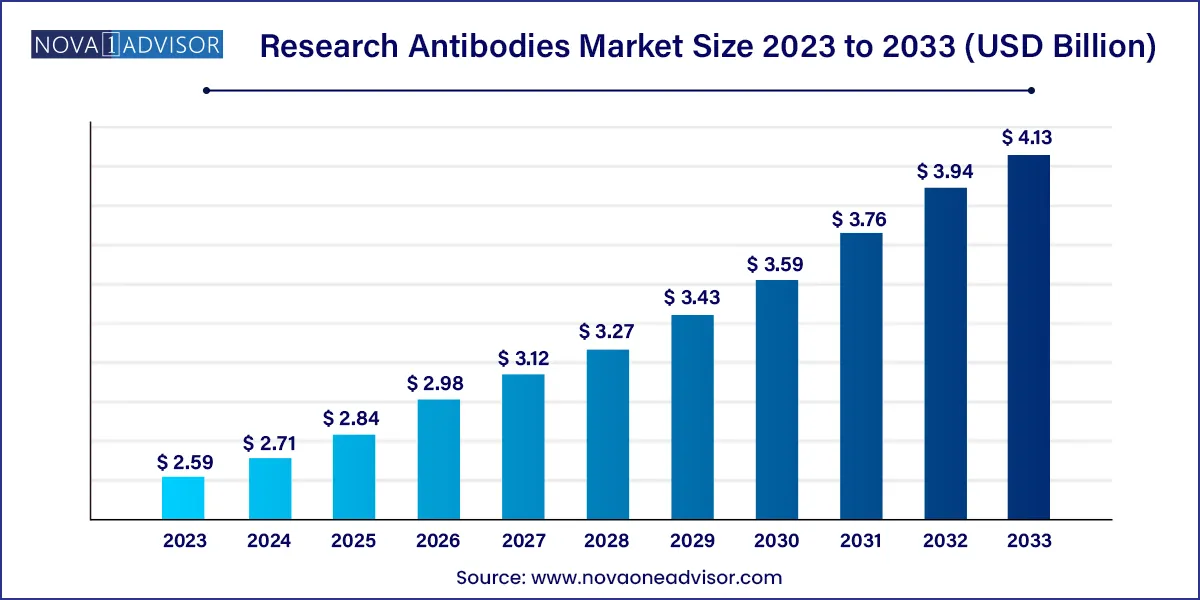

The global research antibodies market size was exhibited at USD 2.59 billion in 2023 and is projected to hit around USD 4.13 billion by 2033, growing at a CAGR of 4.78% during the forecast period 2024 to 2033.

Key Takeaways:

