The global rear-view mirror market size was exhibited at USD 9.04 billion in 2023 and is projected to hit around USD 13.77 billion by 2033, growing at a CAGR of 4.3% during the forecast period of 2024 to 2033.

Key Takeaways:

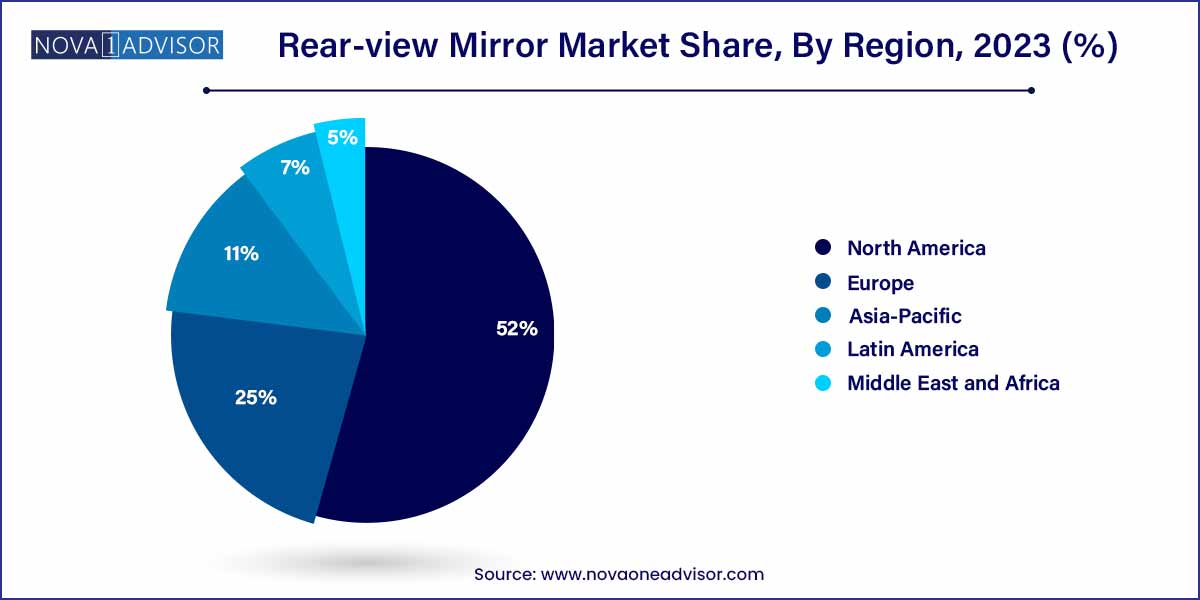

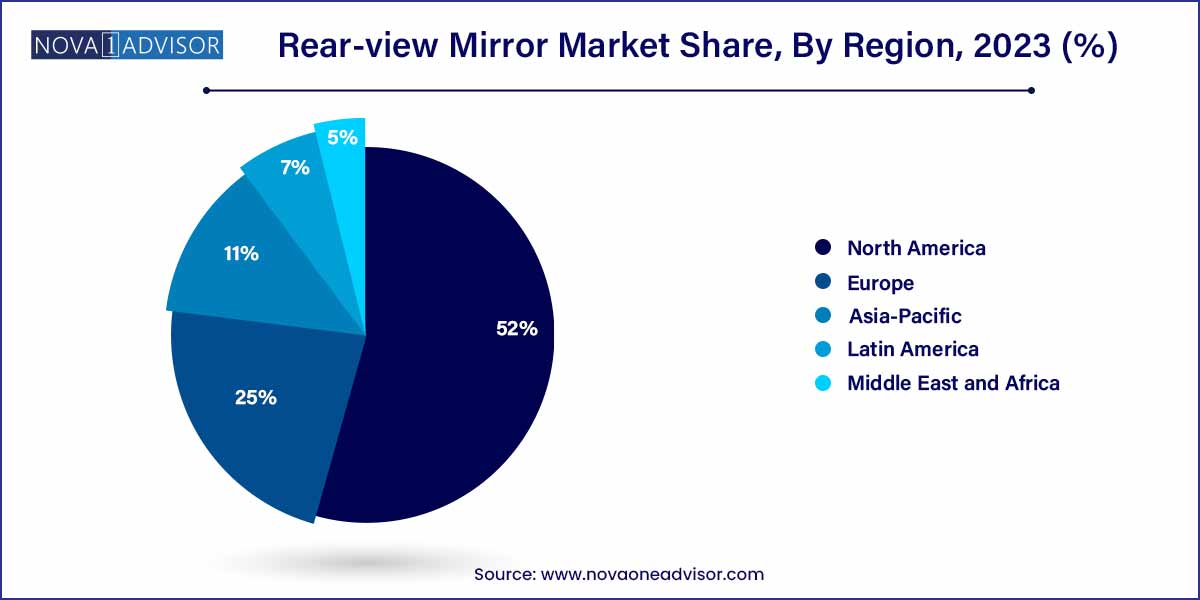

- Asia Pacific dominated the market with the largest revenue share of 52.0% in 2023.

- The heating function segment accounted for the largest revenue share of over 49.3%, due to its extensive usage in cold weather.

- The passenger car segment dominated the market with the highest revenue share of 76.0% in 2023.

