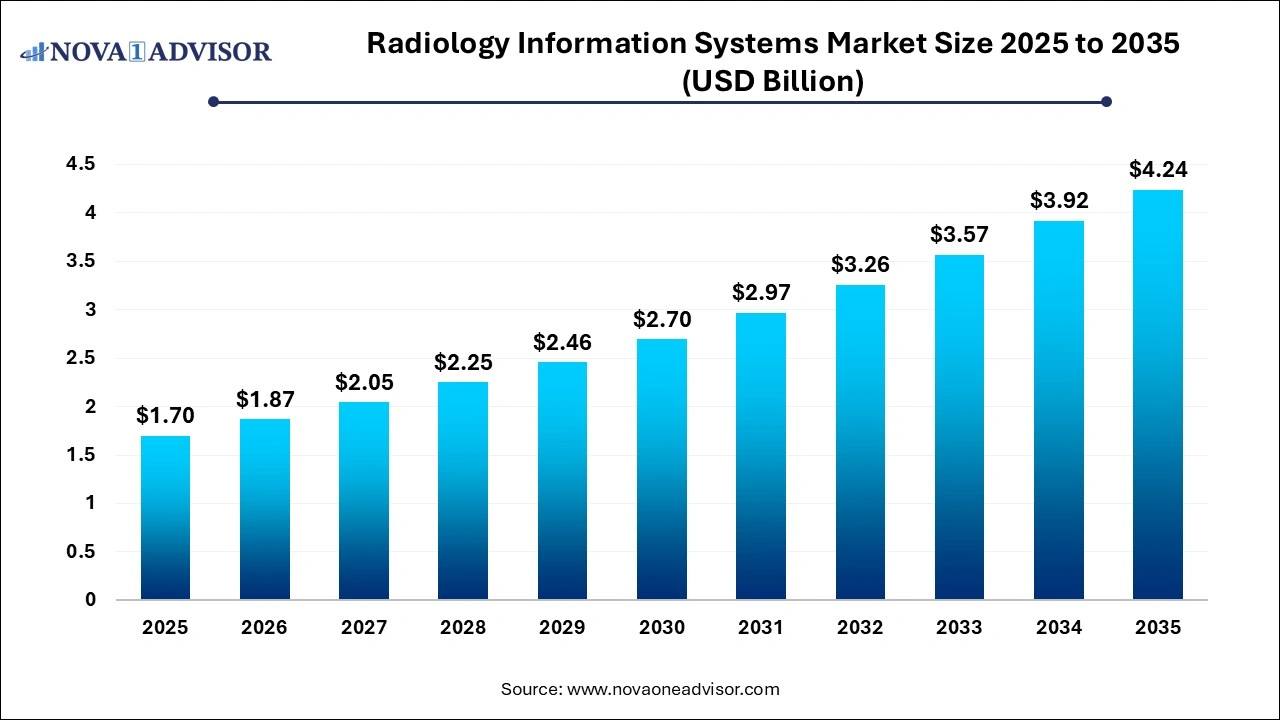

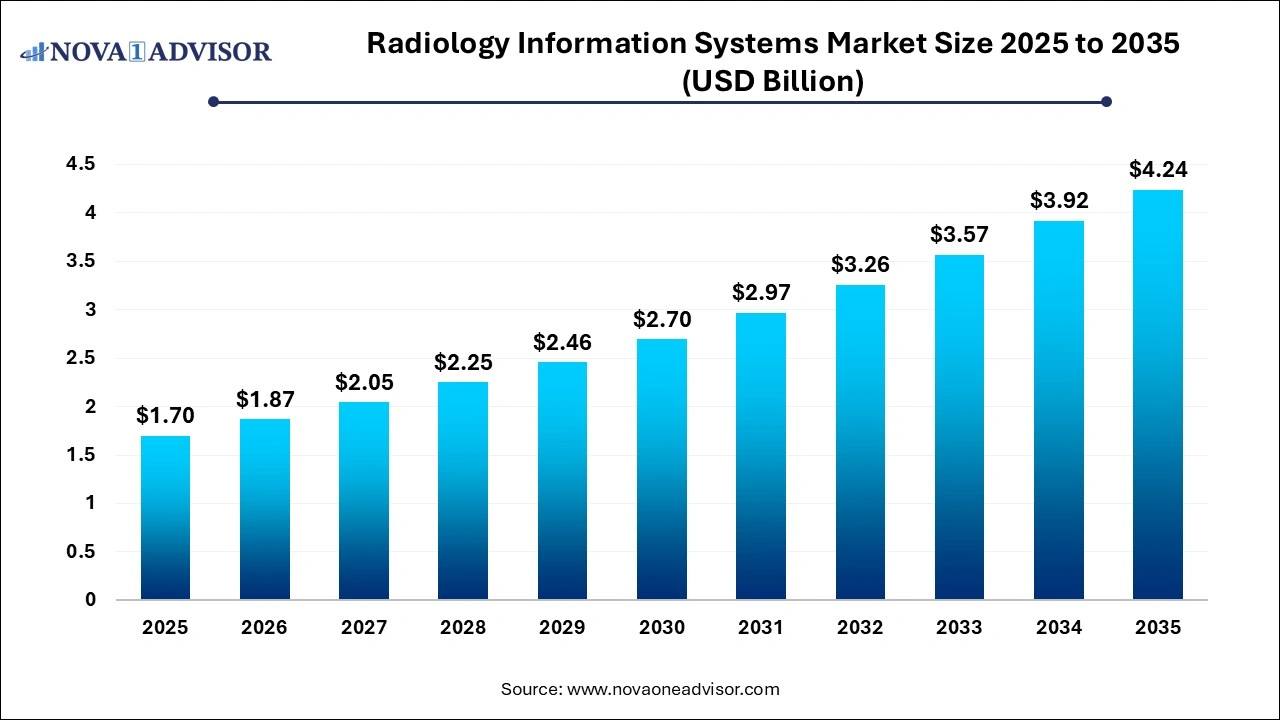

The radiology information systems (RIS) market size was exhibited at USD 1.7 billion in 2025 and is projected to hit around USD 4.24 billion by 2035, growing at a CAGR of 9.57% during the forecast period 2026 to 2035. The growth of the radiology information systems market is driven by digitalization of healthcare infrastructure, rising prevalence of chronic diseases and continuous advancements in imaging technologies. Rise in number of diagnostic laboratories and radiology professionals is fuelling the market expansion.

- Based on deployment mode, the web-based segment held the largest revenue share of over 77% in 2025.

- The cloud-based segment is anticipated to grow at the fastest CAGR from 2026 to 2035.