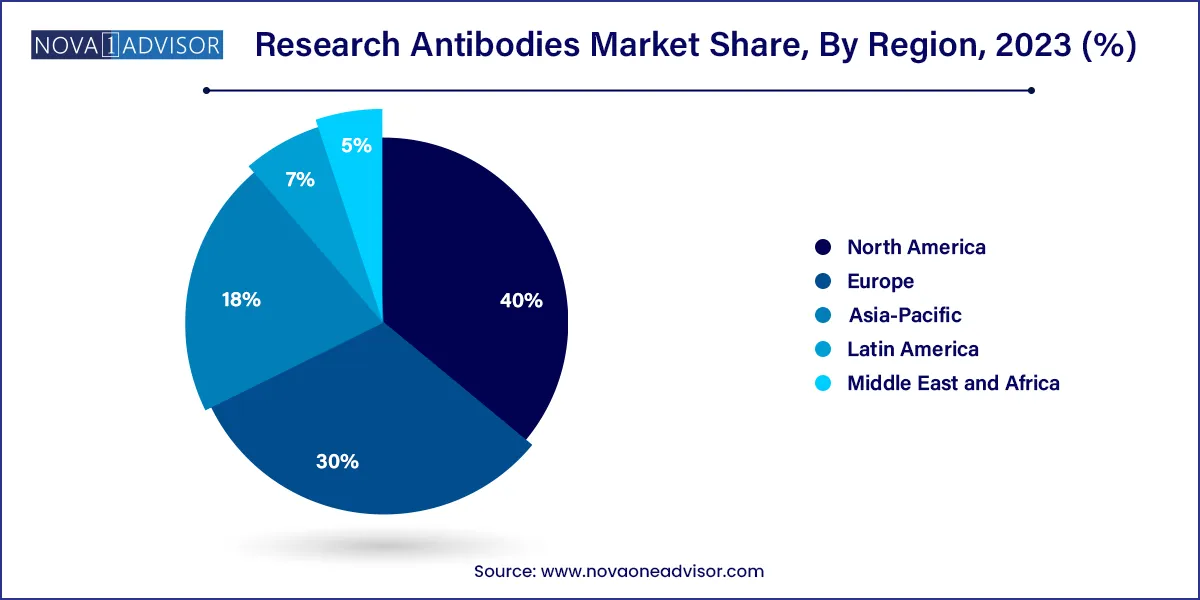

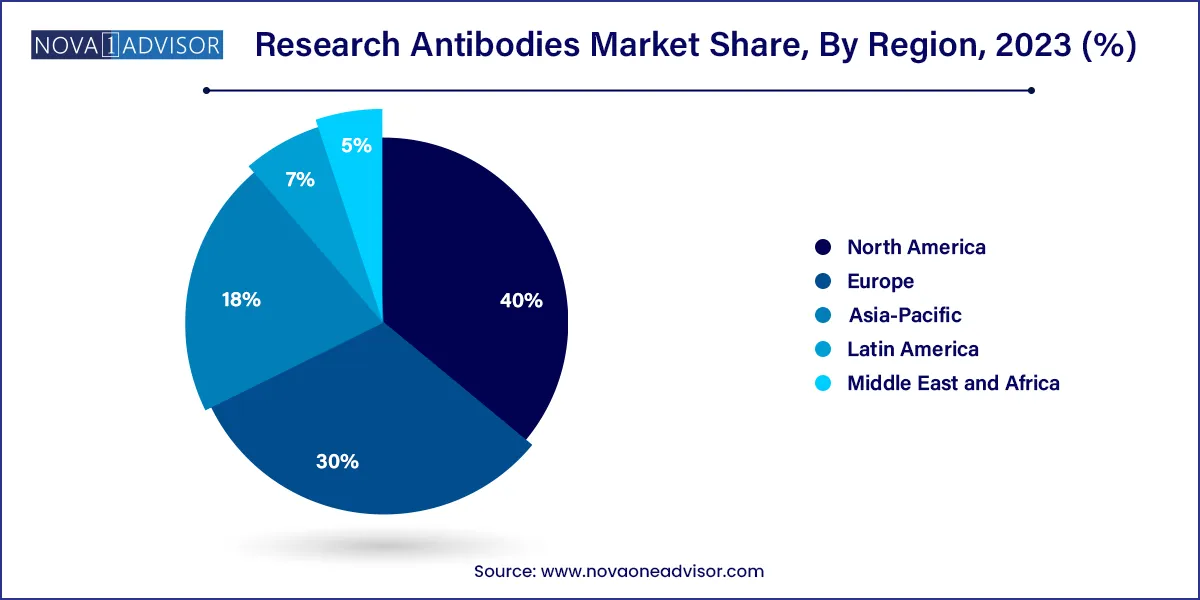

- North America dominated the market in 2023 by capturing the largest revenue share of 40.0%.