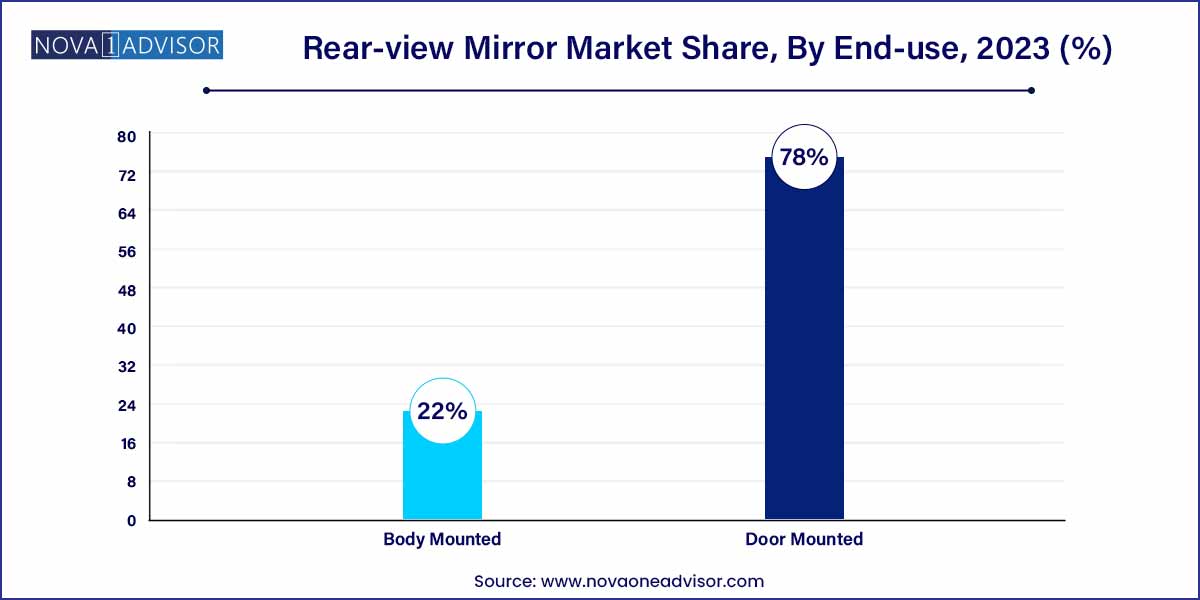

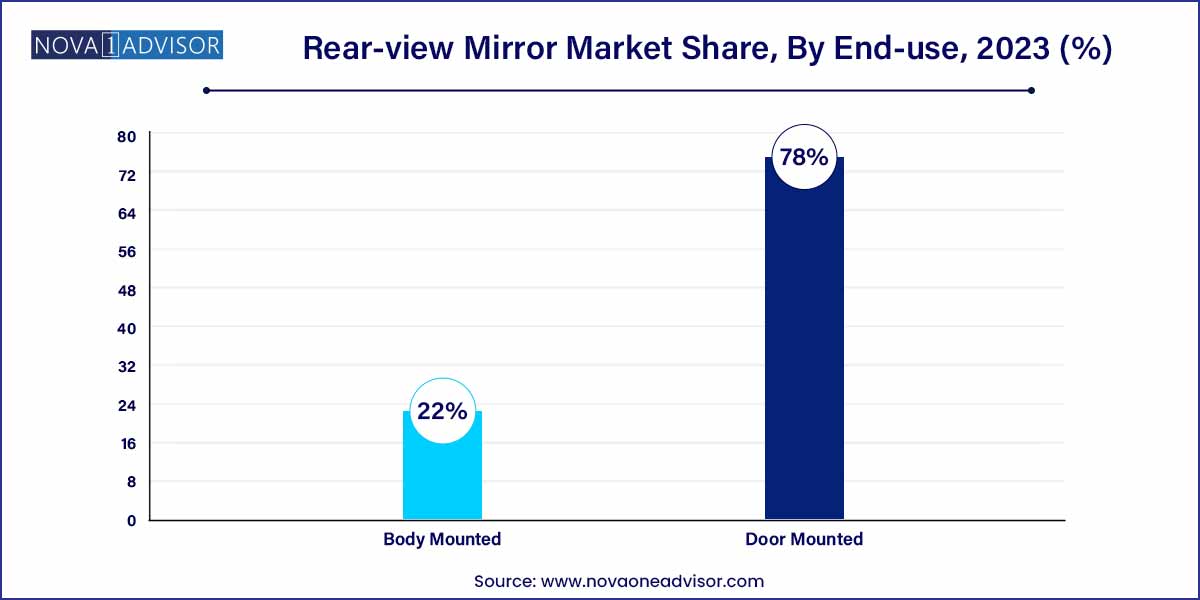

- The door-mounted segment dominated the market, with the highest revenue share of 78.0% in 2023.

- The smart rear-view mirror segment held the largest market share of 74.6% in 2023.

- The exterior mirror segment accounted for the largest share of around 75.2% of the market in 2023.

Market Overview

The rear-view mirror market has undergone a notable transformation over the past decade, evolving from a basic safety component into a complex, technology-integrated system crucial to modern automotive design. Rear-view mirrors, both interior and exterior, provide visibility to the areas behind and beside a vehicle, allowing for safe maneuvering, lane changes, and reversing. While traditionally consisting of simple reflective glass, these components are now embedded with sensors, displays, cameras, and intelligent features designed to enhance driver awareness and minimize blind spots.

The growth of this market has been significantly influenced by the increasing adoption of Advanced Driver Assistance Systems (ADAS), rising consumer preference for vehicle safety and comfort, and the integration of smart electronics. Automakers are now equipping vehicles with auto-dimming, heated, and blind spot detection mirrors, making them integral to both passive and active safety systems. The regulatory environment also plays a key role, as governments across regions mandate specific mirror technologies to improve road safety.

As the automotive industry continues its shift toward autonomous driving and electric mobility, the rear-view mirror segment is being redefined. In many concept and high-end electric vehicles, traditional mirrors are being replaced by camera-monitor systems (CMS), offering broader fields of view, weather-resistance, and digital overlays. For instance, Audi’s e-tron uses side-mounted cameras instead of mirrors, transmitting real-time images to internal OLED displays.

Furthermore, regional market dynamics are shaped by factors such as vehicle production volumes, technological adoption rates, and consumer preferences. While developed markets focus on smart features and luxury integration, developing economies see demand for cost-efficient safety components. Together, these shifts underscore a maturing market poised for innovation and substantial growth.

Major Trends in the Market

-

Shift Towards Smart Mirrors and CMS Integration

High-end vehicles are increasingly replacing traditional mirrors with smart rear-view mirrors and camera-based solutions to improve visibility and aerodynamics.

-

Increasing Demand for Auto-Dimming and Heated Mirrors

Auto-dimming technology is becoming standard in mid to high-range models to reduce glare at night, while heated mirrors prevent fogging in cold climates.

-

Growth of Blind Spot Detection Systems

Integration of radar or ultrasonic sensors within mirrors for blind spot detection is rapidly becoming a safety feature expectation among consumers.