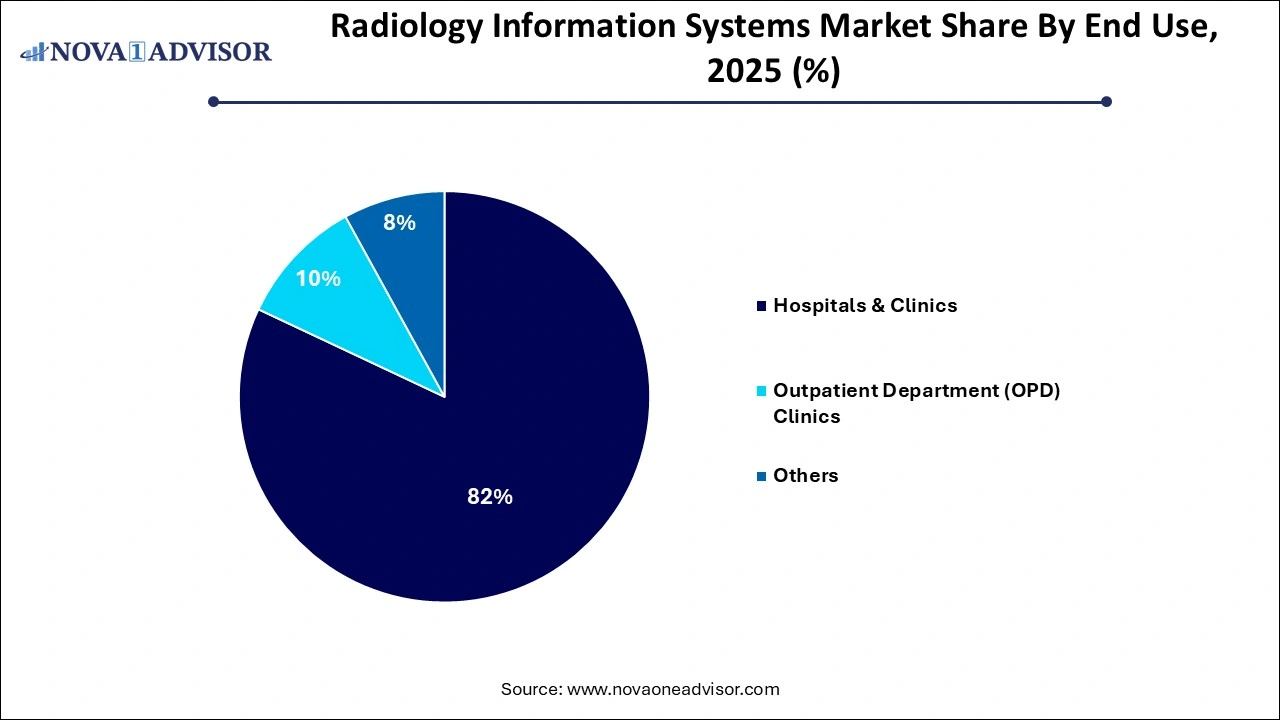

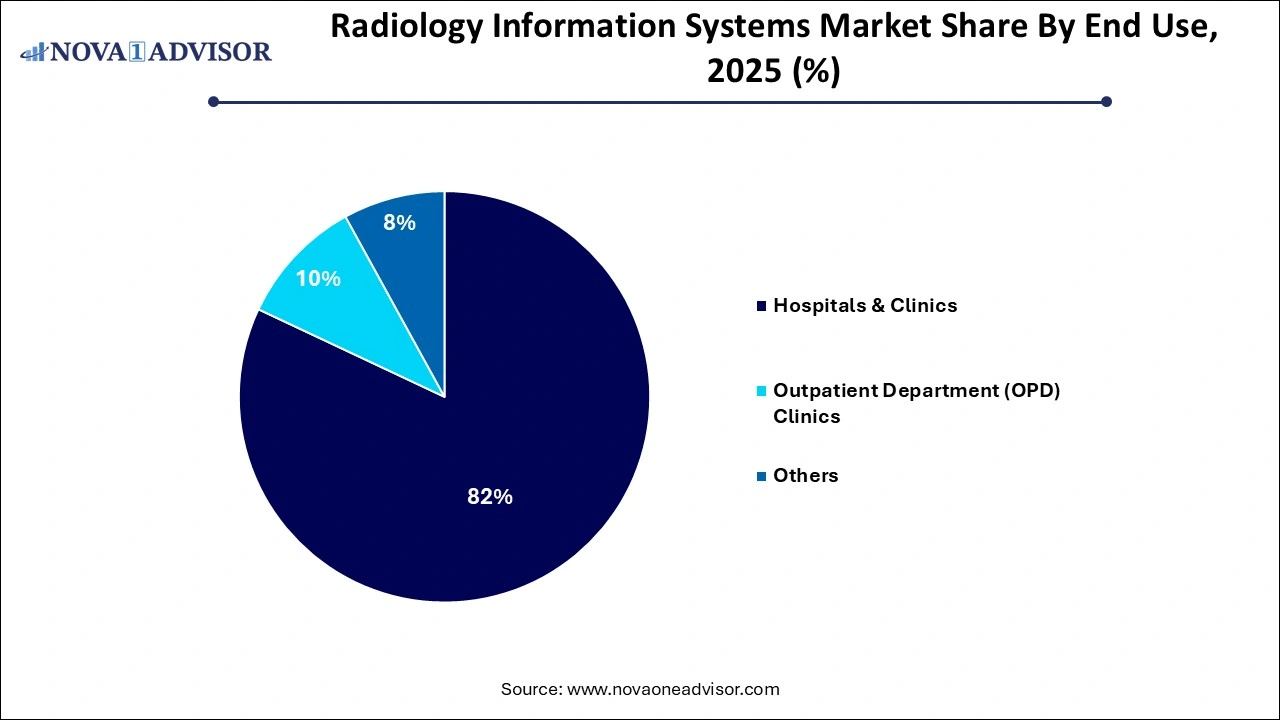

- The hospitals & clinics end use segment dominated the market with a revenue share of over 82.0% in 2025.

- The integrated RIS segment held the largest revenue share of over 67% in 2024 and is anticipated to grow at the fastest CAGR from 2026 to 2035.

- The radiology information systems market in North America held the largest share of over 50.0% in 2025.