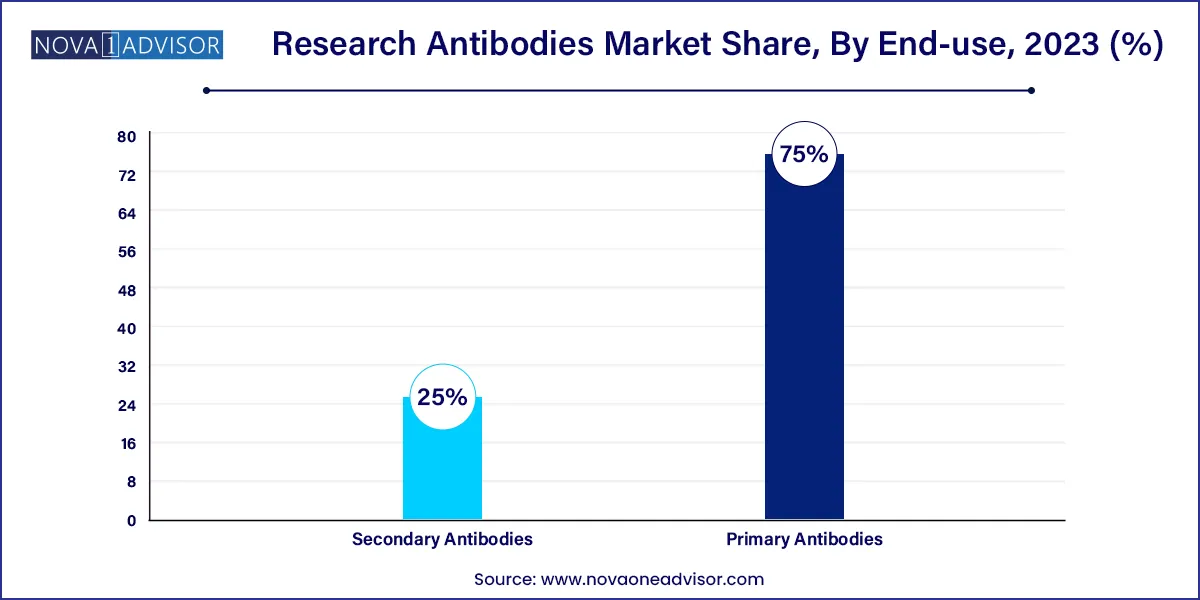

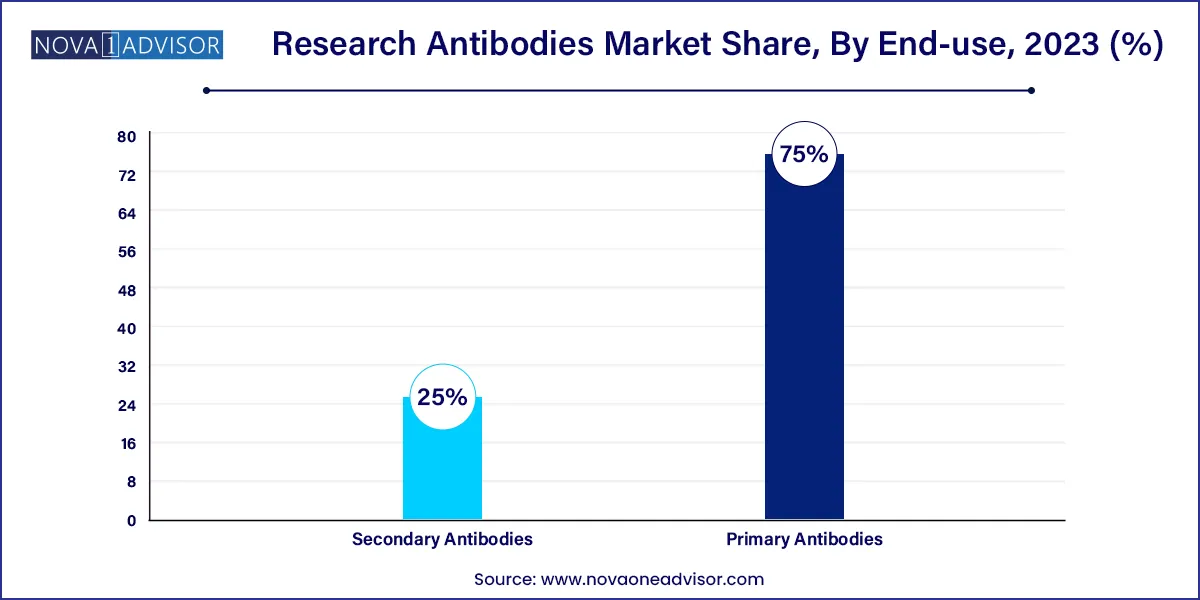

- The primary antibodies segment captured the highest revenue share of 75.0% in 2023.

- Monoclonal antibodies segment accounted for the dominant share of the market in 2023.

- Western blotting segment accounted for the largest market share in 2023.

- The rabbit source segment held the largest market share in 2023.

- Oncology segment accounted for the largest market share in 2023,

- The academic & research institutions segment captured the highest revenue share in 2023

Market Overview

The research antibodies market is a critical subset of the life sciences tools industry, driving innovation across molecular biology, cellular assays, immunodiagnostics, proteomics, and drug discovery. Research antibodies are indispensable reagents used to detect, isolate, and quantify proteins or antigens in various biological samples, and they form the backbone of experimental workflows in academic, pharmaceutical, and clinical research settings.

These antibodies are either monoclonal (produced by identical immune cells and recognizing a single epitope) or polyclonal (produced by different immune cells targeting multiple epitopes of the same antigen). They are extensively utilized in methodologies like ELISA, Western blotting, flow cytometry, immunohistochemistry, immunoprecipitation, and immunofluorescence, supporting wide-ranging applications from oncology and immunology to neurobiology and stem cell research.