-

Rising Adoption of Power-Controlled and Folding Mirrors

Power-operated mirrors that can be folded or adjusted electronically are gaining traction for convenience, especially in urban and high-traffic environments.

-

Integration with Vehicle Telematics and HUD Systems

Rear-view mirrors now serve as display panels for telematics, navigation prompts, or alerts linked with HUD (head-up display) systems.

-

Expansion of Smart Rear-view Mirrors in Fleet and Commercial Vehicles

Commercial trucks and buses are adopting intelligent mirror systems for side visibility and rear monitoring, reducing collision risks and aiding logistics efficiency.

Rear-view Mirror Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.04 Billion |

| Market Size by 2033 |

USD 13.77 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Feature Type, Mounting Location, Product Type, Type, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Continental AG; Murakami Corporation; VALEO; TOKAIRIKA, CO; LTD.; SL Corporation.; Ishizaki Holdings; GENTEX CORPORATION; Ficosa Internacional SA; Magna International Inc.; Mitsuba Corp. |

Rear-view Mirror Market Dynamics

- Safety Regulations as Market Catalyst

The rear-view mirror market is dynamically influenced by the stringent safety regulations governing the automotive industry. Regulatory bodies worldwide have imposed rigorous standards to enhance vehicle safety, making rear-view mirrors pivotal components for compliance. Manufacturers are compelled to integrate advanced safety features such as blind-spot detection and auto-dimming capabilities to align with these standards. This regulatory-driven demand acts as a catalyst for continuous innovation in rear-view mirror technologies, fostering a dynamic market environment.

- Rise of Smart Mirrors Shaping Market Landscape

A transformative dynamic shaping the rear-view mirror market is the ascendancy of smart mirrors. These mirrors, equipped with connectivity features and often incorporating AI and IoT technologies, redefine the driving experience. The integration of real-time information, navigation assistance, and entertainment options within the rear-view mirror not only enhances safety but also aligns with the growing trend of connected vehicles.

Rear-view Mirror Market Restraint

- Cost Implications of Advanced Technologies

One notable restraint in the rear-view mirror market is the cost implications associated with the integration of advanced technologies. As manufacturers strive to meet evolving safety standards and consumer demands for innovative features, the production costs of rear-view mirrors have increased significantly. The incorporation of smart technologies, such as cameras and connectivity features, amplifies manufacturing expenses. This elevated cost structure can pose a challenge, especially for price-sensitive markets, limiting widespread adoption and potentially hindering market growth.

- Compatibility Issues with Existing Vehicles

Another significant restraint in the rear-view mirror market is the challenge posed by compatibility issues with existing vehicle models. As automotive technologies advance, retrofitting older vehicles with the latest mirror innovations can be a complex and costly endeavor. The diversity in vehicle designs and specifications across different manufacturers further exacerbates this challenge. Retrofitting existing vehicles to accommodate advanced rear-view mirror technologies may not always be feasible, creating a restraint in the market's ability to reach a broader consumer base.

Rear-view Mirror Market Opportunity

- Growing Demand in Emerging Markets

A prominent opportunity within the rear-view mirror market lies in the growing demand from emerging markets. As these regions experience a surge in economic development and an increase in disposable income, there is a parallel rise in vehicle ownership. The demand for safety features, including advanced rear-view mirrors, is on the upswing, presenting manufacturers with a substantial opportunity to tap into burgeoning markets. Strategic market penetration and tailored product offerings for these regions can pave the way for sustained growth and market expansion.

- Technological Advancements and Innovation

The continuous evolution of technology presents a lucrative opportunity for the rear-view mirror market. Ongoing advancements in sensors, cameras, and connectivity solutions allow for the development of even more sophisticated and efficient rear-view mirror systems. Innovations such as augmented reality displays, gesture controls, and further integration with vehicle infotainment systems open avenues for differentiation and added value. Companies that invest in cutting-edge technologies and stay at the forefront of innovation are poised to capitalize on this opportunity, catering to consumers seeking the latest in automotive safety and convenience features.

