly in urban India and Southeast Asia, is also driving companion animal vaccination. Regional manufacturing initiatives, including local production of rabies vaccines to reduce dependency on imports, are further contributing to market expansion.

Market Overview

The global rabies veterinary vaccines market plays a vital role in the protection of both animal and human populations against one of the most fatal yet preventable zoonotic diseases—rabies. Rabies is transmitted primarily through the bite of infected animals, and once clinical symptoms appear, it is almost always fatal. While rabies is a preventable disease through vaccination, it still causes thousands of deaths annually, particularly in Asia and Africa, underscoring the importance of widespread animal immunization.

Veterinary vaccines for rabies are administered to a wide range of animals including companion animals (dogs and cats), livestock (cattle, pigs, sheep, and goats), and wildlife (bats, foxes, raccoons). Among these, dogs are the most significant vector for transmission to humans, especially in countries with high stray dog populations. As a result, global and regional health agencies have prioritized dog vaccination campaigns to eliminate dog-mediated human rabies.

The rabies veterinary vaccine market includes both inactivated (killed virus) and recombinant vaccines, with the former being the most commonly used. These vaccines are produced under stringent quality controls and administered via subcutaneous or intramuscular injection. The market is supported by a mix of government procurement programs, international non-profit campaigns (e.g., WHO, OIE, and GAVI initiatives), and commercial distribution channels catering to pet owners and livestock farmers.

With growing awareness, expanding pet ownership, increasing livestock farming, and a strong push for “One Health” approaches integrating animal and human health, the rabies veterinary vaccines market is experiencing significant advancements. Moreover, regulatory approvals, innovations in vaccine delivery, and enhanced cold-chain logistics are helping manufacturers expand access across both developed and developing regions.

Major Trends in the Market

-

Shift Towards Recombinant and DNA-based Vaccines: Growing interest in advanced vaccine technologies with improved safety and efficacy profiles.

-

Public-Private Partnerships for Mass Dog Vaccination: Collaborations between governments, NGOs, and pharma companies to eliminate rabies by 2030.

-

Oral Vaccination Campaigns in Wildlife: Use of bait vaccines to immunize wild animals like raccoons and foxes in North America and Europe.

-

Growth in Pet Ownership Driving Companion Animal Vaccination: Urban pet parents increasingly vaccinate pets as part of routine preventive care.

-

Veterinary Telehealth and E-commerce Boosting Access: Digital channels for vaccine booking, awareness, and product delivery are expanding.

-

Cold Chain Optimization and Vaccine Portability: Technological improvements in transport and storage improving outreach to rural areas.

-

Emergence of Rabies Vaccination as Mandatory Regulation: Several jurisdictions now mandate routine rabies vaccination for pets and livestock.

-

Integration into National Disease Eradication Programs: Rabies included under broader zoonotic disease prevention frameworks in emerging economies.

Report Scope of Rabies Veterinary Vaccines Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 825.64 Million |

| Market Size by 2034 |

USD 1292.96 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 5.11% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Application, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Boehringer Ingelheim International GmbH; Zoetis Services LLC; Merck & Co., Inc.; Elanco; BroadChem Philippines Biopharma Corporation; Virbac; Ceva; BiogénesisBagó; Indian Immunologicals Ltd. |

Market Driver: Global Rabies Elimination Campaigns and Vaccination Mandates

A prominent driver of the rabies veterinary vaccines market is the global commitment to eliminate dog-mediated human rabies by 2030, led by the World Health Organization (WHO), World Organisation for Animal Health (WOAH), and Food and Agriculture Organization (FAO). This ambitious target has catalyzed large-scale dog vaccination drives, public health campaigns, and funding from international stakeholders, significantly increasing demand for safe and effective veterinary vaccines.

Furthermore, regulatory authorities in many countries are mandating rabies vaccinations for pets and certain livestock. In the United States, for example, all 50 states require dogs to be vaccinated against rabies, with many extending the requirement to cats and ferrets. Such mandates ensure a consistent and predictable market, benefiting vaccine producers, distributors, and veterinary service providers. The alignment of veterinary practice with public health objectives provides both moral and commercial momentum to the rabies vaccine industry.

Market Restraint: Limited Access in Remote and Low-income Regions

Despite the global push for rabies control, limited access to vaccines in rural and underserved regions remains a key constraint. In many parts of Asia and Africa, where rabies is most prevalent, logistical challenges such as poor road infrastructure, inadequate refrigeration, and limited veterinary presence make widespread vaccination difficult. Vaccine wastage due to temperature excursions and stockouts further complicate effective immunization coverage.

