Saliva Collection And Diagnostics Market Size and Research

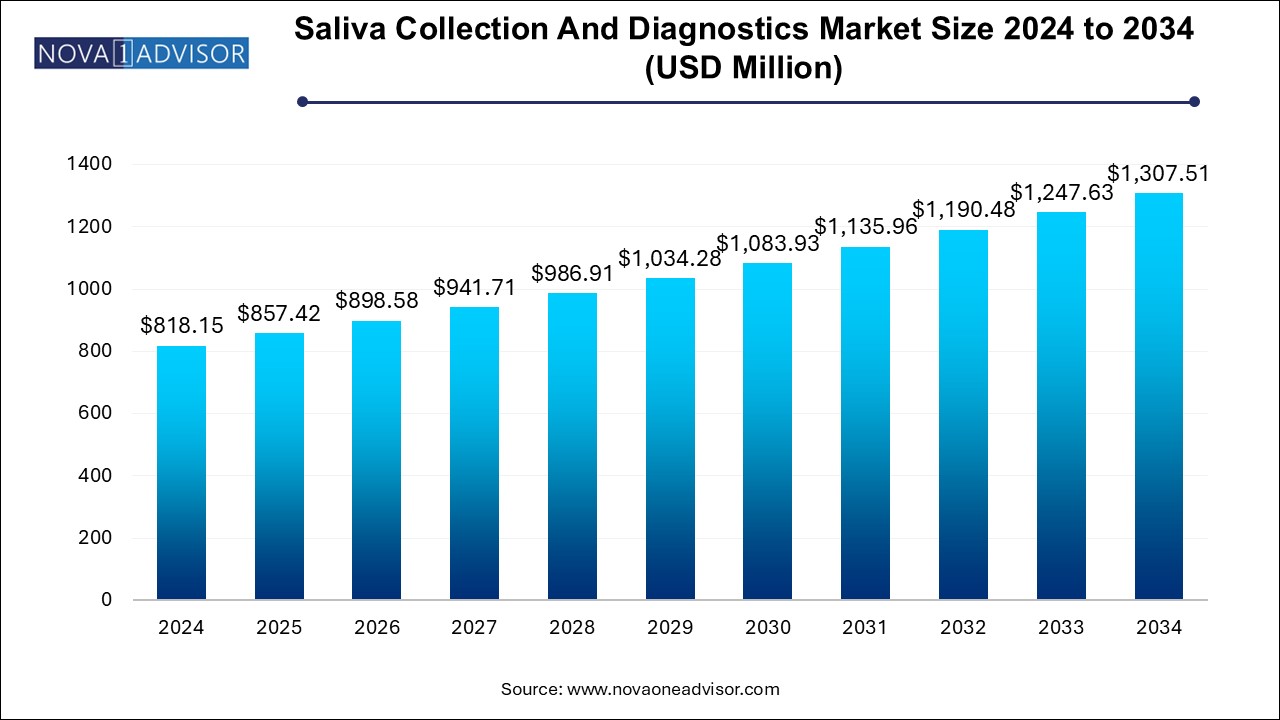

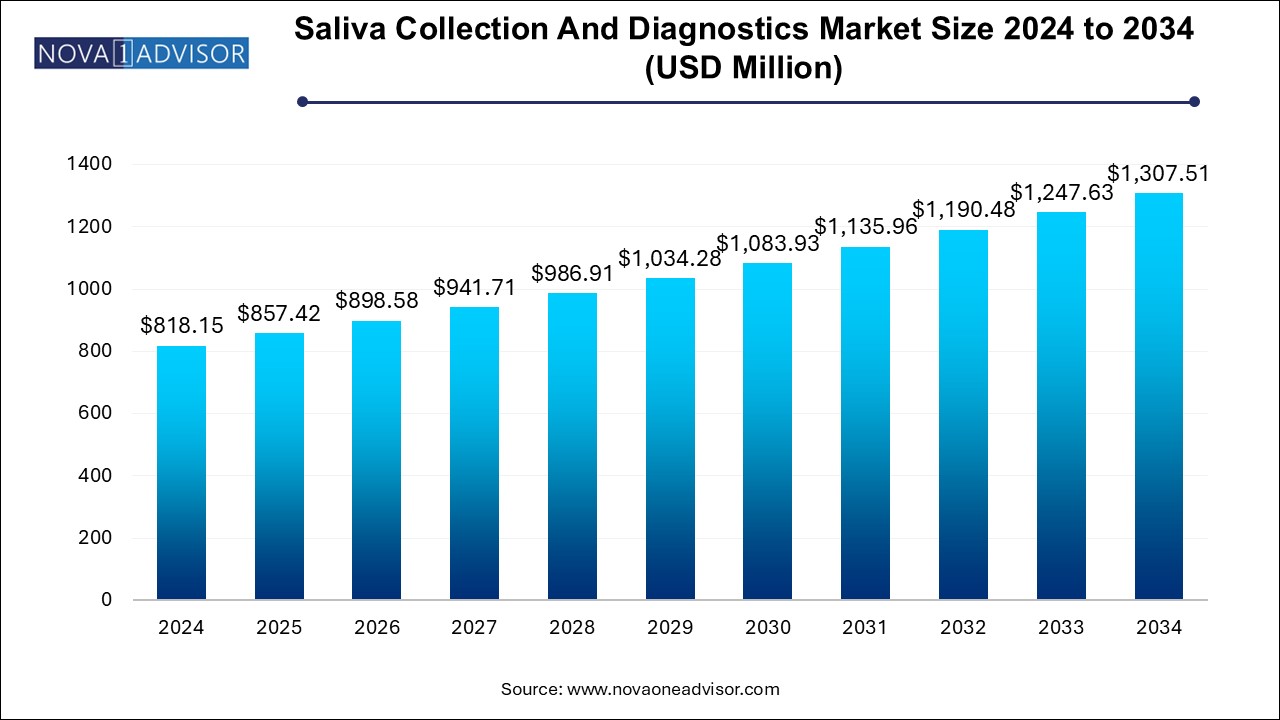

The saliva collection and diagnostics market size was exhibited at USD 818.15 million in 2024 and is projected to hit around USD 1,307.51 million by 2034, growing at a CAGR of 4.8% during the forecast period 2024 to 2034.

Saliva Collection And Diagnostics Market Key Takeaways:

- Based on site of collection, the submandibular/sublingual gland collection segment led the market with the largest revenue share of 49.2% in 2024.

- The parotid gland collection segment is expected to grow at a significant CAGR during the forecast period.

- Based on application, the disease diagnostics segment led the market with the largest revenue share of 90.6% in 2024.

- The forensic segment is likely to grow at the fastest CAGR of 3.8% over the forecast period.