Rear-view Mirror Market Challenges

- Global Supply Chain Disruptions

One of the primary challenges facing the rear-view mirror market is the impact of global supply chain disruptions. The automotive industry heavily relies on a complex network of suppliers, and any disruptions, whether due to geopolitical factors, natural disasters, or unforeseen events like the COVID-19 pandemic, can result in material shortages and production delays. These disruptions can, in turn, hinder the timely manufacturing and delivery of rear-view mirrors, posing a significant challenge for industry players striving to meet market demands and deadlines.

- Increasing Complexity of Vehicle Designs

The increasing complexity of modern vehicle designs presents a substantial challenge for the rear-view mirror market. As automotive manufacturers strive to enhance aerodynamics, aesthetics, and fuel efficiency, traditional mirror placements and designs are being reimagined. Integrated cameras, sensors, and new materials further contribute to the evolving landscape. Adapting rear-view mirrors to fit seamlessly within these intricate designs requires ongoing innovation and engineering, posing a challenge for manufacturers to keep pace with the dynamic changes in vehicle architecture while ensuring optimal safety and functionality.

Segments Insights:

By Feature Type Insights

Auto-dimming mirrors dominated the feature type segment, thanks to their widespread adoption across passenger cars and luxury vehicles. These mirrors automatically adjust their reflectivity to reduce headlight glare from trailing vehicles, improving night-time driving comfort and safety. They have become a standard feature in many mid-segment sedans and SUVs such as the Toyota Camry, Honda Accord, and Ford Edge. With increasing urban traffic and highway usage, this feature has gained traction due to its tangible safety benefits.

Blind spot detection is the fastest-growing feature type, driven by ADAS implementation and consumer demand for safer driving experiences. Mirrors equipped with radar sensors or cameras alert drivers to nearby vehicles in adjacent lanes, reducing the risk of side collisions. Premium brands like BMW, Audi, and Mercedes-Benz have incorporated this as a standard or optional feature, while mass-market OEMs like Hyundai and Kia are adding it to more affordable trims. Its relevance in crowded city driving and highway overtaking scenarios ensures continued growth in the years ahead.

By Vehicle Type Insights

Passenger cars dominate the rear-view mirror market, owing to their sheer production volumes and consumer inclination toward feature-rich, safe, and comfortable vehicles. OEMs focus heavily on differentiating passenger cars with aesthetic and functional mirror enhancements, especially in urban and high-traffic markets where lane changes and tight maneuvering are frequent. Brands such as Hyundai, Toyota, and Chevrolet have rolled out models with advanced mirror options even in compact and mid-range offerings.

Commercial vehicles represent the fastest-growing segment, particularly in logistics, fleet, and long-haul transportation. These vehicles require enhanced visibility and safety features due to their larger size and operating environments. Mirror systems in trucks and buses are being upgraded with wide-angle lenses, surround-view cameras, and real-time display screens to help drivers avoid accidents and improve operational safety. With the rise of e-commerce and last-mile delivery, smart mirror systems are gaining ground as essential tools for fleet management.

By Mounting Location Insights

Door-mounted mirrors currently dominate the segment, as they are essential for lateral visibility in all vehicle categories. Door-mounted designs offer a wider angle of view and easier adjustment, housing features like blind spot indicators, heaters, and turn signals. They are universally adopted across all vehicle segments and are the preferred location for incorporating camera systems in EVs and autonomous vehicle concepts.

Body-mounted mirrors are witnessing increasing adoption, particularly in commercial vehicles and large trucks where visibility requirements are different. Body-mounted mirrors often provide better rear and downward angles, essential for maneuvering in tight delivery zones or construction sites. In certain regions like Japan, body-mounted mirrors are used in buses and public transportation to provide clear side views and pedestrian safety.

By Product Type Insights

Conventional rear-view mirrors continue to dominate, primarily due to their ubiquity and cost-effectiveness. Every vehicle, regardless of price or class, is equipped with at least one conventional interior mirror, often coupled with basic day/night switching mechanisms. Their simplicity, durability, and low maintenance make them ideal for base trims and budget-friendly models.

Smart rear-view mirrors are the fastest-growing product type, especially with rising demand for integrated safety and infotainment solutions. Smart mirrors combine traditional reflectivity with digital displays that stream live feeds from rear-mounted cameras. Some systems can toggle between reflection and display modes, offering greater flexibility and enhanced field of view. For instance, Nissan’s Intelligent Rear View Mirror system replaces the rear-view mirror with a high-resolution video feed to eliminate rear seat or pillar obstruction.