The demand for highly specific, reproducible, and validated antibodies has grown significantly in the wake of reproducibility crises in life sciences. This has compelled manufacturers to focus on stringent validation, reagent traceability, and quality certifications. Technological advancements, such as recombinant antibody production and CRISPR-based target identification, are also contributing to market expansion by improving antibody consistency and functional precision.

With rising investments in biomedical research, personalized medicine, and infectious disease surveillance (such as during the COVID-19 pandemic), the research antibodies market has experienced a resurgence in demand. Moreover, the proliferation of multi-omics platforms, AI-guided epitope mapping, and high-throughput screening tools is broadening antibody applications and pushing researchers to seek custom and premium-grade antibody solutions.

Major Trends in the Market

-

Recombinant Antibodies on the Rise: High reproducibility and scalability make recombinant antibodies increasingly preferred over traditional hybridoma-based antibodies.

-

Multiplex Assay Expansion: Multi-analyte detection platforms are fueling the demand for antibody panels compatible with multiplex immunoassays.

-

Customized Antibody Services: Pharma and academic researchers are turning to tailored antibodies with enhanced epitope specificity and novel conjugation options.

-

AI and Bioinformatics Integration: AI-driven antibody design and data analytics are improving epitope prediction, reducing time-to-validation cycles.

-

High Demand from Neuroscience and Stem Cell Fields: Advancements in brain and stem cell research are creating a need for specific antibodies to track cell lineage, biomarkers, and signaling pathways.

-

Digital Antibody Validation Repositories: Online databases and citation indices are being leveraged for validation credibility and reagent selection.

-

Increased Outsourcing to CROs: Pharmaceutical and biotech firms increasingly outsource antibody development and assay design to contract research organizations.

-

Post-COVID Demand for Viral Research Tools: Research related to virology, immunopathology, and pandemic preparedness continues to rely heavily on antibodies for tracking viral proteins and host responses.

Research Antibodies Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.71 Billion |

| Market Size by 2033 |

USD 4.13 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.78% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, Technology, Source, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Abcam Plc; Merck KGaA; Thermo Fisher Scientific, Inc.; Cell Signalling Technology, Inc.; Santa Cruz Biotechnology Inc.; PerkinElmer, Inc.; Becton; Dickinson and Company; Bio-Techne Corporation; Proteintech Group, Inc.; Jackson ImmunoResearch Inc. |

By Product

Primary antibodies dominate the research antibodies market, accounting for the largest share due to their direct interaction with specific antigens of interest. These antibodies are critical for applications such as Western blotting, immunohistochemistry (IHC), and immunoprecipitation (IP), where specificity, sensitivity, and cross-reactivity are crucial. Researchers increasingly prefer primary antibodies with high citation history, validated by multiple techniques and species. Vendors like Abcam and CST have built competitive advantages around highly cited, peer-reviewed primary antibodies.

Secondary antibodies are growing steadily, especially due to their role in signal amplification in detection assays like ELISA and immunofluorescence. As multiplexing and fluorescent detection increase, so does the need for highly specific, low-background secondary antibodies conjugated with fluorophores, enzymes, or biotin. The market is also shifting toward secondary antibodies with pre-adsorbed and cross-adsorbed variants to enhance target specificity across species.

By Type

Monoclonal antibodies lead the market, as they offer consistent performance, high specificity, and minimal cross-reactivity. These are preferred in quantitative assays and diagnostics, where reproducibility is paramount. Mouse and rabbit monoclonal antibodies dominate this space, with vendors investing heavily in recombinant monoclonal production to replace traditional hybridomas.

Polyclonal antibodies are still widely used due to their robustness in detecting low-abundance proteins or multiple epitopes. Particularly in immunoprecipitation and detection of denatured proteins, polyclonals provide superior sensitivity. However, quality variability and limited scalability are gradually pushing researchers toward monoclonal and recombinant formats.

By Technology

Western blotting is the dominant technology segment, owing to its prevalence in protein expression validation across academic and pharma labs. It remains a gold-standard tool for qualitative protein analysis and requires reliable antibodies with high epitope recognition in denatured proteins. Demand is driven by cancer biology, neurodegenerative research, and drug mechanism-of-action studies.