The Radiology Information Systems (RIS) Market has evolved significantly as radiology departments across healthcare institutions have progressively embraced digital transformation. A RIS is a robust database and software system used to manage medical imagery and associated data. It is primarily utilized in radiology departments to store, manipulate, and distribute patient radiological data and imagery. With a growing emphasis on efficient diagnostic processes, streamlined workflows, and improved communication among healthcare providers, the adoption of RIS has seen a substantial upsurge.

Increased healthcare digitization, especially in developed economies, has driven RIS integration with Picture Archiving and Communication Systems (PACS) and Hospital Information Systems (HIS). These integrations provide a seamless flow of patient data, enable appointment scheduling, improve reporting efficiency, and enhance overall diagnostic accuracy. Additionally, the growing prevalence of chronic diseases, rising demand for early diagnostic services, and the mounting volume of diagnostic imaging procedures are propelling the market forward.

The COVID-19 pandemic further underlined the significance of digital platforms, especially cloud-based and web-based systems, in managing large volumes of patient data remotely. With healthcare IT infrastructure continuing to develop across emerging economies, especially in Asia Pacific and Latin America, the global RIS market is poised for sustained growth in the forecast period.

-

Integration of Artificial Intelligence (AI): RIS platforms are increasingly incorporating AI for image recognition, workflow automation, and predictive analytics to improve clinical decision-making and operational efficiency.

-

Cloud-based Adoption Surge: Healthcare institutions are rapidly shifting from on-premise to cloud-based RIS solutions due to their scalability, lower upfront costs, and ease of remote access.

-

Mobile Access and App-based Interfaces: RIS vendors are developing mobile-friendly solutions, allowing radiologists and technicians to access imaging data and reports on the go.

-

Regulatory Compliance and Data Security Enhancements: Heightened focus on compliance with data privacy laws such as HIPAA in the U.S. and GDPR in Europe is influencing RIS feature development, particularly around encryption and access controls.

-

Tele-radiology Expansion: With the demand for remote diagnostic services rising, RIS is being optimized for tele-radiology services, enabling radiologists to provide interpretations across geographical boundaries.

-

Vendor Neutral Archiving (VNA) Integration: There is an emerging trend of integrating RIS with VNA systems to allow easy interoperability among different imaging systems and streamline data exchange.

-

Value-based Healthcare Models: Transition from volume-based to value-based care models is prompting healthcare facilities to adopt systems that enhance diagnostic precision and outcome-driven workflows.

Integrating artificial intelligence in radiology information systems (RIS) market is streamlining radiology workflows. AI algorithms can enhance diagnostic accuracy by analyzing medical images for detecting pathological conditions and identification of anomalies. Optimized workflows such as automating tasks like procurement of images, selecting protocols and scheduling various tasks can be achieved with AI integration. AI can reduce downtimes for radiologists by accurately and quickly generating radiology reports.

Increased emphasis on patient safety and data security by regulatory agencies is driving RIS solution makers to comply with healthcare standards and to continuously update their systems to prevent data breaches. Stringent regulatory compliance standards imposed by Health Insurance Portability and Accountability Act (HIPPA) in U.S. and the General Data Protection Regulation (GDPR) in Europe is pushing RIS vendors for integrating features such as audit trails, data encryption and user access controls. Promotion of integrated RIS solutions facilitating seamless integration with Picture Archiving and Communication System (PACS) and Electronic Health Record (EHR) systems by governments and healthcare organizations are enhancing interoperability and data exchange.

| Report Coverage |

Details |

| Market Size in 2026 |

USD 1.87 Billion |

| Market Size by 2035 |

USD 4.24 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 9.57% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Deployment Mode, By Product, By End use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Veradigm LLC; Oracle; Epic Systems Corp.; Mckesson Corporation; DeepHealth; Siemens Healthineers AG; Koninklijke Philips N.V.; Pro Medicus, Ltd.; MedInformatix, Inc.; General Electric Company; IBM |

Driver: Rising Diagnostic Imaging Procedures

A key driver propelling the Radiology Information Systems Market is the increased volume of diagnostic imaging procedures worldwide. With the rise in chronic illnesses such as cancer, cardiovascular disorders, and orthopedic conditions, diagnostic imaging—particularly CT, MRI, and PET scans—has become central to disease management and early detection. RIS facilitates efficient management of these imaging records, appointments, and patient data, significantly improving diagnostic throughput.

For example, in the U.S. alone, the number of MRI scans exceeds 40 million annually, a number that is growing steadily due to an aging population and proactive health screening trends. Hospitals and diagnostic centers are under pressure to manage this high throughput efficiently while ensuring quality and compliance. RIS helps achieve this by streamlining workflow automation, enabling digital access to records, and integrating with PACS for seamless image handling—making it a core asset in modern radiology departments.