By Type Insights

Exterior mirrors dominate the market, accounting for the majority of sales and technology upgrades. These mirrors are indispensable for monitoring adjacent lanes and are often the first point of integration for ADAS components. Innovations like heating, folding mechanisms, integrated turn signals, and blind spot alerts are frequently applied to exterior mirrors, making them technologically rich compared to their interior counterparts.

Interior mirrors are growing steadily, especially with increasing demand for smart rear-view solutions. Interior mirrors are now being transformed into multifunctional tools, integrating display screens for reverse camera feeds, navigation assistance, or even biometric access control. For instance, Mitsubishi and Panasonic are jointly developing interior mirrors with facial recognition for personalized vehicle access and preferences.

By Regional Insights

Asia-Pacific leads the global rear-view mirror market, supported by massive vehicle production volumes, technological advancement, and cost-effective manufacturing ecosystems. China, India, Japan, and South Korea are central to this dominance. China is home to both leading OEMs and suppliers of rear-view mirrors and smart mirror modules. Brands like BYD and NIO are pushing innovations with camera-based mirror systems, especially in their EV offerings.

India’s automotive sector is expanding rapidly, with growing consumer interest in safety-enhanced vehicles that include features like power-folding mirrors and blind spot detection. Japanese OEMs like Toyota and Nissan are pioneers in smart mirror adoption, while South Korea’s Hyundai and Kia are rolling out advanced mirrors even in mid-size SUVs. The region’s focus on technological integration, combined with consumer affordability, makes Asia-Pacific the most influential region in the market.

North America is emerging as the fastest-growing region, driven by regulatory emphasis on safety, high-tech adoption, and the presence of major automotive innovation hubs. The U.S. market, in particular, has embraced advanced mirror features such as blind spot detection, smart rear-view displays, and heated mirrors across multiple vehicle segments. The National Highway Traffic Safety Administration (NHTSA) supports safety initiatives that indirectly promote the use of technologically advanced mirrors.

North American automakers like General Motors, Ford, and Tesla are leading in mirror innovation. For instance, GM’s rear camera mirror is now featured in models like the Chevrolet Tahoe and Cadillac CT6, offering drivers a video feed in place of the conventional mirror. With rising consumer preference for SUVs and pickup trucks, the market for rugged, feature-rich exterior mirrors is also expanding. Additionally, autonomous vehicle pilots in the U.S. are setting the stage for camera-monitor systems to replace conventional mirrors in the coming years.

Recent Developments

-

February 2025 – Gentex Corporation launched a new smart rear-view mirror with biometric authentication for fleet vehicles, allowing secure, personalized driver profiles.

-

December 2024 – Magna International partnered with Fisker to supply digital rear-view mirror systems for its electric SUV “Ocean,” incorporating HD streaming and auto-brightness control.

-

October 2024 – Murakami Corporation began mass production of integrated CMS units for Japanese EV models, combining cameras and OLED screens in exterior mirror housings.

-

August 2024 – Samvardhana Motherson Reflectec (SMR) opened a new manufacturing facility in Mexico to cater to growing demand for smart and power-folding mirrors in the North American market.

-

June 2024 – Ficosa International unveiled a new ultra-slim blind spot detection mirror designed specifically for urban electric vehicles, offering better aerodynamics and reduced drag.

Some of the prominent players in the rear-view mirror market include:

- Continental AG

- Murakami Corporation

- VALEO

- TOKAIRIKA,CO, LTD.

- SL Corporation.

- Ishizaki Holdings

- GENTEX CORPORATION

- Ficosa Internacional SA

- Magna International Inc.

- Mitsuba Corp.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global rear-view mirror market.

Feature Type

- Auto-Dimming

- Blind Spot Detection

- Power Control

- Automatic Folding

- Heating Function

- Others

Mounting Location

- Door Mounted

- Body Mounted

Product Type

- Smart Rear-View Mirror

- Conventional Rear-View Mirror

Type

- Exterior Mirror

- Interior Mirror

Vehicle Type

- Passenger Car

- Commercial Vehicles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)