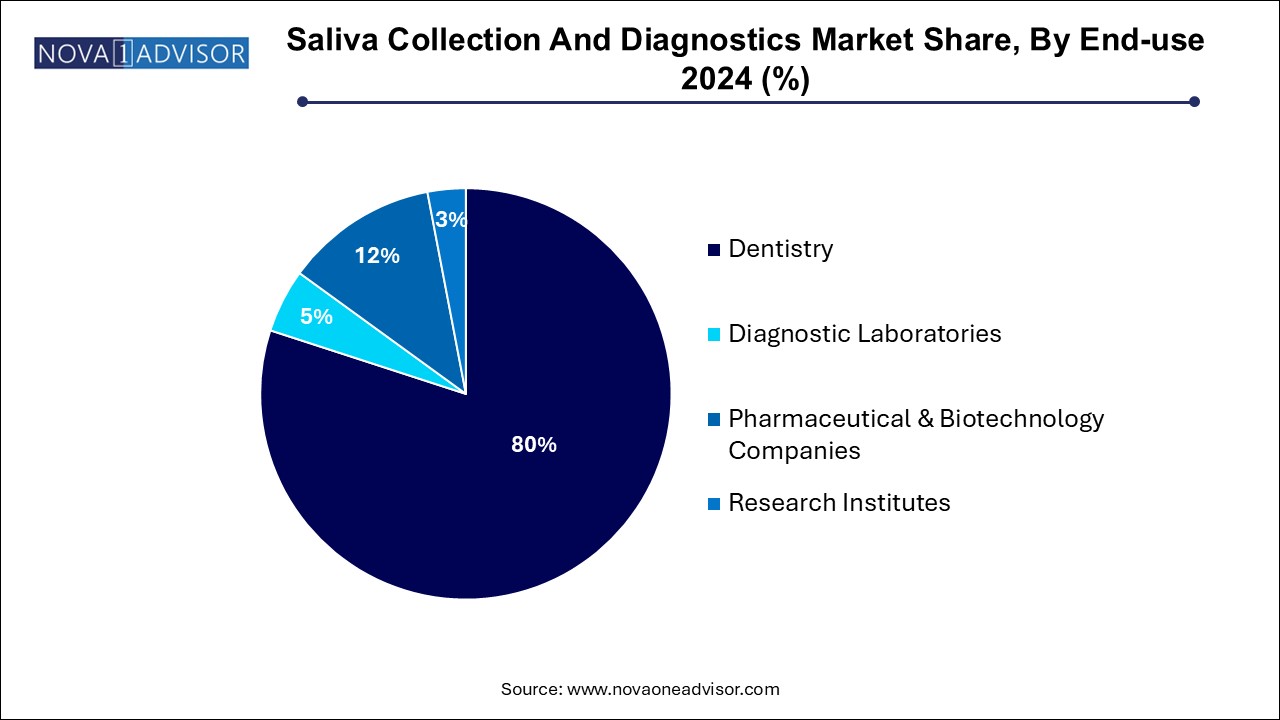

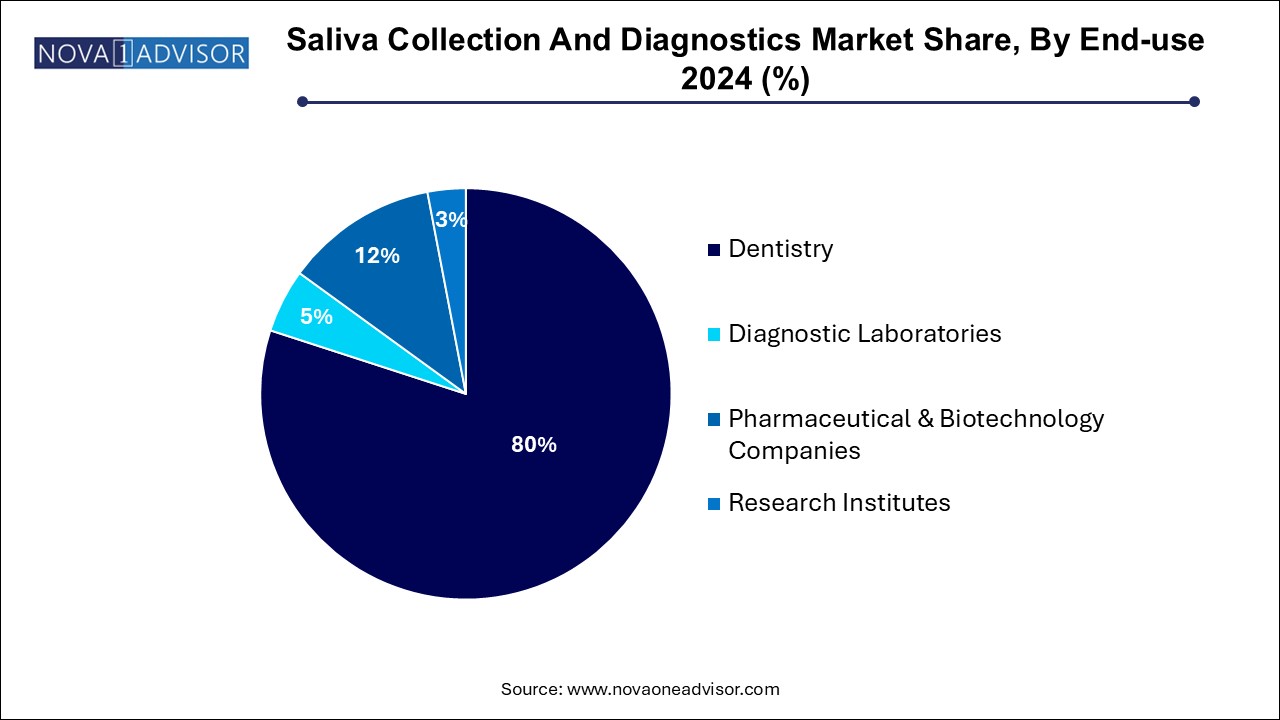

- Based on end use, the diagnostic laboratories segment led the market with the largest revenue share of 80.0% in 2024.