Restraint: High Cost of Implementation and Maintenance

Despite its many advantages, the high initial cost and ongoing maintenance of RIS solutions remain a significant restraint, particularly for small- and medium-sized healthcare facilities. Deploying an advanced RIS involves substantial capital investment in hardware infrastructure, software licensing, IT staffing, and system integration with existing platforms such as HIS and PACS.

For example, integrating RIS with PACS and Electronic Health Records (EHRs) in a mid-sized hospital could cost upwards of several hundred thousand dollars. Additionally, ensuring data security, HIPAA compliance, and continuous system upgrades add to operational expenditures. This cost burden is particularly pronounced in developing economies, where budget constraints and lack of skilled IT professionals limit widespread adoption.

Opportunity: Expansion of Healthcare Infrastructure in Emerging Economies

The expanding healthcare infrastructure in emerging markets such as India, Brazil, and Southeast Asia presents a promising growth opportunity for the RIS market. Governments in these regions are increasing healthcare spending, encouraging public-private partnerships, and implementing health IT digitization programs. For instance, India’s Ayushman Bharat Digital Mission aims to create an integrated digital health infrastructure across the country, which will necessitate the deployment of RIS systems in public and private diagnostic centers.

Moreover, the growth of multi-specialty hospitals and diagnostic chains in urban and semi-urban areas has created demand for scalable, cloud-based RIS platforms that can handle diverse imaging modalities and interconnect across branches. Vendors targeting these markets with affordable, modular, and mobile-enabled RIS solutions stand to gain significantly in the years ahead.

By Deployment Mode Insights

Based on deployment mode, the web-based segment held the largest revenue share of over 77% in 2025, owing to its ability to offer remote access, simplified deployment, and cost-effectiveness for institutions not ready for full-scale cloud adoption. These systems provide a middle-ground solution that delivers many of the benefits of cloud platforms such as accessibility and flexibility without relinquishing complete data control, which is often a concern in highly regulated environments.

Web-based RIS are especially popular among medium-sized diagnostic centers and hospitals in both developed and developing countries. These systems allow radiologists to work from multiple locations, coordinate with remote teams, and maintain continuous access to patient data and reports, improving both efficiency and care quality. The reduced need for onsite infrastructure further adds to its appeal.

The cloud-based segment is anticipated to grow at the fastest CAGR from 2024 to 2034. driven by advancements in cloud infrastructure, cybersecurity, and telehealth adoption. Cloud RIS offers scalable storage, real-time updates, and seamless multi-site integration, making it ideal for large hospital networks and growing diagnostic chains. Moreover, as the cost of cloud storage continues to decline and 5G/IoT technologies expand, cloud RIS adoption is expected to accelerate further.

The pandemic amplified the need for remote access and virtual care delivery, fueling demand for cloud-based systems. For example, cloud RIS allowed radiologists in Europe and North America to interpret scans and generate reports while working remotely during lockdowns. This agility has positioned cloud RIS as the future-ready choice for healthcare providers aiming for long-term resilience.

By End Use Insights

The hospitals & clinics end use segment dominated the market with a revenue share of over 82.0% in 2025. RIS helps hospitals manage patient imaging workflows across departments, improve turnaround times for diagnostic results, and comply with clinical documentation standards.

Hospitals also benefit from integrating RIS with their centralized HIS and EHR platforms, enabling a comprehensive view of patient health records and reducing redundancy. In addition, multi-specialty and teaching hospitals are increasingly investing in AI-integrated RIS to aid in research and enhance diagnostic precision.

On the other hand, OPD clinics are emerging as the fastest growing end-use segment, driven by the increasing popularity of outpatient diagnostic services and the shift toward ambulatory care. OPDs are expanding their imaging capabilities to offer MRI, CT, and ultrasound services, and RIS adoption in these settings helps improve scheduling efficiency, result turnaround time, and patient satisfaction.

Moreover, the rise of telemedicine and virtual radiology consultations has made RIS essential in OPD clinics, where data sharing and digital recordkeeping are now critical. Vendors are offering compact, web-based or standalone RIS platforms tailored for such facilities, contributing to this segment's rapid growth.