Flow cytometry and ELISA are among the fastest-growing segments, with the former gaining momentum in immunophenotyping, stem cell research, and cell signaling studies, and the latter being essential in cytokine quantification, serological testing, and vaccine research. The expansion of multiparameter flow cytometry has increased demand for fluorophore-conjugated antibodies with minimal spectral overlap.

By Source

Rabbit remains the dominant source for antibody generation, particularly in polyclonal and recombinant formats. Rabbit antibodies offer high affinity and broader epitope recognition, especially in detecting post-translational modifications. They are also useful in immunohistochemistry where tissue cross-reactivity must be minimized.

Goat and mouse-derived antibodies are significant contributors, especially in secondary antibody production and hybridoma technologies. Mouse monoclonals continue to dominate in well-characterized targets due to their historical prevalence and cost-efficiency.

By Application

Oncology holds the largest market share, owing to intense research in tumor biology, biomarker discovery, and therapeutic development. Cancer-specific antibodies are used extensively in cell signaling, gene expression profiling, and apoptosis assays. Antibodies targeting proteins like p53, HER2, and EGFR are ubiquitous in cancer labs.

Neurobiology and stem cell applications are among the fastest growing, driven by the need to track differentiation, lineage, and neuronal activity. Researchers investigating Alzheimer’s, Parkinson’s, or neural regeneration require highly specific antibodies for IHC, ICC (immunocytochemistry), and live-cell imaging. Custom antibody development for rare neuron-specific proteins is a key growth area.

By End Use

Academic and research institutes dominate the end-use landscape, accounting for the largest consumption volume. These institutions rely on grant-funded studies to investigate novel biological mechanisms, where antibodies are essential for molecular and cellular experiments.

Pharmaceutical and biotechnology companies are rapidly growing consumers, especially as biologic drug development and companion diagnostics become mainstream. The need for target validation, mechanism-of-action studies, and preclinical biomarker research is driving commercial antibody procurement. CROs also play a rising role as outsourced antibody users for assay development, screening, and validation.

By Regional Insights

North America holds the leading position in the research antibodies market, driven by robust funding in biomedical research, well-established academic infrastructure, and the presence of major biotech and pharma companies. The U.S. National Institutes of Health (NIH) and private foundations allocate billions annually toward basic and translational research.

In the U.S. and Canada, leading institutions such as Harvard, Stanford, NIH, and the University of Toronto are major consumers of research antibodies. The region also benefits from early adoption of recombinant antibody technologies, strong publication output, and a well-regulated commercial landscape. Companies such as Thermo Fisher Scientific, Abcam (U.S. subsidiary), and Bio-Rad Laboratories have established significant market presence.

Asia-Pacific is the fastest-growing regional market, buoyed by rising investments in biomedical R&D, expanding pharmaceutical pipelines, and increasing academic output. China, India, South Korea, and Japan are aggressively building life sciences research capabilities through government initiatives and public-private partnerships.

For example, China's Made in China 2025 strategy and Japan’s funding for regenerative medicine are translating into greater demand for research reagents. The rise of regional antibody producers, competitive pricing, and growing participation in global research projects are also contributing to APAC’s rapid growth trajectory.

Recent Developments

-

March 2025: Abcam launched a new portfolio of synthetic monoclonal antibodies validated for use in high-throughput multiplex assays and humanized disease models.

-

January 2025: Thermo Fisher Scientific expanded its recombinant antibody production facilities in the U.S. to meet increasing demand from pharma and CRO customers.

-

November 2024: Bio-Rad introduced a range of fluorophore-conjugated antibodies compatible with next-gen flow cytometry platforms and AI-based image cytometers.

-

September 2024: Cell Signaling Technology (CST) partnered with a major academic consortium to develop an open-access repository of antibody validation data across 15 disease pathways.

-

July 2024: Proteintech acquired ChromoTek GmbH to enhance its offering of nanobody-based reagents and single-domain antibodies for super-resolution imaging.

Some of the prominent players in the Research antibodies market include:

- Abcam Plc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Cell Signalling Technology, Inc.

- Santa Cruz Biotechnology Inc.

- PerkinElmer, Inc.

- Becton, Dickinson and Company

- Bio-Techne Corporation

- Proteintech Group, Inc.

- Jackson ImmunoResearch Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global research antibodies market.

Product

- Primary Antibodies

- Secondary Antibodies

Type

- Monoclonal Antibodies

- Polyclonal Antibodies

Technology

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

Source

Application

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

End Use

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)