- North America saliva collection and diagnostics market held the largest revenue share of 48.71% in 2024

Market Overview

The saliva collection and diagnostics market has witnessed a transformative shift in the last decade, positioning itself as a key segment within the broader diagnostics industry. Saliva-based testing is emerging as a non-invasive, patient-friendly, and cost-effective diagnostic tool that can detect a wide array of biomarkers relevant to diseases, drug usage, genetic mutations, and hormonal fluctuations. Traditionally underestimated, saliva is now being recognized as a valuable biological fluid capable of reflecting systemic health conditions.

Saliva diagnostics leverage biofluids collected either from whole saliva or directly from specific glands—such as parotid or submandibular glands—to detect biomarkers like enzymes, hormones, DNA, RNA, and antibodies. The market’s growth has been fueled by the urgent need for scalable, easy-to-administer testing alternatives during the COVID-19 pandemic. From mass viral screening to chronic disease monitoring, the role of saliva-based testing has expanded significantly, making it a preferred mode of diagnostics in both clinical and homecare settings.

Technological advancements in assay sensitivity, sample preservation kits, and high-throughput molecular analysis have contributed to the broader acceptance of saliva diagnostics. Academic research, pharmaceutical trials, and forensic science are actively adopting this method. Companies are developing FDA-cleared, CE-marked saliva testing kits across areas like infectious diseases, oncology, endocrinology, and genetic screening.

This market reflects a unique convergence of convenience, accuracy, and scalability. It holds strong appeal for public health agencies, researchers, clinicians, and direct-to-consumer (DTC) test providers alike. As innovation continues to refine sample collection tools, storage stability, and multiplexing capabilities, saliva diagnostics are poised to revolutionize healthcare delivery through non-invasive and accessible solutions.

Saliva diagnostics offers a cost-effective, non-invasive and convenient approach for collection and examination of several biomarkers present in the saliva facilitating rapid diagnosis and detection of potential health issues. The rising demand for accurate, accessible and rapid testing solutions in on-site testing clinics, emergency departments, remote areas and especially in home settings is driving the development of sophisticated point-of-care and at-home saliva tests.

Salivaomics is a rising trend which will facilitate the development multiplex assays for detection of multiple biomarkers from a single saliva sample, further enabling accurate and early diagnosis of wide range of health conditions such as cardiovascular diseases, different cancers, neurological disorders and autoimmune conditions. Furthermore, strong emphasis on sample stabilization and processing, focus on developing advanced biosensors, integration with telehealth platforms and standardization of protocols for enhancing clinical adoption and reliability for comparative studies regarding saliva collection and processing are the factors expected to shape the future of saliva collection and diagnostics market.

Major Trends in the Market

-

Increased use of saliva in direct-to-consumer (DTC) genetic and wellness testing, such as ancestry, lifestyle, and dietary insights.

-

Expansion of saliva-based diagnostic tools for infectious diseases, including COVID-19, HIV, influenza, and respiratory pathogens.

-

Advancements in microfluidic saliva collection devices, offering better sample preservation and ease of use.

-

Rising demand for remote testing solutions, enabling at-home diagnostics with online physician support.

-

Growing acceptance of saliva testing in forensic science, particularly in crime scene investigation and toxicology.

-

Surge in clinical trials using saliva samples for non-invasive monitoring of drug pharmacokinetics and response.

-

Application of AI in interpreting multi-omics saliva data (proteomics, metabolomics, and transcriptomics).

-

Development of compact, point-of-care diagnostic platforms for real-time saliva biomarker analysis in clinics and homes.

-

Increased integration of saliva diagnostics in pediatric and geriatric healthcare, where blood collection may be challenging.