By Product Insights

The integrated RIS segment held the largest revenue share of over 67% in 2024. Integrated systems offer a unified platform for appointment scheduling, image tracking, result distribution, and billing processes, thereby reducing administrative overhead and errors.

Hospitals and imaging centers are increasingly favoring integrated RIS to streamline operations and reduce the complexity of managing multiple standalone systems. Moreover, regulatory requirements for integrated documentation and comprehensive patient records have made integrated RIS indispensable for accreditation and quality assurance purposes.

However, standalone RIS systems are gaining traction, particularly among smaller outpatient facilities, diagnostic laboratories, and specialty clinics. These systems offer cost-effective and customizable solutions for facilities that do not require a full suite of integrated hospital systems. Standalone RIS is often easier to deploy and requires less complex IT support, making it suitable for environments with limited infrastructure.

These systems are also increasingly being equipped with interoperability features to allow future integration with PACS and EHRs as the need arises, thus offering scalability without initial heavy investment. For example, many independent radiology clinics in Latin America and Southeast Asia are adopting standalone RIS to digitize their operations incrementally.

The radiology information systems market in North America held the largest share of over 50.0% in 2024. The U.S. remains the largest contributor due to widespread EHR usage, high healthcare spending, and the presence of leading RIS vendors. Additionally, government support through initiatives such as the HITECH Act and interoperability mandates has further driven the deployment of RIS across healthcare institutions.

Radiology departments in North America are also at the forefront of adopting AI and machine learning-integrated RIS solutions, creating a technologically advanced market landscape. Moreover, the presence of organizations like the Radiological Society of North America (RSNA) helps promote innovation and best practices, further bolstering market maturity.

How is the U.S. Radiology Information Systems Market Growing?

U.S. plays a major role in the driving the market growth in North America. Rising prevalence of chronic diseases such as arthritis, cancer and cardiovascular diseases as well as aging population is creating high demand for diagnostic imaging technologies which requires efficient management of patient data and workflow offered by radiology information systems. Moreover, continuous advancements in healthcare technology, increased government influence promoting standardization of medical data and records and adoption of cloud-based RIS solutions are driving the market growth.

Asia Pacific is the Fastest Growing Region

In contrast, Asia Pacific is the fastest growing region, fueled by rapid healthcare infrastructure development, rising awareness about digital health tools, and increased government investments. Countries like China, India, and South Korea are witnessing rising diagnostic imaging volumes due to aging populations and the increasing burden of chronic diseases.

Moreover, private hospital chains in the region are aggressively investing in health IT systems to improve service quality and patient experience. Local and international vendors are offering low-cost, scalable RIS platforms tailored for the diverse needs of the Asia Pacific market. For instance, in India, the emergence of chain diagnostic labs such as Dr. Lal PathLabs and Metropolis is creating demand for centralized RIS systems.

What Fuels the Expansion of Radiology Information Systems Market in China?

China is expected to show fastest growth in the Asia Pacific market over the forecast period. The country’s huge population with rising chronic disease burden is leading to increased volume of data and medical images generated through diagnostic imaging procedures is creating the demand for strong radiology information systems. Rising investments in healthcare infrastructure, advancements in RIS technologies, digitalization of health records and diagnostic workflows as well as surge in number of healthcare outsourcing services in China are the factors fuelling the market expansion.

- In January 2025, WindRose Health Investors, a healthcare private equity firm based in New York, made a strategic investment in CIVIE, an AI-driven radiology solutions ecosystem. The investment will help CIVIE in developing its innovative technology platform for enhancing productivity, optimizing revenue and improving patient outcomes for radiology practices and hospital systems.

- In November 2024, Mach7 Technologies, an innovative medical imaging and data management solutions providing company, launched UnityVue, a unique AI-powered radiology software platform developed in collaboration with NewVue. The software is designed for improving patient care and streamlining diagnostic workflows which reducing radiologist burnout.

- In August 2024, Hexarad, a London-based radiology tech company, secured €13 million through a funding round for its end-to-end radiology workflow software.

- In July 2024, Sana Health Diagnostic, a Dublin-based healthcare provider, announced the integration of Aptivision’s VisionRIS-Professional software-as-a-service (SaaS) solution into their system for enhancing booking processes, performance and reporting of ultrasound scans.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the radiology information systems (RIS) market

Deployment Mode

- Web-based

- Cloud-based

- On-premise

Product

- Integrated RIS

- Standalone RIS

End Use

- Hospitals & Clinics

- Outpatient Department (OPD) Clinics

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)