Additionally, in resource-poor settings, the cost of vaccination—though modest by Western standards—can be a significant barrier for farmers or pet owners. In the absence of government-funded programs or NGO-led campaigns, commercial vaccine sales in these regions remain low. Overcoming these barriers requires investment in cold chain systems, mobile veterinary services, subsidized vaccination drives, and stronger local manufacturing capabilities.

Market Opportunity: Development of Thermostable and Oral Rabies Vaccines

A transformative opportunity in the rabies veterinary vaccines market lies in the development and distribution of thermostable and orally administered vaccines. Traditional vaccines require stringent cold chain management, limiting their use in remote or resource-limited environments. Thermostable formulations, which remain effective without refrigeration, could significantly reduce wastage and expand geographic reach.

Similarly, oral rabies vaccines (ORVs), particularly in bait form, have been successfully used in wildlife populations such as raccoons, foxes, and coyotes. Expanding this model to include stray and feral dog populations in high-risk countries could be a game-changer for achieving the 2030 elimination target. As vaccine delivery becomes more adaptable, manufacturers that invest in oral and thermostable technologies are well-positioned to lead the next wave of innovation and impact.

Rabies Veterinary Vaccines Market By Application Insights

The Companion animals dominated the rabies veterinary vaccines market in 2024, driven by increasing pet ownership, mandatory vaccination regulations, and growing awareness of preventive animal healthcare. Dogs, in particular, are the primary source of human rabies infections and thus remain the top target for immunization. Annual or triennial vaccinations are standard in most developed countries and are often required for pet licensing and travel. In addition, cat vaccination is gaining prominence, especially in urban areas where feline rabies is occasionally reported due to contact with infected wildlife.

Wildlife animals represent the fastest-growing application segment, particularly in regions like North America and parts of Europe where rabies in raccoons, skunks, and foxes continues to pose public health risks. The use of oral rabies vaccines in bait form—scattered in forests or distributed via drones—has proven effective in controlling the spread of rabies in wildlife. Government wildlife agencies and conservation groups are increasingly incorporating vaccination into ecosystem health strategies. With ongoing R&D to develop species-specific bait vaccines and delivery methods, this segment is expected to expand further.

Rabies Veterinary Vaccines Market By Distribution Channel Insights

The Hospital/clinic pharmacies accounted for the largest distribution channel share, reflecting their central role in veterinary care. Most companion animal vaccinations are administered during routine check-ups at veterinary clinics or animal hospitals. These settings also facilitate vaccine record-keeping, patient monitoring, and reminders for booster doses. Clinics tend to procure vaccines directly from manufacturers or licensed distributors, ensuring batch quality and storage integrity.

E-commerce is expected to grow at the fastest pace, enabled by the rise of online pet pharmacies, direct-to-consumer models, and digital veterinary services. While regulations in many countries require vaccines to be administered by licensed veterinarians, over-the-counter availability for certain livestock or follow-up booster formulations is expanding. Online platforms offer convenient ordering, auto-replenishment services, and bulk discounts for farmers or shelters. As pet e-commerce booms, vaccine logistics are evolving to include cold-chain delivery and mobile veterinary services for home vaccination.

Some of the prominent players in the rabies veterinary vaccines market include:

Rabies Veterinary Vaccines Market Recent Developments

-

In March 2025, Boehringer Ingelheim announced the expansion of its rabies vaccine production facility in the U.S. to meet rising demand from veterinary clinics and wildlife programs.

-

In January 2025, Indian Immunologicals Ltd. launched a new thermostable rabies vaccine for dogs, designed for field use in rural and low-infrastructure areas.

-

In November 2024, Merck Animal Health (MSD) entered a partnership with the U.S. Department of Agriculture to supply oral rabies vaccine baits for wildlife immunization across five states.

-

In September 2024, Ceva Santé Animale announced results from a successful pilot program in the Philippines using drones to deliver oral rabies vaccine baits in remote regions.

-

In July 2024, Zoetis introduced a new dual-antigen veterinary rabies vaccine designed to protect against rabies and distemper in a single dose for easier administration in animal shelters.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the rabies veterinary vaccines market

By Application

- Companion Animals

- Livestock Animals

- Wildlife Animals

By Distribution Channel

- Retail

- E-Commerce

- Hospital/Clinic Pharmacies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)