Report Scope of Saliva Collection And Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 857.42 Million |

| Market Size by 2034 |

USD 1,307.51 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 4.8% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Site of Collection, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Neogen Corporation; Abbott; Sarstedt AG & Co.KG; Autogen, Inc.; Oasis Diagnostics; Porex; Salimetrics, LLC; Takara Bio Inc.; Arcis Bio; Orasure Technologies |

Market Driver: Demand for Non-Invasive, Easy-to-Use Testing Methods

The dominant driver for the saliva collection and diagnostics market is the global push for non-invasive, rapid, and user-friendly diagnostic tools, especially in the wake of pandemics, decentralized healthcare, and preventive medicine trends. Traditional diagnostics—particularly blood draws and nasopharyngeal swabs—can be uncomfortable, require trained personnel, and present infection risks.

Saliva, on the other hand, offers a convenient alternative that can be self-administered, stored easily, and used without complex instrumentation. This ease of use has catalyzed adoption in direct-to-consumer testing, school-based public health programs, elderly care, and occupational health. Moreover, saliva samples can be collected frequently, making them ideal for longitudinal studies, chronic condition monitoring, and personalized medicine initiatives.

Market Restraint: Variability in Sample Composition and Standardization Challenges

A key restraint in the saliva diagnostics market is the variability in biomarker concentration and composition of saliva samples, which can fluctuate due to hydration levels, circadian rhythms, medications, and dietary factors. Unlike blood, where biomarker concentrations are relatively stable, saliva poses unique challenges in ensuring analytical consistency and reproducibility.

Moreover, lack of standardization in collection methods, storage protocols, and assay validation can affect test accuracy. These challenges hinder regulatory approval and limit integration into formal clinical pathways for high-stakes diagnostics like oncology or autoimmune diseases. As a result, developers must invest significantly in robust clinical validation, stabilization agents, and assay calibration to ensure credibility and clinical acceptance.

Market Opportunity: Integration with Telehealth and Remote Patient Monitoring

An important opportunity lies in the integration of saliva-based diagnostics with telehealth and remote care models. The global shift toward virtual consultations and home-based health management has opened new channels for sample collection and disease tracking. Saliva-based kits are increasingly being bundled with virtual diagnostic services, enabling users to collect samples at home, ship them to central labs, and receive results via apps or physician calls.

This opportunity is particularly relevant in managing chronic diseases (e.g., diabetes, hormonal imbalances), screening for STDs, and conducting regular health checkups without the need for clinic visits. Companies that can combine sample collection, molecular diagnostics, cloud-based reporting, and data analytics will be well-positioned to lead the market transformation toward preventive and digital-first healthcare delivery.

Saliva Collection And Diagnostics Market By Site of Collection Insights

Parotid gland collection dominates the market, primarily due to its established use in research and clinical trials where uncontaminated, gland-specific saliva is required. These samples offer clearer biomarker profiles for detecting systemic diseases, drugs, and hormones. Specialized collection devices and aspiration techniques make parotid samples ideal for analytical consistency, especially in pharma and diagnostic R&D.

Submandibular/sublingual gland collection is the fastest growing segment, gaining traction for its ease and speed of collection. These samples are richer in certain enzymes and mucins, making them suitable for oral disease diagnostics and hormonal monitoring. As point-of-care and at-home tests become more accessible, the sublingual method is being widely adopted for both self-use and clinical workflows.

Saliva Collection And Diagnostics Market By Application Insights

Disease diagnostics dominate the application segment, accounting for the highest market share due to saliva’s growing role in detecting conditions like COVID-19, HIV, periodontal diseases, hormonal disorders, and even early-stage cancers. Saliva-based PCR and immunoassays are becoming key tools in clinical laboratories and DTC kits alike. The shift toward minimally invasive diagnostics has made saliva the preferred biofluid for mass screening and public health campaigns.

The research segment is expanding rapidly, driven by the surge in multi-omics studies, drug development trials, and epidemiological surveys. Saliva’s ease of collection allows frequent sampling without disrupting daily activities, making it ideal for longitudinal research. From microbiome analysis to gene expression profiling, researchers are exploring saliva as a proxy for systemic and localized health states, further fueling demand for robust collection and preservation solutions.

Saliva Collection And Diagnostics Market By End-use Insights

Based on end use, the diagnostic laboratories segment led the market with the largest revenue share of 80.0% in 2024. As most saliva samples—especially for disease detection—are processed in central labs equipped with ELISA, RT-PCR, and next-gen sequencing platforms. These labs offer clinical-grade accuracy and support the scale required for public screening programs. Saliva testing has now become a key offering in the test menus of commercial diagnostic giants.

Research institutes are the fastest growing segment, reflecting the massive expansion in translational research involving saliva samples. Universities, biotech incubators, and academic hospitals are investing in saliva-based testing for neurodegenerative disease biomarkers, oral microbiome dynamics, and salivary RNA-based diagnostics. Increasing grants, academic-industry collaborations, and biobanking initiatives are supporting this growth.

Saliva Collection And Diagnostics Market By Regional Insights

North America leads the global saliva collection and diagnostics market, due to its advanced healthcare infrastructure, widespread use of DTC health testing, and favorable regulatory pathways for saliva-based products. The U.S. was one of the first countries to approve at-home saliva kits for COVID-19 testing, accelerating public trust in this method.

Major market players such as OraSure Technologies, DNA Genotek, and Thermo Fisher Scientific are based in North America, providing innovative collection kits, stabilization buffers, and molecular assays. Moreover, strong academic research output and consumer interest in wellness and ancestry tests (e.g., 23andMe) reinforce the region’s dominance.

What drives the dominance of U.S. in North America?

U.S. is a major contributor to the market in North America. The market growth is driven the rising preference for convenient and non-invasive testing methods, increased demand for home-based and direct-to-consumer (DTC) testing, ongoing advancements in saliva diagnostics, and growing emphasis on early diagnosis for chronic and infectious diseases. Moreover, increased government influence through agencies like the National Institutes of Health (NIH) and the Food and Drug Administration (FDA) which provide research funding, regulatory oversights and promote innovative diagnostic technologies are further expanding the market.

Asia Pacific is the fastest growing regional market, propelled by rapid healthcare modernization, growing demand for early diagnostics, and rising prevalence of chronic and infectious diseases. Countries like China, India, and Japan are increasingly integrating saliva testing in diagnostics and public health initiatives.

Local startups and multinational companies are launching saliva-based tests for TB, hepatitis, oral cancer, and STIs. Additionally, mobile health units and telemedicine platforms are incorporating saliva kits to extend diagnostics into rural and underserved areas. With increasing government support, digital infrastructure, and growing public awareness, Asia Pacific is poised to be a key growth engine through 2034.

Some of the prominent players in the saliva collection and diagnostics market include:

Saliva Collection And Diagnostics Market Recent Developments

-

In May 2025, CaviSense Inc., a dental biotechnology start-up founded by Dr. Gill Naveh in the Tufts University, developed a first-of-a-kind CaviSense Toothpick which is a simple, color-changing diagnostic toothpick tool for detecting signs of early-tooth decay by examining acidic conditions on the tooth’s surface. The new tool was licensed in 2024 and is set to hit the markets by mid-2025.

-

In January 2025, Eli Health, a Canadian start-up, launched its instant testing kit, Hormometer at the CES 2025 tech fair. The Hormometer is a first-of-a-kind portable and instant saliva-based testing product for giving precise reading across multiple hormones.

-

In September 2024, Nucleome Informatics, a provider of genomics services, launched the DrSeq IRD panel, a genetic test for diagnosis of wide range of Inherited Retinal Diseases (IRDs) such as Leber Congenital Amaurosis (LCA), Cone Dystrophy, Retinitis Pigmentosa (RP), Stargardt’s Disease and Maclaren Dystrophy for individuals with a family history of blindness. The test features a saliva-based collection method.

-

In August 2024, Pattern Computer, Inc., developed a research partnership with the Medical College of Wisconsin (MCW) Cancer Center to launch a new pilot study for assessing the detection of cancers through analysis of saliva by leveraging Pattern’s ProSpectral multi-disease hyperspectral diagnostics research platform.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the saliva collection and diagnostics market

By Site of Collection

- Parotid Gland Collection

- Submandibular/Sublingual Gland Collection

- Others

By Application

- Disease Diagnostics

- Forensic Applications

- Research

By End-use

- Dentistry

- Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Research Institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)